The Best FX pairs to Trade During the Sydney Session

Currency pairs involving the AUD, JPY, and NZD are the best to trade during the Sydney session.

Trading sessions dictate when to expect significant moves to happen in the currency market. During hours of session overlap, heaps of traders flood into the market and create volatility - a perfect recipe for making more money in the markets. Traders can’t watch the market 24/7, so the next best thing is to be aware of periods of significant market volatility and adjust their trading style and strategy accordingly. In this article, Traders Union looks deeper into the Sydney session, its characteristics, and the ideal Forex currency pairs to trade during this session.

Best Forex pairs to trade in Sydney trading sessions

During the London/New York session overlap, the EUR/USD pair would be the best pair to trade. The pair not only represents 20% of the trading volume in the Forex market but also represents the key demographics of the sessions open during this overlap, making it ripe for price fluctuations and volatility.

That said, there are many other possible currency pairs to trade during the Sydney Session, including AUD/USD, USD/JPY, AUD/NZD, USD/CHF, and GBP/USD. While there are many options to consider, two stand out in particular.

AUD/USD

The AUD/USD pair is the most liquid pair to trade during the Sydney trading sessions, with an average daily pip change of 81.50 for 2022. The geographical location of the traders during this session makes it easier for them to follow news events and forecast impact.

For those outside of Australia, the popularity stems from the geology and abundance of natural resources and commodities in the area. Its government policy of stable high-interest rates and counter-cyclical, volatile currency with a close tie to the price of commodities make it appealing to traders.

USD/JPY

The USD/JPY currency pair is also another popular pair to trade during this session. Historically speaking, the average daily pip movement for USD/JPY has hovered around 90 pips a day. For 2022, however, this number rises by 30% to an astonishing 117.5 pips daily.

The volatility could be attributed to Japan being the world’s third-largest economy and a significant exporter on the world stage. The Japanese Yen is also considered to be a safe haven currency whenever the market’s fear-greed index enters a risk-off sentiment. Traders account for Japan’s low inflation and current account surplus, exporting more than imports when making decisions.

Major global FX trading sessions

The 24-hour Forex trading day can be broken down into four major trading sessions:

-

-

The Sydney Session

-

-

These are also often referred to as the Asian, Pacific, European, and North American sessions. Trading in each session is a little different. The regions are represented by the major financial centers for their region and scheduled depending on when the banks and corporations within their demographic make the most day-to-day transactions. Each session’s specific characteristics often force traders to alter their strategies and watch-listed coins.

For example, the London session will offer the most opportunities for all Forex traders - accounting for nearly 43% of all Forex transactions. London’s morning overlaps with late trading in Asia, and London’s afternoon overlaps with New York City creating high volatility and participation during this session. The risks associated with this volatility make the London session one of the hardest to navigate for beginners.

Here is a breakdown of the market session schedule:

| Session | Major Market | Hours (GMT) |

|---|---|---|

|

Asian Session |

Tokyo |

11 p.m. to 9 a.m. |

|

Pacific Session |

Sydney |

10 p.m. to 6 a.m. |

|

European Session |

London |

8 a.m. to 4 p.m. |

|

North American Session |

New York |

1 p.m. to 9 p.m. |

When looking at characteristics specific to Australia, one should point their attention to the market opening on Sunday afternoon, as this is when individual traders and financial institutions will often attempt to make up for “time lost” over the weekend. Despite being the smallest of the megamarkets, Australia continues to experience periods of high liquidity.

Sydney session key takeaways

Despite London offering more opportunities for all Forex traders compared to the Asian and Pacific sessions, certain advantages are provided to those who trade during the Sydney Session.

These benefits include relatively low volatility and the capability to quickly react to news events in the Asia-Pacific Region, which is perfect for traders who prefer to rely on fundamental analytics and key economic releases to make their decisions. Low volatility can be good for new traders to get into the market without facing high levels of risk. Experienced traders could also benefit during these times as it allows them to test new strategies without fearing substantial price swings.

