deposit:

- $5000

Trading platform:

- Bloomberg - EMSX

- Bluewater

- Stealth Trader

- Zlantrader

- SEC

- NFA

- FINRA

- SIPC

Phillip Capital (PhillipCapital) Review 2024

deposit:

- $5000

Trading platform:

- Bloomberg - EMSX

- Bluewater

- Stealth Trader

- Zlantrader

- Floating

Summary of Phillip Capital Trading Company

Phillip Capital is a moderate-risk broker with the TU Overall Score of 6.25 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Phillip Capital clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Phillip Capital ranks 27 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

PhillipCapital is a company for those who have fairly large start-up capital and have experience in the stock markets.

Phillip Capital is a broker of PhillipCapital Inc Group, founded in Singapore in 1975. The PhillipCapital subsidiary was established in 2010. Its main office is located in the United States in the Chicago Chamber of Commerce building. Since July 2014, the broker has been regulated by the US Commodity Futures Trading Commission (CFTC) and is also registered with the FINRA (CRD#: 173869/SEC#: 8-69558), SIPC, and the OCC. PhillipCapital provides direct access to the stock market and offers over 2,000 instruments for trading on 30 exchanges in 16 countries. The company also provides a wide range of clearing, financial, and executive services.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | from 5,000 USD |

| ⚖️ Leverage: | Floating |

| 💱 Spread: | Stocks, options, bonds, futures |

| 🔧 Instruments: | N/A |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Phillip Capital:

- No brokerage fees for trading stock market assets.

- Providing access to major American and global exchanges, including CME, EUREX, CBOT, DME, IEX, COMEX, NYMEX, NFX, ICE US, CFE (CBOE), and ICE EU.

- Uses proprietary software.

- Membership in all Asian futures exchanges, which allows traders to expand the list of available trading tools.

- Large selection of supported trading platforms.

- Regulated by CFTC and SEC, membership in FINRA and SIPC.

👎 Disadvantages of Phillip Capital:

- High minimum deposit amount of $5,000.

- Technical support is provided by phone, fax, or email; there is no online chat.

- It does not cooperate with electronic payment systems and charges a commission for withdrawing funds from accounts.

Evaluation of the most influential parameters of Phillip Capital

Table of Contents

Geographic Distribution of Phillip Capital Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Phillip Capital

PhillipCapital provides direct access to most of the major Asian, European, and American exchanges. For traders with a large trading volume, there is assistance in renting a trading space on the exchange and coordinating payments. To avoid getting a negative balance on the client’s account, it is possible to set an individual margin for intraday trading.

For a monthly subscription fee, PhillipCapital offers a whole list of trading platforms, distributed on exchanges by their functionality and availability. Also, a trader, after getting technical support approval by email, can create and connect his own interface using the API service. In the absence of access to the trading terminal, clients use the round-the-clock telephone of the order execution service.

On the negative side of PhillipCapital, it should be noted that it is possible to apply for withdrawal of funds only by email. There is a $25 fee for wire transfer withdrawals. There is no commission when converting currencies, but the rate is too high. Deposit and withdrawal of funds from the account are possible only by bank transfer, checks, and ACH transfer. Another disadvantage of PhillipCapital is the lack of comprehensive training for novice traders.

Dynamics of Phillip Capital’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

PhillipCapital offers about 2,000 types of futures, bonds, and stocks on 30 exchanges, including all major Asian ones, which further expands the list of traded instruments. The broker provides dealer services, performing the function of a counterparty for the client when making transactions.

Characteristics of PhillipCapital cooperation:

-

When trading with a broker, $5 is charged in addition to the commission.

-

The company assists professional market participants in buying (renting) a trading place on the exchange.

-

Clients have the opportunity to create and connect to their account an individual trading platform based on their own software.

-

At the end of each business day, a password-protected report is sent to the client’s email.

-

Anyone who has no experience in the stock market can apply for a trial use of a demo account.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

PhillipCapital affiliate program:

-

Introducing Broker (IB) — individual terms of cooperation for independent brokers who serve their own clients.

The introducing broker receives an individual link to the application where he can control the trading activity of his traders and perform all actions available in the administrator’s status.

Trading Conditions for Phillip Capital Users

The broker offers clients a large number of financial instruments for investment on the world’s major stock exchanges. The subscription fee for access to work is up to $40 per month, depending on the chosen trading terminal, such as CQG Integrated Client; CTS T4 - Advanced Data & Charting; and TT Platform have an additional one-time fee of $100 per connection. The site also features trading terminals of partner brokers. When choosing a platform supported by PhillipCapital, the minimum deposit is $5,000 for US traders and international clients.

