deposit:

- $1

Trading platform:

- Proprietary Firsttrade platform

- FINRA

- SIPC

Firstrade Review 2024

deposit:

- $1

Trading platform:

- Proprietary Firsttrade platform

- Floating

- Zero options fees: $0 per trade and $0 per contract

Summary of Firstrade Trading Company

Firstrade is a moderate-risk broker with the TU Overall Score of 5.89 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Firstrade clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Firstrade ranks 33 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Firstrade does not specialize in seasoned traders but offers equally favorable conditions to both professionals and beginners in the stock market. The broker cooperates not only with US residents but also with investors from other countries.

Discount broker Firstrade was founded in 1985 in the state of New York. In 1997, the company began providing online stock exchange brokerage services. Nowadays, Firstrade serves clients in 30 countries and offers a vast array of investment assets, a trading platform with an intuitive user interface, and favorable conditions for traders with different backgrounds and trading skill levels. For many years, major industry publications such as Forbes, Barron's, and Smart Money have awarded Firstrade the title of Best Online Broker. Firstrade was named Best in Class by StockBrokers.com in 2019.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | Floating |

| 💱 Spread: | No-charged |

| 🔧 Instruments: | stocks, options, exchange-traded funds (ETFs), mutual funds, bonds, CDs, and fixed incomes |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Firstrade:

- A vast array of available assets such as stocks, options, exchange-traded funds (ETFs), mutual funds, and fixed income products.

- In addition to US and permanent residents, the broker accepts clients from 29 other countries.

- A zero-entry fee for trading stocks, options, and ETFs.

- A zero-initial deposit for trading with your funds.

- Availability of insurance coverage from SIPC.

- Access to comprehensive research instruments and analytical market reviews.

- The ability to trade from mobile devices as well as through a web browser without the need to install an application.

👎 Disadvantages of Firstrade:

- The broker's clients cannot trade on international exchanges. At the moment, Firstrade only deals with securities listed on the US markets and exchanges.

- The company does not offer fractional stock trading.

- US citizens temporarily or permanently residing abroad cannot open accounts as US residents. Only international accounts are available to such traders.

Evaluation of the most influential parameters of Firstrade

Geographic Distribution of Firstrade Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Firstrade

The Firstrade brokerage company offers a full range of investment products like stocks, options, exchange-traded funds (ETFs), mutual funds, bonds, and CDs. There are no trading fees for several instruments (e.g., stocks, options, and exchange-traded funds). Clients are provided with a functional platform with convenient access to information on trading accounts, order status, option chains, and current market news. The terminal works through a web browser or mobile app.

Firstrade Securities offers its clients comprehensive research tools and market insights from the world's most trusted investment news providers such as Morningstar, Benzinga, Briefing.com, Zacks, and PR Newswire. Also, traders with active accounts get free access to professional instruments like advanced screeners, price alerts, and streaming watchlists.

Firstrade offers extended trading hours: Pre-Mkt - from 8:00 am to 9:25 am and After-Mkt - from 4:05 pm to 8:00 pm. Outside business hours and before trading, clients can trade in securities listed on the NYSE, NASDAQ, or AMEX, however, only limit orders are allowed. Otherwise, trading fees during extended hours and regular business hours are identical.

Dynamics of Firstrade’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Firstrade allows investors to create professionally managed diversified portfolios with low fees. The broker offers to invest in mutual funds to get a stable income without daily trading.

A proposal from Firstrade Securities to invest in mutual funds

The Firstrade website provides a list of available mutual funds. It includes over 11,,000 Load Funds, No-Load Funds, and NTF Funds. The investor invests in the selected mutual fund and transfers the money to professional managers to generate income. The broker offers the following instruments to facilitate the search for a suitable fund:

-

Advanced screener. The investor selects a mutual investment fund by entering criteria (e.g., minimum investment amount, type of load, risk category), and the system uses automatic algorithms to find a suitable mutual fund.

