Trading.com Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $5

- MT5

- FCA

- CFTC

- NFA

- 1997

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $5

- MT5

- FCA

- CFTC

- NFA

- 1997

Our Evaluation of Trading.com

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Trading.com is a moderate-risk broker with the TU Overall Score of 5.44 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Trading.com clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Trading.com is a professional trading broker with a narrow focus on UK clients only.

Brief Look at Trading.com

Trading.com is a UK broker whose full name is Trading Point. Previously, it was called XMUK, but in 2019 it was rebranded and the company began to operate under its new title: Trading.com. The company offers to trade six asset classes such as currency pairs, metals, as well as CFDs on stocks, stock indices, commodity futures, and energy resources. More than 1,250 assets are available in total. The main office is located in London, the broker is regulated by the FCA (Financial Conduct Authority), and its registration number 705428.

- Favorable trading conditions - average spreads in major pairs are 0.6 pips.

- No commissions.

- Moderate requirements compared to the size of the minimum deposit. You can start trading when you deposit at least $5 to your account.

- MetaTrader 5 desktop and mobile platforms, as well as a web terminal, are available for trading.

- Reliable FCA regulation.

- The broker only provides services to UK citizens.

- The absence of PAMM and MAM accounts for passive investing.

- The absence of bonuses, training programs.

TU Expert Advice

Financial expert and analyst at Traders Union

The broker has been providing services under the Trading.com brand since 2019. Only UK citizens can become their clients. Due to regulatory changes and Brexit, Trading.com has stopped opening accounts for citizens of other European countries. To keep floating spreads as tight as possible, the broker cooperates with several liquidity providers but does not disclose them, while claiming that it has the status of a market maker.

Trading.com offers two types of accounts: Ultra-Low Standard and Ultra-Low Micro. The first difference between them is in the size of the contract. So, 1 standard lot is 100,000 units of the base currency, and 1 micro lot is 1,000 units of the base currency. The second difference is that the Ultra-Low Micro account provides only a limited set of trading instruments (currencies and metals).

The broker complies with the policy of prohibiting requotes and hidden fees. It uses an automated system to monitor monetary transactions and manage risks to avoid negative balances on clients’ accounts. Visit Trading.com for up-to-date spreads, commissions, and other costs for each underlying instrument. Detailed terms of trading accounts can be checked with technical assistance specialists. Live chat operators respond quickly in 8 languages 5 days a week around the clock.

- You want MetaTrader 5 desktop and mobile platforms, as well as a web terminal, available for trading. This provides flexibility and convenience in accessing your trading account.

- You want favorable trading conditions, with average spreads in major pairs at 0. 6 pips. This indicates potentially competitive pricing, contributing to lower trading costs.

- The absence of bonuses and training programs is a deal-breaker for you. If you expect or value bonuses and comprehensive training programs, this broker may not meet those specific needs. Consider your preferences and requirements in terms of educational support and promotional offerings before choosing this broker.

Trading.com Summary

| 💻 Trading platform: | МТ5 (desktop, mobile, WebTrader) |

|---|---|

| 📊 Accounts: | Ultra-Low Standard, Ultra-Low Micro |

| 💰 Account currency: | EUR, USD, GBP, CHF, AUD, PLN, HUF |

| 💵 Replenishment / Withdrawal: | Credit/debit cards, wire transfer, Skrill |

| 🚀 Minimum deposit: | from 5 USD |

| ⚖️ Leverage: | from 1:1 up to 1:30 depending on the instrument |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Average spread 0.6 pips |

| 🔧 Instruments: | Currency pairs (57), CFD on shares (1200+), commodity group (8), indices (14), metals (2), energy resources (5) |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | Not disclosed |

| 📱 Mobile trading: | Available |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | $5/month – payment for inactivity on the account |

| 🎁 Contests and bonuses: | No |

Trading.com offers clients more than 1,250 trading instruments, a powerful MetaTrader 5 terminal. Traders receive leverage from 1:1 to 1:30, and it cannot be increased due to the requirements of the regulator. Potential clients can test the trading conditions on demo accounts. You are allowed to trade on the demo for a maximum of 90 days. Muslim traders can work on Islamic accounts (no swaps).

