deposit:

- $1

Trading platform:

- Mobile application

- Proprietary browser platform

Interactive Investor Review 2024

deposit:

- $1

Trading platform:

- Mobile application

- Proprietary browser platform

- 1:1

- There are several tariff plans with different size of monthly subscription fee

Summary of Interactive Investor Trading Company

Interactive Investor is a moderate-risk broker with the TU Overall Score of 5.59 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Interactive Investor clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Interactive Investor ranks 38 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Interactive Investor is equally targeted at the beginners and professional investors, which is why you don’t necessarily have to have stock trading experience in order to work with the broker.

Interactive Investor (II Investor) is a private brokerage limited liability company founded in 1995. The controlling share package in Interactive Investor is owned by the top British investment company JC Flowers & Co. The broker is 100% financed by its own capital with no outside debt. The broker is controlled by the Financial Conduct Authority (FCA) and Financial Services Compensation Scheme (FSCS). Interactive Investor is headquartered in Manchester, UK. In 2021, the broker received the Best Low Cost Stock Broker award at the ADVFN International Financial Awards.

| 💰 Account currency: | GBP, USD |

|---|---|

| 🚀 Minimum deposit: | 1 British pounds |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | $3.99 – 7.99 |

| 🔧 Instruments: | Stocks, bonds, mutual investment funds, ETFs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Interactive Investor:

- No minimum deposit requirement on all investment accounts.

- An opportunity to reduce trading commissions as much as possible.

- Wide range of assets to invest in.

- Secure mobile app with facial recognition feature.

- Investment account with tax preferences up to 100%.

- Fixed commissions on trading stocks, ETFs and bonds.

- Withdrawal via the mobile app.

👎 Disadvantages of Interactive Investor:

- No stationary trading platform.

- The broker does not provide access to trading cryptocurrencies, derivative financial instruments and fractional stocks.

- The official website does not have an online chat.

Evaluation of the most influential parameters of Interactive Investor

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Interactive Investor News

- Analysis of Interactive Investor

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Interactive Investor

- User Reviews of Interactive Investor

- FAQs

- TU Recommends

Geographic Distribution of Interactive Investor Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Interactive Investor

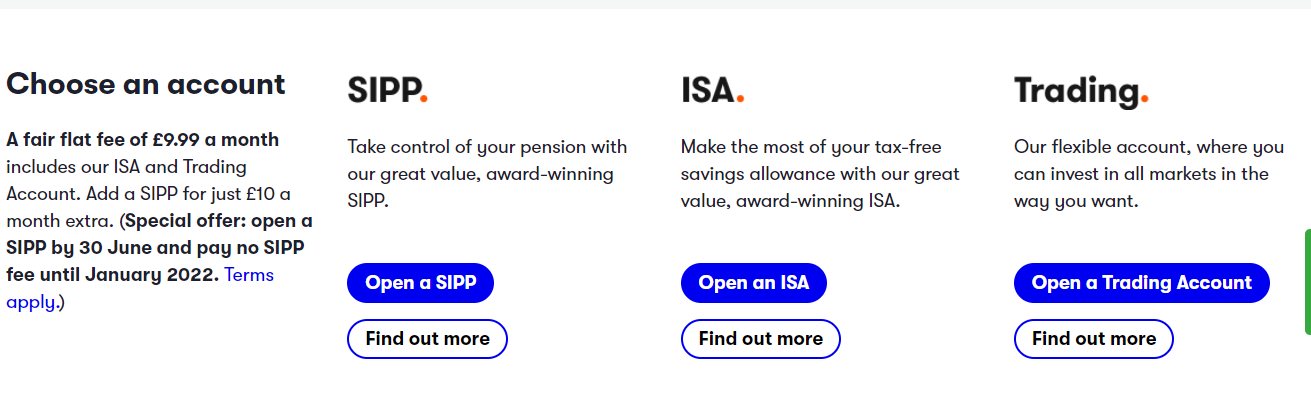

Interactive Investor (II Investor) offers three account types for investment, which differ in taxation amounts and number of instruments for trading. The investment account line features retirement accounts SIPP with tax preferences. There is also an option of opening an account for your child, who will be able to manage it independently once he/she reaches the age of 16 and dispose of the money fully once they come of full age.

