deposit:

- $250

Trading platform:

- MT4

- Proprietary platform

- FDIC

- FINRA

- SIPC

- SEC

- CFTC

- NFA

Ally Bank (Ally Invest) Review 2024

deposit:

- $250

Trading platform:

- MT4

- Proprietary platform

- Up to 1:200

- Forex trading with GAIN Capital partner

Summary of Ally Bank Trading Company

Ally Bank is a moderate-risk broker with the TU Overall Score of 6.67 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Ally Bank clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Ally Bank ranks 20 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Ally is a regulated self-trading and money management broker that caters to experienced traders and professional investors.

The Ally Bank broker is part of Ally Financial Inc., which is an American holding company. The original company was created in 1919 by the General Motors automobile corporation to conduct activities with its auto parts suppliers and associated automobile dealerships. In 2014, Ally started offering banking products, and since 2017, it has also offered brokerage services. Currently, it operates solely as an online bank and brokerage firm and has no physical branches. It does, however, offer favorable terms of cooperation at consistently competitive rates with professional round-the-clock support. The company's services are used by more than 8.1 million customers globally.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | From USD 250 (for Forex accounts) |

| ⚖️ Leverage: | Up to 1:200 |

| 💱 Spread: | From 0.7 pips |

| 🔧 Instruments: | Currencies, metals, stocks, ETFs, options (stocks and indices), mutual funds with fixed income |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Ally Bank:

- It has official licenses for banking, dealer, and brokerage activities from reputable US regulators.

- A wide range of assets is available such as currency pairs, metals, securities, and options.

- There is an opportunity to invest in diversified portfolios for passive profit.

👎 Disadvantages of Ally Bank:

- The company works only with US tax-paying residents.

- On the broker's website, there is no training on trading in various financial markets, nor is there a Forex glossary of terms.

- There are high commissions for withdrawing funds and the company does not compensate customers in any way.

- Only registered users can ask a question in the online chat.

- There is a time-consuming procedure for opening an account, which in some cases takes up to two weeks.

Evaluation of the most influential parameters of Ally Bank

Geographic Distribution of Ally Bank Traders

Popularity in

Video Review of Ally Bank i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Ally Bank

Ally Bank is a financial holding company that has been offering online banking services since 2009. Since 2017, the company has been providing brokerage services, providing a money management platform, and access to Forex and stock markets. A high minimum deposit, lack of cent accounts, and absence of full-fledged training materials on the stock and foreign exchange markets indicate that the broker is aimed at working with professionals and experienced investors, but not with beginners.

At the same time, Ally Bank offers a wide range of tools for options traders. These include options chains, probabilities, P&L calculators, and volatility charts. All of these tools are available free of charge to all customers. Forex traders can also use Ally as an intermediary in the foreign exchange market. In addition to currencies, the broker offers to trade metals on a spot basis.

The company's website cannot be called the most informative, especially in matters related to Forex. The terms of trading accounts are not spelled out here, so you have to look for them on the GAIN Capital partner website and in the MT4 trading terminal specifications. Online chat is only available to customers with active accounts with Ally Bank.

Latest Ally Bank News

Dynamics of Ally Bank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Ally offers a wide range of stand-alone and managed portfolio products and low fees to help you manage your securities investments profitably. Four types of diversified portfolios include more than 100 assets. Also, the investor can choose the optimal level of risk for himself, ranging from conservative to aggressive. Forex traders have access to MetaTrader 4 trading signals and a built-in service for automatically copying trades of experienced market participants.

Ally Invest Managed Portfolios manages customer accounts using different risk levels

Experienced investment professionals of Ally Invest manage portfolios using analytics, mathematics, as well as technical and fundamental analysis. The investor chooses the type of portfolio based on the tasks and the level of acceptable risk and deposits money into an investment account. Further, daily management and monitoring are carried out using intelligent technology. If necessary, the portfolio can be rebalanced without investor intervention. The main features of Ally Invest Managed Portfolios are:

-

There are four types of portfolios available, which are Core (with a high diversification by assets); Income (with a high dividend yield while maintaining a conservative level of risk); Tax optimized (for ETF trading with tax incentives); Socially Responsible (for investments in green companies).

-

The minimum investment to start investing is $100.

