Is ETF Good for Trading? Pros & Cons and Strategies

Over 50k supported assets, advanced trading platform

Generally, ETFs are financial products designed for long-term investing, but there are a number of reasons why actively trading ETFs is a good choice:

-

Catching trends: ETF as a trend tracking tool. Some ETFs have a unique set of components and therefore best match current market trends.

-

Strategy: Sector rotation, arbitrage, and hedging.

-

Cost: ETF trading can be done with low fees, a small entry amount, and narrow spreads.

-

Simplicity. Many brokers offer access to a wide range of ETFs based on countless sectors and regions, which offers ease of access, especially for beginners.

-

Diversification: You can use ETF trading to diversify your strategy sets and markets.

-

Liquidity: The more popular ETFs with high trading volume offer high liquidity, making it easy to enter and exit trades.

-

Stability: ETFs generally tend to exhibit lower volatility than most individual assets.

Exchange-Traded Funds, or ETFs, are, as the name suggests, investment funds that can be traded on exchanges. These ETF funds can be structured to track the performance of anything, from the spot price of Bitcoin or a commodity to entire stock market indices like the S&P500. Much like individual stocks or assets, ETFs can be bought and sold for short-term profit, but are generally preferred as long-term investment tools.

However, just because ETFs tend to be used for their long-term outlooks, doesn’t mean that they don’t have uses for intraday traders. In this article, we’ll look at how ETFs can be used in trading, explore their multiple use cases, and explain how to trade ETFs.

-

What is ETF in trading?

An Exchange-Traded Fund, or ETF, is a type of investment fund that also trades on stock exchanges. It holds assets such as stocks, commodities, or bonds (and now even Bitcoin) and aims to track the performance of a specific index. ETFs offer diversification and are bought and sold throughout the trading day like individual stocks.

-

Are ETFs good for beginners?

Yes, ETFs can be good for beginners due to their simplicity, diversification, and low costs compared to mutual funds. They offer exposure to various asset classes and are traded on stock exchanges like individual stocks, making them accessible to novice investors.

-

Can you make money trading ETFs?

Yes, as is the case with trading individual stocks, it's possible to make money trading ETFs by buying low and selling high. However, also similarly to stock trading, your success depends on various factors such as market conditions, investment strategy, and risk management.

-

How to choose ETFs for beginners?

As a beginner, it's essential to consider things like expense ratio, diversification, liquidity, and the underlying assets of the ETF. Start by researching broad-market index ETFs with low fees and a track record of stability. Additionally, consider seeking advice from a financial professional, or better yet, see our free list of the best ETFs for beginners: Top 9 Low-Cost ETFs To Invest.

Is it better to day trade ETFs?

Exchange-traded funds (ETFs) are pooled investment securities that can be structured to track any type of investment, including stock market indices, commodities, bonds, Bitcoin, and much more. They could be based on stocks within a particular sector such as AI or healthcare, track the stock market of China or India, or even the price of crude oil. Because they mostly function as a basket of securities rather than a direct investment in one asset, they tend to be favored by long-term investors and beginners.

For example, a beginner investor who knows little about the stock market but sees a lot of growth potential in AI and robotics might opt for investing in the Global X Artificial Intelligence & Technology ETF (AIQ:NMQ:USD). Or, they might understand the US stock market has generally grown over time and invest in a stock market index ETF like the SPDR S&P 500 ETF Trust (NYSE:SPY) or the Invesco QQQ Trust Series 1 (NASDAQ: QQQ). By investing in ETFs that track the performance of a group of investments, long-term investors can capitalize on industry trends, diversify their portfolio, and gain low-risk exposure to investments that tend to grow over a longer period.

However, there are a number of reasons why actively trading ETFs day to day is also beneficial. In fact, much of the intraday movement you’ll see on an ETF’s chart is due to the rapid buying and selling of that ETF. An ETF’s value is mostly determined by the underlying asset on which it’s based, but its daily price fluctuates due to trading activity too. Studies have suggested that intraday trading activity accounts for a significant portion of short-term price movements in ETFs, ranging from 50% to 70% on average.

So why are ETFs good for trading? In a nutshell, actively trading ETFs is good for:

-

Trends

-

Strategy

-

Cost

-

Simplicity

-

Diversification

-

Liquidity

-

Stability

We’ll look at those uses in more detail in the coming section.

ETF as a trend-tracking tool

As ETFs can be structured to track any financial instruments, including certain sectors within the stock market, they can be effective trend-tracking tools for day traders. ETF prices are based on the performance of specific indices, sectors, or asset classes, which makes them inherently tied to market trends and sentiments. ETF prices reflect the collective movement of underlying assets, offering a comprehensive snapshot of market dynamics. Day traders leverage this information to identify emerging trends, gauge market sentiment, and make informed trading decisions.

