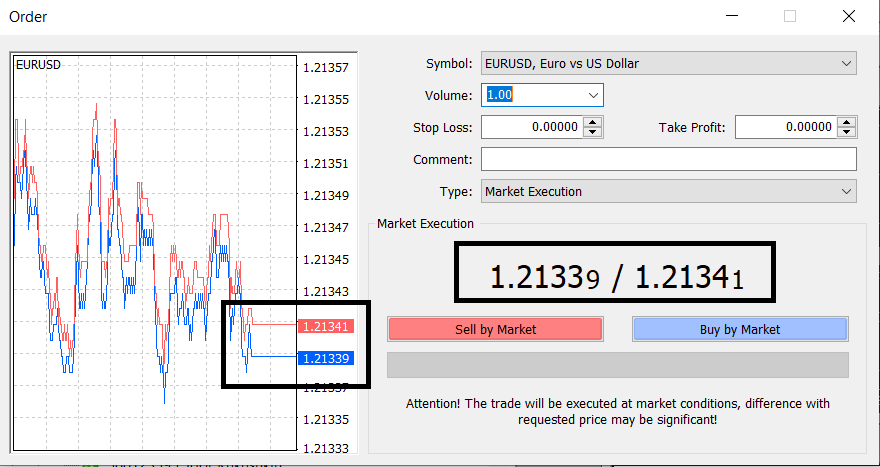

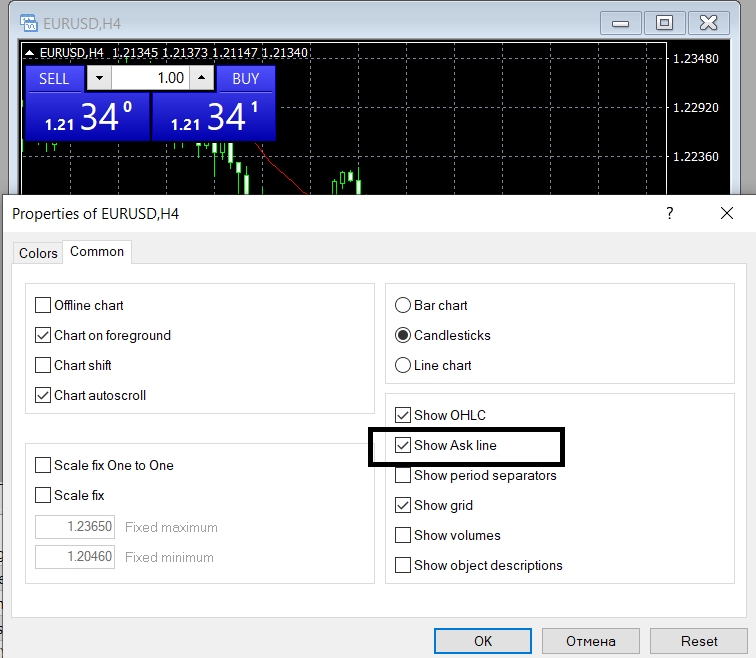

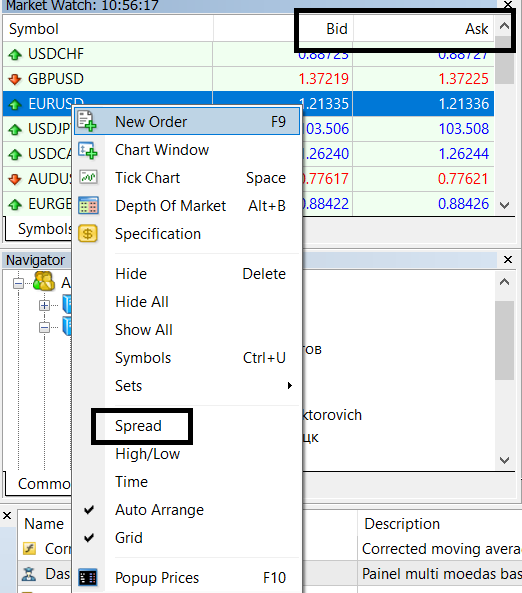

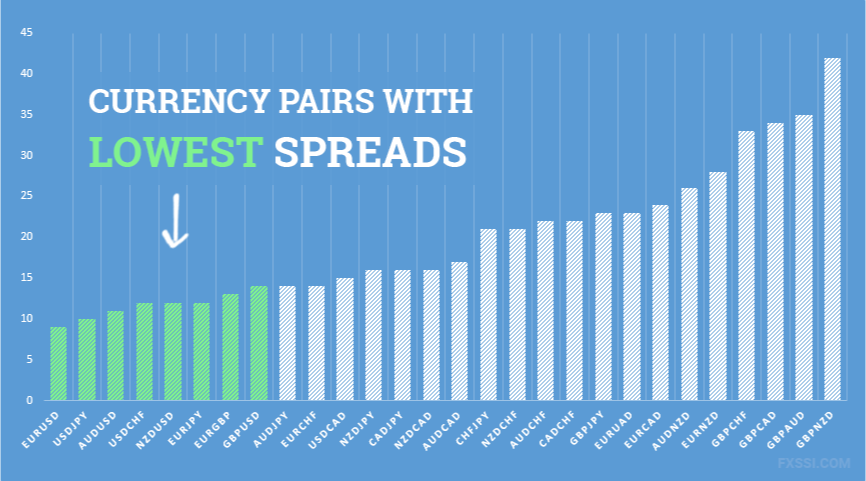

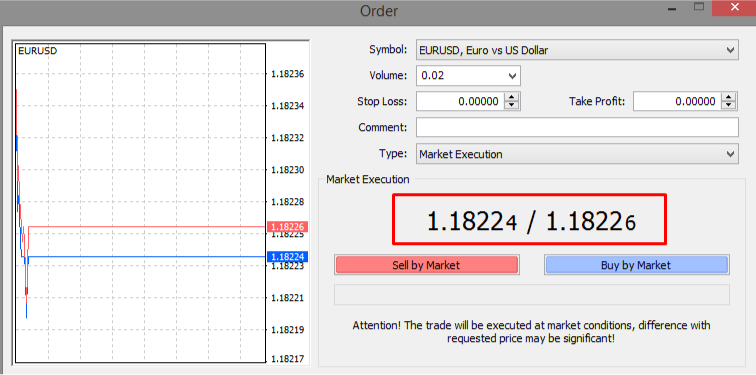

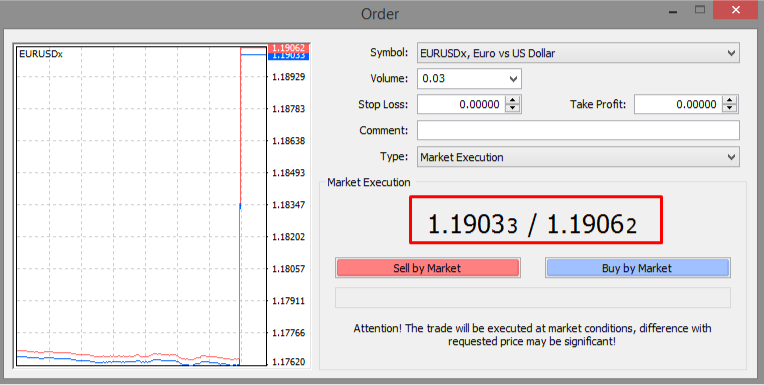

One definition of a spread is the difference between the best bid price that a dealer is willing to pay for a currency (or other trading instruments) and the ask price that a dealer is willing to sell the same currency. These