How to use Fibonacci retracement tool effectively

The Fibonacci retracement tool is a popular technical analysis tool used by Forex traders to identify possible support and resistance price levels. It is based on the idea that prices tend to retrace predictable portions of a previous move. After that the trend tends to continue in the initial direction. The tool is named after the mathematician Leonardo Fibonacci, who discovered the numerical sequence where the ratios used in the tool are derived. While Fibonacci retracements can be a powerful tool in trading, using them effectively requires a good understanding of how they work and how to apply them in different market conditions. In this article, we explore how to use the Fibonacci retracement tool effectively to improve your trading decisions.

How to use Fibonacci retracement tool in MT4:

-

Determine whether we are looking for support or resistance based on the preceding trend

-

Click the Fibonacci icon on the top toolbar of MT4

-

Move the tool to the top of the trend and then let go (opposite for a downtrend)

-

The ratios will then show up on your chart

What is a Fibonacci retracement?

The Fibonacci retracement tool is used to assist in identifying support and resistance levels during countertrend moves (retracements, pullbacks) to assist in finding potential support levels in uptrends and resistance in downtrends. In addition, it can be used for targets for counter trend trading. This article focuses on using the tool for trading in the direction of the trend.

Retracement levels are derived mathematically based on the prior swing that is being measured. Once a trend high or low is established the retracement tool can be used. Retracement levels used in the tool are derived from the Fibonacci series of numbers where each number in the series is the sum of the two preceding numbers. Read more in the article: Why The Fibonacci Indicator Is Important.

Fibonacci number series starting with 0:

0, 1, 1, 2, 3, 5, 8, 13, 21 34, 55, 89, 144, 233, 377, …

0 + 1 = 1

1 + 1 = 2

2 + 1 = 3

… etc

As the series progresses the ratio between two adjacent numbers gets closer to the golden ratio of 1.618. The Golden ratio (phi) is a mathematical constant that appears in a variety of natural and human phenomena. Since human decision making is behind all market activity it also works in markets. Golden ratio relationships are found throughout the human body, in the self-organized structure of a hurricane, and the spiral of galaxies, to name a few examples:

144/89 = 1.6179

233/144 = 1.6180

377/233 = 1.6180

. . . etc

Further, if we measure the ratio of an earlier number with the next highest in the series, we start finding the Fibonacci retracement ratios as we move further into the series. The primary ratios used in the Fibonacci retracement tool are:

-

0.236 (23.6%)

-

0.382 (38.2%)

-

0.50 (50%)

-

0.618 (61.8%)

The 50% level is not a Fibonacci ratio, but it is a common retracement ratio that originates from the Dow Theory, while 61.8% is related to the golden ratio as it is the reciprocal (1/1.618):

13/21 = 0.6190

34/55 = 0.618

. . . etc

The 38.2% ratio comes from dividing a number in the series by the number two places forward. Ex. 144/377 = 38.2% (1/1.618)

The first ratio used, 23.6% is the result of taking a number in the series and dividing it by the number three forward. Ex. 89/377 = 23.6%

How Does Support and Resistance Work in TradingHow to draw Fibonacci retracement levels in MT4

To draw the Fibonacci retracement tool, we first need to determine whether we are looking for support or resistance based on the preceding trend. Once identified, click the Fibonacci icon on the top toolbar of MT4. Once the tool is active, left click and hold down at the bottom of the trend and move the tool to the top of the trend and then let go (opposite for a downtrend). The ratios will then show up on your chart. Editing is possible, discussed later, if you want to change color, line thickness or style, or the ratios.