-

30% of the portfolio is set aside in cash, which serves as a buffer against market volatility.

-

The broker does not withhold consulting fees, annual fees, or rebalancing fees. The service fee depends on the total account balance at the end of the trading day. Commissions are summed up on a daily basis and are set monthly in the investor's personal account.

To receive passive income, you need to open an Ally Invest account, select the type of strategy and make a deposit of $100 or more. An investor can monitor portfolio performance 24/7 using virtual instruments and, if financial needs change, update investment parameters. The service fee is charged during the first 10 days of the month for the previous month. Its exact amount is shown in the monthly statement.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Ally Bank’s affiliate program

Ally does not have its own affiliate programs. However, the company is an introducing broker (IB) for GAIN Capital Group. For this reason, clients who open a Forex account here can receive rewards for participating in affiliate programs provided by GAIN Capital, which include Affiliates, White Label, and Introducing Broker. The main condition for receiving commissions from the broker is the connection of new active users and the expansion of the client base of GAIN Capital Group.

Trading Conditions for Ally Bank Users

The Ally broker offers competitive pricing for options, with stock options trading fees reduced to $0.50 per contract. The company's clients can also trade ETFs and US-listed stocks with zero trading fees. Ally does not have a minimum deposit required to open a stand-alone securities cash account. However, to trade from margin accounts, you need to deposit $2,000 or more. For accounts with managed portfolios, the initial investment is $100. The minimum deposit for Forex accounts is $250.

$250

Minimum

deposit

1:200

Leverage

24/7

Support

| 💻 Trading platform: | Proprietary platform (for investment trading), MT4 (for Forex) |

|---|---|

| 📊 Accounts: | Demo (Forex only), Self-Directed Trading (for self-trading), Managed Portfolio (managed portfolios), Forex |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Debit cards, wire transfer, ACH payment, checks |

| 🚀 Minimum deposit: | From USD 250 (for Forex accounts) |

| ⚖️ Leverage: | Up to 1:200 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.7 pips |

| 🔧 Instruments: | Currencies, metals, stocks, ETFs, options (stocks and indices), mutual funds with fixed income |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | No |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Forex trading with GAIN Capital partner |

| 🎁 Contests and bonuses: | Bonus for the first replenishment of the deposit, compensation for the costs of transferring assets from other brokers |

Ally Bank Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Forex | From $7 | Yes |

| Stock market | From $1 | Yes |

A swap fee is charged for transferring a position to the next trading day. Also, the Traders Union analysts compared the size of the spread of Ally Bank and other Forex brokers. Taking into account the obtained average data, each company was assigned an appropriate level of commission.

| Broker | Average commission | Level |

| Ally Bank | $4 | Medium |

| Charles Schwab | $11 | High |

| Webull | $0.02 | Low |

Detailed Review of Ally Bank

Ally Bank serves over 8 million clients worldwide. Its services are used by active traders and passive investors who prefer to use money management solutions. The company's activities are regulated by state and federal financial commissions such as FDIC 57803, SEC 170301, CFTC, and NFA 0408077. Investment protection in the stock market is ensured by Ally's membership in FINRA 136131 and SIPC. The broker offers favorable terms of cooperation to investors by refusing to withhold fees for consulting services.

Ally's official website contains the following information about the company's activities:

-

More than 2.25 million customers opened deposits here with total assets of USD 137 billion.

-

More than 18,700 dealers use Ally Bank's lending services.

-

The company serves more than 405 thousand Invest brokerage accounts with assets totaling $13.4 billion.

Ally is a company with a wide range of banking, dealer, and brokerage services

Ally is a company that regularly introduces innovative digital technologies to improve brokerage, dealer, and banking services. The award-winning online bank offers a full range of banking products, including housing and personal loans, lending, certificates of deposit (CD), and individual retirement accounts (IRAs). The American holding company also provides securities brokerage and investment advisory services through Ally Invest. Its clients can trade in securities (stocks, options, fixed income ETFs, and mutual funds), spot metals, and currency pairs.

The broker provides its clients with two trading platforms. Traders perform operations with securities through its proprietary terminal. Forex assets are traded through the MetaTrader 4 platform. Both terminals are available in desktop, mobile, and web versions.

