Trading platform:

- PayPal Wallet

- FCA

PayPal review in 2024

- All developed countries

- No

Currencies:

- USD, EUR, GBP and 22 other currencies

cryptocurrencies:

- Yes

Summary of PayPal

PayPal is the first modern-type electronic payment system, established in 1998. The service allows users to shop all around the world and send and accept money transfers between the banks in different countries. PayPal Review shows that the system works with 25 currencies and it has its own PayPal Card that is a Mastercard you can use to pay offline. The service has a simple account registration system that requires only your email. You can connect a card from any bank to your account. The system does not charge a registration or service fee. The sender is not charged with a transfer fee. Instead, the recipient pays the transfer fee (depends on the amount and region).

| 💼 Main types of accounts: | Personal and Business |

|---|---|

| 💱 Multi-currency account: | Yes (25 currencies) |

| ☂ Deposit insurance: | Depends on the transaction type |

| 👛️ Savings options: | Savings account, pots, setting targets with alerts, cash back |

| ➕ Additional features: | Purchase/sale of cryptocurrencies |

👍 Advantages of trading with PayPal:

- The service is simple to use. All you need is your email and password to pay online or make a transfer from your mobile device.

- All transactions are instant or almost instant; it is the faster method of money transfers and paying for purchases.

- Interaction between the buyer and the seller is carried out through PayPal accounts; the system does not use bank card data.

- In order to make and receive transfers, you need to be registered on PayPal. Nothing else is required.

- The service allows you to request a refund for return shipping costs. Up to 12 returns per year are allowed for an amount that depends on your country of residence.

- The service is free; the system does not have premium accounts; the transfers inside the country are free.

- PayPal Card allows you to pay offline anywhere where Mastercard is accepted.

👎 Disadvantages of PayPal:

- The system provides personal information of users to third parties, which is required for processing transactions, making payments and transfers.

- Online stores using PayPal pay a fee for receiving transactions (when clients pay for their purchases).

- Personal information of users is stored on U.S. servers, the physical location of which is not disclosed.

Analysis of the main features of PayPal

Table of Contents

Geographic Distribution of PayPal

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of PayPal

PayPal electronic payment system has been successfully operating for more than decades, providing services to the clients all over the world. Its key advantages include simple registration, convenience of transfers, and high transaction speed. Unlike many peers, PayPal does not charge a subscription fee. The system does not offer any other types of accounts except the standard ones (there are only accounts for individuals and businesses).

PayPal Review shows that the system is intuitive, with a minimum of features and they are all simplified to improve usability. Users can transfer funds to other users registered in the system and also shop online at platforms connected to PayPal. The sender does not pay any fee, as the transfer fee is charged on the recipient.

In recent years, keeping up with the times, PayPal has been adding the most demanded features, similar to neobanks. For example, users can now buy and sell cryptocurrency directly in the PayPal app. Cryptocurrency is credited to the client’s internal account; it can be used to pay online, if the merchant accepts cryptocurrency.

The service also offers the PayPal Savings feature that allows users to set aside money from different accounts to the internal savings account at 0.60% APY (that’s 10x than the majority of online US banks). You can also form pots to achieve different targets with the option of setting milestones and alerts. This is a standard functionality of modern-day neobanks, which the majority of electronic payment systems lack. In this sense, PayPal is a clear leader.

Latest PayPal News

Dynamics of PayPal’s popularity among

Traders Union’s traders, according to 2023 data

Investment programs, available markets, and products of PayPal

PayPal Review shows that although the payment system strives to introduce the most popular features of modern mobile banks, it still primarily remains a means of remote payments and transfers. Therefore, PayPal offers only one option for growing capital – a savings account.

A user can use the service’s mobile app at any time to transfer money from the card(s) linked to the account to an internal savings account that offers 0.60% APY. Note that the rate is fixed, and users are not required to fulfill additional conditions to qualify for higher benefits. Also note that PayPal is not a bank. Banking services in PayPal are provided by Synchrony Bank, a Member of FDIC.

The funds are not blocked on the savings account; it can be fully or partially withdrawn at any time. You can always replenish the account with a direct transfer from any linked card. The service and its partner bank do not charge any additional commissions and fees. The system is 100% transparent.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

PayPal Money Transfer Terms & Conditions

PayPal electronic payment system does not set limits for its clients. It does not matter in which country you reside or where you are physically, as your PayPal account exists on a remote server and you can access it from any device connected to the internet. The same applies to transfers; they are available in all regions of the world. However, not that PayPal supports only 25 currencies. If the payment currency does not correspond to the account currency, the transfer will be converted automatically at the current market exchange rate (this feature is set in the account).

