Most Popular Trading Strategies Explained

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Most popular trading strategies:

- Day Trading – Buying and selling assets within the same day to profit from short-term price movements.

- Swing Trading – Holding positions for several days to capture medium-term market swings.

- Scalping – Making quick, small trades throughout the day to profit from tiny price fluctuations.

- Buy and Hold – Investing long-term in assets, ignoring short-term volatility.

Navigating the intricate landscape of trading requires a keen understanding of various strategies and the ability to determine the most suitable approach for your individual needs. Whether you're a novice or a seasoned trader, the key to success lies in identifying the optimal trading strategy that aligns with your risk tolerance, capital, time commitment, and skillset. So, through this in-depth guide, our team of trading specialists at TU will examine an array of trading strategies, such as day trading, swing trading, scalping, and buy-and-hold, to help you identify the most effective method tailored to your unique goals and preferences. By the end of this comprehensive analysis, you'll be equipped with the knowledge and confidence to navigate the world of trading and select the strategy that best complements your journey to financial success

What is a trading strategy?

A trading strategy is a systematic, well-defined plan that outlines specific rules and guidelines for engaging in financial markets. It is a combination of technical and fundamental analysis, risk management, and psychological factors, designed to help traders identify, execute, and manage their trades in a disciplined manner. By adhering to a trading strategy, traders can make informed decisions and minimize the impact of emotions on their trading activities.

Day trading

Day trading is a fast-paced approach to financial markets that involves entering and exiting positions within a single trading day. This strategy aims to capitalize on short-term price movements and requires a high level of focus, discipline, and risk management. In this section, the experts will explore what day trading entails, its benefits, and two strategy illustrations – one for beginners and another for advanced traders.

Why day trading?

Day trading can offer several advantages, including the potential for quick profits, no overnight risk exposure, and the opportunity to leverage intraday price volatility. However, it also comes with a higher level of risk and requires a substantial time commitment, technical knowledge, and emotional control.

How to day trade successfully?

To day trade effectively, a trader must develop a solid trading plan, adhere to strict risk management rules, and continuously monitor market conditions. Employing a well-defined strategy is crucial to navigating the rapidly changing market environment.

1: Breakout Trading Strategy

The breakout strategy for day trading centers around the value of a particular asset or position as it surpasses a specific threshold (along with a rise in trading volume). Typically, there is a surge in volatility as the security or asset exceeds this price point, leading to a shift in prices in the direction of the breakout.

Entry point: Determining the entry point in the breakout strategy is very simple, as the prices are set to close and require a bullish position below a support level. On the other hand, the prices are set to close and need a bearish position above the resistance levels.

Exit point: A trader will need to analyze the recent performance of the asset in order to determine his/her price target. By using the chart patterns, a trader can make this process accurate.

Stop loss: A good way to determine stop loss is to take a margin below the low of the breakout candle and vice versa.

Profit taking: A sensible target would be the average price that moved three points beyond several last price swings. Once this goal has been reached, a trader can consider it the exit point.

2: Ichimoku Kinko Hyo Indicator

The Ichimoku Cloud indicator is a momentum-based tool that helps identify trend direction and support and resistance levels. It consists of five main elements, providing reliable trade signals:

Tenkan-Sen (Conversion Line): The midpoint of the last 9 candlesticks, calculated as [(9-period high + 9-period low)/2].

Kijun-Sen (Base Line): The midpoint of the last 26 candlesticks, calculated as [(26-period high + 26-period low)/2].

Chiou Span (Lagging Span): Plotted 26 periods behind the price.

Senkou Span A (Leading Span A): Midpoint between the Conversion Line and Base Line, plotted 26 periods ahead. It forms the faster cloud boundary.

Senkou Span B (Leading Span B): Midpoint of the last 52 price bars, plotted 52 periods ahead. It forms the slower cloud boundary.

Chikou Span: Represents the closing price, plotted 26 periods back.

Entry point: Utilize the Tenkan and Kijun crossover signals for entry points. A bullish signal occurs when the Tenkan crosses the Kijun from below, suggesting a long position below a support level.

Exit point: To determine the exit point, a bearish signal occurs when the Tenkan crosses the Kijun from above, indicating a short position above the resistance levels.

