What are the Risks of High Financial Leverage?

In trading, leverage is a two-edged sword. It offers the potentialbenefit of increasing profits, but it carries 4 major risks:

Amplified losses: Magnifies both profits and losses.

Margin calls and forced liquidation: Demands more funds or position closure.

Higher costs: Incurs interest and fees.

Psychological impact: Causes stress and impulsive decisions.

Leverage in trading acts as a powerful amplifier of outcomes, capable of both elevating potential profits and exacerbating potential losses. This financial tool, while enticing for its promise of significant gains, harbors inherent risks that can transform it into a double-edged sword.

The allure of leveraging large positions with relatively small capital injections tempts many, but without a comprehensive understanding of its risks and strategic management, traders may find themselves facing dire consequences. Recognizing these dangers is the first step towards mitigation, paving the way for a more informed and cautious approach to leverage trading.

How does margin trading work?

Margin trading allows traders to borrow money to invest in stocks, Forex, or other financial instruments, increasing their purchasing power but also their potential risk.

What does leverage do in trading?

Leverage in trading enables investors to control larger positions than their own capital would otherwise allow, magnifying both potential profits and losses.

What is considered high leverage?

High leverage is typically considered any ratio that significantly exceeds the trader's own capital, often starting from 10:1 and going up to 100:1 or more in certain markets.

What are the problems with high leverage? Why is high leverage bad?

High leverage can lead to amplified losses, margin calls, and forced liquidation if the market moves unfavorably, making it risky as it can quickly deplete capital and lead to financial ruin.

What are the risks of high financial leverage?

Leverage essentially allows traders to amplify their exposure to financial markets by borrowing capital. For example, with a 100:1 leverage, a trader can control a position worth $100,000 with just $1,000 of their own capital. This magnification, while promising outsized returns on successful trades, equally applies to losses, potentially leading to rapid depletion of capital.

In trading, leverage is a two-edged sword

The main risks associated with high financial leverage include:

Amplified losses: The same multiplier that can dramatically increase profits can also lead to equally significant losses, often exceeding the initial investment.

Margin calls and forced liquidation: Traders must maintain a minimum account balance, or margin. If the market moves unfavorably, they might face a margin call, requiring additional funds or facing forced liquidation of positions.

Higher costs: Leveraged positions often incur costs, such as interest on the borrowed funds, which can erode profits or deepen losses.

Psychological impact: The emotional stress of managing leveraged positions can lead to hasty decisions, impacting trading strategies and results negatively.

Understanding these risks is crucial for anyone considering leverage in their trading strategy.

Amplified losses

Leverage in trading is akin to a magnifying glass, intensifying both the brightness of profits and the darkness of losses. When a trader's predictions are accurate, leverage can significantly boost their returns, allowing them to achieve substantial gains from relatively small market movements.

However, this magnification works both ways. If the market moves against the trader's position, losses are not just increased; they are amplified to a level that can exceed the original investment, sometimes manifold. This stark reality underscores the high stakes involved in leverage trading.

How to avoid?

The key to mitigating the risk of amplified losses is prudent risk management. This includes setting stop-loss orders to limit potential losses, regularly monitoring market conditions, and adapting strategies in response to market volatility.

Additionally, traders should leverage only a portion of their portfolio, ensuring that a single loss does not jeopardize their entire trading capital. Education and experience play critical roles in understanding when and how to apply leverage effectively.

Margin calls and forced liquidation

Leveraged trading necessitates the maintenance of a minimum account balance, known as the margin requirement. Should the market turn adverse, and the value of the leveraged position decline below this threshold, traders face a critical situation known as a "margin call."

This scenario demands the trader to deposit additional funds into their account to meet the minimum margin requirement. Failure to comply within the stipulated time frame can lead to forced liquidation, where the broker closes the positions to cover the shortfall, often at a loss to the trader.

How to avoid?

Avoiding margin calls begins with conservative leverage use and vigilant account management. Employing lower levels of leverage can reduce the risk of falling below margin requirements during volatile market periods. Setting up protective measures, such as stop-loss orders, provides a buffer against significant market moves.

Furthermore, maintaining a healthy margin surplus in your account acts as a safeguard against unexpected market fluctuations, ensuring that trades can withstand volatility without triggering a margin call.

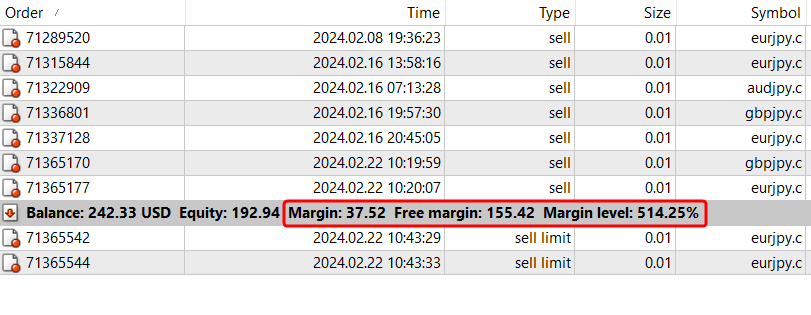

Make sure you always have enough margin. Screenshot from MT4

Higher costs

Engaging in leveraged trading introduces not just opportunities for magnified gains but also the certainty of higher costs. These expenses, which can include interest charges on the borrowed funds and various fees associated with maintaining leveraged positions, directly impact the profitability of trades.

