deposit:

- $1

Trading platform:

- MT4

- MT5

- FCA

- SCB

- FSC

- 0%

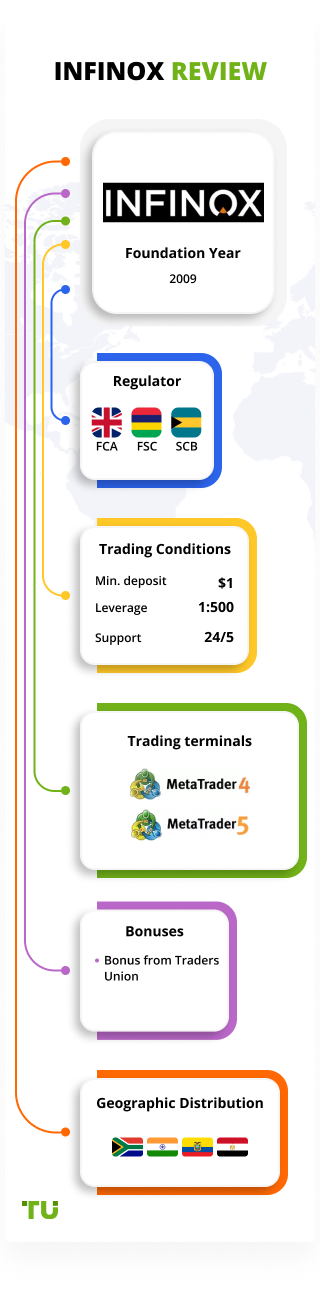

Infinox Review 2024

deposit:

- $1

Trading platform:

- MT4

- MT5

- FCA

- SCB

- FSC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Infinox Trading Company

Infinox is a broker with higher-than-average risk and the TU Overall Score of 4.94 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Infinox clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Infinox ranks 123 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Infinox is a CFD and Forex broker suitable for traders who prefer ECN and STP technology.

Infinox is a CFD and Forex broker that has been providing trading services since 2009. The company has its head office in the Bahamas, as well as 14 regional offices. The broker provides the opportunity to trade currency pairs (Forex) and contracts for difference (CFDs) on stocks, stock indices, commodities, cryptocurrencies, and futures. Infinox operates under licenses from the UK (FCA, 501057), Mauritius (FSC, GB20025832), and the Bahamas (SCB, SIA F-188) regulators.

| 💰 Account currency: | USD, EUR, GBP, AUD |

|---|---|

| 🚀 Minimum deposit: | From USD 1 |

| ⚖️ Leverage: | Up to 1:500 |

| 💱 Spread: | From 0.8 pips (STP), from 0.2 pips (ECN) |

| 🔧 Instruments: |

currency pairs (34) CFDs on stocks (8 markets) indices (14) commodities (14) cryptocurrencies (5) futures (5) |

| 💹 Margin Call / Stop Out: | 100% / 50% |

👍 Advantages of trading with Infinox:

- Six classes of trading instruments.

- Access to CFDs on stocks in eight markets.

- Insurance for deposits up to USD 500,000.

- Access to IX Social and MQL5 copy trading services.

- Tight spreads (from 0.2 pips on an ECN account).

👎 Disadvantages of Infinox:

- No PAMM accounts.

- Limited educational materials.

- The support service works only 24/5.

Evaluation of the most influential parameters of Infinox

Trade with this broker, if:

- You're comfortable with widely-used platforms, as Infinox offers the MetaTrader 4 and 5 platforms. These platforms are renowned for their user-friendly interfaces and extensive features, making them suitable for traders of all levels.

- You are looking for insurance for deposits. With deposit insurance up to USD 500,000, Infinox provides an added layer of security and peace of mind for traders, ensuring that their funds are protected in case of unforeseen circumstances.

- You're interested in copy trading, Infinox offers access to IX Social and MQL5 copy trading services. These platforms allow you to replicate the trades of experienced traders automatically, potentially boosting your trading performance.

Do not trade with this broker, if:

- You're specifically looking for PAMM accounts. Infinox may not be the right choice for you as they do not offer this service.