Useful services of Ally Bank:

-

Maxit Tax Manager. A service that helps an investor to automatically calculate the number of deductions for filling out a tax return.

-

Research. Quotes, charts, company news, earnings, and key figures

-

Ally Invest LIVE. Streaming quotes for non-professional users

Advantages:

Licensed by reputable US government regulators and investment insurance by the Securities Investor Protection Corporation (SIPC).

Low trading fees on all account types.

Managed Portfolio investment accounts allow you to receive income on investments from $100.

In addition to access to the securities market, the broker provides an opportunity to trade on Forex.

A wide range of available stock and foreign exchange market instruments.

The ability to conduct through one company not only professional trading activities but also use the full range of banking and credit services.

A trader can transfer assets from other brokerage companies to Ally: when transferring more than $2,500, compensation for the commission for the operation is available.

How to Start Making Profits — Guide for Traders

Ally offers accounts for active trading and passive investing. They differ in the size of the minimum deposit and the range of assets available for trading.

Account types:

To train for Forex trading, you can use demo accounts with conditions identical to real accounts.

Ally is a company with a wide variety of instruments, which is aimed at both independent traders and investors who prefer to receive passive income from their investments.

Bonuses Paid by the Broker

There’s a Welcome bonus from $50 to $3,000 for opening an investment account

The amount of remuneration depends on the amount of the deposit made. To receive the minimum bonus, you need to replenish the balance from $10,000; for the maximum bonus, the replenishment must start at $2 million.

Compensation of up to $150 commission for transferring assets to Ally from another brokerage company

The bonus is available for transfers of $2,500 and more.

Investment Education Online

The company's website has a training section, but the articles presented in it are focused on customers who primarily use Ally Bank's banking services. Useful information for Forex traders is not presented there.

The information provided will help form the right habits to improve the future state of personal finances.

Security (Protection for Investors)

The banking activities of Ally Bank are regulated by the FDIC - Federal Deposit Insurance Corporation. Securities trading is available through Ally Invest Securities LLC, a member of FINRA and SIPC. Advisory products and services are offered through Ally Invest Advisors, Inc., an SEC-registered investment advisor.

Clients trading Forex assets are served by the division of Ally Invest Forex LLC., which is the representative broker of the largest American holding company GAIN Capital Group. It is regulated by the Commodity Futures Trading Commission (CFTC), is a member of the National Futures Association (NFA), and acts as a clearing agent and counterparty for all Forex trades. Ally Invest Forex LLC is also registered with the NFA under the number 0408077.

👍 Advantages

- The broker provides services strictly under the requirements of regulators

- Membership in the Securities Investor Protection Corporation (SIPC) allows you to satisfy client claims up to $500,000

- The trader can file a formal complaint with the regulators against the brokerage company

👎 Disadvantages

- SIPC coverage does not apply to clients who trade Forex assets

- Lengthy account opening procedure

- Only US residents can open investment accounts

Withdrawal Options and Fees

-

Withdrawal requests from verified clients, generated from 7:00 am to 3:55 pm (EST), are processed by the company on the same day.

-

On top of any bank charges, the broker will charge $25 for each withdrawal.

-

Withdrawals are made via ACH (Automated Clearing House), bank transfer, and to cards. With the first two methods, withdrawals can be made only after 60 calendar days from the date of the deposit. Withdrawals to Ally Bank accounts are made within a few minutes.

-

When withdrawing to an account with another bank, Ally Bank charges a fee of $30. The customer can also request a check by paying a $5 fee. If the check request is confirmed over the phone, there is an additional $50 fee.

-

Withdrawal and deposit currencies include US dollars, euros, Japanese yen, Swiss francs, Canadian and Australian dollars, and pounds sterling.

Customer Support Service

Calls to Ally Bank are available Monday through Friday from 8:00 am to 11:00 pm and Saturday from 9:00 am to 7:00 pm ET. The online chat is available 24/7.

👍 Advantages

- There is a 24/7 online chat service

- A separate communication channel is available for each service

👎 Disadvantages

- Telephone support is closed on Sunday

- Only registered users can ask questions in chat

- Support is provided in English only

Available communication methods:

-

call to the phone numbers indicated on the website;

-

email;

-

online chat on the company's website;

-

feedback form;

-

messenger apps on Facebook and Twitter;

-

company profiles on Instagram and LinkedIn.

