Bank of America Review 2024

- US dollar

Currencies:

- USA

- 2%

- FDIC protects depositor funds ($25,000)

Summary of Bank of America

Bank of America (also “BofA”) is one of the world’s largest digital banks. It provides its services to more than 68 million private clients and small businesses. Credit and savings accounts, money transfers, payments for various services, deposit certificates, and investment programs are available. Bank of America provides its services exclusively to U.S. taxpayers. Clients of this bank can open business, credit, savings, and deposit accounts, which have their own benefits, such as cash back on all purchases or discounts on credits. This bank is a subsidiary of Bank of America Corporation and a member of the Federal Deposit Insurance Corporation (FDIC).

| 💼 Main types of accounts: | Credit, deposit, savings, and business |

|---|---|

| 💱 Multi-currency account: | No |

| ☂ Deposit insurance: | FDIC protects depositor funds in case of this bank’s bankruptcy |

| 👛️ Savings options: |

Preferred Rewards program with cash back up to 75% and increased interest on savings accounts; Discounts on loans; Account maintenance fee is $0; Increased cash back for investors. |

| ➕ Additional features: | Multifunctional online banking, automatic money transfers, notifications on user account activity |

👍 Advantages of trading with Bank of America:

- Wide choice of account types with different conditions and saving options;

- Only an account number and email are needed for fast money transfers to other accounts using the Zelle® application;

- Flexible loan conditions with deferred deduction of interest;

- Up to 75% cash back when paying with BofA’s credit cards;

- Multifunctional mobile app with a comprehensible and simple interface;

- Merrill investment program for small, medium, and large investors;

- Erica, a virtual financial assistant, is available in the mobile app for notifications, searching for required transactions, and menu navigation.

👎 Disadvantages of Bank of America:

- No affiliate programs for receiving passive income;

- Fees for maintaining a current account are $4.95-$25 subject to the account type;

- All transfers from credit accounts are subject to a 3% fee.

Evaluation of the most influential parameters of Bank of America

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Bank of America News

- Analysis of Bank of America

- Dynamics of the Popularity

- Investment Programs

- Terms for Cooperation

- Detailed Review

- Banking features

- Technical Support

- Social programs

- How to open an account?

- User Reviews of Bank of America

- FAQs

- TU Recommends

Geographic Distribution of Bank of America Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Bank of America

Since 2011, Bank of America has been one of the systemic banks - organizations on which the stability of the entire U.S. financial system largely depends. According to Forbes, this bank was among the top 6 world’s largest companies in 2018, which indicates its reliability and stability.

Bank of America offers a variety of account types for individuals and businesses. Clients can open corporate business accounts, savings, and deposit accounts, as well as apply for mortgages and auto loans. All accounts are opened free of charge, and the maintenance fee depends on their type. However, if certain conditions are met, you can avoid the subscription fee and additionally receive various discounts and bonuses, if you register in the Preferred Rewards program.

The company offers profitable deposit accounts with a minimum balance of $1,000 and an annual interest rate of up to 4.5% depending on the amount and duration of the agreement. Savings accounts are less attractive, with maximum interest rates of only up to 0.02% per annum.

This bank offers investors three different programs where funds can be managed independently or entrusted to Merrill (Merrill Lynch, Pierce, Fenner & Smith Inc; hereinafter “Merrill” or “Merrill Lynch”) investment professionals. Investment amounts are from $0 for self-directed management, and from $1,000 or $20,000 when investing under the management of Merrill specialists.

Dynamics of Bank of America’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of Bank of America

Bank of America offers investors the opportunity to earn passive income through the Merrill Lynch investment bank integrated into BofA’s structure. You can trade securities yourself or entrust your funds to professionals. With the second option, you can use managed investment programs, where specialists help clients to create an investment portfolio or take full responsibility for increasing their capital. Depending on the program type, the investment amount can be from $0, from $1,000, or from $20,000. Investors are offered bonuses and discounts on credit cards depending on the invested amount.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Overdrafts, loans, and flex accounts

BofA offers lending services for purchasing cars and real estate, opening current and savings accounts, and issuing debit and credit cards. Cards and accounts are opened for free. Monthly maintenance fees for savings accounts range from $0 to $25. The overdraft fee is $10 (not available for the Advantage Safe Balance account).

For all transfers from credit accounts, this bank charges a fixed fee of 3% of the amount. For investment programs, clients who choose the managed option will be charged a fee of 0.45%-0.85% per annum depending on the instrument. There are also investment costs, which depend on assets included in the portfolio and are calculated individually.

