deposit:

- $1

Trading platform:

- eOption

- eOption Mobile

- Sterling Trader Pro

- DAS (Pro, web, mobile)

- FINRA

- SIPC

deposit:

- $1

Trading platform:

- eOption

- eOption Mobile

- Sterling Trader Pro

- DAS (Pro, web, mobile)

- Floating

- The minimum deposit on accounts for non-US residents is $25,000

Summary of eOption Trading Company

eOption is a reliable broker with the TU Overall Score of 7.63 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by eOption clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company. eOption ranks 3 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

eOption is regulated by the following financial institutions: FINRA and SIPC. The next trading instruments are available to the clients of the company: stocks, options, ETFs, bonds, as well as fixed-income instruments. eOption fees are lower than those of competitors. In addition, a section with professional analytics is available on the official website of the broker. The eOption broker is a regulated broker focused on active US traders who prefer to trade options.

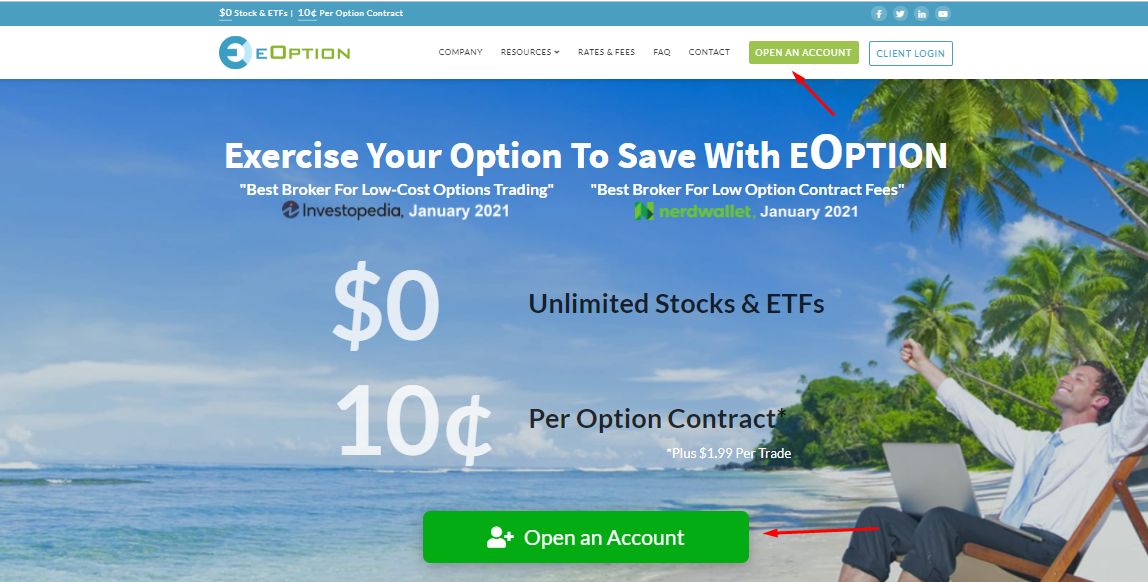

The eOption broker (eoption.com) is an American stockbroker headquartered in Glenview, Illinois. It has been operating since 2007 and is a member of FINRA (CRD#: 7297/SEC#: 8-21765) and SIPC. It specializes in options trading and also acts as an intermediary in trades involving the popular securities classes. The company offers low trading commissions, super-fast execution of orders, and modern platforms with an advanced set of analytical tools. In 2020-2021, eOption was recognized as the best options broker by several resources such as Investopedia, The Tokenist, Benzinga, Investormint, and NerdWallet.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | Cash account — from $1 Margin account — from $2000 |

| ⚖️ Leverage: | Floating |

| 💱 Spread: | No |

| 🔧 Instruments: | Options, stocks, fixed income, ETFs, listed bonds |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with eOption:

- Low commissions for options trading — $0.10 per contract plus $1.99 per trade.

- No minimum deposit requirements for cash trading accounts opened by US residents.

- FINRA membership and the protection of clients’ funds are available through Securities Investor Protection Corporation (SIPC).

- Access to professional trading platforms such as DAS and Sterling Trader Pro are developed by third-party software developers for the proprietary eOption terminal.

- An affiliate program with high rewards.

- Compensation for commissions for funds or assets from other brokerage firms and institutions transfer.

- Prompt support by phone and online chat in the trading platform during company business hours.

👎 Disadvantages of eOption:

- The narrow range of choice of investment solutions to generate passive income.

- You cannot trade Pink Sheet and Bulletin Board stocks.

- There is no online chat on the company's website.

