What Is Forex Leverage? Definition and Use Cases

Forex Leverage is a concept that deals with the use of borrowed funds or debt to artificially amplify the returns from investments for the trader. In order to multiply the buying power in the Forex market, traders use leverage as an investment strategy. On the other hand, organizations use leverage instead of raising capital by issuing stock to finance their assets and invest in their business operations to improve shareholder value.

If you want to buy shares but you don’t have a considerable sharing capital amount, it’ll take you a handsome amount of time to start earning a full-time income. That’s where leverage comes into play, which you can use to earn profit easily. This article will discuss what leverage is in Forex and how you can use it to improve your Forex trading returns in the shortest possible time.

What is Leverage?

Leverage is one of the most critical concepts that Forex traders must understand. According to the leverage definition, it’s a concept that involves the use of borrowed capital that a trader acquires to facilitate his investment. Resultantly, it magnifies the potential returns of the trader that otherwise can take a long time. Leveraged trading enables both professional and retail traders to use their small initial deposits in order to access large position sizes.

For example, if you want to perform leverage Forex trading, then you'll need to borrow money from your brokerage in order to increase your buying power while placing orders. Once you close your trade and earn a substantial amount of profit, the borrowed money is returned to your brokerage. You might also be liable for the loss if your trade wasn't successful. Moreover, it's also important to put down a fractional amount of your trade as a deposit (margin) to maintain your leveraged position.

Leverage Pros and Cons

👍 Pros

• Improve Your Profits

• Upsurge Your Capital Efficiency

• Offer Remedy Against Low Volatility

👎 Cons

• Can Cause High Losses

• Leverage is Considered as a Constant Liability

Using Leverage in Forex Trading

The first step to perform Forex leverage treading is to choose the brokerage that offers everything according to your unique needs. FxPro can be a great example, and you can use leverage in Forex trading on this online trading platform by following the information given below.

How Does FxPro Leverage Work?

The leverage on FxPro works the same way as the general Forex leverage model does. Here’s all the information regarding the execution policy of this platform.

