How to Trade Gold Online? A Guide For Beginners

Gold is an important investment asset and has been a means of exchange for goods and services for centuries. Trading gold can be profitable if you know what you are doing.

In this guide, you will know the basics of trading gold and provide a list of the best derivatives for gold trading.

So, let's get started!

Do you want to start trading gold-based CFDs? Open an account on Roboforex!Is Gold Trading a Good Idea?

Gold is generally popular as a hedge against crisis risk and during large-scale money printing (as we have today). That is why gold is the best investment during inflation. Here are three cases when buying and selling gold is a good idea:

Speculative Trends

Gold is a liquid asset, meaning you can quickly turn it into cash. This liquidity makes gold a popular choice for trading purposes. For example, if you think the price of gold will go up, you can buy gold today and sell it at a higher price in the future. This is known as speculation, and it can be a profitable way to trade gold.

Safe Haven Asset

Gold is a haven asset, meaning that the gold price will increase in times of crisis. If you believe that a financial crisis is happening or will happen soon, you should buy gold. This way, if the crisis occurs, you will easily convert your physical gold into cash and take advantage of its higher price.

The Store of Value

Gold is a good store of value because it tends to hold its value over time. This means that if you buy gold today, you will likely sell it for the same price in the future. This is not always the case with other investments, such as stocks, which can go up or down in price over time.

Investors often turn to gold when inflation is expected. Gold's value is not tied to the activity of any one company, so it can often maintain its value even during economic downturns. If you want to know what the average return on gold is, read the Traders Union article. Learn more what is the optimal to invest in gold.

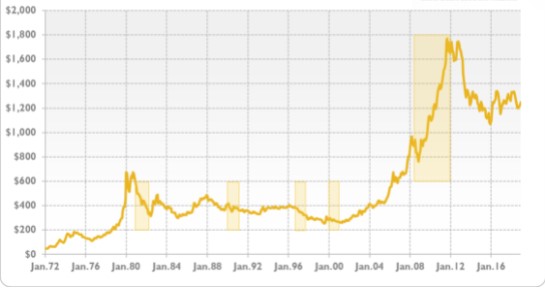

Gold prices

Step 1. Choose Your Market to Trade Gold

There are a few different markets where you can buy and trade gold. Futures, ETFs, CFDs, gold stocks, and physical metals are the most popular markets. Each market has its advantages and disadvantages. The following are the main features of each:

Gold Based ETFs

Gold ETFs are investment funds that hold gold as their primary asset. This means that when you buy a gold-based ETF, you are investing in gold. Gold-based ETFs can be traded on most major stock exchanges.

Some popular gold-based ETFs include:

-

iShares Gold Trust (IAU)

-

SPDR Gold Shares (GLD)

-

VanEck Vectors Gold Miners ETF (GDX)

-

Market Vectors Junior Gold Miners ETF (GDXJ)

Advantage

1. Low transaction costs

You can trade Gold-based ETFs like stocks. This means they have low transaction costs because there are no other fees involved.

2. Liquidity

You can trade gold-based ETFs on major exchanges; their prices tend to be stable. Therefore, if you buy or sell a gold-based ETF quickly, you will not lose much money.

3. Diversification

Gold-based ETFs are a great way to diversify your portfolio. They offer exposure to the gold market without investing in physical gold.

4. Tax Benefits

Gold-based ETFs offer some tax benefits. For example, you can sell them at a loss and use the loss to reduce your taxes.

5. Continuous Access

Gold-based ETFs can get sold at any time. You do not need to wait for the trading day to end.

Disadvantages

1. Limited selection

Gold-based ETFs are a new investment product, and as such, there are not many funds to choose from.

2. High management fees

Gold-based ETFs often have high management fees. This means that you will not earn as much profit from your investment.

3. No control over the gold

When you invest in a gold-based ETF, you give up control of your gold to the fund manager. This means that you may not be able to get your money back when you want it.

4. Risky investment

Gold-based ETFs are a risky investment. The price of gold can go up or down, which can affect the value of your ETF.

Gold-Based CFDs

Gold-based CFDs are contracts that allow you to trade gold without owning any physical gold. This means that you can make profits from the price of gold without ever owning a single ounce.

Most mainstream forex brokers offer Gold-based CFDs. The contracts usually repeat the quotes for gold futures.

Some advantages of trading gold-based CFDs include:

1. Low Transaction Costs

The transaction costs for trading gold-based CFDs are lower than those for trading physical gold.

2. Liquidity

Gold-based CFDs are liquid assets. This means that you can buy and sell them quickly without losing money.

3. Diversification

Gold-based CFDs are a great way of diversifying your portfolio. They give you exposure to the gold market without owning any gold.

4. Tax Benefits

As with most financial derivatives, trading gold-based CFDs can offer tax benefits. For example, you will only have to pay taxes on your profits, not your original investment.