-

Completed fund profiles. They display the history of fund performance, asset allocation, manager information, and also contain comments from Firstrade investment experts.

-

Periodic investment program. The investor can customize the service taking into account the averaging of the dollar value, which contributes to the active development of the portfolio and reduces the need for market surveillance.

-

Investors are allowed to invest in several mutual funds at once. This tactic allows you to form an investment portfolio of funds (a set of multiple unit investment funds) and reduce the risk of an unfavorable outcome.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Firstrade’s affiliate program:

-

Refer Friends. A partner and a client who opened a brokerage account using a referral link receive one free promotion each. Shares ranging from $3 to $200 are provided.

-

Affiliate Program. Here, an affiliate receives $50 for each referral who replenished the account within 30 days from the date of opening the account and has at least $500 in his account at the moment when the accrual of remuneration is confirmed (usually at the end of each month).

A partner can invite an unlimited number of referrals. There is no maximum fee, however, the total value of received free shares cannot exceed $500.

Trading Conditions for Firstrade Users

If an investor makes four or more daily trades within five business days and the number of daily trades is more than 6% of the trading volume, then Firstrade, under FINRA (CRD#: 16843/SEC#: 8-34642) requirements, qualifies the account as a Pattern Day Trader (PDT). To conduct day trading, PDT must maintain a total account balance above $25,,000, otherwise, the broker limits the ability to trade to 90 days. Firstrade does not require a minimum balance to open an account or invest in securities. However, a trader must deposit a certain amount to place certain types of option orders: from $2,000 - for spreads, straddles, butterfly, and condor; and from $10,000 - for uncovered puts.

$1

Minimum

deposit

1:1

Leverage

10/5

Support

| 💻 Trading platform: | Proprietary Firsttrade platform |

|---|---|

| 📊 Accounts: | Brokerage accounts (individual, joint (WROS & Tenants in Common), custodial, Coverdell ESA, trust), Retirement accounts (Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, Simple IRA), International accounts, Cash Management Account, Cash Account, Margin Account |

| 💰 Account currency: | USD |

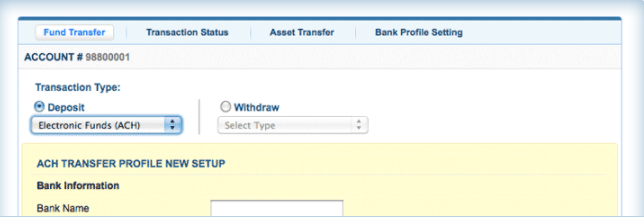

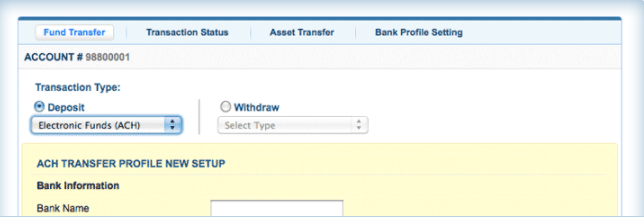

| 💵 Replenishment / Withdrawal: | ACH wire transfer, wire transfer, account transfer from another financial institution, check through a US bank |

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | Floating |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 Spread: | No-charged |

| 🔧 Instruments: | stocks, options, exchange-traded funds (ETFs), mutual funds, bonds, CDs, and fixed incomes |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Proprietary aggregator |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Zero options fees: $0 per trade and $0 per contract |

| 🎁 Contests and bonuses: | Yes |

Firstrade Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Brokerage account | From $0 | Yes |

Firstrade doesn’t charge fees for opening an account.

Many US brokers do not charge commissions for trading stocks and ETFs. For this reason, for a complete analysis of Firstrade Securities trading fees, we compared the broker's commissions for options trading with Charles Schwab and Ally brokers.

| Broker | Average commission | Level |

| Firstrade | $19.95 | High |

| Charles Schwab | $11 | Medium |

| Ally Bank | $4 | Low |

Detailed Review of Firstrade

Firstrade invites its clients to trade stocks, ETFs, options, mutual funds, and fixed income securities online. Since April 2018, the broker does not charge a fee for ETF trades. In August of the same year, Firstrade canceled fees for trading in stocks, exchange-traded funds, options, and mutual funds. The broker supports trading during extended hours, which allows you to increase the time of the trading session from 8 am to 8 pm.

