According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- WebTrader

- MetaTrader Supreme Edition

- FSA (Seychelles)

- 2007

Our Evaluation of Admirals

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Admirals is a moderate-risk broker with the TU Overall Score of 6.99 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Admirals clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Admirals is a suitable broker for both beginner traders as well as professional traders.

Brief Look at Admirals

Admirals was founded in 2001. In more than 20 years of operation, a regional Estonian broker has grown into an international financial group of companies providing access to over-the-counter markets in more than 130 countries, as well as to exchange-traded stock instruments. Following the 2021 rebranding, Admirals became Admirals. The updated platform received new integrated risk management solutions.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- 5,000+ trading assets, with stock assets trading on exchange markets available.

- The company’s proprietary social trading platform (copy trading).

- Relatively tight spreads on most assets.

- The company’s own Supreme Edition plug-in for MT4 and MT5, which expands their technical and chart functionality.

- Relatively low initial deposit that provides for opening trades within risk management subject to leverage.

- Restrictions on leverage for retail traders without the “professional” status as required by regulators.

- Withdrawal fee is charged.

TU Expert Advice

Financial expert and analyst at Traders Union

Admirals is a universal broker for over-the-counter Forex trading and exchange trading of stocks with tools for both active trading and passive investing. Following the rebranding in 2021, the company focused on the development of its technical functionality. Traders can use the StereoTrader trading panel with smart automation of executing trades, Trading Central technical analysis tools, volatility protection tools, the Supreme Edition plug-in, and other applications for free.

More than 3,000 CFDs are available for trading almost all types of assets, including ETFs, bonds, cryptocurrencies, and more than 4,500 stocks on 15+ stock exchanges globally. Average spread starts from 0.3-0.6 pips subject to the asset and account type, which is a relatively good indicator for a CFD broker. Although cent accounts are not provided, Admirals offers a good scope of educational materials. Step-by-step usage of acquired knowledge on a demo account allows novice traders to approach the “professional” status.

Recently, the broker's technical product line has been expanded with a social trading platform. Now Admirals’ clients can earn extra profit by delivering signals or, on the contrary, subscribe to trades of successful traders and copy them to their accounts. When you first discover the functionality of the broker and its security guarantees, you get a positive impression of Admirals, because the company is included in the TU Top 10 every month.

- You need a platform with a low entry threshold. When opening an Invest account, it is sufficient to deposit just $1.

- You are a novice and want to gain practical knowledge about trading. In fact, Admirals educational materials will be beneficial even to professionals. The website includes articles, guides, video tutorials, and regular webinars conducted by the broker's experts. There are also two specialized courses, basic and advanced.

- You are not interested in contracts for difference. Admirals is a CFD broker, meaning that all assets, including currency pairs, stocks, indices, bonds, cryptocurrencies, and more, are available only in this format.

Admirals Trading Conditions

Your capital is at risk. Forex & CFDs are complex products, not suitable for everyone, and come with the high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МТ4, MT5, MetaTrader Supreme Edition, WebTrader |

