deposit:

- 100 AUD

Trading platform:

- Proprietary Mobile app

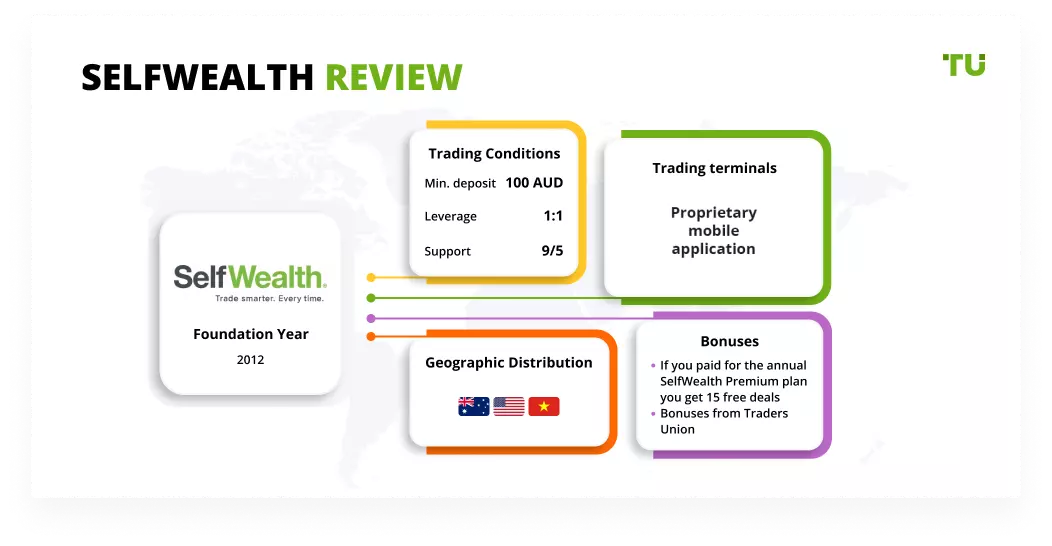

SelfWealth Review 2024

deposit:

- 100 AUD

Trading platform:

- Proprietary Mobile app

- 1:1

- The size of the trading commission depends on the market, there is a commission for currency conversion (AUD to USD)

Summary of SelfWealth Trading Company

SelfWealth is a broker with higher-than-average risk and the TU Overall Score of 4.6 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SelfWealth clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. SelfWealth ranks 68 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

SelfWealth is a reliable ASIC-licensed broker that offers favorable terms for trading in the Australian securities market.

SelfWealth is an Australian broker that offers access to the Australian and US exchange markets. It has been providing services since 2012. The broker is regulated by the Australian Securities and Investments Commission (ASIC, 421789) and serves over 100,000 Australian investors. The company doesn’t limit its clients in choosing a strategy and offers a full range of services for trading and passive investing. SelfWealth offers a variety of account types, such as a wide range of US and Australian securities, and a flat commission on all asset classes.

| 💰 Account currency: | AUD |

|---|---|

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | No |

| 🔧 Instruments: | Australian market: Shares, ETFs, Australian listed property shares, Australian listed debt securities, Australian listed investment company shares;US Market: Shares, ETFs, US notes, American Depository Receipts (ADRs). |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with SelfWealth:

- A wide range of assets, including over 9,000 stocks, ETFs and ADRs.

- The ability to invest in securities listed on the largest US stock exchanges (NYSE, Nasdaq) and the Australian Securities Exchange (ASX).

- Positive control by Australia's most reputable financial commission, the ASIC.

- Participation in the compensation Financial Claims Scheme, which guarantees coverage of losses up to $250,000 in the event of a bankruptcy of the broker.

- The fixed commission per trade of 9.5 AUD or USD depending on the asset being traded.

- No additional fees for deposits and withdrawals in Australian dollars.

- The ability to get passive income in the form of dividends for owning shares of American companies.

