Note:

That to decide to trade binary options, you should carefully weigh all attendant risks. It is not worth investing more than the amount that you are willing to risk painlessly.

The success of a trader largely depends on the choice of a broker in the financial markets, since factors such as reliability, commissions, and a modern trading platform play a huge role. At the same time, different types of brokers have their own specialities, which you need to navigate to make the right choice.

In this article, you will explore the definition of “broker” and focus on what to look for when assessing the attractiveness and efficacy of the various broker types.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Brokerage activities in most countries are licensed and require confirmation of specialized knowledge of applicants. In the case of legal entities, a minimum equity capital and other requirements may also be required.

The specificity of a broker's work is that it is obliged to act exclusively in the interests of its clients. In the stock market, to avoid a conflict of interest, a broker is prohibited from holding its own open positions in stocks or other assets. This is an important difference from a dealer who is also a member of the exchange but works for his own benefit and on his own behalf.

For his work, the broker receives a reward in the form of a percentage of the trade, a fixed fee for each lot or a spread. In some cases, the exchange itself pays for a broker’s work.

Also, large companies often act as investment banks, offering their clients margin trading. In this case, they can earn a percentage of the borrowed money, shares or other assets.

The broker's role is often not limited to just executing trades. Companies may offer clients a range of related services such as:

Integrated trading platforms and other proprietary software;

Consulting and analytical support;

Investment estimates and forecasts;

Risk management services.

The full list of services can contain dozens of items.

