deposit:

- $1

Trading platform:

- Alpaca Trading (Web)

- Alpaca Dashboard (Mobile)

Alpaca Review 2024

deposit:

- $1

Trading platform:

- Alpaca Trading (Web)

- Alpaca Dashboard (Mobile)

- 1:4 for intraday trading, 1:2 for transactions postponed till the next day

- You can trade fractions of stocks

Summary of Alpaca Trading Company

Alpaca is a broker with higher-than-average risk and the TU Overall Score of 4.42 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Alpaca clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Alpaca ranks 74 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Alpaca is a broker with a proprietary API for trading under algorithms set by a trader. This allows him to create his own trading bots. Knowledge of programming languages is not required.

Alpaca is a U.S. broker that has been offering API solutions for algorithmic trading in the U.S. stock market since 2015. Since March 2022, its international clients and traders from 49 states have been able to trade cryptocurrencies. Alpaca Trading is constantly adding new stocks, and as of November 2022, it offers over 8 thousand. The broker also offers margin trading in fractional stocks and ETFs. Besides that, there are stocks on which Alpaca pays dividends.

| 💰 Account currency: | USD and cryptocurrencies (with some limitations) |

|---|---|

| 🚀 Minimum deposit: | 1$ |

| ⚖️ Leverage: | 1:4 for intraday trading, 1:2 for transactions postponed till the next day |

| 💱 Spread: | No |

| 🔧 Instruments: | U.S. stocks, ETFs, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Alpaca:

- Regulation by FINRA and SIPC.

- Protection of investments by the Federal Deposit Insurance Corporation (FDIC).

- No broker fees on transactions with stocks and ETFs in the U.S. market.

- Possibility to start trading with any amount of money.

- Free methods to deposit and withdraw funds from investment accounts.

- Access to simple trading bot builders that are understandable even for traders who have no experience in working with API.

- Advanced instruments and professional market data for experienced algorithmic traders.

👎 Disadvantages of Alpaca:

- Only U.S. stocks and ETFs are available. Trading in assets from other markets is presently not offered.

- Client support is only provided by email.

Evaluation of the most influential parameters of Alpaca

Geographic Distribution of Alpaca Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Alpaca

Alpaca is a broker for algorithmic trading in U.S. stocks, ETFs, and cryptocurrencies. Supervised by FINRA and SIPC, it carries out all its obligations under the brokerage services agreement. Regulation by U.S. committees is highly reliable but it limits trading opportunities. For example, payments can be made only via bank or ACH transfers and only in USD, while cryptocurrency transactions cannot be made by residents of the State of New York and some countries.

Compared with traditional stock brokers, Alpaca’s features are limited. Such services as transfers of assets or funds from other brokers, as well as opening joint accounts and IRAs are not available. In contrast, Alpaca carries out basic brokerage functions: provides a trading platform for transactions with securities, including fractional stocks. Fractional investing allows Alpaca’s clients to buy fractions of more than 2,000 stocks at $1 or more.

Traders can place market, limit, and advanced orders, such as One-Cancels-the-Other (OCO) orders, Immediate-or-cancel (IOC) orders; Market-On-Open (MOO) orders, and Market-on-Close (MOC) orders. With Alpaca, you can develop trading bots yourself using programming languages or builders that don’t require special knowledge.

Dynamics of Alpaca’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Alpaca specializes in algorithmic trading in stocks and cryptocurrencies. The company offers software for the development of bots intended for various strategies. Unlike full-fledged stock brokers, Alpaca does not manage the funds of its clients. Additional income from inviting new users is exclusively available to institutional clients.

Investment solutions

Experienced algorithmic traders can create bots in such programming languages as Python, JavaScript, Ruby, C#, Go, Node, etc. Beginners who can’t code are given access to simple trading bot builders, such as Trellis, Streak, Zipline Trader, etc.

Special features of Alpaca trading bots:

Trade entry and exit with a pattern or trend set by the developer.

Access to testing any bot on a paper account without depositing funds.

Different ways to turn on the trading app, such as manually or with an automatic buy or sell trigger.

Traders can create and use an unlimited number of bots, including for every stock.

Also, traders who prefer passive earnings can gain profits in the form of dividends on stocks. Dividends are paid not only on whole but also on fractional stocks. The amount of payment depends on the policy of a security issuer, as well as on the proportional cost of equity units owned by an investor.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Affiliate program:

Alpaca presently does not have an affiliate program for retail traders.

