What is Bitcoin (BTC), and Should You Buy It?

It doesn’t look like the growth of cryptocurrency will be slowing down any time soon. As usual, Bitcoin, the world’s most valuable cryptocurrency, is leading the charge.

Nasdaq published a projection showing that the Bitcoin adoption rate is faster than that of the internet. As a result, Bitcoin is predicted to reach the billion-user mark almost twice as fast as the internet did.

If you feel like you don’t quite understand all the hype or whether you should invest in some Bitcoin yourself, this article is for you. Let’s take a deep dive into the revolutionary cryptocurrency, Bitcoin.

What is Bitcoin?

Essentially, Bitcoin is a form of decentralized digital currency. It was created to be a revolutionary method of peer-to-peer currency that is secure, transparent, and doesn’t require any middlemen.

You can use it for payments or transfer money over the internet. But Bitcoin as technology also encompasses the software and protocols that govern the Bitcoin network and blockchain.

Bitcoin is the first cryptocurrency that hit the global market and is the most valuable. Its current market cap is over $900 billion.

Besides being the most valuable, it’s also the most influential. Bitcoin created the space for the thousands of cryptocurrency projects in the market today. Furthermore, the blockchain technology that powers Bitcoin has disrupted the financial industry and almost every industry in the world. If you want to learn more about Bitcoin, read our Guide Bitcoin for Dummies

Bitcoin as a payment system

Bitcoin works in some ways like other digital payment systems, such as PayPal. However, you’re exchanging digital assets, not fiat currency.

Users have online or offline wallets that each have unique addresses and are used to store their cryptocurrency. Making a payment or transfer is as simple as entering the destination wallet’s address and clicking send.

For example, let’s say you wanted to send money to a friend or relative in another country. With Bitcoin, you could deposit money directly into the personal crypto wallet within minutes, not days. Instead of paying high fees to payment processors, you would only have to pay a minimal transaction fee that helps maintain the network.

Bitcoin as digital gold

Bitcoin is often referred to as ‘digital gold.’ Like gold, it has several inherent characteristics that make it a valuable asset. For example, both gold and Bitcoin are deflationary, decentralized, and offer a hedge against inflation.

For one thing, Bitcoin’s token supply is regulated. Unlike fiat currency, which can be printed without limit, Bitcoin has a supply cap of 21 million tokens. Over 90% of them are already in circulation.

Learn How to Get Free BitcoinsSince it’s a scarce asset, many people compare it to gold as a hedge against inflation. Assets suitable to hedge against inflation generally exhibit these features: scarcity, accessibility, and durability.

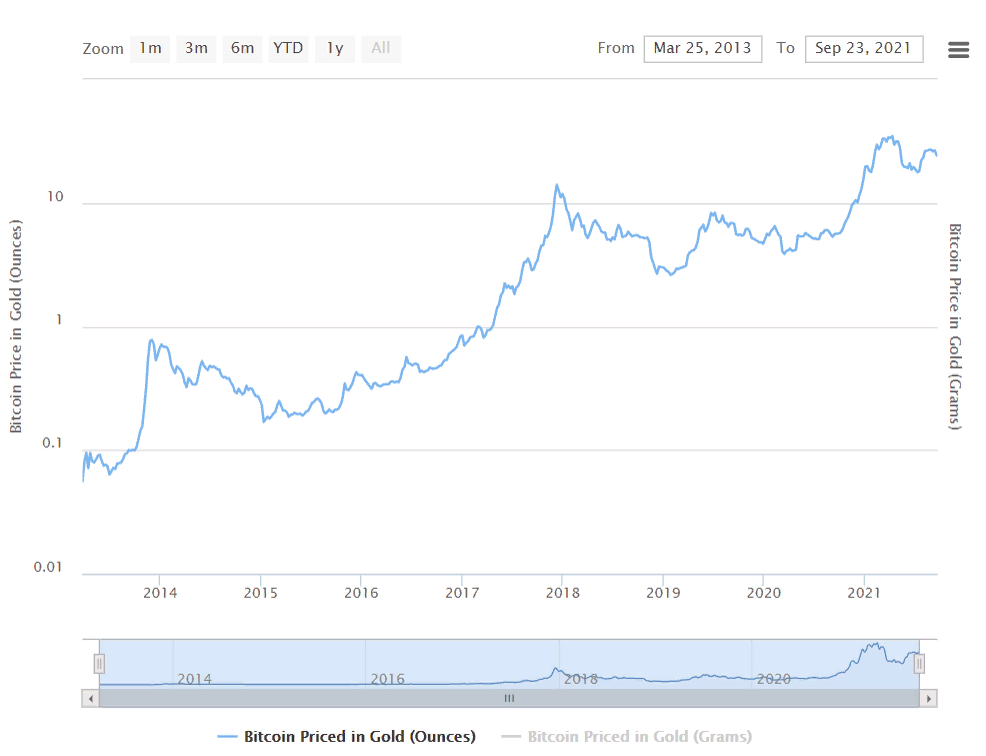

Bitcoin has established an influential position in the market and demonstrated that it could accumulate growing demand over time. This chart shows the rising value of Bitcoin relative to the price of gold. Comparing BTC to gold is probably a better comparison than fiat currency due to fiat’s potentially volatile inflation rates.

Bitcoin Chart from 2013

Pros and Cons of Bitcoin

Pros

Decentralized

No single party or institution controls Bitcoin. Transact directly peer-to-peer, without influence from banks or governments.

Transparency

Bitcoin’s blockchain is open-source. As a result, every transaction is verified and published to the public blockchain, making it impossible to forge or manipulate records.

Privacy

Bitcoin facilitates anonymous payments. Your personal information isn’t shared when you make a transaction.