|---|---|

| 📊 Accounts: | Trade.MT5, Invest.MT5, Zero.MT5, Trade.MT4, Zero.MT4 |

| 💰 Account currency: | AUD, USD, EUR, GBP, BRL, MXN, CLP, SGD, THB, VND |

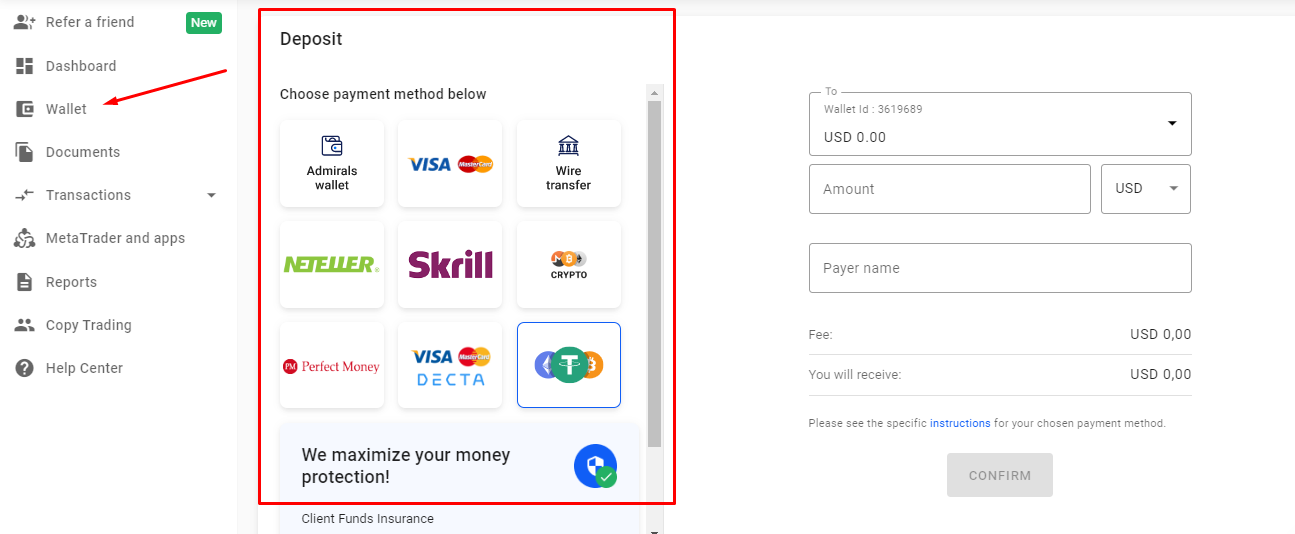

| 💵 Deposit / Withdrawal: | Bank transfer, Visa and MasterCard bank cards, Skrill, Neteller, Crypto |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 (step — 0.01) — 100 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | stocks, ETFs, as well as CFDs on currency pairs, commodities, stocks, indices, bonds, ETFs, and cryptocurrencies. |

| 💹 Margin Call / Stop Out: | 30% |

| 🏛 Liquidity provider: | Institutional banks from different countries, such as Citibank, Goldman Sachs, UBS, and Deutsche Bank. |

| 📱 Mobile trading: | Mobile version available |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market and exchange execution for the Invest account |

| ⭐ Trading features: | Available options for protection against volatility; One-click trading. |

| 🎁 Contests and bonuses: | No |

Admirals trading conditions are suitable for any category of traders, regardless of their trading experience. There are 5 account types which differ in platforms, spread/fee, and asset type. Trade and Zero accounts with a minimum deposit of $25/$100/$250, subject to the regulator, are opened on MT4 and MT5 and are intended for trading CFDs on any type of assets. The Invest account with a minimum deposit of $1 is only available on MT5. This account type is intended for trading stocks and ETFs on the stock market.

How to buy/sell on AdmiralsStrict adherence to regulatory requirements is the reason for restrictions on leverage. For retail clients, maximum leverage is 1:1000. On the Trade account on both platforms it is from 0.6 pips, on the Zero account it is from 0 pips with an additional fee per lot of $1.8-$3 for currency pairs and metals. Both account types also have a fixed fee for trading stocks and ETFs.

There are no restrictions on use of strategies and tools: scalping, hedging, algorithmic trading, arbitrage, and carry trade are allowed. Hedging is only prohibited on the Invest account. Also, there is no negative balance protection on the Invest account.

Admirals AI-based analytical research terminal provides traders with advanced tools to enhance their trading experience. It is free for all clients, providing powerful analytical features to inform investment decisions based on news, sentiment, and price movements. The terminal is powered by Acuity's AI technology and seamlessly integrates with the MT4 and MT5 platforms. Key features of this new terminal include:

-

Corporate calendar tool that helps stock traders stay ahead of upcoming corporate events.

-

Economic calendar to help traders navigate macroeconomic events and market volatility.

-

NewsIQ tool that detects trading opportunities by combining news data with other datasets.

-

Integration with Dow Jones for financial news and insights.