However, professional market participants (hedge funds, investment consultants, broker-dealers, etc.) can become Alpaca’s partners on individual conditions.

Trading Conditions for Alpaca Users

With Alpaca, you can trade stocks and ETFs outside regular hours using pre-market (from 04:00 to 9:30) and post-market orders (from 16:00 to 20:00) Eastern time. The broker currently offers trading in 20 cryptocurrencies and 52 pairs with BTC, BCH, ETH, LTC, and USDT, but new assets are constantly being added to the list. Margin trading is only available for securities. The broker does not provide loan funds for cryptocurrency transactions. Alpaca accepts payments, including international bank transfers, only in USD.

$1

Minimum

deposit

1:4

Leverage

24/7

Support

| 💻 Trading platform: | Proprietary Alpaca Trading web platform, Alpaca Dashboard mobile app |

|---|---|

| 📊 Accounts: | Paper account (demo), individual brokerage account, cryptocurrency account (not in all jurisdictions), business trading account (beta) |

| 💰 Account currency: | USD and cryptocurrencies (with some limitations) |

| 💵 Replenishment / Withdrawal: | Margin Call: 50% |

| 🚀 Minimum deposit: | 1$ |

| ⚖️ Leverage: | 1:4 for intraday trading, 1:2 for transactions postponed till the next day |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 1 USD |

| 💱 Spread: | No |

| 🔧 Instruments: | U.S. stocks, ETFs, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Investors Exchange LLC (IEX), Securities Information Processors (SIP), CTA (managed by NYSE), and UTP (managed by Nasdaq) |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market, limit, stop, stop limit, opening and closing auction, bracket, OCO (one-cancels-the-other), OTO (one-triggers-the-other), and trailing stop |

| ⭐ Trading features: | You can trade fractions of stocks |

| 🎁 Contests and bonuses: | Yes |

Alpaca Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual brokerage account | $1 | For withdrawals via bank transfers |

The margin APR is 6.25%. The table below presents a comparison of the average commissions of three brokers – Alpaca Trading, eOption, and DEGIRO – and clearly shows which company offers the best trading conditions.

| Broker | Average commission | Level |

| Alpaca | $1 | Low |

| DEGIRO | $1.5 | Medium |

| eOption | $3.54 | High |

Detailed Review of Alpaca

Alpaca provides access to margin trading in the U.S. stock market, as well as to fundamental and historical data through its proprietary API. The broker has been in business for over 7 years and specializes in algorithmic trading. Thanks to the variety of available trading apps, professional market data, and the absence of minimum deposit requirements, Alpaca is suitable for both novice and experienced algorithmic traders.

Alpaca by the numbers:

-

Over 8,000 stocks and ETFs registered in the USA are available for trading.

-

Every client’s deposit is insured for up to $500,000.

-

Alpaca has attracted investments amounting to more than $70 million.

Alpaca is an API broker for algorithmic trading on margin

With Alpaca, you can use any trading style but there are nuances. If a trader makes four or more transactions in 5 business days, he is qualified as a pattern day trader (PDT). FINRA requires that day traders keep at least $25,000 in their margin accounts, otherwise, accounts may get blocked. Alpaca offers protection for intraday traders: if an order can potentially cause a trader to be marked as a PDT, the broker rejects that order.

