Cheapest way to send money internationally

The need to send money internationally has become more common as the world economy becomes increasingly globalized. Unfortunately, international money transfers can be expensive and time-consuming.

Anyone sending money abroad will likely lose significant sums of money to fees and poor exchange rates. The good news is that there are a few ways to avoid these costs. This article will review the cheapest and fastest ways to send money internationally in 2023.

We will compare the fees, exchange rates, and speed of different money transfer options so that you can choose the best option for your needs. So, if you need to send money internationally, read on to find out the best way to do it in 2023.

Start working with digital banks now with the Wise Bank!What Are Typical International Transfer Costs

When sending money internationally, there are three main types of fees:

Sending Fees: These are charged by the money transfer company for processing your transaction. Sending fees are typically a percentage of the transaction amount, with a minimum fee.

Receiving Fees: Some countries charge a fee for receiving an international money transfer. This fee is typically a flat rate, regardless of the amount being transferred.

Exchange Rate Margins: When you send money abroad, the recipient will receive the funds in their local currency. The money transfer company will use an exchange rate to convert your funds into the local currency.

Most companies charge a margin on the exchange rate, which means you will lose money on the conversion. The margin size varies depending on the company and the currency being exchanged.

In addition to these fees, you may also be charged other hidden costs, such as currency conversion fees. To avoid these hidden costs, you should use a money transfer company that does not charge fees.

However, the fees vary depending on the mode of transfer. For instance, bank wire transfers typically have higher fees than money transfer apps. Below, we will compare the fees, exchange rates, and speed of different money transfer options.

Best Digital Bank Accounts For International StudentsOption #1: Money Transfer App

One of the cheapest and fastest ways to send money internationally is through a money transfer app.

Some of the most popular money transfer apps are TransferWise, WorldRemit, and Remitly. These apps allow you to send money abroad quickly and easily.

Most money transfer apps charge a small, flat fee for each transaction. They also offer competitive exchange rates, which means you will lose less money on the conversion.

👍 Pros

•Convenience: You don't need a bank account to use a money transfer app. All you need is a smartphone and an internet connection.

•Speed: Money transfer apps are very fast. You can typically send money within a few minutes.

•Transaction history: You can view your transaction history on most money transfer apps. This helps track your expenses.

•Cheap: Money transfer apps typically charge lower fees than banks.

•Personal use: Money transfer apps are great for sending money to friends and family.

👎 Cons

•Limited currencies: Some money transfer apps only allow you to send money in a limited number of currencies.

•Security: Money transfer apps are not as secure as banks. Someone could access your account and send money without your permission if your phone is lost or stolen.

•Geographical restrictions: Some money transfer apps only work in certain countries.

Option #2: Visa/Mastercard

Another option for sending money internationally is through a Visa or Mastercard.

Visa and Mastercard are accepted in almost all countries. Over 210 countries have "direct connectivity" with Visa and MasterCard, which means you can send money directly to a bank account.

Visa and Mastercard are typically used for business transactions and are not ideal for personal use. However, they can be used with a money transfer app to send money internationally.

👍 Pros

•Convenience: You can use Visa or Mastercard to send money anywhere in the world.

•Speed: Visa and Mastercard are very fast. You can typically send money within a few minutes.

👎 Cons

•Fees: Visa and Mastercard typically charge higher fees than money transfer apps.

•Exchange rates: Visa and Mastercard have poor exchange rates, which means you will lose money on the conversion.

Option #3: Bank Wire Transfer

Bank wire transfers are one of the oldest and most common methods of sending money internationally.

Wire transfers can be done online, over the phone, or in person at a bank branch. The system uses the SWIFT network to send money from one bank to another.

Bank wire transfers typically take longer than other methods, such as money transfer apps.

Bank wire transfers are a good option for large amounts of money. They are also more secure than other methods, such as money transfer apps.

👍 Pros

•Security: Bank wire transfers are very secure. The sender and receiver are both verified by the bank.

•Large amounts: You can send large amounts of money with a bank wire transfer.