Security

Blockchain technology is highly secure. Since it relies on a consensus mechanism, it would take enormous financial resources and computing power to force the network into accepting fraudulent information. For personal use, both online and offline storage methods offer highly encrypted protection of your cryptocurrency.

Mobility

You can use Bitcoin anywhere, as long as you have an internet connection. No more requesting approval from your bank to use your credit card when you’re traveling abroad.

Irreversibility

Once a Bitcoin transaction is made, it can’t be reversed by anyone, not even a bank or government. This protects sellers by eliminating credit card chargeback fraud and gives buyers confidence that no one can manipulate their financial transactions.

Low fees

Since there aren’t any middlemen between sender and recipients, fees are drastically reduced. You only need to pay a small fee to the network, which is used to maintain the blockchain.

Accessibility

Bitcoin removes barriers to entry that exist in traditional finance. Many people around the world are prohibited from accessing banking services, but anyone can use Bitcoin as long as they have a computer or phone with an internet connection.

Cons

Price volatility

Bitcoin and other cryptocurrencies are susceptible to wide fluctuations in price. This weakens confidence in the crypto industry and presents a concern for further adoption.

Lack of inherent value

Critics will argue that Bitcoin doesn’t have any inherent value since it isn’t tied to a physical asset.

High energy usage

Mining and maintaining Bitcoin’s blockchain has high electricity requirements.

Scalability

Traditional financial systems still reign over the market. Payment processors like VISA process far more digital transactions than Bitcoin, and further public adoption is needed before crypto can compete on that level.

Potential for illegal activities

Since crypto offers a high degree of privacy and anonymity, it is attractive to criminal enterprises.

Regulation

Governments and global regulatory bodies are constantly introducing new laws that apply to cryptocurrency. Since the industry is still relatively young, it remains to be seen what effect these regulations will have on the further adoption of Bitcoin and crypto as a whole.

How to Buy Bitcoin with a Bank AccountHistory of Bitcoin

1. August 18, 2008 – Registration of bitcoin.org

The domain was registered anonymously, so the identity of the person is still unknown.

2. October 31, 2008 – Bitcoin whitepaper published

A person or group going by the name Satoshi Nakamoto released a whitepaper titled Bitcoin: A Peer-to-peer Electronic Cash System.

3. January 3, 2009 – First bitcoin block mined

Block 0 is known as the “genesis block.” It contains this text referencing The Times newspaper: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

4. January 12, 2009 – First bitcoin transaction

The first ten bitcoins are sent from creator Satoshi Nakamoto to Hal Finney, another pioneer in the blockchain space.

5. November 6, 2010 – Market cap exceeds $1 million

The combined value of all bitcoins in circulation passed the million-dollar mark for the first time.

6. October 2011 – Litecoin created

Bitcoin forks for the first time, and a new token, Litecoin, was formed.

7. September 27, 2012 – Bitcoin Foundation founded

The group was established to promote and encourage the adoption and development of Bitcoin.

8. December 17, 2017 – New all-time high

The price of Bitcoin reached $19,783.06. This brought Bitcoin even more into the mainstream.

9. January 1, 2019 – Cryptocurrency bear market continues

Since reaching its all-time high, the price dropped significantly throughout 2018. By the beginning of 2019, it stood at $3,747 – an 81% drop from its peak.

10. December 2020 – Price rebounds after interest from institutional investors

Bitcoin reached $24,000, an increase of 224% since the start of the year, after sustained interest from large corporations and investors.

11. April 14, 2024 – Current all-time high reached

Bitcoin’s price passed $64,000 for the first time in its history.

12. June 9, 2024 – El Salvador makes Bitcoin legal tender

El Salvador became the first country to adopt Bitcoin as legal tender. This set a global precedent for the nationwide adoption of cryptocurrency. Read more in the article BTC Full Price History: Evolution of Bitcoin.

How does Bitcoin work

Now that you know a little more about what Bitcoin is and how it came to be, let’s discuss how it works.

Learn how to Earn BitcoinBitcoin mining

Mining is the process of creating new bitcoins that are entered into circulation. More specifically, miners work as validators of the blockchain network that Bitcoin is built upon.

Each new block of bitcoin transactions must first be mined. Only then can it be added to the blockchain. With the help of special computer hardware and software, miners compete to solve complicated mathematical problems. The first miner to correctly solve the problem can add a new block of transactions to the blockchain.

Since mining new blocks is expensive and energy-intensive, successful miners are rewarded with bitcoin and transaction fees.

Bitcoin blocks are mined once every ten minutes or so. Other cryptocurrencies have different mining rates.

How to mine Bitcoin?Proof of Work (PoW) algorithm

The Bitcoin network relies on a proof of work consensus mechanism. Essentially, it’s a decentralized process for securing the network.

Through proof of work, the network can validate transactions and reach agreements about shared information without involving any trusted third parties.

A network of computers spread across the globe must reach a consensus about which transactions are valid. They do this by working on computer-generated algorithms until a set of validated transactions are grouped into blocks. These validated blocks comprise the blockchain.

Network growth

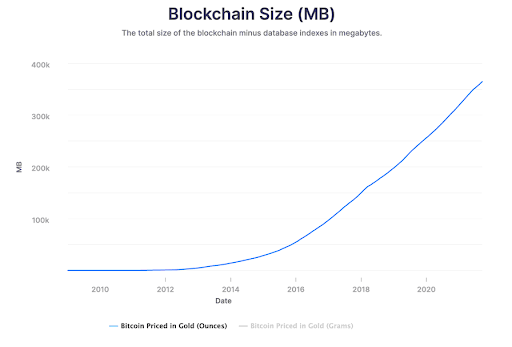

Overall, Bitcoin’s blockchain has continued to grow at an exponential rate since its inception. The blockchain size is indicative of the number of transactions that occur on the network.

