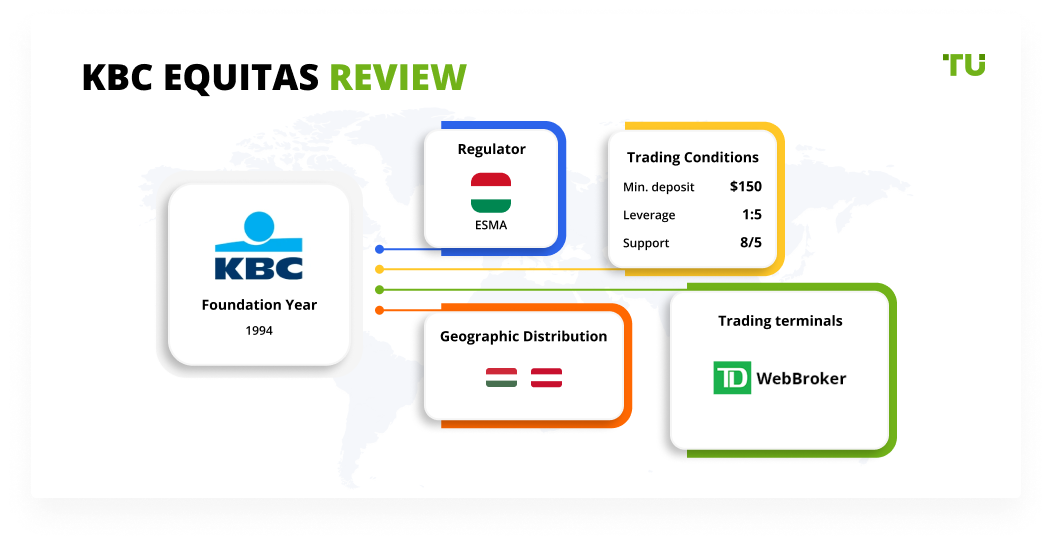

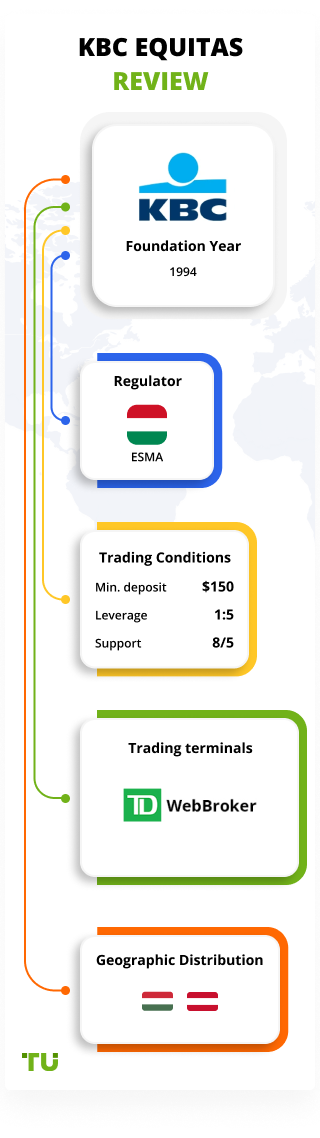

deposit:

- $150

Trading platform:

- WebBroker

- ESMA

KBC Equitas Review 2024

deposit:

- $150

Trading platform:

- WebBroker

- Up to 1:4-1:5

- Flexible tariff policy

Summary of KBC Equitas Trading Company

KBC Equitas is a broker with higher-than-average risk and the TU Overall Score of 4.51 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by KBC Equitas clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. KBC Equitas ranks 71 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

KBC Equitas is an exchange stockbroker for novice traders and traders who have a theoretical trading background and who want to gain practical experience.

KBC Equitas is a Hungarian stockbroker that has operated in the international market since 1994. The target audience of the broker is novice traders and traders with an average level of experience and who are interested in intraday trading. The company also has long-term stock investment products. The Regulators are the national regulator of Hungary that conducts an external exchange audit, and ESMA, the EU regulator.

| 💰 Account currency: | Hungarian forint (HUF) |

|---|---|

| 🚀 Minimum deposit: | HUF 25,000 for an investment account, HUF 5,000 for a retirement account, HUF 50,000 to open a trading account e |

| ⚖️ Leverage: | Up to 1:4-1:5 |

| 💱 Spread: | Market margin between the purchase/sale price of securities |

| 🔧 Instruments: | Stocks, options, ETFs, bonds, certificates, futures |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with KBC Equitas:

- Access to 27 exchanges in Europe and the USA, including Xetra, Euronext, Nasdaq, and NYSE. More than 20 thousand securities are available for trading.

