What Happens If You Don't Use Stop Loss?

Trading without a stop loss is risky because it exposes traders to:

-

Unlimited Losses:Losses may exceed financially and psychologically acceptable levels

-

Margin Calls: Requirement to add funds due to falling account value.

-

Account Blow-Up: Total depletion of trading capital.

The thin line between profit and loss in trading often comes down to the strategies employed by traders. One critical tool in the arsenal of successful traders is the stop loss order, a mechanism designed to limit an investor's loss on a position. Yet, a surprising number of traders venture into the markets without this safeguard, exposing themselves to unnecessary risks.

This article aims to explore why trading without a stop loss is akin to sailing in stormy seas without a life jacket, and how implementing this tool can protect your capital and peace of mind.

-

What is the meaning of stop loss?

A stop loss is an order placed with a broker to buy or sell a security when it reaches a certain price, aiming to limit an investor’s potential loss on a trade.

-

Is stop loss necessary?

While not absolutely necessary, a stop loss is highly recommended as it provides a crucial risk management tool, helping to prevent excessive losses in volatile trading environments.

-

Is stop loss mandatory?

No, stop loss is not mandatory, but it is a strategic practice for managing risk and protecting investment capital in trading.

-

Do Successful Traders Use Stop Losses?

Yes, many successful traders often use stop losses as part of their trading strategy to manage risk and protect their profits from unexpected market movements. To learn more, read our article on Do Professional Traders Use Stop Losses?

How does stop loss work?

A stop loss order is a directive sent to a broker to buy or sell a security when it reaches a certain price. It's essentially an exit strategy for traders, designed to cap losses on a trade gone sour. For instance, if a trader buys a currency pair at 1.1000 and sets a stop loss at 1.0950, the position will automatically close if the price drops to 1.0950, limiting the trader's loss.

This mechanism functions as a critical risk management tool, ensuring that traders do not hold onto losing positions in the hope of a market reversal that may never materialize.

Setting a stop loss, traders can predetermine the maximum amount they are willing to lose on a trade, which helps in maintaining a clear financial and emotional boundary against the market's unpredictability.

To learn more about stop loss, read our in-depth guide on Stop Loss Order - How to Use It Correctly to Earn More?

👍 Pros

The utilization of stop loss orders in trading encompasses a range of advantages that significantly enhance risk management and operational efficiency:

• Controlling Risks: The primary benefit of a stop loss is its ability to cap potential losses on any trade. This function is essential for traders to manage and mitigate the financial risks inherent in the volatile markets of Forex and cryptocurrencies. By predetermining the maximum amount one is willing to lose, traders can ensure that a single trade does not adversely affect their entire portfolio.

• Locking Profits: Stop losses are not only about preventing losses; they can also be strategically used to protect profits. As a position moves into profit, adjusting the stop loss to a breakeven point or setting it to secure a portion of the gains can safeguard those profits against market reversals. This proactive approach enables traders to solidify their gains without needing to constantly monitor market movements.

• Reduced Need for Market Monitoring: With stop loss orders, traders can reduce the time spent watching the markets. Knowing that their trades will automatically close at predetermined levels allows traders to allocate their time more efficiently, focusing on market analysis, strategy development, or even personal activities, without the stress of needing to manually close positions in a rapidly changing market.

• Promotes Strategic Trading: Implementing stop loss orders encourages a disciplined approach to trading. Traders are compelled to analyze the market meticulously to determine the most effective entry and exit points for their stop loss orders. This requirement fosters a more thoughtful and less impulsive trading behavior, guiding traders towards making decisions based on analysis rather than emotion.

• Enhances Leverage Management: Effective use of stop loss orders can significantly aid in managing leverage. By defining the maximum loss per trade, traders can ensure that they utilize leverage within their risk tolerance. This careful management of leverage is particularly crucial in leveraged trading environments like Forex and cryptocurrencies, where the potential for high returns comes with the risk of substantial losses.