Blockchain Size (MB)

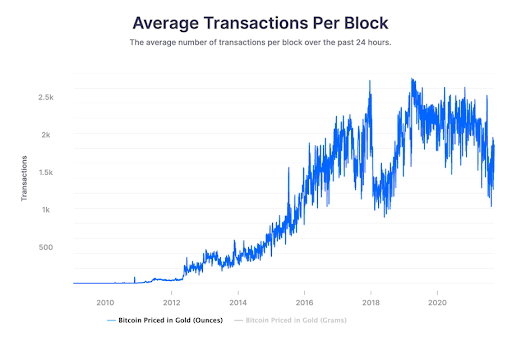

Likewise, the average number of transactions per block is a good indicator of network activity. As shown by the chart below, block transactions correlate to price action. Increased activity occurred around the all-time highs of 2017 and 2020-2023. Overall, the average number of transactions per block is on an upward trend.

Average Transactions Per Block

Bitcoin advantages

There are a few main advantages that Bitcoin presents over fiat currency or other traditional financial assets. Namely, decentralization, limited supply, and high security.

Decentralization

Decentralization is a foundational aspect of Bitcoin. Since no country or institution controls Bitcoin, the network is open-source and accessible to all.

Once a transaction has been added to the blockchain, not even a government can reverse it. This gives individuals the confidence that they are in complete control over their own money.

Crypto transactions aren’t connected to your identity either. For example, when you use Bitcoin to pay an online seller, they don’t access your personal data. As a result, your private information won’t be sold or shared with advertisers, credit agencies, or banks. In addition, your risk of identity theft and personal data leaks is significantly lowered.

A decentralized network also results in lower fees for the user since no third party is charging intermediary processing fees. Secure global transfers can be made in seconds or minutes, compared to the days it would take with traditional payment providers.

Limited supply

As mentioned earlier, Bitcoin’s supply is limited by a hard cap of 21 million tokens, and 90% of these coins are already in circulation.

Circulating Supply

The tokens also have a decreasing rate of supply to control inflation. Every four years, the mining rewards are cut in half. This also cuts in half the inflation rate and the rate of new coins entering circulation. This event is called a halving. It means that by around 2140, the entire supply of Bitcoin will be mined.

To put halvings into perspective, imagine if the world’s gold mining rate and output were cut in half every four years. This would likely drive up the price of gold and establish a limit to its supply. The same is true for Bitcoin. Historically, every time a halving occurs, the price of Bitcoin surges. Over the next four years, the price usually drops before surging again at the next halving.

High security

Blockchain technology is highly secure. It is incredibly hard to corrupt the system since it relies on an extensive network of independent validators constantly verifying new transactions. The blockchain ledger is unable to be changed once a block has been added. Thus, not even a government or bank can manipulate the record.

Attempting to attack the Bitcoin blockchain would require enormous amounts of energy and money. Just in terms of the computer hardware needed, such an attack would cost over $5.4 billion.

Who owns the most bitcoins - top 15 holdersBitcoin as Investment

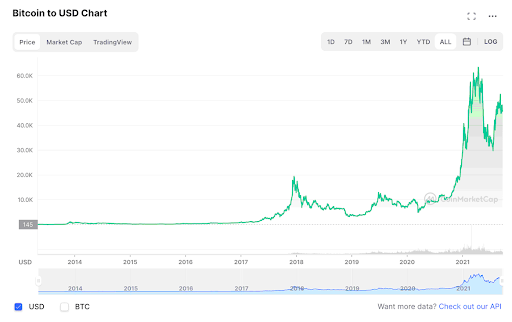

BTC to USD Chart

Regulation in major countries

Governments can’t manipulate crypto technology. However, they can regulate implementation and usage. China’s issued a ban on bitcoin mining which caused a substantial drop in global hash rates. This is an excellent example of the effects of national regulations on the worldwide crypto market.

Bitcoin mainstream adoption

More and more countries are taking a positive stance towards crypto. In January 2023, El Salvador became the first country to make Bitcoin legal tender. Perhaps other countries will follow El Salvador’s lead. If so, crypto adoption will continue to rise.

MicroStrategy investment firm is one of the leaders in the Bitcoin investment space. They now hold over $5.3 billion in Bitcoin and are leading the way for other investment groups to follow suit. Their example shows how Bitcoin adoption is becoming more accepted in the world of mainstream finance.

Bitcoin Criticism

Bitcoin is not without its critics. As with any new, disruptive technology, people are quick to point out its shortcomings. Two of the most common criticisms are its high energy consumption and potential for use in illegal activities.

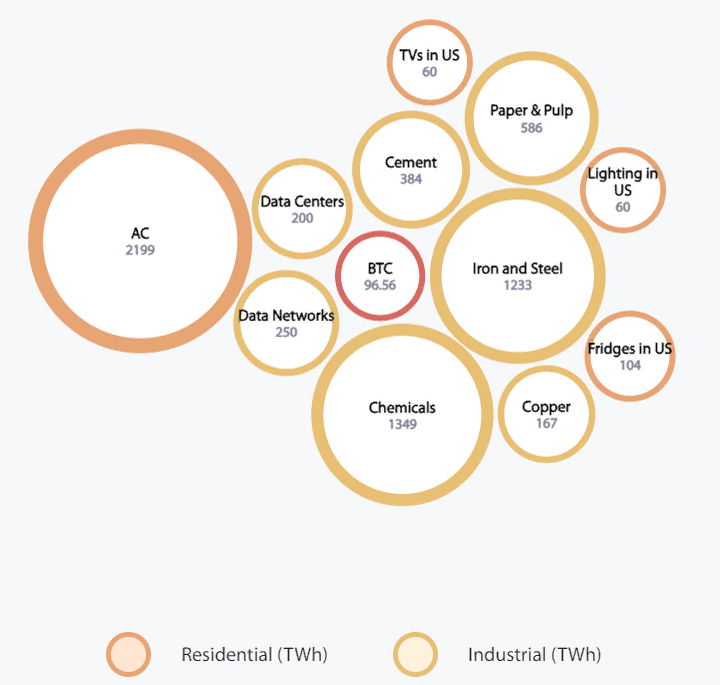

High energy consumption

Whenever the price of bitcoin gets a boost, the media is filled with stories about Bitcoin’s reportedly unsustainable energy consumption. Since this is one of the most discussed criticisms, it’s worth taking a detailed look.