For anyone looking to trade within the Sydney session, here’s everything else that you’ll need to know:

When to look to trade

There are two periods that TU recommends traders participate in the market: periods of overlap and Sunday afternoons.

The Sydney session starts one hour before the Tokyo session, creating the Tokyo/Sydney overlap from 11 p.m. to 6 a.m. GMT. This coincides with our findings. After carefully analyzing historical market trading volumes, Trader Union’s researchers have found that the best time for Forex day trading in Australia would be between 11 p.m. to 7 a.m. GMT.

Apart from these times, TU has also found Sunday afternoons to be a favorable trading time. When the markets open on Sundays, traders rush in and inject hundreds of thousands of dollars of liquidity into the markets. Of course, a trader may make a mistake and position themselves on the wrong end of a trend, but Sunday afternoons are the perfect moment to set the tone for the rest of the week.

When to avoid trading

The Sydney session during the following times is unpredictable and dangerous for the intrepid trader. Sunday nights, for example, aren’t favorable when weekend news events impact them. Political announcements or economic data releases can significantly and unpredictably impact the market when it opens. These occurrences can lead to increased volatility and large price swings, which are often difficult to predict unless a trader is quick to act and remains vigilant throughout the week. The best-case scenario? Nothing happens. Worst case? Your positions liquify or drop 20-30%.

For that same reason, releasing significant data points like the U.S. Non-Farm Payrolls report is another period where trading could be perilous.

Traders should also look to avoid trading Fridays for similar reasons. The market anticipates the weekend, and positions are often placed to counter the week’s trend as trade positions are squared away and profits are cashed in.

Major pairs almost always come with high volatility

Once you’ve identified the right time to trade the markets, the next step would be to pay attention to the Forex pairs you want to trade. The most active pairs during the Sydney session are the following:

The AUD/USD pair, in particular, is the most popular currency pair in the Australian market, accounting for 47% of the average daily turnover. This pair is mainly influenced by the price of gold, which is a major export of Australia, as well as the economic data released from both countries.

Major Drivers of the AUD/USD Pair During the Sydney Session

When the global foreign exchange markets open each trading day in Sydney, the AUD/USD currency pairing becomes a key area of focus. Savvy traders understand there are several important macroeconomic variables originating from Australia that routinely influence the price action of this major FX cross during the early hours. A thorough examination of these domestic economic factors is thus prudent for market participants seeking the best trading opportunities in the AUD/USD market.

Primary among the considerations is monitoring fluctuations in Australian commodity export prices, such as iron ore and coal, given the nation's prominence as a supplier of these global commodities. Significant overnight variations in the valuation of these goods will likely impact prevailing exchange rate dynamics between the Australian dollar and its US counterpart.

Another essential data point is the monthly interest rate decisions announced by the Reserve Bank of Australia. The MPC's monetary policy stance offers crucial guidance regarding the direction of domestic monetary conditions and near-term Aussie dollar valuation.

Domestic labor market conditions as captured in Australia's employment report also bear scrutiny, as substantial misses to jobs growth expectations may instill heightened downside pressures. Likewise, macroeconomic performance releases from Australia's largest trade partner, China, necessitate attention, as changes in Chinese import demand can influence the country's export-driven economy. Broader geopolitical risks stemming from fluctuating Sino-Australian ties additionally warrant consideration from informed market players.

What is the best time to trade Forex in Sydney?

The Sydney/Tokyo session overlap occurs from 11 p.m. to 6 a.m. GMT and represents a period when both markets are open simultaneously. The implications of trading an overlap have been discussed in the previous sections. However, note that a trader can expect high volatility and liquidity during this overlap, making it the best time to execute trades for Asian and Pacific traders.

