Best Forex chart patterns

Chart patterns play a crucial role in the realm of Forex trading, as they provide valuable insights into the market's underlying psychology and potential future price movements. Understanding and identifying these patterns can significantly enhance a trader's decision-making process, ultimately leading to more informed and profitable trades. In this article, the experts at TU will explore the top 10 most powerful Forex chart patterns that professional traders utilize to improve their trading performance. By gaining a deep understanding of these patterns and their underlying principles, you will be better equipped to navigate the complexities of the Forex market and make well-informed trading decisions.

According to Traders Union’s experts, the top 10 Forex chart patterns are:

-

Double Top

-

Head and Shoulders

-

Flag pattern strategy

-

Engulfing patterns (bullish and bearish)

-

Morning Star

-

Piercing Line

-

Hammer

-

Shooting Star

-

Harami

-

Doji

Top 10 Forex chart patterns

The following are the top 10 Forex chart patterns that every trader should know, as suggested by our experts:

Head and Shoulders pattern

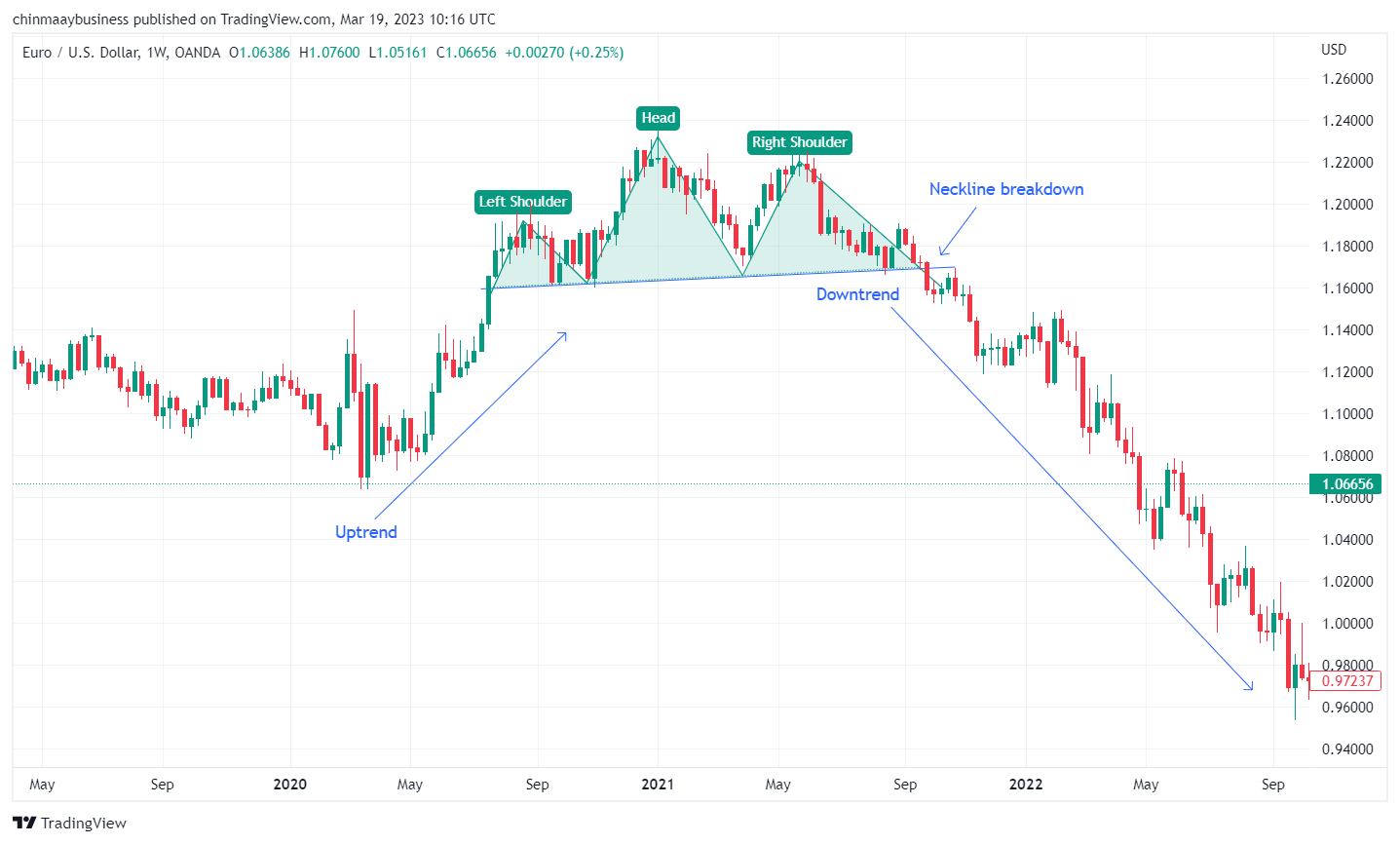

The Head and Shoulders pattern is a widely recognized trading strategy designed to identify trend reversals by interpreting distinct formations on the chart. This approach hinges on spotting a particular price pattern composed of a central peak (the head) surrounded by two lower peaks (the shoulders). By scrutinizing the market's activity around these crucial formations, traders can make well-informed decisions regarding entry, exit, and risk management.

Entry Point: To identify the entry point in the Head and Shoulders pattern, look for the pattern's completion, indicated by a break below the neckline. The neckline is a support level drawn by connecting the lows between the head and the shoulders.

Exit Point: To determine exit points using the Head and Shoulders pattern, measure the distance between the head's highest point and the neckline, known as the pattern's height. Project this distance downward from the neckline to establish a price target for exiting the trade.

