Wire Transfer Explained

Today, transferring money from person to person, over short distances or even globally has become as easy as child’s play compared to the past when it was difficult to move funds. The only possible way was through checks, drafts, and money orders which could take a lot of time. But after the introduction of wire transfers, the exchange of money across jurisdictions became more straightforward and quicker.

Every day, hundreds of thousands of people all across the world transfer money. If you are buying a house, paying rent, or offering money as a gift, you might want to know what a wire transfer is and how it works. In this guide, the Traders Union comprehensively explains wire transfers and their benefits and disadvantages.

Start working with digital banks now with Wise!What is a wire transfer?

A wire transfer is one of the most effective and fastest ways to move money electronically across town or across the globe. If you want to send money to a relative in a foreign country, you can transfer money through a bank or a non-bank source such as Western Union, Wise, and many other service providers. Wire transfers are feasible because you can transfer a few or even thousands of dollars nearby or to a foreign country in that country’s local currency.

Wire transfers do not involve physical cash. Instead, the transfer facilitates the movement of electronic or digital cash between banks or non-bank payment services, such as Western Union.

The receiver can take payment almost anywhere, by bank card, his personal bank account, or at any authorized pick-up location, such as a Western Union office. However, it usually takes a bit of effort compared to other money transfer methods. Such as person-to-person transfer, which is free and done using applications. A detailed list of pros and cons is discussed below.

👍 Pros

•It is the fastest channel to transfer funds nationwide. You don't have to wait for it. Once you transfer the money, the receiver will be able to withdraw the money right away or within a few hours.

•The receiver doesn't have to go too far to collect the money because service providers have many branches or authorized pick-up sites globally, and some wire services coordinate with local banks or other payment services within a shared network. So, be sure which service the sender is using to complete the transfer.

•This method is much safer as providers must follow international wire transfer laws. As a result, you can rest assured that your funds are securely transferred minus, of course, any fees you must pay.

👎 Cons

•Wire transfer services charge a fee for every transaction. Typically, the sender pays for the charges, and the receiver will get the amount sent in full and without deductions. But some services also charge a minimal fee from the receiver or a small percentage of the money received.

•It is risky because it's a non-reversible payment method. Once you make the transfer, you won't be able to stop or reverse the payment if you change your mind. This is problematic, especially if you don't know the beneficiary personally and the transaction is to pay for something that is unsatisfactory.

•Banks often impose a limit on the maximum amount of a transfer. So, this may conflict with a sender or receiver using this service.

Typical wire transfer case studies

There are many scenarios where a sender would want to send money quickly to the receiver, and a wire transfer is the best solution. The following are some of the most popular uses for wire transfers:

Money can be transferred overseas through wire transfers: This can be useful for circumstances like sending money to students studying overseas, for your Forex trading account, or sending money to family or friends.

Online bills can be paid with a wire transfer. Also, when you make an online purchase, the seller may request payment by wire transfer instead of using a credit or debit card. This is usually the case for high-value items.

Stocks and bonds can be purchased using wire transfers: Many stock brokers accept wire transfers as a form of payment for stocks and bonds.

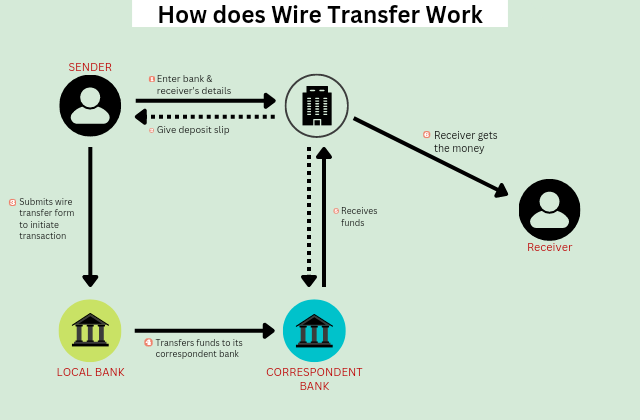

How wire transfers work

You have probably given money to someone by hand, but in a wire transfer, there is no need to hand over the physical money. Instead, it allows the transfer of funds between two parties, even if both are in different geographical areas. Wire transfers or wire payments usually require specific information to transfer money successfully.

