The History of Bitcoin From Zero To Hero

BTC Full Price History:

-

Bitcoin's all-time high reached $68,789.63 on November 10, 2021.

-

The largest single-day drop was a 20.5% fall on May 19, 2022.

-

The largest single-day rise was a 17.8% increase on November 10, 2021.

-

From 2013 to 2023, Bitcoin's average annual return was 230%.

-

A $1000 investment in Bitcoin in 2010 would be worth over $859 million at the 2021 peak.

-

Factors influencing Bitcoin's price include speculation, adoption, and regulation.

-

Bitcoin's pricing benefits from decentralization but suffers from high volatility and susceptibility to market sentiment.

-

Despite significant year-to-year price fluctuations, Bitcoin's long-term growth has exceeded 1 million times its initial value.

Bitcoin is not just a digital currency, it's a phenomenon that has reshaped the financial landscape since its inception. The history of Bitcoin is pivotal for understanding its current value and potential future. It was conceived as a decentralized alternative to traditional currencies, a digital form of money that uses cryptography to control its creation and management, rather than relying on central authorities.

-

What is BTC all time high?

Bitcoin's all-time high was $68,789.63, reached on November 10, 2021.

-

What is the Bitcoin price bottom?

The "bottom" or lowest recorded price of Bitcoin is difficult to pinpoint due to its early negligible trading value, but it was effectively worth a fraction of a cent in 2009.

-

How much did Bitcoin cost in 2009?

In 2009, Bitcoin was released and had no established market price (effectively, it was worth 0) until 2010.

-

What was the price of 1 Bitcoin in 2010?

In 2010, the price of one Bitcoin was around $0.08 in July, before it appreciated to $0.30 by the end of the year

Bitcoin price history: from $0 to $1

In the early days of Bitcoin, the pricing mechanism was rudimentary at best. On October 5, 2009, the New Liberty Standard set the first exchange rate, valuing Bitcoin at $0.000764 per unit, meaning $1 could purchase a staggering 1,309.03 BTC.

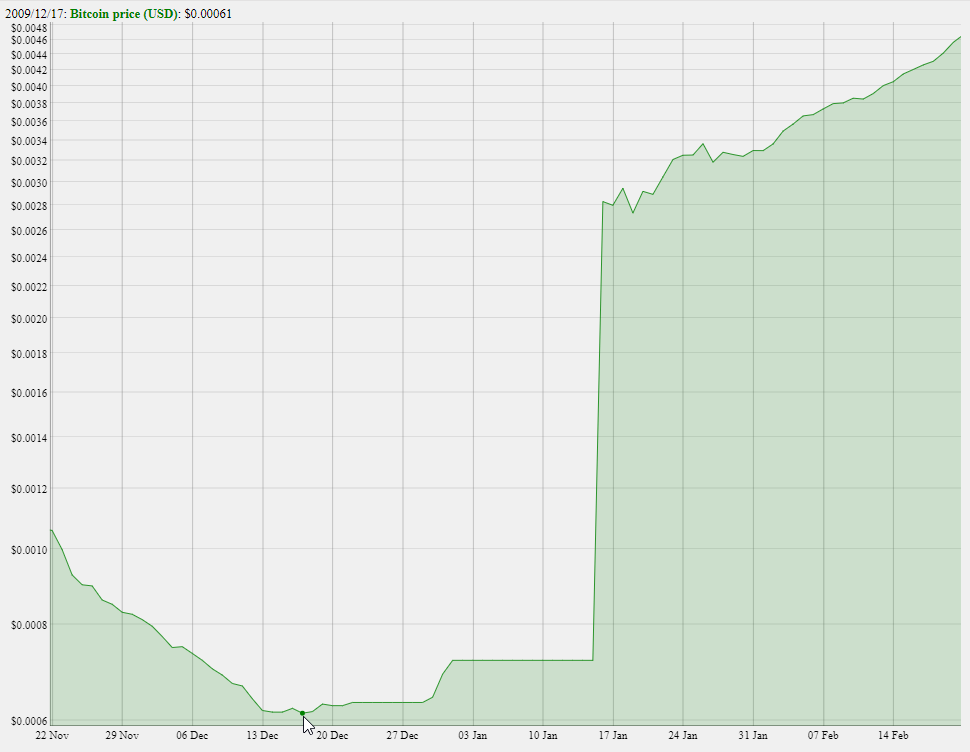

The recorded historical low of bitcoin

The provided image depicts a line graph that illustrates the early price movements of Bitcoin. The X-axis represents the time frame from late November 2009 to mid-February 2010, while the Y-axis shows the price of Bitcoin in USD. Initially, the price is a flat line, near zero, indicating negligible or no trading activity. However, the line then spikes dramatically, suggesting a surge in interest or valuation of the cryptocurrency.