Stop loss: To set a stop loss, measure the average of recent price swings to judge the volatility and the average distance of a buy signal failure confirmation from the suggested entry points.

Profit taking: A reasonable profit target would be an average price that moves three pips beyond the last several price swings. Once this target is reached, consider it the exit point.

Swing trading

Swing trading is a popular strategy that focuses on capturing gains by holding positions for several days to weeks. By leveraging short-term trends and price fluctuations, swing traders seek to profit from the natural cycles of the market. In this section, the experts will explore what swing trading is, its advantages, and two strategy illustrations – one for beginners and another for advanced traders.

Why Swing trading?

Swing trading offers several benefits, including the potential for significant profits, lower time commitment compared to day trading, and a balance between long-term investing and short-term trading. However, it also requires patience, discipline, and the ability to analyze market trends effectively.

How to swing trade successfully?

To excel in swing trading, a trader must develop a solid trading plan, adhere to risk management principles, and maintain a strong understanding of technical and fundamental analysis. Employing well-defined strategies is also essential to navigating market swings.

1: Moving Average Crossover (Beginner)

The moving average crossover strategy is a popular approach for beginners in swing trading. This method relies on two moving averages, one short-term and one long-term, to generate buy and sell signals.

Entry point: A trader enters a long position when the short-term moving average crosses above the long-term moving average, indicating the beginning of an uptrend.

Exit point: The trader exits the position when the short-term moving average crosses below the long-term moving average, suggesting a potential downtrend.

Stop loss: A stop loss can be placed below a recent swing low to protect the trade from excessive losses.

Profit taking: Profits can be taken when the trader reaches a predetermined price target or when a reversal signal is observed.