II Investor (Interactive Investor) provides Level 2 quotations level, which in addition to the bid/ask prices shows information about the type of the trades (long or short) that are the priority in the intraday market. Together with the instruments for technical analysis of the market, Level 2 quotations provide an opportunity to predict the short-term movement of prices with higher probability.

The trading platform is available not only in English, but also in Italian. The minimum deposit is not set, which makes Interactive Investor attractive for the novice traders. However, the broker also has some drawbacks, the key one being up to 15 minute quotation delays due to the absence of clearing and a possibility to perform no more than one trade a month without the additional fee. There is also no online chat on the company’s website.

Dynamics of Interactive Investor’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Interactive Investor offers its clients a wide choice of options for investment, including shares, managed investment funds and ETFs.

Investment portfolio modeling is a popular project of Interactive Investor

To make the job of investors easier, the broker offers five ready-made investment portfolios managed by Interactive Investor with support of Money Observer to choose from:

-

Low-cost tracker funds, who replicate an index.

-

Automatic rebalancing of the portfolio is performed every quarter.

-

Monthly report on all performed transactions is available.

-

Each portfolio features 10% of bonds, which reduces investment risks.

Investors who are not willing to entrust their capital to Interactive Investor specialists, can copy an investment portfolio and manage it independently, without the broker’s involvement.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Interactive Investor’s affiliate program

-

Refer a Friend partnership program. A participant of the program earns passive income for each new client, who opens and funds an account using the referral link provided by the partner. There is a multi-tier structure of the bonus reward, the amount of which depends on the number of clients who opened an account using the referral link.

In order to become a partner of Interactive Investor, you need to send an application to the broker with contacts and addresses of the website, where the links are to be placed in the future.

Trading Conditions for Interactive Investor Users

Interactive Investor offers its clients an opportunity to invest without the brokerage commission in the majority of assets of the American and European stock markets. The margin depends on the type of trade and equals 25-35% of the deposit. The minimum deposit on all accounts is GBP 0. For the trading transactions of the clients, who are not UK residents, a GBP 3.99 commission is charged.

$1

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Proprietary web-platform, mobile application for iOS and Android |

|---|---|

| 📊 Accounts: | Demo, Trading, SIPP, ISSA |

| 💰 Account currency: | GBP, USD |

| 💵 Replenishment / Withdrawal: | Wire transfer, transfer to card via the mobile application |

| 🚀 Minimum deposit: | 1 British pounds |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 10$ |

| 💱 Spread: | $3.99 – 7.99 |

| 🔧 Instruments: | Stocks, bonds, mutual investment funds, ETFs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | There are several tariff plans with different size of monthly subscription fee |

| 🎁 Contests and bonuses: | Yes |

Interactive Investor Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| SIPP | From 3.99$ | Applicable to non-residents of the UK |

| ISSA | From 3.99$ | Applicable to non-residents of the UK |

| Trading | From 3.99$ | Applicable to non-residents of the UK |

Also the recipient/intermediary banks processing payments may charge additional commission.

TU analysts compiled a comparative table of trading commissions of Interactive Investor and other top brokers in the stock market. The commissions are specified for trading stock volumes that do not exceed GBP 25,000.

| Broker | Average commission | Level |

| Interactive Investor | $3.99 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Interactive Investor

Interactive Investor provides capital management services, offers an opportunity to invest in shares, bonds, mutual and stock funds via trading accounts and also ISA and SIPP. The broker provides its investors with in-depth Level II quotations and a monthly credit of GBP 7,99 for a term of up to 90 days for free trading, which allows for starting to trade without the deposit. For inexperienced traders, Interactive Investor offers ready-made investment portfolios with provision of monthly reports on performed transactions, which are managed by the broker.

Interactive Investor achievements in figures:

-

The company’s net assets exceed 100 million British pounds.