Terms for Cooperation with Bank of America

BofA’s services are available exclusively to U.S. residents, both individuals and legal entities. The account currency is USD. When making an international transfer, currency is converted at the rate set by this bank.

| 💼 Main types of accounts: | Credit, deposit, savings, and business |

|---|---|

| 💱 Multi-currency account: | No |

| 💵 Deposit terms and conditions: | Profitability on savings accounts is floating of 0.01% per annum, and for deposit certificates it is 0.02%-4.5% per annum subject to the balance and terms |

| 💳 Loan terms and conditions: |

Annual interest rate on credit cards ranges from 17.99% to 27.99%; For auto loans, it is from 6.19%; For mortgages, it is from 6.125% |

| ☂ Deposit insurance: | FDIC protects depositor funds in case of this bank’s bankruptcy |

| 👛️ Savings options: |

Preferred Rewards program with cash back up to 75% and increased interest on savings accounts; Discounts on loans; Account maintenance fee is $0; Increased cash back for investors. |

| 📋 Types of payment: | Debit cards, digital wallets, and paper checks |

| ➕ Additional features: | Multifunctional online banking, automatic money transfers, notifications on user account activity |

Comparison of Bank of America with other Brokers

| Bank of America | Wise | Bunq | Curve Bank | SoFi Bank | Starling Bank | |

| Supported Countries | US dollar | Globally | Netherlands, Germany, Austria, Italy, Spain, France, Belgium, Ireland, Bulgaria, Croatia, Slovenia, Republic of Cyprus, Finland, Greece, Hungary, Latvia, Lithuania, Luxembourg, Malta, Norway, Poland, | UK and EEA | USA | UK |

| Supported Currencies | USA | 54 currencies | Euro (16 European currencies in the Easy Money plan) | 26 currencies | USD | GBP, EUR, USD |

| Deposit insurance | FDIC protects depositor funds ($25,000) | No | EUR 100,000 | No | $250,000-$500,000 | Yes |

| Minimum deposit | $20 - $100 | No | No | No | $1 | No |

| Deposit rate | 2% | No | 0.09% APY | No | 0.90%-1.50% | 15%-35% |

| Loan Rate | Credit cards ranges from 17.99% to 27.99. Auto loans — 6.19%, mortgages — 6.125% | No | The bank does not issue loans | No | 1.89%-22.23% | 0.05% |

Bank of America Commissions & Fees

All Bank of America’s accounts are opened free of charge. Monthly subscription fees vary by account type, but they are canceled for all clients registered in the Preferred Rewards program. Also, zero maintenance fees are available to clients who have met the necessary conditions. As a rule, to do this, it is enough to always have a certain minimum amount of funds in your account and not go below the required limits.

Business accounts offer up to 500 financial transactions without fees. The monthly fee also depends on compliance with requirements and can be zero or $16-$29.95. Setting up account access for each employee and small business specialist is free. The Business Advantage Banking Relationship account does not have any fees for electronic deposits, transfers, or stopping mandatory payments. Moreover, you can connect Fundamentals and Relationship Business Advantage savings accounts to this account type for free.

To avoid subscription fees on business accounts, an average monthly balance of $5,000 is required for Fundamentals, while for the Relationship account, this amount is $15,000. Another option to avoid fees is to become a member of the Preferred Rewards for Business program.

Credit accounts are serviced in accordance with the conditions for each account type. There are accounts with no annual fee. For Premium Rewards the fee is $95 per year, and for Premium Rewards Elite it is enough to maintain an account balance of $550. All credit accounts have a transfer fee of 3% of the transaction amount.

Savings accounts have a monthly maintenance fee that varies depending on the account type. For Advantage Safe Balance, it is $0-$4.95; for Advantage Plus, it is $0-$12; and for Advantage Relationship, it’s $0-$25. There are no fees for transfers between internal accounts and stopping payments.

There are no fees on deposit accounts, but there are penalties for early withdrawals. The fee is determined by the terms of the agreement and can range from 7% to 365% of the early withdrawal amount. If a client receives bonuses when opening a deposit account, this bank will also withhold them along with penalty interest.

| Broker | Overdraft fee | ATM Withdrawal Fee | International transfer fee | International exchange fee |

| Monzo Bank | 19-39% | Free in the UK In other countries: - up to £200 - free - beyond £200 - 3% | €0.5 | 0.35%-2% |

| Chime Bank | No | No | No | 3% (max.$5) |

| Bank of America | $10 | from 7% to 365% | fixed fee of 3% of the amount | fixed fee of 3% of the amount |

Bank of America is rightfully included in the ranking of the most popular in the country. This digital bank offers a wide range of accounts, such as current, business, savings, and deposit accounts. All are opened free of charge, and the maintenance fee depends on the conditions. Each account owner has the opportunity to avoid a subscription fee by becoming a member of the Preferred Rewards program or ensuring that the balance is always at least equal to the established limit. Although BofA does not have the most favorable interest rates on deposits and savings accounts, its digitalization of services and security are at the highest level. This digital bank is a reliable partner for individuals and businesses.

