deposit:

- $1

Trading platform:

- IBKR Mobile

- Trading Workstation 4

- BaFin

Brokerpoint Review 2024

deposit:

- $1

Trading platform:

- IBKR Mobile

- Trading Workstation 4

- Margin trading available

- Clients have access to mutual funds

Summary of Brokerpoint Trading Company

Brokerpoint is a moderate-risk broker with the TU Overall Score of 5.29 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Brokerpoint clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Brokerpoint ranks 45 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Brokerpoint trading conditions are satisfactory for both active traders and investors. The broker aims to cooperate with users who already have experience in trading stocks, futures, and other instruments.

Brokerpoint is an international broker providing its services in more than 33 countries. The company is part of Interactive Brokers LLC and provides services under the German Banking Act. Brokerpoint is a member of the Securities Investor Protection Corporation (SIPC). Brokerpoint GmbH is regulated by the German BaFin (80176133). In 2020, the broker received “Best Futures Trading Broker” and “Best Customer Service Broker-Dealer” awards.

| 💰 Account currency: | AUD, GBP, CAD, CZK, DKK, EUR, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, RUB, SGD, SEK, CHF, USD, CNH |

|---|---|

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | Margin trading available |

| 💱 Spread: | from €1.89 for trading futures and options; from €2.99 for trading CFDs |

| 🔧 Instruments: | Stocks, currencies, futures, options, bonds, CFDs, ETFs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Brokerpoint:

- Clients gain access to a variety of international markets and exchanges.

- The broker offers a wide range of trading assets.

- Traders have access to mutual funds to generate passive income.

- Multilingual support service: the broker’s staff provide assistance in 20 languages.

- Trading is available 24/7 both from a personal computer and mobile devices.

- Before starting trading, traders can open a demo account and check the broker’s trading conditions, their skills, and test different trading strategies.

👎 Disadvantages of Brokerpoint:

- There are few ways to deposit and withdraw funds.

- The broker does not provide training materials to clients.

- Traders are not credited with bonuses for trading, and there are no referral programs or contests either.

Evaluation of the most influential parameters of Brokerpoint

Geographic Distribution of Brokerpoint Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Brokerpoint

Brokerpoint is a broker focused on cooperation with those market participants who have trading experience of three years or more. This factor is always taken into account when applying to open an account. This broker is not good for novice investors due to the lack of training materials. They have only periodic webinars that are available to registered clients of the company. Brokerpoint has no minimum deposit requirements.

Users can open individual, joint, or trust accounts. There are two types of accounts: margin (for margin trading) and cash (for trading using equity capital). Brokerpoint’s clients gain access to 130 markets and a variety of international exchanges. The broker provides financial services at an international level, therefore the support service is multilingual, the site interface is also presented in more than 10 languages.

The disadvantages of the broker include a limited number of ways to make deposits to the account and withdraw funds. You can see that the company is focused on active traders as there are no automated trading systems.

Dynamics of Brokerpoint’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Brokerpoint is focused on cooperation with active market participants, so there are no fully automated programs for generating passive income in the company. Instead, the broker provides its clients with the opportunity to receive dividends through participation in mutual funds.

Investment funds

Mutual funds are a reliable way to generate income without trading. They are also the way to balance your portfolio. Brokerpoint provides clients with access to 24,000 investment funds, 280 of which are international.

-

This method of investment is actively used by investors to diversify their portfolios.

-

Mutual funds are suitable for investors with different trading strategies.

-

Commission fees for American funds are fixed, and they automatically include the commission of regulators. The commission for European funds also includes a fee for the provision of clearing services and regulatory services.

-

An investment fund can be viewed as equity capital and thereby increase the purchasing power of the margin.

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Brokerpoint’s affiliate program

Brokerpoint does not provide its customers with the opportunity to receive passive income through participation in the referral program. The broker provides investment programs and instruments for active investment and does not intend to cooperate with users who do not show trading activity.

Trading Conditions for Brokerpoint Users

Brokerpoint offers users to choose one of three types of accounts with different forms of ownership and allows both trading with their own funds and using margin trading. The company has only one trading platform. On the site, traders can also download an application for a mobile phone to trade remotely. Both the app and the web platform are free. There are no requirements for the minimum amount of the deposit, the client can open an account in 20 fiat currencies. Financial transactions can be carried out via bank transfers or securities transfers. There are no bonuses for trading with the company, and there is no referral program either. Users can receive passive income with the help of mutual funds.