Key numbers about Firstrade:

-

More than 35 years of experience in the financial industry.

-

Serves clients from 30 countries.

-

Provides traders and investors with access to trade in 7 asset classes.

Firstrade is a broker with an adequate level of information security and lightning-quick execution of transactions

The Firstrade broker strives to provide its clients with top-drawer security. To protect the personal and payment data of traders registered on the platform, the company uses Secure Sockets Layer (SSL) encryption technology. The Entrust digital certificate system is used to encrypt information exchanged with Firstrade. The broker guarantees that the execution time of the transaction does not exceed 0.1 seconds.

Firstrade has developed an intuitive trading platform that is easy to use and allows you to easily manage your account, place orders, receive market updates, and conduct research. You can connect to it through a computer, iPad, and other mobile devices based on the iOS and Android protocols. The trading platform is available in English, Traditional Chinese, and Simplified Chinese.

Useful instruments of the Firstrade trading platform:

-

Dashboard. An accounting dashboard that allows you to track market movements in stocks and all indices, including the Dow Jones Industrial Average, S&P 500, and Nasdaq. With its help, the user can manage all open accounts and read market news.

-

Quick Bar. This provides a quick access panel for entering orders and obtaining market information based on the trading needs of the investor. Through the Quick Bar, a trader can simultaneously place deals on different accounts, as well as view ratings, news, and market analysis for the assets of interest.

-

Navigator. An instrument that allows you to manage accounts and trade from one screen. The user has access to customizable widgets related to the account and the market, technical analysis, stock predictions, and pie charts.

-

Watchlist. Displays real-time quotes and provides one-click access to the live trading charts page. The user can create up to 10 watchlists. They are available on any device, no additional plugins are required.

Advantages:

A vast array of investment opportunities: access to trade in stocks listed on the NYSE and Amex, the Nasdaq stock exchange, or over-the-counter (OTC) markets, such as the OTC Bulletin Board or Pink Sheets.

Custody of customer funds in segregated accounts with major US banks.

Control of activities by the Financial Industry Regulatory Authority (FINRA).

The broker supports extended trading hours.

Investments in over 11,000 mutual funds are available.

No fees are charged for making a deposit, maintaining an account, or using the trading platform.

The broker has no requirements for the volume of trade. A trader can make transactions with any number of securities.

How to Start Making Profits — Guide for Traders

Firstrade offers its clients a vast array of retirement accounts, as well as a single account for trading and investing. Investment accounts can be opened not only by US residents but also by traders from 29 other countries. IRA retirement accounts are only available to US citizens who reside in the States.

Account types:

Currently, Firstrade does not have virtual demo accounts for testing trading conditions without financial investment. However, Firstrade is suitable for both experienced investors with a reserve of free capital and newbies who are just planning to trade stock market instruments.

Bonuses Paid by the Broker

Firstrade compensates for the commissions charged by another brokerage company for a full account transfer (ACATS only) to Firstrade

The broker will reimburse up to $200 for account transfers of $2,500 or more. Compensation is not available for mutual funds and fixed income instruments.