The story of Bitcoin's creation traces back to 2008 when an individual or group under the pseudonym Satoshi Nakamoto published the Bitcoin whitepaper. This revolutionary document outlined a method for creating a decentralized ledger, the blockchain, to record transactions securely and anonymously. The network came into existence with Satoshi mining the first block of Bitcoin in January 2009.

From 2009 to 2011, Bitcoin's journey was characterized by its adoption by a niche community of cryptographers and technology enthusiasts. The first real-world transaction occurred in 2010 when Laszlo Hanyecz famously purchased two pizzas for 10,000 Bitcoin, an amount valued at about $30 at the time but an amount that would be worth millions today.

This era was marked by significant milestones, including the establishment of the first Bitcoin exchange and the release of version 0.3 of the Bitcoin software, which garnered attention from tech giants and the media alike. The chronology of these years laid the foundation for Bitcoin's future as a disruptive force in finance.

Bitcoin price history: from $1 to $200

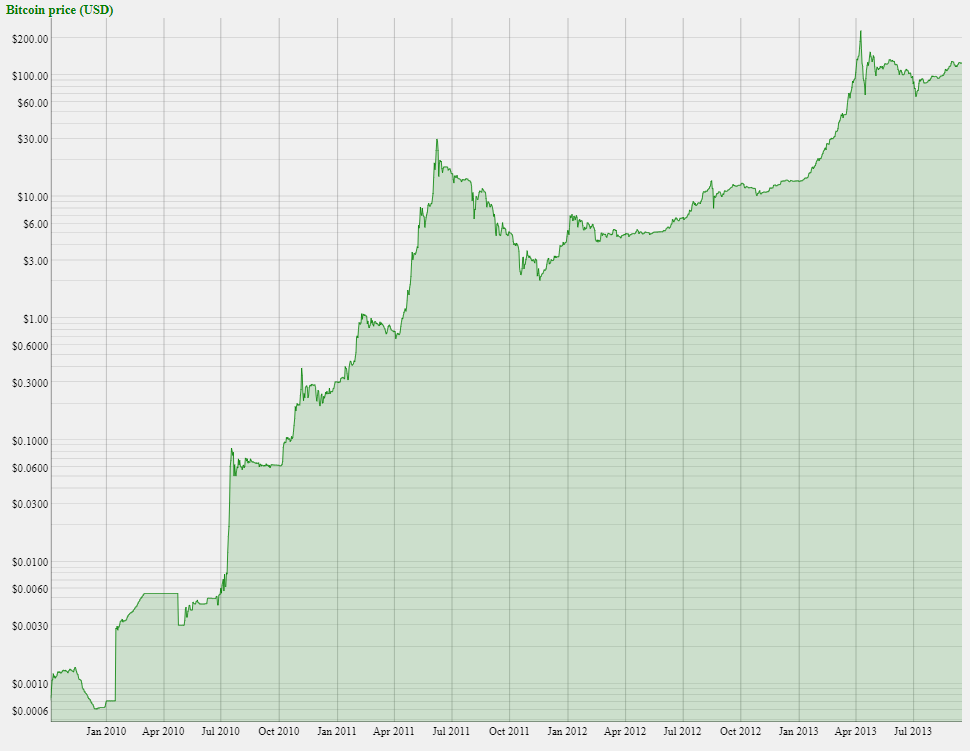

Bitcoin history: 2010-2013

The graph reveals a series of dramatic climbs and volatile dips. The first noticeable peak occurred in June 2011, when the price reached around $30 before falling sharply. It then entered a period of relative stability, followed by a significant upward trajectory beginning in late 2012, culminating in a sharp spike to over $200 in April 2013.

