Best Stock Price Alerts 2024

Best Stock Alerts Service is The Trading Analyst

8 Best Stock Alerts Services 2024:

The Trading Analyst – best stock alert service;

Market Chameleon – Best platform for options research;

eToro – best for copying other traders;

Finimize – an affordable stock or forex market monitoring tool;

ForexSignals – is a perfect stock tracker.

Do your uncertainties increase whenever you plan any speculative swing trading? Are your doubts and worries making you miss out on trading where other stock market players are making marked bearish or bullish bets? Well, worry no more! Stock price alert service providers can give you a great wealth of information to make bold decisions that can help you grab the market opportunities and profits.

Investing in resourceful stock market monitoring tech- may help you improve your financial planning and trading. Proper use of the information gathered through configured pending alerts may help you in making less risky decisions, which may improve your profits and reduce your trading risks.

Instead of spending the whole day in front of your desktop or trading floor display screens, you can track your portfolio and get stock market updates from stock alert service apps and online platforms. This article presents to you some top stock alert service providers, and the tools that may help you pick the right investment vehicles, make proper trades, and get timely market information updates.

Start trading stocks right now with eToro!-

Are stock alerts helpful for beginner traders?

Yes, basic alerts on popular stocks can help newcomers track markets without extensive knowledge. But learning technical and fundamental analysis is also important for successful long-term trading.

-

What are the pros of using stock alerts?

Key benefits include real-time notifications, convenience, automatic portfolio monitoring, ability to scale across many holdings, and opportunities for timely trades.

-

What are potential cons of relying on stock alerts?

Cons may include unreliable triggers, information overload, distractions from core analysis, over-reliance on alerts impacting rational decision making, and disruptions if alerts systems fail.

-

Do free stock alerts provide the same features as paid versions?

Free tiers usually offer basic alerts, whereas premium versions give expanded choice of stocks, deeper tools and sometimes trading signals based on analysis. Paid tiers add more value.

What is a stock Price Alert?

Stock alerts are pieces of information that present information relating to the change of prices and volumes in stocks or other asset classes. These alerts inform traders and help them in making trading information. Such alerts are often received via email or short text messages.

The real-time information shows the current changes in stock market condition, stock status, price action, economic results, or important news events that traders need to know about the current state of the stock market.

Providers know that it’s challenging for traders to gather sufficient information from the entire market elements to make clear and informed trading decisions. As such, they create concise and accurate highlights of important market changes that they monitor, and present to traders. The stock alert service providers know that this information is vital to the trading process where traders have to make informed decisions to minimize trading risks.

The principle is that traders can’t have sufficient time and resources to conduct thorough market research on their own to make timely trading that reduces trading risks while earning profit without fail. As such, the traders have to use tools such as stock price alert apps to make timely decisions and actions so as to take advantage of trading opportunities that occur.

So, what kind of apps can you use to better your stock market trading outcomes? Read on to get insightful tips on the top-five stock price alert apps that can make your trading hassle-free and profitable.

Best stock picking services8 Best Stocks Price Alerts 2024

What is a stock or market alert? Unlike a market alert that is market-specific, a stock alert provides information relating to a single stock. Such information may include stock volume, price, and news relating to the stock. Typically, a market alert provides pieces of information on market conditions, price action, and economic results – among others.

There are numerous online platforms and stock price alert apps that provide market and stock price alerts, but here are some of the five best stock price alerts in 2024.

The Trading Analyst

If you're looking for a reliable options trading alert service, The Trading Analyst is definitely worth checking out. The Trading Analyst stands out as an exclusive options trading alert service operated by experienced options traders. Their platform delivers real-time SMS alerts featuring clear signals and accurate prices, simplifying the process of following and executing trades. Upon becoming a member, you gain access to alerts that offer significant potential gains ranging from 10% to 25% while minimizing downside risk.