•Trackability: You can track bank wire transfers to ensure the money has been received.

👎 Cons

•Fees: Bank wire transfers typically have higher fees than mobile apps.

•Speed: Bank wire transfers can take several days to complete.

Option #4: Cryptocurrency Transactions

Cryptocurrency transactions are a newer way of sending money internationally.

Cryptocurrencies, such as Bitcoin, Ethereum, and tether, are digital assets that can be used to send and receive payments. They use blockchain technology to facilitate secure and fast transactions.

Cryptocurrency transactions don't need financial institutions, such as banks. This makes them cheaper and faster than traditional methods.

Cryptocurrency transactions are irreversible. This means you cannot get the money back once you send it back.

👍 Pros

•Cheap: Cryptocurrency transactions are typically more affordable than traditional methods, such as bank wire transfers. For example, bitcoin transactions are 300 times cheaper than bank wire transfers.

•Fast: Cryptocurrency transactions are also much faster than traditional methods. For example, a bitcoin transaction can be completed in as little as ten minutes, while a bank wire transfer can take up to five days.

•Security: Cryptocurrencies are also much more secure than traditional methods. For example, a bitcoin transaction is irreversible, while a bank wire transfer can be reversed.

👎 Cons

•Volatility: Cryptocurrencies are notoriously volatile. For example, the price of bitcoin can fluctuate by hundreds of dollars in a single day.

•Lack of regulation: Cryptocurrencies are not regulated by any government or financial institution.

•Risk of fraud: There is a risk of fraud when dealing with cryptocurrencies. For example, there have been numerous cases of people losing money to scams.

What is the Cheapest Way To Send Money Abroad

The cheapest and fastest way to send money internationally today is through peer-to-peer payment services, also known as money transfer apps. These are apps that allow you to send money directly to another person without going through a bank or other financial institution.

You can use your bank or credit card to send money through these apps, or you can use their built-in payment system.

The most popular peer-to-peer payment apps are PayPal, Venmo, and Cash App.

How P2P Payments Work

Peer-to-peer payments work by connecting you with another person who wants to send or receive money.

For example, let's say you want to send money to your friend in Germany.

First, you need to find a peer-to-peer payment app that supports international transfers. Once you've found an app, you need to create an account and link your bank account or credit card.

Once your account is set up, you can enter your friend's information and the amount of money you want to send. The money will then be transferred directly from your account to your friend's account.

They can then hold onto the money in their account or transfer it to their bank account.

7 Cheapest Money Transfer Apps Comparison

When it comes to finding a cheap way to send money abroad, there are a few things you need to compare.

First, you need to compare the fees. Most money transfer apps charge a small fee for each transaction, but some charge more than others.

Second, you need to consider the speed of the transfer. Some apps allow you to send money instantly, while others may take a few days. A slow transfer can be costly if you need the money immediately.

Finally, you need to consider the supported countries. Some apps allow you to send money to a few countries, while others support dozens of countries.

The best way to compare money transfer apps is to use a cheap money transfer app comparison tool. This will allow you to see the fees, speeds, and supported countries for each app side-by-side.

The cheapest money transfer app will depend on your specific needs. However, some of the most popular and affordable options include:

Paypal

Wise

Revolut

Payoneer

Skrill

PaySend

Remitly

The table below compares the typical costs of the leading money transfer apps, the speed of transfer, and the number of countries supported.

| Money transfer app | Typical costs | Speed | Supported countries |

|---|---|---|---|

PayPal |

5.00% Minimum fee of $0.99 Maximum fee of $4.99 |

Instant |

more than 200 countries |

Wise |

4.15 USD + 0.47% of the amount that's converted |

From instant- 5 days |

80 countries |

Revolut |

0.3% Minimum of $0.3 Maximum of $6 |

1-5 days |

European Economic Area (EEA), Australia, Singapore, Switzerland, Japan, the United Kingdom and the United States |

Payoneer |

From free upto 2% of the transaction |

Instant-5 days |

Over 200 countries |

Skrill |

Free to 4.99% |

1-3 days |

131 countries |

PaySend |

From $2 |

instant-3 days |

Over 170 countries |

Remitly |

0.5%-1.5% |

Instant-5 days |

Over 28 sending countries Over 100 receiving countries |

1. PayPal: The Most Popular e-payment System

PayPal is one of the most popular money transfer apps, with close to 400 million users worldwide. It's a good choice for sending money internationally, as it supports more than 200 countries.