How to draw Fibonacci retracement levels in MT4

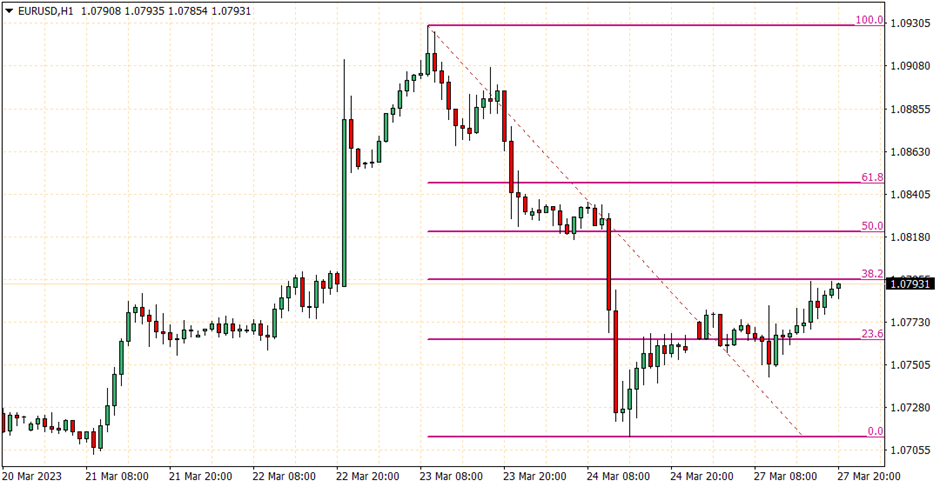

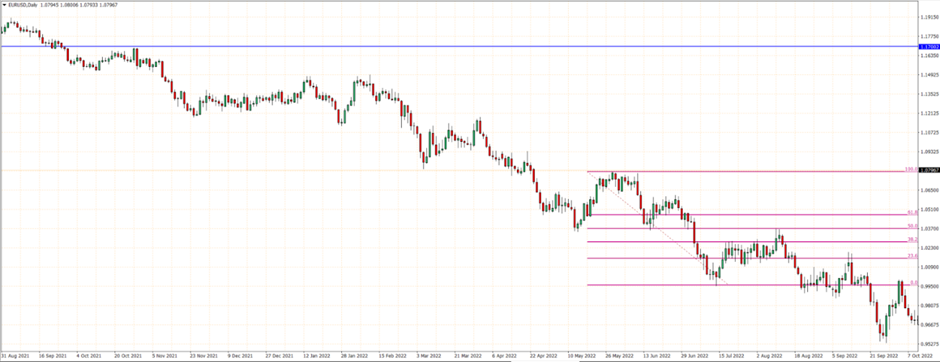

If we are looking for support, we are anticipating a pullback from a prior advance in which case we need a trend high and low identified to draw the tool. In this example of the EUR/USD we start the tool at the bottom trend and bring it up to the top of the trend and let go. You can see how the price stalled around the 23.6% level on the way down, went through the 50%, until finding support around the 61.8% level.

How to draw Fibonacci retracement levels in MT4

In this next EUR/USD example we are looking for resistance as we anticipate a decline. First, identify the downtrend. Start the tool at the top of the trend and move down to let go at the bottom of the trend. You can see on the way up that price stalled at the 23.6% level but did break through before rising to the 38.2% level and stalling.

How to draw Fibonacci retracement levels in MT4

Fibonacci retracement levels use cases

Best Reversal Indicators And PatternsUsing the Fibonacci retracement tool in an uptrend

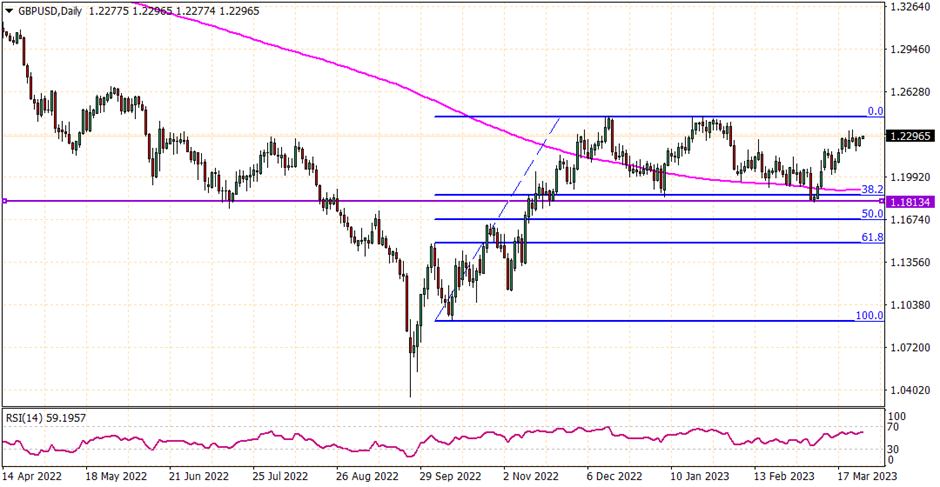

Here, we look at the development of an uptrend and where Fibonacci analysis could have been utilized. Starting from the bottom of the trend the retracement tool is drawn from the low to the high. The GBP/USD retraced to the 50% zone (doesn’t have to be exact) before the stronger force kicked in and prices continued to rise.

Using the Fibonacci retracement tool in an uptrend

Next, we look at the second swing and measure low to high. During this retracement support was seen at the 38.2% level. We can say then that momentum is improving as the first retracement was deeper. This means that buyers are stepping up earlier in the retracement, compared to the previous swing retracement, to support price.