Detailed review of Bank of America

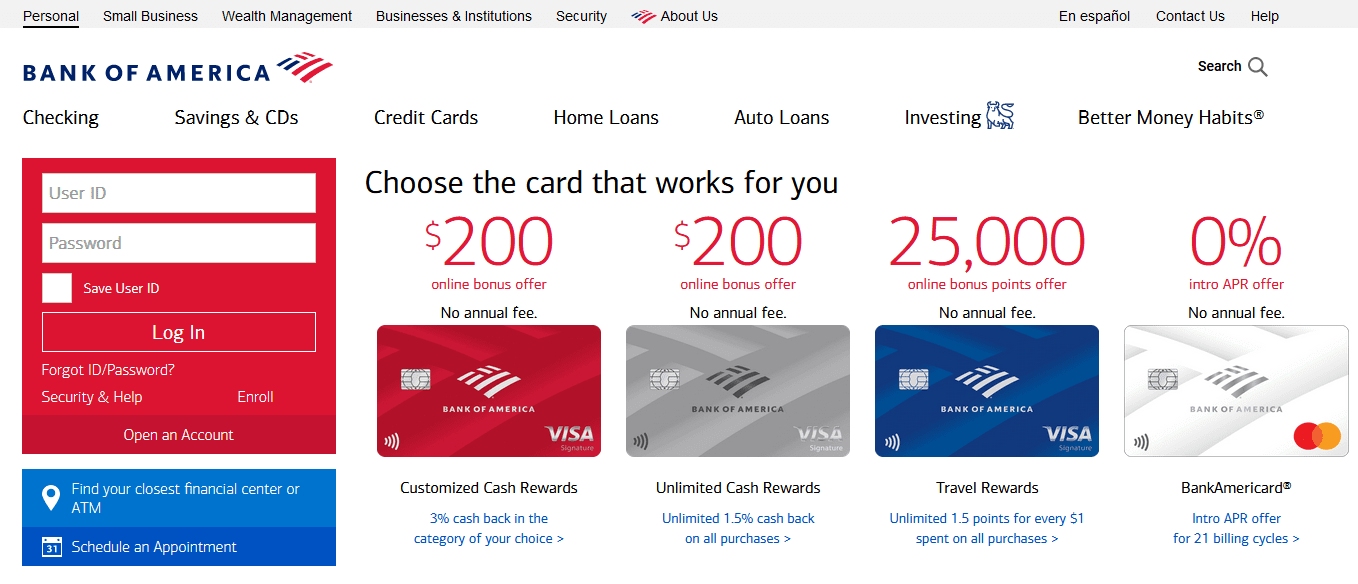

Bank of America offers an intuitive interface and features for all clients, regardless of their financial competence. Everything is simple and accessible both on the website and in the app. Software for mobile devices includes Erica, a virtual assistant that helps you find the necessary transactions, navigates the menu, and notifies you about everything that happens in your user account.

Bank of America by the numbers:

To open an account cost $0;

56 awards for contributions in various fields;

75% cash back can be received when paying with credit cards;

171,000 employees work at Bank of America;

$232 billion is the company's market value.

Among the important features of Bank of America, two main ones can be distinguished. The first is a wide choice of account types for a variety of needs that range from obtaining a loan to preserving and increasing available funds. The second is profitable investment programs for all clients. Investors can use both personal and trust management when Merrill professionals are involved in developing strategies and building a portfolio.

Features of Bank of America’s business account:

Setting up access. Corporate accounts can be set up so that every employee has access to the account. This opportunity is provided free of charge;

Zelle transfers. Using this service, you can transfer funds to other accounts in a few minutes with the recipient's phone number and email;

Balance Connect. It is an overdraft protection for the Business Advantage Banking account. You can link up to five user accounts to cover transactions with your own funds from other accounts;

Payroll and tax registration. Due to the QuickBooks online service, it is easy to organize the financial part of the company and manage your payments;

Monitoring your credit score. Bank of America’s clients can monitor credit scores of their companies thanks to the digital bank’s partnership with Dun & Bradstreet;

Savings on business benefits. The Preferred Rewards for Business program members receive various discounts on interest rates and zero maintenance fees.

Advantages:

Functional app with a high degree of security, a virtual assistant, and a comprehensible menu;

Wide range of account types with favorable conditions and opportunity to avoid monthly subscription fees;

Fast transfers between internal accounts and to accounts opened with other banks;

All account types are opened free of charge;

Opportunity to open business accounts with flexible employee access settings and free switching from one account type to another;

Available history of financial transactions, notification of all fund movements, and payment planning;

Opportunity to save and receive various bonuses and discounts when connecting to the Preferred Rewards for Business program.