- You rely heavily on educational resources to enhance your trading knowledge and skills, as you may find Infinox lacking in this aspect.

Geographic Distribution of Infinox Traders

Popularity in

Video Review of Infinox i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Infinox

One of the main ideas of the Infinox broker is to provide traders with direct access to liquidity providers, without dealing with the broker. Since 2009, Infinox has continuously improved its software and made order execution faster. Support for ECN and STP technologies provides traders not only with higher execution speed but also profitable commissions and no slippage and requotes.

The platform provides clients with two types of trading accounts - STP and ECN. For each of them, you can choose the MetaTrader 4 or MetaTrader 5 trading terminal. On the STP trading account, the commission is charged in the form of a spread (average - 0.9 pips for EUR/USD); and on ECN, a fixed commission of USD 7.5 per lot. Clients also get access to eight stock markets, and separate commissions are applied for each.

The broker's clients have six types of trading instruments available. Passive investors can earn income using IX Social and MQL5. Both are services for copying trades. The platform also provides free access to the AutoChartist technical analysis service, with the possibility of free VPS connection, etc.

Latest Infinox News

Dynamics of Infinox’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Clients of the broker Infinox have the opportunity to receive passive income. For this, the platform provides social trading services IX Social via MQL4 and MQL5. Here, the company's clients can copy the transactions of more experienced traders and thus increase their income and experience. Infinox also offers affiliate programs. Brokers and institutional investors can use the software through the Introducing Broker program, and retail traders and webmasters will receive additional income from the affiliate program.

Copy trading via IX Social program

The IX Social platform is a full-fledged social trading service developed by Infinox specialists. Here clients can follow the news from other traders, discuss certain market situations, etc. However, the main function is the service of copying trades. The IX Social copy trading service offers clients the following features:

-

Selection of traders using filters. Signal providers can be selected according to profitability, degree of risk, ROI, type of trading instruments that a trader works with, etc. Detailed statistics can be found in the account of each trader.

-

Risk management settings. For each trader, you can set a separate amount for copy trading, you can set limits, choose to work only with certain trading instruments, etc.

-

Control over trades. All copied trades are opened automatically in the MetaTrader 4 trading terminal. A trader can manually close a trade if he does not agree with the signal provider.

The profitability of copy trading varies depending on the selected trading instruments, the degree of risk, and the strategy of each specific signal provider. The average profitability of the service is 17% per annum. Infinox does not charge commissions for copying trades, but the commission is withheld in favor of the signal providers. The average commission is 20% of the profit per trade.

Copy trading using MQL4 and MQL5 programs

The MQL4 and the MQL5 are the largest communities for traders working with MetaTrader 4 and MetaTrader 5. Copy trading is one of their key areas of activity. Clients can copy trades through either of these two trading terminals.

The copy trading services of MQL4 and MQL5 have the following features:

-

Traders can choose an unlimited number of signal providers. A total of 1,050 managing traders offer their services on the platform.

-

The services provide detailed statistics for signal providers. Thanks to this, users can learn the profitability, the degree of risk, ROI, statistics on the time of opening each trade, etc.

-

You can select a trader by eight unique categories in MQL4 and MQL5. For example, you can find a signal provider based on monthly profitability, select users who trade intraday, high- or low-risk strategies, etc.

The average return on investment is 13% per annum. The commission of signal providers on services is charged in the form of a subscription, its average size is USD 50 per month.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Infinox’s affiliate programs

-

Introducing Broker (IB). This variety of the broker’s affiliate programs is for banks, account managers, hedge funds, and investment companies. Affiliates can use the broker's software, including all trading terminals and the IX Social service. Income is provided in the form of a rebate, the amount of which varies from USD 2 to 10 per trade, depending on the selected trading account.

-

Affiliate program. This type of affiliate program is intended for private traders of the brokerage company. These clients can promote the services of the broker and receive payments for their efforts for USD 20 to USD 1,000 per referral, depending on the method of promotion and the affiliate program the client chooses.

