deposit:

- $1

Trading platform:

- Zhixin

- Zhisheng

- Stock Options Meeting Point

- Online Trading System

- Online trading system (MAC)

- Option Fully Simulated

- Express 2

- Boyi Master

- Mobile Meeting Point

- CSRC

- SIPF

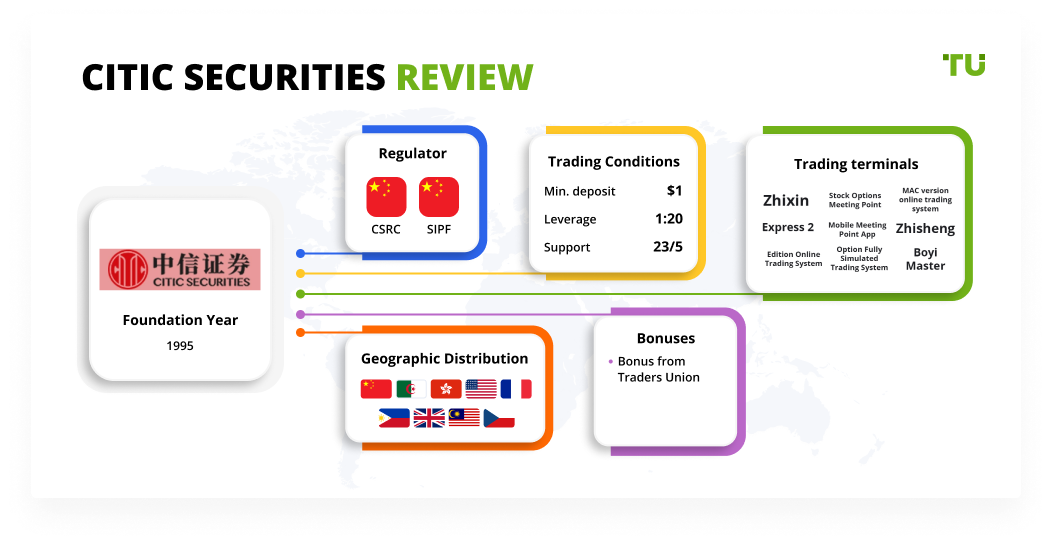

CITIC Securities Review 2024

deposit:

- $1

Trading platform:

- Zhixin

- Zhisheng

- Stock Options Meeting Point

- Online Trading System

- Online trading system (MAC)

- Option Fully Simulated

- Express 2

- Boyi Master

- Mobile Meeting Point

- up to 1:20

- Only securities of China and Hong Kong are available

Summary of CITIC Securities Trading Company

CITIC Securities is a broker with higher-than-average risk and the TU Overall Score of 4.75 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by CITIC Securities clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. CITIC Securities ranks 63 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

CITIC Securities is a regulated stockbroker with good conditions that specializes in serving Chinese investors.

CITIC Securities is the largest Chinese investment holding company, which has been providing brokerage services on Forex transactions, asset management, social, financial, and retirement planning since 1995. Its activities are regulated by the China Securities Regulatory Commission (CSRC) and the Central Bank of China. CITIC Securities is also a member of the SIPF — China Securities Investor Protection Fund. The broker and its partner subsidiaries have won over 100 awards for excellent banking and brokerage services.

| 💰 Account currency: | USD, CNY, and HKD |

|---|---|

| 🚀 Minimum deposit: | From 0 units of the base currency of the account |

| ⚖️ Leverage: | up to 1:20 |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, options, ETFs, mutual funds, IPOs, futures, and bonds |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with CITIC Securities:

- No requirements for the size of the minimum deposit. The clients can fund the account with any amount that is enough to buy the asset of their choice and pay the trading commission.

- This broker works strictly within the law. Only products and services approved by the government regulators are available to its customers.

- Favorable terms of trade and financial settlements. The company offers low trading fees, and free deposits and withdrawals.

- Wide range of terminals. Investors can trade from any device (mobile or desktop), including a web terminal.

- A huge variety of investment decisions. Clients can transfer capital to trust, receive passive income on pension accounts, and activate algorithmic trading.

- Free provision of professional tools for market research, fundamental analysis, news, and market data in real-time.

- Fast and fully digital account opening within 1 business day.

