MFSA | Financial Regulator Of Malta

The MFSA was created in 2002 and received part of its powers from the Central Bank of Malta and the Malta Stock Exchange. As an independent government regulator, the MFSA only reports to the country’s parliament, but can also refer to other government bodies for assistance.

MFSA comprises a group of government and non-government regulators that license and control brokers and their financial activities. It also supervises and monitors the investment attractiveness within its jurisdiction; ensures that licensees comply with local and international laws; settles disputes; and protects investor rights. Such a regulatory system may include the National Bank, ombudsmen, government or private regulators, and auditors. Licenses are mandatory for brokers that operate within the legal framework.

For a broker, holding a license means:

-

Meeting its regulator’s requirements disclosing information about its financial state, organizational structure, and management team, and going through external audits. In some cases, brokers must pay contributions to a compensation fund.

-

Observing international law on the condition that there is an official agreement with regulators. In EU countries, brokers must follow the protocols of the Markets in Financial Instruments Directive of the European Union (MiFID II).

-

Confirmation of the broker’s existence and partial or full transparency.

For a trader, a broker’s license promotes confidence in the company’s reliability and the possibility to seek the regulator’s help in resolving disputes.

In this post, TU explores the MFSA’s functions, mandate, procedures for confirming licenses on the website, and procedures for filing complaints, as well as reviews and an expert’s opinion of this regulator.

Description and functions of the MFSA

The Malta Financial Services Authority was created in 2002 and received part of its powers from the Central Bank of Malta and the Malta Stock Exchange. As an independent government regulator, the MFSA only reports to the country’s parliament, but can also refer to other government bodies for assistance. The regulator supervises lending and financial organizations; investment, insurance, and retirement funds; stock and Forex markets; and part of the cryptocurrency market.

The MFSA’s mission and objectives in the Forex market:

-

Fully inspect brokers before issuing licenses. Besides standard entitling and financial documents, the MFSA can require the disclosure of a company’s risk management policy, the confirmation of its employees’ qualifications, etc.

-

Protect investors’ interests and ensure equal competitive opportunities for all licensees.

-

Inform all market participants about their rights and resources and about changes in legislation.

-

Inform investors about violations and possible dangers of cooperation with brokers or exchanges.

-

Keep a database of legal entities registered in Malta. Keep a blacklist of brokers that have violated local and international laws.

Malta is a member of the EU. A license from the MFSA allows brokers to render services to residents of almost all European countries and operate in some Asian countries if it doesn’t violate local laws. MFSA-licensed brokers must abide by MiFID II which, in particular, restricts leverage and transactions with high-risk assets.

To obtain an MFSA license, a broker has to:

-

Register an office in Malta.

-

Confirm the availability of the €730,000 minimum capital and keep it at this level. The amount is revised and can be increased to €1 million or higher.

-

Pay annual organizational contributions.

-

Open an account at any bank in Malta.

-

Work with European counterparties only.

-

Comply with MiFID II, which is obligatory for all legal entities operating in the eurozone.

Similar to the Cyprus Securities and Exchange Commission (CySEC), the MFSA is deemed an offshore regulator. Registration requirements are strict and meet European norms. But later, licensees are not inspected as thoroughly as brokers licensed by the UK’s Financial Conduct Authority (FCA), Germany’s Federal Financial Supervisory Authority (BaFin), or U.S. regulators. Although an MFSA license formally permits operating in Europe only, brokers also work with residents of Asia, and the regulator does not see it as a violation. The MFSA does not have a compensation fund or require brokers to be examined by international auditors. The disclosure of public information is also questionable, as the MFSA website only provides superficial information about its licensees.

Official website and available information

The MFSA website is informative and relatively well-structured. It contains a lot of useful information ranging from laws and regulations to blacklists of offenders. However, its multi-level structure may confuse some researchers. You can follow 4-5 links, fail to find the needed information, and be returned to the homepage to start searching all over again.

Overview of the website:

-

Upper main menu.

Upper main menu

-

Information sections that partially repeat the main menu and present the latest news and an overview of the regulator’s history and tasks.

Section of the website

-

Footer. Here, you can subscribe to the regulator’s newsletter, find useful links to calculators and finance courses, view statistics on licenses by categories of companies, etc.

