Tastytrade (Tastyworks) Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Tastyworks proprietary app

- 1:1

- No

Our Evaluation of Tastytrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Tastytrade is a moderate-risk broker with the TU Overall Score of 6.31 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Tastytrade clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Tastytrade is suitable for users of all experience levels: professionals and newbies. However, it should be borne in mind that the client must have an account with an American bank to trade freely.

Brief Look at Tastytrade

Tastytrade is a brokerage company that strives to allow its clients to trade single-handedly, without managing the account or copying transactions of other traders. To make self-investing a reality, the company has created a separate platform with a humongous library of learning materials. Tastytrade (Tastyworks) is controlled by bodies such as the Financial Industry Regulatory Authority (FINRA, CRD#: 277027/SEC#: 8-69649 ), the National Futures Association (NFA, 0492333), and the Securities Investor Protection Corporation (SIPC).

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- No minimum deposit. The client independently chooses how much to deposit to the trading account.

- A vast array of educational materials for which the broker has allocated a special platform it calls the Tastytrade.

- The company offers clients flexible trading accounts with different functions. Any of the three offered accounts have varieties, so the trader can choose the option that suits him the most.

- To gain access to trading, the user must go through a snail-paced registration procedure and provide a list of documents that the broker requests.

- To open a trading account and start working, a client must have an open account with an American bank.

- The broker does not allow clients to test trading on a demo account; only a real trading account can be opened.

TU Expert Advice

Author, Financial Expert at Traders Union

Tastytrade offers a range of trading services, focusing on stocks, ETFs, futures, micro futures, small futures, cryptocurrencies, and options through its proprietary Tastyworks app, accessible on both browsers and mobile devices. The broker offers individual, entity/trust, and joint accounts, with no minimum deposit requirement, encouraging flexibility in trading. Its educational resources are extensive, making it an attractive option for traders who prioritize learning and self-investment. Additionally, Tastytrade caters to users looking for standalone trading experiences without account managers.

Despite these advantages, Tastytrade's drawbacks include a complex registration process requiring a U.S. bank account. The lack of an immediate demo account for general practice may be a consideration for some. Client support is comprehensive, including phone, live chat, and email. Therefore, Tastytrade may suit U.S. residents, interested in self-guided investment rather than those primarily seeking high leverage in every asset class.

Tastytrade Summary

| 💻 Trading platform: | Tastytrade proprietary app, trading in browser or mobile mode |

|---|---|

| 📊 Accounts: | Individual, Entity/Trust, Joint |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | ACH, domestic and foreign transfers, domestic, foreign, and dividend checks, ACAT |

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 EUR/USD spread: | From $1.20 |

| 🔧 Instruments: | Stocks, ETFs, futures, micro futures, small futures, cryptocurrency, and options |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | No |

| 🎁 Contests and bonuses: | No |

The Tastytrade brokerage company offers its clients favorable trading conditions. Most of the assets that a trader can use are suitable for investing and making a profit in the long term. There are no currency pair instruments.

The broker does not set the size of the minimum deposit, so the user chooses the amount to replenish the account on his own. There are no bonuses or contests, and no leverage is provided. The size of the commission depends on the asset that the client uses in his work, and the method of replenishment or withdrawal of funds.