$1

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Trading Workstation 4 (TWS 4), mobile application IBKR Mobile for iOS and Android |

|---|---|

| 📊 Accounts: | Individual, Joint, Trust |

| 💰 Account currency: | AUD, GBP, CAD, CZK, DKK, EUR, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, RUB, SGD, SEK, CHF, USD, CNH |

| 💵 Replenishment / Withdrawal: | Bank transfer; securities transfer: ACAT, ATON, Basic FOP Transfer, DRS (US), DWAC, FOP (US) |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | Margin trading available |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No information |

| 💱 Spread: | from €1.89 for trading futures and options; from €2.99 for trading CFDs |

| 🔧 Instruments: | Stocks, currencies, futures, options, bonds, CFDs, ETFs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | SmartRouting |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Clients have access to mutual funds |

| 🎁 Contests and bonuses: | Yes |

Brokerpoint Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual | from €1.89 | None |

| Joint | from €1.89 | None |

| Trust | from €1.89 | None |

There is no information about the commission for the transfer of an open position to the next day (swap). Brokerpoint commission fees were also compared by TU’s experts with those of popular stockbrokers such as Charles Schwab and Ally. The comparative result can be seen in the below table:

| Broker | Average commission | Level |

| Brokerpoint | $1.89 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Brokerpoint

Brokerpoint is an international broker registered in Germany. The company provides investment services as well as investment advice. The target audience of the broker is traders and investors who have at least three years of experience in trading futures, stocks, and options. Brokerpoint offers an individual trading account, as well as joint and trust accounts. Each of the accounts can be opened in two options: cash or margin. There are no minimum deposit requirements to start trading.

Brokerpoint by the numbers:

-

The average number of profitable trades per day is 1.83 billion.

-

Brokerpoint’s capital is estimated at $8.5 billion.

-

The broker’s clients get access to 135 markets.

-

The company has over 981,000 accounts.

-

Brokerpoint has a surplus regulatory capital of $6 billion.

-

The broker provides access to trading 24/7.

-

The broker’s support service assists in 20 languages.

-

Over 100 types of orders are available to the company’s clients.

Brokerpoint is a broker for professional market participants who have at least three years of experience in trading

Brokerpoint aims to cooperate with active traders and investors who prefer to earn income trading independently. For this reason, the company does not have fully automated trading platforms and services for copying transactions to generate passive income. There is no referral program either. However, investors can become members of mutual funds. Brokerpoint’s total number of mutual funds is 24,000.

The broker offers one trading platform for executing trades from a personal computer and a mobile application for remote trading and portfolio management. There is no fee for using the trading terminal or applications.

Brokerpoint’s useful services:

-

Securities trading by phone. This service allows a trader to manage his assets when there is no internet access or the ability to execute a trade on his own.

-

Pre-borrowing program. It is suitable for traders who have opened a margin account. It provides the opportunity to borrow stocks for short sales and to avoid a forced buy-in on settlement day.

-

Newsletter with useful materials. The function is free and available to traders after opening and funding a real trading account.

Advantages:

Brokerpoint provides clients with a wide range of trading instruments.

Opening both real and demo accounts with the company is free.

The broker provides access to many international, European, American, Asian, Australian markets and exchanges.

Brokerpoint allows you to invest in mutual funds.

Traders are able to trade from mobile devices.

How to Start Making Profits — Guide for Traders

Brokerpoint has three types of accounts with different forms of ownership. Each of the accounts can be opened in two versions: cash (in this case, the trader uses only his own capital) and margin (in this case, the trader has the possibility of borrowing funds from a broker). A resident of any country where trading in stocks, bonds, futures, and other instruments is permitted by law can open an account with Brokerpoint.

Account types:

Brokerpoint clients have the opportunity to test the broker’s trading conditions and try out new trading strategies on a free demo account.

Bonuses Paid by the Broker

Trading with Brokerpoint does not imply the accrual of financial or other bonuses to traders and investors for their trading activity, account replenishment, and other trading or non-trading operations. There is also no welcome bonus, there are no contests among users either.

