deposit:

- $50

Trading platform:

- Exclusive QuadCode trading platform (web, mobile app, desktop)

SabioTrade Review 2024

deposit:

- $50

Trading platform:

- Exclusive QuadCode trading platform (web, mobile app, desktop)

- Trading with cryptocurrencies not allowed, no restrictions on strategies

- Up to 1:500

Summary of SabioTrade Trading Company

SabioTrade is a prop trading firm with higher-than-average risk and the TU Overall Score of 4.12 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SabioTrade clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work. SabioTrade ranks 40 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

SabioTrade employs a single-stage evaluation process but imposes strict requirements on funding candidates and staff traders. Failure to meet the requirements results in the account being closed without the possibility of unlocking it.

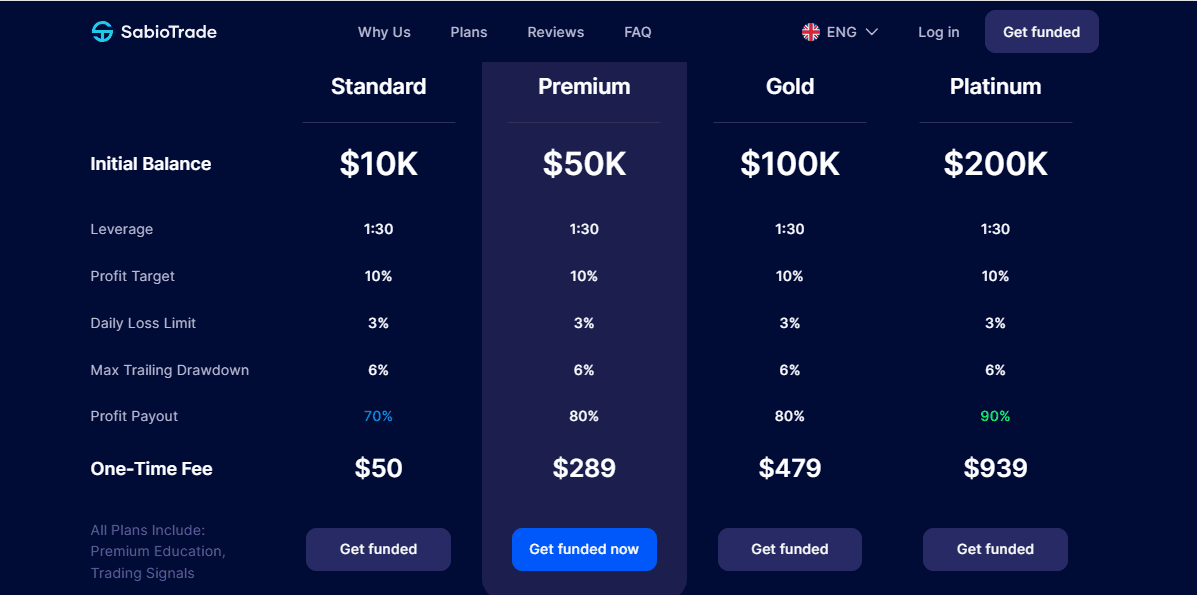

SabioTrade is a proprietary (prop) trading company founded in 2021 in Dublin, Ireland. It offers traders who have passed the skills assessment stage accounts with funding ranging from $10,000 to $200,000 and payouts of 70%-90% of their profits. A 7-day trial period is available without a fee. SabioTrade clients trade CFDs on currency pairs, commodities, indices, stocks, and ETFs on the platforms of the multi-regulated broker QuadCode with leverage ranging from 1:30 to 1:500, depending on the asset. Funding programs are available in countries not included in the OFAC sanctions list.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:500 |

| 💱 Spread: | From 0.9 pips |

| 🔧 Instruments: | CFDs on: currency pairs, gold, oil, global indices, stocks, ETFs |

| 💹 Margin Call / Stop Out: | 100%/50% |

👍 Advantages of trading with SabioTrade:

- Funding up to $200,000 upon passing the evaluation;

- A tariff plan with a fee of $50;

- All strategies are allowed, including trading on news events;

- One-time fee for using the evaluation account and a refund after the trader receives funding;

- Favorable cooperation terms are the company retains 10%-30% of the trader's profits;

- The maximum drawdown level is dynamic, not fixed;

- Coupons are available to reduce the one-time contribution.