-

The broker manages a capital of 45 billion British pounds.

-

Over 350,000 people are the company’s clients.

Interactive Investor is a broker that provides equal opportunities for professionals and for novice traders.

Interactive Investor offers over 40,000 British and foreign stocks, bonds, mutual funds and ETF for trading. The broker’s clients have access to free Level 2 quotations, using the data of which, together with technical and fundamental analyses, improve the chances of earning a profit in intraday trading. In addition, setting limits and stop orders for a term of up to 90 days is allowed with an option of their cancellation prior to expiry.

The broker does not have a stationary trading platform, but the Web-platform is available for all devices connected to the Internet, supports all operating systems and opens in any browser. In the mobile application, available for iOS and Android, users can not only trade, but also withdraw money from their investment accounts.

Useful services offered by Interactive Investor:

-

Subscription to free newsletters, composed by the company experts.

-

Quarterly investment forecast of key assets effectiveness and discussion of the near future prospects.

-

Super 60 — an updatable rating of British and foreign stocks by categories and return rate.

-

A section with forms for filling out the applications on account management and money withdrawal.

-

Pension calculator and slippage calculator for adjustment of financial risks.

Advantages:

Access to trading over 40,000 financial instruments.

Compensations for the paid taxes on an income up to GBP 40,000 on retirement accounts.

Free opening and servicing of the trading account with an option of forming tariff plans for increasing the number of trades and adjustment of commissions.

The company offers ready-made investment portfolios, which include bonds without the financial risk.

There is an option of opening an account in the child's name with subsequent transfer of the accumulated capital to the child once he/she comes of full age.

Setting limits and stop orders, Stop Loss and Trailing Stop is available for all account types.

How to Start Making Profits — Guide for Traders

Interactive Investor offers three account types for its clients, one of which is a pension account. They differ in commission sizes and taxation conditions.

Account types:

To discover the Web-platform and peculiarities of trading on Interactive Investor, the broker offers to open a demo account.

Interactive Investor specialists provide capital management services and ready-made investment solutions, which is why the broker is suitable not only for professional traders, but also for the beginners in the stock market.

Bonuses Paid by the Broker

Refer a Friend

Every investor who opens a trading account upon the referral of the existing client of II Investor is exempt from subscription fee for a term of six months. The friend who referred him/her is awarded a bonus in the amount of 100 British pounds.

Investment Education Online

The broker does not provide courses on stock market trading basics, but it does feature a Help and Learning section on its website with descriptions of trading strategies and methods of work with different financial instruments.

In order to learn trading without the risk of losing your own money, you test your strategy on a demo account.

Security (Protection for Investors)

Interactive Investor Services Limited is regulated by the Financial Conduct Authority (FCA) and Financial Services Compensation Scheme (FSCS), and Fi service, where the data from third-party auditors are submitted based on the results of the annual audit.

Interactive Investor is one of the largest British companies in the global securities market, and the deposit of each client is insured, with the compensation limit currently at GBP 85,000. The broker holds client funds on the accounts of third-party banks and uses them solely for trading at the investor’s instrument, which is a guarantee of their safety.