$5000

Minimum

deposit

1:1

Leverage

24/6

Support

| 💻 Trading platform: | Bloomberg - EMSX, Bluewater, CQG Mobile, CQG Trader, CQG Q Trader, CQG Integrated Client, CTS T4 Mobile, CTS T4 Core+Charting, CTS T4 Advanced Data & Charting, eSignal, Multicharts, PhotonTrader, QST, Qbitia, Rithmic R|TRADER, Rithmic R|TRADER Pro, SierraChart, Stealth Trader, Trade Navigator, TT Platform, Zlantrader, Zlantrader Mobile |

|---|---|

| 📊 Accounts: | Individual, joint, corporate, LCC, LLP, trust, IRA, pension plan, discretionary |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Wire transfer, payments through the automated clearing house ACH, checks |

| 🚀 Minimum deposit: | from 5,000 USD |

| ⚖️ Leverage: | Floating |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | absent |

| 💱 Spread: | Stocks, options, bonds, futures |

| 🔧 Instruments: | N/A |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | available |

| 📱 Mobile trading: | available |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | No |

| 🎁 Contests and bonuses: | No |

Phillip Capital Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual | from $0.03 | Yes |

| Joint | from $0.03 | Yes |

| Corporate | from $0.03 | Yes |

| LCC | from $0.03 | Yes |

| LLP | from $0.03 | Yes |

| Trust | from $0.03 | Yes |

| IRA | from $0.03 | Yes |

| Pension Plan | from $0.03 | Yes |

| Discretionary | from $0.03 | Yes |

There is no conversion fee when depositing a currency other than USD, but the exchange rate is too high. Paper trade confirmations and statements of $2.5-$5 per action. The account closing fee is $100. We have compared Philip Capital stocks trading commission fees with those of other well-known brokers. This is what Traders Union found:

| Broker | Average commission | Level |

| Phillip Capital | $0.03 | Medium |

| Fidelity | $2 | High |

| Webull | $0.02 | Low |

Detailed Review of Phillip Capital

PhillipCapital is one of the oldest stock market brokers. It does not do proprietary trading, so it benefits from the successful work of clients. The company has proprietary software and also provides terminals for partner brokers.

The success of PhillipCapital is confirmed by the following numbers:

-

PhillipCapital Inc.’s offices are located in 15 countries.

-

The share capital is over $1.5 billion.

-

The company manages assets worth about $35 billion.

PhillipCapital is a company for clients with experience in trading on exchanges and those using financial instruments

PhillipCapital’s presence on Asian exchanges provides its clients with an expanded list of stocks, options, and futures. Traders and financial institutions trading in large volumes can get assistance in buying or renting a trading place on the selected exchange with further service support.

Clients registered with partner brokers can work on their interfaces. The broker supports 21 trading platforms with different functionalities. PhillipCapital offers two mobile platforms for iOS and one for Android. Thanks to this, trading is available from any device that has an internet connection. There is a possibility to connect proprietary terminals.

PhillipCapital useful services:

-

Trading Asia newsletter. A monthly newsletter that covers Asian news.

-

Podcasts. Recorded conversations of Co-CEO Lynette Lim with industry leaders.

-

Trade and economic calendars. Events that can affect the movement of the value of trading instruments are displayed here.

Advantages:

Trading is available from all stationary and mobile devices.

The possibility to choose a trading platform with the necessary functionality and a set of indicators for technical analysis.

Expanded list of trading instruments through access to Asian exchanges.

Access to stock markets from the accounts of partner brokers.

Every day, a trading report is sent to clients’ emails.

The company offers daily trading margins ranging from 25% to 50%. The applicable rates depend on the assets chosen to trade and the experience of the investor and are set by PhillipCapital’s risk department.

How to Start Making Profits — Guide for Traders

PhillipCapital has developed a line of trading and savings accounts for retail traders and corporate clients.

Account types:

You can also apply to open a demo account, but it is not available on all supported platforms.

The broker PhillipCapital is focused on clients with trading experience and high investment levels.

Bonuses Paid by the Broker

Currently, the broker does not provide any bonuses to its clients.

Investment Education Online

The PhillipCapital website does not provide training, but it does have a newsletter section. Also, useful information can be found in the FAQs section.

A demo account is provided to gain experience without the danger of losing money.

Security (Protection for Investors)

PhillipCapital is regulated by the Commodity Futures Trading Commission (CFTC), the Securities and Exchange Commission (SEC), and the National Futures Association (NFA, 0422202). The broker is also a member of FINRA and SIPC.

PhillipCapital clients’ funds are kept in segregated bank accounts, which guarantees they are safe in case of a force majeure. The company’s website has a form for registering and filing a claim with the regulatory organization.