Particularly in scenarios where positions are held open over long periods, these costs accumulate, eroding potential profits and deepening losses, especially in trades that do not perform as expected.

How to avoid?;

To mitigate the impact of these higher costs, traders should carefully consider the terms of leverage offered by their brokers, including interest rates and any associated fees. Opting for strategies that involve holding positions for shorter durations can reduce the amount of interest accrued.

Additionally, incorporating these costs into the trading plan and calculating their impact on potential returns can help in making more informed decisions about when and how to use leverage.

Psychological impact

The psychological ramifications of leverage trading cannot be overstated. The volatility amplified by leverage can lead to significant fluctuations in account value, triggering stress and emotional responses that are counterproductive to rational decision-making.

This emotional rollercoaster can precipitate a cycle of impulsiveness, where fear of loss or the euphoria of potential gains leads to hasty, ill-considered decisions. Moreover, the lure of quick profits may embolden traders to overextend their use of leverage, significantly heightening their risk exposure.

How to avoid?

Establishing and adhering to a well-considered trading plan is paramount in mitigating the psychological impacts of leverage. This plan should include clear criteria for entering and exiting trades, risk management strategies, and predefined limits on leverage use. Additionally, traders should cultivate emotional resilience and discipline, perhaps through practices like regular review of trading decisions and outcomes, to maintain objectivity.

Embracing a mindset of continuous learning and acceptance of losses as part of the trading process can also help in managing the psychological challenges associated with leverage trading.

What is the biggest risk of high leverage trading for beginners?

For beginners, the most formidable risk presented by high leverage trading is the potential for amplified losses, which can swiftly escalate to complete financial ruin. Novices, often lured by the promise of significant returns, may not fully appreciate the speed and magnitude with which losses can accumulate when leverage is misapplied.

Without a solid foundation in risk management and an understanding of market dynamics, beginners areparticularly susceptible to making oversized trades that exceed their capacity to absorb losses, potentially leading to a rapid depletion of their trading capital.

Best Forex brokers in 2025

What is the best leverage to have?

The optimal leverage for any trader depends on their risk tolerance, trading strategy, and market experience. Generally, a conservative approach recommends using lower leverage levels to mitigate risk, especially for those new to trading. A leverage ratio of 10:1 or lower is often cited as prudent because it offers a balance between increasing potential returns and limiting exposure to losses.

Is 1:500 leverage good for a beginner?

Leverage of 1:500 is considered extremely high and, while it allows for significant position sizes with a small amount of capital, it comes with substantial risk. For beginners, this level of leverage is generally not recommended. The potential for large gains is matched by the equally high risk of rapid losses, which can exceed the initial investment.

Is 1 to 30 leverage good?

A leverage ratio of 1:30 strikes a balance between offering the potential for appreciable profits and maintaining a manageable level of risk. For many traders, especially those with some experience and a moderate risk tolerance, 1:30 provides a good mix of opportunity and exposure control. This level of leverage is often considered suitable for a broad range of trading strategies and market conditions.

What leverage is good for $100?

For a trading account starting with $100, a conservative leverage level is advisable to protect the limited capital while gaining trading experience.The problem is that most brokers do not allow you to open trades with a lot less than 0.01. Therefore, for a deposit of $100, leverage of 1:100 is recommended, but not more. At the same time, it is necessary to trade with a lot of no more than 0.01-0.05 in order to maintain a comfortable level of trading margin. This level allows traders to explore the dynamics of leveraged trading with a reduced risk of significant losses. A cautious approach helps in

Tips on trading with high leverage

Trading with high leverage requires a disciplined approach and a clear understanding of the risks involved. Here are some essential tips for navigating the volatile waters of leveraged trading:

Start Small: Begin with lower leverage to understand its impact on your trades and gradually increase as you gain more experience and confidence.

Implement Strict Risk Management: Use stop-loss orders to limit potential losses and protect your capital. Determine the maximum percentage of your capital you are willing to risk on a single trade.

Monitor Trades Closely: Leverage can lead to rapid changes in account value. Regular monitoring allows you to react swiftly to market movements.

Educate Yourself: Continuously learn about the markets, leverage, and trading strategies. Knowledge is a powerful tool in minimizing risks associated with leverage.

Adhering to these guidelines can help traders use leverage more effectively, enhancing their trading potential while safeguarding against the pitfalls of excessive risk.

For further insights, consider reading our article on Best High Leverage Forex Brokers in 2024.

Conclusion

High leverage in trading is akin to a potent catalyst, capable of both accelerating gains and magnifying losses. Its judicious use demands a deep understanding of the inherent risks and a commitment to disciplined risk management.

As a tool, it offers significant opportunities but requires a cautious and informed approach to navigate successfully. Traders are advised to approach leverage with respect, ensuring they are fully equipped with the knowledge and strategies necessary to leverage its potential while safeguarding their capital.

Glossary for novice traders

-

1

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

2

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

3

Margin Call

A margin call is a demand made by a broker or a financial institution to a trader or investor who is using margin (borrowed funds) to cover potential losses in a trading account. It occurs when the value of the securities or assets held in the account falls below a certain threshold, known as the maintenance margin or margin requirement, as specified by the broker.

-

4

Forex Risk Management

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).