Trading Conditions for Infinox Users

The Infinox broker offers traders five classes of instruments. These are Forex, as well as CFDs on stocks, indices, commodities, futures, and cryptocurrencies. Margin trading with leverage up to 1:500 is available to traders. Muslim clients can open a dedicated Muslim (swap-free) account. You can test the broker's platforms, trading conditions and practice trading on Infinox using a demo account.

$1

Minimum

deposit

1:500

Leverage

24/5

Support

| 💻 Trading platform: | МТ4 (desktop, mobile, web), МТ5 (desktop, mobile) |

|---|---|

| 📊 Accounts: | Demo, STP, ECN |

| 💰 Account currency: | USD, EUR, GBP, AUD |

| 💵 Replenishment / Withdrawal: | Credit cards, wire transfers, Neteller, Skrill |

| 🚀 Minimum deposit: | From USD 1 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.8 pips (STP), from 0.2 pips (ECN) |

| 🔧 Instruments: |

currency pairs (34) CFDs on stocks (8 markets) indices (14) commodities (14) cryptocurrencies (5) futures (5) |

| 💹 Margin Call / Stop Out: | 100% / 50% |

| 🏛 Liquidity provider: | More than 20 large banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | There is an inactivity fee on the account |

| 🎁 Contests and bonuses: | No |

Comparison of Infinox with other Brokers

| Infinox | RoboForex | Eightcap | Exness | NPBFX | 4XC | |

| Trading platform |

MT4, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4 | MT5, MT4, WebTrader |

| Min deposit | $1 | $10 | $100 | $10 | $10 | $50 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.8 points | From 0 points | From 0 points | From 1 point | From 0.4 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 80% / 50% | No / 60% | No / 30% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Instant Execution, Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Infinox | RoboForex | Eightcap | Exness | NPBFX | 4XC | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | Yes | No |

| Options | No | No | No | No | No | No |

Infinox Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| STP | From $9 | No |

| ECN | From $2 | No |

There are swaps (commission for transferring a position to the next day).

The analysts at the Union also compared the size of the average trading commission of Infinox, RoboForex, and Pocket Option. The comparative results are presented in the below table.

| Broker | Average commission | Level |

| Infinox | $5.5 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of Infinox

The Infinox broker does everything possible to ensure that clients get the best trading opportunities. The company does not impose restrictions on the use of any trading strategies. Infinox provides clients with the opportunity to work with six classes of trading instruments and provides access to CFDs on stocks from eight world markets. Traders have access to the Market type of order execution. The STP, ECN, and Islamic accounts are available to clients.

Infinox by the numbers:

-

More than 11 years of experience in the market.

-

Offices in 15 countries around the world.

-

10 awards earned during its period of operation.

Infinox is a broker for traders and investors

The Infinox broker operates on STP and ECN technologies. This means that when trading on any Infinox account, clients get direct access to liquidity providers, minimal spreads and commissions, and fast execution without requotes and slippage. Infinox provides traders with access to six types of trading instruments, including Forex and CFDs on stocks, commodities, stock indices, cryptocurrencies, and futures. Passive investors can earn income through the IX Social trading service by copying the trades of managing traders.

The broker provides clients with the opportunity to work with proven trading terminals such as MetaTrader 4 and MetaTrader 5. The service allows automated trading, you can configure the opening and closing of trades in one click.

Useful services of the Infinox broker:

-

Autochartist. This is one of the world's most popular technical analysis platforms. Autochartist includes over 100 tools and indicators, trend analyses, and candlestick analysis.

-

VPS. This is a dedicated server that relieves you from having to constantly monitor trading operations. If the terminal accidentally closes or the trader leaves, the trade will not be canceled, but due to the connection to the VPS, it will be completed.

-

MQL4 and MQL5. These are communities of traders who trade via MetaTrader 4 and MetaTrader 5. Here, clients have access to a copy trading service, trading robots, and additional tools for technical analysis.

Advantages:

There are six asset classes available for trading.

To ensure the safety of client funds, the company holds them in segregated accounts.

Tight spreads (from 0.2 pips) on ECN accounts.

Investors have access to the IX Social, MQL4, and MQL5 social trading platforms.

The broker provides free analytics and online tools to improve the quality of trading.