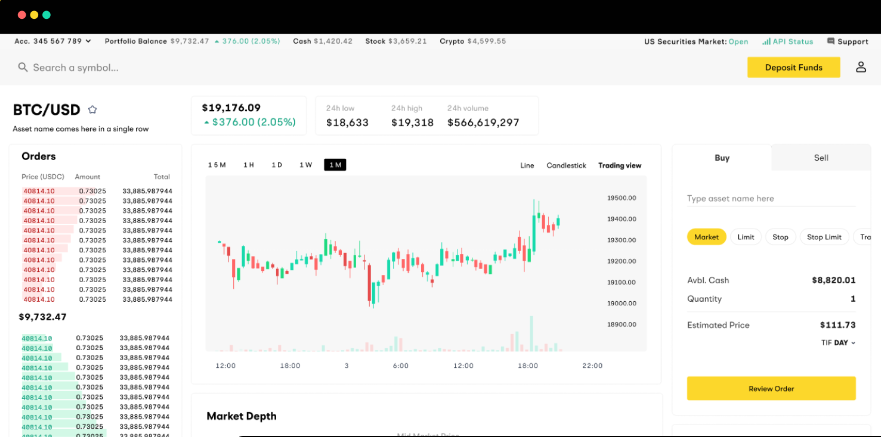

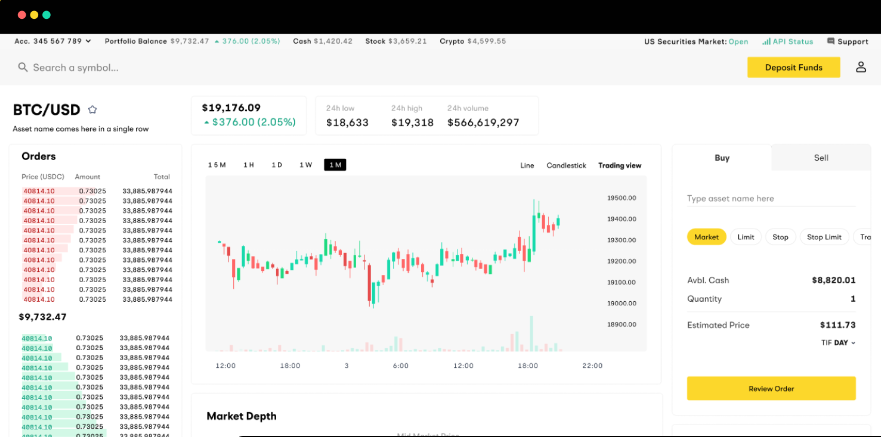

Alpaca Trading offers its proprietary web platform. It provides real-time data and TradingView charts, which contain over 100 technical analysis indicators. Alpaca’s clients can also use mobile apps compatible with Android and iOS devices. All platforms support two-factor authentication but, because of the use of API, traders stay logged in until they log out manually, which reduces security.

Useful services:

-

Stock and crypto price API. Historical data on prices of stocks and cryptocurrencies in the last 5 years is provided in real-time.

-

Newsfeed. It displays historical and current events in stock and cryptocurrency markets.

-

Real-time data on the prices of stocks. Two rate plans are available: one is free with a limited number of channels; the other is without limits and costs $99 per month.

-

Forum. A space for communication with other members of the community and Alpaca representatives.

-

Blog. It contains company news and information on new products, services, and instruments.

Advantages:

Convenient interface for the web platform and mobile apps.

TradingView charts and free market data.

Access to pre-market and after-hours trading.

Protection of user accounts with two-factor authentication.

Advanced chart plotting tools.

More than 10 programming languages, including Python and JavaScript.

You can set up other trading platforms for Alpaca, e.g., brokerage accounts with Midas or Gotrade and Robo-advisor accounts with Investore.

Guide on how traders can start with Alpaca broker

Alpaca offers two account types for retail traders: demo (paper account) and real (individual brokerage account). Individual accounts are not retirement accounts. They can be used only for algorithmic trading and investing.

Account types:

International clients and traders from 49 U.S. states (except for the State of New York) have access to trading cryptocurrencies with a cryptocurrency account.

Alpaca is a broker for algorithmic trading that uses customizable bots. It offers solutions not only for experienced traders but also for beginners who haven’t used API for investing in the stock market before.

Investment Education Online

Users can find Alpaca’s educational materials in the Community tab. It contains several sections with useful information for beginners such as Forum, FAQs, and Learn.

The most effective educational tool is the so-called “paper” account. Trading with this account imitates real transactions but traders can never lose money because they use virtual deposits.

Security (Protection for Investors)

Alpaca is the property of AlpacaDB Inc, which has two subsidiaries. Stock market services are provided by Alpaca Securities LLC, which is a broker-dealer regulated by FINRA and SIPC. Alpaca Securities LLC is also a member of the FDIC, which insures securities in Alpaca user accounts for up to $500,000.

The second subsidiary of AlpacaDB Inc is called Alpaca Crypto LLC. It is registered with FinCEN and provides digital asset trading services. Alpaca Crypto LLC is not a member of FINRA or SIPC. Cryptocurrencies are not securities, so funds invested in them are not protected by compensation programs.