Trading.com Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

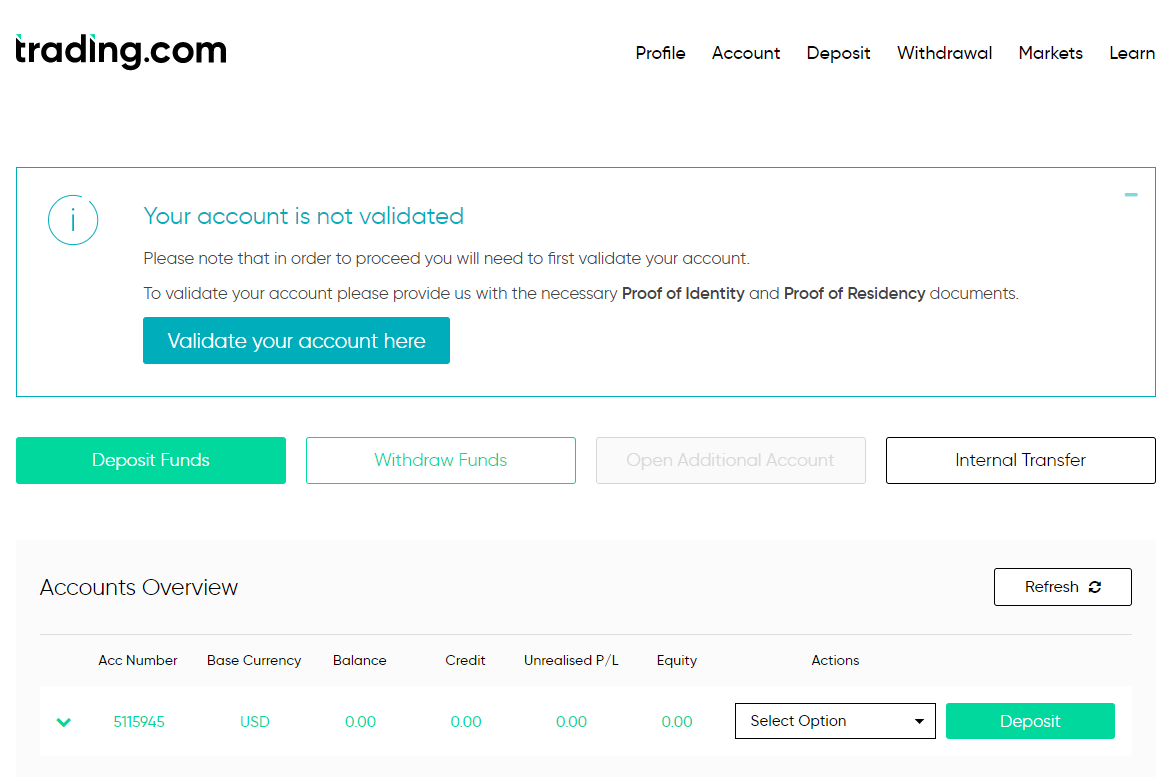

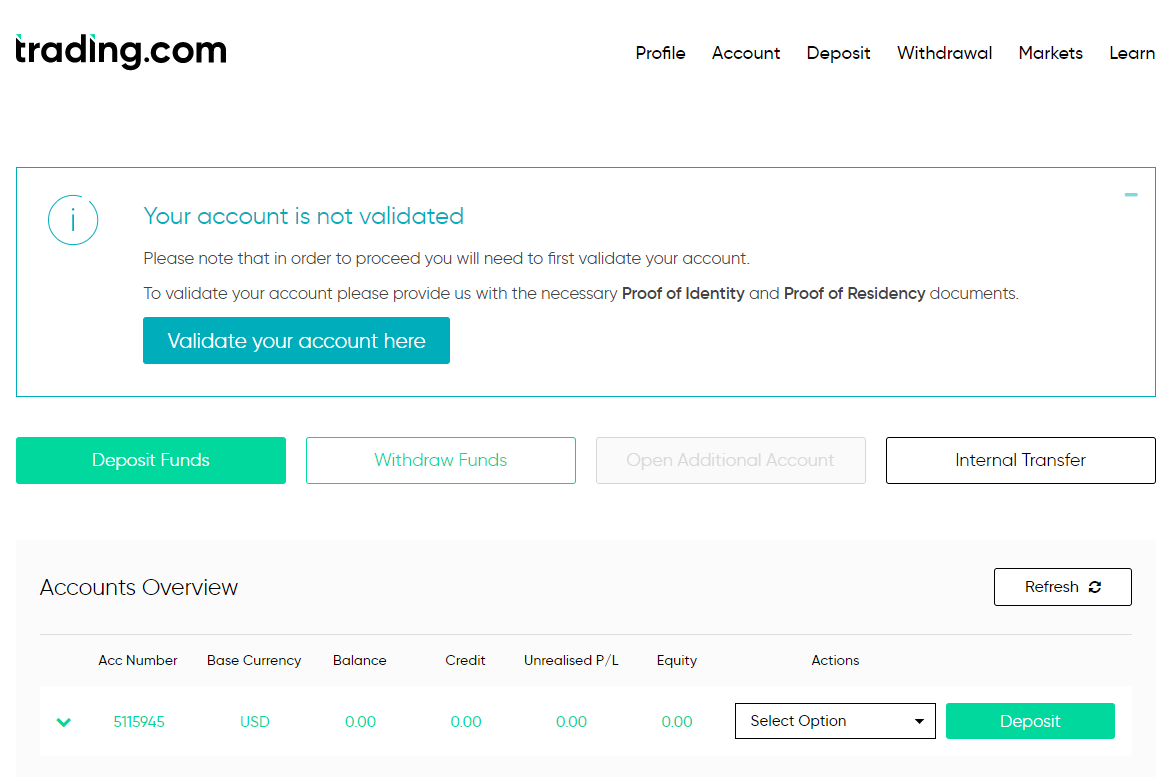

Trading Account Opening