👍 Advantages

- Insurance policy

- It is possible to file a complaint with the broker’s regulator

- Deposits are kept on segregated accounts

- The company has a 100% own capital without borrowed funds

- Controlling share package is controlled by J.C. Flowers & Co

👎 Disadvantages

- The regulator has restrictions on withdrawals via electronic payment systems

- Compensation amount is limited to GBP 85,000

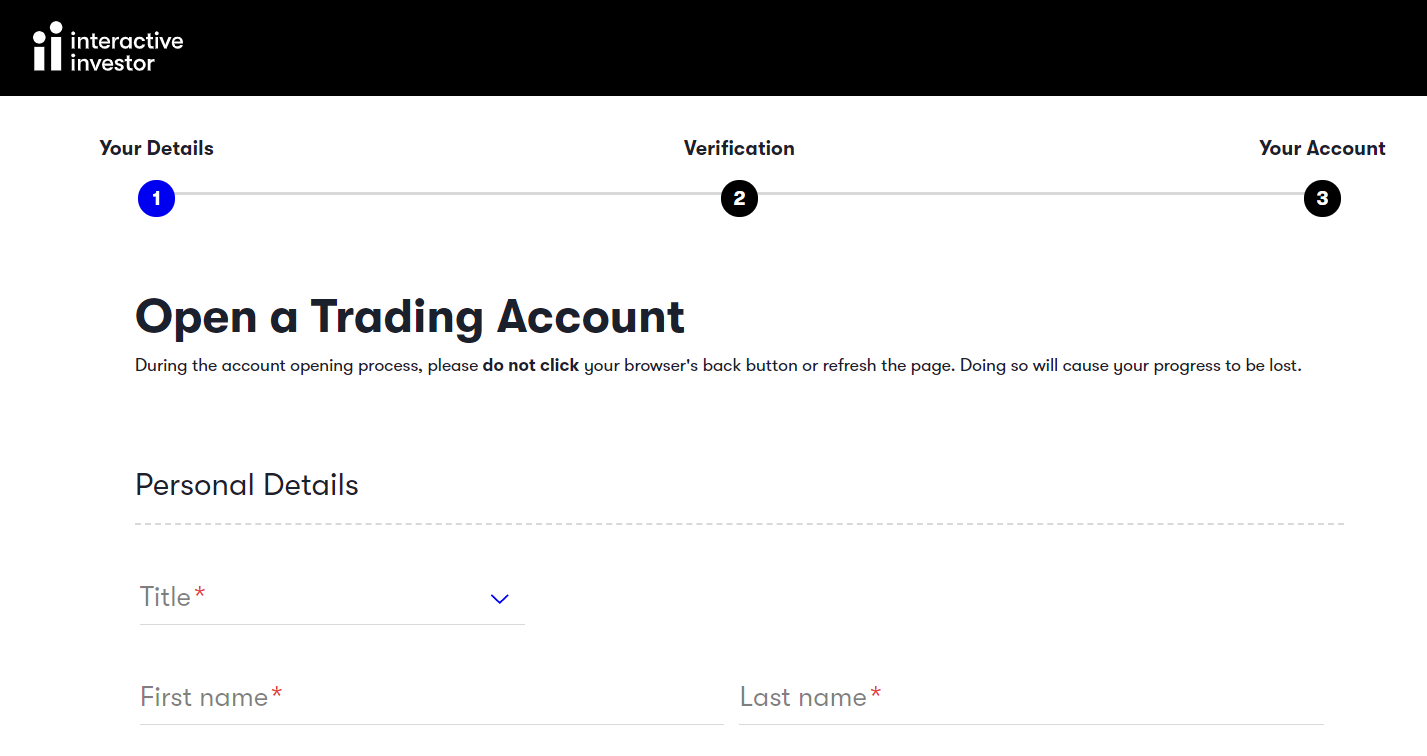

- Complicated registration and account opening procedure

Withdrawal Options and Fees

-

There are two available methods of withdrawal: wire transfer and withdrawal to a card via the mobile app. The transfer is performed on the following working day, if the application was submitted prior to 2:00 pm European time. If the withdrawal application is submitted after 2:00 pm, the withdrawal takes up to two working days.

-

In order to withdraw funds to a bank account outside the UK, a client must provide a bank statement. If the investor has several trading accounts with different currencies, there must be a separate bank account for each of them.

-

For withdrawal via the mobile app, a customer needs to request the verification code and confirm it via SMS. Withdrawal is available only if there are no open orders.

Customer Support Service

Interactive Investor customer support is available during working hours, except for the weekends and holidays.

👍 Advantages

- There is New Customer Hub section

- Ready-made forms for filling out the applications are available on the website

- Secure messaging service

- Phone calls are free of charge

- Support languages – English and Italian

👎 Disadvantages

- No online chat

- No 24h support

There are several methods of contacting customer support:

-

Phone call;

-

Feedback form;

-

Email;

-

Writing a ticket in the user’s Personal Account.