It has also been around for over two decades, so it's a well-established powerhouse in the money transfer space.

Costs

PayPal international transfer fees depend on the country you're sending money to. The fee is calculated as a percentage of the amount you're sending, plus a fixed fee (domestic transactions fee). They charge a 5% fee, with a minimum of $0.99 and a maximum of $4.99.

Unfortunately, this is one of the highest fees charged by any of the leading money transfer apps.

Speed

PayPal international transfers can take one business day to complete. However, in normal circumstances, the money should arrive in minutes. The fast transfer option is one of the reasons PayPal is so popular.

👍 Pros

•Widely available

•Fast international transfers

•Well-established

•High transfer limits

👎 Cons

•High fees

•Complex fee structure

Regulation and Safety |

7.9 |

Costs |

4.0 |

Speed |

7.8 |

Easy account opening |

8.8 |

2. Wise: Best for Bank Transfers

Wise is a newer player in the money transfer space, but it's quickly become one of the most popular options.

One of the things that make Wise different is that it uses the real exchange rate - also known as the mid-market rate. This is the rate you'll find on Google, and it's the fairest rate you can get.

With Wise, you can make cheap money transfers to about 80 countries.

Costs

Typically Wise charges start from as little as 0.41% of the amount you're sending, plus a small fixed fee of $4.15. However, this fee will vary depending on the currency involved.

Wise's goal is to make money transfer as cheap as possible for you — and they're succeeding. Ultimately, they hope to offer free money transfers. Wise also applies a transparency policy to its pricing. You'll always know how much your transfer will cost before you make it.

Speed

A Wise money transfer may take a few days depending on the country you're sending money to. However, it's now getting better and faster, with most transfers now taking place within 24 hours. Currently, over 45% of all transactions are instant.

👍 Pros

•Low fees

•The real exchange rate

•Transparent pricing

•Fast international transfers

👎 Cons

•Not available in all countries

•Relatively new company

Regulation and Safety |

9.8 |

Costs |

9.2 |

Speed |

9.0 |

Easy account opening |

9.0 |

3. Revolut: Widest Banking Features

Revolut started as a prepaid travel card but has since evolved into a full-fledged financial app. It's now one of the most popular money transfer apps, with over 20 million users.

Revolut offers a wide range of banking features, including international money transfers. Currently, Revolut sends money to around 28 countries.

Costs

Revolut's standard plan has a 0.3% fee on international money transfers, with a minimum fee of $0.3 and a maximum fee of $6. This fee is not the lowest on the market but is still better than that of established apps like PayPal.

Speed

Revolut international money transfers typically take one business day. But in some cases, they may take up to 5 days. It depends on the country and currency involved.

👍 Pros

•Top up and hold multiple currencies

•Transparency pricing

•Expanding range of features

•One of the cheapest money transfers

•Better mid-market rates than most banks

👎 Cons

•Available in limited countries

•High conversion rates

Regulation and Safety |

8.1 |

Costs |

7.2 |

Speed |

8.0 |

Easy account opening |

7.5 |

4. Payoneer: Best for Free Services

Payoneer is an online payment platform that helps businesses and professionals receive payments from overseas. It offers a range of free services, including a prepaid debit card, a PayPal-like service, and direct bank deposits in select countries.

Payoneer is available in over 200 countries.

Costs

Sending funds from Payoneer to another Payoneer account is free. If you're sending money to a bank account, the fee depends on the country. But still, it's very low, starting at only $1.50.

Speed

Payoneer international money transfers usually take a few business days. But in some cases, they can be instant.