| 💼 Main types of accounts: | Personal and Business |

|---|---|

| 💱 Multi-currency account: | Yes (25 currencies) |

| Deposit terms and conditions: | Savings account at 0.60% APY |

| Loan terms and conditions: | No |

| ☂ Deposit insurance: | Depends on the transaction type |

| 👛️ Savings options: | Savings account, pots, setting targets with alerts, cash back |

| Types of payment: | Electronic transfers, PayPal Card |

| ➕ Additional features: | Purchase/sale of cryptocurrencies |

Comparison of PayPal with other e-payment systems

| PayPal | Advcash | Payeer | Skrill | FastSpring | Stripe | |

| Supported Countries | All developed countries | 150 countries | 127 countries | 200 countries | 200 | 48 |

| Supported Currencies | USD, EUR, GBP and 22 other currencies | 9 currencies (USD, EUR, GBP, RUB, BRL, TRY, UAH, KZT, VND) | 3 fiat currencies (USD, EUR, and RUB) and most cryptocurrencies | 40 currencies | 20 | 135 |

| Support for cryptocurrencies | Yes | Yes | Yes | Yes (deposit) | No | No |

| Subscription fee | No | No, only transaction fees | No, transaction fees only | No, only transaction fees | 8.9% or 5.9% +95 cents per transaction | 2.9% + 30 cents per account |

| Payment acceptance equipment | Upon receipt of payment/transfer, depend on the region | No, only software | No, online only | No, only online | No, only software in the form of SaaS | No, just the software |

PayPal Commissions & Fees

No fee is charted if a user shops online or makes a transfer. If the user receives a transfer or payment for goods/services provided, he/she pays a fee that is determined by his/her region. You can calculate the fee in advance on the PayPal website or app (Consumer Fees and Merchant Fees menus).

The fixed fee for commercial transactions depends on the currency, for example USD 0.49 for the US dollar. The fixed fee for QR code transactions for USD 10.01 and higher also depends on the currency, for example USD 0.10 for the US dollar. If the QR code transaction is lower than USD 10.01, the fee is lower (USD 0.05). These are the fees for the U.S., they are different for other regions.

Note that there are special fees for donations and other special transfers. You can see the fees in the Fees section on the PayPal website. The section features information about all types of consumer and merchant fees that we haven’t mentioned here.

No fee is charged on deposits of funds from a bank card/account to the PayPal account, if no conversion is required (the same applies to withdrawal). The spread on conversion is usually 3% or 4% depending on the type of transactions, but other values are also possible. In some cases, for example when interacting with a non-linked account, a 1.5% withdrawal fee may be charged.

The fees are fixed for buying and selling cryptocurrencies and are based on how much crypto you buy or sell. The minimum transaction amount is USD 1. If the transaction amount is up to $4.99, the fee is $0.49. The fees change from the fixed to percentage, if the transaction amount is higher than $200. Then, the fee is 1.80% and 1.50% if the transaction amount is higher than $1,000.

Users who actively use their PayPal account, making many transactions, need to consider the limits. For example, you cannot instantly transfer more than USD 25,000 to your bank account. The limit on instant transfers to a card is USD 5,000 per one transfer, not more than USD 5,000 a week, and the monthly limit is USD 15,000.

Traders Union also compared PayPal’s fees with similar types of fees on other e-payment systems.

| FastSpring | 2Checkout | PayPal | |

| Payment commission | 5.9% + $0.95 | 3.5% + 0.35$, 4.5% + 0.45$ or 6% + 0.60$ per transaction | $0.49 |

| Deposit commission | 2% (max $20) | Depending on the payment method | No fee |

| Withdrawal commission | $5 | Depending on the payment method | 1.5% |

| Commission for international transfers | 8.9% | Depending on the payment method | Depend on the transaction type and region |

PayPal electronic payment system is free and universal. It operates in all developed countries and allows users to shop online and make transfers with the majority of popular currencies. At that, the fee for a standard transfer is charged on the recipient and is objectively low, compared to the fees of other systems. PayPal also provides a possibility to buy and sell cryptocurrency, open a savings account, as well as several features that are standard for modern neobanks.

Detailed review of PayPal

As of today, PayPal has the biggest experience among electronic payment systems. The service is trusted by hundreds millions of users; it has steady relations with all global banks; it provides services of online transfers and payments under loyal conditions. It is important that a PayPal account is opened for free with no subscription or additional fees charged. However, you do have to pay for a physical PayPal card (the amount depends on the country, as the shipping costs are taken into account).

PayPal in figures:

-

400 million clients across the world;

-

25 supported currencies without conversion;

-

0.60% APY on the savings account;

-

2-3% cash back on all purchases made with PayPal Card;

-

0 – the cost of account opening and subscription fee.

Convenience of working with PayPal is determined by the intuitive interface of Personal Account. You can access it from the app installed on a mobile gadget or from the official website of the service. You can access the website from any device with a browser and internet connection.