Tastytrade Key Parameters Evaluation

Video Review of Tastytrade

Share your experience

- Best

- Last

- Oldest

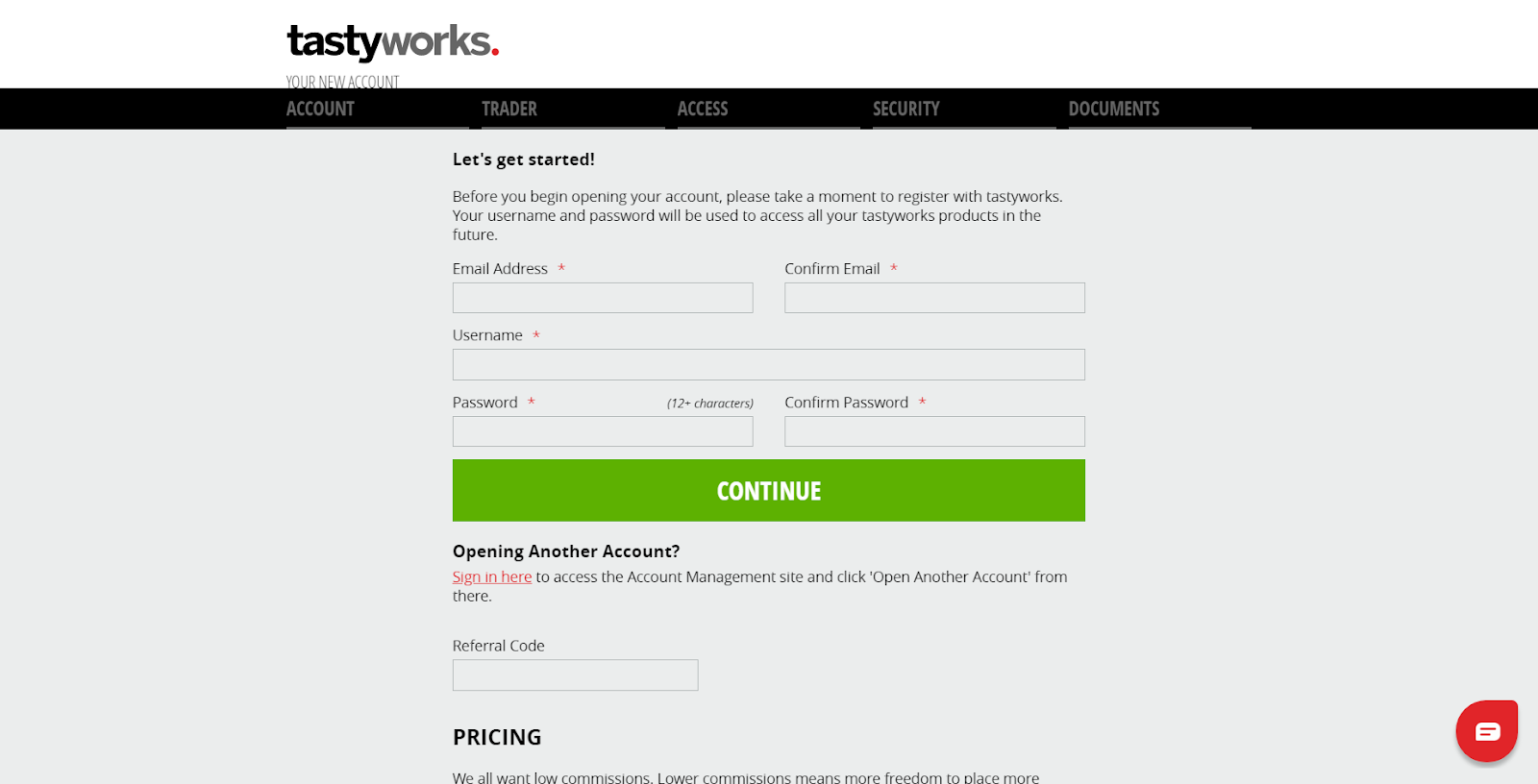

Trading Account Opening

To be able to invest with Tastytrade, you need to open a personal trading account on the official website. Registration and trading with the presented broker are available to clients who have their own registered business in the United States. Before opening an account, the broker necessarily requests documents confirming this, and only after verification, can the client replenish the account and start investing.

Register on the official website of the Tastytrade broker. To do this, click on the "Open an account" button in the upper right corner.

Fill out the registration form and enter your email address, password, and username. Here you can also enter the referral code if you have one.