Admirals Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

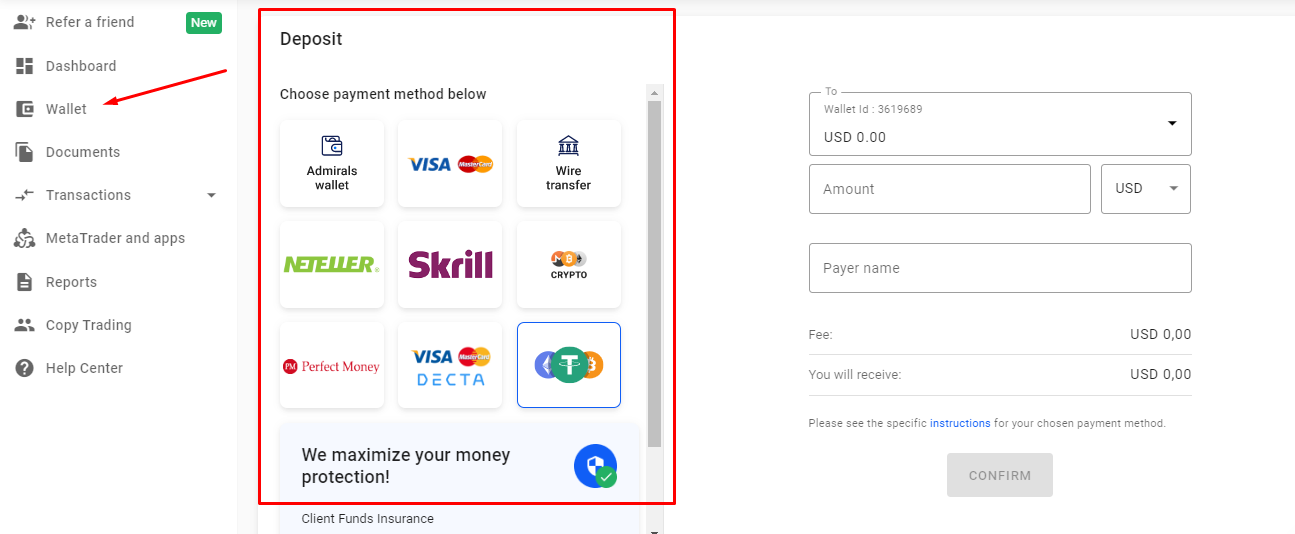

Follow these steps to start earning money with the Admirals brokerage company and receive funds for trading using Traders Union:

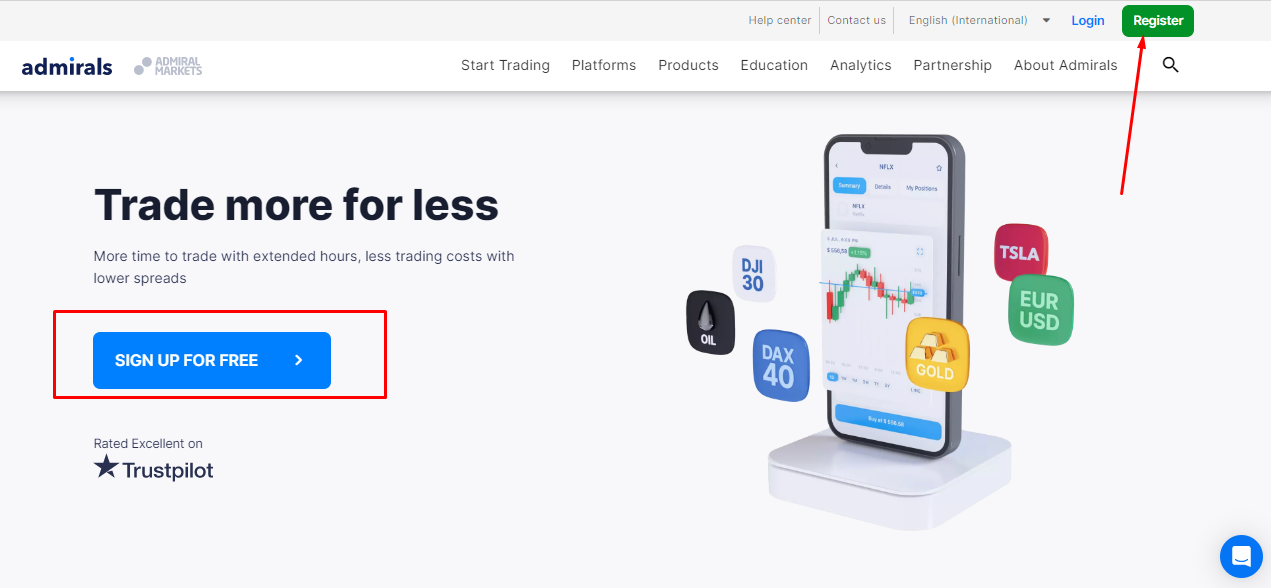

Register on the website of the Traders Union. Follow the affiliate link to the official website of Admirals and click the “Start Trading” button.

Enter your first name, last name, email address. Follow the instructions in the email to complete the profile creation on Admirals.

