The Best FX Pairs to Trade During the New York Session

Best New York Session Forex Pairs to Trade:

Currency pairs like EUR/USD, USD/JPY, and GBP/USD are the best you can trade during the New York Forex market hours

As the trading day gets underway in New York, currency markets experience a surge of activity. Major players from across North America flood into the action, stirring significant volatility. But navigating this lively session requires focusing your energy on the right pairs. Certain currencies simply perform better when under the influence of Wall Street. In this article, I'll outline the premier options for the New York hours, focusing on liquidity, overlap with other sessions, and economic ties. For those hoping to profit from the financial hubbub in New York City, understanding these heavy hitters can give your trading an advantage.

Do you want to start trading Forex? Open an account on RoboForex!-

Should I only trade when sessions overlap?

No, you can trade during any session, but volumes are generally higher during overlaps which may offer better opportunities.

-

What economic reports influence USD pairs?

Major US releases like employment data, GDP, inflation figures, retail sales, industrial production can move USD pairs like EUR/USD significantly.

-

Which days of the week are best to trade?

Wednesday and Thursday often see increased volatility. But trends can form any day - have a plan and trade your strategy.

-

If I'm in Asia, can I still trade New York pairs?

Yes, you'll have the New York session hours available to trade just as traders in America do based on the GMT time frame.

Major global FX trading sessions

Trading continuously is an option for traders thanks to the Forex market's constant accessibility. But you must be aware of the best times to trade and the days in particular when you should take your trading seriously. This is where becoming familiar with the FX trading session globally is helpful.

Primarily, there are three major trading sessions:

Asian sessions (22:00 – 08:00 GMT)

London Session (08:00 - 16:00)

New York session (13:00 - 21:00 GMT)

Global FX Sessions

Sydney and Tokyo together make up the Asian sessions. Trading during market activity, when many Forex traders are opening and closing positions, results in a high volume of trades. The Asian markets will already be closed for several hours when the North American session starts. However, for European traders, the day has only reached halfway.

The largest volumes of trades are observed on the market between 13:00 and 16:00 GMT, along with the greatest liquidity and volatility. But on the other hand, a market with high volatility is difficult to predict. Therefore, for novice traders, the period preceding the overlap is preferable.

The United States dominates the Western session, with contributions from Canada, Mexico, and South American nations. This is why the New York City Forex trading sessions record high volatility and participation for the session.

Interestingly, after the traders from the London session finish their lunch break, the New York (US) session starts. However, among the pieces of advice you would receive when trading New York session Forex pairs is to refrain from trading when there is only one open trading session. Instead, wait for trading sessions to overlap.

This is because when two major financial centers are open, more traders actively buy and sell a particular currency. The highest trading volume happens when the London and New York trading sessions overlap, which works to your advantage.

Importantly, you can pick the most advantageous time to trade based on the currency pair you want to use. Most trading activity for a given currency pair happens when the trading hours of the individual currencies coincide.

While the trading volume for EUR/USD will be higher when both the London and New York sessions are open, the same is true for AUD/JPY when the Sydney and Tokyo sessions are active. Let's look at some key takeaways from the New York session.

Forex Market Hours: Schedule and Trading SessionsNew York session key takeaways

The first strategy or planning a newbie trader must undergo in New York has to do with the Forex trading sessions, which is knowing when the New York trading market opens.

Being the second-largest Forex platform in the world and watched heavily by foreign investors, the U.S. dollar is involved in 90% of all trades. Changes in the New York Stock Exchange (NYSE) can have a sizable and direct impact on the value of the dollar.

As before, the U.S./London markets have the greatest market overlap. The best time to trade currency pairs is during the New York Forex trading session because it has the most extended trading hours. Other New York session key takeaways include:

Among the trading sessions that overlap with the London session, the New York session is among the most active

The high rate of liquidity ensures tighter spreads and better execution for traders during the overlap between the London and New York session

With a large selection of currency pairs and financial instruments available for trading, the New York session has a serious market depth

For a few hours, the London session and the Asian session are concurrent with the New York session. As a result of the market's state at this time, traders contend for higher trading volume and volatility due to the presence of participants from various time zones

Approximately 19% of all Forex transactions take place during the London trading session

Big market-moving potential: 85% of trades involve the US dollar

And liquidity and volatility decrease during the afternoon hours

What is the best time to trade Forex in New York?

People around the world appear to engage in a variety of financial activities from Monday through Friday. While some companies favor particular days for carrying out specific tasks, Wednesday is the best day for Forex trading.