Investment Education Online

Brokerpoint provides traders and investors with information exclusively about the markets and exchanges available to them, as well as an overview of instruments and trading strategies. There is no training section per se.

Brokerpoint clients have access to a demo version of a trading account. Using a demo account, clients can check the broker’s trading conditions without financial risks.

Security (Protection for Investors)

Brokerpoint (Kaiser Global Invest GmbH) provides investment brokerage services as well as legal investment advisory services. The broker’s activities are in compliance with the German Banking Act, Section 2 (10). The broker is a member of the Interactive Brokers LLC group with a consolidated capital of $8.5 billion, which is $6 billion above the standard.

The protection of investor funds is guaranteed by SIPC - Securities Investor Protection Corporation. The authority guarantees the protection of accounts, the maximum amount of coverage is $500,000, of which $250,000 can be requested by investors as financial compensation. Users’ accounts are also protected by temporary two-factor authentication (for clients whose deposits are up to $500,000) or a digital security card (if the amount of the deposit exceeds $500,000).

👍 Advantages

- Client funds are kept in segregated accounts with European banks

- Investor capital and rights are protected by SIPC

- Clients’ trading accounts are protected from hacking

👎 Disadvantages

- The broker does not indicate the authorities that regulate its activities

Withdrawal Options and Fees

-

Brokerpoint allows clients to fund a trading account using bank or securities transfers, including ACAT, ATON, Basic FOP Transfer, DRS (US), DWAC, FOP (US).

-

You can withdraw funds from the account up to three working days from the date of the account funding. Funding of a trading account via bank transfer takes up to four days.

-

There is no commission for deposits or the withdrawal of funds to a personal account. All transactions are free.

Customer Support Service

Brokerpoint customers can contact the support team for help with login, transaction, workflow, and technical issues. Clients can communicate with the company’s employees from Monday to Friday, within business hours. The broker also allows the download of an application for a Windows or Apple-based personal computer to get access to remote support.

👍 Advantages

- Customer service is multilingual: experts provide help in 20 languages

- Customers can download the AnyDesk app to get help remotely

- Customer service resolves software-related issues

👎 Disadvantages

- Customer service doesn’t work on weekends

- Traders can only get help during business hours

- No callback function

This broker provides the following communication channels:

-

email;

-

feedback form on the website;

-

phone call to the number listed in the “Assistance service” section and in the header of the website.

There is no online chat on the broker's website.

Contacts

| Foundation date | 2017 |

| Registration address | Emilienstraße 19, 20259, Hamburg, Deutschland |

| Regulation |

BaFin |

| Official site | brokerpoint.de |

| Contacts |

Email:

premiumservice@brokerpoint.de,

|

Review of the Personal Cabinet of Brokerpoint

You can start trading with Brokerpoint only after opening a trading account with the company. To become a client of a broker, follow the step-by-step instructions described below:

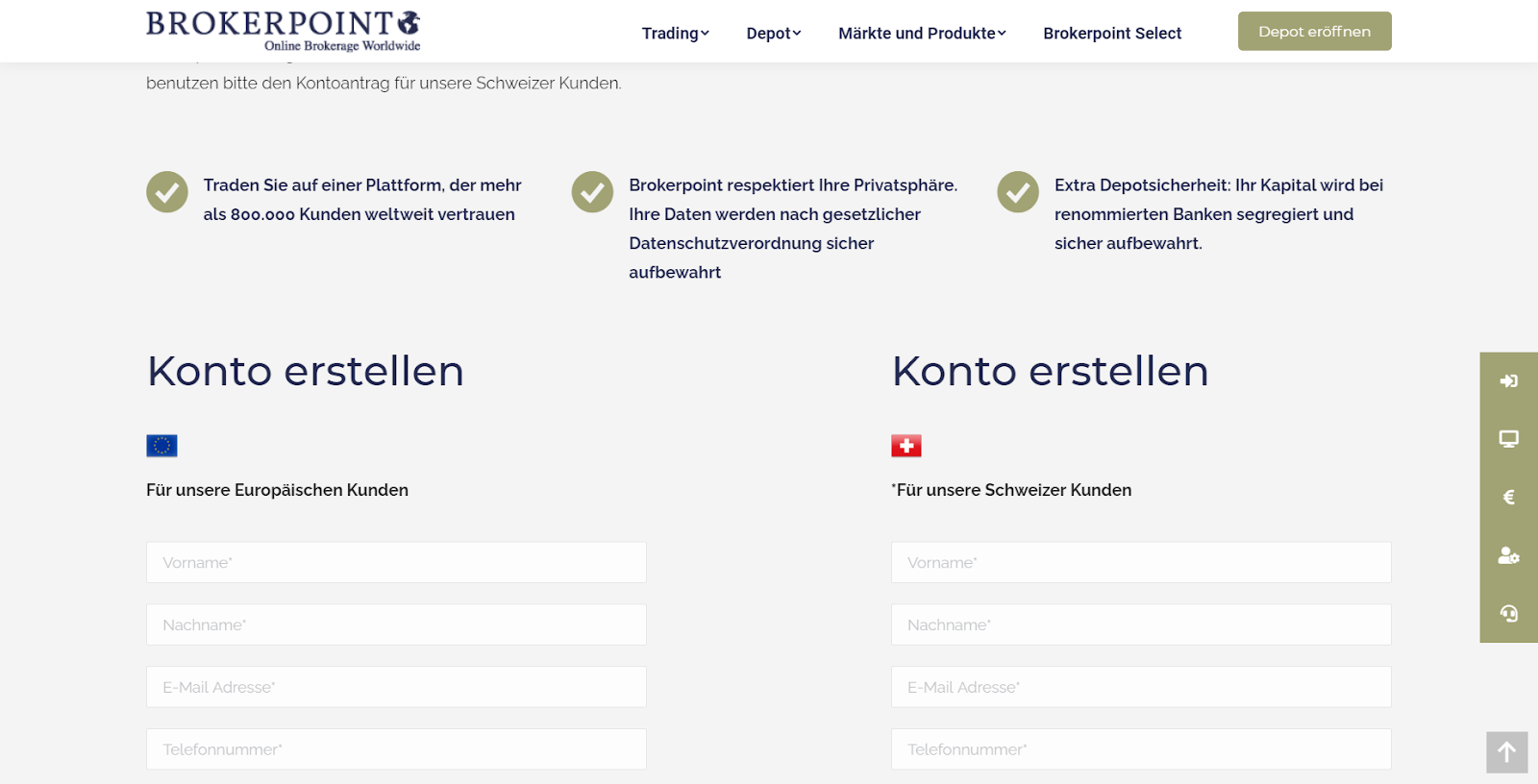

Go to the broker’s official website: brokerpoint.de. To open an account, on the main page click on the “Depot eröffnen” button.

Then fill out the short form on the left if you are a resident of a European country, or the form on the right if you are a resident of Switzerland. Enter your first name, last name, email address, and telephone number.

