What Is The S&P 500 In Simple Terms?

-

S&P 500: Market-cap-weighted index of top U.S. companies

-

Inclusion criteria: $8.2B min market cap, positive earnings

-

Average long-term annual return: around 10%

-

Invest via ETFs or mutual funds

-

Notable historic shifts: Black Monday (1987), COVID-19 stimulus-response (2020)

In the dynamic world of finance, the S&P 500 Index stands as a cornerstone, embodying the pulse of the U.S. economy. This index, a collection of 500 of the most influential companies in the United States, acts as a key indicator of the overall stock market performance. It reflects not just the health of individual corporations but also offers a broad view of the economic strength and trends within the U.S.

This article explores the essence of the S&P 500 Index, unraveling its significance and workings in the realm of stock markets. As a barometer of U.S. equities, understanding this index is important for both investors and analysts and provides insights into market trends and economic health.

-

What does S&P 500 stand for?

"S&P" stands for Standard & Poor's, the company responsible for creating the S&P 500 index.

-

Is the S&P 500 only composed of US stocks?

Yes, the S&P 500 is comprised exclusively of U.S.-based companies.

-

Does the S&P 500 include Nasdaq stocks?

Yes, the S&P 500 includes companies that are traded on the Nasdaq, as well as those on the NYSE and CBOE.

-

Can you just invest in the S&P 500?

If you want to invest in the S&P 500 as a whole, you don't need to purchase all 500 stocks individually.

What is the S&P 500 Index?

The S&P 500 Index, created by Standard & Poor's, captures approximately 80 percent of the total market value of U.S. stocks, making it a critical indicator of economic health and investor sentiment.

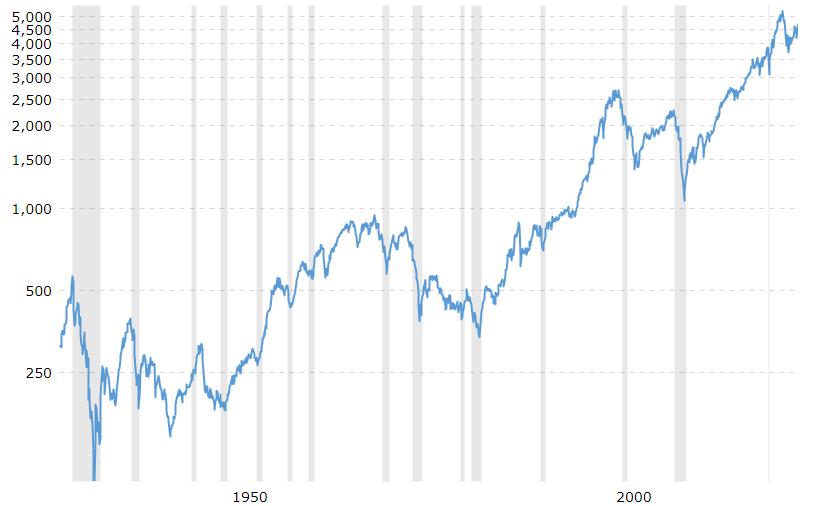

Macrotrends.net

From its inception, the S&P 500 has evolved, mirroring the dynamic nature of the U.S. economy. Originally, it started as a concept to track the performance of the largest companies in the United States, and over the years, it has grown into a barometer for the overall stock market.

Today, it encompasses a diverse range of sectors, from technology giants to financial powerhouses, offering a comprehensive snapshot of the U.S. corporate sector's vitality.

How Do Companies Get Added to the S&P 500?

Gaining a spot in the S&P 500 Index is a hallmark of corporate success in the United States, but it comes with stringent criteria. To be considered for inclusion, a company must first and foremost be based in the U.S., highlighting the index's focus on domestic economic performance.

The financial threshold is high. A company must boast a market capitalization of at least $8.2 billion. This ensures that only firms with substantial size and influence cut. Additionally, at least half of the company's shares must be publicly available for trading (“floated”) on the exchange. This criterion ensures liquidity and public participation in the company's stock.

Trading location is also key. The company's stocks must be listed on a major U.S. exchange such as the New York Stock Exchange or Nasdaq, ensuring they meet the high regulatory standards and visibility associated with these prestigious markets.

Financial health is non-negotiable. Companies must demonstrate positive earnings in the most recent quarter and cumulatively over the past four quarters. This requirement filters out companies that are not financially viable or are experiencing temporary success.