It is possible to contact customer support by email and phone without registration on www.ii.co.uk.

Contacts

| Foundation date | 1995 |

| Registration address | Exchange Court, Duncombe St, Leeds LS1 4AX, United Kingdom |

| Official site | https://www.ii.co.uk/ |

| Contacts |

Email:

interactivehelp@ii.co.uk,

|

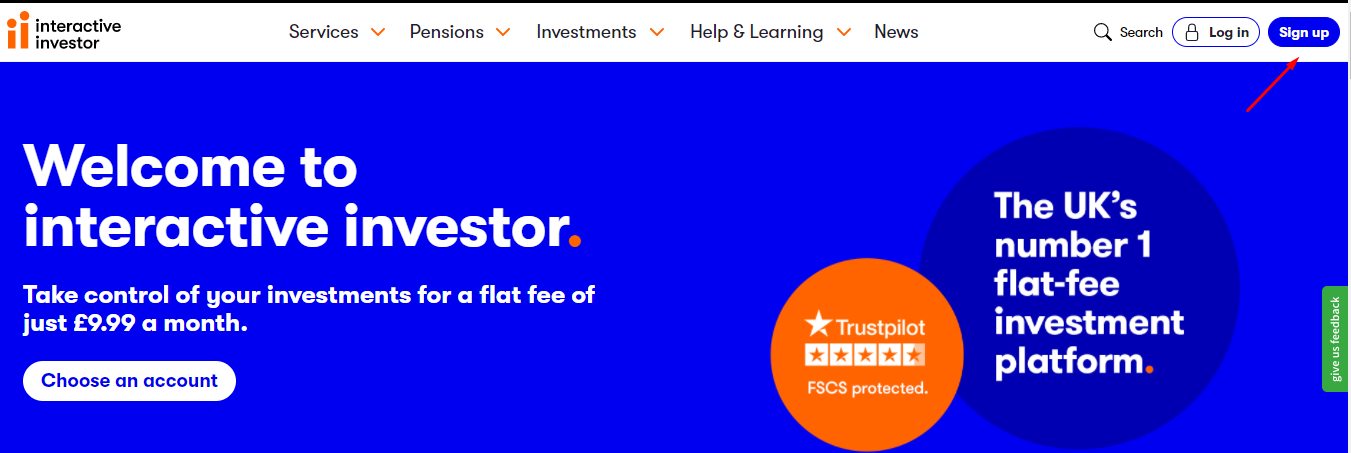

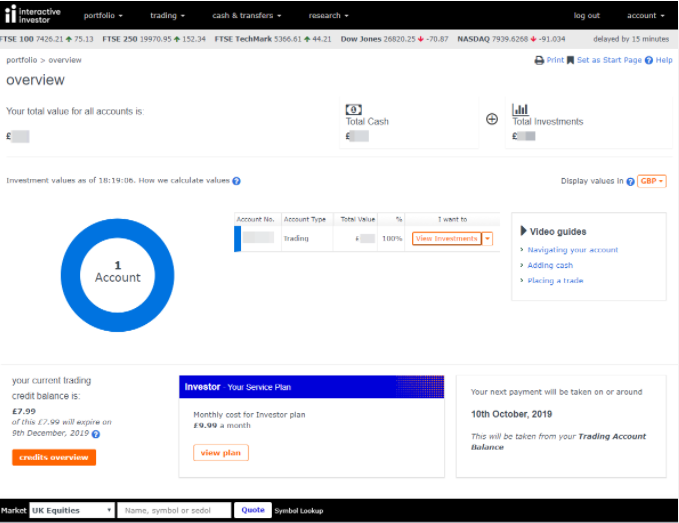

Review of the Personal Cabinet of Interactive Investor

In order to become a client of Interactive Investor, you need to:

Visit the broker’s official website and click on Sign Up on its home page in order to register.