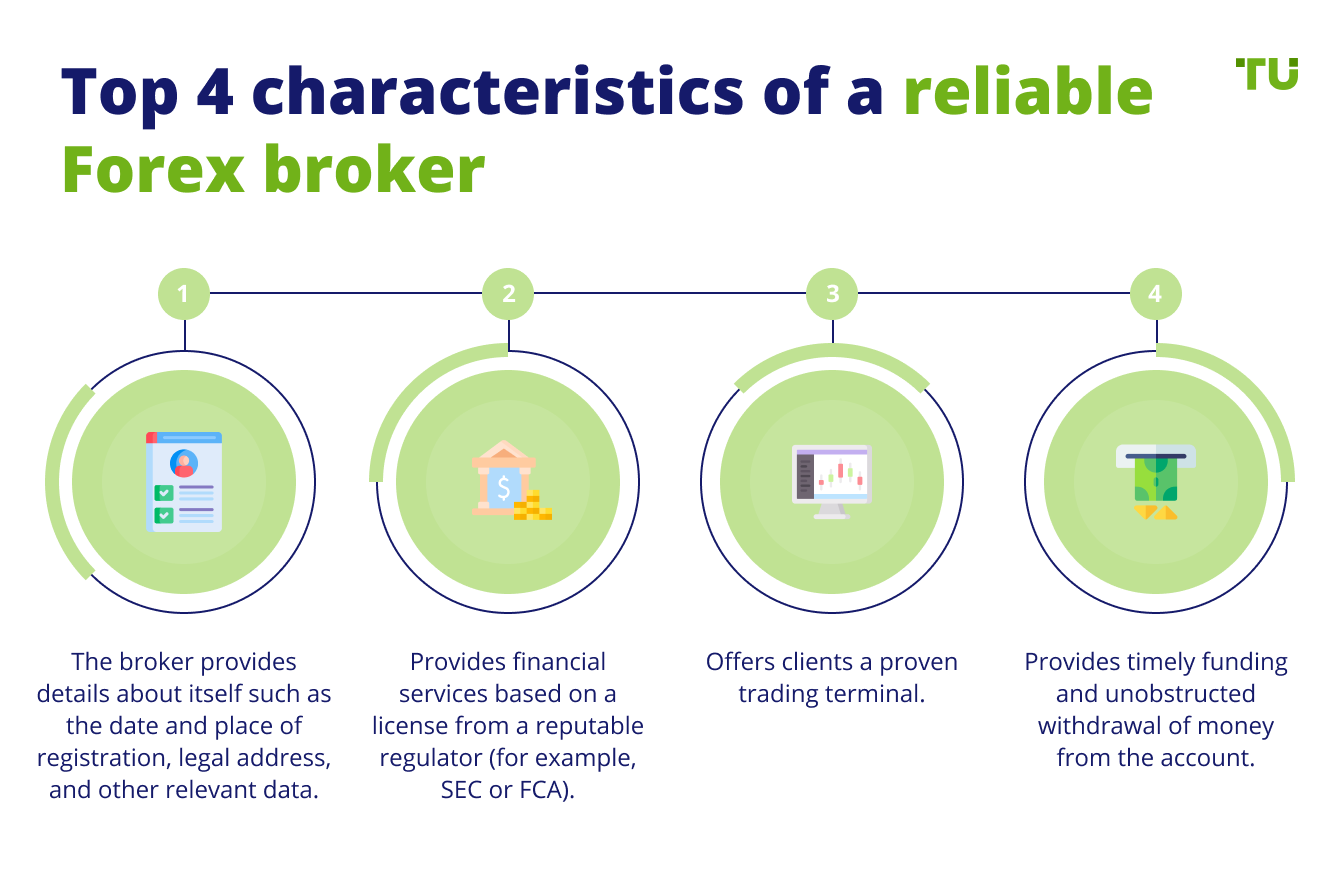

The choice of a broker plays a huge role in the success of investing and trading. For a good broker, the following characteristics are important:

Reliability and official regulation;

A wide range of markets;

Completeness of information and analytical services;

Size of the commission or fees;

Speed and quality of executions of trades’;

Multiple modern trading platforms;

Low minimum deposits;

Favorable conditions for margin trading;

Easy and fast deposits and smooth withdrawals of funds.

Your investment goals should determine which broker type you should choose. For example, if you are a long-term investor with significant capital, then commissions will play a secondary role for you, while reliability, a broad list of markets, and superb analytical services will come out on top.

For novice traders with limited capital, such indicators as the size of the commission, the minimum deposit and the ability to make trades using leverage come to the fore.

The key parameter when choosing a broker is whether it is governed by a reputable regulator. Unfortunately, financial markets attract scammers (“follow the money”) who deceive clients under the guise of brokerage companies.

The existence of a license from an authoritative regulator is prima facie evidence that the broker does not abandon its promises. It should accurately and timely disburse funds to clients and conduct itself completely within the law and its Terms & Conditions.

Experts at the Traders Union recommend giving preference to brokers regulated by agencies headquartered in the USA, UK, EU countries and other countries with high legal culture. Brokers with offshore licenses often operate without any control, and then, on average, are less reliable. The experts at Traders Union strongly recommend against working with brokers that are not licensed!

The experts at the Traders Union recommend paying attention to the following 5 tips when choosing a broker:

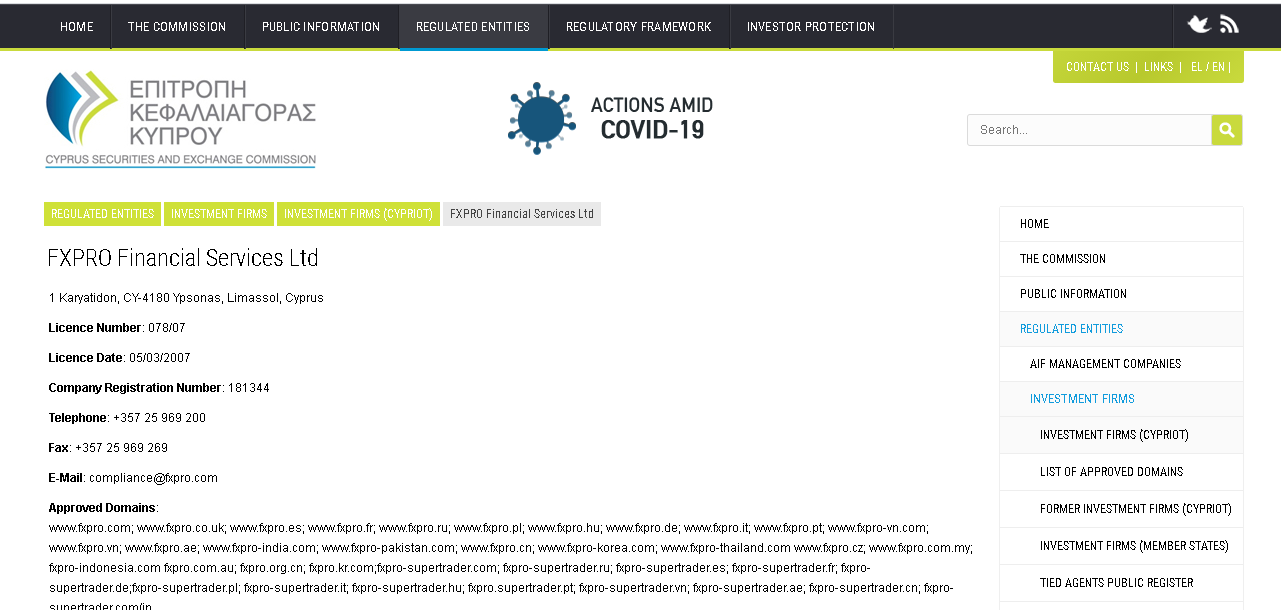

On the official websites of regulators, you can check through the search whether the company really has the declared license at that agency. For example, we checked the FxPro company on the CySEC website. All the required data was found in the search results.

CySEC Regulator

Be keenly interested in non-obvious fees. For example, in the Forex market, a swap is very important when transferring a position to the next trading day. Swap sizes are often very different from platform to platform. In the stock market, brokers charge commissions for margin trading, which can range in rates from 1.6% to 20% per annum. Also, some brokers charge withdrawal fees, inactive account fees, etc. It is important to study both explicit and implicit fees and commissions in advance.

Check out the broker’s overview on our website and read its clients’ reviews. This will help you better understand whether the broker is adhering to its promises. Often it is the reviews of former clients that protect newcomers from unscrupulous companies. Also on our website, there is a blacklist of brokers that are scam artists — allegedly.

Consider the ways of depositing and withdrawing funds that the broker offers since the commissions of payment systems can make up a significant part of your expenses.

You should be very careful about brokers who promise guaranteed profits or an easy way to make money. This is usually done by scammers. A serious broker will always warn clients about the risks and provide all important information about its work in the public domain.

For different classes of financial instruments, the specifics of the terms and conditions of the brokerage may differ. There are several types of brokers.

A stockbroker is a company that offers entry to a stock exchange of which it is a member. On behalf of and in the interests of clients, it makes trades for the purchase and sale of stocks, ETFs, mutual funds, bonds, and other assets of the stock market.

The main advantage of working with a stockbroker is that you are trading real assets. If the broker buys shares on the client's order, then the client acquires ownership of them, can receive dividends and participate in the management of the company.

Also, many stockbrokers lend stocks and money to clients, carry out a comprehensive assessment of the investment attractiveness of securities and provide portfolio management services. A stockbroker is the most classic type of brokerage.

A Forex broker is an intermediary in the currency exchange market. It has a fundamental difference from a stockbroker due to the fact that trading in the foreign exchange market is over-the-counter.

There is a large number of currency exchange channels provided by large international banks and government authorities. Individuals cannot directly participate in these trades, so the broker acts on their behalf and in their interests. Forex brokers negotiate with liquidity providers (usually leading international banks) and offer clients a connection to their exchange channels.