Accounts types for private individuals and legal entities

Bank of America’s clients can open credit, deposit, and savings accounts. For each account type, this bank provides detailed information about the terms of use. Bank of America offers six types of credit cards. Bonus points or real funds (up to $300) are credited to each account upon opening. Annual maintenance fee is from $0 to $95 subject to the account type. All cards have a chip for contactless payments.

The digital bank has three savings accounts, namely Advantage Safe Balance, Advantage Plus, and Advantage Relationship. The minimum deposit ranges from $20 to $100, and the monthly maintenance fee is $4.95-$25. To avoid these costs, register for the Preferred Rewards program or (depending on the account) be under 18 years old, a student under 25 years old, or always keep a balance of at least $1,500 or $10,000. For the Advantage Relationship account, an annual accrual of 0.01%-0.02% is provided. Overdraft is only available for Advantage Plus and Advantage Relationship accounts.

You can set up your Business Advantage Banking business account yourself and change settings at any time. Two account types are available, namely Fundamentals and Relationship. The maintenance fee is $0-$16, free access to account management, and 200-500 transactions without fees per month are provided. To open an additional savings account, a subscription fee of $0-$10 is required.

There are three deposit accounts at BofA: Featured, Fixed Term, and Flexible. All of them are FDIC-insured with $25,000. The minimum balance is $1,000 for all account types. Deposit terms for Featured are from 7 to 37 months; for Fixed Term, it’s from 28 days to 10 years; and for Flexible, it’s 12 months. There are penalties for early withdrawals, amounts of which are specified in the Deposit Agreements and Disclosure document. Depending on the amount and term of the deposit, the annual profitability is 0.05%-4.5% for Featured; 0.03%-4% for Fixed Term; and 2% for the Flexible account.

Banking features

Bank of America focuses on maximum performance and simplification of processes through automation. Individuals and corporate clients can manage their accounts from the app using convenient auto-complete options, track cash receipts, schedule payments, etc. Transferring funds from BofA is quick and convenient, it requires minimal information about recipients, and it only takes a few minutes for the money to be credited to their accounts. All clients have access to programs for receiving cash back, discounts, and preferential loan conditions.

Technical Support

The horizontal menu and footer of the website have sections with all the necessary information about Bank of America’s products and conditions. This is a help center where you can learn about card and account management, payments and transfers, available digital services, security technologies, and additional tools.

Clients can contact technical support via telephone, live chat, X (formerly Twitter), and Facebook. You can also visit one of this bank’s branches in person or send a letter to its physical address. Phone calls are available on weekdays 8:00 a.m. to 9:00 p.m., Saturday from 8:00 a.m. to 8:00 p.m., and Sunday from 8:00 a.m. to 5:00 p.m. Eastern Time.

Social programs of Bank of America

Since 2007, Bank of America has provided funds necessary for developing solutions to climate and environmental problems. It focuses on problems of water conservation, energy efficiency, land use, and eco-vehicles. The company is involved in the poverty eradication program in Buffalo. Its task is to provide opportunities to receive technical and artistic education for high school students, as well as training specialists in occupations that are in demand.

How to open an account at Bank of America

You can open an account with Bank of America on the main page of its official website. To do this, click the “Open an Account” button on the left side of the interface. On the new page, select the account type, click the “Get started” button, read the conditions, and click the “Open account” button.

Since BofA has many different account types, the registration process will vary from case to case. However, the information required from a client is the same in most cases. You must provide your first and last names, residential address, state, city, and zip code. Next, enter your phone number (indicate mobile or home) and email address. Approval of your application takes no more than 10 minutes if all fields are completed correctly.

In some cases, proof of identity may be required. Typically, this occurs with limited credit and/or employment history or due to problems that arose during the online verification process. To open an account, contact the Bank of America financial center and provide proof of your identity.

Articles that may help you

FAQs

How does Bank of America earn money?

The main income of Bank of America is from commissions. You can learn the structure of commissions in detail on the bank's website.

How does Bank of America protect its customers?

Bank of America uses two-factor authentication, data encryption and other security methods.

Is it possible to check the statistics of expenses?

Bank of America provides clients with extended statistics. You can study the detailed information about revenue receipts, expenses, split into different periods of time, etc.

Is it possible to make international payments through Bank of America?

Yes. Bank of America allows you to make payments between customers in different countries.

Traders Union Recommends: Choose the Best!

Via Wise's secure website.

Via Bunq's secure website.

Via Curve's secure website.