The sender pays his bank for facilitating the transaction

The following details must be provided to the bank by the sender:

Personal information

To start a wire transfer, you must give the recipient's name, address, and phone number, plus any other information the service requires.

Banking information

The recipient's financial information must also be given. This includes banking information like account and branch numbers. This step is required to ensure the money goes to the proper person.

Bank's information

The bank’s details for the beneficiary must be provided. This includes the bank's name, address, routing number, and its Society for Worldwide Interbank Financial Telecommunications (SWIFT) code.

Reason for transfer

At last, you need to explain why you are making the wire transfer. This is also necessary, where you provide the information and reasoning to the bank for the specific wire transfer. Mentioning the reason for each transfer is also mandatory to remove hints of money laundering, etc.

Once the information is documented, the wire transfer can begin. In the next step, the starting company sends a message containing payment instructions to the recipient's institution using a secure network, such as Fedwire or SWIFT routing. The recipient's bank deposits its reserves after receiving the information from the initiating bank.

Best International Banks For Active TravelersDomestic and international wire transfers

A wire transfer is also known as a wire payment or payment by wire, which authorizes money to be moved rapidly and securely without any requirement of the exchange of physical money. It allows the transfer of money between two parties even if they are in different geographical locations. The sender shares information about the receiver, their account number, and the amount they want to transfer.

There are two wire transfer types:

Domestic wire transfers

Domestic transfers are payments made to various banks or financial institutions within the same nation. The recipients will securely provide their bank code to the sender for the particular account address. Therefore, receiving the money won't be a problem for the recipient.

The quickest payment for such transactions may take a few hours, but it may take up to an entire day. The reason is that domestic payments must pass through a domestic automated clearing system before being finally sent, which can take some time.

International wire transfers

In international wire transfers, if you send money you must provide the receiver's name, address, bank details and its SWIFT code, and the recipient’s bank account number. Money is transferred between two countries or regions using a wire transfer. Wire transfers to your friends or colleagues in another country are known as international wire transfers.

Often the wire transfer may take two business days to complete. So, you might be thinking, why is there an extra day? Because this extra time is used to clear the payment through the domestic automated clearing system and its foreign equivalent, so you shouldn't worry.

How to Send Money Internationally? 10 Cheap and Fast OptionsAre wire transfers safe?

People dealing with online banking and money transfers are constantly concerned about the safety and security of the funds. These concerns are valid as there are a rising number of bank frauds. In addition, wire transfers are carried out between banks before being put into the recipient's account.

Wire transfers are considered much safer than mailing a check or cash as a method of money transfer. They are safe transactions initiated by authorized staff members of your bank or a non-bank wire transfer service. Once they have begun, it is impossible to stop them.

Federal rules require individuals in the U.S. to provide proof of their identity and address when opening an account and using wire transfers.

The only safety concern is when swindlers gain access to someone else's bank account and can withdraw or redirect the funds to another account. In such circumstances, account holders might not be able to get their money back unless they report the incidents quickly enough to stop the swindlers from carrying out their schemes.

Digital Banks | Lists, Features, and BenefitsAre wire transfers expensive?

Senders are concerned about the fees charged while transferring money via wire transfer. Moving money through a wire transfer might not be cheap. For example, sending funds from a bank to the recipient's bank ranges from $0 to $50.

Domestic banks usually charge an outgoing fee of about $0 to $35. On the other hand, an international wire transfer for an outgoing transfer usually charges around $35 to $50.