The Trading Analyst boasts a track record of proven profits, employing a data-driven approach to options trading. By leveraging their swing trading method, which places emphasis on trading volume, over 11,450 individuals have enhanced their trading strategies. Furthermore, The Trading Analyst remains accessible to beginner traders as it offers affordable pricing for valuable trading insights. Rather than inundating users with excessive alerts, the platform focuses on delivering high-quality trade notifications at a satisfactory frequency.

| Stock Alerts Provider | Alert channel | Term of use | Pros | Cons |

|---|---|---|---|---|

|

SMS, Email |

Monthly Subscription - $147 per mon Annual Subscription - $787 per year Annual Subscription - $787 per year |

1. Professional stock analysis and alerts 2. Timely notifications for trading opportunities 3. Detailed research reports |

1. Requires a paid subscription 2. Limited alert channels (only SMS and email) |

Market Chameleon

Market Chameleon stands out as a comprehensive platform for options research, offering traders a wide range of information and tools to stay ahead in the market. The platform provides real-time data on options trading, historical stock prices, and extensive market analysis, equipping traders with valuable insights to make informed decisions. Market Chameleon caters specifically to options traders, offering intraday and end-of-day market data, press releases, earnings reports, and dividend information.

The platform provides comprehensive data and analysis through direct download, including historical options trading data, volatility trends, upcoming earnings and dividend events, and daily stock market activity. With its vast resources, Market Chameleon serves as a valuable source of trading ideas, featuring a variety of trading ideas such as earnings alerts and options strategies.

| Stock Alerts Provider | Alert channel | Term of use | Pros | Cons |

|---|---|---|---|---|

|

Push, Email |

Service Level: - Starter - $0 - Stock Trader - $39/month - Options Trader - $69/month - Earnings Trader - $79/month - Total Access - $99/month |

1. Free stock alerts and notifications 2. Variety of alert channels 3. Customizable alert settings |

1. Limited features compared to paid plans 2. Advanced features available only in paid plans |

eToro

eToro presents itself as a dependable stock alert service that offers traders a robust set of features and a user-friendly interface. It serves as an excellent option for those seeking accurate and timely alerts to make well-informed trading decisions. The platform fosters a vibrant community of traders who actively share insights and ideas, ensuring that traders never operate in isolation.

eToro's alerts can be personalized to suit individual preferences, enabling traders to receive notifications regarding projected economic events that may impact prices, whether they rise or fall. Furthermore, their alerts seamlessly integrate with traders' trading platforms, ensuring they stay updated on the latest market trends. Distinguishing itself from other alert services, eToro's alerts are grounded in both technical and fundamental analysis, offering traders a comprehensive market perspective. With its wide range of features, eToro empowers traders to stay ahead of the curve and maximize their potential profits.

| Stock Alerts Provider | Alert channel | Term of use | Pros | Cons |

|---|---|---|---|---|

|

Push, Email |

Free |

1. Free stock alerts and notifications 2. Real-time updates on selected stocks 3. Integration with eToro trading platform |

1. Limited customization options 2. Limited range of alert channels 3. May require an eToro account to access |

Finimize

Are you looking for affordable stock or forex market monitoring tools? If so, then the Finimize app from Fiminize Limited allows you to get full and affordable access to stock and market alerts at an annual fee of $59.99. If you can’t get full premium access, then you can take advantage of some of the platform’s services that are free.

The platform presents its market and stock updates via a daily newsletter delivered by email or any other chosen method. The brief newsletter is often less than 500 words, and it often covers three areas – the status of targeted stock, the implication of the stocks’ status, and the possible effect of the status on a trader’s portfolio.

| Stock Alerts Provider | Alert channel | Term of use | Pros | Cons |

|---|---|---|---|---|

|

Fiminize |

Email, streaming content, or text alerts |

$59.99 per year and free trial upon registration |

-Short engaging content |

-No free trial without paid subscription |

FInimize

ForexSignals

Do you love sharing stock market projections, trading insights, and ideas that may help all traders in bettering their trading outcomes? If so, then the Forexsignals trading platform is a perfect stock tracker for you. The platform hosts approximately 83,000 forex and trading experts.