On the one hand, it’s true. Bitcoin’s network does require a lot of energy. The Cambridge Bitcoin Electricity Consumption Index (CBECI) puts Bitcoin’s annual electricity consumption at around 99 terawatt-hours (TWh) per year (though this number fluctuates) – roughly somewhere between the annual power consumption of the Philippines and the Netherlands.

But country-based comparisons aren’t the most helpful metric for determining Bitcoin’s energy efficiency. After all, one large city in a developed nation may use more energy than an entire developing economy. Bitcoin should be compared to financial assets, not countries.

Estimates for the gold industry’s electricity consumption are between 131 TWh and 265 TWh annually. As for the traditional banking system, a recent report by Galaxy Digital found that the entire banking system consumes a staggering 263.72 TWh of energy per year. By most accounts, this makes both gold and the banking system much bigger energy users than Bitcoin.

Here’s another interesting comparison. The electricity used by “always-on” household appliances in the United States adds up to around 1,375 TWh/year, over 12x the power consumption of Bitcoin’s network.

Overall, Bitcoin’s share of global energy consumption only amounts to roughly 0.06%. So, it appears that the label of ‘dirty business’ is unfairly applied to Bitcoin. Traditional assets and financial systems consume much more significant amounts of energy.

Bitcoin energy usage compared to other industries

Money Laundering

Criminals laundered around $2.8 billion via cryptocurrency exchanges in 2019. More recently, British police confiscated a crypto haul valued at roughly $250 million from an ongoing money-laundering operation. This made it one of the largest cryptocurrency seizures in history.

Why are criminals so attracted to crypto?

Since crypto is digital and decentralized, it offers some convenient characteristics. Anyone can use it, the identity of users is relatively anonymous, and it’s easy to move across international borders.

However, before the issue is blown out of proportion, it should be noted that less than 1% of all cryptocurrency transactions today are suspected to be connected to illegal activity. This is down from 35% in 2012.

Most major crypto exchanges now have rigorous KYC and anti-money laundering regulations, contributing to the sharp decrease in unlawful activity.

Should you buy Bitcoin?

Before you jump into crypto investing, make sure you conduct your own research. Find projects that you believe in and learn all about them before investing. Don’t just jump on the bandwagon of tokens with the largest following.

Here are some of the reasons why you might decide to buy Bitcoin:

-

You support a decentralized financial system without governing oversight.

-

Bitcoin is a deflationary asset. It’s likely to increase in value over time and could offer a hedge against fiat inflation.

-

It gives you a flexible, mobile way to make payments, send money, and invest. It’s global and operates 24/7.

It might be a profitable way of diversifying your investment portfolio. You can make big profits if you buy and sell Bitcoin on time. You can open both long and short trades. There are many ways to make money with Bitcoin. You can also learn information about the best time to trade Bitcoin. You can choose the best option for yourself.

Remember, never invest more money than you can afford to lose. Cryptocurrencies can be highly volatile, and many investors have lost considerable amounts of money by making uninformed decisions.

Read more in the article: How Much Should I Invest In Bitcoin To Start?

Should I Buy Bitcoin in 2024?How to buy Bitcoin in 4 steps

Choose an exchange

There are many cryptocurrency exchanges to choose from. Here are some of the key features to look out for when making your decision:

Country support

It doesn’t matter if it’s the best platform out there. If it doesn’t support your country, you won’t be able to trade. Make sure you check if you’re eligible to use the exchange before judging other criteria.

Security

Every day, people lose money to scam exchanges or platforms with weak security. Make sure you choose a trusted platform that offers high-security measures and even some measure of insurance if they lose your funds.

Purchase method

Do you want to fund your account with a bank transfer, credit card, PayPal, or another payment option? Check to see if your preferred method is supported. Some exchanges only allow you to exchange between cryptocurrencies, and some only offer KYC-approved bank transfers. Do your research.

Supported coins

If you’re only interested in buying the most popular cryptocurrencies, then most exchanges will list them. However, if you’re also interested in up-and-coming altcoins, then you’ll want to find an alternative platform that lists tokens with less exposure.

Fee structure

How much is the exchange charging users to conduct trades? This is a crucial question if you buy and sell often. On the other hand, if your strategy is to buy rarely and hold for an extended period, user experience and security would be more important for you.

User experience

You should enjoy using your platform of choice. It should be intuitive and offer the level of technical analysis you need to conduct your investment strategy. Take a look at a demo interface and see if it suits your style.