FxPro Leverage

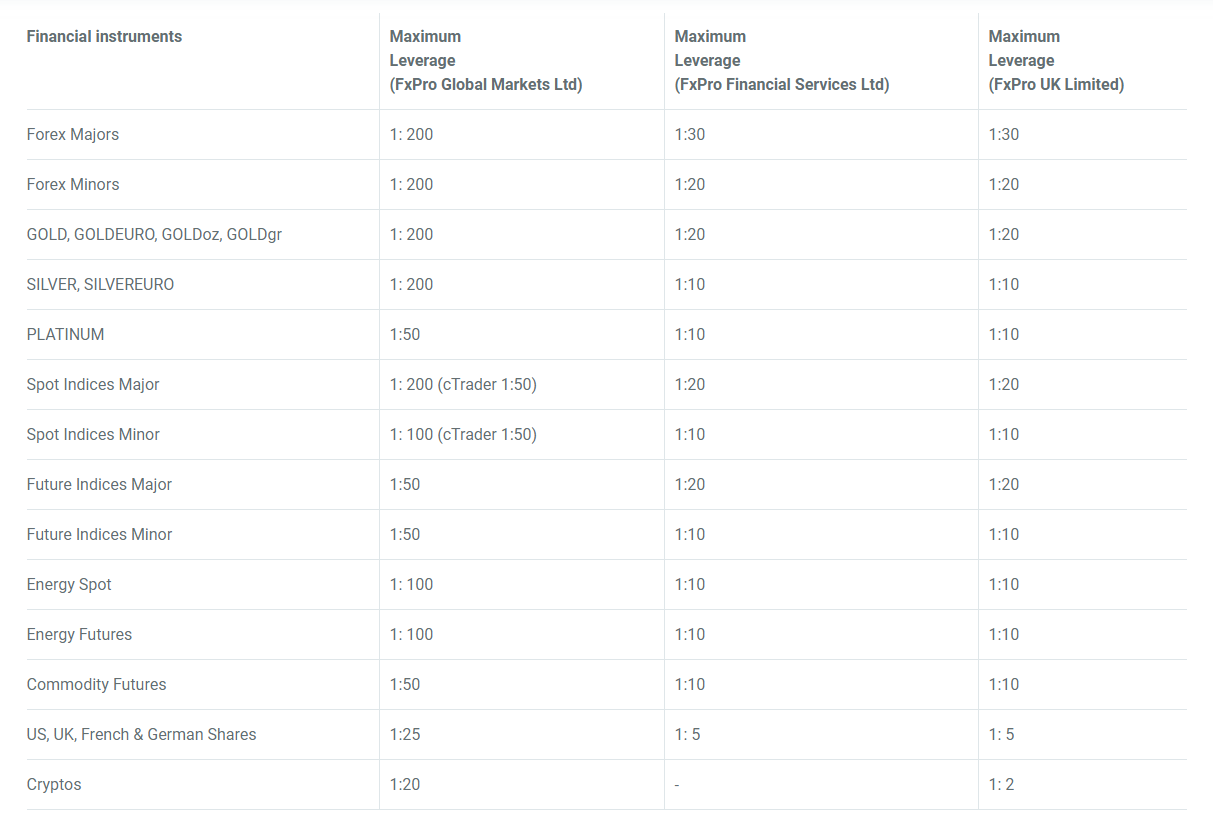

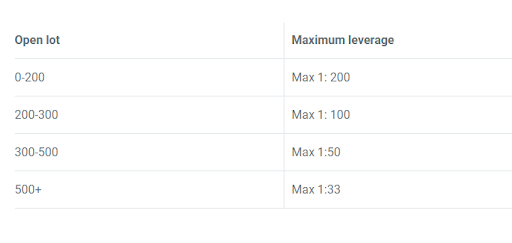

FxPro Maximum Leverage Offered

FxPro Maximum Leverage Offered

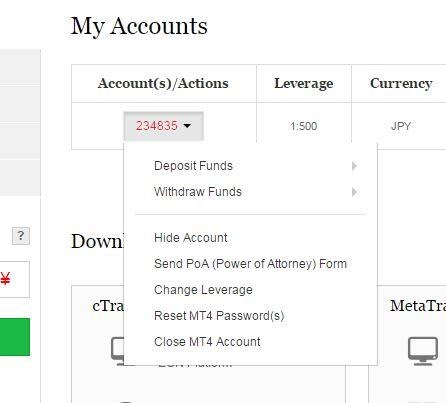

Once you have acquired leverage from FxPro, the platform allows you to change it anytime you want as well. You can achieve it by using the steps mentioned below.

-

1

Log in to your FxPro account and click on the “My Account” options.

-

2

Now click on the "Pencil" icon, which you’ll be able to see right next to your account number.

-

3

Here a menu will be opened with multiple options, and you'll need to locate the "Change Leverage" option as shown in the image below:

FxPro Leverage by Account Types

It’s important to bear in mind that you’ll first need to close all your open positions if you wish to change your leverage. Moreover, the maximum leverage that the online brokerage offers might also vary depending upon the rules and regulations of your area.

Example 1 of Leverage Forex Trading: Profit

As mentioned, you can earn profit by using leverage, and the following example explains it in detail.

Let's assume trader X and trader Y are interested in Forex trading, and both have 10,000 US dollars as initial capital. The online broker they’re using requires at least a 1 percent margin to be deposited. They study the market and analyze the USD/JPY currency pair will be profitable, and they short it at 120.

Trader X acquires the leverage from the brokerage with a ratio of 50:1. It means his/her position size will be 50,000 US dollars because:

50 x 10,000 US dollars = 500,000 US dollars

On the other hand, Trader Y goes for the leverage with only a 5:1 ratio. So, his/her position size will be:

5 x 10,000 US dollars = 50,000 US dollars

A single pip for one standard lot is approximately = 8.30 US dollars. Therefore, one pip movement will reflect approximately 41.50 US dollars for five standard lots. Finally, the pip rises to 121 as it goes in favor of both of the traders. So, both the traders gain 100 pips, but the results for both of them are dramatically different.

Trader X, with leverage, earns a profit of 4,150 US dollars which is equivalent to 41.5 percent of his initial capital of 10,000 US dollars. On the other hand, trader Y earns a profit of 415 US dollars which is only 4.15 percent of his/her initial capital.

Earn more with Best Forex Cashback RebateExample 2 of Leverage Forex Trading: Loss

This time both trader X and Y have the initial capital of 5,000 US dollars. This time trader X goes for the leverage with a 25:1 ratio, and trader Y also plans for the leverage with only a 2.5:1 ratio.