The following is available in the personal account of Admirals:

In the broker's account, you will find many other useful functions and features such as:

-

the global analytical portal is a novelty from Admirals;

-

the option to subscribe to notifications of deposit/withdrawal of funds, about margin call and current market news;

-

access to downloading broker software for any type of device — PC, tablet, smartphone;

-

customer support portal with contact details.

Alternatively, you can use the reference materials that are always at hand if there are difficulties at the start of trading. It is also possible to contact the Admirals technical support in case of problems with the resource.

Regulation and safety

Admirals has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 18 years

- Strict requirements and extensive documentation to open an account

Admirals Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

CIRO CIRO |

Investment Industry Regulatory Organization of Canada | Canada | CAD 1,000,000 | Tier-1 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

| JSC (Jordan) | Jordan Securities Commission | Jordan | JOD 10,000 | Tier-2 |

Admirals Security Factors

| Foundation date | 2007 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Admirals have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No deposit fee

- Above-average Forex trading fees

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Admirals with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Admirals’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Admirals Standard spreads

| Admirals | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,1 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,8 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Admirals RAW/ECN spreads

| Admirals | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Admirals. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Admirals Non-Trading Fees

| Admirals | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 1 | 0 | 0 |

| Withdrawal fee, USD | 1 | 0 | 0-15 |

| Inactivity fee ($, per month) | 10 | 0 | 0 |

Account types

You can open the following account types with Admirals:

Leverage is from 1:10 to 1:1000. Its maximum is subject to the asset, the “Retail” or “Professional” statuses, and the trader’s jurisdiction.

Admirals - How to open, deposit and verify a trading account | Firsthand experience of TU

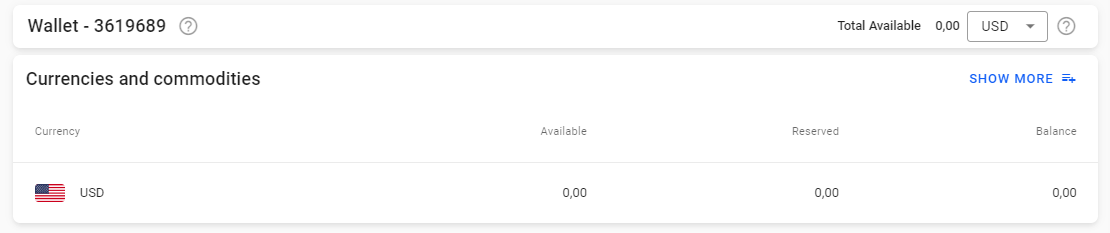

Deposit and withdrawal

Admirals received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Admirals provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Supports 5+ base account currencies

- Minimum deposit below industry average

- No deposit fee

- BTC available as a base account currency

- PayPal not supported

- Wise not supported

- USDT payments not accepted

What are Admirals deposit and withdrawal options?

Admirals provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Neteller, BTC.

Admirals Deposit and Withdrawal Methods vs Competitors

| Admirals | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Admirals base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Admirals supports the following base account currencies:

What are Admirals's minimum deposit and withdrawal amounts?

The minimum deposit on Admirals is $1, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Admirals’s support team.

Markets and tradable assets

Admirals offers a wider selection of trading assets than the market average, with over 8000 tradable assets available, including 80 currency pairs.

- Passive income with bonds

- 8000 assets for trading

- Crypto trading

- Regional restrictions are possible

Supported markets vs top competitors

We have compared the range of assets and markets supported by Admirals with its competitors, making it easier for you to find the perfect fit.

| Admirals | Plus500 | Pepperstone | |

| Currency pairs | 80 | 60 | 90 |

| Total tradable assets | 8000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Admirals offers for beginner traders and investors who prefer not to engage in active trading.

| Admirals | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

Admirals received a score of 7.5/10, reflecting an average offering in terms of trading platforms and tools. The broker covers essential functionality but may fall short in some advanced features or platform diversity compared to leading competitors.

- Trading bots (EAs) allowed

- One-click trading

- MetaTrader is available

- No TradingView integration

- No access to API

Supported trading platforms

Admirals supports the following trading platforms: MT4, MT5, WebTrader. This selection covers the basic needs of most retail traders. We also compared Admirals’s platform availability with that of top competitors to assess its relative market position.

| Admirals | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key Admirals’s trading platform features

We also evaluated whether Admirals offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 161 |

| Tradable assets | 8000 |

Additional trading tools

Admirals offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Admirals trading tools vs competitors

| Admirals | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | No | No | Yes |

| Free VPS | No | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

Admirals supports mobile trading, offering dedicated apps for both iOS and Android. Admirals received 8.01/10 in this section, reflecting strong user engagement and well-developed functionality. High ratings, solid download numbers, and the presence of advanced mobile features contributed to the high score.