Section of the website

Main menu structure:

-

About us. General information about the MFSA: mission, strategic plan, risk management system, tasks and principles, etc.

-

Consumers. Regulatory documents on investing, banking, and insurance. Risk notices and advice on how to avoid fraud. Consumer rights and duties. Useful links to websites of the Central Bank and other government bodies; and finally, FAQs. The “How to Complain” subsection tells harmed traders what to do.

-

Our Work. Compensation schemes for clients of bankrupt companies, insurance supervision, stock market supervision, etc.

-

Newsroom. News, posts, reports, warnings to brokers, and information about revoked licenses.

-

FSA. Information about the Financial Supervisors Academy, its training plan, etc.

-

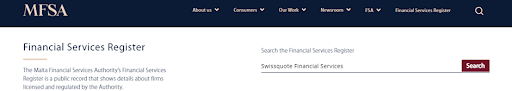

Financial Services Register helps to find brokers in the regulator’s database.

Potential clients of brokers are mostly interested in the “Financial Services Register” section, where they can confirm a broker’s license and see which types of services it is permitted to offer. “Warnings” is another section that is important for traders.

Section of the website

How to confirm a broker’s license on the MFSA website

The regulator’s website is overfilled with information. Searching on the homepage by the broker’s legal name only gives you a list of articles in which the company is mentioned. It can help you see what the broker is known for and whether it has committed violations or drawn the regulator’s attention in any other way. Search results may consist of 50 or more links.

To confirm a broker’s license on the MFSA website, do the following:

-

1

On the broker’s website, find confirmation that it holds an MFSA license. Usually, such information is in the footer and sometimes in “About Us”. When searching for the broker by name (which is the only way entities can be found on the MFSA website), take into account that the company may have several branch offices with different legal names and licenses. See which division of the broker is mentioned in your client agreement (offer). You need the license granted to this division.

MFSA Review — broker’s website

-

2

On the MFSA website, open the “Financial Services Register” and enter the broker’s name in the search box.

MFSA Review — Section of the website

-

3

The results include all valid licenses held by the broker.

MFSA Review — Section of the website

Follow each link to get detailed information. Just in case, compare the details included in the license to the details on the broker’s website. If they do not match, ask the broker’s support service some questions.

MFSA’s basic requirements for brokers

Basic requirements to obtain a license:

-

Provide documents that disclose all information about the broker such as related entities, related private individuals, financial statements, information on checking accounts at foreign banks, etc.

-

Possess registered capital of €730,000 or more, depending on the services rendered.

-

Work with European counterparts only.

-

Obtain a passport that allows operating in any EU country.

The MFSA has hard conditions for license acquisition, but exercises relatively mild control after a license is issued. The Authority requires a large amount of registered capital, information disclosure, and cooperation with European entities only. However, after obtaining a license, brokers find ways to partially go around the MFSA’s requirements without breaking EU laws. That is why, for traders, a license from the Maltese regulator means more lenient trading conditions with higher risks and a less stringent guarantee of brokers’ reliability.

Pros and cons of an MFSA license

The MFSA is a golden mean for brokers that are geared toward the European financial market and don’t want to lose competitive advantages because of the strict requirements of the FCA or BaFin. Malta is an offshore jurisdiction with relatively mild taxation and oversight of money flows. The Maltese regulator requires the observation of the European rules for doing competitive and transparent business. But at the same time, the MFSA forgives licensees for insignificant violations and doesn’t have a deep interest in their work.

Advantages of trading with an MFSA-licensed broker:

-

Upon registration, the broker is fully checked by the regulator. The license confirms that the company truly exists and has the right to render brokerage services.

-

An MFSA license is recognized in Europe. Brokers with a Maltese license can work with residents of any eurozone country.

An MFSA license is a cross between strict, conservative European regulators and offshore regulators whose main purpose is to receive contributions from licensees. The Maltese regulator has high requirements for capital and compliance with MiFID II, regularly updates the lists of offenders and issues warnings. But that is all the leverage it has over offenders.

Disadvantages of trading with an MFSA-licensed broker:

-

This authority does not consider individual complaints but acknowledges that its licensees must have a procedure for resolving disputes with their clients and respond to requests within certain terms. This means that, in rare cases (for example, when a broker ignores a trader’s questions), the regulator can reply to a complaint by a private individual.