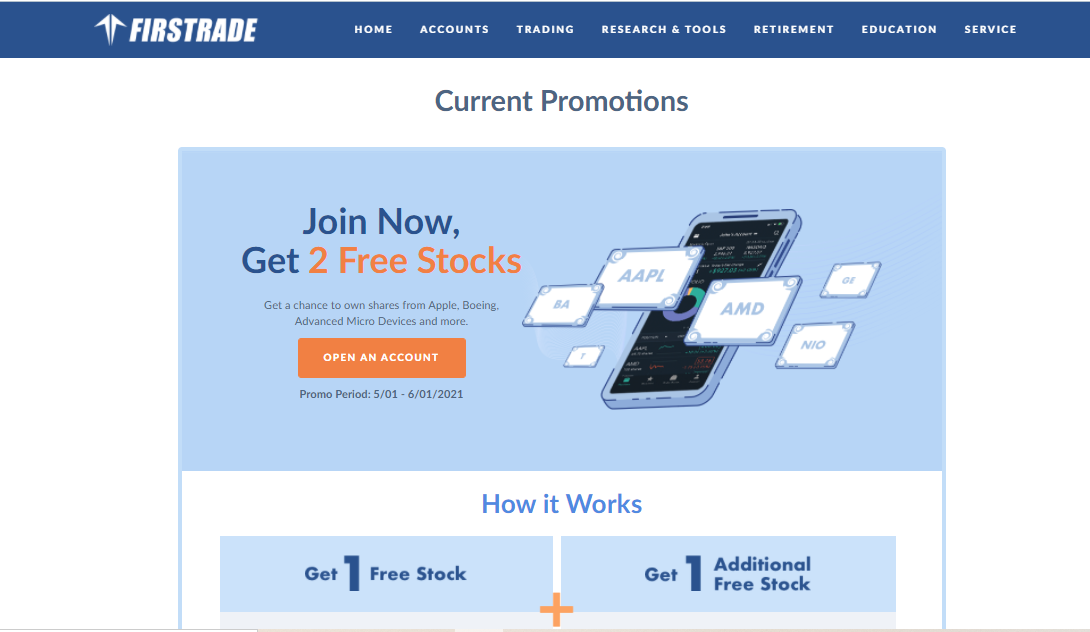

A chance to get two free shares of Apple, Boeing, Advanced Micro Devices, etc

The broker provides securities worth from $3 - $200. One share is credited upon opening an account. To qualify for the additional promotion, the customer must deposit at least $100 within 30 days from when the account was approved. Free shares are determined randomly using an algorithm.

Investment Education Online

A separate section of the Firstrade Securities website is dedicated to investment education. Here, novice market participants can read about the specifics of trading in various asset classes and receive investment advice from professionals.

The broker does not provide demo accounts. Therefore, the knowledge you obtained from studying Firstrade’s knowledge base can be applied only through using a real trading account and under real market conditions.

Security (Protection for Investors)

Firstrade Securities provides brokerage services under the Firstrade brand, is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

In the event a broker is declared bankrupt, SIPC insurance is available to his clients for up to $500,000, but not more than $250,000 for monetary claims. After the SIPC limits are exhausted, an additional insurance policy purchased by the clearing firm Apex Clearing Corporation is used to cover the costs of investors. The total insurance limit of US $150 million provides payouts to each client up to US $37.5 million for securities and US $900,000 for cash.

👍 Advantages

- SIPC insurance coverage is available to all clients

- FINRA handles complaints from all traders, regardless of where they live

- The broker provides services with strict adherence to the rules governing the offer

👎 Disadvantages

- Electronic payment systems are not supported

- Verification requires the provision of detailed information about income and its sources

Withdrawal Options and Fees

-

ACH wire transfers requested by 1:00 pm ET will be processed the same day. The transferred funds are credited to the account within 1-2 business days. The daily limit for ACH transfers is $50,000.

-

Only customers with domestic accounts in the United States are eligible to withdraw checks. International clients with a foreign mailing address cannot withdraw money by check. A withdrawal request by check made before 10:00 am ET is confirmed on the same day.

-

When withdrawing Wire Transfer funds, the company charges a fee of $30 for an internal transfer or $35 for an international transfer.

-

For security reasons, the employees of the brokerage company will call the client to confirm the request within 1-2 business days after the withdrawal request is made.

-

The priority withdrawal method for international clients is bank transfer. An electronic funds transfer via ACH is available if the investor has a US bank account.

-

All new deposits are held for 10 business days. Customers cannot withdraw funds until the hold expires.