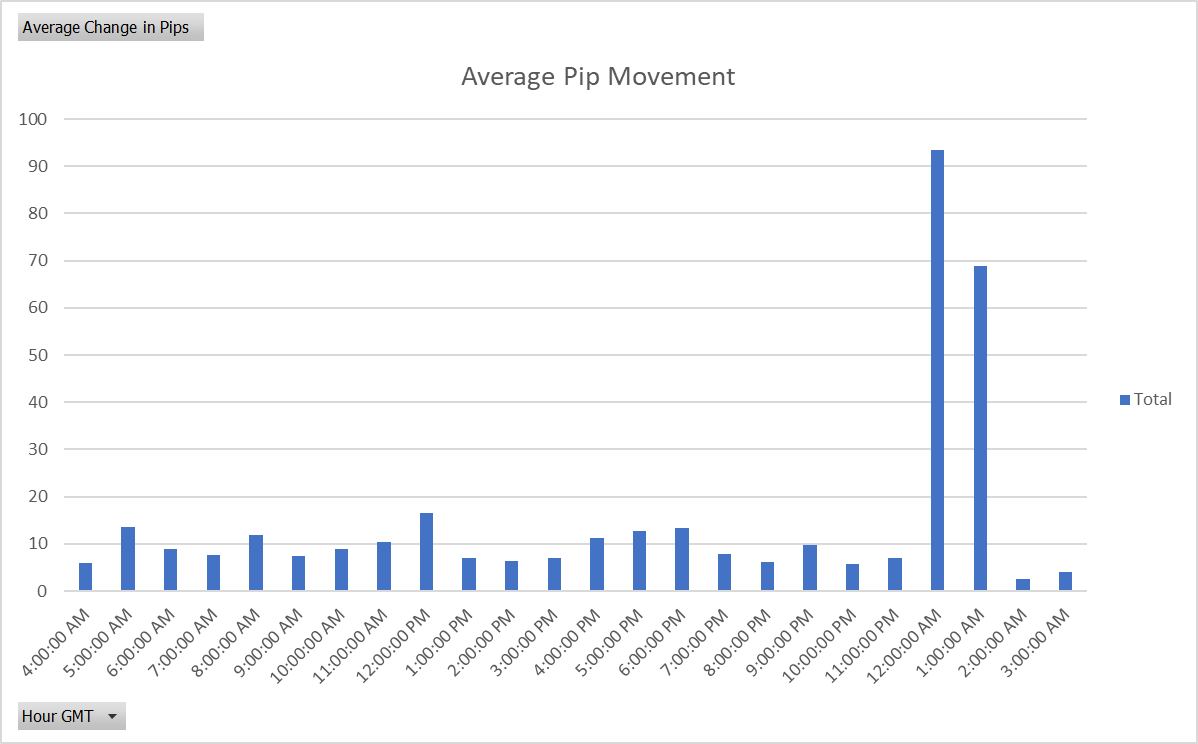

More specifically, look at the historical pip movement of AUD/USD for the last three months, broken down per hour.

Pip movement of AUD/USD - illustration

Source: Myfxbook

The graph shows that the most pip movement occurs between 12 p.m. and 2 a.m. GMT, with an average pip movement of 90 and 68 pips, respectively. For context, currency pairings are often trapped in understandably narrow pip spreads with about 30 pips of movement when only one market is active. But when significant news is revealed, or two markets are open at once, traders could easily see volatility north of 80-100 pips, which coincides with our findings from the graph above.

Best Forex brokers in Australia

Your location is United States

If you would like to learn about the best brokers in your region, please use the “Find my broker” service.

What are the most popular currency pairs?

The Forex market is active 24 hours a day, five working days a week, with a wide range of Forex currencies to trade. To succeed with Forex trading, you need to understand these pairs deeply. Earlier, we stated that choosing pairs from the major currencies is the best option for trading, especially if you are new to Forex. We have provided a brief profile of the six most traded currency pairs to help you make the right call.

EUR/USD

The EUR/USD pair accounts for 28% of daily Forex trades, making it the most traded currency pair on the Forex market. This is expected considering the pair represents the two largest economies globally, the United States and Europe. For beginners, stability and liquidity are two key factors to consider when trading. Unlike other currency pairs, there aren’t so many big price swings when trading EUR/USD.