Fund your account

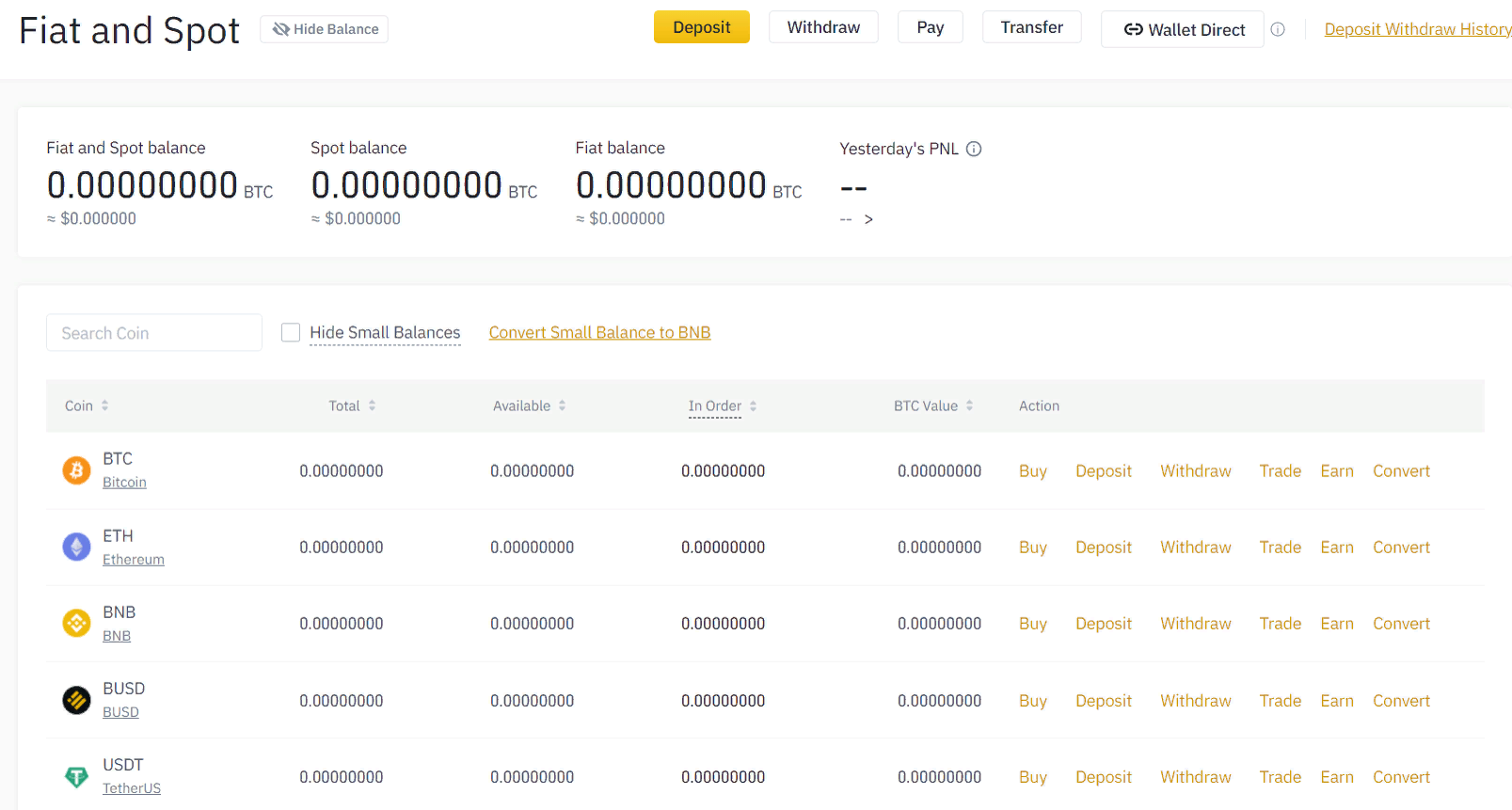

Using Binance exchange as an example, here’s how you fund your account to buy crypto.

First, log in to your account, go to your wallet, and click fiat/spot.