👎 Disadvantages of SelfWealth:

- Only Australian tax residents and permanent residents can become its customers.

- When trading US securities, traders have to pay a conversion fee to exchange USD to AUD.

- Live chat is only available during trading hours on the stock exchanges.

Evaluation of the most influential parameters of SelfWealth

Geographic Distribution of SelfWealth Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of SelfWealth

SelfWealth is an Australian broker that offers CHESS — (Clearing House Electronic Subregister System. It is operated by the Australian Stock Exchange and facilitates the transfer of a security's legal ownership from a seller to a buyer) — investment in real stocks. Although it supports the trading of securities listed on the Australian Stock Exchange (ASX) and US exchanges, its services are available only to Australian tax residents and permanent residents. At the same time, investors who are living in the country for at least 183 days (6 months) fall under this category.

SelfWealth doesn’t support partial trading, which means that its clients can buy or sell only the whole share, not fractional shares. Moreover, the broker sets requirements for the minimum size of the first trade. For this reason, an account can be opened without making a deposit, but to start trading, you must have at least $100 (US Market) or $500 (Australian Market) + amount to cover the brokerage commission.

SelfWealth doesn’t offer desktop or web terminals. All transactions and account management are carried out in a mobile application that supports two-factor authentication (2FA). Customers can create targeted portfolios themselves by combining stocks from their own watchlists with assets from the portfolio of the best-performing members of the SelfWealth Premium community.

Dynamics of SelfWealth’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

SelfWealth is a broker for independently trading in securities, and for passively investing. Its clients get access to over 9,000 stocks, ETFs, and ADRs.

Basic investment solutions from SelfWealth

The company's management believes that any person can make money on the stock market, even without professional knowledge and investment experience. Currently, SelfWealth offers its clients 3 options for earning passive income:

-

SelfWealth Adviser Platform. After connecting to the platform, you can use an advisor robot to form up to five model portfolios to assist you in your investments. The brokerage fee is $9.50 for each $70,000 trading block.

-

SelfWealth Premium. Buying the package opens access to the virtual portfolios of over 80,000 SelfWealth members and each of their trades. The investor can set up notifications at the moment when the tracked trader makes a trade. The cost of the premium package is $240 per year.

-

Dividends. They are transferred to the custodian of the funds, Phillip Securities Pte Ltd, who then transfers them to the shareholder's cash account. All dividends paid are subject to 15% tax and processing fees (fees vary). The funds received are not subject to automatic reinvestment. To participate in the Dividend Reinvestment Plan (DRP), a shareholder shall apply to an organization that maintains a register of shareholders on behalf of the company.

Investment programs are available to all clients of the company. A potential investor can choose one option or combine several solutions to diversify and increase the efficiency of their own portfolios.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

SelfWealth’s affiliate program:

-

Referral Program. Clients get 5 free trades if the referral opens an account using his link. They can be used within 30 days of a new client’s registration and only for trading on the Australian Stock Exchange. The referral's account must be verified.

Five free trades are given to both the referrer and by the user connected through his link. The term for their submission is also 30 days.

Trading Conditions for SelfWealth Users

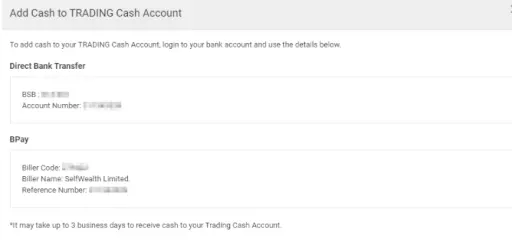

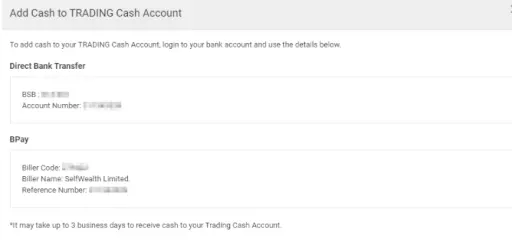

The SelfWealth broker doesn’t offer margin trading, so its clients can only use their own capital to make trades with securities. All accounts are opened in AUD. A trader can deposit and withdraw funds in USD, but a currency exchange fee is charged. SelfWealth clients can place market and limit orders during trading sessions, but traders can only limit orders after the close of trading. All payment transactions are made using only commission-free bank transfers and the BPAY system.