USD/JPY

The next most traded currency pair after the EUR/USD is the USD/JPY. As it is otherwise known, the ‘gopher’ represents 13% of daily Forex trades. The USD/JPY rate is a standard for the performance of the Asian economy. The pair’s movement also tends to be in tandem with the USD/CHF and USD/CAD currency pairs due to the presence of the US dollar in all pairs as the base currency.

GBP/USD

The British Pound against the Dollar is the third most traded currency pair. It makes up for 11 percent of trading volumes. The currency pair is usually called "the cable" by traders and investors, which comes from the 19th century when the exchange rate was transmitted across the Atlantic by a submarine cable.

AUD/USD

The Australian Dollar, the official currency of the Australian Commonwealth since 1966, replaced the Australian Pound (which includes Australia, seven dependent territories, and three countries). The Australian Dollar (AUD) is one of the world's most traded currencies (fifth behind USD, EUR, JPY, and GBP), accounting for 6% of trading volumes. Iron ore, coal, petroleum gas, gold, and aluminum oxide are just a few of the essential commodities that the Australian economy produces and exports in significant quantities. For this reason, the Australian Dollar is also referred to as a commodity currency and the Canadian Dollar.

USD/CAD

The “loonie”, as the US dollar-Canadian currency pair is otherwise known, is popular among professionals and beginner traders. The pair accounts for 5% of daily trade volumes in the Forex market. Like the other major pairs, the loonie is a good option for traders because of its high liquidity and better spreads. This makes it suitable for swing trading or day trading. The exchange rate of the USD/CAD is influenced mainly by crude oil prices, particularly Brent and US crude.

USD/CHF

The USD/CHF pair represents the US and Swiss economies. CHF stands for “Confoederatio Helvetica” Franc, the only Franc still in circulation in Europe. The “Swissie”, as this pair is sometimes called, accounts for 5% of daily global trades. Traders choose this pair in times of increasing market volatility because they expect price drops as the Swiss franc gains against the dollar due to increased investment in the currency. However, it remains one of the least actively traded major pairs.

Summary

Though the Sydney trading session may be the smallest megamarket, it’s the first to open each day, setting the tone for trading. An influx of liquidity during market opening and closing present traders before the weekend may be challenging for even the most experienced trader. However, the calm fluctuations in price between session overlaps present an opportunity for beginners to get their feet wet in a slower-paced market. The most popular pairs to trade during this session are the AUD/USD and USD/JPY pairs, given the session’s focus on the Asia-Pacific region.

FAQs

What is the Sydney Session?

The Sydney Session is the trading hours for the Forex market in Sydney, Australia. It’s characterized as the first trading session to open each day. It is one hour behind the opening of the Tokyo market, causing an increase in volatility as an influx of traders come online during this time. During the Syden session, traders can expect high volumes in currency pairs involving the AUD, JPY, and NZD.

When is the Sydney foreign exchange session?

The Sydney foreign exchange session takes place between 10 p.m. GMT to 6 a.m. GMT. Something of note to traders is the Sydney session’s overlap with the Tokyo markets, opening at 11 p.m. GMT. This creates the Sydney/Tokyo session overlap between 11 p.m. and 6 a.m. GMT, where traders can expect increased liquidity and volatility.

Which countries participate in the Sydney Session?

The Sydney Session primarily includes traders from Australia and New Zealand, the primary markets open during this session. With a primary focus on the Asia-Pacific region, the most active Forex pairs during the Sydney session are AUD/USD, NZD/USD, and USD/JPY.

Is the Sydney Session a good time to trade?

The Sydney session is perfect for experienced and beginner traders alike. Volatility can be both an enemy and a friend. Experienced traders will likely look for moments of high volatility to capitalize on massive price swings. Beginner traders will likely look for low volatility to practice trading, experiment with their strategies, and build familiarity with their broker.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

4

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

5

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

Team that worked on the article

Matthew Du is a SEO Content Marketing Professional and a contributor to the Traders Union website with five years of experience in digital marketing, along with a proven track record in SEO content strategy, media planning, data analytics, and copywriting. He has excellent communication skills and the ability to engage the audience with his deep understanding of the market.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).