The platform is popular for its accurate presentations of the present and future market trends as well as timely and accurate trade alerts. The unique ideology behind Forexsignals is to bring many traders together to share insights and ensure that no single trader trades alone.

Forexsignals syncs well with your trading platform, and it presents live streaming of content hosted by top global forex and stock trading professionals. Also, it provides accurate market analyses, and you can customize its push notifications to get alerts from projected economic events that may cause price drops or hikes.

| Stock Alerts Provider | Alert channel | Term of use | Pros | Cons |

|---|---|---|---|---|

|

Livestreams, Email or text alerts |

-$97 – Monthly Apprentice member offer with (7-day free trial) |

-Affordable discounted rates and free trials |

New users have to take lots of time to study the platform before they can use it effectively. |

MarketWatch

The MarketWatch platform is a Dow Jones Inc. venture, which provides in-depth analysis of the stock or forex market. It also provides an accurate presentation of the present and projected future market trends as well as timely and accurate trade alert details pertaining to stocks of interest or other investment options. Apart from presenting important market alerts and in-depth analyses, MarketWatch also offers a wide array of informative articles on trading, money, and the forex and stock markets.

| Stock Alerts Provider | Alert channel | Term of use | Pros | Cons |

|---|---|---|---|---|

|

MarketWatch |

Email or test message alerts |

Free |

-Commission free |

-The platform has lots of distracting ads. |

MarketWatch

CNBC

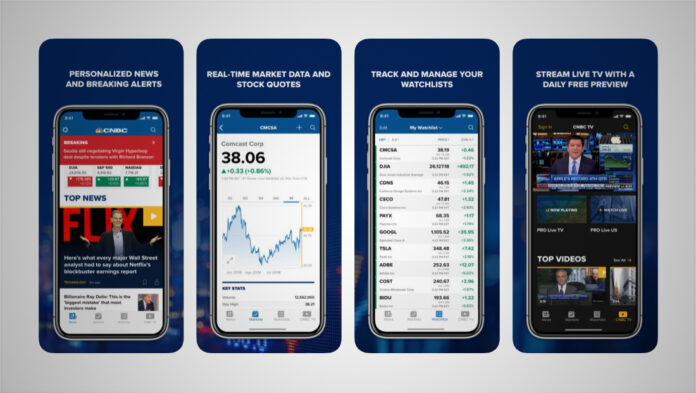

You know the CNBC for real-time financial market and business news coverage, but you may not have known that it’s part of the best stock price alerts platform in 2024. NBC is the main investor in the CNBC stock price alert platform.

CNBC’s platform presents stock projection estimates, real-time stock quotations, and projections of stock/forex market trends. All this information is given free of charge via the CNBC app and its online platform. In addition, you may also get access to popular CNBC shows on money matters, including “American Greed,” and “Mad Money.”