The period between 2011 and 2013 was pivotal in Bitcoin's history. After achieving parity with the US dollar in February 2011, Bitcoin's credibility as a potential investment began to solidify. This era witnessed heightened media attention and public interest, leading to a surge in Bitcoin's price. However, the newly emerging market was also prone to extreme volatility. The June 2011 spike was followed by a crash, attributed to a security breach at Mt. Gox, then a leading Bitcoin exchange, which shook investor confidence.

Despite these challenges, the underlying technology of Bitcoin continued to attract a growing community. This period saw the establishment of several Bitcoin businesses and services, further embedding cryptocurrency in the fabric of digital transactions.

By the end of 2012, Bitcoin began another meteoric rise, driven by the financial crisis in Cyprus and the subsequent concerns about the stability of traditional banking. The increased demand for a decentralized currency saw Bitcoin's price soar to unprecedented levels, peaking at over $200 in April 2013, before enduring another price correction.

These years laid the groundwork for Bitcoin's recognition as more than just an experimental digital currency, marking its entry into the mainstream financial discourse.

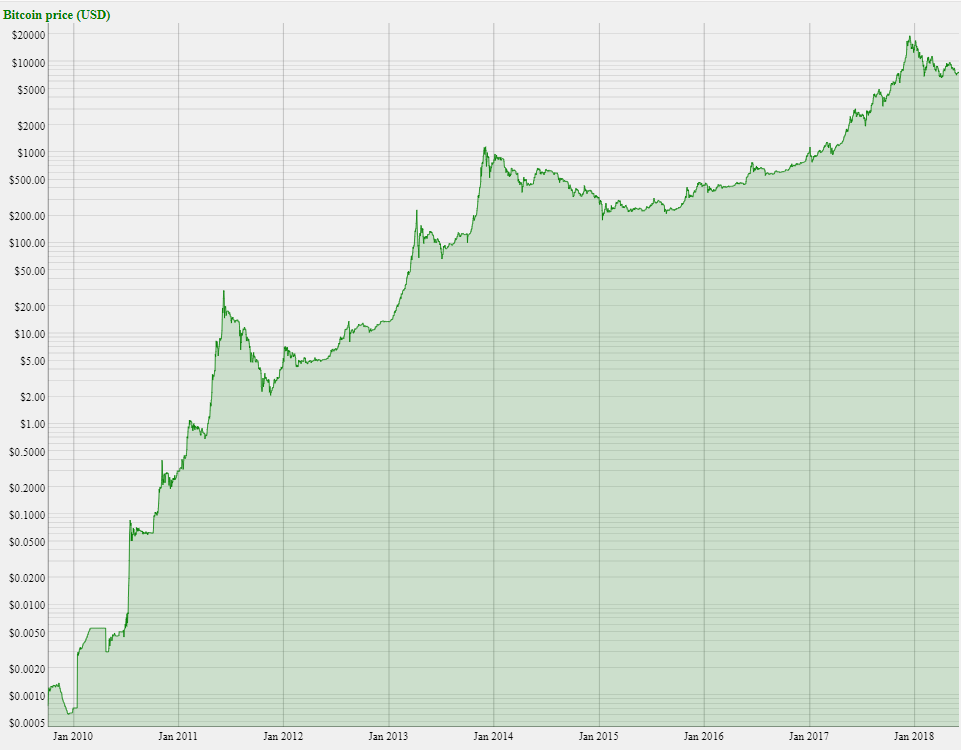

Bitcoin price history: from $200 to $20,000

The evolution of Bitcoin's value from 2013 to the end of 2017 is nothing short of spectacular. From humble beginnings, Bitcoin's price trajectory during these years mirrors the waxing and waning of a new technology struggling for mainstream acceptance.

In 2013, Bitcoin's price fluctuations were a rollercoaster, soaring to over $1,000 by November. This surge was propelled by a mixture of factors, including the adoption of Bitcoin for international transactions and an increased interest from China. However, the ride was not smooth. Regulatory challenges, notably in China, led to steep price drops, underscoring the sensitivity of the cryptocurrency to government actions.

The following year, 2014, was marked by regulatory headwinds and the infamous collapse of Mt. Gox, which resulted in a significant price correction. Bitcoin spent much of 2015 in recovery mode, slowly regaining trust as infrastructure and security practices improved. Innovations such as multi-signature wallets and advances in blockchain technology reinforced Bitcoin's utility and resilience.