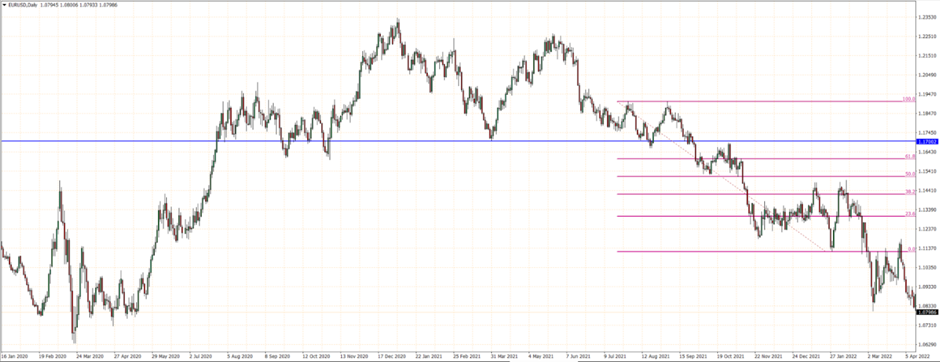

Using the Fibonacci retracement tool in a downtrend

This next example looks at the evolution of a downtrend and use of Fibonacci analysis. In a downtrend we are looking for areas of possible resistance that may present shorting opportunities. First, a breakdown occurs on a move below the blue horizontal. Then a downtrend (within a larger trend) is chosen. In this case, the retracement of the downtrend comes off the low at 0 on the Fibonacci tool. The retracement almost reached the 50% level as more aggressive selling took hold leading to a bear trend continuation.

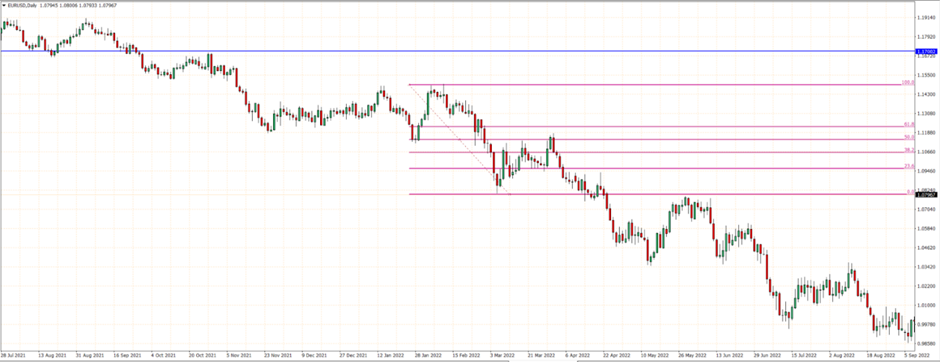

Using the Fibonacci retracement tool in a downtrend

The market keeps falling and we continue to look for a short entry on a retracement.

Using the Fibonacci retracement tool in a downtrend

Here, we see that the retracement reached the 50% zone before meeting resistance and reversing back down.

And then again below, a retracement to the 50% on a new trend measurement before trend continues.

Using the Fibonacci retracement tool in a downtrend

How to use Fibonacci retracement tool effectively

Best Trading Tools To Improve Your SkillsWhat trend do you want to measure?

There is no absolute answer to this question. It will depend on what the trader is trying to accomplish when looking to identify possible support and resistance. Whether it is the Fibonacci tool that is being used or other methods to identify price levels, the idea is the same.

Advantage of Fibonacci confluence?

The identification of retracement levels from the Fibonacci tool can provide greater value when multiple trend measures identify similar price zones, referred to as Fibonacci confluence. In this next example we’re looking at a 1-Hour chart and recent resistance.

Three measures are drawn starting at each dominant swing high (1) and drawn to the same low (2) for each. In addition, colors and line style are changed in the Fibonacci tool properties for clarity. Each measure identified a similar price level but with different ratios. Instead of one indication of support there are three thereby increasing the potential significance of the level.

USD/JPY chart

Assessing relative strength with the Fibonacci tool

Trends by their nature move forward, either up or down, and then retrace part of the advance before the dominant direction takes hold again. In an uptrend, it would be fair to say that the shallower the retracement the stronger the buying pressure. If a pullback to the 38.2% level occurs followed by a resumption of the uptrend, the pair is showing greater strength than a trend that retraced to the 61.8% level before continuing. This is one way to compare relative performance between different pairs.