Forex Trading in the USAThe poll results from the top TU Forex experts on the best trading days of the week are listed below.

| Days of the week | Votes | % |

|---|---|---|

Monday |

339 |

Assets for copy trading 16% |

Tuesday |

285 |

Assets for copy trading 14% |

Wednesday |

730 |

Assets for copy trading 35% |

Thursday |

400 |

Assets for copy trading 19% |

Friday |

326 |

Assets for copy trading 16% |

Total |

2080 |

Assets for copy trading 100% |

Trading the New York session Forex pair between 13.00 and 22.00 GMT from Monday afternoon to Thursday is a top option. But remember, your profits are assured, provided you know the best pairs to trade during the London session. Since the US dollar and the euro (EUR) are the two most traded currencies, these account for more than 70% of all trades.

Changes in the New York market can impact the dollar's value. So the dollar may instantly increase or decrease in value when the market is busy. With all the benefits you can enjoy trading in the London session, the wrong New York session Forex can mar your efforts.

The U.S./London market has the highest trading volume and offers the best trading opportunities. Since volatility (or price activity) is high, trading is best done at this time.

The US is the last session to open and close. And when it overlaps the London session in the morning, there is a historical record of high liquidity, which declines during the afternoon hours. Therefore, selecting the appropriate currency pair is essential for the best outcomes. So which are the best currency pairs for the American session?

The Best Time to Trade Forex - ResearchBest Forex pairs to trade in New York trading sessions

The best days to trade Forex are Tuesday, Wednesday, and Thursday, and this is because of the rush in the trading market on these days. So it is recommended that you make your Forex trades at the busiest times, and these days seem to be the busiest.

Remember, the New York session is among the most active and overlaps with the Asian and London sessions. During this period, traders can expect high volatility and liquidity, making it an ideal time to trade.

So when choosing the best New York session Forex pairs, it is recommended you go with pairs with the highest liquidity (trading volume). Such pairs can allow you to use the maximum number of trading strategies and not pay for gaps.

Some of the New York session Forex pairs you should consider are:

EUR/JPY

Additionally, they are even better to trade when the London and New York markets overlap. To get the most out of New York, you should try to stick with currency pairs that include the USD. Therefore, EUR/USD, GBP/USD, and USD/JPY are the top three Forex pairs to trade during New York hours.

Combining these American currencies will increase your profits, but traders must constantly evaluate and review their trading approaches.

The most popular currency pair on the Forex market, the EUR/USD, is renowned for having small spreads and high liquidity. Another heavily traded currency pair is GBP/USD, which is characterized by high volatility and wide price swings.

The USD/JPY is a popular currency pair among traders due to its high liquidity, small spreads, and sensitivity to trade-related economic data releases.

Finally, it can be said that the New York session is a very active and volatile trading session that offers traders a lot of chances to profit. But this is only when you trade the best American session Forex pairs. These are pairs that respond quickly to political and economic events, have narrow spreads, and have high liquidity.

Best Currency Pairs to Trade ForexCurrency pairs classification

The currency pairs in the Forex market follow one common rule – only two monetary units are involved in trading, always, where one is bought and the other is sold. Other options of interaction between the national currencies are impossible (there are options of exchanging money for other assets, however, precious metals for example). This is also stipulated by the ISO regulation.

We’ve deciphered the currency pairs above, but it is not enough to only know the ratio between the currency that is sold and the currency that is bought. You also need to understand which type of the currency pair it is, because that is what determines the trading strategy.

Today, there are three types of currency pairs in Forex trading:

Majors

Minors or crosses

Exotics

Let’s understand the notions of “direct” and “inverse” currency pairs. Direct pairs are those, where the quotes are provided in US dollar, New Zealand dollar and Australian dollar and also British pound (their currency codes are on the right side). Inverse currency pairs is when the codes of the US dollar, New Zealand dollar and Australian dollar or British pound is on the left side of the quotation (which means that this is the currency that is being purchased).

Example: EUR/USD is a direct pair, USD/CAD is an inverse pair.

The Most Active Currency Pairs To Trade NowWhat are the most popular currency pairs?