👎 Disadvantages of CITIC Securities:

- The company only works with clients from China and Hong Kong.

- It offers a limited selection of assets — only local Chinese market securities.

- It does not provide bonuses and rewards for partners.

Evaluation of the most influential parameters of CITIC Securities

Table of Contents

Geographic Distribution of CITIC Securities Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of CITIC Securities

CITIC Securities is a brokerage and investment bank with over 25 years of history. Over the years, the holding company has received a net profit of 158 billion yuan and paid dividends to its shareholders of more than 56 billion yuan. In 2003, the company was listed on the Shanghai Stock Exchange and in 2011 on the Hong Kong Stock Exchange.

CITIC Securities works only with Chinese and Hong Kong clients, and foreigners residing in China. The broker offers securities of local markets and does not provide an opportunity to trade stocks of the USA, Europe, and other Asian countries. At the same time, its clients are not limited in their choice of trading strategies. CITIC Securities not only provides favorable conditions for active traders who trade exchange products themselves but also provides wealth management and retirement planning services.

The company allows professional and retail clients to trade on margin. At the same time, it charges low trading commissions, maintains accounts for free, and does not charge software fees. CITIC Securities also provides prompt technical support on all emerging issues, delivers high-quality analytics, news, reviews, and research.

Dynamics of CITIC Securities’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

This broker is part of an investment holding company, therefore it offers many solutions for passive earnings. All of them are approved by the China Securities Regulatory Commission.

CITIC Securities’ passive income solutions

CITIC Securities allows its clients to receive income without active trading. The following services are available to retail investors:

-

Asset Management. The company offers several options for trust management. Individual capital management is available, depending on the investment needs of the client and his/her attitude to risk. Experienced investors can participate in collective management plans that involve between 2 and 200 investors.

-

Algorithmic trading. The broker offers 4 platforms for automatic stock trading — CITIC Securities Investment Trading System (A8), CITIC Securities Automated Trading Platform (CSET Plus), Xun Investment Trading System, and the Hang Seng PB Trading System. Platforms developed based on APAMA support quantitative algorithms (such as TWAP, Iceberg, VWAP, and VOL), are stable and scalable.

-

Retirement planning. It provides the possibility to generate income from investing in fixed income products, stocks, or hybrid types of portfolios. The main difference between retirement investment accounts and other types of investment accounts is that their owners can withdraw income only after reaching a certain age.

The broker makes it possible to invest in securities even without minimal trading experience but to do this, you need to be a tax resident or resident of the PRC.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

CITIC Securities’ affiliate program

The broker is widely known in China and therefore does not need additional advertising. For this reason, CITIC Securities does not offer retail clients a reward for attracting new investors.

Trading Conditions for CITIC Securities Users

CITIC offers trading in securities listed on the largest stock exchanges in China — in Shanghai, Shenzhen, and Hong Kong. The size of the trading commission varies within 0.03-0.12% of the transaction amount, the company does not withhold additional fees for depositing or withdrawing money. Clients can trade with their own funds from cash accounts or from margin accounts using leverage. The minimum deposit is zero USD/CNY/HKD.

$1

Minimum

deposit

1:20

Leverage

23/5

Support

| 💻 Trading platform: | Desktop: Zhixin (Online Trading System, New Online Trading System, Option Special Edition), Zhisheng (Almighty Edition Online Trading System, Edition Independent Ordering System), Stock Options Meeting Point, Edition Online Trading System, MAC version online trading system, Option Fully Simulated Trading System, Express 2, Boyi Master. Mobile: Meeting Point App and Web terminal |

|---|---|

| 📊 Accounts: | Stock trading Accounts (Margin Account, Cash Account), Futures trading Accounts (through affiliate company CITIC Futures) |

| 💰 Account currency: | USD, CNY, and HKD |

| 💵 Replenishment / Withdrawal: | Bank transfer, credit/debit cards |

| 🚀 Minimum deposit: | From 0 units of the base currency of the account |

| ⚖️ Leverage: | up to 1:20 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | N/A |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, options, ETFs, mutual funds, IPOs, futures, and bonds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Proprietary aggregator China CITIC Bank |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Only securities of China and Hong Kong are available |

| 🎁 Contests and bonuses: | Yes |

CITIC Securities Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Stock trading account | from $1 | No |

The fees charged by processing payments and card-serving banks vary.