👎 Cons

While stop loss orders are invaluable tools for traders, they come with their own set of challenges and limitations:

• Risk of Slippage: Slippage is a significant concern in volatile markets, where the price at which a stop loss order is executed may not match the predetermined stop price. This discrepancy can result in larger losses than expected, especially during market events that cause rapid price movements.

• Possibility of Premature Exit: Market volatility can trigger stop loss orders during temporary price spikes, exiting traders from their positions before the price moves back in their favor. This can lead to missed opportunities for profit, as positions are closed out based on short-term price fluctuations rather than long-term trends or analysis.

• Increased Transaction Costs: The frequent execution of stop loss orders can lead to higher trading costs. Each time a stop loss triggers, it may necessitate re-entry into the market, incurring additional spreads and commissions. Over time, these costs can accumulate, potentially eroding the profitability of trading strategies, especially for those who trade frequently or with tight margins.

• Psychological Challenges: The psychological aspect of setting stop loss orders can be tricky. Fear of loss may lead traders to set stop losses too tightly, causing them to exit trades prematurely and miss out on potential gains. Conversely, setting stop losses too broadly in an attempt to avoid being stopped out can expose traders to larger losses, undermining the principle of effective risk management. Finding the optimal balance requires experience, a clear trading strategy, and an understanding of one's own risk tolerance.

Best Forex Brokers in 2025

What happens if there is no stop loss?

Operating without a stop loss significantly amplifies the risks involved. The absence of this crucial risk management tool exposes traders to several adverse scenarios, with the potential for:

-

Unlimited Losses: Without a stop loss, a losing position can continue to decline unchecked, leading to substantial financial loss. The market's volatility can exacerbate this issue, making it possible for losses to extend far beyond the initial investment.

-

Margin Call: As losses mount, traders may face a margin call, requiring them to deposit additional funds to maintain their positions. If unable to meet the margin requirements, positions may be forcibly closed at a loss.

-

Account Blow-Up: In the worst-case scenario, continuous losses without the safeguard of a stop loss can result in the total depletion of the trading account, effectively wiping out the trader's capital.

The absence of stop loss orders also influences trader psychology, encouraging emotional decision-making. Without predefined exit points, traders might hold onto losing positions for too long, hoping for a market reversal that may never come. This hope-driven approach can cloud judgment and lead to irrational trading decisions.

Moreover, forgoing stop loss orders means missing out on strategic re-entry points. A well-placed stop loss can allow traders to exit a position at a loss but re-enter the market under more favorable conditions, optimizing their trading strategy. Lastly, the lack of a stop loss reflects a broader disregard for risk management principles, exposing traders to unnecessary risks and potentially catastrophic financial consequences.