Useful features by PayPal:

-

Instant transfers. The clients of the service can transfer money to other clients all across the world; the transactions are processed as quickly as technically possible.

-

Online purchases. Today, the majority of online stores accept payments with PayPal. All a client needs to do is to enter their email and pay for the order within seconds and without additional fees.

-

Savings account. You can open a savings account with a reliable partner bank at 0.60% APY. No commissions are charged, the funds are not frozen.

-

Pots and targets. You can create pots inside the account and distribute your savings among them, and also specify the targets (milestones) upon reaching which you will get an alert.

-

Detailed statistics. All transactions are saved to the account archive. A user can learn how much, when and to whom he/she paid at any time (the same applies to received payments).

-

Complete anonymity. An online store or another user of the service you transfer money to will never learn anything about you. Bank data is 100% confidential.

-

Interest-free installment. When making an order at an online store, a PayPal client can select the payment by installments option and break the amount to 4 parts. If the order is paid in full within 6 months, no fees are charged.

-

Cash back on purchases. Every time a client pays with a PayPal Card, he receives 2% or 3% cash back. Almost all major stores offer this cash back.

-

Automatic conversion. PayPal supports 25 currencies, but if the currency on the linked card does not correspond to the payment currency, the payment will be automatically converted at the market exchange rate.

It is also worth noting that the service recently introduced the feature of buying and selling cryptocurrency. A user has access to the global cryptocurrency market from his mobile app; he can freely buy and sell any cryptocurrency available at the exchange. Market exchange rate is used, and additional fees are charged (depending on the amount of cryptocurrency).

Benefits of PayPal payment system:

-

Simplicity. In order to register in PayPal, all you need is your email. There is no need to provide proof of identity by sending scanned copies of your identification documents.

-

Universality. A client can link a card or account of any bank to a PayPal account.

-

Mobility. Clients can access the account from PayPal mobile app (logging in from the website is also possible).

-

Reliability. The service has never been hacked; it is secured by advanced cryptographic techniques.

-

Quickness. An absolute majority of payment and transfer transactions are executed instantly or almost instantly.

-

Loyalty. The service does not charge a subscription fee, or transfer fee. The fees that the service does charge are lower than average in the segment.

-

Profitability. A Savings Account at 0.60% APY and 2%-3% cash back allows users to grow their capital.

-

Adaptability. A client can defer payment for a product/service at any time without additional payment.

-

Anonymity. The recipient of payment/transfer knows you’re your email and nothing more.

Types of accounts in the PayPal payment system

You can open one of two account types in PayPal: Personal or Business. Personal accounts are opened by individuals. It has all standard features. You can link a card/account of any bank to it. Payments and transfers all around the world, a savings account, cash back, buying and selling cryptocurrency is available.

Business account type is opened by legal entities, usually owners of online stores with online payments. A business account allows its owner to accept all types of remote payments from a debit or credit card. The fees charged on the recipient are lower than of the absolute majority of peer services (calculated individually). Also, this account type allows you to create and set up a separate email for communicating with clients.

You can connect up to 200 people to a business account, setting individual limitations for them in terms of available features. The owner of such an account can also use the additional solution offered by PayPal, for example PayPal Checkout.

Banking features

PayPal electronic payment system is not a mobile bank, but it does offer some banking features that are standard for neobanks. In particular, PayPal allows users to defer payments for their purchases. This means that a user places an order and receives the product or service, but pays for them later. You can split the payment into 4 parts you have to pay within 6 months. If the user fails to pay within this period, the service starts charging a fee (if the deadline is observed, no additional fees are applied).

PayPal users can also transfer funds from different client accounts to a savings account at Synchrony Bank. This partner bank is regulated by FDIC, which makes it a reliable one.

The cash back feature is also related to online banking, as are the corporate features of the business account of the service. Therefore, PayPal considerably expands the boundaries of a standard electronic payment system, allowing clients to use a single account for aggregating their financial flows.

Social programs of PayPal

PayPal does not implement social programs. The mission of the service is to make interaction between individuals and service providers across the world as simple as possible through creation of a stable system of instant electronic transfers and payments. However, large charity foundations regularly use PayPal to raise money, as well as hold thousands of fundraising events every year.

