deposit:

- $1

Trading platform:

- Proprietary platform

- FINRA

- SIPC

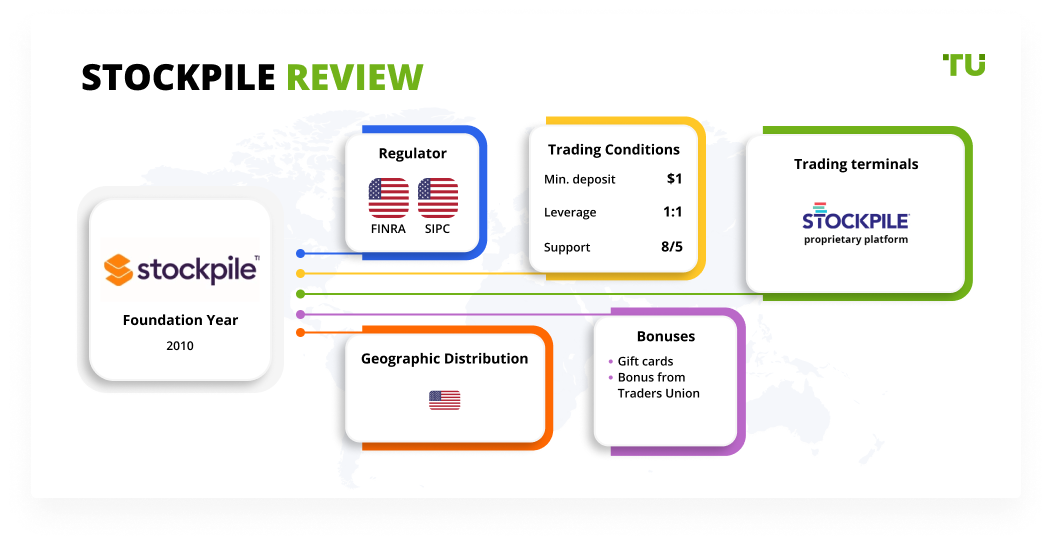

Stockpile Review 2024

deposit:

- $1

Trading platform:

- Proprietary platform

- No

- Trading with fractional shares is allowed, there are no trading commissions

Summary of Stockpile Trading Company

Stockpile is a broker with higher-than-average risk and the TU Overall Score of 4.66 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Stockpile clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Stockpile ranks 66 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The Stockpile broker focuses on clients who do not have experience in trading on the stock exchange and gives you the possibility to start working with a small amount of capital.

Stockpile is an American broker which is a subsidiary of Stockpile Investments Inc. that has been offering services in the stock market since 2010. All transactions are settled through the largest US clearing company Apex Clearing. Stockpile is controlled by the private American corporation Financial Industry Regulatory Authority (FINRA, CRD#: 156170/SEC#: 8-68772), which oversees the implementation of trading rules on stock exchanges. The security of the client’s capital is guaranteed by the non-governmental non-profit organization Securities Investor Protection Corporation (SIPC), which provides the opportunity to insure accounts up to $500,000 in case of a broker’s bankruptcy.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | from $1 |

| ⚖️ Leverage: | No |

| 💱 Spread: | No |

| 🔧 Instruments: | Shares, ETF |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Stockpile:

- Access to trading fractional shares, which enables you to use insignificant funds for investment.

- No brokerage fees, including the absence trading fees set by FINRA.

- Possibility to purchase gift cards for friends and relatives, which they can exchange for shares after registration.

- Presence on the New York Stock Exchange, where Stockpile represents the leading US brokers.

- Provision of an easy-to-use trading platform, the interface of which is easy to understand even for clients without experience in trading stocks and other financial instruments.

- There are no requirements for the size of the minimum deposit, which allows you to start investing with a comfortable amount.

- Possibility to open custodial accounts owned by minors but managed by an adult, not necessarily a parent.

👎 Disadvantages of Stockpile:

- A limited number of ways to deposit and withdraw funds.

- There is no possibility of technical analysis.

- A small selection of financial instruments.

Evaluation of the most influential parameters of Stockpile

Geographic Distribution of Stockpile Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Stockpile

Stockpile offers over 2,000 stocks and ETFs for investing. The list of assets is constantly updated but it does not include shares under $3. They do not provide borrowed funds, so the clients should rely only on their capital. But thanks to the possibility to trade fractional stocks and the absence of a minimum deposit, you can start trading with a small amount on your account.

The customer account can be additionally secured using two-factor authentication. To do this, after entering the password, you need to enter a one-time code that comes to the phone specified during registration. You can do security settings independently in your personal account. To simplify transactions, the mobile application has a debit card scan function that is linked to a trading account. However, customers who think it is unsafe can disable this option.