Evaluation of the most influential parameters of eOption

Trade with this broker, if:

- You're a US resident looking to start trading without being restricted by minimum deposit requirements. This broker offers the flexibility you need to get started with investing.

- You require FINRA membership and protection of clients' funds through SIPC. Membership with the Financial Industry Regulatory Authority (FINRA) and protection of clients' funds through the Securities Investor Protection Corporation (SIPC) offer added security and peace of mind for investors.

- Access to professional trading platforms is a must for you. The broker provides access to professional trading platforms like DAS and Sterling Trader Pro, developed by third-party software developers. These platforms offer advanced features and tools for active traders, enhancing the trading experience.

Do not trade with this broker, if:

- You're looking for a broker that offers a wide range of investment solutions to generate passive income. This broker may not offer the variety you seek, such as dividend stocks, bonds, or ETFs focused on income generation.

- You're interested in trading Pink Sheet and Bulletin Board stocks, which typically include smaller or less-established companies. This broker may not support those trading options.

Geographic Distribution of eOption Traders

Popularity in

Video Review of eOption i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of eOption

The eOption broker is a US-regulated stockbroker; therefore its terms are more suitable for American traders. A $1 minimum is all that’s required to get started. Customers from other countries are deprived of such an advantage because many have a minimum deposit amount of $25,000.

The terms of most margin accounts are standard. Like other US stockbrokers, eoption.com requires a deposit of $2,000+ to trade on margin. However, there are still differences in the terms of companies that are very similar. We are talking about reduced commissions for trading options, and eOption offers the lowest or next to the lowest commissions among its competitors.

In our opinion, the main disadvantage of eOption is the lack of investment programs from which to choose. The broker offers only one investment option, the Auto Trading service. You can also participate in an affiliate program to make passive income. However, professional traders may feel the lack of sufficient investment opportunities.

Dynamics of eOption’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

The eOption broker is focused on trading options for active traders. The broker offers them the lowest commissions. At the same time, the broker maintains the automatic trading function, which enables the investor to make a profit without making trades on his own.

Auto Trading is an investment solution for generating passive income

Clients who subscribe to Auto Trading services choose one or more among 36 suggested trading signal providers. After that, eOption starts auto-trading to sell or buy securities following the parameters set by the investor. Here are some of the features offered by eOption’s Auto Trading program:

-

The broker or other party cannot start, stop or change the auto-trading status. If the subscription period for signals has not expired and there are funds on the account, then the decision to suspend trading shall be made by the investor himself.

-

All funds are under your total control. Subscribers can set the maximum trade size based on the USD amount, the number of contracts, the account balance percentage, and can start or stop the service at any time.

-

The broker doesn’t charge any auto-trading commissions. However, orders made by the Auto Trade Desk without the investor’s intervention shall be subject to a rate of $2.00 for stocks and $3.99 + 10 cents per contract for options.

-

After you open a brokerage account and pass verification, you can connect to the Auto Trading service online.

The eOption broker doesn’t verify, monitor, or evaluate the trading signals supplied, but acts as an executing broker following the specific Auto Trading Service instructions. The investor himself chooses the auto trading concept that is most compatible with his investment strategy.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Affiliate program from eOption:

-

Affiliate program. Here, an affiliate will get up to $100 for each attracted client who has replenished a trading account for $2,000 or more. Also, if the partner's account balance is over $2,000, the client and the referral receive two free BUZZ shares.

Participation in the affiliate program enables eOption clients to get monetary rewards from the company for attracting new users.

Trading Conditions for eOption Users

As an eOption client, you can trade options, stocks, listed bonds, fixed income assets, and ETFs. At the same time, the broker is focused on traders who use option strategies. The commission for derivative financial instruments trading is 10 cents per contract and that is lower than its competitors, plus $1.99 per trade. There is no minimum value for US residents to open a cash account. A deposit for international accounts is required from $25,000, and $2,000 for margin accounts. The new account shall be replenished within 60 days from the date of opening, otherwise, the broker may close it.