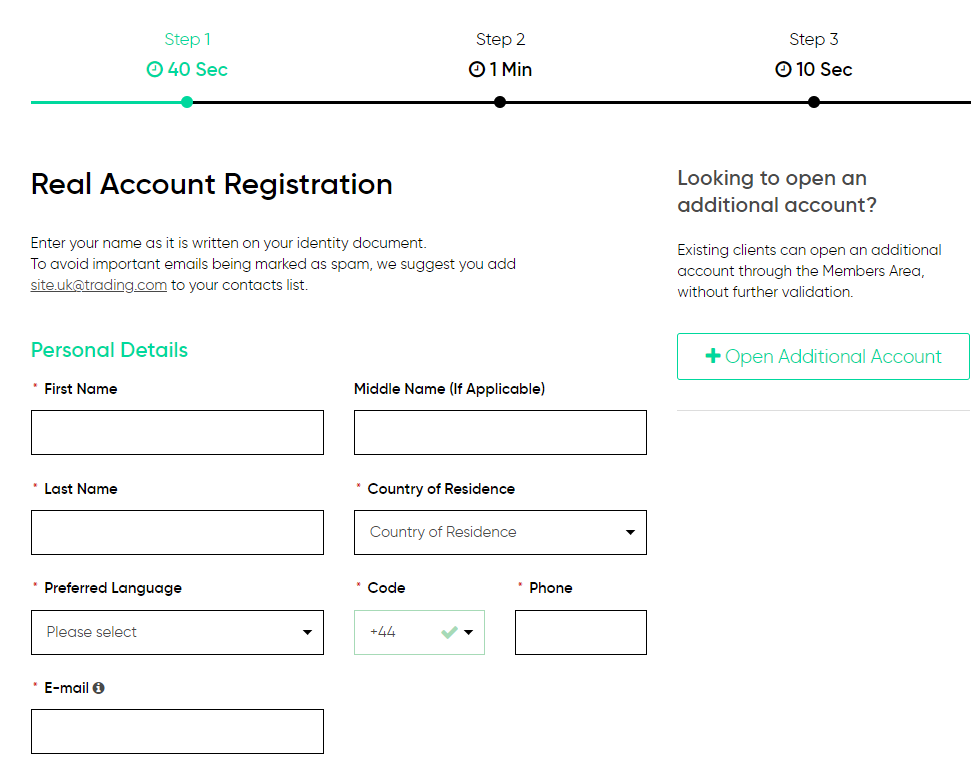

Trading.com is only open to customers with UK passports. A quick guide to opening an account looks like this:

Click Open Account on Trading.com.