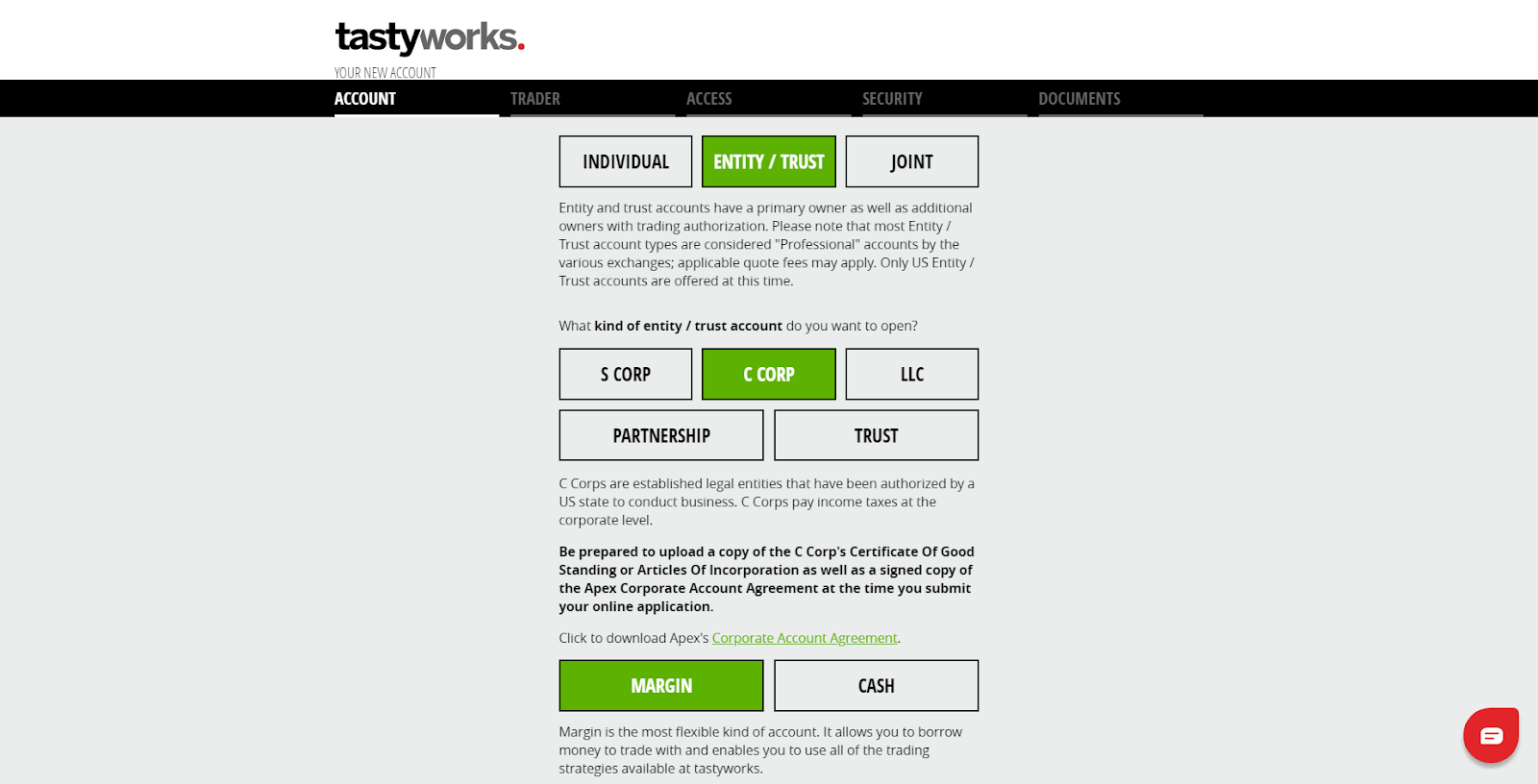

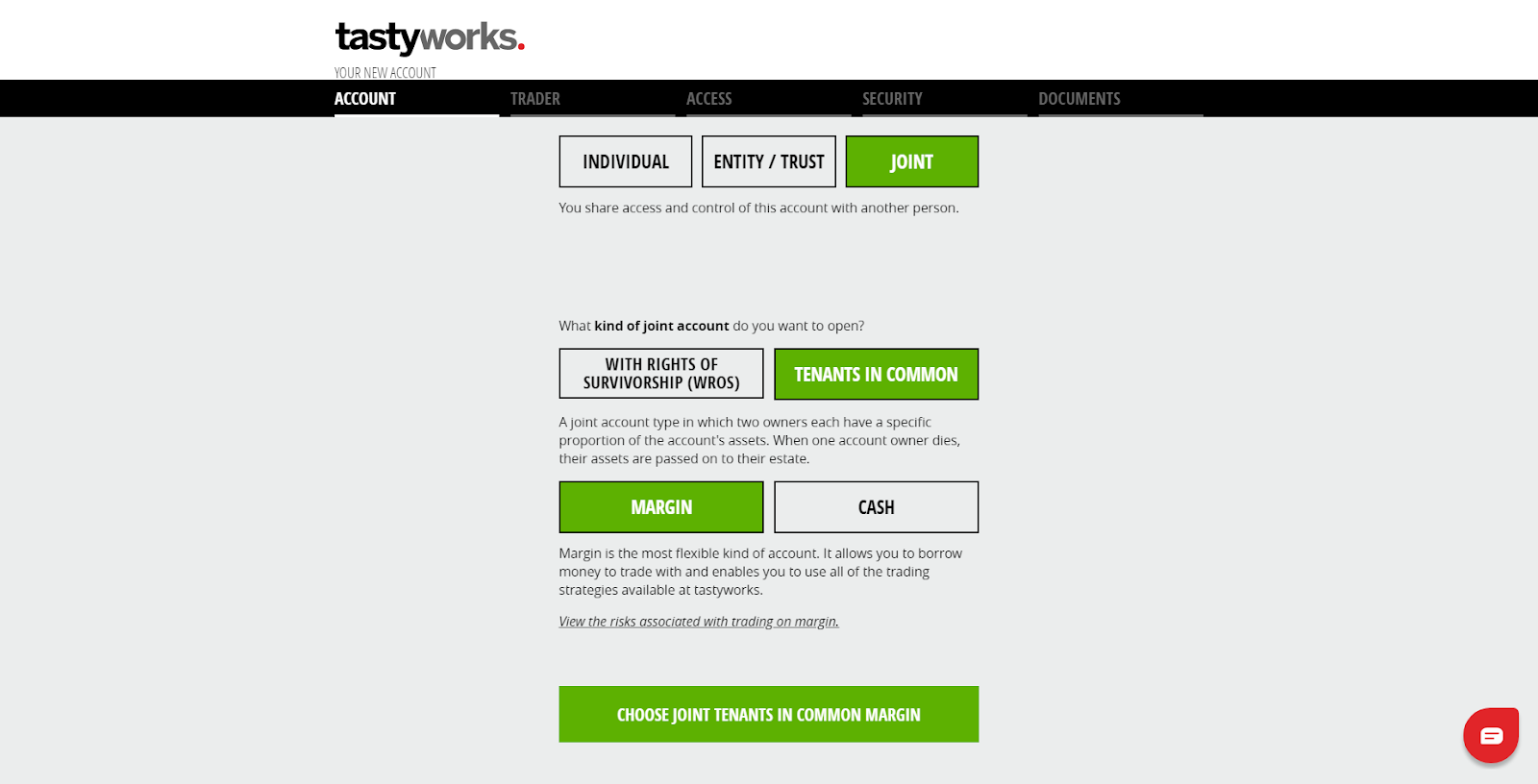

Select the type of trading account. Tastytrade (Tastyworks) offers three main types of accounts: Individual, Entity / Trust, Joint. Each of them has distinct characteristics. To familiarize yourself with them, select the type of account that interests you:

Fill in the form with your personal data and indicate your first and last name, residence address, phone number, date of birth, and more.

After filling in the required fields, click on the "Continue to trading access" button and indicate:

-

Information about your experience in trading and investing.

-

Activate the protection of your account with two-factor identification.

-

Upload documents. The broker requests them regardless of the type of trading account. Working with the assets is only possible after you submit these documents.