The trader X enter a trade of 25 US dollars for every 1 US dollar available in his/her account which means:

25 x 5,000 US dollars = 125,000 US dollars

The position size of the Trader Y is:

2.5 x 5,000 US dollars = 12500 US dollars

This time the market doesn't go in favor of the traders, and both of the traders lose 100 pips. So, the loss of the trader X will be:

100 x 25 x 1 = 2500 US dollars (50 percent of the initial capital)

On the other hand, the loss of the trader Y because of his/her 5:1 ratio will be:

100 x 2.5 x 1 = 250 US dollars (5 percent of the initial capital)

What is Forex Leverage Specific?

The most important reason why leverage is somewhat specific to Forex trading is the low volatility of major currency pairs as compared to the rest. The low volatility in Forex trading occurs because of the extra careful nature of traders. Moreover, if you plan to perform forex trading without leverage, then you’ll only make a profit somewhere between 0.3 to 0.5 percent of your initial capital per month. Not only is it too low to make a living, but you won't be able to achieve both your short-term and long-term financial and investment goals.

It's also important to keep in mind that if you perform currency trading without leverage, then you'll also have low risk associated with your orders. That's because the higher the leverage, the more risk involved. But it certainly doesn't mean that you can't have leverage in other types of trading. The following are the markets where you can opt for leverage trading.

Stock and Derivative Leverage

Any financial instrument whose value, characteristics, and performance depend upon the same properties of the underlying asset such as index, currency, commodity, stock, etcetera is known as a derivative. In other words, any financial instrument is a derivative that depends on the relative value/absolute value change of the underlying asset.

When the underlying asset's price moves significantly, then the derivatives can increase the leverage greatly. Against a very little outlay amount (or even nothing), you can control big positions in derivatives. The initial capital that you need to take large positions in derivatives is usually very less as compared to the initial capital amount that you need to take large positions in the stock market. So, it’s safe to say that in some aspects, performing trade with derivatives is similar to purchasing a stock on margin.

Leverage in Stock Market

Most stockbrokers allow the investors to perform leverage treading by borrowing up to 50 percent of your position's value. But it also varies from broker to broker as you can also experience some more stringent requirements. The maximum leverage in forex trading can be very high. Typically, brokers offer the leverage of over 100:1.

Typical Leverage Size

The typical leverage size primarily depends upon the risk management rules and regulations of the broker that are subjected to a certain country. It’s important to understand those rules in order to perform Forex leverage trading seamlessly. The typical amounts for leverage are:

-

50:1 - For every 1 dollar/currency unit available in your account, you can perform a trade of 50 dollars/currency unit.

-

100:1 - For every 1 dollar/currency unit available in your account, you can perform a trade of 100 dollars/currency unit.

-

200:1 - For every 1 dollar/currency unit available in your account, you can perform a trade of 200 dollars/currency unit.

-

400:1 - For every 1 dollar/currency unit available in your account, you can perform a trade of 400 dollars/currency unit.

Forex Leverage in the US

Here’s the list of key provisions for US traders regarding Forex leverage trading.

Here’s the list of key provisions for US traders regarding Forex leverage trading.

-

The leverage available to traders is limited to a 50:1 ratio or 2 percent of the notional transaction value on the major currencies to keep the uneducated investors from unprecedented risk.

-

The leverage available to traders is limited to 20:1 or 5 percent of the notional transaction value on all the minor currencies.

-

Full option premium will be required for the long forex options as security.

-

The option premium receives as well as the notional transaction amount will be required for the short forex options as security.

Forex Leverage in Europe

According to the March 2018 modification by the European Union, the following regulations are applied to retail Forex.

-

The maximum possible leverage will be 30:1 that will be applied to all major currencies.

-

The leverage available to traders is limited to 20:1 that will be applied to all the minor currencies

-

No broker can offer individual equities with leverage more than 5:1.

-

The maximum leverage on cryptocurrencies is 2:1.

-

All the brokers must provide negative balance protection, which means no trader can lose more money than he deposited.

Offshore Brokers Leverage

The leverage that offshore and unregulated brokers offer is much more than the limit allowed for the US limit. In the pursuit to get higher returns, you can acquire this higher leverage, but you'll be risking your funds at the same time. The ratio of leverage of offshore brokers varies from company to company. You can even get 1:1000 Forex leverage from brokers such as Trader’s Way.