👍 Pros

•Free to send money from Payoneer to Payoneer

•One of the most affordable ways to send money internationally

•Available in over 200 countries

•Fast transfer processing

👎 Cons

•Unclear pricing structure

•Not ideal for international payments unless using a Payoneer account

•Currency conversion works for business transactions only

Regulation and Safety |

9.8 |

Costs |

8.0 |

Speed |

7.7 |

Easy account opening |

8.3 |

5. Skrill: Best for Versatility

Skrill is an all-round great money transfer service, allowing you to send and receive money in 131 countries. You can also hold funds in your Skrill account and use their prepaid Mastercard to make ATM withdrawals and in-store purchases.

Skrill is a great option if you need to send money internationally on a regular basis, as they offer very competitive exchange rates.

Costs

Skrill does not have a fixed fee for international money transfers. Instead, they charge a percentage of the amount you're sending. This makes it one of the best options for people sending small amounts of money.

If you're using a credit or debit card to fund your transfer, you'll pay a fee of up to $4.99.

Speed

Skrill international money transfers are usually instant. But in some cases, it can take up to 3 days for the funds to arrive.

👍 Pros

•Competitive fees

•Excellent customer reviews

•A high number of countries supported

•International transfers via credit and debit cards available

👎 Cons

•The exchange rate margin is unclear

•Only sends money to mobile wallets or banks

Regulation and Safety |

8.0 |

Costs |

8.6 |

Speed |

8.0 |

Easy account opening |

8.5 |

6. PaySend: Best for Card Transfers

If you'd like to send money internationally to a visa, UnionPay, or Mastercard holder, then PaySend is the best app for you. With PaySend, you can send money to over 150 countries at very reasonable rates. The service is available 24/7 from your desktop or mobile device.

PaySend delivers money in all supported currencies at the mid-market exchange rate, making it one of the most affordable ways to send money internationally.

Costs

The cost of sending money with PaySend depends on the currency you're sending. For example, when sending money internationally from the US to other wallets in local currency, the charge is $2. If the receiving wallet is in USD, you pay $2 for amounts less than $200. Above that limit, you pay 1% of the amount being sent.

Speed

PaySend has a partnership with Visa, Mastercard, and UnionPay, so it can send money to over 150 countries very quickly. In most cases, the funds will be available in the recipient's account within 30 minutes. For some countries, it can take up to 3 days.

👍 Pros

•Can send money to over 150 countries

•Mid-market exchange rate

•Instant transfers in most cases

•Competitive fees and exchange rates

👎 Cons

•Hidden fees

•Bank transfers are not supported in some countries

Regulation and Safety |

9.8 |

Costs |

8.7 |

Speed |

8.4 |

Easy account opening |

8.0 |

7. Remitly: Best for Cash Pick-up

Remitly is an international money transfer service that offers fast, convenient, and safe money transfers. It's one of the most popular ways to send money internationally, with over two million users. Remitly is available in over 100 countries and offers cash pick-up in select countries.

Only the sender needs a Remitly account. The recipient can pick up the cash at any of Remitly's partner locations.

Costs

The cost of sending money with Remitly depends on the country you're sending to, the amount you're sending, and the method of delivery. Once you login to Remitly, you'll see the exact fee for your transfer.

Speed

Remitly offers two pricing tiers: Economy and Express. With Economy, you can send money for a low fee, but it will take a few days for the funds to arrive. With Express, you'll pay a higher fee, but the funds will arrive in minutes.

👍 Pros

•Best for cash pick-ups

•Available in many destinations

•Wide range of pay-in and pay-out options

👎 Cons

•Fees are hidden in the exchange rate margin

•Few sender countries allowed

Regulation and Safety |

8.9 |

Costs |

9.5 |

Speed |

7.5 |

Easy account opening |

8.0 |

How to Choose the Cheapest Money Transfer Service

When looking for the cheapest money transfer service, there are a few things you should keep in mind:

Look for a Service With Low Fees

Some services charge a flat fee per transaction, while others charge a percentage of the total transaction amount. Look for a service that charges low fees so that you can save money on each transaction.