Infinox clients get access to AutoChartist and MQL5 for free. You can also use VPS without restrictions.

How to Start Making Profits — Guide for Traders

The Infinox broker offers its clients two main types of trading accounts - STP and ECN. The key difference between the two is the fee policy. Traders have access to all types of trading instruments and leverage up to 1:500, regardless of the selected type of trading account. There are no requirements for the size of the minimum deposit on any account.

Account types:

Infinox is a broker for clients who prefer to work using ECN and STP technologies, but without dealing with the platform.

Bonuses Paid by the Broker

At the moment, the Infinox broker does not provide bonuses to its clients. Traders who have opened an account here have to use 100% of their personal funds to trade.

Investment Education Online

There is no training section on the Infinox website. All information is presented in the form of videos on the broker's Youtube channel. Training is limited and the broker only provides information on the use of its services.

The broker does not have cent accounts, so traders can practice their knowledge only on a demo account. The demo account is provided free of charge, with no time limits.

Security (Protection for Investors)

Infinox is headquartered in the Bahamas and has 14 regional offices in countries and territories such as Great Britain, Singapore, Egypt, United Arab Emirates, Germany, Spain, etc.

The broker carries out financial activities based on three licenses to conduct financial activities from UK regulators (FCA # 50506), The Bahamas ( SCB # SIA-F188), and Mauritius (FSC # GB20025832). The broker also provides clients with insurance in the amount of up to USD 500,000.

👍 Advantages

- Client funds are segregated from Infinox capital and held in segregated bank accounts

- Negative balance protection is active

- In case of violation by the broker of the obligations prescribed in its offer, the client can file a complaint with the regulator

👎 Disadvantages

- To open an account, you must provide detailed financial information

- Without verification, you cannot make a deposit or withdraw funds

Withdrawal Options and Fees

-

Infinox processes a withdrawal request within 24 hours.

-

Money can be withdrawn to Visa and Mastercard (debit and credit), bank transfer, and electronic payment systems such as Neteller and Skrill.

-

Bank transfers take up to one business day. Money is received on EPS within a few minutes after the broker approves the withdrawal request.

-

The broker does not provide commissions for account replenishment and withdrawal of funds.

-

To be able to make a deposit, you must go through verification.

Customer Support Service

Support operators are available 24 hours a day, five days a week. Support is provided in over 20 languages.

👍 Advantages

- In the online chat, you can ask a question without being a client of the company

- Support is available in over 20 languages

👎 Disadvantages

- Works only 24/5

This broker provides the following communication channels for existing clients and potential investors:

-

phone number (as specified in the Contact section);

-

email;

-

online chat on the website and in the personal account;

-

feedback form;

Not only a registered client but also a trader without an active account can ask the broker's representative a question.

Contacts

| Foundation date | 2009 |

| Registration address | 201 Church St, Sandyport, West Bay Street, P.O Box N-3406, Nassau, Bahamas |

| Regulation |

FCA, SCB, FSC |

| Official site | https://www.infinox.com/ |

| Contacts |

Email:

support@infinox.com,

Phone: 0-800-060-8744 |

Review of the Personal Cabinet of Infinox

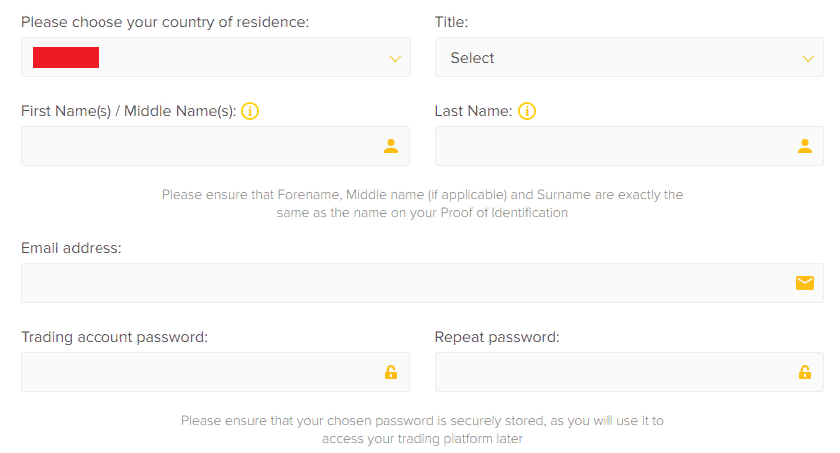

To start trading with the Infinox broker, you need to register. Below are brief instructions on how to open an account on the platform.