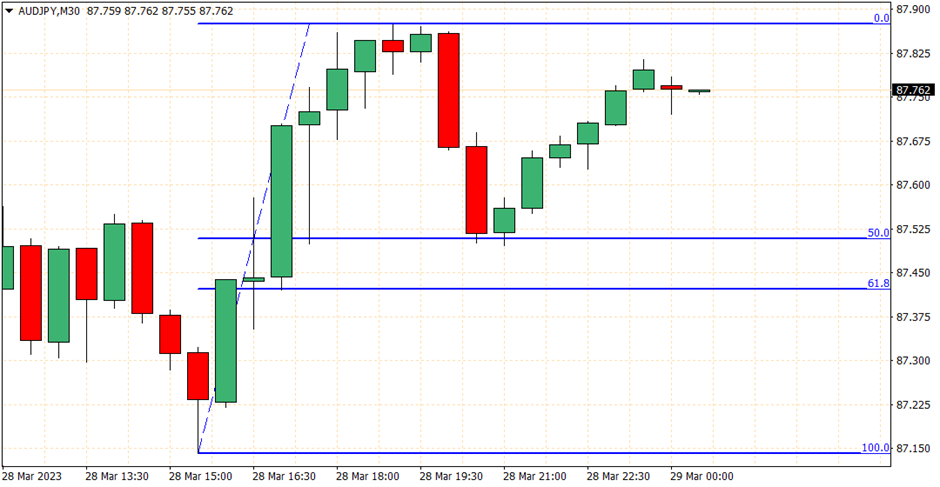

Let’s look at two Yen pairs on the 30-minute time frame, assuming other characteristics are equal. In each chart we’re analyzing the recent uptrend and degree of retracement. The AUD/JPY retraced to the 50% level before advancing while the EUR/JPY turned back up at the 38.2% retracement. Based on those results alone we can say that the EUR/JPY is exhibiting greater relative strength.

AUD/JPY chart

EUR/JPY chart

It is the opposite situation in a downtrend. The weaker or lower the retracement, the more significant the selling pressure.

Best Chart Time Frames For Day Trading to UseImproving effectiveness of the Fibonacci retracement tool

Any technical analysis observations are enhanced when there is confirming analysis. A retracement level is going to potentially be more significant if there is confirming analysis such as prior support or resistance, a moving average at similar price, and so on.

There is a concept in technical analysis called the weight of evidence. Each element of analysis is looked at individually to see what the evidence is telling us. If the evidence is clearly, bullish, or bearish, then there might be an action to take. If not, there is greater risk the future price action won’t go as planned.

In this next chart support is seen at the 38.2% retracement, confirmed by the horizontal from prior support, as well as the 200-Day moving average. Three pieces of evidence indicating support.

GBP/USD chart

Changing properties of the Fibonacci tool in MT4 for visual clarity

To adjust the properties in the Fibonacci tool first draw a retracement on a chart. Then, double left click on the tool trendline to highlight it. Next, right click and go to Fibonacci properties.

Changing properties of the Fibonacci tool in MT4

Best Forex brokers

Summary

This article explains the concept of Fibonacci retracement ratio levels and where they come from. It introduces the Fibonacci retracement tool and explains how to calculate and plot Fibonacci retracement levels on a chart. Examples are provided on how to use the tool to identify potential entry and exit points in Forex trading. The author also provides tips on how to use Fibonacci retracement levels in combination with other technical analysis tools to increase the accuracy of trading decisions. Overall, this article offers a comprehensive introductory guide for Forex traders looking to incorporate Fibonacci retracement levels into their trading strategy.

FAQs

Is Fibonacci retracement a good strategy?

It can be if it is used correctly and as part of a larger strategy. Fibonacci retracements provide an additional tool for market analysis and typically is used with other analysis. The effectiveness of any analysis tool depends on how it is deployed. The same is true for Fibonacci ratio analysis.

Where do you start the Fibonacci retracement?

For an uptrend you start at the bottom of the trend or swing you want to measure, and for an uptrend start at the top of the trend. Otherwise, the sequence of retracement ratios will be out of order. If the ratio sequence is reversed, you have drawn it backwards.

Which time frame is best for Fibonacci retracement?

There is no best time frame. For sure you want to use it on your primary time frame that you use for trading. If your trade decisions are primarily based on the hourly chart, then use the hourly and at least one higher time frame, such as 4-Hour or Daily. In addition, know your Fibonacci retracement levels on a higher time frame. If hourly, then be aware of the 4-Hour or daily, and maybe also the weekly.

Do professional traders use Fibonacci?

Yes, many professional traders use Fibonacci ratio analysis as part of their decision making process. Typically, professional traders use Fibonacci analysis in combination with a variety of technical analysis tools.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

-

4

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

5

Trend Trading

Trend trading is a trading strategy where traders aim to profit from the directional movements of an asset's price over an extended period.

Team that worked on the article

Bruce Powers is an expert trader and technical analyst with over 20 years of experience in Forex, commodities, ETFs, cryptocurrencies and other assets. He is an active trader, technical and fundamental analyst, media commentator, educator and a writer. As an author for Traders Union, he contributes his deep analytical skills, expertise and understanding of the global economy and financial markets to provide market analysis and insights. Powers is also a frequent guest on business TV news shows.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).