Lastly, a robust trading volume is essential. A company must have traded at least 250,000 shares daily, on average, in the six months leading up to consideration for inclusion. This criterion confirms active market interest and a stable trading environment for the company’s stock.

Recent additions to the S&P 500 serve as prime examples of companies meeting these rigorous standards. The most recent additions to the S&P 500 include Blackstone Inc. (NYSE:BX) and Airbnb Inc. (NASD:ABNB), which replaced Lincoln National Corp. (NYSE:LNC) and Newell Brands Inc. (NASD:NWL) in the index.

Blackstone Inc. and Airbnb Inc. were added in September 2023, and reflect the dynamic nature of the Index, where roughly 20 changes occur annually.

Best stock brokers 2024

Is the S&P 500 an Equally Weighted Index?

Contrary to what some might assume, the S&P 500 is not an equally weighted index. Instead, it employs a market capitalization-weighted methodology. This means that each company's influence on the index is proportional to its market value.

Larger companies with higher market caps have a more significant impact on the index's movements, while smaller companies exert a comparatively lesser influence. This method reflects the real-world dominance of major corporations in the U.S. economy and offers a more accurate representation of market dynamics.

The market capitalization of a company is determined by multiplying the current stock price by the total number of outstanding shares. As these stock prices fluctuate, so does the company's market cap and, by extension, its weight in the S&P 500.

What Companies Make up the Most S&P 500?

The S&P 500, as a reflection of the U.S. market's upper echelon, is composed of industry giants from various sectors. These companies not only lead in their respective fields but also have substantial market capitalizations, giving them a more pronounced presence in the index. Some of the most influential companies in the S&P 500 include:

-

Technology titans: Companies like Apple, Microsoft, and Alphabet (Google's parent company) dominate this sector, driving innovation and market trends.

-

Financial firms: JPMorgan Chase, Berkshire Hathaway, and Bank of America represent the financial backbone, indicative of the sector's influence on the economy.

-

Consumer staples and retail: Essential consumer brands such as Procter & Gamble, Johnson & Johnson, and Walmart show the enduring power of consumer demand.

-

Healthcare leaders: Pfizer, UnitedHealth Group, and Merck, among others, underscore the sector's critical role, especially highlighted during the global health crises.

-

Industrial and energy giants: Companies like Exxon Mobil and Boeing, despite market fluctuations, remain key players in these foundational sectors.

This list is not exhaustive but offers a glimpse into the diverse yet concentrated power structure within the S&P 500, illustrating the broad yet deep reach of this influential index.

What are the heaviest weighted stocks in the S&P 500?

| # | Company | Symbol | Weight |

|---|---|---|---|

1 |

Apple Inc. |

AAPL |

7.33% |

2 |

Microsoft Corp |

MSFT |

6.84% |

3 |

Amazon.com Inc |

AMZN |

3.37% |

4 |

Nvidia Corp |

NVDA |

3.01% |

The Largest Changes in the S&P 500 Index

Since its inception on January 4, 1957, starting at a modest 98.62, the S&P 500 Index has been a dynamic entity, reflecting both the triumphs and tribulations of the U.S. economy. This journey has seen some notable peaks and valleys, marking key historical events that have shaped financial markets globally.

-

The Sharpest Single-Day Decline: October 19, 1987, stands out in market history as 'Black Monday.' On this day, the index plummeted by a staggering 22.6%, shedding 508.29 points. This dramatic fall was influenced by a myriad of factors, including global economic worries and the sudden collapse of Japan's stock market.

-

The Most Significant Annual Drop: Fast forward to 2008, a year deeply etched in the annals of financial history due to the global financial crisis. The S&P 500 bore the brunt of this turmoil, registering an annual decline of 37.04%, translating to a loss of 1,295.19 points.

-

The Record Single-Day Surge: In a turn of events, March 29, 2020, marked a significant rebound with the S&P 500 witnessing its largest single-day leap. The index surged by 12.34%, gaining 481.42 points. This remarkable recovery was fueled by the U.S. Congress passing the CARES Act, a colossal $2.2 trillion stimulus package, in response to the economic fallout from the COVID-19 pandemic.

What is the S&P 500 Average Return?

Historically, the S&P 500 has been a benchmark for robust returns in the stock market, often used as a proxy for gauging the health of the U.S. economy.