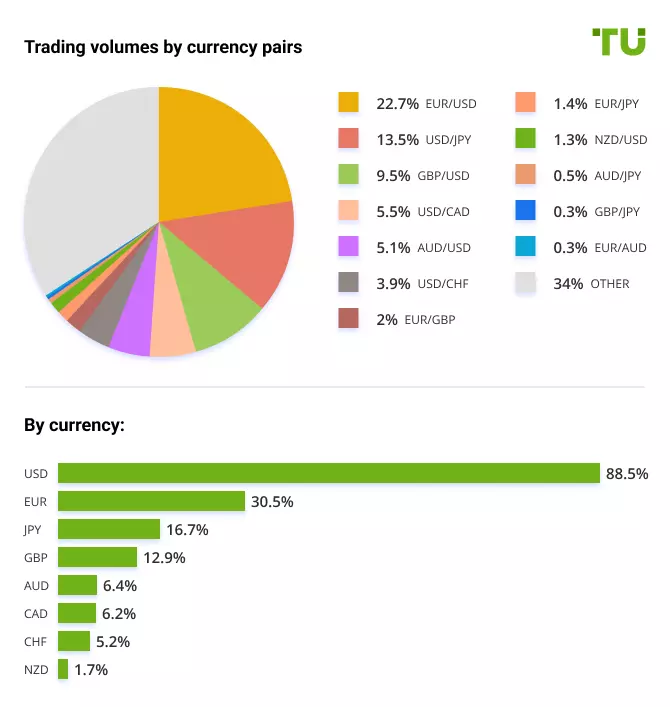

Trading volumes by currency pairs

EUR/USD

The Euro/U.S Dollar is the most crucial Forex pair. The currencies are the most traded globally and have the first and second largest reserve currencies accounting for 22.7% of trading volumes. This pair is used in almost a quarter of all currency transactions.

The Euro is the newest currency among the major pairs. It was launched in 1999, initially replacing 11 national currencies but is now used by over 300 million individuals in nineteen European countries.

The U.S Dollar is the world's primary reserve currency and controls trade internationally. The Federal Reserve, the nation's central bank, regulates the flow of U.S. dollars. The U.S. dollar remains a haven in times of crisis and the primary global reserve currency, despite predictions that it will eventually cede its dominant position to the Euro.

Euro to Dollar Signals and Price PredictionsUSD/JPY

The U.S. dollar against the Japanese Yen is the second most traded currency pair, with 13.5% of trading volumes. And this is because the Yen is the third most traded currency worldwide and a well-liked reserve currency.

For equity markets, this is the crucial currency pair to monitor. The Japanese Yen is usually seen as a haven in times of uncertainty. This is a result of various factors, such as the super low-interest rates in Japan since the 1990s, the need to repatriate funds due to the country's favorable net foreign asset position, and historical, traditional factors. A rising yen usually means falling stock markets.

This is a crucial currency pair to monitor for equity markets. In uncertain times, the Japanese Yen is frequently regarded as a refuge of safety. This is due to several causes, including Japan's historically low-interest rates since the 1990s, the need to repatriate funds due to the country's favorable net foreign asset position, and conventional historical factors. A rising yen frequently signals a decline in stock prices.

GBP/USD

The British Pound against the Dollar is the third most traded currency pair. It makes up for 9.5 percent of trading volumes. The currency pair is usually called "the cable" by traders and investors, which comes from the 19th century when the exchange rate was transmitted across the Atlantic by a submarine cable.

Pound to Dollar (GBP to USD) Signals and Price PredictionsAUD/USD

The Australian Dollar, the official currency of the Australian Commonwealth since 1966, replaced the Australian Pound (which includes Australia, seven dependent territories, and three countries). The Australian Dollar (AUD) is one of the world's most traded currencies (fifth behind USD, EUR, JPY, and GBP), accounting for 5.1% of trading volumes. Iron ore, coal, petroleum gas, gold, and aluminum oxide are just a few of the essential commodities that the Australian economy produces and exports in significant quantities. For this reason, the Australian Dollar is also referred to as a commodity currency and the Canadian Dollar.

AUD/USD forecast for today by Traders Union analystsUSD/CAD

The Canadian Dollar, sometimes known as the loonie in foreign exchange trading, is the name of the one-dollar coin featuring a picture of the loon, a common bird in Canada. It makes up 5.5% of the trading volume. Due to the close ties between their economies as neighbors, the Canadian and American dollars have a strong correlation. Canada exports 85% of its total output to the U.S. while importing 50% of its total imports of goods and services. Oil and lumber are two of Canada's largest exports, and the price of oil is a key determinant in determining the value of the Canadian Dollar. Because of this, the Canadian Dollar is included in a group of currencies known as commodity currencies.

US dollar to Canadian dollar Signals and Price PredictionsUSD/CHF

The currency code, CHF, is derived from the former Latin name for Switzerland, Confoederatio Helvetica, with the F standing for Franc. The Swiss Franc is also called the "Swissie" in the world of currency trading. The Swiss Franc is also supported by significant gold reserves, making Switzerland's economy one of Europe's most prosperous and secure.

The Swiss have been reluctant to adopt the Euro or enlist in the EU. With its historical neutrality regarding international wars, the Swiss Franc's stability is one factor that makes it a haven currency. The currency pair also, like the USD/CAD, accounts for 3.9% of the trading volume.

USD/CHF forecast by Traders Union – Analysis, Rate & ChartBest Forex brokers

Summary

The Forex market can be intimidating for novice traders, but success is guaranteed with the best Forex broker and the right knowledge. The top Forex pairs for the New York session give a trader an advantage over the market. However, currencies like EUR/USD, USD/JPY, and GBP/USD are the best you can trade during the New York Forex market hours.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.