100 AUD

Minimum

deposit

1:1

Leverage

9/5

Support

| 💻 Trading platform: | Proprietary mobile platform |

|---|---|

| 📊 Accounts: | Individual, joint, company, trusts, and self-managed Super Funds (SMSFs) |

| 💰 Account currency: | AUD |

| 💵 Replenishment / Withdrawal: | Bank transfers, BPAY |

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | $100 USD for the US market$500 AUD for the Australian market |

| 💱 Spread: | No |

| 🔧 Instruments: | Australian market: Shares, ETFs, Australian listed property shares, Australian listed debt securities, Australian listed investment company shares;US Market: Shares, ETFs, US notes, American Depository Receipts (ADRs). |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | The size of the trading commission depends on the market, there is a commission for currency conversion (AUD to USD) |

| 🎁 Contests and bonuses: | Yes |

SelfWealth Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual | From $9.50 | Available when withdrawing in USD |

SelfWealth doesn’t charge any fees for maintaining an account or providing financial advice.

Analytical specialists at the Traders Union compared the average trading commissions of the SelfWealth broker with its top competitors. In the table below, find the levels assigned to companies based on the comparison of their average commissions.

| Broker | Average commission | Level |

| SelfWealth | $9.5 | Medium |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Low |

Detailed Review of SelfWealth

SelfWealth is a Melbourne-based broker that offers Australian investors trading in assets listed not only on the Australian Stock Exchange, but also on the US stock exchanges such as NYSE, Nasdaq, NYSE American, and NYSE Arca. The company's clients can create portfolios themselves or use a robotic advisor for these purposes. SelfWealth agents only provide general investment advice and don’t provide client wealth management services.

SelfWealth's success by the numbers:

-

The company has been providing brokerage services and financial advice for over 9 years.

-

Over 100,000 Australian investors trade securities through the broker's mobile app.

-

Over 7,500 US stocks and 2,000 Australian stocks are available for trading.

-

SelfWealth clients' daily trading volumes exceed $80 million.

SelfWealth is a professional investment broker specializing in Australian securities.

SelfWealth offers access to CHESS-sponsored shares. CHESS (Clearing House Electronic Subregister System) is a computer system used by the Australian Stock Exchange (ASX) to register the ownership of shares and manage the trades with them. Thus, SelfWealth clients actually buy real stocks, and the broker transfers the information to the ASX. In this case, the investor shall be considered the owner of the share, and not the broker, who acts as a custodian. Each investor is assigned a unique HIN (Holder Identification Number). With its help, you can easily transfer shares from one broker to another.

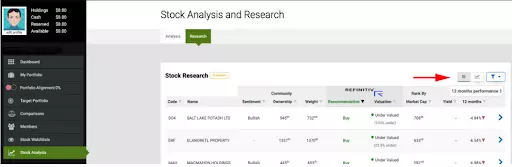

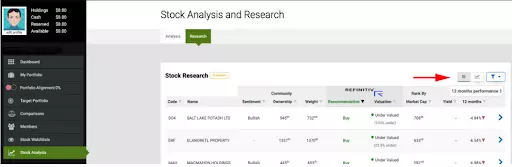

All transactions for the purchase and sale of securities are made by SelfWealth clients in the mobile application. The company offers 2 versions of the program for smartphones and tablets based on Android and iOS. The application allows not only placing trade orders but also managing a trading account, as well as viewing information on portfolio rebalancing and accrued dividends. It also has stock screeners, market analyses, and portfolio optimization tools.