$1

Minimum

deposit

1:1

Leverage

5/8

Support

| 💻 Trading platform: | eOption, eOption Mobile, Sterling Trader Pro, DAS (Pro, web, mobile) |

|---|---|

| 📊 Accounts: | Paper Trading (Demo), eOption Live (cash account and margin account), IRA (Traditional, Rollover, Roth, SEP, Simple, Coverdell Education) |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Wire transfer, ACH, checks (certified and cash), transfer of funds and assets from another brokerage company, share certificates |

| 🚀 Minimum deposit: | Cash account — from $1 Margin account — from $2000 |

| ⚖️ Leverage: | Floating |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | No |

| 🔧 Instruments: | Options, stocks, fixed income, ETFs, listed bonds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | The minimum deposit on accounts for non-US residents is $25,000 |

| 🎁 Contests and bonuses: | Yes |

eOption Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Margin Account | From $2.09 | Yes |

| Cash Account | From $5 | Yes |

The client shall pay an extra $6 for orders on options, stocks and ETFs made with the help of a broker. There’s an inactivity fee of $50 per year. We compared the trading fees of eoption.com and other stock brokers. The calculation was made for 10 contracts. The eOption broker withholds a fee of 10 cents per contract + $1.99 per trade.

| Broker | Average commission | Level |

| eOption | $3.54 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of eOption

The eOption broker provides clients with access to trading options, stocks (NVDA), ETFs, quoted bonds, and fixed income instruments. The broker offers the lowest options commissions, high-tech trading platforms, and professional analytics. It offers services to private and corporate clients and provides trading, investment, and savings accounts. The eOption broker is a member of FINRA and SIPC, which offers protection of customers’ funds.

About eOption in figures:

-

Over 14 years of experience in the field of online brokerage services.

-

The company was awarded 5 times in the category "Best Options Broker” during 2020-2021.

The eOption broker caters to traders with different professional qualifications

The eOption broker specializes in options trading, but also provides a full range of investment services to a wide range of clients globally. The broker offers commission-free stock trading, powerful trading platforms, competitive low margin rates, and real-time expert support. There are no mandatory minimum retirements for opening an account nor are there trading volume requirements. The eOption broker provides a training demo account and free training materials on options trading.

The broker offers its clients a proprietary eOption trading platform along with several third-party terminals such as Sterling Trader Pro and DAS. They are available in desktop and mobile versions and compatible with iPhone, iPad, and Android OS-based devices. They also work in popular browsers. The broker’s proprietary terminal is provided free of charge. Note that the minimum capital needed to employ the Sterling Trader Pro and DAS platforms is $25,000.

Useful eOption services:

-

OptionsPlay. An online tool that increases the efficiency of options trading. It displays the historical analysis of thousands of stocks, buy and sell signals, has over 65 technical indicators, price action analysis, resistance, and support levels. It is provided free of charge for eOption customers. The fee for unregistered users is $500 per year.

-

Charts. Charts are based on ChartIQ, Quote Media, OptionsPlay, and ETNA data. There are about 30 technical studies available. You can link the charts’ graphical display to the actual watchlists.

-

News. Trading platforms display news feeds from Apollo News, GlobeNewswire, Quote Media, PR Newswire, Market News Publishing, Canada Newswire, Business Wire, Marketwired, UPI, and Fly on the Wall. You can sort news by topic, ticker, industry, or company.

-

Third-Party Research from Hammerstone Markets. The clients of eOption get high-quality analytical materials, stock market news, and expert comments four times a day.

Advantages:

The broker offers proprietary trading platforms and professional Sterling Trader Pro and DAS terminals from third-party software providers.

Online trading is available from 8:00 to 9:28 AM for the premarket session and from 4:00 to 6:00 PM for the post-market session.

The company’s partners can get referral bonuses for attracting new customers. The reward amount is up to $100 for each referral.

The broker provides training materials and daily free analytics with comments and forecasts from stock market experts.

Clients have access to automatic trading based on signals from over 35 notification systems.

The eOption broker supports the following option types: Buy-writes, Spreads, Combos, Straddles/Strangles, Butterflies/Condors, Iron Butterflies/Iron Condors, and Rollouts.

How to Start Making Profits — Guide for Traders

The eOption broker offers active and passive auto trading accounts and IRA retirement savings accounts for retail customers to not only US residents, but also to traders in the UK, Germany, Austria, Australia, China, Ireland, Luxembourg, Mexico, Switzerland, the Netherlands, New Zealand, Singapore, and South Africa.

Types of accounts:

Paper Trading allows potential investors to practice their trading strategies using virtual funds (similar to a demo account).

The eOption broker is focused on US traders and investors but also works with stock market participants internationally.

Bonuses Paid by the Broker

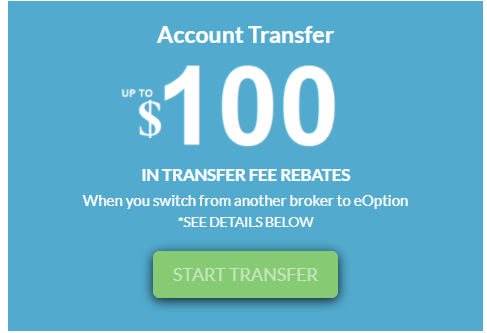

Discount on fees for an account relocation from another brokerage company

The eOption broker refunds fees up to $100 for asset relocation through ACATS when making a full account relocation of $2,500 or more. Compensation is not available for IRA and retirement accounts.