For clients with active accounts, support is available from the broker's website and through the personal account.

Contacts

| Foundation date | 2020 |

| Registration address | 500 Woodward Ave, Detroit, MI 48226, USA |

| Regulation |

FDIC, FINRA, SIPC, SEC, CFTC, NFA |

| Official site | ally.com |

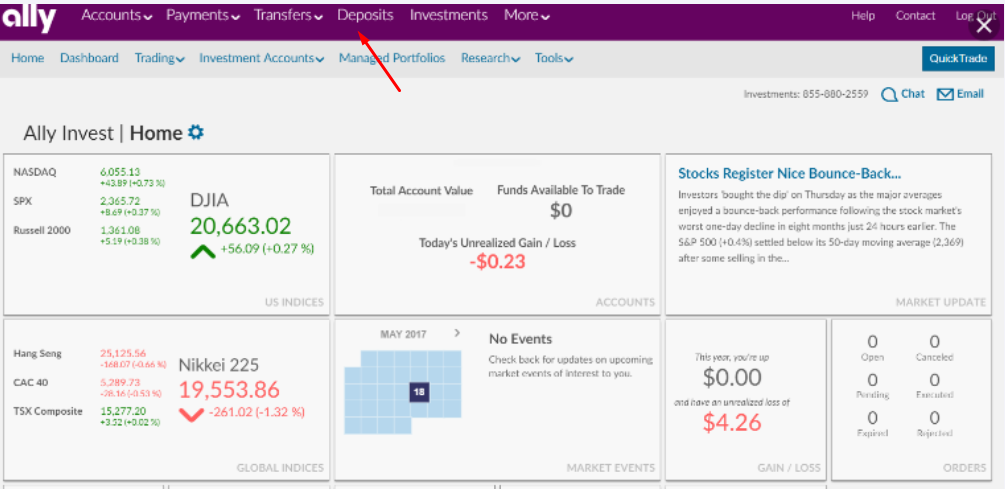

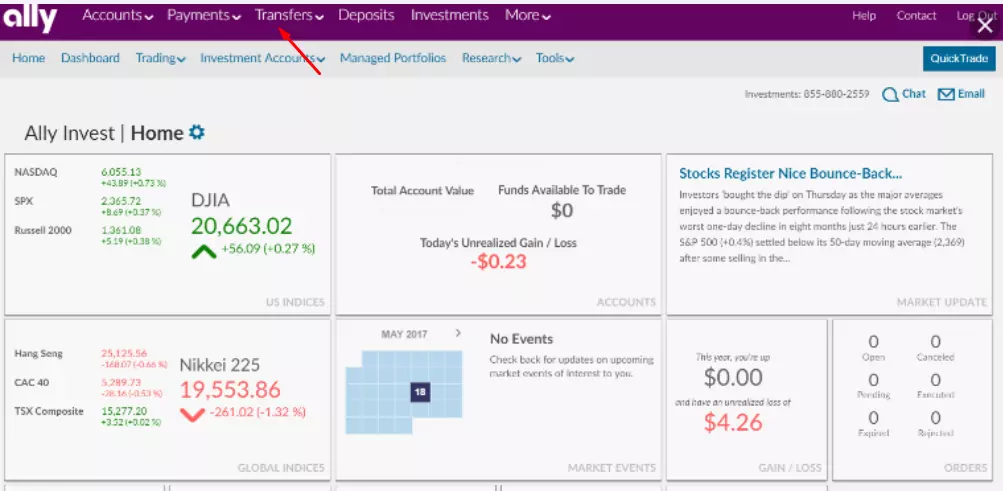

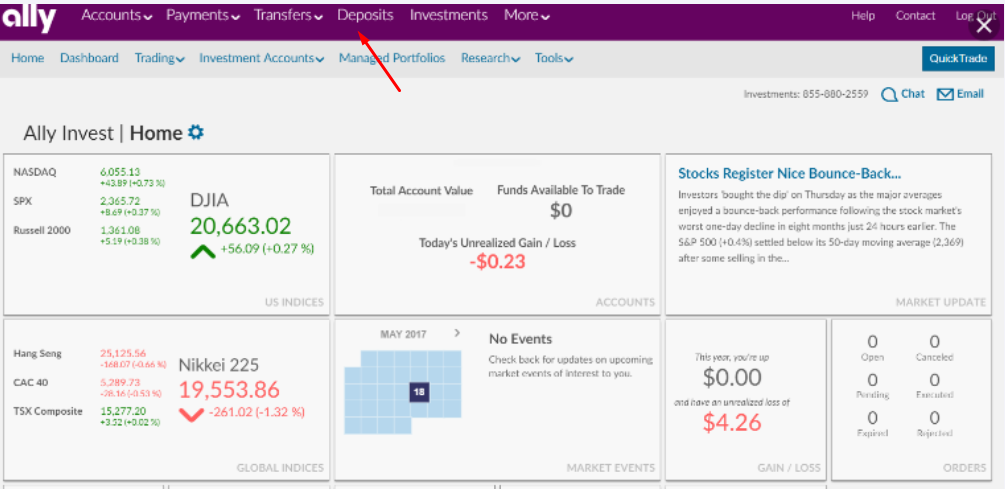

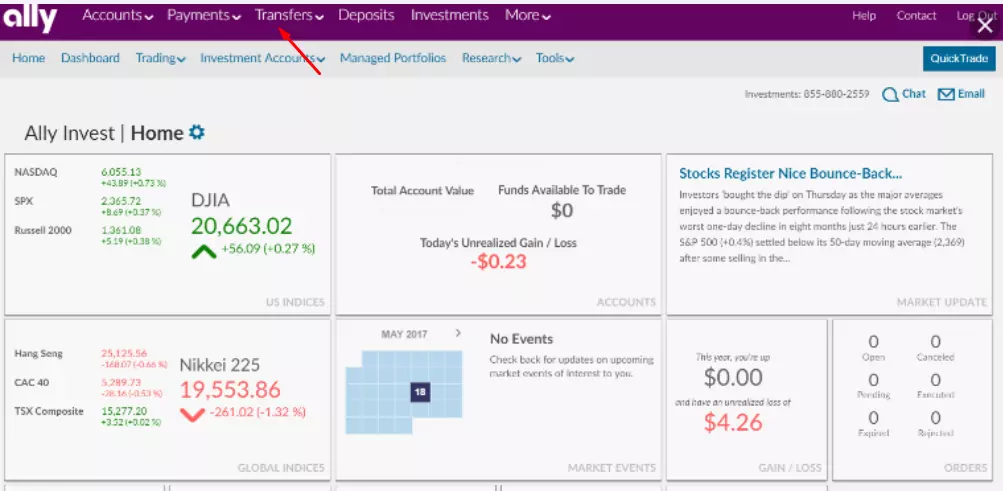

Review of the Personal Cabinet of Ally Bank

To start trading with Ally Bank, you need to open a real account with the company. Registration on the site is only available to those with a US Social Security number. The procedure for creating an account and personal account differs depending on the selected type of account:

To open an Invest account, visit the official Ally website, go to the Self-trading section, and click Start trading. Next, fill out the registration form and log in to your personal account.

To start trading on Forex, you need to go to the website of the broker GAIN Capital, which provides access to the foreign exchange market. After that, you should choose a platform with optimal trading conditions, such as City Index or FOREX.com. Visit the official website of the selected broker and open a trading account under the rules established by the company. After passing the verification in the personal account, you can make a deposit and download the trading terminal, and then start trading.

The following functions are available in your Ally personal account:

1. Making a deposit:

2. Transferring funds between accounts opened with Ally Bank, generating an application for withdrawing money from investment accounts:

1. Making a deposit:

2. Transferring funds between accounts opened with Ally Bank, generating an application for withdrawing money from investment accounts:

In addition, the following functions are available to the user in the personal account:

-

View market data for popular assets, as well as generate watch lists for trading instruments of interest.

-

Track trading statistics for investment and managed accounts.

-

Study financial research and analytical materials.

-

Quickly communicate with technical support staff via online chat.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Ally Bank rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Ally Bank you need to go to the broker's profile.

How to leave a review about Ally Bank on the Traders Union website?

To leave a review about Ally Bank, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Ally Bank on a non-Traders Union client?

Anyone can leave feedback about Ally Bank on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.