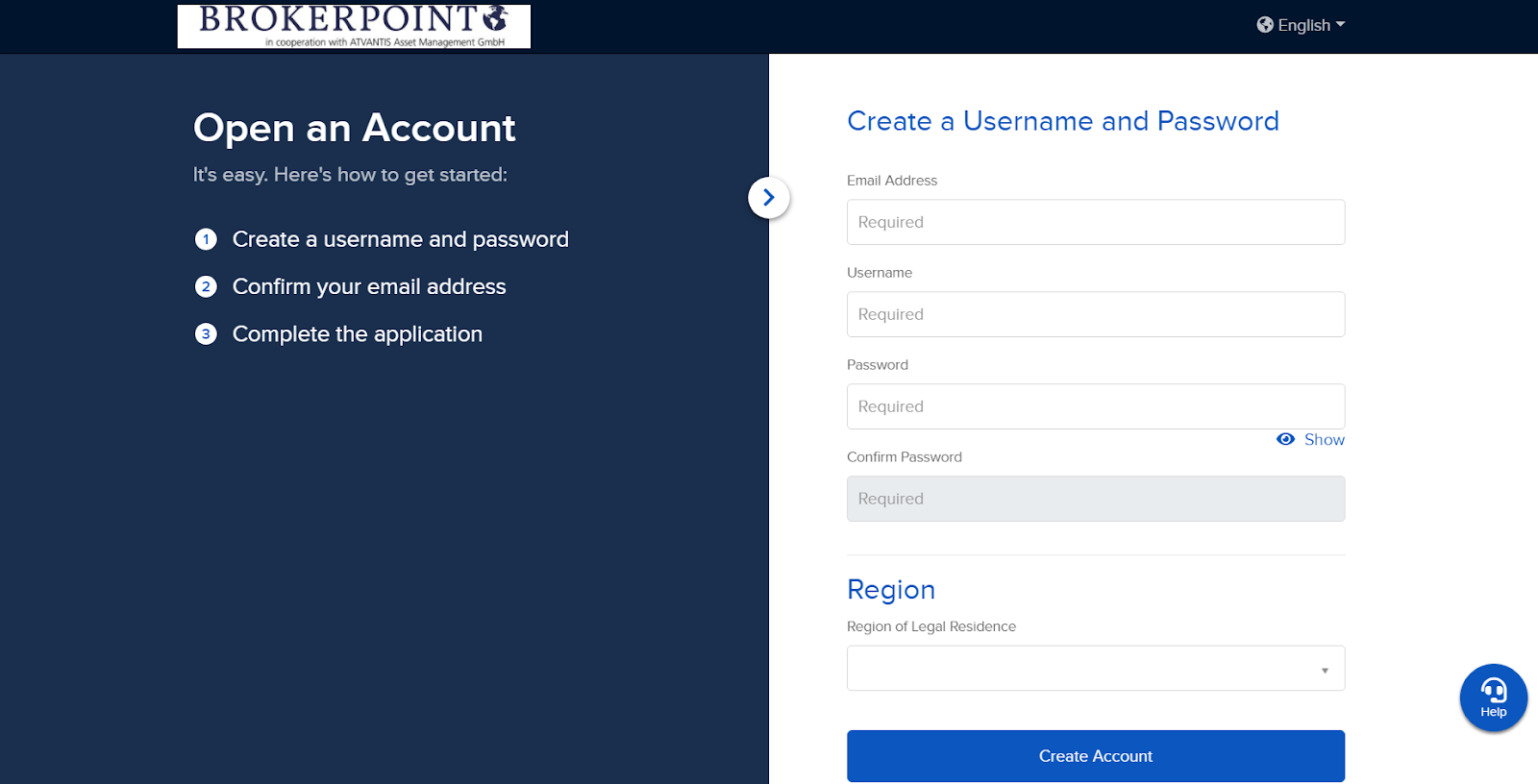

On the form, enter your email address again, create a username and password that you will later use to enter your personal account. Also, select from the list the country in which you currently reside.