Special Conditions for Currency Conversion

Some services offer special conditions for currency conversion, such as no-fee conversions or preferential exchange rates. These can save you money when you're transacting in foreign currencies.

Support for Multiple Currencies

Some services allow you to hold and transact in multiple currencies, which can be helpful if you frequently deal in foreign currencies. This can save you time and money by eliminating the need to convert funds between currencies.

Additional Services Offered by the Provider

Some payment providers offer additional services beyond just processing payments. For example, some providers offer invoicing, accounting, and tax filing services. These additional services can save you time and money by simplifying your financial operations.

Number of Countries Supported

If you're doing business internationally, choose a payment service that supports a large number of countries. This will ensure that you can accept payments from customers in many different countries without worrying about cross-border restrictions or other problems.

How Can I Reduce my International Transfer Costs

When you make an international money transfer, you're likely to be charged a transaction fee by your bank or transfer provider. The good news is that you can do a few things to reduce the cost of your international money transfer.

Shop Around for a Competitive Exchange Rate

When transferring money abroad, getting a competitive exchange rate can make a big difference to the cost of your transfer. Make sure to shop around and compare exchange rates before you make your transfer. You can do this easily online with a currency converter.

Compare International Money Transfer Fees

Most banks and transfer providers charge a transaction fee for making an international money transfer. This fee is usually a percentage of the amount you're transferring, so it's important to compare fees before you make your transfer. You can find out more about the fees charged by banks and transfer providers on their websites.

Pay Attention to the Details

Make sure you know exactly what currency you're sending, how much money you're sending, and where it's going. Knowing these details will help you avoid any costly mistakes.

Best Apps to Send Money AnonymouslyHow to Send Money Internationally in Wise

1. Sign up with Wise

Enter your email address, create a password, or sign up with Google or Facebook. If you already have a Wise account, log in and choose "send money."

Sign up with Wise

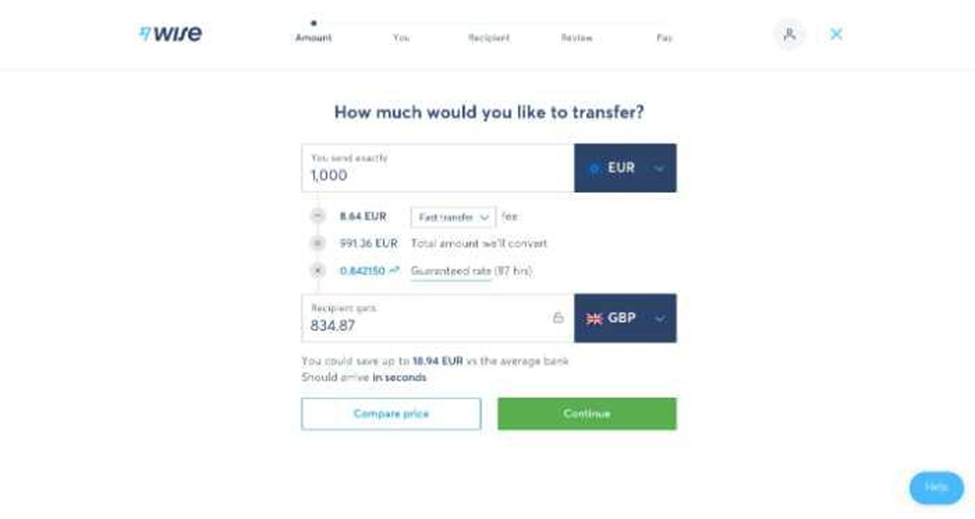

2. Check the Fees

Before you start your transfer, check the fees. Wise has a transparent fee structure, so you'll always know how much your transfer will cost.