Useful SelfWealth services:

-

Watch lists. They allow you to track the price movement and the profitability of stocks of companies of interest to the user.

-

Analytics from Refinitiv Global Markets, Inc. (formerly Thomson Reuters). It is a company that provides a data search tool for achieving effective profits in securities.

-

Stock Screener. Allows you to filter stocks by recommendations and analysts' estimates, as well as by market capitalization, profitability, and price dynamics for selected time periods of 1 to 12 months.

-

WealthCheck. This is a tool for tracking the effectiveness of individual portfolios. With its help, an investor can check his profitability for 1, 3, 6, or 12 months and compare it with the performance of other clients of the company.

Advantages:

The investor can place limit orders after the close of the exchange. They will be executed immediately after the opening of trading.

The commission for trading is fixed and doesn’t change with an increase or decrease in the trading volume.

If you have selected the Premium plan you can track the transactions of other investors and copy them if desired.

The functionality of the mobile application allows the trader to conduct a qualitative analysis of the market situation, as well as evaluate his portfolios in terms of profitability and safety.

The company offers free trades to members of the referral program.

SelfWealth customers can sign up for courses (paid and free) from the Rask Australia education portal.

The broker's website contains market news, educational video tutorials on investing, and legal documentation with detailed terms of cooperation.

How to Start Making Profits — Guide for Traders

SelfWealth offers individual, joint, corporate, and juvenile accounts. All of them allow you to buy and sell US and Australian stocks, but we will take a closer look at the most popular account types.

Types of accounts:

Potential SelfWealth clients who plan to entrust their investments to an automated advisor can request a demo.

SelfWealth allows its clients to transact in securities listed in the USA and Australia with fixed fees.

Bonuses Paid by the Broker

If you paid for the annual SelfWealth Premium plan you get 15 free deals

Moreover, if a subscriber gets income from trading shares, then his subscription is not taxed. Free trades are valid for 12 months from the date the annual fee is paid.

Investment Education Online

The SelfWealth website has several training sections such as Education, Learn How to Invest, and a Help Center. They contain information mainly for novice traders who want to master the basics of investing in securities on their own and without attending specialized paid courses.

SelfWealth is cooperating with Rask Australia, an educational organization that offers both paid and free investment and finance courses of various complexity levels.

Security (Protection for Investors)

SelfWealth is licensed to provide general consulting on financial products and work with financial products from the ASIC regulator, with license number 421789. The company is a member of the Australian Securities Exchange (ASX:SWF)

Funds deposited into a SelfWealth trading account are held in segregated trust accounts. Moreover, all deposits are subject to the Financial Claims Scheme. It is ensured by the Australian government and guarantees coverage of up to $250,000 in damages in the event of a broker or custodian bankruptcy. Also, if SelfWealth declares financial insolvency, its clients can continue trading with Phillip Capital Limited, a direct partner of the ASX Group and Chi-X Australia with an ASIC license.

👍 Advantages

- In case of violation by the broker of the obligations prescribed in its offer, you can file a complaint with the regulator

- Client funds are not available to the broker as they are kept in segregated trust accounts

- Broker participates in the state compensation scheme, i.e., the Financial Claims Scheme

👎 Disadvantages

- You cannot open a trading account without verification.

- Withdrawals are only possible by bank transfer

- To open an account with a broker, you must live in Australia for 6 months or be a tax resident of the country

Withdrawal Options and Fees

-

If the client has made a withdrawal request before 2:00 pm, the money will be credited to the bank account on the next business day.

-

By default, the company displays profits in Australian dollars. However, you can also request a withdrawal in USD. For this, you will have to pay a commission for the conversion to the bank + 60 base points to the broker as a conversion fee.

-

If an investor has made a request to withdraw funds in USD before 9:00 (AEDT), the funds will be credited to the bank account on the same day. Withdrawals in US dollars, issued after 9:01 am, are carried out during the next business day until 2:00 pm.