On the main page of the site, you need to click on the Sign Up button.

After that, a form with basic information will appear. Here you need to enter your first name, last name, email address, password, and country of residence. Also in this form, you can select the type of trading account.

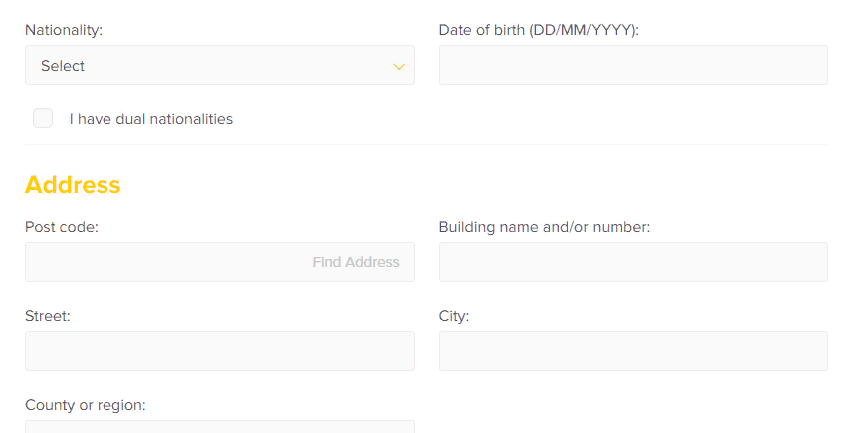

Further, the broker will ask you to provide more detailed information. You will be asked to provide your residential address, age, nationality, financial details, etc. You also need to agree with the terms of the internal documents, such as the User Agreement, Privacy Policy, and Risk Warnings.

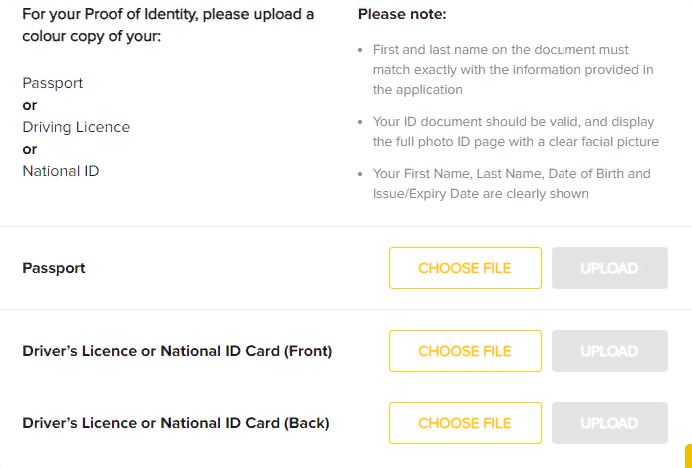

Next, complete the verification procedure. To do this, you need to upload scanned copies of your identity card and residential address. You also need to upload a selfie with ID in hand.

Also in the personal account, the trader has access to:

-

The ability to open Infinox wallets in different currencies. The platform allows you to carry out not only replenishment and withdrawal of funds but also transactions between users' wallets.

-

Instruments. This is where traders can access Autochartist, MQL5 and other tools available on the platform.

-

Downloads. Here the company's clients can download all versions of the MetaTrader 4 and MetaTrader 5 trading terminals, including desktop (for Windows) and mobile (for iOS and Android). From there you can also go to the web version of the trading platform.

Articles that may help you

FAQs

Do reviews by traders influence the Infinox rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Infinox you need to go to the broker's profile.

How to leave a review about Infinox on the Traders Union website?

To leave a review about Infinox, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Infinox on a non-Traders Union client?

Anyone can leave feedback about Infinox on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.