Also, the experts at the Traders Union compared the average commission of CITIC Securities with other stockbrokers: Charles Schwab and Ally Bank. The commission level demonstrates how competitive the conditions of the reviewed brokerage companies are.

| Broker | Average commission | Level |

| CITIC Securities | $1 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of CITIC Securities

CITIC Securities is a trading and asset management brokerage company staffed by professional investment, trust, social, and pension managers. The company provides cash and margin accounts for trading assets listed on China’s two main stock exchanges, Shanghai and Shenzhen. The company has branches in 13 countries, and the number of internal offices in the PRC has reached 400.

Survey of CITIC Securities by the numbers:

-

It has provided brokerage services for over 25 years.

-

It has been in the asset management business for over 22 years.

-

At the moment, it has 7 main subsidiaries on the first level.

-

It provides service to over 75,000 corporate clients and over 10 million domestic and foreign companies.

-

For more than 11 years in a row, it has taken the leading position in the ratings of Chinese investment resources in the field of trust management.

CITIC Securities is a broker that offers extensive analytical opportunities.

CITIC is a stockbroker that works with Chinese citizens (including those abroad) and foreigners living in the PRC at the time of registration. It supplies its clients with research and detailed fundamental data such as financial statements of companies with profit margins. Traders also have access to high-quality news that can be sorted by instrument and industry. The desktop platforms offer trading suggestions (specific stock recommendations from large brokerage companies) and over 200 technical indicators.

CITIC offers investors a wide range of desktop platforms, including those supporting algorithmic trading. Also, the company’s clients can make transactions using a mobile application or web terminal. The interface language of all desktop and internet platforms is Chinese, while the languages of the mobile terminals are Chinese and English.

Useful services of CITIC Securities are:

-

Free application for generating MD5 code. Clients can use it to encode credit card numbers, tokens, passwords, and any other sensitive information that is passed to the broker.

-

News center. It publishes reviews of events related to the activities of CITIC Securities such as innovations, financial reports, and awards.

-

Brain center. Here you will find recommendations for investments from artificial intelligence such as forecasts of changes in the value of assets in the market, based on the results of historical data.

-

Market tab. It is displayed on the right side of the website and shows market prices, price changes, news, research (industry-specific and conducted by the company’s specialists).

Advantages:

The broker offers terminals for various customers’ needs: simpler and more convenient mobile and web platforms for retail clients on the go, as well as desktop programs with advanced technical analysis capabilities for professional investment.

The company has established itself well in the brokerage market. It has been operating for over 25 years and is regulated by China’s most reputable supervisory authorities.

Desktop terminals allow you to set price alerts, notifications about changes in daily profit or closing a trade with a loss, as well as create your own templates.

The broker’s clients receive prompt support on all emerging issues through a quick chat in real-time or a chatbot with artificial intelligence. The virtual assistant is available 24/7.

Investors who open an account with CITIC Securities can buy and sell assets not only with their own money but also with funds borrowed from the broker.

The site regularly publishes the company’s financial statements: quarter, half a year, and consolidated for the operating year.

If CITIC Securities cannot fulfill its financial obligations, it pays insurance coverage to its clients.

How to Start Making Profits — Guide for Traders

CITIC Securities offers its clients a huge number of accounts for investment and money management. However, there are 2 types of stock trading accounts available to retail investors for independent trading: margin accounts and cash accounts.

Account types

CITIC Securities does not have demo accounts, but its clients can use simulation trading via Zhixin Option Special Edition, Meeting Point Edition, Option Fully Simulated Trading System, and Mobile Meeting Point App.

CITIC Securities partners with Asian investors who trade in securities listed on the Chinese stock exchanges.

Bonuses Paid by the Broker

The broker does not offer a bonus in the form of a percentage of the deposited amount or free shares for registration. However, CITIC Securities promises gifts and prizes for newcomers.

Investment Education Online

In the footer of the CITIC Securities website, there is the Investor Education block. Through it, you can go to the investor.org.cn resource, which contains tons of educational information. The training modules are in 3 blocks: “Securities”, “Funds”, and “Futures”.