are sometimes referred to as the bid-ask spread, the buy-sell spread, the biding price and the asking price; and brokerage commission.

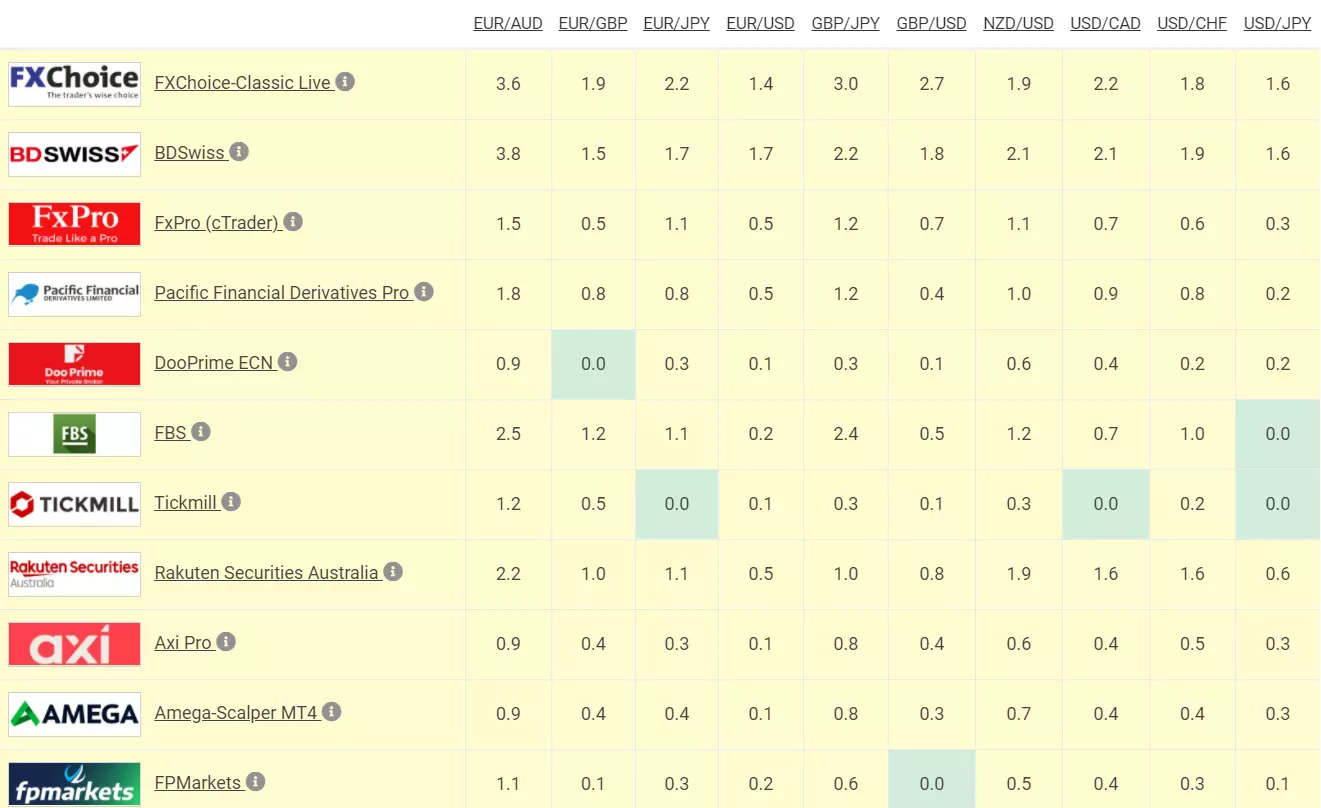

If a broker is just an intermediary, how then can the spread be its commission? Why does each brokerage company have different spreads? And why do some brokers offer a zero spread? Also, how does a broker make money then? You will find the answers to these questions and many more in this review.