After that, the system will offer to pass through registration, which consists of three steps. At the first step, you need to provide basic information: name, address, citizenship, and phone number, etc.

In the second step, you will need to select the account parameters (base currency, account type). The broker will also ask you to provide information about the amount of available capital, the origin of income, social status, the purpose of opening an account, as well as existing trading experience and knowledge. The system will even ask a few test questions.

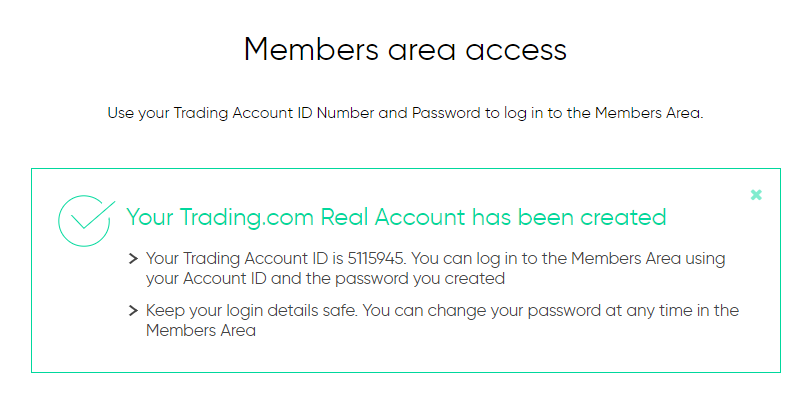

In the third step, you just need to confirm the email by clicking the link in the letter from the broker. After that, you will receive an account ID and you will be redirected to your personal account.

Trading.com personal account functionality:

In the personal account, the trader has access to:

-

Functionality for managing accounts (you can open up to eight accounts in different currencies).

-

Functionality for depositing or withdrawing funds.

-

Functionality for managing the account profile (personal data, tax data, etc.).

-

Security settings (setting 2FA, changing password).

-

Links for downloading the trading platform.

Regulation and Safety

Trading.com operates under license from the UK government regulator - FCA. The registration number is 705428. Clients of the broker are protected from negative balance, and in case of bankruptcy of the broker, funds are insured under the Financial Services Compensation Scheme in force in the UK.

Advantages

- Client funds are segregated from Trading.com’s capital and kept in segregated bank accounts

- Negative balance protection is active

- In case the broker violates the obligations prescribed in the offer, the client can file a complaint with the regulator

- Clients’ funds are insured

Disadvantages

- To open an account, you must provide detailed financial information

- Without verification, you cannot make a deposit or withdraw funds

- Limited choice of electronic payment systems for making deposits and withdrawals of money

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Ultra-Low | from $6 | No |

| Ultra-Low Micro | from $6 | No |

There are swaps (commission for moving a position to the next day). The procedure for calculating them is described in the Overnight Positions section.

The analysts at Traders Union also compared the size of the average spread of Trading.com, with Admirals, and FxPro. The comparative results are presented in the below table.

| Broker | Average commission | Level |

|---|---|---|

|

$6 | |

|

$1 | |

|

$8.5 |

Account Types

Trading.com offers two types of accounts. You need the MetaTrader 5 platform to trade on both accounts. The maximum allowable leverage is 1:30, its size depends on the selected trading instrument. Accounts with zero balance that have been inactive for more than 90 days are automatically archived. With an inactive account after 90 days of inactivity, you will be charged a monthly fee of $5.

Account types:

In addition to Ultra-Low Micro, demo accounts are available to practice trading skills on the MT5 terminal. The maximum number of simultaneously open positions for all types of accounts is 200.

Trading.com is a low-cost broker that provides professional traders from the UK with favorable conditions for trading currencies and CFDs.

Deposit and Withdrawal

-

Trading.com processes withdrawal requests within 24 hours on business days.

-

Money can be withdrawn to Visa and Mastercard (debit and credit), wire transfer, or via Skrill.

-

Wire transfer and withdrawal to the card take from 2 to 3 business days. The Skrill e-wallet receives money on the same day.