Check the Fees

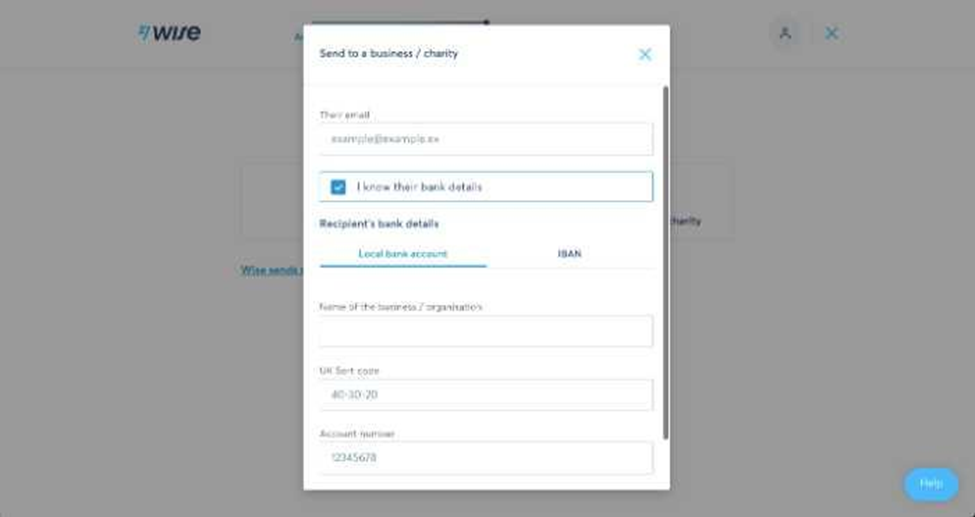

3. Add the recipient's details

You'll need the recipient's name, address, and bank details if you're sending money to a bank account.

Add the recipient's details

4. Verify your identity

Wise may ask you to provide additional information, such as your photo ID for large amounts of money or some currencies.

5. Make the transfer

You can then complete the process by choosing your payment method. Wise has three main payment methods: bank debit (ACH), debit or credit card, and wire transfer.

Are Money Transfer Services Safe?

With so many money transfer services, it can be hard to know which one to choose. And even once you've made your decision, you might still have doubts about whether the service is safe. After all, you're trusting them with your hard-earned money.

Here are a few things to keep in mind when you're choosing a money transfer service:

See if the Service Is Licensed by a Regulator

Each country has its own financial regulator, so you'll need to check the website of the regulator in your country of residence. The license should be prominently displayed on the money transfer service's website. If you can't find it or are unsure whether the license is legitimate, contact the regulator directly and ask.

Look at Online Reviews

Look for reviews on independent websites rather than just on the service's own website. See what people are saying about their experience with the service — good and bad. If there are many complaints about hidden fees or poor customer service, that's a red flag.

But remember that even the best money transfer services will have some negative reviews—after all, you can't please everyone! Just make sure that the positive reviews outweigh the negative ones.

Contact Customer Support

Contact customer support and ask them any questions you have about using the service. See how long it takes them to respond and whether or not they're able to answer your questions satisfactorily. A good customer support team should be quick to respond and knowledgeable about all aspects of the service.

Summary

Sending money internationally doesn't have to be complicated or expensive. By following the tips in this article, you can save money and avoid any costly mistakes. Just make sure to shop around, compare fees, and pay attention to the details. And if you're ever unsure about anything, contact customer support for help.

FAQs

What's the cheapest way to transfer money internationally?

There is no one-size-fits-all answer to this question, as the best way to transfer money internationally depends on your specific circumstances. However, you can do a few things to reduce the cost of your international money transfer, such as shopping around for a competitive exchange rate and choosing a money transfer service with low fees.

How can I avoid hidden fees when sending money internationally?

The best way to avoid hidden fees is to choose a money transfer service that is upfront about all of its charges. You can also contact customer support and ask them about any potential fees before you make your transfer.

How do I know if a money transfer service is safe?

You can do a few things to make sure a money transfer service is safe, such as checking to see if it's licensed by a financial regulator and reading online reviews.

How long does an international money transfer take?

The time it takes for an international money transfer to go through can vary depending on your service and the country you're sending money to. In general, however, most transfers are completed within a few days.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!