The real inflection point came in 2016. Political events like Brexit and the devaluation of the Chinese Yuan triggered a flight to Bitcoin's decentralized nature. By 2017, a confluence of factors, including widespread media coverage, the advent of Initial Coin Offerings (ICOs), and the growing adoption of blockchain technology, ignited an explosive price growth. Retail investors flocked to Bitcoin, enticed by its spectacular returns and the allure of an alternative investment class.

The pinnacle of this ascent occurred in December 2017, when Bitcoin's price peaked at around $20,000. This staggering high marked a crescendo in investor interest and speculation, setting the stage for the subsequent market adjustments.

Bitcoin history: 2010-2018

Throughout this period, Bitcoin's journey was more than just about price, it was the narrative of a digital asset that challenged conventional financial systems and introduced the world to the potential of blockchain technology.

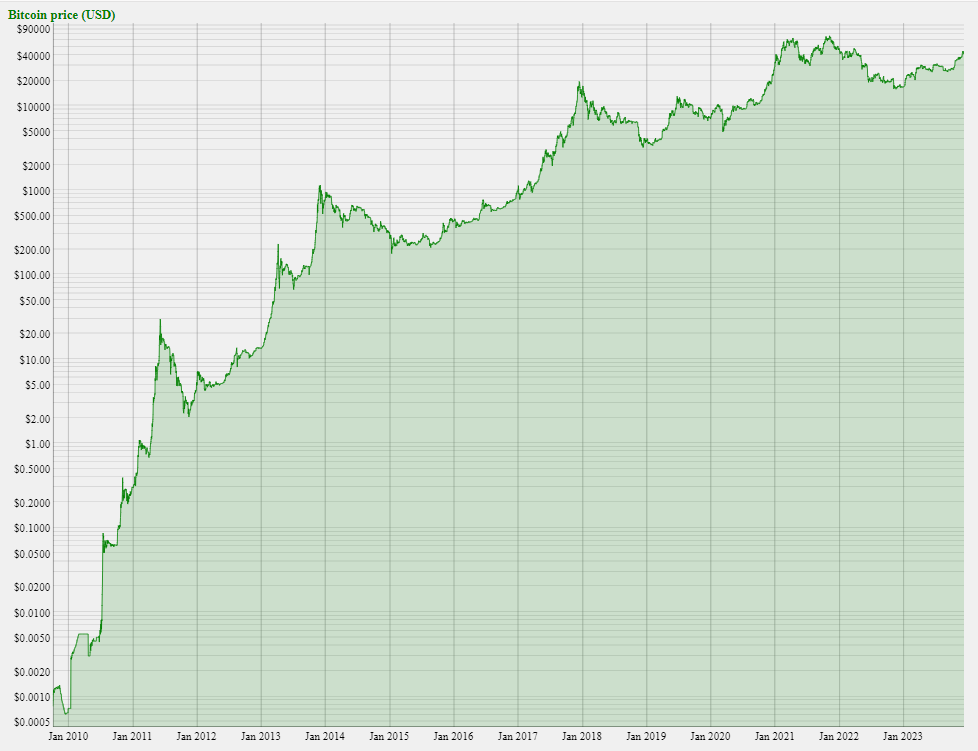

Bitcoin price history: from $20,000 to nowadays

The image below displays a line graph tracking the Bitcoin price movement from late 2017, where it hovered around $20,000, through to 2023. The price exhibits significant volatility, with remarkable peaks and sharp declines, reflecting the market's reactive nature to a variety of stimuli.

Bitcoin history: 2010-2023

Post-2017, Bitcoin entered a bear market, with values declining substantially throughout 2018. This downturn was a result of several factors, including regulatory scrutiny, a series of high-profile hacks, and a general cooling-off after the feverish speculation bubble burst. However, as the market began to stabilize, Bitcoin gradually regained its value, and by 2019, it started to show signs of a strong recovery.

The year 2020 marked a turning point as the pandemic's onset led to a widespread economic slowdown. In this climate, Bitcoin emerged as a haven asset, akin to gold, attracting significant investment and driving prices to new all-time highs. Institutional investors began to take notice, and Bitcoin's narrative as a hedge against inflation took hold.

2021 was a banner year, as Bitcoin's price soared to an ATH (all-time-high) of just under $70,000, driven by factors such as increased adoption by businesses and payment platforms, endorsements from high-profile individuals and companies, and the advent of Bitcoin ETFs, which provided easier access to the cryptocurrency for a broader range of investors.