The head and shoulders pattern

Flag Pattern strategy

The Flag Pattern strategy is a dynamic trading approach that focuses on capturing continuation patterns within an ongoing trend, whether ascending or descending. These patterns serve as reliable indicators that the current trend is likely to resume after a temporary pause in the asset's price movement, offering traders valuable insights into potential future price action.

Entry Point: To pinpoint the entry point for the Flag Pattern strategy, keenly observe the breakout of the flag formation. In the case of a bullish flag, you would want to initiate a long position when the price breaks above the upper boundary of the flag formation, signaling a likely continuation of the upward trend.

Exit Point: To establish the exit points for this strategy, start by measuring the length of the flagpole, which represents the initial price movement before the consolidation phase. Next, project this length from the breakout point of the flag formation. This projection will provide you with a price target, enabling you to determine an appropriate exit point for your trade.

Flag pattern

Double Top pattern

The Double Top pattern is a highly regarded reversal pattern that can be identified across a variety of chart types. This pattern frequently indicates that an asset's current trajectory is about to change, reversing its course and moving in the opposite direction. The Double Top is defined by two separate peaks at roughly the same price level, with a trough between them, commonly referred to as the neckline.

Entry Point: In a Double Top pattern, after the formation of the second peak, and as the price starts to retreat towards the neckline, consider entering a short position as the price breaks below the neckline. This break signifies the potential beginning of a downward trend.

Exit Point: A popular method for setting an exit point involves measuring the distance between the peaks and the neckline. Once measured, project this distance downward from the neckline to establish a price target. This target will guide you in determining a suitable exit point for your trade, allowing you to capitalize on the potential trend reversal.