- Strong Android user ratings, currently at 4.4/5

- Supports mobile 2FA

- Solid iOS user feedback, with a rating of 4.8/5

- Limited features vs desktop

We compared Admirals with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Admirals | Plus500 | Pepperstone | |

| Total downloads | 500,000 | 10,000,000 | 100,000 |

| App Store score | 4.8 | 4.7 | 4.0 |

| Google Play score | 4.4 | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

Information

Educational resources covering topics in trading are available on the Admiral Markets website. They are useful for both the beginner trader and for professional traders.

If you have any questions, use the additional FAQ section, and contact technical support if there is no answer.

Customer support

Information

Admirals support service is available to contact you at any time 24/7. The advantage of Admirals is multi-language support depending on the version you are using.

Advantages

- Opportunity to get help in different languages

- The prompt response through any form of communication

Disadvantages

- No

Clients can use the following communication methods:

-

Phone (subject to traders’ country);

-

Email (subject to traders’ country);

-

Live chat;

-

Social media and instant messengers.

Contacts

| Foundation date | 2007 |

|---|---|

| Registration address | Suite 3, Global Village, Jivan’s Complex, Mont Fleuri, Mahé, Seychelles |

| Regulation |

FSA (Seychelles)

Licence number: SD073 |

| Official site | admiralmarkets.com |

| Contacts |

+27 12 004 1882

|

Comparison of Admirals with other Brokers

| Admirals | Eightcap | XM Group | RoboForex | Pocket Option | Octa | |

| Trading platform |

MT4, MT5, WebTrader, Mobile platforms | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | MetaTrader4, MetaTrader5, OctaTrader |

| Min deposit | $1 | $100 | $5 | $10 | $5 | $25 |

| Leverage |

From 1:1 to 1:1000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:40 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.5 points | From 0 points | From 0.8 points | From 0 points | From 1.2 point | From 0.6 points |

| Level of margin call / stop out |

100% / 30% | 80% / 50% | 100% / 50% | 60% / 40% | 30% / 50% | 25% / 15% |

| Order Execution | Exchange execution, Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed Review of Admirals

Admirals was founded in 2001. Over more than 20 years, it has grown into a group of companies operating in more than 130 countries worldwide. During this time, the broker has become a high-tech platform that operates in both over-the-counter and stock exchange markets. Through direct access to institutional liquidity providers, Admirals offers traders the best spreads and guarantees almost no requotes and slippages when trading CFDs. The broker’s separate technological solution is the Invest account, which provides for trading stocks and ETFs with a minimum deposit of $1.

Admirals by the numbers:

-

5,000+ assets from exchange and over-the-counter markets.

-

More than 6 licenses from regulators and insurance of client money of up to $100,000, regardless of the trader’s jurisdiction.

-

1,000,000+ users worldwide.

Admirals is a broker for regular investment and active trading

The broker offers two most popular platforms for over-the-counter trading which are MT4 and MT5. MT5 also has additional functions for trading stocks. The broker’s unique features include plug-ins, add-ons, and trading panels for platforms. They expand the MetaTrader technical and graphical tools for speeding up and automating charts analysis, and making trading decisions.

For novice traders there is an educational section, which helps them become traders with a confident medium level of knowledge. The Admirals website has articles on all analysis types, risk management, visual webinars, etc.

Useful services offered by Admirals:

-

Constantly updated data on technical and fundamental analysis.

-

VPS. It is necessary for uninterrupted trading in case of the internet and electricity shutdown, or disconnection from the server. It is free with deposits from $5,000.

-

Premium Analytics. It includes market news, technical analysis, and fundamental analysis on data taken from over a thousand sources of financial news. All data is provided by such financial companies as Dow Jones, Trading Central и Acuity.

Advantages:

rapid account opening;

possibilities of rapid deposit and withdrawal;

many European currencies are available for trading;

several types of analytics that allow you to decide on the next steps;

minimum spread.

You can use proven trading strategies to increase the efficiency of your work on the Admirals website.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i