2: Elliott Waves

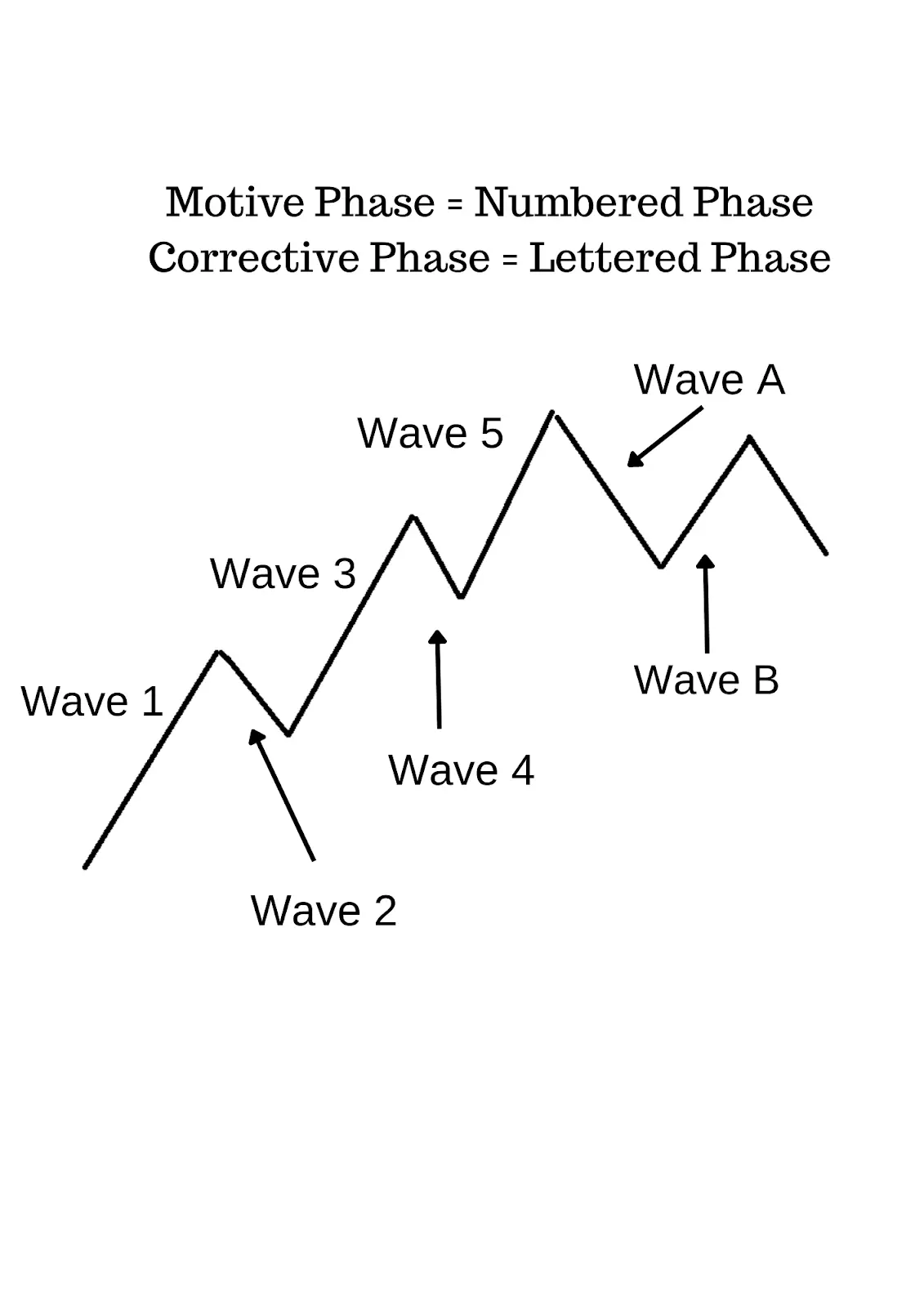

The Elliott Wave Theory is an advanced method of technical analysis that aims to predict price movements based on recurring wave patterns driven by investor psychology or sentiment. This complex theory identifies two types of waves: motive (impulse) waves and corrective waves.

Entry point: Traders using the Elliott Wave Theory enter a position when they identify the beginning of a new motive wave or the end of a corrective wave.

Exit point: The position is exited when the motive wave is expected to end, or a corrective wave is about to begin.

Stop loss: A stop loss can be placed below the recent low in an uptrend or above the recent high in a downtrend to limit potential losses.

Profit taking: Profits can be taken based on Fibonacci ratios, such as 38% or 62% retracements of the preceding impulse wave, or when the trader anticipates the completion of the current wave pattern.

Scalping

Scalping is a high-frequency trading strategy that aims to make profits from small price movements in the market. This approach involves entering and exiting multiple trades within a short time frame, often seconds to minutes, taking advantage of rapid market fluctuations. In this section, the experts will discuss what scalping is, its advantages, and two strategy illustrations – one for beginners and another for advanced traders.

Why scalping?

Scalping offers the opportunity for quick profits and limited exposure to market risk due to the short holding periods. However, it requires strong discipline, quick decision-making skills, and the ability to manage multiple open positions simultaneously.

How to scalp effectively?

Successful scalping demands a solid trading plan, strict risk management, and a comprehensive understanding of technical indicators.

1: Parabolic SAR Indicator

The Parabolic SAR (Stop and Reverse) indicator is a popular tool for beginners in scalping. This method helps identify potential entry and exit points by plotting dots either above or below the price bars, indicating the direction of the trend.

Entry point: A trader enters a long position when the Parabolic SAR dots are below the price bars, suggesting an uptrend. Conversely, a short position is entered when the dots are above the price bars, indicating a downtrend.

Exit point: The trader exits the position when the Parabolic SAR dots reverse their position, signaling a potential trend change.

Stop loss: A stop loss can be placed at the most recent Parabolic SAR dot, limiting potential losses.

Profit taking: Profits can be taken when the trader reaches a predetermined price target or when the Parabolic SAR signals a trend reversal.

2: Bollinger Bands and Stochastic Scalping Strategy

The Bollinger Bands and Stochastic scalping strategy focuses on identifying potential reversals in price action when a specific asset or position reaches overbought or oversold levels. This strategy is ideal for day traders looking to capitalize on small price movements to generate profits. To implement this strategy, set up the following indicators on your chart:

Bollinger Bands (20, 2).

Stochastic (14, 5, 3).

Entry point: For a long position, enter the trade when the price breaks below the lower Bollinger Band and then closes above it, with the Stochastic indicator below 20. Conversely, for a short position, enter the trade when the price breaks above the upper Bollinger Band and then closes below it, with the Stochastic indicator above 80.

Exit point: Traders can consider taking profits at the middle line between the Bollinger Bands before moving their stop to breakeven. Alternatively, they can close their positions when the price reaches the opposing Band, as this often indicates a potential reversal in the current trend.