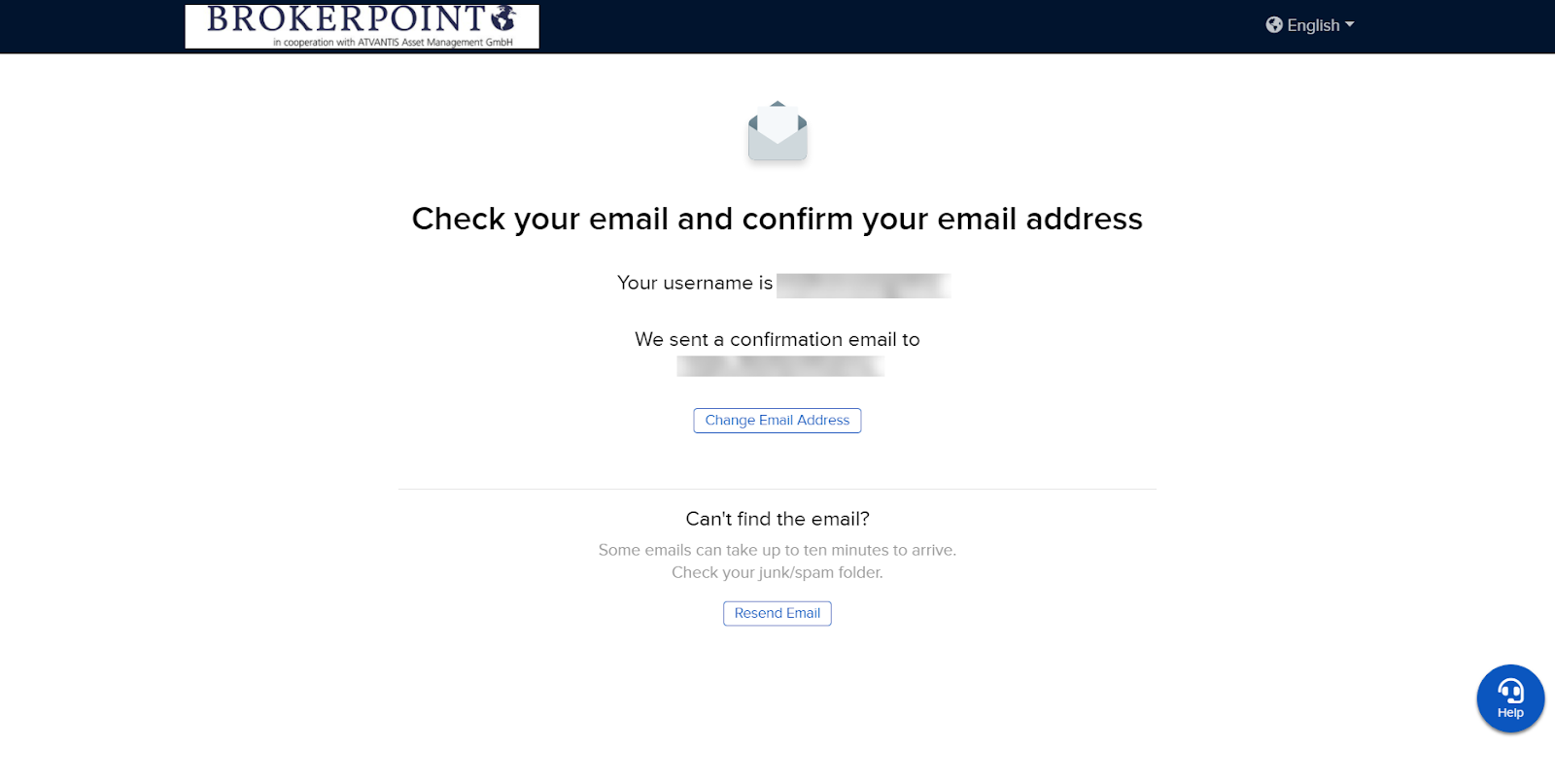

After you fill in all the fields, the broker will send a confirmation to your email.

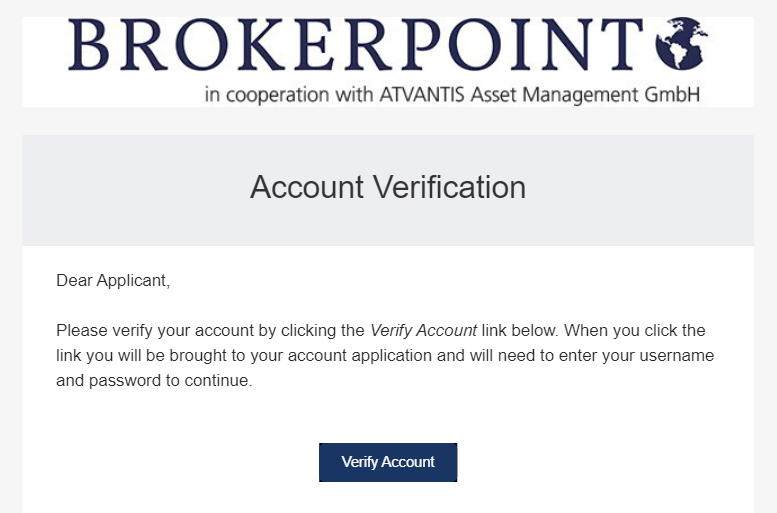

To continue the registration procedure, go to your mailbox, find the letter from Brokerpoint, open it and click on the “Verify Account” button.