👎 Disadvantages of SabioTrade:

- Each trader has only one attempt to pass the evaluation stage;

- Strict requirements for the daily loss limit which is no more than 3% of the account balance;

- The company prohibits holding trades open on Saturdays and Sundays and automatically closes them at the market price, which can result in losses for the trader.

Evaluation of the most influential parameters of SabioTrade

Geographic Distribution of SabioTrade Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of SabioTrade

SabioTrade, a proprietary trading company, focuses on providing funding to traders who operate intraday or throughout the week from Monday to Friday. Leaving orders open on weekends is prohibited. However, traders are allowed to use any legal trading strategies, including executing trades during the release of important news events and hedging positions.

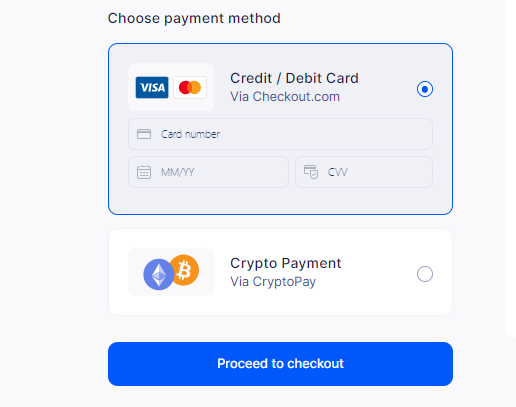

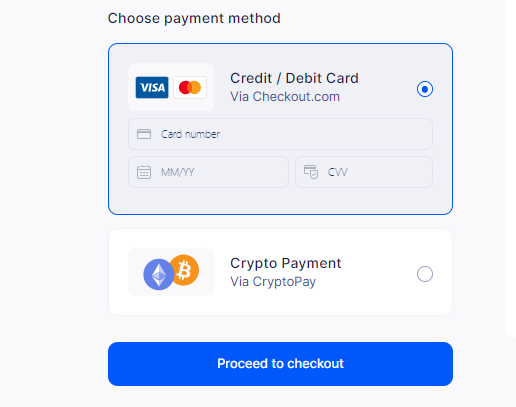

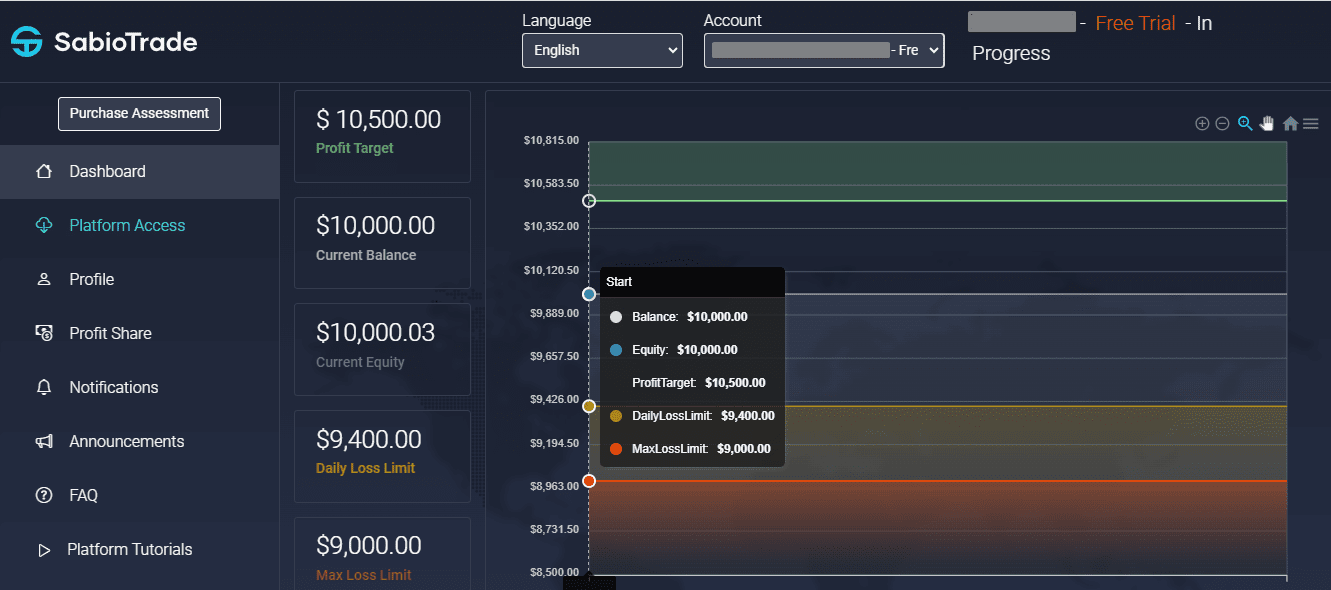

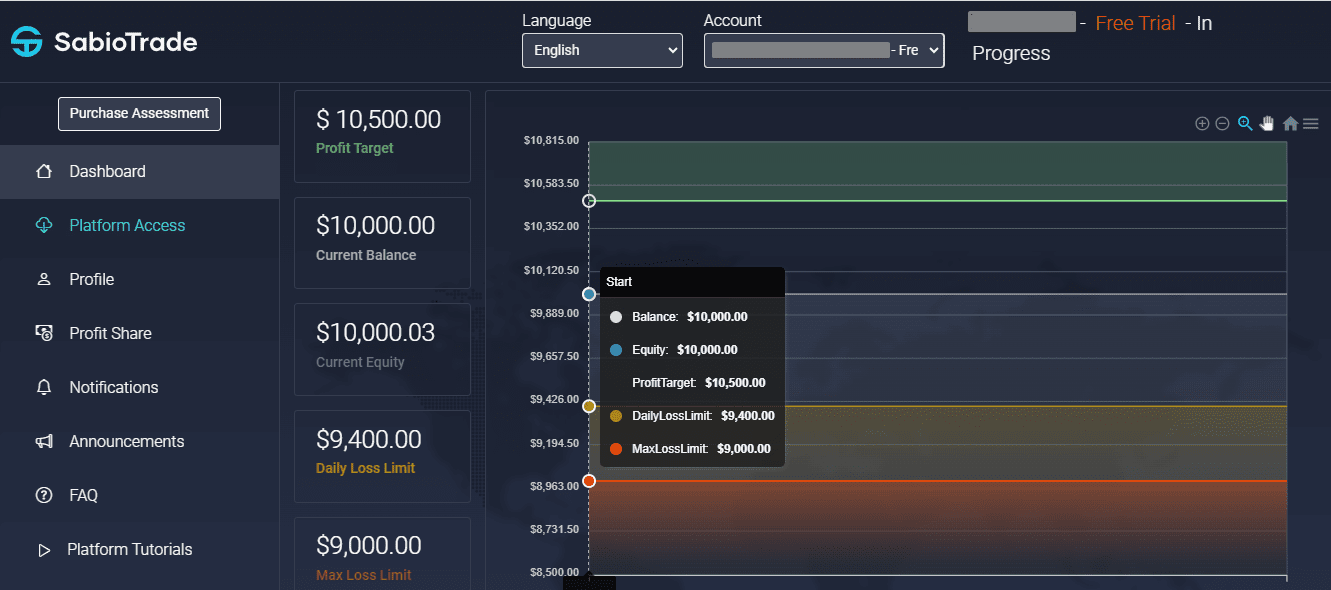

One-time contributions for accessing the trading platform can be made through various methods such as card payments, electronic or cryptocurrency wallets, and bank transfers. Profits from trading on funded accounts are withdrawn exclusively via bank transfer. SabioTrade offers three models for distributing trading income between the trader and the company: 70%/30%, 80%/20%, and 90%/10%. The overall profit level on all accounts must not drop below 10% of the initial balance. Drawdown requirements are no more than 6%, and loss requirements are no more than 3%.