In 2022, the bear market started again, with Bitcoin’s price dropping precipitously to a low of around $16,000 in November of 2022. For the next 10-12 months, Bitcoin was trading in the range of $16,000 - $30,000. However, in Q4 of 2023, the sentiment turned positive once again and the price broke above the $40,000 mark. As of December 2023, the price is currently sitting in the $38,000 to $44,000 range.

Read our forecast for Bitcoin price in the coming years in our article Bitcoin Forecast 2024, 2025, and 2030.

Best cryptocurrency exchanges

Key facts about the history of the Bitcoin price

The historical trajectory of Bitcoin's price is a testament to its volatility and the transformative impact it has had on the concept of money and investment. Here are some key facts that punctuate its history:

-

All-Time High: On November 10, 2021, Bitcoin's price surged to its highest value ever recorded at $68,789.63. This pinnacle moment represented an astronomical gain of over 1,000,000% from its humble inception price point.

-

Steepest Decline: The volatility inherent in Bitcoin's market was starkly highlighted on May 19, 2022. In a single day, the price plummeted from $36,950 to $29,737. This 20.5% drop marked the largest one-day price descent, showcasing the digital currency's susceptibility to rapid shifts in market dynamics.

-

Record Growth in a Day: Conversely, Bitcoin has also seen days of rapid ascent. The very same day it achieved its all-time high, it also recorded its largest single-day price jump. On November 10, 2021, Bitcoin's price escalated from $58,958 to its zenith of $68,789, a notable 17.8% increase within 24 hours.

These key moments encapsulate the extreme highs and lows of Bitcoin's price history and serve as a stark illustration of the high-risk, high-reward nature of cryptocurrency investment.

А table of Bitcoin price OHLC by year

| 2009 | 0,0008 | 0,0009 | 0,0007 | 0,0008 |

2010 |

0,0008 |

0,0824 |

0,0008 |

0,0081 |

2011 |

0,0081 |

31.95 |

0,0081 |

31.95 |

2012 |

31.95 |

266.99 |

2.6 |

11.20 |

2013 |

11.20 |

1,242.69 |

1.16 |

1,242.69 |

2014 |

1,242.69 |

507.90 |

459.37 |

507.90 |

2015 |

507.90 |

511.15 |

255.75 |

284.20 |

2016 |

284.20 |

778.84 |

266.99 |

713.79 |

2017 |

713.79 |

20,089.00 |

506.26 |

19,783.06 |

2018 |

19,783.06 |

3,122.00 |

11,222.00 |

3,850.00 |

2019 |

3,850.00 |

13,860.00 |

3,122.00 |

10,460.00 |

2020 |

10,460.00 |

64,863.00 |

3,850.00 |

64,863.00 |

2021 |

64,863.00 |

68,789.63 |

29,737.00 |

64,863.00 |

2022 |

64,863.00 |

46,100.00 |

29,737.00 |

41,487.00 |

The annual return on Bitcoin investments

From 2013 through 2023, Bitcoin has posted an astonishing average annual return of 230%. This remarkable performance surpasses many traditional investment vehicles. To put this into perspective, let's examine the annual returns over the last decade:

-

In 2022, Bitcoin investors faced a challenging year with a --58.1 % return, reflecting the turbulent market conditions and broader economic headwinds.

-

The year 2021 saw a healthy return of 64.8%, buoyed by increasing institutional adoption and mainstream interest in cryptocurrencies.

-

The unprecedented events of 2020 led to a surge in Bitcoin investment, yielding a 300% return as investors sought digital safe havens during global uncertainty.

-

In 2019, the return stood at a solid 91.7%, as Bitcoin continued to recover from the previous year's slump.

-

The year 2018 was tough for Bitcoin, with the market correcting by -75.2% after the spectacular bull run in 2017.

-

A banner year for Bitcoin, 2017 showcased a return of 2,221.8%, driven by frenzied speculative investment and growing public awareness.

-

In 2016, the return was 130.9%, reflecting growing confidence in the cryptocurrency's potential.

-

The year 2015 provided a steady return of 47.1%, as Bitcoin began to gain more mainstream traction.