- The trading platform is provided by an independent developer called WebBroker. It does not have professional trading tools but is great for those who try their hand at stock exchange trading.

- Flexible tariff policy, providing a grid for novice traders, investors, and professionals.

👎 Disadvantages of KBC Equitas:

- Orientation is more towards the regional market.

- The exchange and dealer fees are nonexistent in the over-the-counter market.

Evaluation of the most influential parameters of KBC Equitas

Geographic Distribution of KBC Equitas Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of KBC Equitas

The KBC Equitas broker is a regional stockbroker that provides investors with access primarily to the Hungarian securities and derivatives market. The company provides both active trading and investment services through affiliate funds. Passive investment is represented by the following products: classic investment account and retirement savings account. There are offers for active traders such as margin trading in securities, earnings on short positions (provided as a separate product), trading with leverage, and intraday trading.

WebBroker is the trading platform. It is designed for trading stocks, options, and ETFs. It has online resources from the analytical services of TD Securities, Morningstar Equity Research, etc. The tariff policy is loyal, but there are more favorable tariffs for professional trading.

When first using the broker, the impression is positive. The advantages of the broker are access to certain securities of the US stock market, Euronext and Xetra, and to the European stock exchanges. There are long-term investment products and relatively small commissions.

Dynamics of KBC Equitas’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

KBC Equitas combines the functions of a stockbroker for trading securities and an investment fund for individuals who are miles from the financial markets, but who want to get a higher yield than bank deposits.

The broker's investment programs are represented by the following products:

1. Accumulative retirement account. A state-supported program that allows you to receive income from pension savings by transferring them to the management of a broker or investment fund. Its features are:

-

Savings up to 20% per year (up to HUF 100,000).

-

Pension payments start with the third tax year.

-

Tax exemption on interest after 10 years.

The account is intended for long-term money storage and for active trading in securities.

2. The permanent investment account is for individuals who intend to transfer money to the trust management of KBC Equitas. Its features are:

-

Account management fees are HUF 199 per month.

-

Separate account for medium- and long-term investments.

-

Full or partial exemption from 15% tax on income and dividends.

A prerequisite is the preliminary opening of a securities account, from which the money will be credited to the investment account.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

KBC Equitas’ affiliate program:

The affiliate program is not provided for by the KBC Equitas development policy. The goal of the broker is to attract traders and investors by expanding the investment products range and reducing commissions.

Trading Conditions for KBC Equitas Users

KBC Equitas offers two types of services: investment products and active trading products. Investment products are part of the trust management and retirement account. Active trading includes intraday, leveraged, short, and algorithmic intraday trading. Each product has its own terms and conditions.

$150

Minimum

deposit

1:5

Leverage

8/5

Support

| 💻 Trading platform: | WebBroker |

|---|---|

| 📊 Accounts: | Currency accounts, securities accounts. Separate trading or investment account can be opened for each task |

| 💰 Account currency: | Hungarian forint (HUF) |

| 💵 Replenishment / Withdrawal: | Bank payment systems |

| 🚀 Minimum deposit: | HUF 25,000 for an investment account, HUF 5,000 for a retirement account, HUF 50,000 to open a trading account e |

| ⚖️ Leverage: | Up to 1:4-1:5 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | Market margin between the purchase/sale price of securities |

| 🔧 Instruments: | Stocks, options, ETFs, bonds, certificates, futures |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Flexible tariff policy |

| 🎁 Contests and bonuses: | Yes |

KBC Equitas Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Margin | From $7.99 | Yes |

The above commissions are relevant for securities only. For certificates, the commission is 1.5%, but not less than USD 22/EUR 20.

A comparative analysis of the KBC Equitas commissions with other brokers was also made. The minimum commission on securities was taken as a comparative basis.

| Broker | Average commission | Level |

| KBC Equitas | $7.99 | Medium |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Low |

Detailed Review of KBC Equitas

KBC Equitas is a regional broker aimed at active novice traders and long-term investors in Hungary. The company does not seek to compete with European brokers, firmly holding its place in a relatively narrow niche of stockbrokers. Most of the broker's instruments are securities of European markets, and access to a part of European stock exchanges is provided by affiliate dealers.