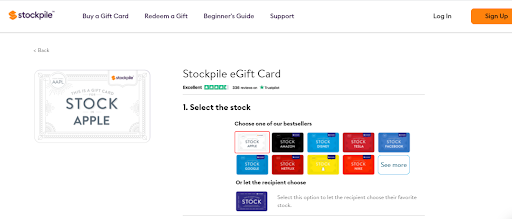

To attract new investors, the broker offers clients to purchase electronic gift cards worth $1-100. The company also issues physical gift cards in denominations of $25, $50, and $100. Delivery cost depends on the region, but for purchases over $100, delivery is free.

Dynamics of Stockpile’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

The Stockpile broker offers over 2,000 stocks and ETFs for investment. This includes all shares of the S&P 500. If the client does not find the shares of interest in the list on the company’s website, then he can submit a request to buy them. The only exceptions are shares that are traded on exchanges at a price below $3.

Custodian account is a popular way to invest in Stockpile

One of the types of investments the company offers is custody accounts for minors. To open an account for a child, you do not have to be the child’s parent. The account belongs to the child, but until the age of majority, it is managed by an adult who receives custodial status. In this case, a minor client will not be able to close the account or withdraw funds from it. Features of custodial accounts:

-

Under the Uniform Transfer to Minors Act (UTMA), which the company is guided by, the financial custodian who manages the account may not be the parent of the child.

-

Once the account is opened, it becomes a “non-refundable gift” that cannot be canceled.

-

Since the owner of the account is a child, the tax payments on it are significantly reduced.

-

Minors can independently perform transactions on the account, but for any order to be viable, it must be approved by the custodian.

To open an account for a child, you have to create a member account, which must include the details of the account holder and custodian. The amount of the deposit is not limited, and when performing transactions with assets, the brokerage commission is not charged.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Stockpile’s affiliate program

Currently, the broker does not offer referral programs, but the Stockpile website has a Partnerships section, where a representative of a financial company can fill out a form indicating the necessary data and report his proposal for partnership cooperation. After reviewing the application, Stockpile sends a response to the specified email.

Trading Conditions for Stockpile Users

The broker provides its clients with the opportunity to trade stocks and ETFs. Financial instruments can be selected from the list on the website or you can send a request to the support service with regard to an asset that you want to trade. Stockpile is focused on independent clients and does not provide portfolio management or financial advice. To attract new investors, the company is actively promoting the sale of electronic and physical gift cards with a package of shares, which, after activation, can be sold or exchanged.

$1

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Stockpile’s proprietary platform |

|---|---|

| 📊 Accounts: | Individual account, Deposit account |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Wire transfers, debit cards, online banking, Automated Clearing House (ACH) payments |

| 🚀 Minimum deposit: | from $1 |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No information |

| 💱 Spread: | No |

| 🔧 Instruments: | Shares, ETF |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Proprietary aggregator |

| 📱 Mobile trading: | No |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Trading with fractional shares is allowed, there are no trading commissions |

| 🎁 Contests and bonuses: | Yes |

Stockpile Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual account | from $1 | Yes — when withdrawing by bank transfer |

| Deposit account | from $1 | Yes — when withdrawing by bank transfer |

The list of additional paid services is presented in the Fees section of the company’s website.

Below is a comparative table of the average commissions of three stock brokers: Stockpile, Charles Schwab, and Ally Bank. Experts for the Traders Union have assigned an appropriate level of commissions charged by each company.

| Broker | Average commission | Level |

| Stockpile | $1 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Stockpile

Stockpile has been providing financial services in the stock market for over 10 years. The company’s goal is to make investing an easy way of earning money for those who have never been involved in stock trading. For this, they developed favorable trading conditions, provide an easy-to-use platform, and actively distribute promotional gift cards.

Stockpile achievement facts:

-

More than 11 years of experience in providing brokerage services.

-

Best App for Beginners Award from Business Insider magazine.

-

Membership in the New York Stock Exchange.

-

Elimination of all trading and account service fees from July 1, 2021

Stockpile is a company that focuses on long-term investors with no trading experience

The broker allows you to invest in American and foreign stocks and ETFs. At the same time, the number of assets is constantly replenished taking into account the preferences of customers who can leave an application for a specific asset on the company’s website. If the investor registered an account after receiving the gift card, but he doesn’t like the assets that the donor has chosen, then he can exchange them at his discretion. There are custodian accounts for minors, where trading can be carried out after the approval of the transactions by the custodian.

You can use iOS and Android mobile applications or a stationary proprietary platform developed by Stockpile specialists for trading. To log in to your account, you have to go through two-factor authentication with a one-time code, which can be disabled in the personal account. The software is designed for users without investment experience, therefore, it has only basic functionalities.

Stockpile’s useful services:

-

Buy stock is a section that provides up-to-date information about companies whose shares are offered for investment.

-

A gift stock warehouse is where you can select assets (fractional shares, etc.) to buy.

-

A calculator for calculating the value of fractional shares, which is designed to determine how much of a share can be bought for $1 to $100.

-

Financial instrument statistics that show price fluctuations over the past 52 weeks.

Advantages:

Easy to use trading platform.

Fully digital account opening.