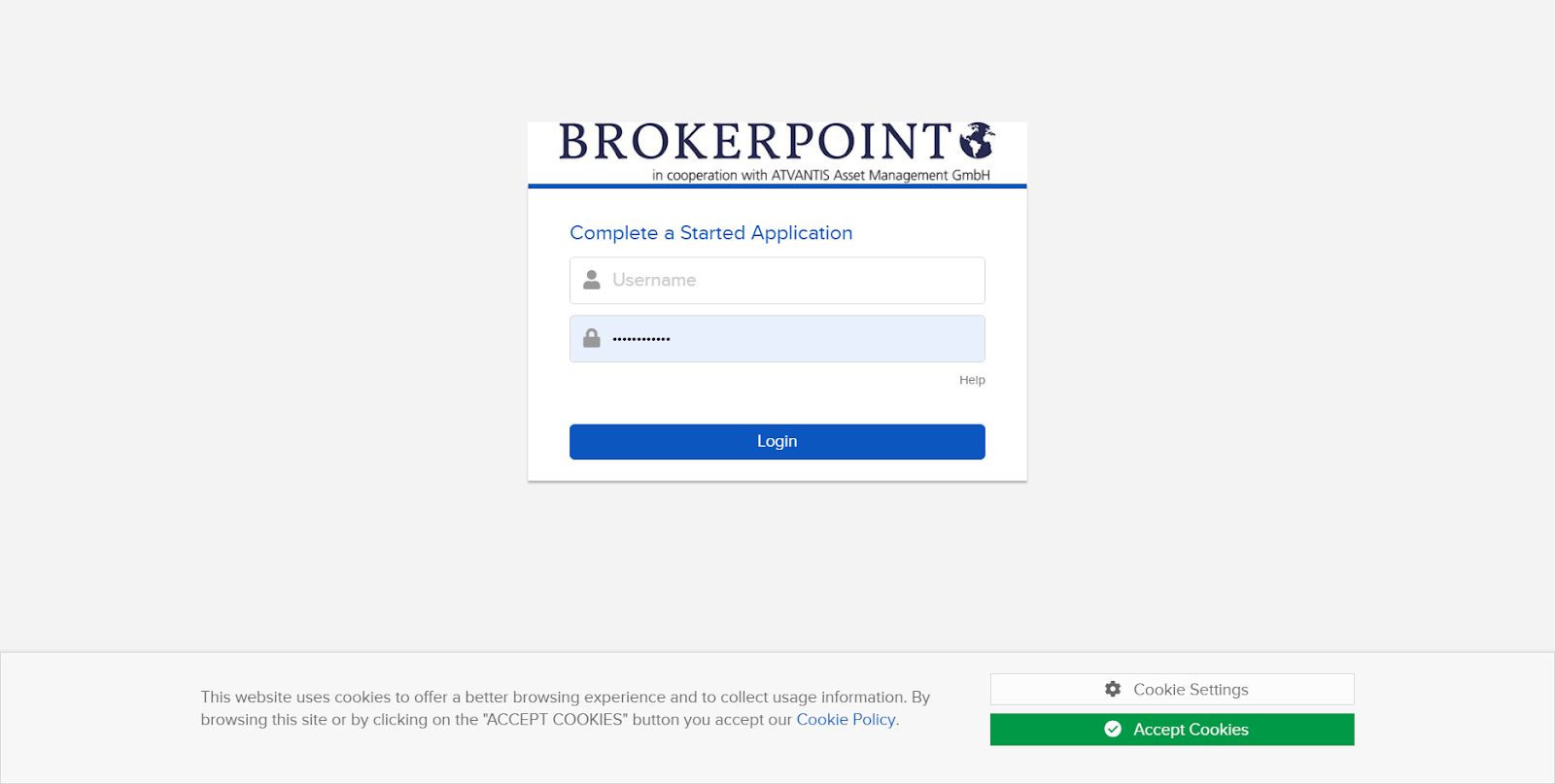

You will be redirected to a window where you need to specify the username and password that you originally came up with to log into your account. Then click on the “Login” button.