Select account type:

Fill out the form for opening a trading account, providing personal data, tax information, occupation and job and then pass verification:

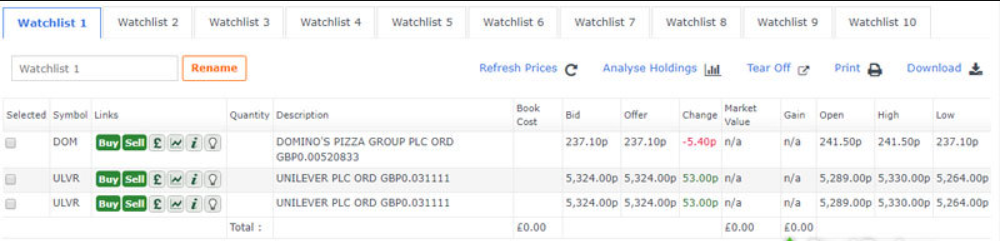

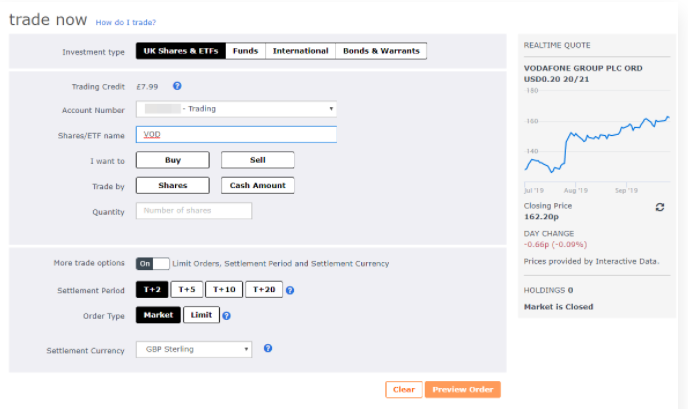

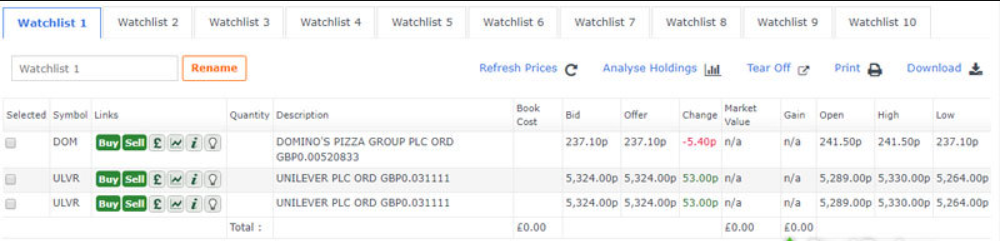

In the Personal Account, an investor can:

1. View selected assets from the watchlists:

2. Form statistics on the accounts:

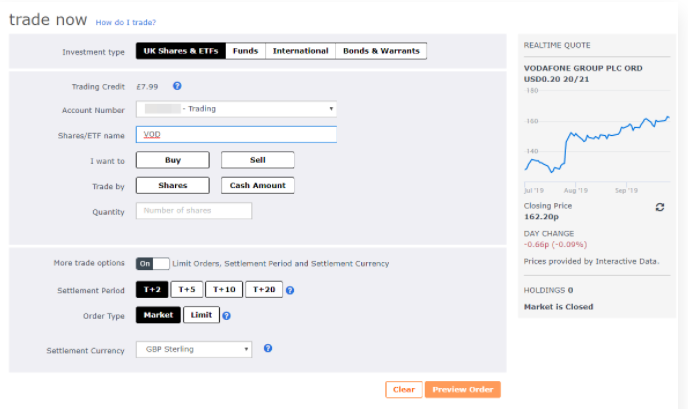

3. Place orders:

1. View selected assets from the watchlists:

2. Form statistics on the accounts:

3. Place orders:

Personal Account tabs:

-

Portfolio;

-

Trading;

-

Watchlist;

-

News;

-

Account.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Interactive Investor rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Interactive Investor you need to go to the broker's profile.

How to leave a review about Interactive Investor on the Traders Union website?

To leave a review about Interactive Investor, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Interactive Investor on a non-Traders Union client?

Anyone can leave feedback about Interactive Investor on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.