Pip - What Is a Pip and Why Does It Matter?

A "pip," short for "percentage in point," is a unit of measurement in the foreign exchange (Forex) market that represents the smallest price movement for a currency pair. It matters because it helps traders gauge price changes, calculate profit and loss, set stop-loss orders, and determine risk/reward ratios when trading. Understanding pips is essential for effective risk management and analyzing potential gains or losses in Forex trading.

Pip basically stands for “percentage in point”, and investors/traders use them all the time to reference losses or gains. At the same time, brokers indicate the size of the spread in pips. Pips are most commonly used in Forex trading, and they reflect the movement of price or level of fluctuation in the exchange rate of a certain currency pair. Almost all the currency pairs that are most heavily traded generally have 4 decimal places in their prices. You can perform pip value calculation for any given currency pair by using its last decimal point. Even one pip difference which is a very small unit can reflect a significant loss/profit. That’s why pips are regarded as the most basic as well as vital measurement unit while trading Forex. If you’re wondering “what is a pip in forex” and how to use it, then continue reading this article as it contains everything you need to know about pips and how they’re used in Forex trading.

What Is a Pip in Forex? Example

In Forex trading, a "pip" is a very small measure of the change in value between two currencies. The term "pip" is an acronym for "percentage in point" or "price interest point." A pip traditionally represents the smallest movement that a currency pair can make - 1/100th of 1%, or one basis point.