👍 Advantages

- Possibility to file a complaint with the regulator

- Clients’ money is kept in segregated accounts following CFTC and SEC rules

👎 Disadvantages

- To pass verification, you must provide a social security number and an individual taxpayer identification number

- You cannot use e-wallets to deposit and withdraw funds

Withdrawal Options and Fees

-

Withdrawal of funds is carried out by request to the broker’s email.

-

You can withdraw money using wire transfer, check, or payment via ACH.

-

For wire transfers, the broker charges a commission of $25 for each transaction, for withdrawals by check the commission is $4.

-

The withdrawal of funds takes from 2 to 5 days, depending on the location of the client and the chosen payment method.

Customer Support Service

Support is available 24 hours a day from 16:00 Sunday to 16:30 Friday CST.

👍 Advantages

- The phone call is free

👎 Disadvantages

- There are days off

- There is no online chat

There are three options for contacting support:

-

phone call;

-

email;

-

fax.

If you have any questions, you can contact the support service before and after registering with a broker.

Contacts

| Foundation date | 1975 |

| Registration address | 141 W Jackson Blvd, Suite 1531A, Chicago IL 60604 |

| Regulation |

SEC, NFA, FINRA, SIPC |

| Official site | phillipcapital.com |

| Contacts |

Phone:

312 356 9000

|

Review of the Personal Cabinet of Phillip Capital

To start cooperation with PhillipCapital, you have to:

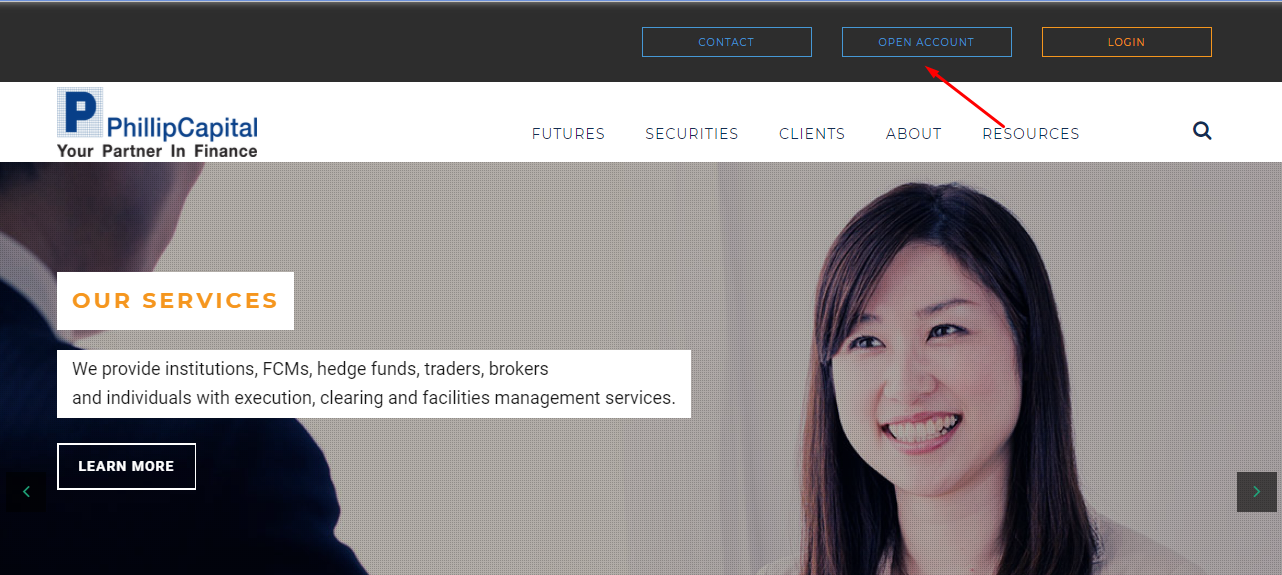

Go to the company’s website and click the Open Account button on its home page.

After that, a form for applying will open; there you have to enter your email, username, and password. Then you have to indicate personal data, the purpose of registration, and put an electronic signature on the client agreement. The application is processed within 24 hours, after which you get a notification to your email with the data for entering the personal account.

Additionally, in the personal account of the broker, you can perform the following actions:

-

Make a deposit to a trading account and order a withdrawal of funds.

-

Download the trading platform and connect to it.

-

View quotes for trading instruments.

-

Monitor the trading activity on the account.

-

Contact support.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Phillip Capital rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Phillip Capital you need to go to the broker's profile.

How to leave a review about Phillip Capital on the Traders Union website?

To leave a review about Phillip Capital, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Phillip Capital on a non-Traders Union client?

Anyone can leave feedback about Phillip Capital on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.