| Stock Alerts Provider | Alert channel | Term of use | Pros | Cons |

|---|---|---|---|---|

|

CNBC |

Email, streaming content, or text alerts |

Free version and pro-version for $29.99 per month |

-After-hours and pre-market trading data available |

The free version has limited capabilities |

CNBC

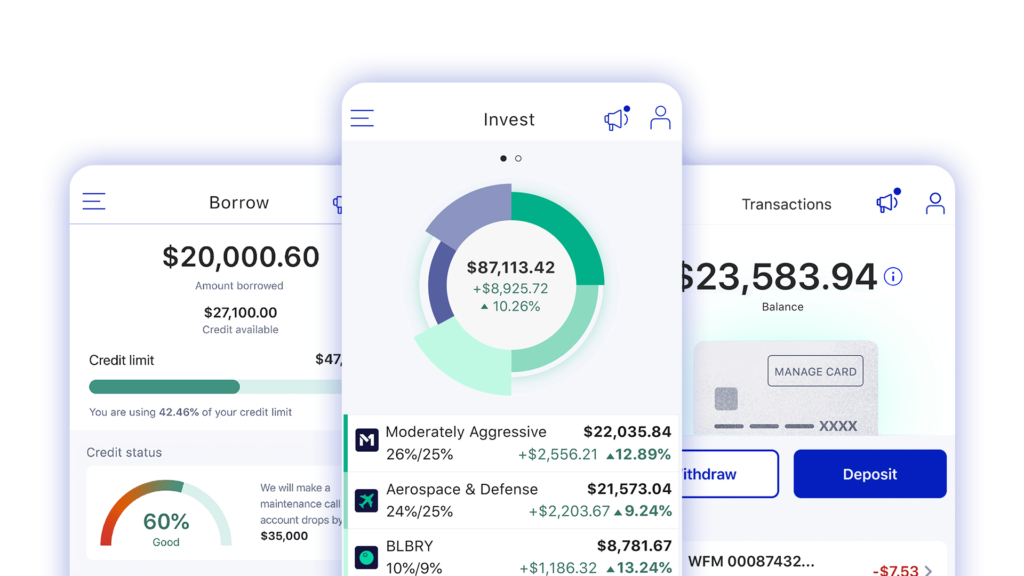

M1 Finance

Do you like freebies? Well, most people do! M1 is one of these freebies in the stock trading industry. M1 is a trading platform that serves as a free portfolio, stock tracker, and trade management online platform. The platform also provides stock price alerts, and essential advice on selling and trading tactics. The platform belongs to M1 Financial services company established in 2015.

M1 doesn’t charge any fee for using its services on any Forex market or trading option. The platform is ideal for new traders who’re trying to grasp market and trading basics. It’s for this reason that it’s perhaps one of the best 2024 stock price alert platforms that helps starters in learning the ropes.

M1 also has useful content on forex trade accounts, trading, and market details. Opening an account on M1’s platform is easy. All you have to do is sign up, provide personal details, and verification documents to get your account approval. Thereafter, you can deposit funds and start trading.

| Stock Alerts Provider | Alert channel | Term of use | Pros | Cons |

|---|---|---|---|---|

|

Email or text alerts |

Free |

-Commission free |

Not ideal for active traders |

M1 Finance

The above highlighted stock alert services provide a wide array of services that improve your trading prospects by providing insights that may help you make prudent decisions that may reduce risk and increase profits.

Read on to learn more about the seven top stock alert services that traders use to reap profits in the trading and forex markets while reducing their trading risk and possible losses.

What do The Best Price Alert Services Offer

The stock price alert services provided by stock alert service providers may earn the service provider some fee, but what’s their benefit to a stock trader? Here is what a stock trader gets from these important alerts.

Real-time stock alert services provide information on stock volume or price related events in the stock market. The information may also show sharp price changes within specific timeframes, large block trades of shares, stock trade resumptions or halts, and any other price or volume-related changes in stock trading. All these pieces of info- are important in making trading decisions.

Apart from monitoring and providing stock-related changes, the stock alert services also provide important educational content to traders who use it to better their trading skills.

Most stock alert service providers also provide analytical services that help the traders to learn about market dynamics and their influence on market and stock trends.

Some of the information provided through market and stock alerts is created by use of speculative and algorithmic processes that review market patterns and create predictions about possible future market or stock states. Such information helps traders to make future market and stock projections.

Some stock alert service platforms sync with trading platforms, and they may integrate with trading platforms to generate automatic signals that traders can use to implement a trading strategy without the human intervention of a trader. Such a possibility creates an automated marketing experience for you.

Stock alert service platforms such as ForexSignals create common online chat rooms for traders who use them to interact and share trading tips and insights in real-time.