Since the lot size in this market is usually high — 100 thousand units of the base currency of the account — Forex brokers differ in that they provide clients with large margin leverage. This allows clients with a small capital to enter the foreign exchange market but carries an increased risk of losses due to volatility.

A futures broker provides access to the derivatives exchange, where, in addition to futures, options, swaps and other complex financial instruments are traded. As a rule, large stockbrokers provide access to the futures market.

This type of broker offers trading in various global markets using Contracts for Difference (CFD). A CFD is a derivative, which is essentially a contract between a broker and a client regarding the price of a financial asset. The underlying asset can be the price of stocks, currency pairs, futures contracts, bonds, etc. Any instrument whose price changes can become the basis for CFDs.

The advantage of this broker is a small entry threshold and easy access to various financial markets. Thanks to the small lot size and high margin, you can even start with as little as $100.

For example, if you buy CFDs on Apple shares, this means that if the price of the underlying asset on the stock exchange rises, you earn, but if the share price falls, you lose. Everything is like in a regular market, with the fundamental difference that CFDs do not give ownership of the asset. You do not receive a part of the company and cannot participate in its management.

Since CFD brokers frequently offer increased leverage and are an interested party in the trade, in many countries their activities are quite strictly regulated.

A discount broker is a company that specializes in online trading with minimal or no commissions. Due to small earnings on commissions, discount brokers offer a limited list of information and analytical services.

A full-service broker offers a complete range of services for investment and advising clients, managing assets, etc. These brokers tend to have higher commissions as they have to maintain large staff. As a rule, these companies are focused not on the mass market, but on wealthy clients who need an individual approach and advice.

The largest international brokers offer access to all or most of the leading markets at once such as stocks, bonds, commodities, derivatives, CFDs, and Forex. The only exceptions are binary options, which are poorly regulated and banned in many countries.

Binary brokers offer trading services for binary options. This is a modern high-risk trading instrument. When trading, the broker is the second party to the contract regarding the rise or fall of the price of a certain financial asset in the future. If the client managed to guess the direction of the market movement, he wins; if not, he loses the rate.

Experts note that the binary options scheme itself contains a lower probability of the client's earning. These factors dramatically increase the risks of a complete loss of funds, and therefore this type of trading should be approached with caution and you should never risk large amounts.

To summarize the information provided, we have prepared a comparative table of different types of brokers, which indicates the risks of the market, a list of instruments.

| Type of brokers | Stockbroker | Forex broker | Futures broker | Discount broker | CFD broker | Binary broker |

|---|---|---|---|---|---|---|

| Type of brokers Market Risk |

Stockbroker Average |

Forex broker Average |

Futures broker Average |

Discount broker Average |

CFD broker High |

Binary broker Very High |

| Type of brokers Leverage |

Stockbroker Low |

Forex broker High |

Futures broker Average |

Discount broker Low |

CFD broker High |

Binary broker High |

| Type of brokers Markets |

Stockbroker Stocks, ETFs, Mutual funds, Bonds |

Forex broker Currencies |

Futures broker Derivatives |

Discount broker Stocks, derivatives |

CFD broker Stocks, currencies, derivatives |

Binary broker Stocks, currencies, derivatives |

| Type of brokers Fees |

Stockbroker Average |

Forex broker Average |

Futures broker Average |

Discount broker Low |

CFD broker Average |

Binary broker Average |

| Type of brokers Regulated |

Stockbroker Yes |

Forex broker Yes |

Futures broker Yes |

Discount broker Yes |

CFD broker Yes |

Binary broker No |

The Traders Union specializes in ratings brokers. The TU's experts have evaluated most of the world's leading financial companies to rank the best stock market brokers. These include companies such as Webull, Interactive Brokers and Degiro.

Webull is a relatively young broker that has already gained recognition from clients all over the world for its high-quality service, a modern trading platform and the lowest fees in the industry.