It will be fair to claim that wire transfers are pricey and not inexpensive because this fee must be paid every time you opt for a wire transfer. But it may be a good option if you are in a hurry and need your funds to be transferred as quickly as possible.

Are wire transfers fast or slow?

Domestic wire transfers are usually completed in three days or less. Transfers between accounts at the same banking institution can take less than 24 hours. If you send money to another country, the receiver may not receive their funds for 5-7 days.

Sometimes, wire transfers can take very long. This could be the result of human error (e.g., making an error when filling out the form), the intervention of public holidays or natural disasters, or exotic locations. However, it becomes obvious why domestic and international wire transfers are so widely used. Consider how long banks might take to process checks or deposits, which can be up to 2 or 3 weeks.

The wait time varies from country to country. Depending on how you send money, there are numerous waiting periods for bank transfers.

The following are illustrations of transfer completion times by selected service providers:

Wise: It takes Wise 2-3 working days to complete the payment, but it could take up to a week for the money to get into the recipient's bank account.

PayPal: The clearing procedure typically takes 1-3 business days (but sometimes up to 3-5 business days).

Revolut: It usually takes 1–3 business days for a transfer to arrive in a recipient's account.

Best wire transfer alternatives

A wire transfer is the safest way to transfer money globally, although a percentage of the transfer amount or a flat fee is imposed on the money transferred. Many users are searching for alternative services due to these less-than-favorable factors and because it was more convenient in the early days of wire transfers for the user to move money from one end to another when wire transfers were initially launched. But today, the process has become convoluted because of heavy regulations.

Various other factors, such as delays in processing time, holidays, or an error while filling out the form, can frustrate the process. In such situations, people opt for different types of payment services.

Some alternative apps and services provide better and more efficient features and ease of use. A brief discussion of two alternatives and their relative features are discussed below.

Wise

Wise is the best service to transfer money today. It is the fastest with no or very little waiting time, but if you are opposed to debit or credit cards, the time limit might be increased up to a couple of days, plus it charges a meager flat fee or around 2% of the transfer/receiving amount.

Wise has no hidden fees; however, the exchange rate fee may be applied. So, this is one of the critical advantages of using Wise. It is 100% safe to use while you are transacting the money transfer. There is no bureaucracy in it. Wise offers meager currency exchange rates, the use of the application is intuitive, and the system has extensive global coverage.

Revolut

Revolut is another alternate application you can use for transferring money between two parties. It also provides many features and an easy-to-transfer-money interface. The application is swift and straightforward and provides rapid payment alerts and analysis.

Revolut offers allocation and auto-saving for your Revolut current account. It also gives frequent alerts and notifications for cryptocurrency rates and prices. Online spending fees are zero, either in the default or foreign currency.

FAQ

How long does it take to complete a money transfer?

Money transfers from one bank to another inside the same company often take 24 hours or less. In the worst-case scenario, you may have to wait three business days for the money to be received by the recipient, or even longer.

Can a wire transfer be misdirected?

You cannot undo a wire transfer if the money has already been transferred and there was no extenuating circumstance surrounding the error-filled transaction. Banks and wire transfer services frequently address in their terms and conditions the sender's responsibility if the sender provides incorrect account information.

Can I monitor my wire transfer?

Your bank will use your Federal Reference number to track your wire transfer if you contact them. They can check the financial records between your bank and the bank receiving the cash, as well as the precise location of the wire transfer.

Can I know if my wire transfer has been received?

Yes. Using your Federal Reference number, your bank will be able to locate your wire transfer. In addition, the bank will have access to information about the transactions between your bank and the bank where the monies are being deposited, as well as the precise location of the wire transfer.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses who want to improve their Google search rankings to compete with their competition.

Over the past four years, Alamin has been working independently and through online employment platforms such as Upwork and Fiverr, and also contributing to some reputable blogs. His goal is to balance informative content and provide an entertaining read to his readers.

His motto is: I can dream or I can do—I choose action.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!