Customer Support Service

Telephone Support‘s Hours of Operation are Monday through Friday, 8:00 am to 6:00 pm ET.

👍 Advantages

- Calls within the USA are toll-free

- Chatbot available

👎 Disadvantages

- Absence of online chat with a live person

- Phone support is not available on weekends and after 18:00

Available communication channels with customer support specialists include:

-

telephone (there is a separate number for residents of the USA and traders who reside outside (i.e., international) the US;

-

virtual robot assistant on the site;

-

email;

-

Fax.

Support is available not only to active customers but also to unregistered users.

Contacts

| Foundation date | 1985 |

| Registration address | 30-50 Whitestone Expwy. Ste. A301 Flushing, NY 11354 |

| Regulation |

FINRA, SIPC |

| Official site | https://www.firstrade.com/ |

| Contacts |

Phone:

1 800-869-8800

|

Review of the Personal Cabinet of Firstrade

The instructions for opening an account with Firstrade are as follows:

Go to the broker’s official website and click Open An Account at the top of any page. The company offers two types of registration forms - for US residents and residents of other countries. When you select an international account, a complete list of supported regions appears.

The first step in registration is to confirm your mobile phone. Then you need to enter personal information and provide social security and taxpayer numbers. If you do not have the documents listed above, or you are not a citizen or permanent resident of the United States, then you will need a W-8 BEN form to open an account. If the address specified during registration differs from the permanent one, then additionally it is necessary to provide a copy of a valid foreign passport and confirmation of foreign residence.

Review of Firstrade’s personal account:

1. Account replenishment and withdrawal of funds:

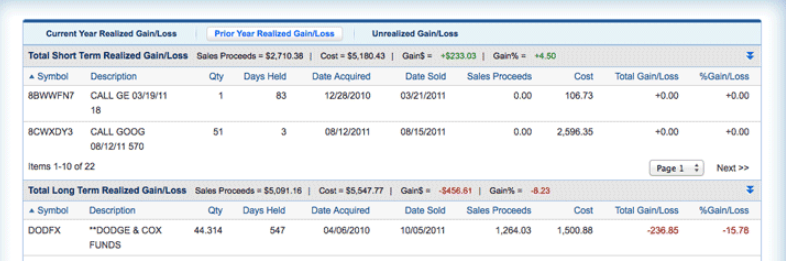

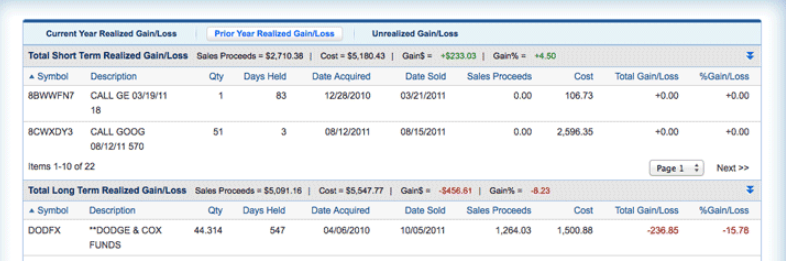

2. Tracking realized gains and losses:

1. Account replenishment and withdrawal of funds:

2. Tracking realized gains and losses:

There are several screens in the personal account:

-

History. Allows you to track the historical performance of securities marked by the user for a certain period, as well as analyze the impact of market trends on the account balance.

-

Balances. A section that shows statistics on the balances of all open accounts in real-time. To assess the purchasing power, the user can view the net change in the balance for the day and the number of blocked funds in pending orders.

-

Profile. Here you might check your account status, manage contact information, and manage account security features (i.e., change your password and PIN). The profile screen also allows you how to link multiple accounts under one login and set up usage rights.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Firstrade rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Firstrade you need to go to the broker's profile.

How to leave a review about Firstrade on the Traders Union website?

To leave a review about Firstrade, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Firstrade on a non-Traders Union client?

Anyone can leave feedback about Firstrade on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.