Forex Leverage in Your Account

You can acquire leverage from your brokerage by going into your account settings at any time. Moreover, you can also change that as well, but for that, all your open positions must be closed. If you’re working with FxPro then, you’ll need to log in to your account and click on the pencil icon that's located right in front of your account number. From there, you can access your leverage settings.

How to Define Your Margin Level?

You can use any only calculator to define your margin level, such as the XM calculator. For that, you’ll need to use the following information.

Margin calculator allows you to calculate the margin that you need for opening and holding positions. You’ll need to select your currency pair, the base currency of your account, leverage, and the size of the position in lots. The calculator performs the calculation of margin in the following manner.

Formula for Margin

Margin = (Trade size) / (exchange rate of your account’s base currency) x (leverage)

Example

-

Leverage = 100

-

Volume in (standard) lots = 3 (300,000 units)

-

Currency pair = EUR/USD

-

Exchange rate = 1.435 (EUR/USD)

-

Account’s Base Currency = USD

Margin = (300,000) / 100 x 1.435 = 2090.59

So, the required margin will be 2090.59 US dollars.

Why Trading with Leverage Is Risky

The Forex market is considered highly volatile, and you need to monitor your positions continuously. By using leverage, you can gain or lose large amounts within a matter of seconds. It's the biggest risk of trading with high leverage.

The points that you drop or gain depends on the volatility of the market entirely, and it can only go in either direction. That's why it's important to watch your positions very carefully and closely while trading with leverage. Moreover, it's also critical to use risk management techniques and tools to minimize the associated risk.

Forex Brokers for Trading with Leverage

As mentioned earlier, the first and the most important step is to choose the online broker to perform leverage Forex trading. It’s also true that the market is filled with countless options. That’s why we have carefully chosen the three best Forex brokers for trading with leverage.

FxPro

FxPro is one of the most trusted online brokers that offer the best Forex trading experience. It’s regulated by renowned authorities and offers education programs that you can use to improve your trading.

Regulated by: FCA, CySEC, SCB, FSCA

Platforms: MT4, MT5, FxPro Edge, cTrader

Leverage: 1:30 to 1:200

Minimum Deposit: 100 US Dollars

Demo Account: Available

Number of Base Currencies: 8

XM

XM is yet another great online brokerage for Forex trading that offers great leverage options as well. It’s considered a low-risk and trusted online trading platform that offers easy account opening and a low withdrawal fee.

Regulated by: CySEC, ASIC, IFSC

Platforms: MT4, MT5, XM WebTrader

Leverage: 1:30 to 1:888

Minimum Deposit: 5 US Dollars

Demo Account: Available

Number of Base Currencies: 11

AvaTrade

AvaTrade is a renowned Forex broker who is registered by many financial authorities. It offers decent leverage options along with great research tools and free deposit and withdrawal options.

Regulated by: ASIC, JFSA, FSCA, Bank of Ireland

Platforms: MT4, AvatradeGo

Leverage: 1:30 to 1:400

Minimum Deposit: 100 US Dollars

Demo Account: Available

Number of Base Currencies: 5

Summary

The primary risk associated with leverage Forex trading is the possibility of losing a considerable amount of money. In some cases, you can even lose more than what you initially deposited in your account. Some brokers provide you with a negative balance protection option, but it’s critical to use risk management techniques and tools. We hope that this guide will answer all your questions regarding leverage and how it affects your Forex trading experience.

FAQ

What does 100:1 leverage mean?

100:1 leverage means that you can perform a trade that’s worth up to 100 US dollars for every single dollar you have in your trading account.

Does leverage increase my profit?

Yes, leverage can help you to increase your profits substantially only if the price movement goes in your favor. Otherwise, it can also result in a large loss as well.

Is it possible to start Forex trading with 10 US dollars?

The one-word answer is yes. You can start Forex trading with 10 US dollars, but it depends upon the minimum deposit policy of your trading platform that varies from brokerage to brokerage.

What does it mean to have 5x leverage?

Many people think that 5x leverage means that their position size has increased by five times. But the fact of the matter is that having 5x leverage only means that as a trader, you can define a position size up to 5x.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.