Account Funding on Binance

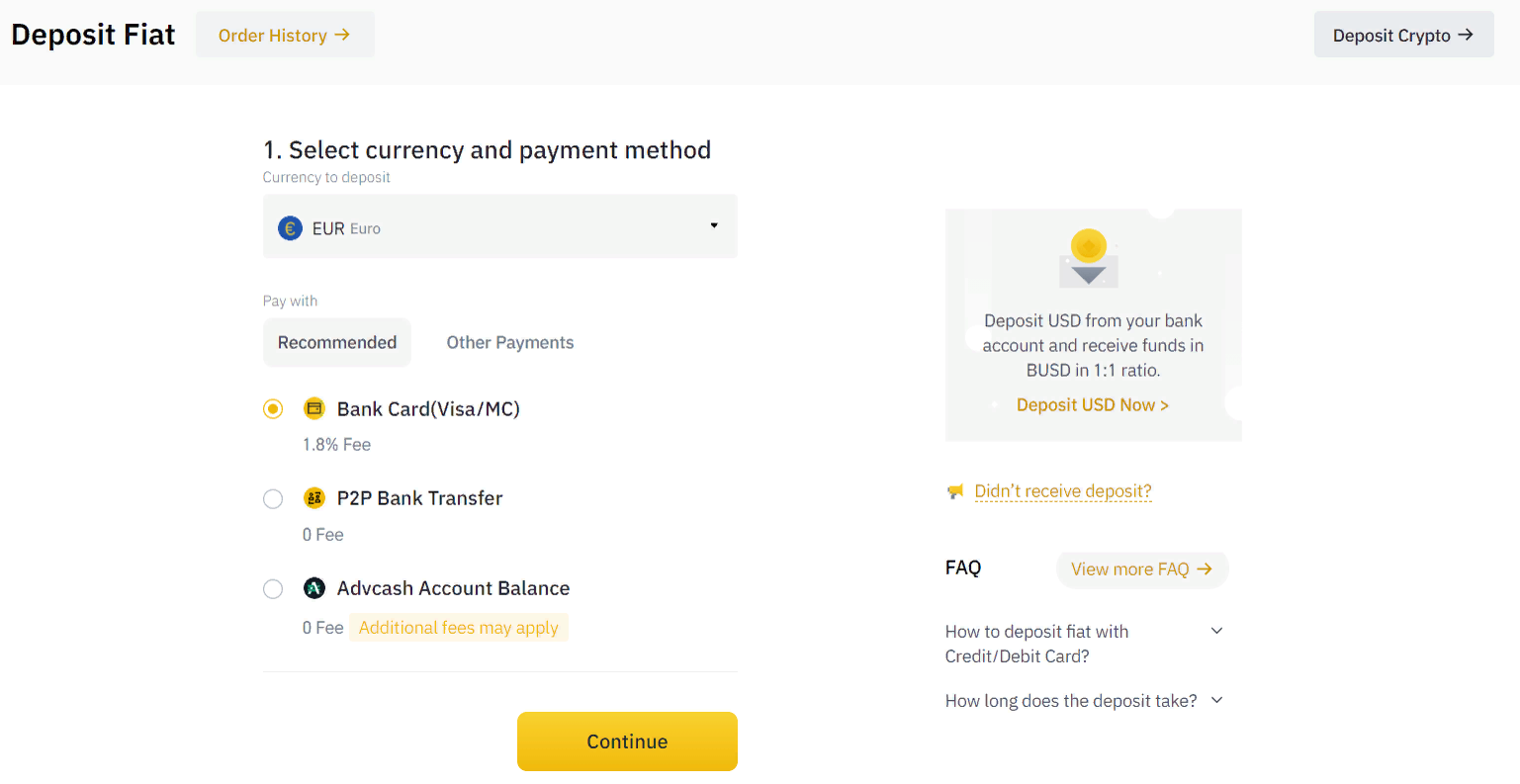

Then, click deposit and select Fiat

Account Funding on Binance

If you’ve passed the verification requirements, you’ll be able to deposit and start trading.