-

No compensation fund. There is information on the regulator’s website that in accordance with the EU Directive 97/9 on investor-compensation schemes, in case of a company’s bankruptcy, the MFSA engages representatives of the Central Bank of Malta and pays compensation. But the amount of compensation is not mentioned. There is also no information about broker contributions to a compensation fund or about any reimbursements that have been made.

For a private trader with small capital, an MFSA license may serve to keep him calm because he knows that his broker is under control and, therefore, is unlikely to be interested in deceiving clients. But this is only partially true. The regulator only helps if there has been a serious violation. In other cases, traders have to deal with brokers on their own.

MFSA’s jurisdiction

The MFSA is a government regulator whose license is recognized in EU countries. This authority is accountable to the Parliament of Malta, operates on its own, and, in some cases, can seek assistance from the Central Bank of Malta or European regulatory bodies. An MFSA license allows brokers to provide services to residents of any eurozone country.

Submission and consideration of complaints

The MFSA does not consider individual complaints and therefore recommends that traders do the following where there’s a dispute:

-

1

Contact your financial services provider and describe the essence of your complaint in detail. The broker must reply within 15 days.

-

2

Contact the Office of the Arbiter for Financial Services (OAFS). The Arbiter will investigate your complaint and try to settle the dispute.

-

3

Go to court.

MFSA-licensed brokers | How to check on a broker

In this section, you can view all valid licenses held by the broker and its branch offices. Here, you can also find information about violations taken from the regulator’s website. Information is updated monthly.

Reviews of the MFSA by complaining investors and traders

This section provides opinions of private traders and investors that will complement your general idea of the MFSA.

Oleg, investor, Moscow

Thank you for the detailed review of this regulator, but the compensation fund issue remains unclear. On the website, I couldn’t find information about contributions that brokers must pay. Maybe the MFSA has a compensation fund that is partially formed from annual organizational contributions. But here is what’s interesting.

The regulator’s website says: “The Investor Compensation Scheme is a rescue fund for customers of failed investment firms which are licensed by the Malta Financial Services Authority (MFSA)”, and mentions the EU Directive 97/9 on investor-compensation schemes. I opened the Directive. It has 91 pages of text, which I probably won’t be able to understand without a lawyer. According to the regulator, the compensation scheme only applies if a broker goes bankrupt.

Hence, the questions:

-

Does the MFSA not require the segregation of client accounts? Or does it not check them? Because client accounts should be separated. And if a broker bankrupts, the accounts are simply transferred to another managing company.

-

The Directive applies to all brokers that hold licenses related to MiFID II, right? Then why do other EU regulators have compensation funds?

In short, is it really possible for a trader to get compensation? Or is it just double talk?

Roman, trader | Ozersk, Russia

The Maltese regulator has a good reputation. But if I had to choose between the Cyprian CySEC and the Maltese MFSA, I’d choose the former for several reasons:

-

The MFSA grants licenses too easily. And it is more a matter of residence. For example, to obtain Maltese citizenship without living in the country, a private individual has to pay a fixed amount, i.e., simply buy a passport. And because Malta is part of the Schengen Area, a Maltese passport automatically entitles you to reside in a number of European countries. The same goes for brokers. It is favorable for the jurisdiction to make money. And although brokers are supposedly required to have offices in Malta, you can pay a hefty amount to register any company remotely and then present it as a European broker. A scandal with TradingBanks and MXTrade in 2016 was an example. Back then, a mess occurred that showed that brokers could register in Malta without acquiring an MFSA license.

-

No examples of real work done by the MFSA. Yes, it publishes warnings often, but do traders read them? It testifies that the regulator hardly conducts any investigations, unlike CySEC.

-

Also, there are no examples of actual consideration of trader complaints.

That is why, although the MFSA is deemed to be a strict regulator, I’d prefer a broker licensed by the FCA or CySEC.

Anatoly, cryptocurrency trader, Kyiv

The MFSA gives a good showing in the cryptocurrency market. On the internet, I often see notices that the regulator has issued a warning or expressed distrust. For example, there was a notice recently about Binance’s problems. The exchange wouldn’t block accounts of unverified traders, letting them withdraw money. Due to this, traders from OFAC (Office of Foreign Assets Control)-sanctioned countries were able to trade on Binance.