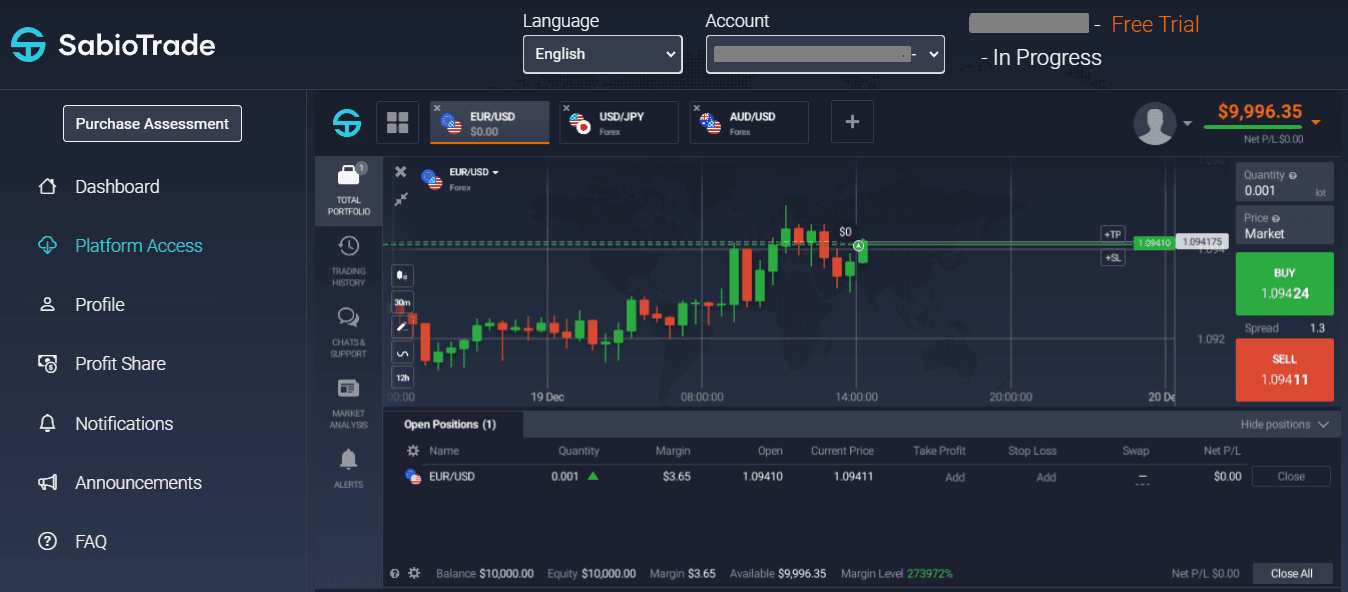

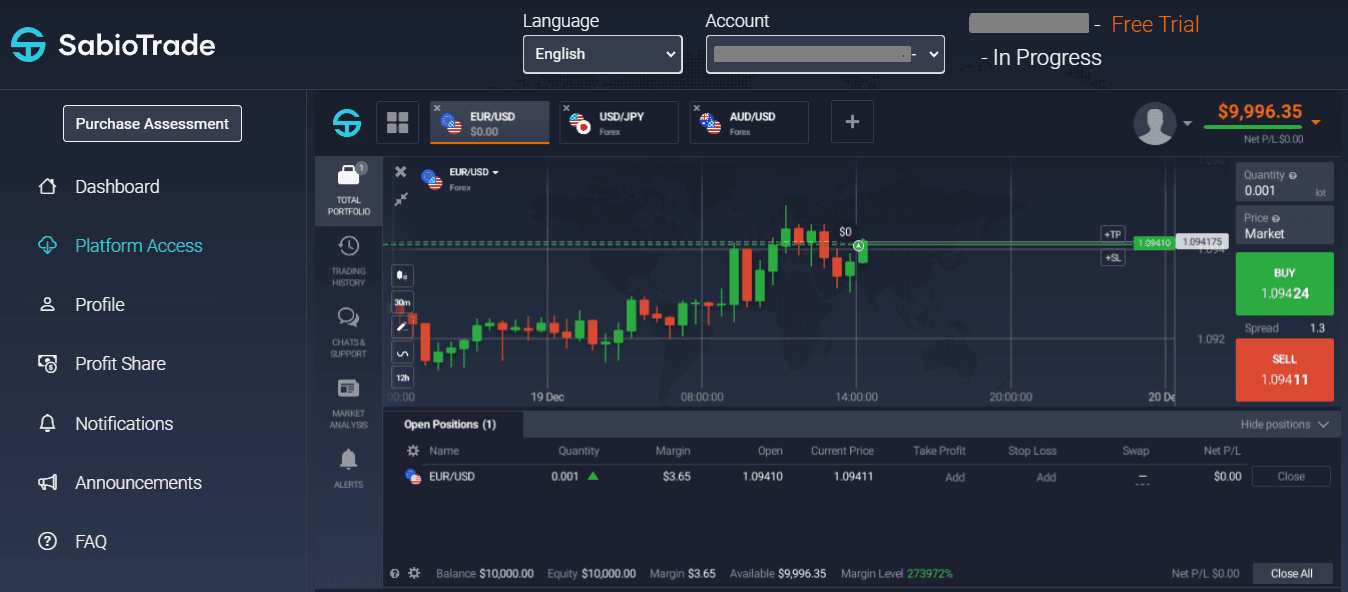

Mobile applications, browser-based, and desktop platforms allow trading with 30 currency pairs, gold, oil, 12 stock indices, 22 ETFs, and stocks of 180 companies. All assets are represented as derivatives, i.e., Contracts for Difference (CFDs). Traders can open trades directly from the chart, set price alerts, and view fundamental data without leaving the platform. The multi-chart mode allows working with 9 charts simultaneously.

Dynamics of SabioTrade’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

As a prop trading firm, SabioTrade specializes in providing funding for active traders. Investment decisions are not among the available services. The broker QuadCode's trading platform does not support automatic trade copying and the use of robots. Investments in PAMM or MAM accounts are not available, and SabioTrade does not collaborate with managed accounts.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program of SabioTrade:

-

CPA (cost-per-action) - a program with a one-time reward for attracting new users of up to $2,000;

-

Revenue share - a solution for those who want to receive up to 80% of the broker's profit from the trading of referrals. The fee under this program will be credited to the partner as long as the trader invited by them trades;

-

Hybrid model combines Revenue Share and CPA programs, bringing even more benefits to the partner from attracting referrals.

Partners are provided with tools to expand their client base, detailed reports, and support from a personal manager in various languages. Reward payouts are made daily. Partners with the highest productivity receive gifts and valuable prizes.

Trading Conditions for SabioTrade Users

Trading conditions are set not by SabioTrade, but by the executing broker, which is QuadCode. It provides leverage up to 1:500, but for currency pairs, its value does not exceed 1:30. Trading is available for CFDs on such assets: currency pairs, stocks, gold, oil, stock indices, and ETFs. Trading with cryptocurrencies is not available. The daily loss limit on all accounts is set at 3%. When calculating, the company takes into account the account balance after 17:00 (EST) of the previous day.