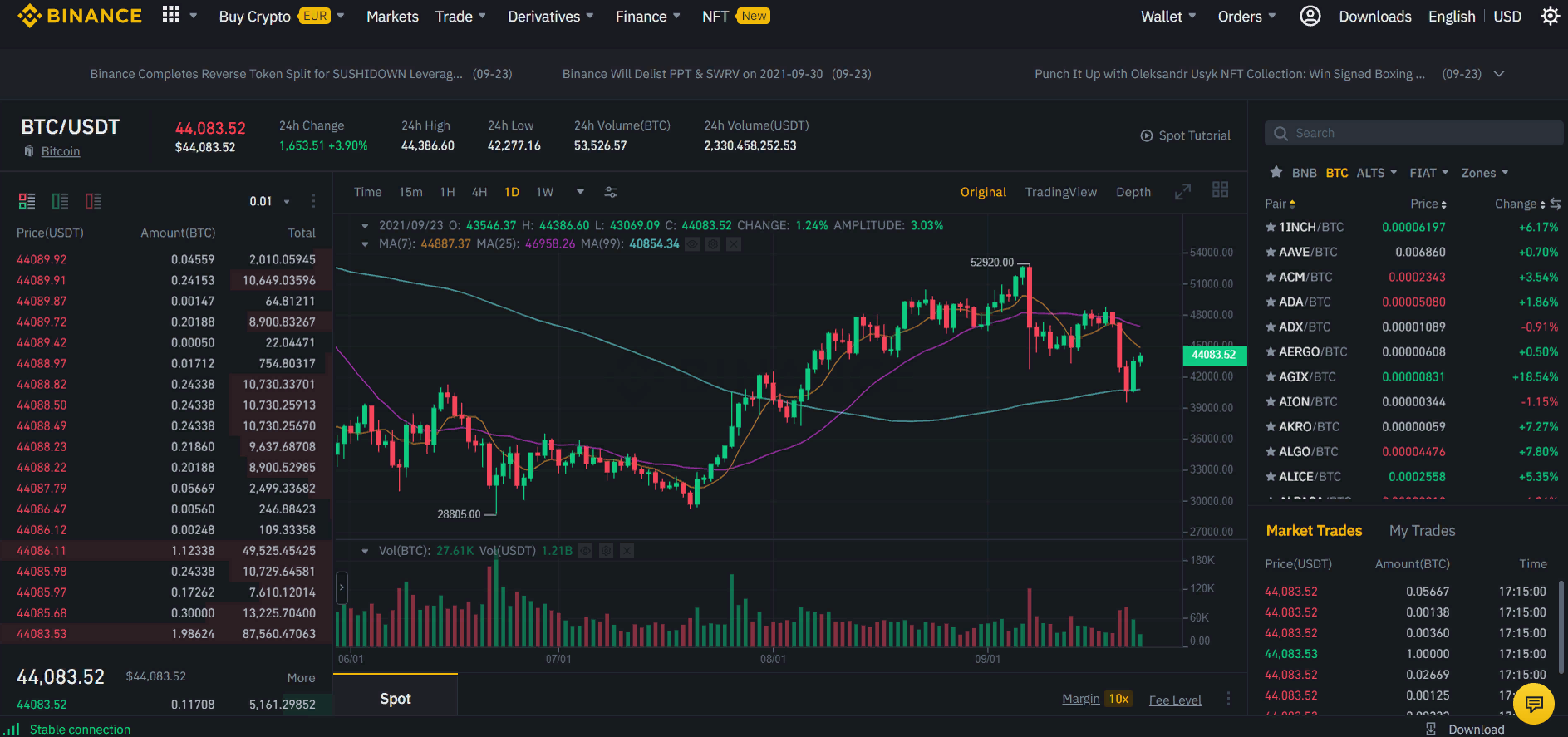

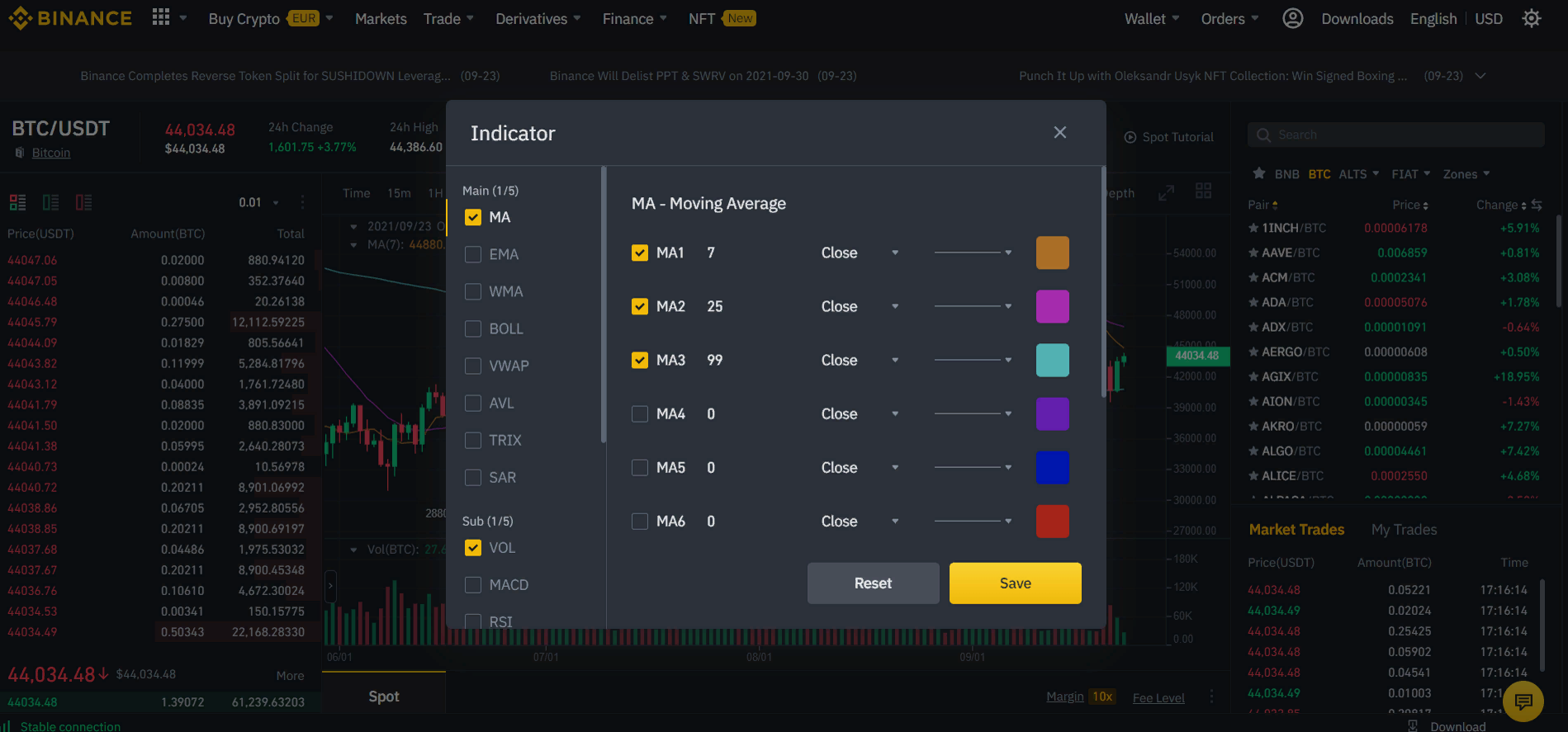

Conduct market analysis

Binance offers a wide range of technical analysis tools. Do your research on using the various indicators that can help you determine when to enter and exit the market.

In the screenshots below, we’ve activated the EMA, BOLL, MACD, and RSI indicators. Of course, you can customize each indicator according to your preference.

BTC Market Analysis

BTC Market Analysis

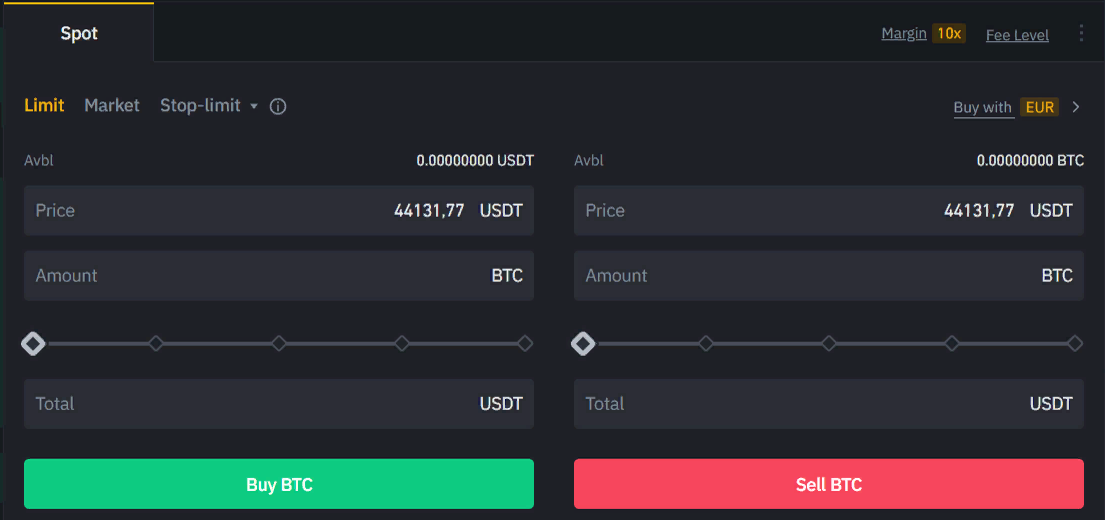

Buy Bitcoin

To buy Bitcoin, first, make sure your account is funded. Then move to the upper right corner of the analysis interface, and you’ll see a box for conducting a trade.

How to Buy Bitcoin

Select the type of order you’d like to place. Choose either limit, market, or stop-limit. Enter your desired amount of Bitcoin, and it will calculate the price in your currency of choice.