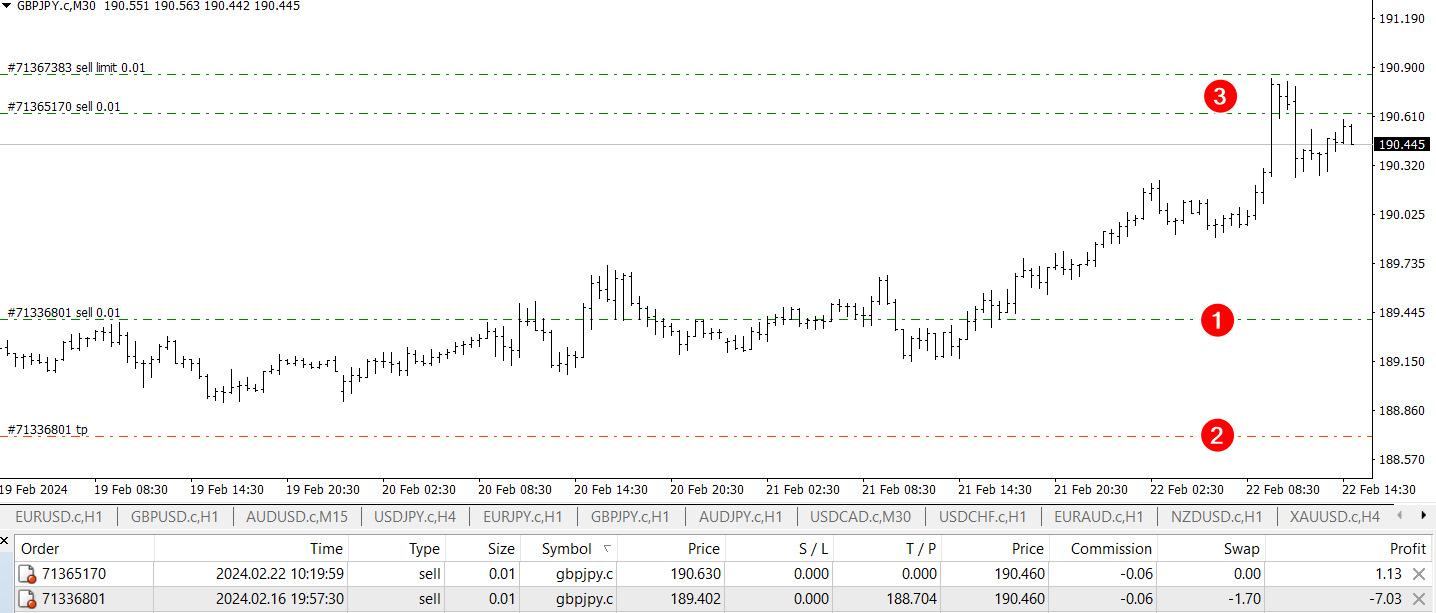

Illustration of trading without stop loss

In this example:

-

A trader opened a short position (1) without a stop loss but with a take profit.

-

The price did not reach the take profit (2), but went up.

-

The trader decided to average out and open new short positions (3) at higher price levels.

Time will show how justified this decision will be in this case. This example shows that the longer you hold a position without a stop-loss, the greater your loss may be (including swaps).

Can you trade without a stop loss?

Trading without a stop loss is indeed possible, but it's a strategy fraught with risk, generally advised only for highly experienced professionals. These seasoned traders might forgo stop losses in certain situations, relying instead on their deep market knowledge, strict discipline, and alternative risk management techniques.

However, even for professionals, this approach demands constant market vigilance, an exceptional understanding of market trends, and a solid exit strategy to mitigate potential losses.

The rationale behind trading without a stop loss often stems from strategies that anticipate wide fluctuations or aim to avoid being prematurely stopped out during volatile market movements. Professionals employing this method might use manual monitoring to decide when to exit trades, or employ other tools like hedging to manage risk.

Nevertheless, for the vast majority of traders, especially those without the luxury of constantly monitoring the market or those still honing their trading strategies, the absence of a stop loss can lead to significant financial losses and is generally not advised.

For further insights into the effectiveness of stop loss, read our article on Stop-loss order: should I use? - TU Research.

Conclusion

The use of stop loss orders stands as a fundamental aspect of prudent trading strategy, particularly in the volatile realms of Forex and cryptocurrency markets. These tools not only safeguard traders from excessive losses but also instill discipline, allowing for strategic trade management and emotional equilibrium.

While trading without a stop loss is feasible for a select group of seasoned professionals, for the vast majority, it is a risky endeavor that can lead to significant financial setbacks. Embracing stop loss orders as part of a comprehensive risk management plan is essential for long-term success in trading.

Glossary for novice traders

-

1

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

2

Brokerage fee

A brokerage fee, also known as a commission, is a fee charged by a brokerage or financial institution for facilitating and executing financial transactions on behalf of clients. Brokerage fees are typically associated with services related to buying or selling assets such as stocks, bonds, commodities, or mutual funds.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

Short selling

Short selling in trading involves selling an asset the trader doesn't own, anticipating its price will decrease, allowing them to repurchase it at a lower price to profit from the difference.

-

5

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).