$50

Minimum

deposit

1:500

Leverage

24/7

Support

| 💻 Trading platform: | Exclusive QuadCode trading platform (web, mobile app, desktop) |

|---|---|

| 📊 Accounts: | Assessment and funded accounts: Standard, Premium, Gold, Platinum |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: |

Deposit and withdrawal: bank transfer Deposit only: credit/debit cards, Neteller, Skrill, CryptoPay |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.001 |

| 💱 Spread: | From 0.9 pips |

| 🔧 Instruments: | CFDs on: currency pairs, gold, oil, global indices, stocks, ETFs |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Trading with cryptocurrencies not allowed, no restrictions on strategies |

| 🎁 Contests and bonuses: | Discounts on plan payment (periodically) |

Comparison of SabioTrade to other prop firms

| SabioTrade | Topstep | FTMO | Funded Trading Plus | The5ers | TopTier Trader | |

| Trading platform |

Exclusive QuadCode trading platform (web, mobile app, desktop) | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MetaTrader5 | MetaTrader4 |

| Min deposit | $50 | $1 | $155 | $119 | $85 | $225 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.9 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 1% / 1% | 50% / 50% | No | No | No |

| Execution of orders | Market Execution | ECN | Instant Execution | Market Execution | N/a | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| SabioTrade | Topstep | FTMO | Funded Trading Plus | The5ers | TopTier Trader | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | No |

| Crypto | No | No | Yes | Yes | No | Yes |

| CFD | Yes | No | Yes | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | No | Yes | No |

| ETF | Yes | No | No | No | No | No |

| Options | No | No | No | No | No | Yes |

SabioTrade Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $9 | No |

| Premium | From $9 | No |

| Gold | From $9 | No |

| Platinum | From $9 | No |

Detailed review of SabioTrade

As a prop-trading firm, SabioTrade has been operating since 2021. Its clients can receive funded real-money accounts for trading on the advanced QuadCode platform with over 100 supported indicators. The company responds to traders' requests regarding usability. At the end of 2023, the ability to deposit cryptocurrencies was added, allowing mandatory payments to be made within 1-3 hours with minimal fees.

SabioTrade by the numbers:

-

Over 400 funded traders;

-

Collaboration with a broker holding 3 licenses;

-

Trading progress updates every 60 seconds;

-

Over 240 financial instruments for trading;

-

4 types of accounts with funding ranging from $10,000 to $200,000.

SabioTrade is a prop firm with its own interactive system with traders

The company sets trading rules for all accounts (evaluation and funded) that cannot be violated. These include requirements for daily loss limits, maximum drawdown size, and profit percentage. If these requirements are not met, both evaluation and funded accounts are closed, meaning the trader cannot continue cooperation with SabioTrade. Additionally, the company blocks the accounts of clients who have had no trading activity for at least 30 days on their accounts.

Furthermore, there is another important rule: trades cannot be carried over the weekends, they must be closed by 15:45 (EST) on Fridays. If a trader ignores this requirement, the trades are forcibly closed, and no profit is accrued on them. However, the account is not blocked, as in the case of serious violations of the established drawdown and profit limits.

Useful functions of SabioTrade:

-

Market analysis in the form of short video clips (in the user account and on the company's YouTube channel);

-

Market news and important events in economics, politics, and finance that can influence changes in the asset price;

-

Telegram channel with trading signals and market data;

-

Setting price alerts in the form of push notifications;

-

Advanced trading courses by professional traders, webinars, and video-based training.

Advantages:

Traders can trade CFDs on various assets, including ETFs and stocks;

Simultaneous trading on 9 charts is available;

Spreads for all assets are variable, and there is no additional fee charged per trade;

The platforms support both market and pending orders;

The minimum trade volume is 0.001 lots;

The trading platforms and website are available in 6 languages.

SabioTrade clients receive all necessary support (both technical and informational) for high-quality professional trading with the funds allocated by the company.

Guide on how traders can start earning profits

After registering on the SabioTrade website and paying for one of the tariff plans, the trader is provided with an assessment account that confirms trading skills and the ability to trade according to the conditions set by the prop firm. Trading on it is done with virtual funds, and profit withdrawal is not available. After passing the assessment and uploading identity documents, SabioTrade transfers the client to an account that’s funded with real money. Trading requirements on assessment and funded accounts are identical.

Account types:

A trader can start the assessment stage of trading skills without depositing funds. SabioTrade offers a free trial version lasting 7 days.

The SabioTrade accounts have the same trading performance requirements but differ in funding amount and, accordingly, the initial contribution.