Two free BUZZ shares for a partner and a referral

Fulfill 2 terms to get shares: the referral shall deposit $2,000 or more within 15 calendar days after the account opening process is completed, and the partner shall be awarded a balance of $2,000 or more. The minimum amount for share accrual can be credited in cash or securities.

Investment Education Online

There is a Training section on the website. There, you can find some useful information to help you make you take your first steps in trading. Also, there is a blog with articles on the stock market to help novice traders.

The eOption broker offers Paper Trading, an educational tool to study the platform and test the trading terms of the broker and your trading strategies.

Security (Protection for Investors)

The eOption broker is a member of Regal Securities, Inc., which is a financial holding company that is a member of the Securities Investor Protection Corporation (SIPC) and is a FINRA member.

SIPC protects broker clients up to $500,000 with a $250,000 limit on cash payments. Moreover, the Hilltop Securities, Inc. clearing firm acquired Excess SIPC insurance, which covers up to $150 million in net worth of client accounts from an underwriting syndicate at Lloyd's of London. Insurance coverage per client is up to $25 million for securities and up to $900,000 for cash.

👍 Advantages

- SIPC settles the balance of clients of a member company in the event of bankruptcy and financial insolvency.

- If the broker violates the terms of the offer, you can file a claim with the supervisory authority.

- No problems with withdrawals

👎 Disadvantages

- You have to provide a complete package of documents confirming your social and tax status to open an account.

- Regulators limit the choice of payment systems available for making trades

Withdrawal Options and Fees

-

Withdrawal requests submitted before 11:00 am Eastern Standard Time (EST) are processed on the same business day.

-

The company withdraws funds from trading accounts by wire transfer, wire transfer via ACH, and checks. Funds cannot be withdrawn to cards or e-wallets.

-

Withdrawals through the auto clearinghouse shall be free of charge; however, there is a charge of $35 if the request is withdrawn or funds are returned.

-

The broker charges $35 for each withdrawal via wire transfer. The cost of cancellation of a request for withdrawal by bank transfer is $50, and for a returned check it’s $40.

-

The broker endorses a fraud and money laundering prevention policy. For this reason, funds credited through ACH cannot be withdrawn earlier than 30 days after the deposit was made.

Customer Support Service

Customer service is available Monday through Friday from 8:00 am to 6:30 pm (EST).

👍 Advantages

- Free phone calls from anywhere

👎 Disadvantages

- There is no online chat on the website

- Closed after 6:30 pm, on weekends and holidays

Available communication channels with customer support specialists include:

-

phone call using the numbers indicated on the website (a call-free number in the USA and for international calls is available);

-

send an email;

-

request information by fax;

-

write a message in Facebook Messenger or Twitter.

-

fill in the contact form;

-

via online chat in the trading terminal.

There is no Live chat on the broker's website, but it is available on the trading platform.

Contacts

| Foundation date | 1997 |

| Registration address | 950 Milwaukee Ave., Ste. 102 | Glenview, IL 60025, USA |

| Regulation |

FINRA, SIPC |

| Official site | eoption.com |

| Contacts |

Email:

support@eoption.com,

|

Review of the Personal Cabinet of eOption

Become an eOption client to start trading with it by following the instructions below:

Visit the official website of the company and click the Open Account button on its main page. Next, specify an email address, create a password and select the type of account. The broker opens an account within 24-48 hours after applying.

Indicate your name, address, and date of birth, as well as the name, address, and telephone number of your employer in the registration form. A U.S. citizen is required to provide a taxpayer identification number (social security number or employee identification number). Non-residents of the United States shall also indicate the passport number and country of issue, the foreigner's ID card number or government-issued ID with a photo, and the exact place of residence. International applicants shall fill in and mail the original form, and provide a copy of their current bank statement or utility bill to confirm the name and address used in your application for a new trading account.

The following is available in the eOption personal account:

-

Auto Trading service settings.

-

Deposit replenishment and funds withdrawal.

-

Financial statistics and reporting.

-

Connection to Support services;

Disclaimer:

Your capital is at risk. Via eOption's secure website. Your capital is at risk.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the eOption rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about eOption you need to go to the broker's profile.

How to leave a review about eOption on the Traders Union website?

To leave a review about eOption, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about eOption on a non-Traders Union client?

Anyone can leave feedback about eOption on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.