Regulation and safety

The Tastytrade broker is controlled by three independent financial regulators. They are NFA (National Futures Association), SIPC (regulator of financial markets and brokers), and FINRA (regulator of the financial services industry).

Tastytrade (Tastyworks) is actively developing in the field of encrypting the personal data of customers, checking the level of security, and taking additional measures to reliably protect its users. The broker engages independent experts to maintain a high level of confidentiality and monitors the access of company employees to customer data.

Advantages

- The broker ensures that customer data is protected from all third-party users, including access to data that Tastytrade employees have

- The company's activities are regulated by independent bodies

- The relationship between the client and the broker is well-regulated

Disadvantages

- Inability to create a segregated account

- To open an account, the client must provide the broker with documents confirming the existence of a business registered in the USA

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Individual | $1.20 | No |

| Entity/Trust | $1.20 | No |

| Joint | $1.20 | No |

Tastytrade (Tastyworks) does not provide information on the availability of swaps, which are fees for carrying over positions to the next day. But there is a trade fee for opening a trade and closing it. The experts also analyzed the performance of Tastytrade's trading commissions in comparison with its competitors. Based on the final analysis, each of the brokers was assigned a low, medium, or high level of commission fees.

| Broker | Average commission | Level |

|---|---|---|

|

$2.8 | |

|

$4 |

Account types

The first step toward making money with the Tastytrade broker is to create a personal account on which the trader can carry out transactions.

Account types:

-

S Corp is an account for Americans who have permission from the state to do business. The user of this type of account does not pay income tax.

-

C Corp is an account for legal entities with a business permit from a state or the United States. There are no restrictions on the number of users; income tax is levied at the corporate level.

-

LLC is an account for limited liability companies. This is an unincorporated legal entity that provides limited access to other users.

-

Partnerships are used for companies consisting of two or more persons. Account holders do not pay taxes, profit and loss are calculated individually for each partner.

-

Trust assumes that a power of attorney can be revoked or changed. The user's social security number is used as the tax identification number.

All account types can be opened in the subtypes Margin or Cash.

-

Joint. Allows you to open access to your account to another person. Account types: With rights of survivorship (WROS), Tenants in common.

-

The rights of survivorship (WROS) type assumes that both owners have equal rights, and in the event of the death of one of them, the other gains full control over the account.

-

Tenants in common give owners different rights to assets. If one of them dies, then a share of his assets goes into his estate and is not transferred to the co-owner. When opening any of the account types, you need to select the subtype: Margin or Cash.

Deposit and withdrawal

-

The withdrawal of funds and replenishment of the trading account are carried out in the user's personal account. Log into your account, open the "My money" tab, and select "Deposits" or "Withdrawals". If you have more than one open account, click on the account with which you want to make a transaction. The broker offers the opportunity to make both one-time transactions and repetitive ones. There is no transaction fee if your account is linked to an ACH bank account. In other cases, the commission is charged depending on the payment system used.

-

To fund a trading account, the broker recommends using an ACH bank account, which assumes no fee for any transactions. It is also possible to fund the account using bank transfers, checks, and ACAT (transfer of funds to an account from another brokerage company).

-

The broker does not provide data on the term for crediting funds to a trading account when replenishing an account or withdrawing funds to a personal bank account.

-

Transactions are made in USD. For information on the possibility of using a different currency for work, contact the Tastytrade support team.

-

Trading and financial transactions with the account will be available to the client after he verifies his account using the documents requested by the broker.

Investment Options

The broker does not provide investment programs. Tastytrade (Tastyworks) specializes in providing favorable conditions for self-trading and offers its clients standard instruments such as futures, stocks, options. The company also positions itself as a broker that gives users complete freedom of action in financial management. Therefore, programs that allow you to receive passive income using a manager or a transaction copy service are not presented here.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Tastytrades affiliate program

-

The broker still allows its users to receive bonuses without engaging in active trading. For this, a referral program has been created. The principle of its operation is simple. A trader needs to attract as many users as possible to actively trade in securities. For each attracted and active client, a trader receives a referral credit, which can later be exchanged for things of value such as items from Google Home to a trip for two to Chicago or even a Tesla Model S. To receive a reward, a trader needs to create a referral link on the Tastytrade website and share it with friends, relatives, and subscribers on social networks. Please note that the client you attracted must fund his securities trading account within two months for at least $2,000. Information about affiliate statistics and attracted referrals is available in the personal account on the Tastytrade website.