Bonuses from SabioTrade

Periodically, the company offers discounts of up to 40% on tariff plan payments. Coupons can be found on SabioTrade's pages on Instagram, Facebook, Telegram, and third-party resources for traders.

Investment Education Online

Trading education is provided not on the SabioTrade website, but on the client portal in the Education section. To gain access to it, fill out a short questionnaire on the company's website. Traders who have paid for the package are provided with trading signals, premium education, and an educational course on the basics of trading and market analysis.

SabioTrade offers a free trial version. With it, you can test the trading platform without depositing funds. The company conducts free weekly webinars for all traders with active accounts.

Security (Protection for Investors)

SabioTrade is registered in Ireland under the number 680139. The regulator of the financial markets in this country is the Central Bank of Ireland (CBI), but SabioTrade is not listed in the registers of licensees of the Central Bank of Ireland. Additionally, the company is not regulated outside of Ireland.

The broker partner, QuadCode, holds licenses from the Cyprus Securities and Exchange Commission (CySEC 247/14), the Australian Securities and Investments Commission (ASIC ACN: 131 376 415), and the Securities Commission of The Bahamas SCB (SIA-F219). Being regulated by multiple financial supervisory bodies indicates the reliability of this intermediary, its fair operations, and sufficient capitalization to meet its payment obligations to clients.

👍 Advantages

- The executing broker operates under the requirements of three regulators

- SabioTrade is registered in an EU member country, not in an offshore zone

- Trading can be started on the evaluation account without verification

👎 Disadvantages

- SabioTrade may close the trader's account and reclaim previously provided funds

- In case of manipulation by the proprietary firm, the client cannot file a complaint with the regulator

- SabioTrade is not responsible for the actions of the broker QuadCode, and vice versa

Withdrawal Options and Fees

-

The client can withdraw profits at any time by submitting a request in their user account. The company makes payments according to the conditions of the specific account, returning 70%-90% of the profit earned by the trader;

-

After submitting a withdrawal request, the account is blocked for trading. The trader can resume trading only after receiving the funds. The process of confirming the withdrawal request takes up to 24 hours;

-

SabioTrade transfers profits to the client's bank account.;

-

After the funds are withdrawn, the maximum allowable drawdown is calculated based on the initial account balance, without taking into account the profit received;

-

SabioTrade does not charge a fee for processing withdrawal requests.

Customer Support Service

If a trader has any questions regarding the operation of SabioTrade or its services, they can request assistance via email. Technical support operates 24/7.

👍 Advantages

- Round-the-clock email support

👎 Disadvantages

- Responses are received within 1-3 hours

- No live chat on the website

Available communication channels depend on the trader's status:

-

email support is available to both clients and all unregistered users;

-

access to live chat is only for clients (the button is integrated into the trading platform).

SabioTrade cannot be contacted by phone. Additionally, there are no feedback forms or call-back requests on the company's website.

Contacts

| Registration address | ODEVIL IT ENGINEERING Ltd, 2c, Grangegorman Lower, Smithfield, Dublin, Ireland, D07a433 |

| Official site | https://sabiotrade.com/ |

| Contacts |

Email:

support@sabiotrade.com,

|

Review of the Personal Cabinet of SabioTrade

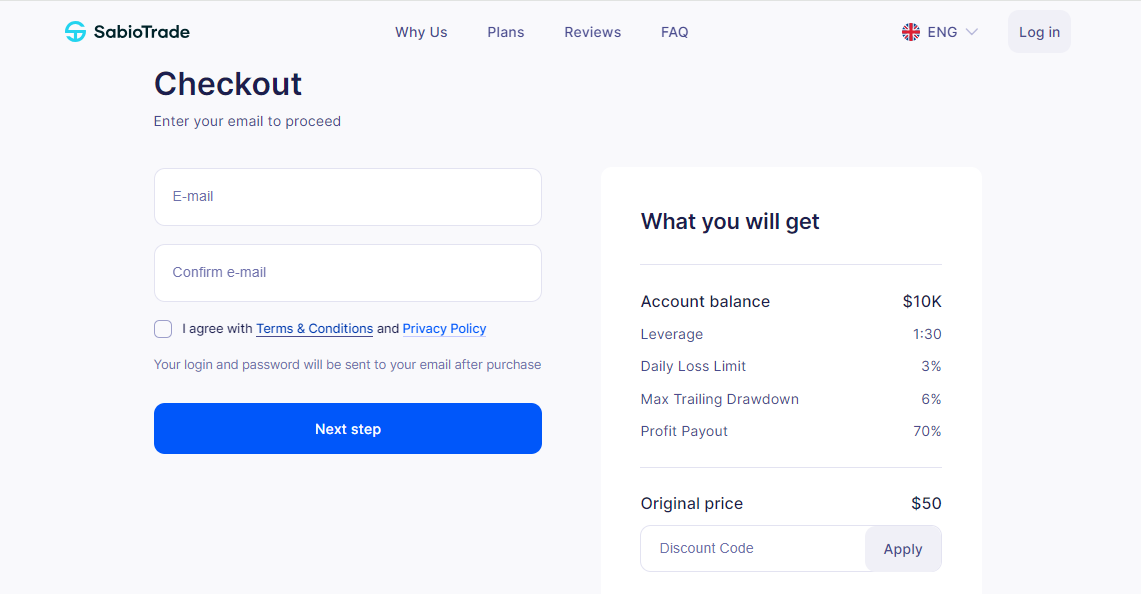

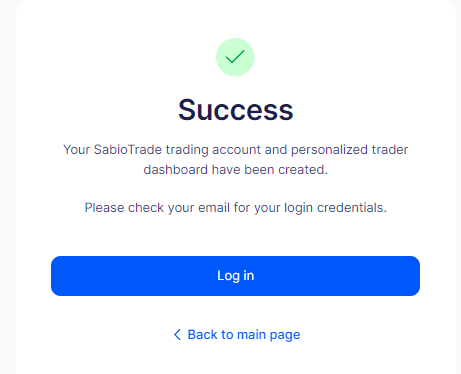

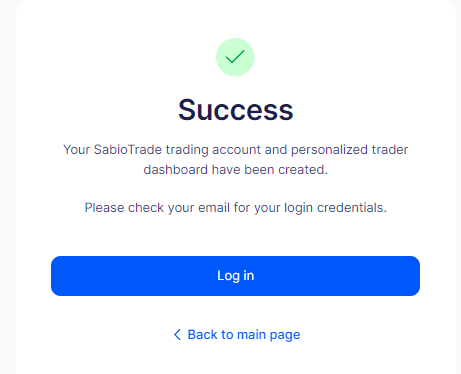

To access SabioDashboard in the client's user account, follow these steps:

Select a tariff plan on the official SabioTrade website and confirm the action by clicking the "Get funded" button below the name of the suitable account.

Next, enter your email address and input the promo code to receive a payment discount.

Afterward, it is necessary to fill out a short form with your name, surname, address, and phone number, and pay a one-time fee ranging from $50 to $939 depending on the selected tariff plan.

After making the payment, an email will be sent to your inbox with login credentials for accessing the user account. The password is generated by SabioTrade's security system, with the email serving as the login.

The trial account is created using the same algorithm, but no real money is required to be deposited because the company offers a virtual deposit.

SabioDashboard Functionality:

In the user account, traders will find the following data and useful options:

-

Profit information - percentage and dollar amount, available withdrawal amount;

-

Setting up and viewing notifications;

-

News and updates from SabioTrade;

-

Library of short video tutorials on the trading platform;

-

Educational videos and technical market analysis;

-

Real-time chat for communication with technical support.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact SabioTrade rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about SabioTrade you need to go to the company's profile.

How can I leave a review about SabioTrade on the Traders Union website?

To leave a review about SabioTrade , you need to register on the Traders Union website.

Can I leave a comment about SabioTrade if I am not a Traders Union client?

Anyone can post a comment about SabioTrade in any review about the company.

Traders Union Recommends: Choose the Best!