In contrast, traditional stocks and gold have offered more modest returns. Over the long term, the stock market typically has an average annual return of about 7-10% when adjusted for inflation. Gold, considered a stable investment, has historically increased in value at a rate that just keeps pace with inflation, yielding returns that are considerably lower than Bitcoin's explosive growth, yet offering a stability that the cryptocurrency market lacks.

These comparisons highlight Bitcoin's potential for high reward, but also its susceptibility to extreme volatility and the influence of market sentiment and regulatory environments.

What if I had invested $1000 in Bitcoin in 2010?

If you had invested $1000 in Bitcoin in 2010 when the price was roughly $0.08, you would have purchased approximately 12,500 BTC. Fast forward to Bitcoin's all-time high in 2021 at around $68,789.63, that investment would have been worth a staggering $859,870,375. Considering the price fluctuations since then, the value of that investment would vary, but it would remain substantial.

What if I had invested $100 in Bitcoin in 2011?

In 2011, if you had invested $100 when Bitcoin's price was about $1, you would have acquired 100 BTC. At the peak of Bitcoin's value in November 2021, your 100 BTC would have been worth approximately $6,878,963. Even with the price drops after the peak, your investment would still hold a value many times over the initial $100.

How much would I have if I invested $1000 in Bitcoin in 2013?

Investing $1000 in Bitcoin in early 2013, with an average price of around $13.30 per Bitcoin, would have netted you about 75 BTC. At the 2021 peak, those 75 BTC would have been valued at approximately $5,159,222.5. While the value would vary with the market's ups and downs, this hypothetical investment would have yielded significant returns.

What factors influence the bitcoin price history?

The price history of Bitcoin is shaped by an interplay of various factors, with speculation, adoption, and regulation standing out as the most influential.

-

Speculation: Bitcoin's market is highly susceptible to speculation. Traders and investors often make decisions based on expectations of future price movements rather than the asset's fundamental value. This speculative interest can lead to rapid price increases, as seen during the late 2017 bubble, but it can also result in swift declines when sentiment turns.

-

Adoption: The rate of Bitcoin adoption is another significant price driver. As more individuals and businesses accept Bitcoin as a form of payment or as an investment, its price tends to increase. Mainstream adoption, when major companies and financial institutions start supporting Bitcoin, often leads to price surges as it validates the cryptocurrency's utility and stability.

-

Regulation: Regulatory developments have a profound impact on Bitcoin's price. Positive regulatory news, such as a country legitimizing Bitcoin as a legal form of currency, can lead to price increases. Conversely, announcements of stricter regulations, potential bans, or enforcement actions against crypto exchanges can cause prices to tumble as they create uncertainty about Bitcoin's future legality and acceptance.

Each of these factors can have both short-term and long-term effects on Bitcoin's price, contributing to its volatility and unique market dynamics. Understanding the interplay between speculation, adoption, and regulation is crucial for anyone looking to interpret Bitcoin's price movements and the cryptocurrency market as a whole.

To learn about trading strategies, read our article on Most Popular Trading Strategies Explained.

Pros and cons of bitcoin pricing

The formation of Bitcoin's price is a complex process influenced by various market forces.

-

One of the pros is that Bitcoin operates on a decentralized network, free from direct manipulation by any single government or institution. This autonomy can lead to price stability in the face of localized economic crises.

-

Moreover, the fixed supply cap of Bitcoin means that, theoretically, its value could continue to appreciate as long as demand grows.

However, there are cons as well.

-

The decentralized nature of Bitcoin also means that there's no central authority to intervene when the market becomes volatile.

-

The price is also heavily influenced by speculation, which can lead to bubbles and sudden market crashes.

-

Furthermore, Bitcoin's price can be significantly affected by changes in regulatory stances, security breaches, technological advancements, and macroeconomic trends.

Summary

In its first 14 years, the price of Bitcoin has experienced monumental growth, appreciating over 1 million times from its initial worth. This extraordinary ascent reflects the unique allure of Bitcoin as a digital asset and its potential to disrupt traditional financial systems.

However, this growth has not been without its challenges. The price of Bitcoin is notoriously volatile, with the potential for significant fluctuations within short time frames. This volatility is a double-edged sword, offering opportunities for high returns while presenting substantial risks.

As Bitcoin continues to mature and integrate into the global financial landscape, it remains a beacon of the potential and pitfalls inherent in the burgeoning cryptocurrency market.

Glossary for novice traders

-

1

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

5

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.