Stop loss: To manage risk, place a stop-loss order three pips above the candle's high for a short trade, or three pips below the candle's low for a long trade. This helps limit potential losses if the trade goes against the trader's expectations.

Profit taking: A reasonable profit target could be the average price movement of three pips beyond several recent price swings. Once this target has been reached, traders can consider exiting the position to lock in their gains. Keep in mind that this is a scalping strategy, and the goal is to capitalize on small price movements, so it's essential to manage risk and maintain discipline in executing the trades.

Buy and Hold Strategy

Buy and hold is a long-term investment strategy in which an investor buys stocks, bonds, or other assets and holds them for an extended period, regardless of market fluctuations. This passive approach relies on the belief that, over time, financial markets will provide a positive return on investment.

What is Buy and Hold strategy?

Buy and hold strategy involves purchasing a diverse mix of assets, such as stocks, bonds, or index funds, with the intent to hold them for a long time horizon, often spanning years or decades. Investors following this strategy typically ignore short-term market fluctuations and instead focus on the long-term growth potential of their investments.

Why should one use Buy and Hold strategy?

The buy-and-hold strategy is based on the idea that, historically, financial markets have provided positive returns over extended periods. By holding investments for the long term, investors can benefit from compounding returns, reduce the impact of short-term market volatility, and avoid the risks and costs associated with frequent trading. Additionally, this passive approach requires minimal time and effort to manage, making it suitable for investors who prefer a hands-off approach or have limited time to devote to active trading.

Let’s consider this in the case of Apple. An investor who believed in Apple's strong fundamentals and observed the positive technical indicators could have employed a buy-and-hold strategy. For example, if an investor had bought Apple shares in 2016 at around $28 per share, they would have seen a significant return on their investment over the years, as the stock price has soared to over $150 per share as of March 2023.

What trading strategies are the best for you

The ideal trading strategy for you depends on various factors, such as your financial goals, risk tolerance, time horizon, and investment knowledge. To help you choose the most suitable strategy, we've prepared a table that offers a brief overview of some popular trading methods. You can read about choosing a trading strategy depending on your type of thinking in the Traders Union article. You can learn more which Forex trading strategies to choose in the Traders Union article.

| Day Trading | Swing Trading | Scalping | Buy and Hold | Position Trading | |

|---|---|---|---|---|---|

Risk | High | Moderate | High | Low | Moderate |

Capital | High | Moderate | Low | Low | Moderate |

Duration | Short-term | Medium-term | Short-term | Long-term | Long-term |

Skills Required | Advanced | Intermediate | Advanced | Beginner | Intermediate |

Frequency of Trades | High | Low | Very High | Very Low | Low |

Time Commitment | High | Moderate | High | Low | Moderate |

Market Sensitivity | High | Moderate | High | Low | Moderate |

Technical Analysis | Essential | Essential | Essential | Helpful | Essential |

Fundamental Analysis | Less Crucial | Important | Less Crucial | Crucial | Important |

Emotional Control | Essential | Important | Essential | Helpful | Important |

Leverage Usage | Moderate | Moderate | High | Low | Moderate |

Commissions Impact | High | Low | High | Low | Low |

How to build a trading strategy?

Experts have suggested the following step-by-step process to help you build your own trading strategy:

Define your objectives: Determine your financial goals, risk tolerance, and investment horizon to create a clear vision of what you want to achieve.

Choose a trading style: Select a trading style that aligns with your objectives, such as day trading, swing trading, or long-term investing.

Research and select trading instruments: Identify the financial instruments you'll be trading, such as stocks, Forex, or commodities.

Identify technical and fundamental analysis tools: Choose relevant tools to analyze the markets, including chart patterns, technical indicators, and economic data. One such method is volume spread analysis, which examines the relationship between volume and price movements.

Develop entry and exit rules: Establish clear rules for when to enter and exit trades, including specific criteria and signals that must be met.

Set risk management guidelines: Define your risk management plan, including position sizing, stop losses, and profit-taking levels.

Create a trading plan: Consolidate your strategy into a written trading plan that outlines your objectives, trading style, instruments, analysis tools, entry and exit rules, and risk management guidelines.