Custodial accounts with a reduced tax rate.

No commission fees for trading and account maintenance.

Free withdrawal of funds via ACH and bank cards.

Authoritative regulator - FINRA.

Prompt support service.

The gift card package includes the Scout Books ebook with a guide for aspiring investors.

How to Start Making Profits — Guide for Traders

After registering with the broker’s website, the client can choose one of two types of accounts for investment. There are no minimum amount requirements for deposits. There are no fees for opening and maintaining an account.

Account types:

Stockpile does not provide a demo account for trial trading, but since trading with fractional shares is allowed, you can start working without significant financial risks.

The broker focuses on independent traders who are planning long-term investments or want to open an account for a minor.

Bonuses Paid by the Broker

Gift cards

Each client of the company has the opportunity to purchase electronic and physical gift cards for friends and relatives for $1 to $100. The recipient of the card can exchange it for fractional shares, the value of which will rise and fall over time.

Investment Education Online

The broker does not offer courses on teaching the basics of investing, but for an independent acquaintance with the stock market, the website has a section called The Ticker. It contains videos and tutorials on trading on stock exchanges. Additionally, they also provide information about cryptocurrencies, although cryptos are not on the list of the broker’s assets.

The Ticker section also contains articles with useful tips for experienced traders and large investors.

Security (Protection for Investors)

Stockpile is legally registered under the name Stockpile Investments, Inc. The activities of the company are controlled by FINRA.

Stockpile clients’ funds are insured by the SIPC Corporation. Each investor has access to compensation for $500,000, including $100,000 in cash if the broker goes bankrupt.

👍 Advantages

- Two-factor authentication for account logins

- Transactions go through Apex Clearing

- Lloyd’s of London optional insurance policy is available

- Clients can contact the support team when needed

- There is a possibility to file a complaint with the supervisory authority if the broker violates its obligations

👎 Disadvantages

- The regulator restricts withdrawal methods

- There are restrictions on the use of financial instruments

- Mandatory account verification

Withdrawal Options and Fees

-

Withdrawal requests are processed from 3 to 5 business days.

-

Withdrawals are made to debit cards, via ACH, by transferring to the linked account, or by bank transfer.

-

A bank transfer fee of $25 is charged. Withdrawals through the ACH chamber are free of charge.

Customer Support Service

Stockpile’s support team is ready to provide its services during market hours.

👍 Advantages

- There is an online chat system

- You can find answers to FAQs on the website

- Problem-solving is available through a proxy

- You can contact one of 52 offices in the USA

👎 Disadvantages

- There is no callback

- There is no 24/7 support

- There is no phone number on the website

This broker provides the following communication channels for its clients:

-

chat;

-

email;

-

personal visit to its office.

The company has accounts in popular social networks, where you can also ask a question.

Contacts

| Foundation date | 2010 |

| Registration address | 716 San Antonio Rd Unit B, Palo Alto, CA 94303, USA |

| Regulation |

FINRA, SIPC |

| Official site | https://www.stockpile.com/ |

| Contacts |

Email:

support@stockpile.com,

|

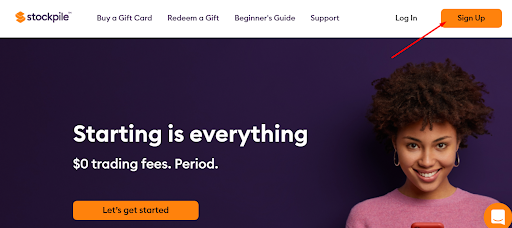

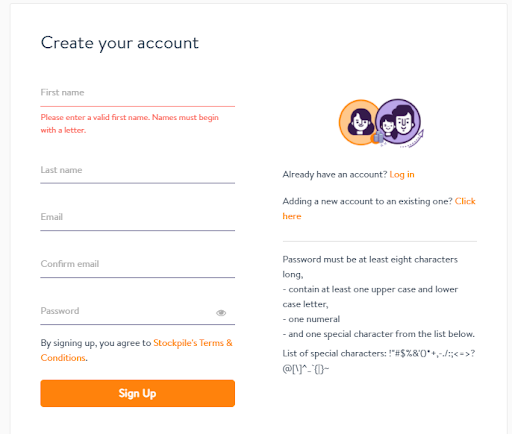

To access the Stockpile personal account, you need to register with their website. For this you need to:

Click the Sign Up button on the company’s official website.

In the form that opens, indicate your name, surname, and email. You also need to come supply a strong password.

After entering personal and financial data, you need to click the Login button. To enter your personal account, you must enter the email address and password specified in the registration form.

In the personal account, you have access to the following sections:

-

Financial.

-

Analytical.

-

Trading.

-

Support service.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Stockpile rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Stockpile you need to go to the broker's profile.

How to leave a review about Stockpile on the Traders Union website?

To leave a review about Stockpile, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Stockpile on a non-Traders Union client?

Anyone can leave feedback about Stockpile on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.