The S&P 500's long-term performance is indeed impressive. Investment sage Warren Buffett has famously recommended that the average investor place their money in an S&P 500 index fund, citing its historical average annual return of approximately 10%. This figure encapsulates the growth potential inherent in the U.S. stock market over extended periods.

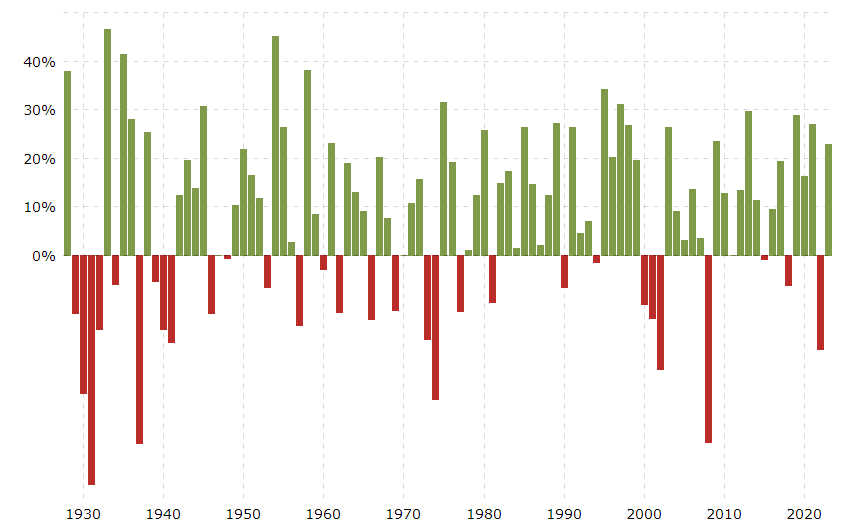

However, the S&P 500's returns vary from year to year, reflecting economic cycles, market volatility, and changes in investor sentiment. To illustrate this variance, consider the historical annual returns depicted in the chart from Macrotrends.net, which shows a mix of positive green bars and negative red bars representing years of gains and losses, respectively.

Macrotrends.net

S&P 500 Historical Annual Returns

Building upon the historical data, we can calculate the S&P 500's average annual returns across different time frames:

| Year | Annual Return, % |

|---|---|

2023 |

24.89 |

Last 3 |

10.23 |

Last 10 |

12.39 |

Last 25 |

10.28 |

Since its creation |

10.17 |

The historical chart clearly shows that while there have been years of significant downturns, marked by red, the overall trend of the index is upward, with many years showing positive returns. It's this upward trajectory that has cemented the S&P 500 as a recommended vehicle for long-term investment.

How Do You Invest in the S&P 500?

Investing in the S&P 500 is a strategy many turn to for its diversification and representation of the U.S. market's performance. While one cannot invest directly in the index, there are instruments designed to emulate its performance. These include mutual funds and exchange-traded funds (ETFs) that track the index, offering investors a share in the collective performance of the 500 constituent companies.

👍 Advantages:

• Diversification. With a single investment, you're buying into 500 different companies across various sectors, reducing company-specific risks

• Simplicity. It's a straightforward way to invest in the stock market without having to analyze individual stocks

• Accessibility. ETFs and mutual funds that track the S&P 500 are readily available through most brokerage accounts

• Cost-Efficiency. Many index funds have low expense ratios, making them a cost-effective choice for investors

• Track Record. Historically, the S&P 500 has returned about 10% annually, which is attractive for long-term investment strategies

👎 Disadvantages:

• Market Risk. While diversified, these funds still carry the market risk associated with equity investing

• No Leverage Over Market. The investment will only match the market performance, there's no opportunity to outperform it

• Limited International Exposure. The index is focused on U.S. companies, which may limit global diversification

• Susceptibility to Market Caps. Larger companies have a greater impact on the index, which can skew performance

For beginners seeking to invest in these funds, you can find more insights in our article on Best low cost index funds to invest in 2024.

Summary

The S&P 500 Index remains a cornerstone of the U.S. economy, offering a broad market snapshot and a proxy for investor sentiment. Its long-term growth trend underscores the value of index funds for portfolio diversification and risk management.

While direct investment in the index is not possible, ETFs and mutual funds that track it provide a straightforward path for investors to tap into the economic prowess of America's top companies. In essence, the S&P 500 stands as a testament to the enduring strength of the U.S. market, presenting a compelling option for those looking to invest in the heart of American industry.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

5

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.