-

The money that the investor deposits to the trading account shall be reserved (i.e., frozen) on it for 3 working days from the date of crediting. For this reason, they can only be withdrawn after this time has elapsed.

Customer Support Service

Live chat is available during trading hours. Australian residents can contact support Monday through Friday from 10 am to 4 pm, Sydney time. US customers can ask a question to the operator Monday through Saturday from 11:00 pm to 6:00 am Sydney time.

👍 Advantages

- An unregistered user can ask a question during an online chat

👎 Disadvantages

- Online chat only works during trading hours

- Answers by email are sent within 1 day

- You cannot contact company representatives by phone

The broker provides the following communication channels:

-

online chat;

-

via email;

-

contact form for request by email;

-

via its social networks and messengers, such as Facebook, Twitter, Reddit, and LinkedIn.

Contacts

| Foundation date | 2016 |

| Registration address | PO Box 199, Surrey Hills, Victoria, 3127, Melbourne, Australia |

| Official site | https://www.selfwealth.com.au/ |

| Contacts |

Email:

support@selfwealth.com.au,

|

Review of the Personal Cabinet of SelfWealth

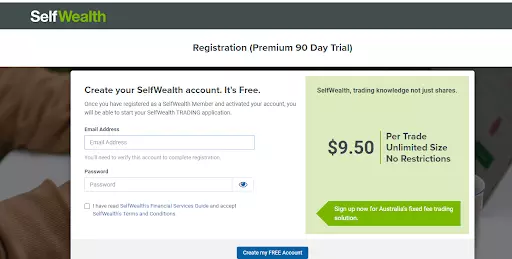

To start trading with SelfWealth, you need to open a trading account with a broker. Follow these instructions:

Visit the official website of the company and click the Join now button at the top of the main page.

Enter your email and create a password.

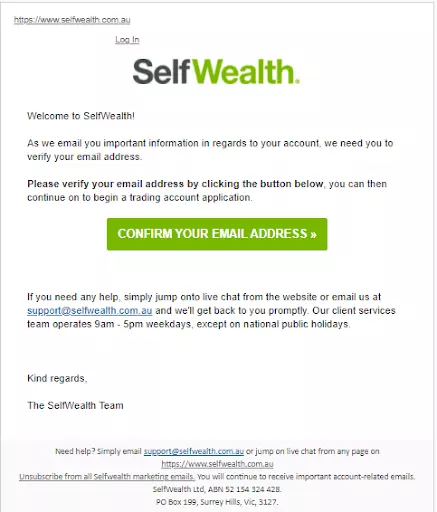

Confirm email address.

Create a login and provide personal data, such as date of birth, your current residence address, mobile phone number, valid driver's license or passport number. Applicants between the ages of 18 and 27 shall also enter their Medicare card number.

Next, retail traders must indicate the Tax File Number (TFN). When registering a corporate account, the broker asks for an Australian Business Number (ABN).

To enter your personal account, enter your email address and the previously specified password.

In the SelfWealth personal account, you can:

1. Replenish the account balance:

2. Open an extra trade account:

3. View forecast and analytics from Refinitiv:

1. Replenish the account balance:

2. Open an extra trade account:

3. View forecast and analytics from Refinitiv:

Also, in your personal account you can see:

-

Forecasts and stock exchange reports for the selected asset.

-

The number of available free trades provided under the terms of the referral program.

-

The history of operations for depositing and withdrawing funds.

-

Watch lists.

-

Portfolio rebalancing reports.

-

The number of open and closed trades for a selected time period.

-

Notes to contracts.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the SelfWealth rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about SelfWealth you need to go to the broker's profile.

How to leave a review about SelfWealth on the Traders Union website?

To leave a review about SelfWealth, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about SelfWealth on a non-Traders Union client?

Anyone can leave feedback about SelfWealth on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.