Double Top pattern

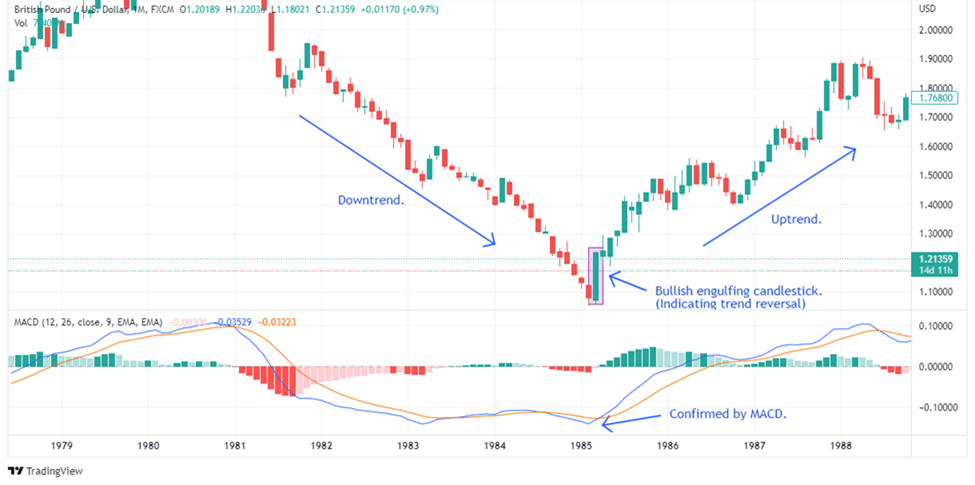

Engulfing pattern

The Engulfing Pattern is a highly critiqued two-candle chart pattern that often emerges when a prevailing trend, be it upward or downward, starts losing steam. This pattern is marked by a smaller candlestick followed by a larger one that fully engulfs the preceding candle. When you spot this pattern, it can be a good level to enter a trade in the direction opposite the prior trend.

Entry Point: A bullish engulfing pattern consists of an initial bearish candlestick overshadowed by a larger bullish candlestick that engulfs the previous one. In this scenario, you can initiate a long position once the second candlestick is completed.

Exit Point: When engaging in a long trade, it is advisable to exit the position when the price reaches a significant resistance level or demonstrates signs of reversing.

The Engulfing Pattern

Morning Star pattern

The Morning Star pattern is a three-candlestick formation that provides insight into potential trend reversals. This pattern consists of a long red candle, a small-bodied candle (which can be red or green) that gaps lower, and a long green candle closing within the range of the initial candle. This pattern signifies a diminishing downtrend, as the small-bodied candle reflects market indecision, followed by a robust green candle indicating a bullish reversal.

Entry Point: After the formation of the small-bodied candle, which denotes market uncertainty, watch for the emergence of the long green candle. Once the green candle closes within the range of the first red candle, consider initiating a long position, as this suggests a potential bullish reversal.

Exit Point: To determine an exit point for a trade based on the Morning Star pattern, observe the market for significant resistance levels with the help of Fibonacci retracement.

The Morning Star pattern

Piercing Line pattern

The Piercing Line pattern is an easy-to-recognize two-candle formation that can help you spot potential market changes. It has a long red candle followed by a long green candle. The green candle starts below the red candle's lowest point, but it ends up closing more than halfway above the middle of the red candle. This strong finish of the green candle shows that the market is shifting and that buyers are becoming more powerful.

You'll mostly see this pattern in stocks because they can experience price gaps overnight. However, you might also find it in other types of assets when you look at weekly charts.

Entry Point: When you see the long green candle closing above the middle of the red candle, it's a sign that buyers are starting to take control. This is a good time to consider buying, as it suggests the market is turning more bullish.

Exit Point: To decide when to exit the market and set a target price, look for important resistance levels or spots where the price reversed in the past. To figure out a target price, measure the distance from the lowest point of the green candle to the highest point of the red candle. Add this distance to the highest point of the green candle, and you'll have a target price.

The Piercing Line pattern

Hammer pattern

The Hammer candlestick pattern is a useful tool for identifying potential shifts in the market's direction. It forms when a security's price falls significantly below its opening price, only to recover and close near the opening price. The pattern's long lower shadow reveals that, despite initial selling pressure, buyers managed to regain control and push the price back up, suggesting a possible bullish reversal.

Entry Point: To leverage the Hammer pattern for market entry, first, look for a candlestick with a long lower shadow and a small body near the end of a downtrend. When you observe this pattern, it indicates that buyers are gaining strength in the market, which is a good opportunity to consider a long position, as an upward trend may be on the horizon.

Exit Point: To establish an exit point and target price, identify key resistance levels or recent price reversal points. A different approach to setting a target price is to consider the overall market context and other technical indicators, such as moving averages or trendlines.

The Hammer candlestick pattern

Doji pattern

The Doji candlestick pattern offers valuable insights into the market's potential shifts by illustrating moments of indecision. This pattern occurs when a security's opening and closing prices are almost the same, leading to a candlestick with a minimal or non-existent body and possibly elongated shadows. The Doji represents a state of equilibrium between buyers and sellers, and depending on the context of previous candles and the overall market trend, it may indicate either a trend reversal or continuation.

Entry Point: When using the Doji pattern to determine an entry point, it is crucial to analyze the surrounding market context. If the Doji appears after a series of bullish or bearish candles, it can signal a weakening trend and potential reversal. In this case, you can consider entering the market in the opposite direction of the prevailing trend once the following candle confirms the reversal.