👍 Advantages

- Investments in stocks and ETFs are protected by the FDIC compensatory fund

- FINRA and SIPC strictly control licensed investment companies

- Segregation of trader assets and the broker’s capital

👎 Disadvantages

- U.S. residents pay mandatory income taxes

- FINRA requires that day traders have at least $25,000 in their accounts

- Deposits and withdrawals can only be made in USD.

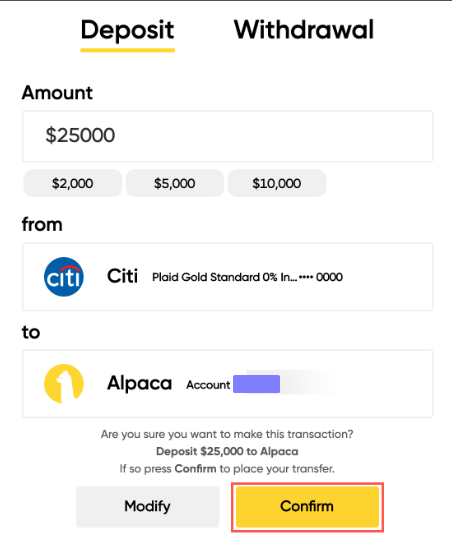

Withdrawal Options and Fees

-

U.S. tax residents make withdrawals via ACH by default. If this way is unavailable, a trader can use bank transfers.

-

Alpaca’s clients outside of the USA can withdraw profits via bank transfers or Rapyd.

-

Payments in Bitcoin, Ether, and Solana are available to residents of 10 U.S. states and traders who live outside of the USA.

-

Processing of ACH transactions usually takes 1–3 business days.

-

For annulment of an ACH transfer due to insufficient funds in a bank account, user account mismatch, transaction repetition, or payment reversal, a trader pays a $30 commission.

Customer Support Service

Client support team is available around the clock, seven days a week.

👍 Advantages

- Tech support works 24/7

👎 Disadvantages

- No online chatroom

- Long wait for operator’s response

- Support cannot be contacted by phone

Alpaca has millions of clients and answers only by email, so operator response time varies from 1 to 7 days.

Contacts

| Foundation date | 2015 |

| Registration address | 710 Oakfield DR, Suite 210, Brandon, FL 33511, USA |

| Official site | https://alpaca.markets/ |

| Contacts |

Email:

support@alpaca.markets,

|

Review of the Personal Cabinet of Alpaca

Trading with Alpaca is impossible without opening a brokerage account, which can be created in a user account. Here is a short guide:

Open the home page of the Alpaca official website. Click the “Sign Up” button to start registration.

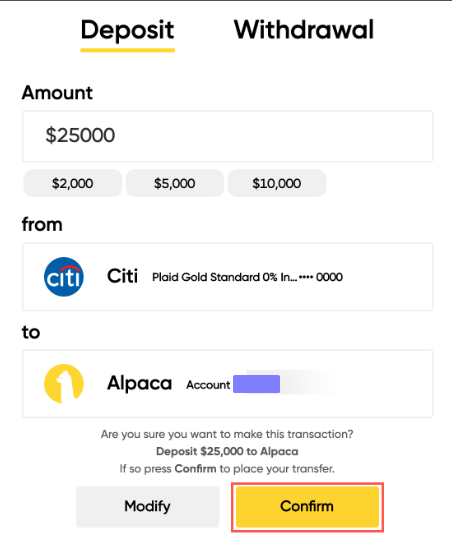

To create a user account, enter your name and email address. Create a strong password, enter it in the corresponding box, and confirm the registration. Then, confirm your email by entering the code you received and sign in using your login (or email address) and password. To make a deposit and start trading, you must get verified through the KYC procedure, i.e., provide pictures of ID documents. It is also mandatory to link your bank account.

In your Alpaca user account, you can:

1. Deposit funds to your trading account and withdraw money.

2. Trade on the web platform.

1. Deposit funds to your trading account and withdraw money.

2. Trade on the web platform.

Also, in your user account, you can do the following:

-

Set up two-factor authentication.

-

View reports on investment portfolios and commissions.

-

Form and manage watchlists.

-

Set up market data streaming.

-

See the full API documentation.

-

See payment history from a time you choose.

-

Use the support button to contact tech support by email.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Alpaca rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Alpaca you need to go to the broker's profile.

How to leave a review about Alpaca on the Traders Union website?

To leave a review about Alpaca, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Alpaca on a non-Traders Union client?

Anyone can leave feedback about Alpaca on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.