In the US stock market, Webull offers a colossal selection of thousands of stocks in the largest US stock exchanges, such as the NYSE, NASDAQ and AMEX. A pleasant bonus is the nonexistence of commissions for trading stocks.

The Webull trading platform combines two important qualities. On the one hand, it is intuitive, even for a beginner; on the other hand, it has a good selection of market analysis tools and filters that professionals will appreciate.

Interactive Brokers LLC (IB) is a USA multinational brokerage company. It operates the largest electronic trading platform in America by number of daily average revenue trades. It’s main strength is its international status. The company offers its services to clients from most countries. The choice of trading instruments for the stock market is very impressive because the stockbroker has access to 135 markets in 33 countries.

In the US stock market, the standard commission is $0.005 per share, which makes the broker's offer very beneficial for active clients. In some trading plans, there are no commissions at all. In addition, at 1.6% per annum in USD, Interactive Brokers have one of the lowest margin lending rates globally.

The IB trading platform is aimed at professional traders, but its basic features are also easy for a beginner to understand.

Degiro is a Dutch discount broker that specializes in dealing with clients from the European Union. For customers from 18 European countries, there is a website version and technical support in their native language.

The broker offers access to 50 stock exchanges in 30 countries. In most cases, these comprise the largest European and North American stock trading platforms. Commissions depend on the selected stock market. Thus, commissions on the US market start at $0.004 per share.

The Degiro trading platform is multilingual and intuitive for a beginner. For professional clients, there may be only a few stand out functions, but it definitely provides all the basic needs of most traders to the fullest.

The Forex market is characterized by great liquidity because the daily trading volume exceeds $6 trillion. The best Forex brokers offer all the obvious benefits of Forex trading.

The eToro team is a US- and EU-licensed broker that specializes in three interrelated areas such as:

An advanced social trading platform allows you to copy trades of successful traders without commissions;

Has its own cryptocurrency exchange that allows you to make trades with increasingly popular digital assets;

Has its own platform for Forex and CFD trading with low commissions and a huge selection of trading instruments.

The eToro trading platform is simple and easy to use; so too is its demo account. The minimum initial deposit for US clients is only $50.

The FxPro broker is licensed in the UK (FCA) and Cyprus (CySec), which allows it to offer services in almost all European countries. Among the positive aspects of eToro is that it manages equity capital of $100 million, has direct access to foreign exchange trading, and boasts a work history of over 14 years.

Trading is available using three modern trading platforms - MT4, MT5 and cTrader - which are great for both beginners and pros. As the European region is multinational, the clients of eToro have multilingual support in all major European languages. An Islamic account is available for Muslim clients.

The XM broker is regulated in the EU (CySec), Australia (ASIC) and Belize (IFCS). The availability of licenses in different regions of the world allows the broker to have the widest audience of clients.

The broker is characterized by maximum loyalty to novice traders. The initial deposit starts at just $5. A demo account and a micro account are available for traders, where you can try your hand at minimal risk.

A total of 55 currency pairs are at the service of traders with minimum spreads from 0.1 pips. Also, you can trade CFDs and stocks on all platforms.

Most of the major Forex brokers offer CFD trading as well. We have selected the brokers with the best offers for CFD trading.

The company is regulated in the United States (CFTC), the United Kingdom (FCA), as well as Singapore and Bermuda. An impressive selection of CFDs is presented to clients. There are over 12,000 CFDs on international shares. In the US market, the commission is only 2 cents ($0.02) per share.

In addition to stocks, the broker offers CFDs on most modern assets such as currencies, commodities, bonds, precious metals, cryptocurrencies, and options. Indeed, over 16 thousand markets are available on the IG platform.

This broker is licensed in the UK (FCA), Cyprus (CySec) and Australia (AFSL), which allows it to provide services in most countries. Clients can trade more than 40 of the most liquid currency pairs with a spread of 0 pips on the broker's platform.