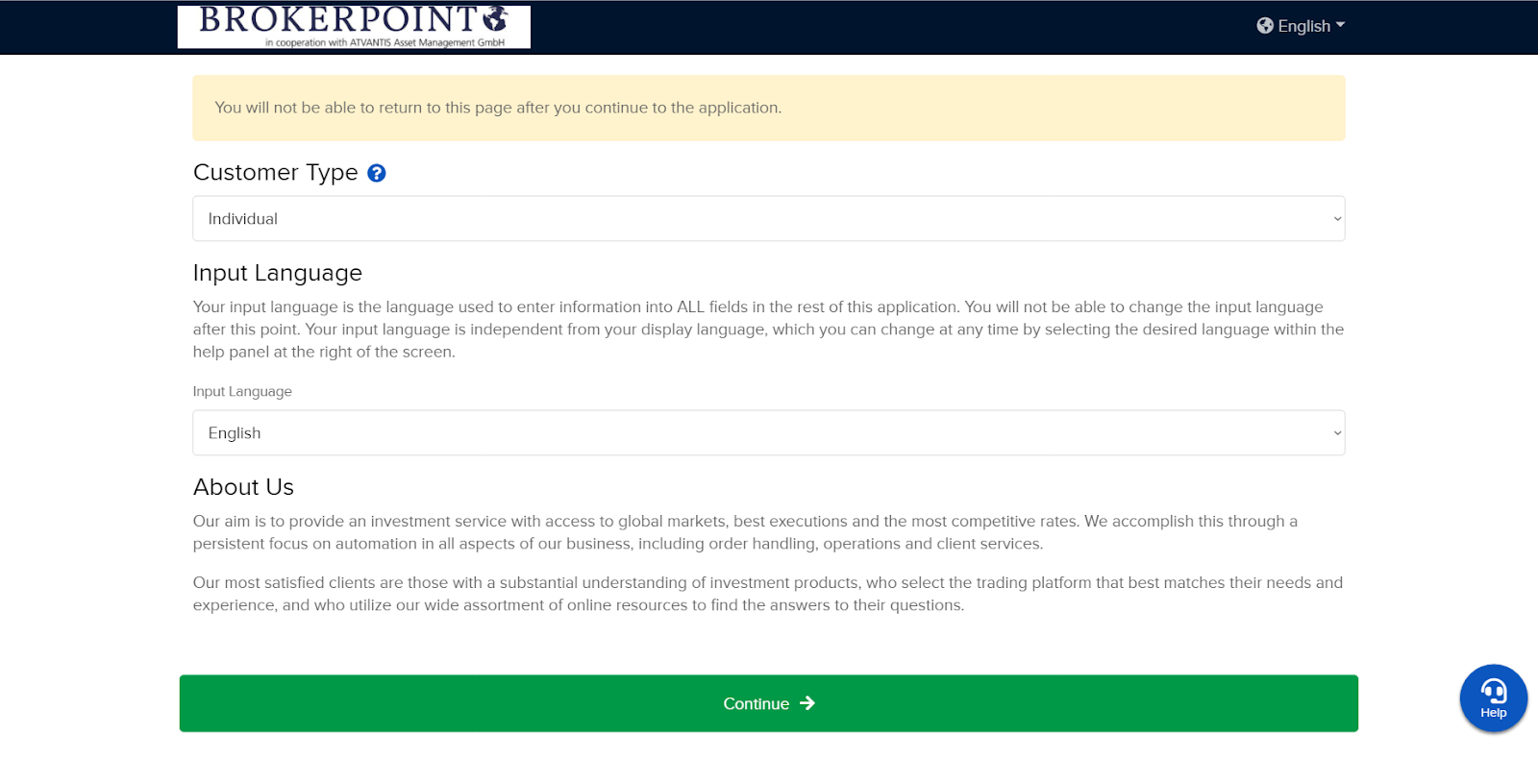

Please indicate the type of account you want and choose a language. Click on the “Continue” button.

Fill out the form with personal data, such as name, surname, address, country, city of residence, phone number, date of birth, identification information, and sources of income in percentage, etc.

Now specify the desired type of account (margin or cash), specific amounts of income, define your investment goals, indicate what experience you have in trading options, stocks, and futures.

Confirm the information about the country in which you are registered.

Check the personal information provided during registration. Edit this information if necessary and proceed with registration.

Now you need to fund your trading account, confirm your mobile phone number, and send a photo to the broker to verify your account. Also, send a copy of the document confirming your place of residence.

The following sections are available in Brokerpoint’s personal account:

-

Customer service.

-

Transaction history - deposit/withdrawal of funds.

-

History of completed trades.

-

Personal data and account setup.

-

Additional services of this broker.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Brokerpoint rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Brokerpoint you need to go to the broker's profile.

How to leave a review about Brokerpoint on the Traders Union website?

To leave a review about Brokerpoint, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Brokerpoint on a non-Traders Union client?

Anyone can leave feedback about Brokerpoint on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.