The analytical nature of stock and market alert service platforms generates market and stock information that is essential in identifying and evaluating possible trading risks. Such information also helps traders to plan on how to avoid the identified trading risks.

Now that we’ve reviewed the importance of stock price and market alerts, let’s take a look at the principles held by the service providers.

What is the best stock price alert App?

The Stock Alarm App

The Stock alarm app is an iOS and Android supported app that you can install on your phone or browser to get push notifications and alerts from stock alert service providers. With this app, you can set triggers on assets to get real-time alerts that can help you get into action instead of creating limit orders that automate some of the trade options.

Some of the Stock alarm triggers that initiate the alert system include, gold cross patterns, price change, percent change, limits, LSI, MACD, SMA, and death cross. You may also get financial news and information about top market losers and gainers within the same notifications.

ForexSignals App

The ForexSignals app is an app from the ForexSignals online platform creators who provide stock alert services. The app provides stock alerts and trading signals to professional traders. The app provides 10 trading tools, market reviews, and exit and entry signals. The app also provides daily Forex signals for instruments that include Nikkei Indexes, Gold, Dow, Oil, and various currency pairs such as GBP/USD and EUR/USD.

The app is helpful to traders, but you should have some knowledge on Forex trading to understand the Forex charts so as to use the app effectively.

Finimize

The Fiminize stock alert trading app has a subscription of approximately 50,000 people, and it has helped many traders in making smart investment decisions. The app provides easy-to-use and actionable ideas in text and audio formats. The analyst insights and daily briefs provide thousands of trading strategies and insightful tips into market trends.

The app also provides live downloadable podcasts where VIP speakers present their insights, and text content that’s presented in an easy-to-read language. The app provides two price offers for U.K residents– a £59.99 annual fee or a monthly fee of £8.99. But the price threshold varies for other regions.

The MarketWatch App

The MarketWatch app is an app developed by Dow Jones & Company Inc. The app is compatible and usable on Android and iOS systems. The app presents stock alert services, which present important stock and market trend information.

The MarketWatch app has approximately 1 million registered users. It presents breaking news stories, in-depth analysis of stock market trends, stock prices, index movements, and the latest finance and business news in real-time. As such, it allows the users to make immediate and properly informed decisions. It’s also possible for you to customize a watchlist of what the app should monitor.

MoneyPatrol

MoneyPatrol is a finance and business app, which keeps track of all the financial accounts, and helps you to manage your finances and track spending. The app provides a list of important tools that help you in monitoring, tracking, and budgeting your financial plans. The app also sends automatic reports on market trends to your device.

The MoneyPatrol stock price alert app is usable on iPads, and devices with Android and iPhone systems. You can also install it on Mac or Windows.

How Do Stock Alerts Work?

The stock generated by stock alert apps are a kind of trading alert or alarm that you set to get notifications on price actions, economic results, or technical conditions that may affect the value of stock. The alert is raised when a certain set parameter is achieved in the metrics that measure stock market dynamics.

For instance, a price alert gives you notification when the stock prices in a market move by a specific amount of percentage or points. Once the movement Is attained an alert message or email is generated and forwarded to your phone or computer. These alerts are distributed to app users via chats, emails, and SMS content that may also contain audio-visual content. You can check the message status on your device to know the status of the market and stocks. Maybe, you also can be interested in information about best stock trading mobiles.

The acquired information is sometimes downloadable. You can store or copy and paste it into a text file or download it into a folder depending on the type of media that you encounter.

Having had a look at some of the best stock alert services and the best stock alert apps, it’s time to look at another important stock market trading tool – the online stock trading platforms where actual stock trading occurs.

Stock Alert Apps: Pros and Cons

Stock alert apps have become popular for providing real-time updates and notifications on the stock market. Here are the key pros and cons of using these apps:

👍 Pros

•Real-time updates: Get instant information on stock prices and market news for timely decision-making.