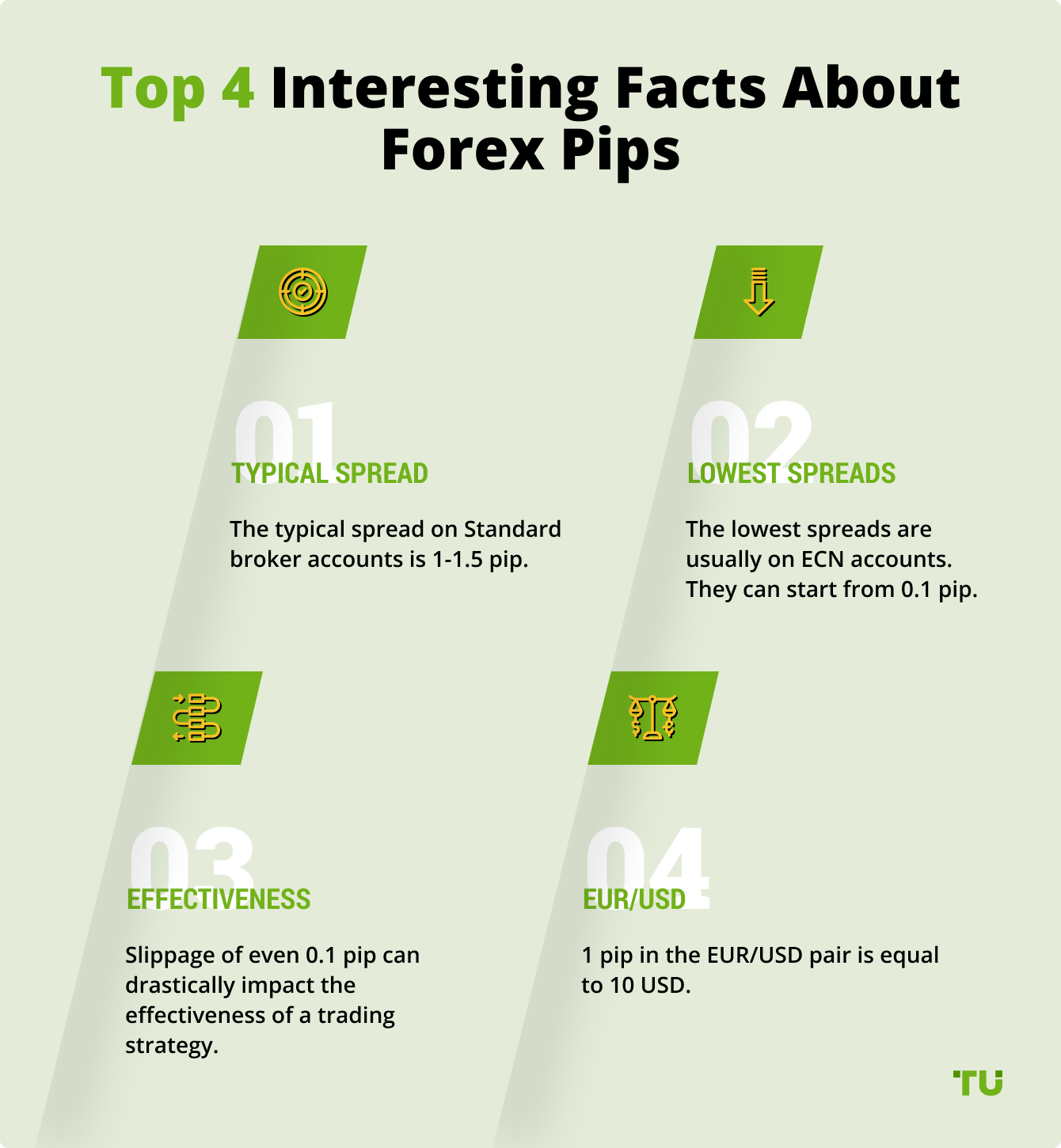

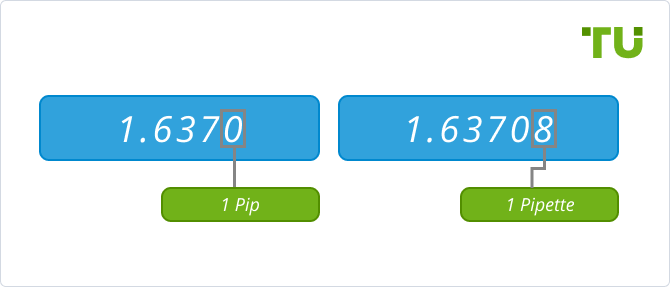

To illustrate, if the EUR/USD rate moves from 1.0738 to 1.0739, that 0.0001 rise in the exchange rate is ONE pip. Most brokers quote Forex pairs to a standard four decimal places, but there are exceptions like Japanese Yen pairs, which are quoted to just two decimal places. In the case of the Japanese Yen, a pip would be 0.01. Minor currency pairs that do not involve the US dollar are usually quoted to the second decimal place, so their pip value is 0.01. For example, in the AUD/CAD pair, each pip equals 0.01.

In recent years, with the advancement in trading technology, many brokers now offer pricing to an extra decimal place; this means a fifth decimal place for most currency pairs (except JPY pairs which have three decimal places). This fifth decimal place is what is referred to as a "fractional pip" or "pipette."

Knowing pip value is important when determining potential profits or losses. Traders need to calculate how many pips an expected currency movement equates to in tangible monetary terms.

What Is a Pip in Forex? Example

How to Calculate Pips?

Now that you’ve understood what pips Forex /Forex pips are, let’s discuss the process of calculating pips.

Pip Value Calculation for USD Account

The most commonly traded currency pairings in the global Forex market are the ones that involve USD in either second or first place. If the base currency of your brokerage’s account is the US dollar and USD is positioned in second place, then the pip values won't be changed. The fixed pip values are:

-

USD 0.01 US dollars for a nano lot that represents 100 currency units

-

USD 0.10 US dollars for a micro lot, and it represents 1000 currency units

-

USD 1 US dollar against a mini lot, and it represents 10,000 currency units

-

USD 10 US dollars for a standard lot, and it represents 100,00 currency units

Remember, the above pip values are applied to only those currency pairs that involve USD positioned in second place, such as GBP/USD, EUR/USD, AUD/USD, etcetera. On the other hand, if the USD isn't listed as second, then you'll need to divide the above-mentioned pip values by the USD/XXX rate.

For instance, if you’re trading with an account that you’ve funded with USD and the rate for USD/GBP is 1.26236 against a standard lot, you can perform a pip value calculation by dividing 10 US dollars by 1.26236.

Pip = 10/1.26236 US dollars = 7.921 US dollars

Pip Value Calculation for Non-USD Account

The pip values are fixed for all the currencies listed second in any given pair regardless of the funded/base currency of the account. For instance, if you have an account funded in AUD (Australian Dollar), then currency pairs where AUD is positioned second, such as GBP/AUD, USD/AUD, etcetera, will have a fixed pip value.

-

Micro lot: AUD 0.10 US dollars

-

Mini lot: AUD 1 US dollar

-

Standard lot: AUD 10 US dollars

If the non-USD currency is placed first, then you’ll have to divide the pip’s fixed value/price by the exchange rate of the targeted currency for pip calculation.

For instance, if the Australian dollar/Canadian dollar (AUD/CAD) exchange rate is 0.54351, then for the mini lot, the pip will be worth 1.8 AU dollars.

Pip = 1/0.54351 AU dollar = 1.8 AU dollar

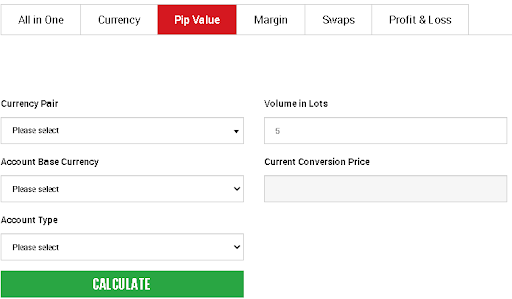

How Can a Pips Calculator Help?