The training section of the site contains a lot of regulatory and legal information that beginners might have problems understanding. At the same time, there is a limited amount of truly useful content for acquiring practical investment skills.

Security (Protection for Investors)

CITIC is part of CITIC Group, an international investment corporation, and is regulated by the China Securities Regulatory Commission (CSRC).

CITIC Securities is listed on the Shanghai and Hong Kong Stock Exchanges, and all of its clients are covered by the China Securities Investor Protection Fund (SIPF). It is controlled not only by CSRC but also by the People’s Bank of China. Under the requirements of financial regulators, the CITIC Securities holding company is obliged to transfer 0.5% of its proceeds to the fund. These funds are used to pay its clients in case of bankruptcy or financial insolvency of the broker.

👍 Advantages

- All client categories are covered by SIPF insurance, including retail investors

- Segregated bank accounts are used to store client assets and funds

- The broker offers a free utility software for encrypting confidential information of clients

👎 Disadvantages

- No negative balance protection

- The broker works only with traders from China and Hong Kong

- Deposits and withdrawals are only possible using cards and bank transfers

Withdrawal Options and Fees

-

Withdrawals can be made via bank transfer and amounts can be credited to credit or debit cards.

-

When applying for a withdrawal of funds from 9:00 to 15:50 (Beijing time), banks can make a transfer on the same day until 16:00.

-

The company does not charge withdrawal fees. The amount of fees from banks making payments is displayed when making a withdrawal request.

-

Withdrawal currencies are Yuan, USD, and Hong Kong dollars.

-

All payments are possible only after verification of identity and payment data.

Customer Support Service

Representatives of the company are ready to help customers from Monday to Friday from 9:00 to 22:00 (UTC + 8).

👍 Advantages

- Fast response time

- The chatbot is available around the clock, any day of the week

👎 Disadvantages

- Human chat operators are available 13 hours a day Monday - Friday

- There is no callback service

- Customer service is in Chinese only

To get an answer to their question, potential and active customers can:

-

contact the operator of the online chat on the website;

-

call the hotline;

-

send a fax;

-

request information via email.

Also, to get quick answers to the most popular questions about investment conditions with CITIC Securities, you can connect to a virtual assistant (chatbot) on the site.

Contacts

| Foundation date | 1995 |

| Registration address | 16F CITIC Securities Tower, No.8 Zhongxin 3rd Road, Futian District, Shenzhen, 518048, China |

| Regulation |

CSRC, SIPF |

| Contacts |

Email:

inquiry@citics.com,

|

Review of the Personal Cabinet of CITIC Securities

Only a citizen or resident of China can become a client of CITIC Securities. The account can be opened using a mobile application, a desktop trading platform, or during a personal visit to a physical outlet of the company. The procedure for registering an account using a smartphone consists of several stages:

To get access to download the application, on the broker’s official website, click on the "Software download" widget on the right side of the page and select a mobile terminal.

Next, you need to scan the QR code that appears on the screen.

After downloading the application, you have to register. To do this, in the form that opens, you need to indicate personal information, investment experience, amount, and origin of income. Further, the broker will require to confirm the identity and place of residence by uploading the relevant documents. After the broker checks them, you will get your personal account, which can be entered not only using the phone but also PC, laptop, or tablet. To have access to your account, you need to use the phone number that was used during registration and you also have to enter the authentication code.

In the CITIC Securities personal account investors can do the following:

1. Buy and sell assets.

2. View market data and streaming quotes:

3. Read the latest news:

1. Buy and sell assets.

2. View market data and streaming quotes:

3. Read the latest news:

Also, in his personal account, a trader can:

-

Make a deposit.

-

View open and closed positions for a specific period.

-

Generate a report on the daily commission for trading.

-

Cancel the order.

-

Check the account balance.

-

Subscribe to upcoming IPOs.

-

Carry out a bank transfer of securities to an investment account.

-

Find nearby company offices by filtering all retail outlets by city and province.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the CITIC Securities rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about CITIC Securities you need to go to the broker's profile.

How to leave a review about CITIC Securities on the Traders Union website?

To leave a review about CITIC Securities, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about CITIC Securities on a non-Traders Union client?

Anyone can leave feedback about CITIC Securities on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.