Exit Point: Setting an exit point and target price with the Doji pattern requires a thorough examination of other technical indicators and support or resistance levels. One way to set a target price is to utilize Fibonacci retracements, which can help identify potential reversal points based on the prior trend's magnitude. To apply this method, draw the Fibonacci retracement levels from the start of the trend to the Doji pattern, and use the retracement levels as potential exit points.

The Doji candlestick pattern

Shooting Star pattern

The Shooting Star pattern is another helpful trading tool for identifying potential reversals in the market. This single candle pattern consists of a small body, a long upper shadow, and little or no lower shadow. The pattern typically appears after an uptrend, with the long upper shadow suggesting that sellers are attempting to drive prices down. The small body of the candle indicates that selling pressure is increasing, potentially signaling a trend reversal.

Entry Point: To apply the Shooting Star pattern in your trading, first, verify that the pattern has formed after a notable uptrend. The appearance of the Shooting Star, with its distinct long upper shadow and small body, is an indication that the bullish momentum is weakening. When you observe this pattern, consider entering a short position, as it suggests that the market may begin to trend downward.

Exit Point: When it comes to setting an exit point and target price with the Shooting Star pattern, it's important to look at the overall market structure and other technical indicators. One approach is to identify nearby support levels where the price has previously bounced back up. You can set your target price at these support levels, anticipating that the price may reverse again once it reaches them.

The Shooting Star pattern

Harami pattern

The Harami pattern can help traders identify potential trend reversals or consolidations in the market. It comprises two candles: the first being a large-bodied candle, followed by a smaller candle (either red or green) whose body is entirely within the range of the preceding candle. The presence of the smaller-bodied candle is an indication that the momentum from the previous day's robust price movement is diminishing, suggesting a possible trend change or a consolidation phase.

Entry Point: When using the Harami pattern to pinpoint an entry point, it is essential to observe the context in which it appears. If the pattern forms after a substantial uptrend or downtrend, the small-bodied candle signifies a potential reversal. In this case, you can consider entering the market in the opposite direction of the prevailing trend once the subsequent candle confirms the reversal.

Exit Point: To set an exit point and target price with the Harami pattern, it's beneficial to examine other technical indicators and significant support or resistance levels. One method is to use moving averages to gauge potential reversal points. For instance, if the price approaches a key moving average, such as the 50-day or 200-day moving average, you can set your target price at this level, anticipating a possible reaction at these points. Another approach is to use the Average True Range (ATR) indicator, which measures the market's volatility. By multiplying the ATR value by a chosen factor, you can establish a target price based on the asset's recent price fluctuations.

The Harami pattern

What is a graphic pattern?

In Forex, currency pairs are sometimes called trading pairs, and that is fair since they are used to exchange one national currency for another. To be more precise - it's buying one currency for the face value of the other. As you see from the word "pair", we are talking about two assets that are recorded sequentially. The order of the currency in the record has conceptual value for currency pairs trading.

Trading patterns in the stock market began to develop actively with the advent of the ability to track price movements on the monitor screen and build charts in programs. By now, over 100 trading patterns have been developed, so that a whole section in the field of technical analysis has appeared. It is called graphical analysis. However, please be aware that the vast majority of formations on the network are nothing more than the fantasies of individual traders. On the other hand, patterns that are now recognized as classics were once also someone's fantasy.

Types of Forex chart patterns

In fact, any classification shall be considered conditional because of the perception of subjectivity. Nevertheless, all trading patterns in the stock market are usually divided into two main types, based on their ratio to the current trend.

Reversal patterns. According to the name, the result of the analysis of such a formation indicates to the trader that the trend will reverse abruptly. For example, the EUR/USD quotes, which have been going up in the past few days, will confidently decrease tomorrow.

Continuations. This group of formations is also called trend formations because they reflect the continuation of the trend. That is, based on the analysis of such patterns, the trader understands that the actual movement on the price chart will continue.

Accordingly, there are indicators for reversal patterns and indicators for trend patterns. Sometimes dual patterns are designated in a separate group. In this case, the level of chart growth is always equal to the level of its fall. This group includes the Wedge and Triangle trading patterns. They are considered the most dangerous for novice traders since it is more difficult for them to predict when a breakout will occur (that is, when the chart will go beyond the pattern).