Alexander, analyst, St. Petersburg

Brokers need a license. It permits them to conclude agreements with providers of liquidity and software. Unlicensed entities get blacklisted. And although nobody can block a domain or a platform (the Tor Browser and VPN easily solve the problem), it’s a blow to their image. That is why, if a broker isn’t going to rob its clients right away, it will acquire a license. But it hardly helps traders because few people are willing to go through the ordeal of proving to foreign authorities that you have really been harmed.

Leonid, trader | Krasnodon, Ukraine

I trust Malta more than Vanuatu or Belize, whose sites I sometimes can’t even access. Malta is at least part of the EU.

Expert’s assessment

The MFSA is a government regulator that derived its powers from the Central Bank of Malta and the Malta Stock Exchange in 2002. In that way, the MFSA became partially independent of other government bodies while remaining accountable to the Maltese Parliament. This provided several advantages:

-

Functions were clearly separated. The Central Bank filled the narrow niche of banking sector control and the MFSA was entrusted with overseeing the stock and over-the-counter markets, including CFD trading.

-

The regulator became independent and remained interested in maintaining a favorable investment climate. For this reason, the MFSA’s requirements to obtain a license are rather strict: brokers must keep their registered capital within the range of €700,000 – €1 million, as well as make sure their counterparts have European citizenship and comply with international conventions (on anti-money laundering, etc.).

Maltese legislation is well disposed to cryptocurrencies. The jurisdiction has created a digital innovations agency and launched special mechanisms that help implement cryptocurrency payment systems. The MFSA’s mandate also includes overseeing cryptocurrency exchanges and brokers to protect investors’ interests and manage risks.

Conclusion

The MFSA is a relatively strict and reputable regulator that is integrated into the European regulatory system but is still considered to be offshore. It almost never conducts investigations. Its formal tasks are to thoroughly select license applicants and ensure that licensees observe European financial laws. But in practice, the MFSA mostly controls entities that operate in Malta. If violations of the EU law are revealed, the regulator publishes a warning on its website and informs European supervisory agencies. And this is all the leverage the MFSA actually has over offenders.

About the author of this review

Oleg Tkachenko, author and analyst at TU

Oleg Tkachenko has been TU’s financial analyst and economic observer since 2016. During this time, he has prepared more than 100 reviews of financial companies and analytic articles on technical and fundamental analysis, as well as developed over 10 trading systems. Oleg’s motto is to help everyone come all the way from a novice trader to a professional.

FAQs

What is the MFSA?

The MFSA is a government regulator of Malta supervised by the Parliament. Operating in the EU legal framework, it grants licenses, ensures that licensees abide by eurozone laws, and informs investors about violations, risks, and their rights.

What do I get from trading with an MFSA-licensed Forex broker?

-

1

Confidence that the broker operates in accordance with the European rules for doing business.

-

2

If the broker has problems, you’ll see a warning on the regulator’s website.

For a trader, a license from the Maltese regulator means the possibility to engage European supervisory bodies in the settlement of issues with brokers. The MFSA operates in the European legal framework and therefore every broker with an MFSA license must follow MiFID II.

How to check if a broker holds an MFSA license?

There are two options:

-

1

On the MFSA website, open the “Financial Services Register” in the upper menu and enter the broker’s name in the search box.

-

2

Find information about valid licenses on the Traders Union website.

The second option is advantageous in that the regulator’s website only includes information about the license held by the Maltese branch office of the broker, whereas the broker’s card on TU’s website shows all valid licenses.

How to submit a complaint against a broker to the MFSA?

-

1

The regulator recommends the following steps:

afile a complaint with the broker;

bsubmit a complaint to the OAFS;

ctake the case to court.

-

2

Register on the Traders Union website and refer to TU’s legal department for help. This service is free for all TU members. This regulator does not consider individual complaints, so TU recommends trying the second option first.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

MFSA

MFSA was established on 23 July 2002. MFSA comprises a group of government and non-government regulators that license and control brokers and their financial activities.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

5

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).