KBC Equitas’ success by the numbers:

-

There are 7 main products for active trading and trust investment.

-

More than 20,000 securities, including US and European stock indices, are available for trading.

-

Access to 27 exchanges including Nasdaq and NYSE.

-

More than 20 dealers and think tanks provide access to exchange platforms and information sources.

KBC Equitas operates trust management and active trading on one platform

The KBC Equitas platform is WebBroker. This is where the investor gets to know the company. The platform exists in desktop and mobile versions. From it, the trader opens accounts corresponding to the broker's products. For example, to open an investment account, an investor opens a securities account with the help of the support service. And then, on the platform in the menu Administration/Contracts, he opens the desired account.

One of the features of KBC Equitas is the possibility of trading on the premarket shares of Nasdaq, NYSE, and the US stock exchanges. Premarket is a short-term trading period before the main session, during which there is a high spread with high volatility. But at the same time, it is an opportunity to open a trade at the best price before making a fundamental move. Regional brokers rarely offer such a service.

Useful services of KBC Equitas Investment:

-

Analytical markets review.

-

Premium brokerage service

Advantages:

Relatively low commission for large trading volumes.

Opportunity to optimize costs by paying for a fixed package of services.

A combination of accumulative, investment, and active trading products.

Separate order types for algorithmic and short trades.

You can find detailed conditions on the broker's website in .pdf format.

How to Start Making Profits — Guide for Traders

Before opening an account, check with the Traders Union support about the possibility of saving on commissions using the rebate service. Then install the platform and open an account by providing broker support with identification documents and your tax ID code.

Active trading products of KBC Equitas:

Bonuses Paid by the Broker

Each new client, when opening an account using a promotional code, receives HUF 20,000 as a bonus to offset trading commissions. It is not possible to withdraw the bonus into real money. The promotional code for receiving the bonus is indicated on the site.

Investment Education Online

Analytical materials are provided by KBC Equitas in a separate section. But they are more informational. These are investment ideas, market reviews, and analysts' opinions. There is no basic theory of the stock market on this site.

Security (Protection for Investors)

KBC Equitas is a broker monitored by the Hungarian regulator and also controlled by ESMA, the EU financial regulator. As an additional control, there is an exchange audit to gain access to stock exchange assets. The company operates under the MiFID II rules.

👍 Advantages

- Cross regular audits by different regional and national regulators

- Compliance with strict rules of work in the legal field

- Possibility to resolve disputes in courts and alternative platforms

👎 Disadvantages

- Difficulty getting through all levels of authority in case of disputes

Withdrawal Options and Fees

There is little information on replenishment and withdrawal of funds on the broker's website. It is only known that the broker works with bank payment systems and money can be deposited through cards. The main settlement currency is the Hungarian forint, but internal conversion to other currencies is possible. Deposit and withdrawal of cash is prohibited.

Customer Support Service

The Support service is closed on holidays and weekends. Contacts with broker representatives and dealers are possible only during certain times. You can find more details on the support service schedule on the website.

👍 Advantages

- Many communication channels

- Clear professional responses on topics

👎 Disadvantages

- Not found

You can contact the support in several ways:

-

Social networks.

-

Email.

-

Telephone.

-

Office at the place of registration of the company.

For detailed information, you need to register and activate your account.

Contacts

| Foundation date | 2011 |

| Registration address | Budapest, Lechner Ödön fasor 10, 1095 Hungary |

| Regulation |

ESMA |

| Official site | https://www.kbcequitas.hu/ |

| Contacts |

Email:

info@kbcsecurities.hu,

Phone: +3614834090 |

Review of the Personal Cabinet of KBC Equitas

How to open a KBC Equitas account:

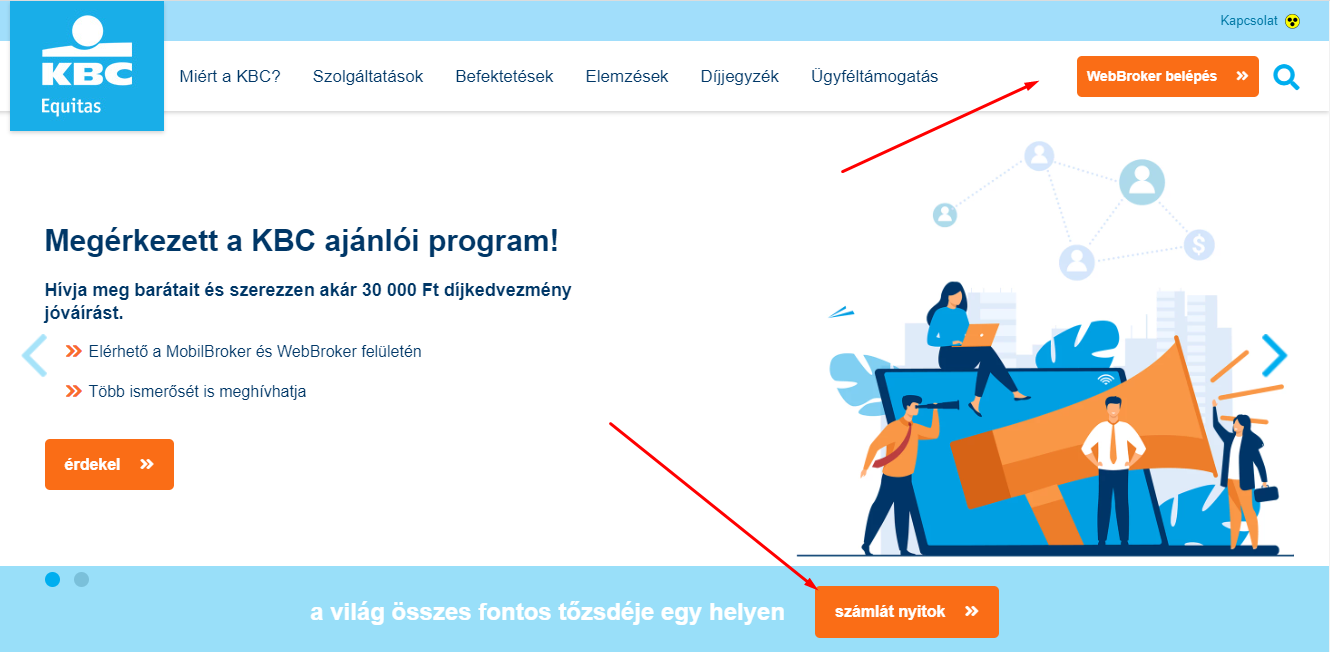

On the main page of the site, go to the section for working with the WebBroker platform or click the button to open an account.

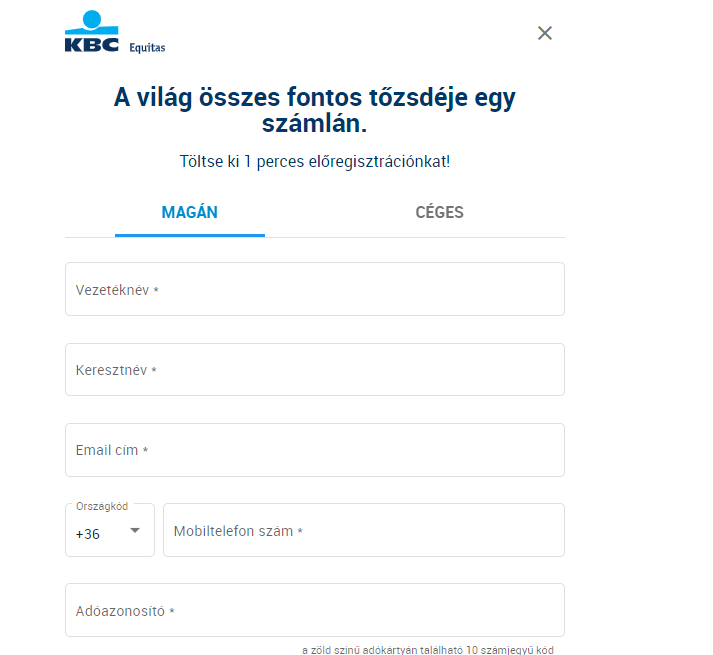

Fill out the registration form:

After registration, you will receive an email with a proposal to contact Support Service for identification. Provide documents, install the WebBroker platform and manage your open accounts.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the KBC Equitas rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about KBC Equitas you need to go to the broker's profile.

How to leave a review about KBC Equitas on the Traders Union website?

To leave a review about KBC Equitas, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about KBC Equitas on a non-Traders Union client?

Anyone can leave feedback about KBC Equitas on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.