Technical patterns: Pros and cons

You cannot name the "best Forex patterns". As in the case of indicators, various technical figures are designed to solve specific problems and identify certain patterns, based on the characteristics of the assets traded and the strategies used. That is why there are so many patterns. Nevertheless, there are a few core patterns among them, and we will analyze each below.

Visual clarity. The first advantage of charting formations. Looking at the chart after the indicator is triggered, the trader can see clearly the emerging pattern that is taking shape. Certain patterns will forecast other similar patterns that may be programmed or triggered.

Consistency. A trading pattern is formed following strict rules. If the rules are violated, this is no longer a pattern and the corresponding analysis methods cannot be applied to it.

Independence. Potentially graphical formations of technical analysis allow you to analyze the market without the use of extra tools. Everything you need to make a decision is provided on the monitor screen.

The pattern formation rules have been developed and tested long ago, so there is no need to do anything by yourself. Just identify these patterns using indicators and analyze them. Moreover, there is no need for indicators to detect a trading pattern, you can use only levels and trends on a rising or downtrend curve.

This really greatly facilitates Forex trading, allowing you to make informed decisions quickly. The only drawback of graphic patterns is the subjectivity of their perception. Expressed differently, an experienced trader can detect a non-standard Forex pattern on the same chart and make money on it, but a novice trader will see some typical formation and make a false solution.

Top 7 Strong Bullish Patterns in TradingPatterns vs Indicators: What should you use?

Chart patterns offer insights into market trends, helping traders identify recurring patterns and potential trading opportunities. However, they require experience and judgment for effective analysis, making them riskier for beginners. So experts suggest that novice traders should use additional sources of information to support or challenge their judgments.

Technical indicators provide a data-driven approach, relying on established data points for predicting market trends. They offer a definitive and objective perspective on trading opportunities. However, they have limitations, as success is not guaranteed, and some indicators may overemphasize specific data or carry a higher risk due to varying historical support.

Ultimately, the decision to use chart patterns or technical indicators largely depends on your trading strategy and personal preferences. A well-rounded approach is to use both techniques in tandem, leveraging the strengths of each method while compensating for their respective weaknesses. This concept is known as confluence, which involves using multiple analytical tools to support or contradict one another, leading to more robust trading decisions.

As you develop your trading skills and gain experience, you'll naturally gravitate toward the methods that resonate with your trading style and risk tolerance. By combining the insights from chart patterns and technical indicators, you can create a comprehensive and adaptable trading strategy that caters to your unique needs and preferences.

How to trade Forex using patterns

According to experts, it is crucial to hone your abilities in detecting and recognizing patterns, as relying on them blindly can lead to the loss of your investment, particularly for beginner traders.

Although patterns may accurately predict outcomes only about 50% of the time, analyzing them remains beneficial. A chart with a distinct pattern provides a clearer understanding of potential price movements compared to one without a pattern.

Summary

Both beginners and experienced traders can benefit from familiarizing themselves with chart patterns such as the Morning Star, Piercing Line, Hammer, Doji, Shooting Star, and Harami. These patterns provide valuable insights into market trends and potential opportunities.

While chart patterns offer a more intuitive approach based on historical patterns, technical indicators provide a data-driven and analytical perspective on trading opportunities. Both methods have their advantages and drawbacks, and the choice ultimately depends on individual trading strategies and personal preferences.

FAQs

What is the most effective chart pattern in Forex?

The most effective chart pattern in Forex varies depending on the trader's experience and strategy. That being said, many traders have suggested that the Head and Shoulders pattern is considered highly reliable for identifying trend reversals.

What is the most successful chart pattern?

The most successful chart pattern is subjective and depends on individual trading styles. That being said, experts suggest that Head and Shoulders and Double Top/Bottom patterns are known for their high success rates in predicting trend reversals.

What is a 3 top Forex pattern?

A 3 top Forex pattern, also known as a Triple Top, is formed by three peaks reaching the same price level with pullbacks in between. This pattern typically signals a bearish trend reversal.

What are the most useful trading patterns?

According to experts, the most useful trading patterns include Head and Shoulders, Double Top/Bottom, Triple Top/Bottom, Harami, and Doji. These patterns provide valuable insights into potential trend reversals and continuations, helping traders make informed decisions.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.