Let’s take a current market trend as an example. You’d have to be living under a rock to not have noticed the massive hype surrounding the artificial intelligence industry recently. Whether it’s AI chipmakers like Nvidia or AI software developers like SoundHound AI Inc - who’ve seen their share prices shoot up in the past year by 236.7% and 175.00% respectively - investor capital is pouring into the AI sector like there’s no tomorrow.

A trader who wanted to capitalize on this booming trend could trade an AI ETF like the First Trust Nasdaq Artificial Intelligence ETF (NASDAQ:ROBT), hoping to capture profits from intraday movements. The ETF saw a sharp sudden increase on March 20, following Nvidia’s announcement of its new Blackwell processor at their company conference. A trend-following trader could profit from movements such as this by trading an AI ETF.

As there are around 8,800 ETFs globally, according to BlackRock, a day trader could try to profit from intraday movements in almost any financial or sector trend.

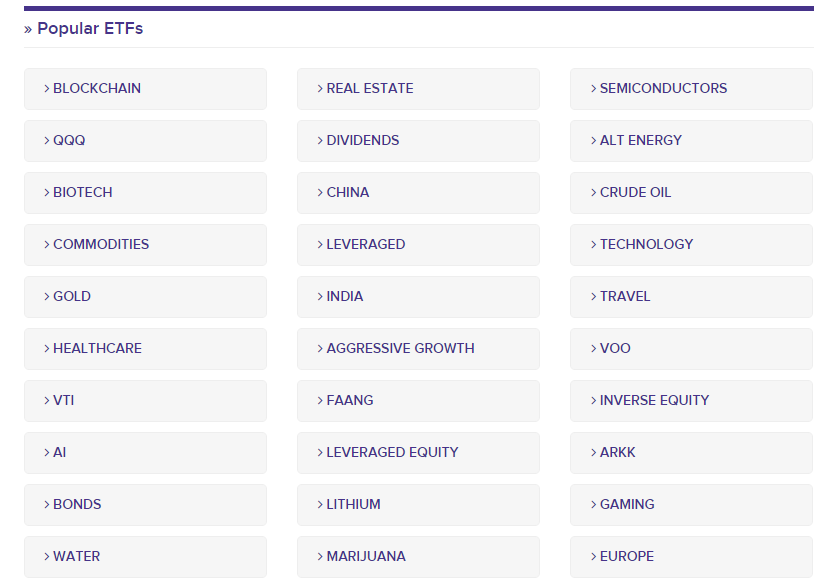

A selection of the most popular ETF categories

Note: It is important to have a good understanding of which assets are traded as ETFs. The share of each ETF element depends on its price/market capitalization. The most expensive assets (currencies, stocks, bonds) have the maximum influence on the price. Capital allocation information for each ETF is publicly available.

Strategies to trade ETF

A trader looking to trade ETFs could make use of a range of strategies tailored to different investment horizons and objectives. While some strategies are better suited for long-term investors seeking to capitalize on broader market trends, others are optimized for short-term trading opportunities. Some of those strategies, briefly, are:

-

Sector Rotation: This long-term strategy involves using sector ETFs to rotate investments across different market sectors based on prevailing trends, redistributing capital between those poised for growth and those underperforming.

-

Arbitrage: This short-term strategy involves exploiting price divergences between the ETF and its underlying assets or related securities.

-

Hedging: Hedging strategies aim to protect against downside risk or volatility in the ETF's value or the broader market, using options contracts, futures contracts, or inverse ETFs.

-

Day Trading: Day traders may develop and backtest intraday trading strategies tailored to specific ETF markets. By analyzing historical data and identifying patterns or trends, traders can formulate strategies that generate consistent positive returns within a short time frame.

-

Analytical tool: ETFs are successfully used to predict the behavior of individual sectors of the economy and the global market because they include relevant stocks. The dynamics of large ETFs such as SPY can help identify trends, support/resistance levels, and potential pivot points.

Cost

One reason why ETFs are attractive to day traders is that they typically incur lower costs than other trading instruments. Compared to mutual funds or individual stocks, ETFs typically have lower management fees and expense ratios. Bid/ask spreads also tend to be narrower on ETFs, but only if the ETF is popular and has high trading volume. Thinly traded ETFs usually have wider spreads.

If you wanted to trade a stock market index ETF or sector ETF, the costs incurred would be much lower than if you traded all of the component stocks individually. Buying or selling an ETF only involves one transaction rather than multiple. Furthermore, the overnight fees or rollover costs on ETFs tend to be lower than on index mutual funds, so a swing trader considering holding a position overnight would be better served with an ETF.

Simplicity

ETFs are one of the simpler financial instruments available to traders, which can make them particularly ideal if you’re a beginner. Most brokers provide access to a diverse selection of ETFs, covering various asset classes, sectors, and regions. This extensive availability allows beginners to easily find ETFs that align with their investment goals and risk tolerance.