When you’ve entered your preferred order, click buy, and the order will be placed immediately.

If you want to save money, pay attention to the article prepared by experienced analysts at Trader's Union, in which they have highlighted the cheapest places to buy Bitcoin and other cryptocurrency.

Best Bitcoin Exchanges in 2024

| Exchange | Fees | Deposit Min. | Range of cryptocurrencies | User Experience | Overall |

|---|---|---|---|---|---|

0.012% - 0.1% |

None |

Extensive |

Excellent. Offers a range of technical options |

5/5 |

|

It varies by transaction type |

$1 |

Below average |

Technically advanced |

3/5 |

|

Coinbase Pro: up to 0.5% |

$10 |

Average |

Excellent. Coinbase for beginners, Coinbase Pro for advanced users |

4/5 |

Binance

Binance is the world’s largest cryptocurrency exchange. It processes over $13 billion in trading volume every day. One significant advantage of the Binance platform is that it offers hundreds of altcoins in addition to the most popular cryptocurrencies.

Its technical analysis interface is one of the best on the market, and it’s customizable according to your needs, whether you’re a beginner or an experienced trader. In addition to spot trades, you can also stake your coins, trade derivatives, and conduct other advanced trading activities.

As far as fees go, Binance offers better rates than most exchanges. Transaction fees can go as low as 0.012% - 0.1% per trade. This is a steal compared to other big players.

Overall, there’s a good reason why Binance is so popular. It’s hard to find a globally-supported platform that offers such a large number of cryptocurrencies, low fees, and advanced analysis tools as the Binance exchange.

ByBit

ByBit offers something different from Binance and Coinbase. It’s a cryptocurrency derivatives exchange. This means you can apply up to 100x leverage on trades.

Trading with leverage can be extremely risky, so beginners are advised against it. However, if you would like to learn how to trade derivatives, ByBit offers a comprehensive demo platform to help you gain experience and an educational resource section.

Overall, it’s not a good option for the general crypto investor who just wants to hold some Bitcoin for the long term. However, more advanced users may appreciate ByBit’s technically advanced platform.

Coinbase

Coinbase is one of the most popular crypto exchanges, especially for users in the U.S. It has performed so well that it’s now a publicly-traded company. When coins become listed on Coinbase, they usually shoot up in value.

One of the best aspects of Coinbase is that they offer two options: Coinbase for beginners and Coinbase Pro for more advanced traders. You can freely transfer your portfolio between the two platforms, so it makes Coinbase an excellent option for those starting out but who want a more advanced option further down the line.

Coinbase Pro offers better technical analysis, market stop and limit orders, and very low fees. It’s also a beautiful, intuitive interface to use. Coinbase, on the other hand, simplifies crypto trading so that anyone can do it. In addition, the interface is exceptionally user-friendly. One drawback to the standard Coinbase option is that the fee structure is high compared to other exchanges.

Overall, Coinbase is an excellent choice for users in the U.S. It is a trusted, secure platform that can grow with you as your requirements advance.

10 Best Platforms To Buy Bitcoins AnonymouslyTop 10 Biggest Cryptocurrencies to invest in

It’s essential to do your own research before investing in any cryptocurrency. However, we’ve compiled a list of some of the top 10 cryptocurrencies to invest in. We’ve based our recommendations on various factors, including the historical annual and monthly returns on investment.

| Cryptocurrency | Industry | Current price | 1y return | 1m Return | Total score | |

|---|---|---|---|---|---|---|

Binance Coin (BNB) |

Cryptocurrency exchange |

603.20$ |

65.29% |

60.03% |

9.5 |

Invest |

Cardano (ADA) |

Blockchain platform |

0.75$ |

79.40% |

31.80% |

9.2 |

Invest |

Ripple (XRP) |

Payments |

0.00$ |

NaN% |

NaN% |

9 |

Invest |

Dogecoin (Doge) |

Payments |

0.00$ |

NaN% |

NaN% |

8 |

Invest |

Polkadot (DOT) |

Blockchain platform |

0.00$ |

NaN% |

NaN% |

8 |

Invest |

LItecoin (LTC) |

Payments |

0.00$ |

NaN% |

NaN% |

7.6 |

Invest |

Stellar (XLM) |

Payments |

0.00$ |

NaN% |

NaN% |

7.5 |

Invest |

Uniswap (UNI) |

Decentralized exchange |

0.00$ |

NaN% |

NaN% |

7.4 |

Invest |

Tron (TRX) |

Blockchain platform/Media |

0.00$ |

NaN% |

NaN% |

7 |

Invest |

IOTA (MIOTA) |

Internet of Things |

0.39$ |

62.48% |

40.10% |

6.9 |

Invest |

Summary

Bitcoin is a liquid, digital store of value built on perhaps the most secure financial network globally, decentralized and protected from corruption and bad actors.

In addition, it has been the basis for the growth of an extensive ecosystem of other cryptocurrency assets and protocols that provide value through a wide variety of usage cases, from smart contracts to governance systems.

Even if you don’t make a personal investment in Bitcoin, it’s important to understand its significance and effect on our society.

FAQs

Will Bitcoin’s supply ever run out?

Over 90% of bitcoin tokens are already in circulation, but it will take until around 2140 before we reach the 21 million token limit.

Is Bitcoin bad for the environment?

Bitcoin mining does require a lot of energy. However, it uses less energy than the gold or banking industries. It can also drive up the efficiency of renewable energy systems by using power in remote locations or during off-peak hours.

What is a simple definition of Bitcoin?

Bitcoin is a digital currency. It can be used to send payments over the internet and is based on a decentralized network that is very secure and transparent.

Will the price of Bitcoin keep going up?

No one can predict the price of any cryptocurrency. However, due to its scarcity and high demand, the value of Bitcoin has historically increased over a multi-year timeframe.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.