-

Trading.com does not charge any fees for depositing or withdrawing funds. Moreover, it claims to compensate each client for possible expenses, even when withdrawing by wire transfer (except for deposits of less than $200 or the equivalent).

-

Since Trading.com is a regulated company, it prohibits accepting deposits from third parties, it supports AML and KYC policies. This means that, for example, a client can withdraw funds only to the account from which they were transferred to the broker.

-

For depositing and withdrawing funds, there is a special section in the personal account.

Investment Programs, Available Markets and Products of the Broker

Trading.com does not offer any kind of cooperation to create passive income. PAMM and MAM trust accounts, social trading services are not available. Third-party trading and account management are prohibited by the terms of service.

The only option to create passive income is to use numerous MQL5 signals that come in the Metatrader platform ecosystem.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Trading.com’s affiliate program

The broker doesn’t provide a referral program.

Customer Support

Support service operators are available 24 hours a day on weekdays. Questions can be asked in English, French, Italian, Polish, Arabic, Spanish, Portuguese and German.

Advantages

- In an online chat without bots, you can ask a question without being a client of the company

- Support is available in 8 languages

Disadvantages

- Support is unavailable on weekends

This broker provides the following communication channels for existing clients and potential investors:

-

phone (24/5);

-

email;

-

online chat without bots.

Not only a registered client but also a trader without an active account can ask this broker’s representative a question.

Contacts

| Foundation date | 1997 |

|---|---|

| Registration address | Citypoint Building, 1 Ropemaker Street, London, EC2Y 9HT. |

| Regulation | FCA, CFTC, NFA |

| Official site | trading.com |

| Contacts |

+44 2031501500

|

Education

Trading.com has a separate tutorial section called Learn. But the section is almost empty, although the broker promises to fill it very soon.

The broker has pages on social networks such as Facebook, Twitter, and Instagram, but there is no Youtube channel where it would be possible to post webinars. Analytics are not provided in any form.

The broker allows you to open a micro account with a reduced lot size to reduce the risks for novice traders when learning to trade. Clients can also open up to five demo accounts for up to 90 days to reduce their learning risks to zero.

Comparison of Trading.com with other Brokers

| Trading.com | RoboForex | Pocket Option | Exness | Tickmill | FxGlory | |

| Trading platform |

MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, Tickmill Mobile App | MT4, MobileTrading, MT5 |

| Min deposit | $5 | $10 | $5 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | No | 8.00% |

| Spread | From 0.6 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 2 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 100% / 30% | 20% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | $30 | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed Review of Trading.com

The mission of Trading.com is to provide the best trading conditions such as tight spreads, zero commissions, the ability to apply any trading strategies (including scalping on the news), and ensure fast execution (Market execution). In addition to Ultra-Low accounts, Islamic and demo accounts with virtual funds of $100,000 are available to traders.

Trading.com by the numbers:

-

1250 available trading instruments.

-

$5 minimum deposit.

-

7 base currencies on the account.

Trading.com is a broker for active manual and algorithmic trading

Trading.com clients can trade Forex, Metals, and CFDs on stocks in nearly 20 countries, stock indices, commodities, and energy products.

Trading.com clients work through various versions of the MetaTrader 5 terminal, including desktop, web, and mobile (for Android and iPhone). Traders have access to one-click trading, they are allowed to use automated advisors, scripts, scalping, and news trading.

Trading.com’s useful services:

-

VPS for MetaTrader 5. Clients with a minimum balance of 5,000 US dollars (or the equivalent in another currency) have the right to request a free VPS in their personal account, provided that they trade at least 5 lots per month.

-

Economic Calendar. It allows you to track current economic events that affect the Forex market.

-

Trading calculators. They help to calculate position size, swap, margin level, etc.

Advantages:

It is estimated that 99.35% of all orders are executed in less than 1 second.

There are six asset classes available for trading.

To ensure the safety of client funds, the company stores them in segregated accounts with Tier-1 European banks.

Negative balance protection is in effect.

Tight spreads (0.6 pips on popular Forex pairs).

No commission for trading or money transfers.

The minimum deposit is only $5.

All clients, regardless of the size of the deposit, have access to Islamic accounts.

User Satisfaction