However, the broker's chip is a huge selection of CFDs. Clients have access to 32 CFDs on cryptocurrencies, 24 on indices, several dozen CFDs on commodities and metals, and about 4,000 CFDs on stocks and ETFs.

Binary options trading is very popular among beginners, but it is rather poorly regulated. In this regard, the reputation of brokers is of particular importance. The Traders Union has collected the binary options brokers that have the best reviews on the Traders Union site.

Note:

That to decide to trade binary options, you should carefully weigh all attendant risks. It is not worth investing more than the amount that you are willing to risk painlessly.

The IQ Option brokerage is one of the most popular international binary brokers. IQ Option offers trading in 25 currency pairs, as well as stocks, commodities and ETFs. The minimum rate is $2 and the leverage is up to 1 in 500.

The trading platform is extremely simple, which makes it very convenient for beginners. A demo account is also suitable for practice.

This broker has a very low minimum rate which is only $0.51, with a minimum deposit of only $5. This allows almost any trader to try his hand. The platform has a huge depth of rates, from 10 seconds to 1 year.

The Binomo broker offers trading with a minimum deposit of $10 and a minimum rate of $1. The broker is notable for its bonus system, the existence of cashback, and various contests among traders. You can also ensure your investment.

A wide variety of brokerage companies are represented in the financial markets. The choice can be really tricky. Traders Union experts work hard to simplify this choice and make trading as safe and profitable as possible.

For example, you can use the Traders Union bonuses to help you get a partial refund of the commissions paid. A huge database of reviews and constant expert and consulting assistance on legal issues are waiting to help traders.

I prefer to work with the Webull discount broker. Given my active trading style, the nonexistence of commissions is much more important than any additional services. For a trader, a broker's analyst is not particularly needed, but commissions can deprive an active trader of a significant part of his income.

Joe Sharp

stock trader

US

I prefer to work on Forex because the trading volumes there are great. For my trading strategy, liquidity is key. Personally, I work with the FxPro broker where the conditions are quite satisfactory. Spreads may not be the lowest, but trades do not fail when executed, and its licensing agency is reliable.

Sean Walsh

Forex trader

Ireland

I would recommend a long term “buy and hold in stocks” strategy for beginners. It is believed that trading is not for everyone. You should focus on world-renowned brokers such as Interactive Brokers or Fidelity. They can offer a truly huge selection of markets and reliability.

Myles Bird

banker

US

First, you should insist that the broker has a license from a reputable regulator. Also, the size of the commissions, a broad variety of markets, the presence of relevant information, and analytical apps, gadgets, and services are also very important.

It all depends on your goals. For active traders, a discount broker is the optimal solution. For large investors with large capital and a passive income strategy, the accompanying analytical services are of great importance, so they may be better to use the services of full-service brokers.

For beginners (and anyone else), the first rule is to protect yourself. Therefore, it is imperative that the broker must have a demo account and a low minimum deposit threshold. A cent/micro account would also be helpful.

Yes, some of the largest international brokers provide access to hundreds of markets in dozens of countries. These are the markets for stocks, futures, Forex, bonds, etc.

Glory is a professional writer for the Traders Union website with over 5 years of experience in creating content in the areas of NFT, Crypto, Metaverse, Blockchain, or Web3 in general. Over the last couple of years, Glory has also traded on different cryptocurrency and NFT platforms including Binance, Coinbase, Opensea, and others.

“I understand a lot about this space, being familiar with CEX, DeFi, and DEX, as well as operating across the Ethereum, Binance, and Polygon networks. Also, I know the intricacies and subtleties of NFTs and crypto, thus I am able to bring to table the best content and help connect with the audience better.”

Matthew Du is a SEO Content Marketing Professional and a contributor to the Traders Union website with five years of experience in digital marketing, along with a proven track record in SEO content strategy, media planning, data analytics, and copywriting. He has excellent communication skills and the ability to engage the audience with his deep understanding of the market.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.