Customer support

During trading, account opening, replenishment, or other operations, the user may encounter problems. To solve them quickly and efficiently, the broker Tastytrade (Tastyworks) offers its clients assistance through its support staff.

Advantages

- A trader can find answers to questions in a special section, without directly contacting the broker

Disadvantages

- You can contact the employees of the brokerage company directly only by fax or mail

- There is no information about the schedule of the support service

- Inability to reach out to the broker via email

Available communication channels with customer support specialists include:

-

sending a letter to physical mail;

-

using the built-in chat on the broker's website;

-

contacting support by fax via the number listed in the Support section;

-

visiting the Help Center section, where the broker has collected answers to frequently asked questions (FAQs) from clients and categorized them by topic.

Contacts

| Foundation date | 2012 |

|---|---|

| Registration address | 1000 W. Fulton Market, Suite 220, Chicago, IL, 60607 |

| Regulation | NFA, SIPC, FINRA |

| Official site | https://tastytrade.com/ |

| Contacts |

312-724-7364

|

Education

The broker Tastytrade (Tastyworks) is open to cooperation with novice users and those traders who already have experience in trading. In addition to favorable trading conditions, the company has created a special platform Tastytrade, where traders and investors can learn, be inspired by the examples of other traders, study historical data and discuss the market situation in live chat sessions. There is a lot of educational materials on the Tastytrade platform, and a trader with any experience can find something interesting and useful for himself.

Tastytrade (Tastyworks) does not allow its clients to open a demo account and test trading conditions, knowledge gained and different trading strategies risk-free.

Detailed Review of Tastytrade

Tastytrade (Tastyworks) is a brokerage company for residents and residents of America who have a business registered in the United States. The main goal of the broker is to allow its clients to independently manage their assets and invest personally, without the help of managers. To make independent trading successful, the company created Tastytrade, a platform with educational materials that will help users understand the nuances of investing, monitor the market situation, analyze archived transactions and study the characteristics of various assets.

A few figures about the Tastytrade broker for investors who are interested in working with the company:

-

$0 is the size of the fee for all transactions (withdrawal of funds and account replenishment, etc.) for users who have linked their trading account to their ACH bank account.

-

Three is the number of main types of trading accounts that a trader can customize at his discretion.

-

$50,000 is the cost of a Tesla Model S vehicle, which can be obtained for active participation in the broker's referral program.

Tastytrade is the best broker for American investors

The company is aimed at users who are interested in long-term investment. Tastytrade (Tastyworks) traders gain access to standard assets and options. Accounts are suitable for clients with different needs, from a personal account to an affiliate account.

The Tastytrade trading platform provides the ability to manage an investment portfolio from a browser or smartphone.

Useful Tastytrade services:

-

Curves analysis. Curves analysis allows you to control the situation and find the most profitable points for entering the market.

-

Quick roll. You can use fast scrolling to control the expiration dates and cycles of the option.

-

Quick order adjustments. The function is needed to correct, duplicate, replace or cancel an order that has not yet been executed.

-

Percent of profit limit orders. Helps you choose the most realistic, executable price for your positions.

-

ETF-equivalent futures delta. This provides the ability to determine the ETF equivalent delta without complex data analysis.

-

In-app trading inspiration. The platform allows you to follow the work of other traders, and learn news from the world of trading.

Advantages:

The broker allows each client to choose an account and customize it according to their individual needs.

Each client has access to a training platform with useful information on the topic of trading and investing.

The company does not set the level of the minimum deposit; instead, the trader determines the amount of replenishment independently.

With the simplistic and intuitive interface of the site, the visitor can easily find the information he needs.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i