Investing in ETFs that cover multiple financial instruments, rather than having to select individual assets, offers simplicity. Unlike with individual stocks, commodities, cryptocurrencies, or forex pairs, where you have to analyze and trade each asset separately, ETFs allow you to gain exposure to multiple assets through a single trading instrument. This simplifies the overall trading process and reduces the time and effort you need to spend managing a diversified portfolio.

Diversification

Trading or investing in ETFs is a simple way to diversify your portfolio without having to manage too many assets. Most traders will already understand the importance of portfolio diversification, but for those who don’t, see: 4 Steps To Choose Stocks For Diversification.

Diversification mitigates risk, increases the odds of positive returns, manages market volatility, and reduces stress. Using ETFs for diversification only improves each of these advantages.

Let’s say you wanted to diversify by trading multiple industries, and stocks in different regions. Rather than having to research which stocks have strong fundamentals or having to keep track of market news from hundreds of sources, you can simply trade or invest in several ETFs. For example, you could invest in ETFs tracking the US, UK, European, and Japanese stock markets, and those based on the AI, healthcare, tech, and gaming industries. This would allow you to hedge against downturns in one area while profiting from gains in another, without having to track the economic indicators of each company or asset.

Liquidity

Liquidity is always a crucial consideration when trading, and that is no different when it comes to ETFs. Many of the popular ETFs provide high liquidity, making it easier to realize short-term strategies. ETFs with a large number of market participants and high trading volume mean that you can enter and exit positions quickly and at competitive prices, without experiencing significant price slippage.

The most popular ETFs, with average daily trading volume in the tens of millions, like SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust Series I (QQQ) offer high liquidity so that you can easily enter and exit traders. When selecting ETFs for day trading, check their daily volume to ensure maximum liquidity.

Stability

Though ETFs are not immune to volatility, most of them tend to be more stable than more risky financial instruments such as individual stocks or cryptocurrencies. This is because they encompass multiple assets, resulting in less overall volatility. A drastic price drop in a tech industry ETF, for example, would require an industry-wide catastrophe that impacts all tech companies – something that is very rare.

Traders Union expert Vuk Martin, in his article Stocks And ETFs: A Comparison, writes: “Since ETFs encompass a variety of underlying assets, they can provide a more stable investment experience, especially attractive to those looking for lower-risk exposure to the markets.”

Top 3 Brokers to Buy ETFs

How to trade ETFs?

Now that we’ve looked at the many benefits of trading ETFs and why trading ETFs can be better than trading other assets, you may be wondering how you can get started. Well, let’s break it down into 6 simple steps:

-

Choose Broker: Select a reputable brokerage platform that offers access to a wide range of ETFs and features competitive trading commissions. Most brokers offer a huge selection of ETFs, so focus on finding the lowest fees in this stage of the process. To help you with opening an account, we've created this ranking: Where to buy ETFs? Best Online ETF Brokers 2024

-

Build a Trading Plan: Develop a comprehensive trading plan outlining your investment goals, risk management strategy, entry and exit criteria, and position sizing rules. Define clear objectives and guidelines to guide your ETF trading decisions.

-

Research: Conduct thorough research to identify ETFs that align with your trading plan. Consider factors such as asset class, sector exposure, expense ratio, and historical performance.

-

Demo Practice: Practice your trading strategy with your chosen ETFs using virtual funds on a demo account. Using a demo account first helps you to familiarize yourself with the platform and test out the strategies you have drawn out.

-

Place Orders: Once you've practiced enough, are comfortable with trading real capital, and have identified the ETFs you want to trade, place buy or sell orders on your chosen platform. Specify the number of shares you wish to trade and whether you want to execute a limit order or market order, and then begin trading!

Once you’ve begun trading, you should monitor the performance of your ETF trades, paying attention to market news, economic indicators, and other factors that may impact the ETFs' prices.

Adjust your portfolio as needed. Make sure to implement risk management techniques, such as stop-loss orders, to limit potential losses. Periodically review your ETF portfolio to ensure it remains aligned with your investment goals and risk tolerance, and make adjustments as necessary based on changes in market conditions, economic outlook, and your financial situation.

Conclusion

In summary, although ETFs are geared more towards long-term investors, they have many uses for intraday traders too, particularly for beginners. They’re simple to trade and provide diversification, liquidity, and stability - all at a lower cost than most financial instruments. They let you trade specific industries or stock market indexes without the complexity of the additional fundamental analysis needed for trading individual assets. Whenever engaging in trading of ETFs, or any other instrument, make sure to do your research beforehand and only invest capital that you can afford to lose.

Glossary for novice traders

-

1

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

2

Forex Risk Management

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

SIPC

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

-

5

Economic indicators

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).