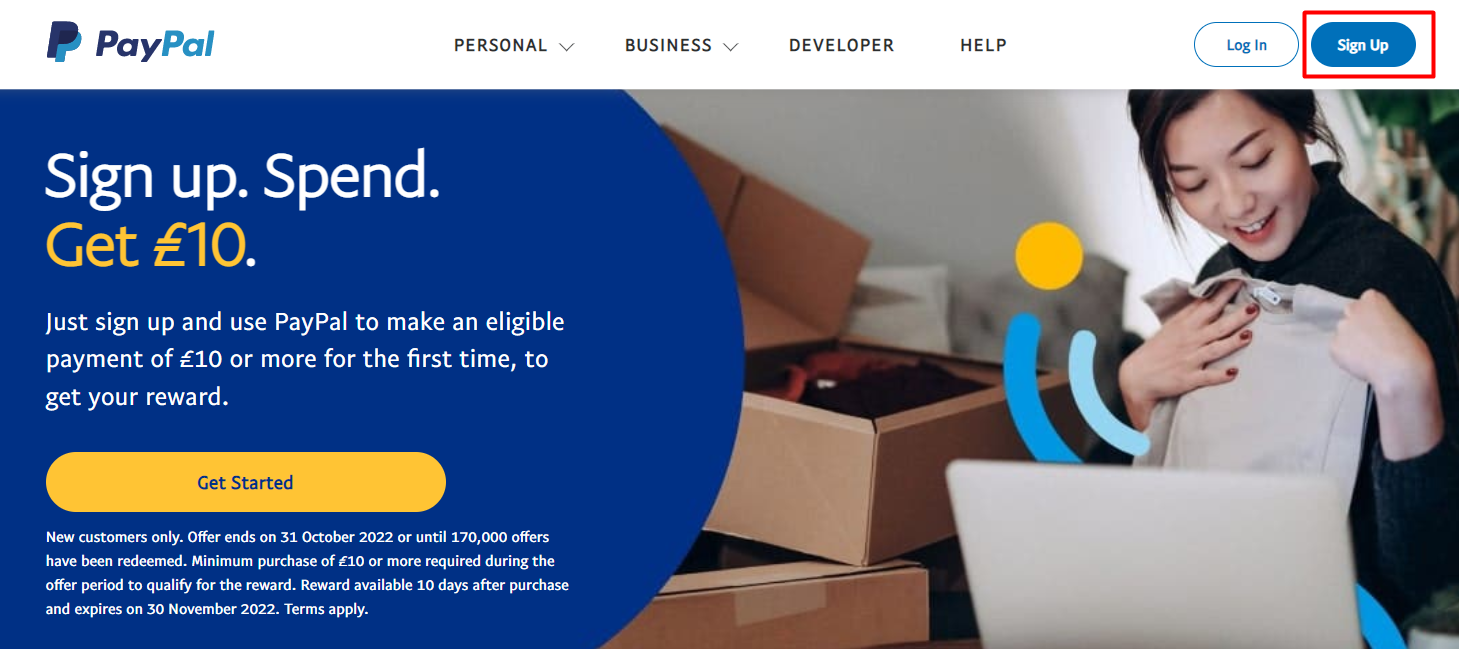

How to open an account at PayPal

Go to the official website of PayPal and click Sign Up in the top right corner. Select the account type – Personal or Business. Enter your mobile phone number and click Next. A confirmation code will be sent to your phone. You will need to enter it in the next window. If you are creating a Business account, you can skip this step, but you have to provide your email in any case.

Enter basic information. The system will not require you to provide identification documents, only minimum information required for account ID. You will also need to come up with a password. You cannot disclose your password to anybody under no circumstance. At the final stage of the registration, you need to agree with the company’s Privacy Policy and Terms of Use. Check the boxes and click Accept and Create Account.

Log into your account and click Wallet. Then click Link a card or a bank and choose the type of account: debit card, credit card or a bank account. Start entering the name of the bank and its information will appear in the pop-down menu. Select the bank or enter information manually, if it didn’t appear automatically for some reason. Next, provide information about your account (card or account), click Accept and Link.

You can do all of this also in the mobile app. For this, go to the app store on your gadget and find PayPal. Download and install the app, launch it and follow the above algorithm of actions.

Technical support

There is a Help tab on the official website of the service, at the bottom of the screen. There are three sections: Personal Support, Business Support and Technical Support. The first two are designed for the namesake accounts, while the third section features explanations to general questions related to the service operation. These sections are basically expanded and detailed FAQ, where the majority of situations a client of the service may face are discussed.

Also at the bottom of the website, there is the Contact tab that features practical advice grouped by topics, as well as channels of direct communication with the service managers. A client can send an email to the managers, contact the Support Center through their account or call the call center. It is also possible to ask a question on the forum. All channels of communication are available in the PayPal app. Customer support is available 24/7.

FAQs

Does the PayPal payment system work officially?

Yes. The payment system is officially registered and licensed for financial activities.

Is it possible to withdraw money to a bank card from a PayPal account?

PayPal customers can withdraw money to debit and credit cards of any bank.

Can I buy cryptocurrency through PayPal?

By means of the PayPal wallet, you can replenish your account on a cryptocurrency exchange and buy cryptocurrency.

Does PayPal have a mobile app?

Yes. The PayPal payment system offers a convenient mobile application for money transfers.

Traders Union Recommends: Choose the Best!

Via Advcash's secure website.

Via Payeer's secure website.

Via Skrill's secure website.