Backtest your strategy: Test your strategy using historical data to evaluate its effectiveness and make necessary adjustments.

Implement your strategy: Start trading using your strategy, monitoring your progress, and making adjustments as needed based on real-world performance.

Review and refine: Regularly review your strategy's performance, making improvements and adapting to changing market conditions.

How to use any trading strategy effectively?

Risk management: Establish and consistently apply risk management principles, such as setting stop losses and limiting the size of each trade relative to your account balance.

Sticking to the rules: Discipline is key; follow the rules of your trading strategy without deviating or letting emotions influence your decisions.

Backtesting: Test your strategy using historical data to assess its performance and identify any weaknesses before implementing it in live trading.

Revising the strategy: Periodically review and adjust your strategy as needed to ensure it remains effective in changing market conditions.

Understanding the macroeconomic environment: Be aware of global economic events and their potential impact on the markets. This awareness can help you adapt your strategy to mitigate risks or capitalize on opportunities during extreme events.

Continuous learning: Stay informed about market developments, new trading tools, and techniques to enhance your trading skills and strategy effectiveness.

Maintain emotional control: Manage your emotions, such as fear and greed, to avoid impulsive decisions that may negatively impact your trading performance.

Read more in the article: Your Keys To Profitable Trading

Best brokers for trading in 2025

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Currency pairs |

60 | 90 | 68 | 80 | 100 |

|

Crypto |

Yes | Yes | Yes | Yes | Yes |

|

Stocks |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Max. Regulation |

Tier-1 | Tier-1 | Tier-1 | Tier-1 | Tier-1 |

|

TU overall score |

6.83 | 7.17 | 6.79 | 6.95 | 6.9 |

|

Open an account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Focus on selecting one strategy that matches your personal risk

As a trading strategist, I often see newcomers overwhelmed by the sheer number of trading strategies available - from scalping and day trading to swing trading and long-term investing. My advice is simple: don’t fall into the trap of constantly switching approaches in search of a 100% win rate. Instead, focus on selecting one strategy that matches your personal risk tolerance, time availability, and capital.

For example, if you have limited time, swing trading or a buy-and-hold strategy may suit you better than high-frequency scalping. Once you’ve chosen your strategy, the key to success is consistency. Backtest your method, stick to a clear set of rules, and keep a trading journal to track your performance over time.

Trading isn’t about chasing the hottest technique - it’s about mastering one approach, refining it through experience, and maintaining emotional control even when markets get rough. That’s the foundation of long-term profitability in any market.

Conclusion

There are various trading strategies, such as day trading, swing trading, scalping, and buy-and-hold, that come as a choice for traders. So, it becomes a task for them to choose the best approach tailored to their individual needs. Success in trading requires discipline, adherence to risk management principles, understanding the macroeconomic environment, and continuous learning. By selecting a suitable trading strategy and maintaining emotional control, traders can effectively navigate the world of trading and achieve their financial goals.

FAQs

What is the most effective trading strategy?

There is no single most effective strategy for trading. Rather, there are several commonly used techniques, such as breakout trading, scalping, and swing trading.

How do I choose a trading strategy?

To choose a trading strategy, consider factors such as your financial goals, risk tolerance, time commitment, and trading knowledge. Research various strategies and select one that suits your needs and aligns with your objectives.

What is the 5- 3- 1 rule in trading?

The 5-3-1 rule in trading represents a guideline for Forex traders to focus on: mastering five currency pairs, becoming an expert in three trading strategies, and consistently trading at the same time every day. This approach helps traders specialize and develop consistency in their trading routines.

Which trading strategy has the highest success rate?

There is no one-size-fits-all answer to this question, as the success rate of a trading strategy depends on various factors, such as a trader's experience, risk tolerance, and market conditions. However, some popular trading strategies with notable success rates include day trading, swing trading, scalping, and buy-and-hold investing.

How to choose a trading strategy?

When selecting a trading strategy among popular ones like breakout trading, moving average crossover trading, and the Elliot Wave Theory, it is recommended to do thorough research and back-testing before selecting a strategy and to always maintain a disciplined approach to risk management.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Breakout trading is a trading strategy that focuses on identifying and profiting from significant price movements that occur when an asset's price breaches a well-defined level of support or resistance.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.