•Customizable alerts: Personalize alerts based on specific criteria to receive notifications tailored to your investment strategy.

•Convenience: Stay connected on the go with notifications delivered to your mobile device.

•Increased efficiency: Save time and effort by receiving immediate alerts, enabling prompt reactions to market developments.

•Portfolio monitoring: Track investments in real-time, view performance metrics, and receive alerts on portfolio holdings.

👎 Cons

•Information overload: Risk of too many notifications, requiring careful management.

•False alarms: Triggers may generate inaccurate alerts, leading to unnecessary trades or missed opportunities.

•Dependence on technology: Technical issues or connectivity problems can disrupt timely alerts.

•Security concerns: Ensure the app provider's reputation and security measures before sharing personal and financial information.

•Potential for emotional decision-making: Constant alerts may lead to impulsive actions based on short-term market fluctuations.

Choosing the Best Stock Alert App: Tips for Traders

Selecting the right stock alert app is crucial for traders seeking to stay informed and make informed investment decisions. With numerous options available, it's essential to consider various factors before making a decision. Here are three to five tips to help you choose the best stock alert app for your needs:

Determine Your Requirements

Before exploring different apps, make a list of the type of stocks you want to monitor and the specific features and services you require. Consider whether you need real-time alerts, customizable notifications, portfolio tracking, news updates, technical analysis tools, or integration with your brokerage account. Knowing your requirements will help you narrow down the options that align with your needs.

Research App Reliability and Reputation

Look for apps with a proven track record and positive user reviews. Research the reputation of the app provider, including their history, reliability, and data accuracy. Check if the app has experienced any significant technical issues or outages in the past. It's crucial to choose an app from a reputable provider that can deliver reliable and timely alerts.

Consider User-Friendly Interface

A user-friendly interface can greatly enhance your experience with a stock alert app. Look for an app that offers intuitive navigation, clear and concise information presentation, and easy-to-use features. A cluttered or complex interface can hinder your ability to quickly and efficiently access the information you need. Try out demo versions or free trials of different apps to assess their user-friendliness before committing to one.

Evaluate Customization Options

Customizability is essential to tailor the alerts and notifications to your specific requirements. Ensure that the app offers sufficient customization options, such as the ability to set alerts based on price levels, volume changes, news releases, or other criteria relevant to your trading strategy. The more flexibility the app provides in setting alerts, the better it can meet your unique needs.

Consider Costs and Value

Evaluate the pricing structure of the stock alert app. Some apps offer basic features for free but charge for premium features or enhanced functionalities. Consider your budget and determine how much you are willing to pay for the services you require. Assess the value you will receive from the app in terms of the features, accuracy, and reliability it offers. Compare the costs of different apps and choose one that provides the best balance of value and affordability.

What Are the Best Stock Trading Platforms?

Expert Opinion

Securities trading alerts are important, but they are by their nature retrospective. They are also widely disseminated. Once you get an alert, everybody's getting the same alert. So trading on it, unless you're an academic trying to prove the efficient markets hypothesis, is pretty much useless.

There are also more effective risk management techniques than calling emergency services after your house has burned down. For example, you can use stop orders. Better yet use trailing stop orders, which follow you up when you are profiting and are triggered when you start experiencing losses.

You can set them to follow you either a given percent or a given dollar amount behind your market position.

Say you set one five percent behind the spot price. The stock pulls an Enron and your stops are triggered long before you can pull your smartphone out of your pocket.

Because once you find out that the market is plummeting, it's too damn late to sell into it. After all, no one likes to catch a falling knife.

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Gismatullin has been an author at Traders Union since 2019. His focus is creation of detailed reviews of brokerage companies and cryptocurrency exchanges, as well as analytical and educational articles on finance.

Rinat’s motto: Always be open to new experiments. By overcoming the hardships you will reach the stars that open to those who seek.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.