Pips Calculator allows you to perform the exact pip value calculation in the desired currency. It’s critical to know the pip value in order to determine whether a certain trade is worth the time, money, and risk or not. It'll also allow you to manage the risk effectively as well.

How Does Pip Calculator work?

The pip calculator measures the pip value by taking the product of the trade amount in the lot and one pip. Then it divides the product by the quoted currency’s current exchange rate.

You must know the following to calculate pip:

-

The position size

-

The focused currency pair

-

The exchange rate

-

Base currency

The formula used by the pip value calculator is:

Pip value = lot size x (one pip/exchange rate)

Many brokers have such a calculator on their website. The pip calculator from the XM broker is very popular.

How to Calculate Pips in Your Trading Account Currency?

It's a fact that not every currency pair to perform Forex trading includes your broker account’s base currency. You are still able to perform the calculation of pip value, if you want to trade in AUD/CAD, but with a USD account.

As mentioned earlier, the currency listed in the second position always has a fixed value if you also have the same broker account’s base currency. For instance, if you hold an AUD account, then the CAD/AUD value of pip will be AUD10 for a standard lot. You’ll only need to convert the AUD10 into your currency. For example, you’ll need to divide AUD10 by the USD/AUD exchange rate if your brokerage account’s base currency is USD.

On the other hand, if your brokerage account’s base currency is GBP and you want to calculate the AUD/CAD pip value against a standard lot (10 CAD), you'll need to divide 10 CAD (standard lot) by EUR/CAD exchange rate to convert it to EUR. If the exchange rate is 1.56732, then the value of the pip against the standard lot will be EUR6.38.

Why Are Forex Pips Important?

Performing the pip value calculation is critical because it allows you to manage the associated risk efficiently. You won’t be able to determine the considered position’s ideal size if the pip value is unknown. Moreover, it also allows you to determine how different exchange rates work and how to perform profit and loss calculation, especially in day trading, where the change of even a few pips is critical. More often than not, your account’s base value determines the pip price fluctuation that will be applied to all the possible currency pairs.

For example, if you open a USD-based Forex account, then the USD will be the quoted currency and you'll be able to track the pip value changes in the USD. It's not very difficult to understand for any Forex trader that pips are of great importance and value.

Best Forex brokers

If you're interested in Forex trading, then the first and the most important thing is to choose the right brokerage that you can use to meet your financial goals. Here, we have mentioned three of the best online Forex brokerages for your convenience.

FxPro

FxPro was founded back in 2006, and it's considered a global Forex broker, which is regulated by world-famous authorities such as FCA, CySEC, SCB, and FSCA. It’s a safe and low-risk online brokerage that comes with the following features:

Fast account opening

Free withdrawal and deposit options

Great customer service

Supports 8 base currencies

Only 100 US dollars of minimum deposit is required

Offers demo account

XM

XM is yet another global Forex broker that was founded back in 2009. It’s also regulated by top-tier authorities such as CySEC, ASIC, and IFSC. It comes with great research and educational tools, and you can enjoy the following features.

Great educational and research tools

Easy account opening

Only 5 US dollars of minimum account is required

Supports 11 base currencies

Offers demo account

Admiral Markets

Admiral Markets was founded back in 2001, and it's regulated by multiple renowned authorities such as ASIC, FCA, CySEC, and EFSA. It flaunts a great track record and a long history of operation. It serves both beginners and professionals equally and offers the following features:

24/7 customer support

No restriction on strategies

Supports 10 base currencies

Offers demo account

Only 100 US dollars of minimum deposit is required

Summary

We hope that now you fully understand what pips are and how you can use them to take your forex trading to another level. Bear in mind that understanding the pips concept is essential to deal with all the changes in Forex rates most efficiently. Understanding the pip concept and knowing each currency pair’s pip value allows you to assess precisely the number of pips of risk you will take. It’ll also enable you to determine whether a certain trade is worth the risk or not.

FAQ

What is a pip?

A pip is the movement of price in the exchange rate, and it's worth 0.0001 US dollars.

What is the worth of 1,000 pips?

1,000 pips are worth 0.1 US dollars.

Is Forex trading good?

The Forex market has the potential to multiply your investment greatly. Some people suggest that you can earn ten-fold of your initial investment overnight. But it only depends upon your trading expertise and risk management techniques.

Why is understanding pip important?

In a given exchange rate, a pip represents the price movement and understanding it is essential, especially for the Forex trader. That's because it helps you to enter or modify your orders not only to improve your trading strategy but also to manage your profit and loss.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.