5. Hedging

You can use Gold-based CFDs as a hedging tool to protect your portfolio from risk.

Disadvantages

1. High Risk

As with all financial derivatives, gold-based CFDs are high-risk investments. The price of gold can go up or down, which can affect the value of your CFD.

2. Limited Selection

At the moment, there are not many gold-based CFDs to choose from. This means that you may not find the perfect contract for your needs.

3. No Control over the Gold

When you trade a gold-based CFD, you give up control of your gold to the broker. This means that you may not get your money back when you want it in some cases.

4. High Management Fees

Most brokers charge high management fees for trading gold-based CFDs. This means that you will earn less profit from your investment.

Gold Futures

Gold futures are contracts that allow you to buy or sell gold at a specific price on a specific date in the future. You can trade them on most mainstream forex brokers. You can use gold futures to hedge your risks or make profits from the price of gold.

The main pros of gold futures in gold trading are:

1. Time Advantage

Gold futures allow you to lock in the price of gold at a certain date in the future. This is useful for businesses that need to buy or sell large quantities of gold at specific prices.

2. Leverage

Traders who want to make profits from the price of gold can use leverage to increase their potential gains.

3. Price Advantage

Gold futures allow traders to buy or sell gold at a closer price to the "spot" price. This means that you will get more profit from your investment when the contract expires.

4. Hedging

Gold futures can serve as a hedging tool to protect your portfolio from risk.

The main disadvantages of trading gold futures include:

1. Limited Contract Terms

You can only trade gold futures for a limited amount of time. This means that they are not ideal for long-term investments.

2. Low Liquidity

Trading gold futures can be complex if there is not enough liquidity in the market. This is especially true when trading outside normal business hours or when major financial news about gold breaks during non-trading times.

3. High Management Fees

Most brokers charge high management fees for trading gold futures. This means that you will earn less profit from your investment.

Gold Mining Stocks

Gold mining stocks are shares in companies that mine gold. The price of gold goes up when there is an increase in demand for the metal, so the value of the stocks also goes up.

However, it's important to note that there are many other factors that affect the price of gold mining stocks, including industry conditions and company management.

Here is a chart that shows how gold mining stocks rallied during periods when the price of gold increased:

Gold prices during a crisis

The main pros and cons of investing in gold mining stocks are:

1. Price Appreciation

Gold mining stocks usually appreciate when the price of gold goes up. This means that you can profit from your investment if you sell at the right time.

2. Dividends

Many gold mining companies pay dividends to their shareholders. This means that you can earn a regular income from your investment.

3. Hedging

Gold mining stocks can serve as a hedge against risk when you are trading gold.

4. Diversification

Gold mining stocks are not highly correlated with other investments, including the price of gold itself. This means that your portfolio will have less volatility when you invest in them.

5. Market Exposure

The price of gold affects many other investments, including stocks and bonds. Gold mining stocks allow you to profit from other markets without trading them directly.

The main disadvantages of investing in gold mining stocks include:

1. Volatility

Gold mining stocks are more volatile than the price of gold itself. This means that you could lose a significant amount of money if the price of gold falls instead of rises.

2. Currency Risk

The price of gold mining stocks is in U.S. dollars, so they will fluctuate with currency changes and with the price of gold. Therefore, to avoid currency problems, you should look for companies that convert their gold reserves into U.S. dollars before paying dividends to shareholders.

3. Mining Risk

Supply and demand help determine the price of gold, but the supply of gold depends on the success of mining companies. This means that the problems at these companies, including labor disputes and environmental issues like pollution, could affect your investment.

Step 2. Open a Trading Account

When you are ready to start trading gold futures, you will need to open a gold trading account with a broker. Most brokers offer access to the gold market, and some specialize in this market. Here is a list of some of the best brokers for trading gold futures:

Interactive Brokers - Best Choice of Gold-Based Instruments

When you are ready to start trading gold futures, you will need to open a trading account with a broker.

Interactive Brokers is a discount broker that offers access to the gold market. They have a wide range of products, including gold futures, options, and CFDs.

Interactive Brokers is the best broker for trading gold futures. They have a deep liquidity pool, low commissions, and a wide range of products.

Their trading platform is called IBKR lite. It is available on Windows, Mac, or Linux PCs. Interactive Brokers also provides mobile apps for iOS and Android devices.

Commission:

-

$1.00 minimum per trade

Best for:

-

It offers a deep liquidity pool and a wide range of products

-

Best Gold Futures Broker

Account minimum:

-

No Minimum required

eToro - Best for Gold Copy Trading

eToro is a social trading platform that offers access to the gold market. They offer Gold-based CFDs and Gold copy trading.

eToro offers gold-based CFDs. Their fees are relatively low but with a limited liquidity pool.

Step 3. Understand What Determines the Price of Gold

Many factors determine the price of gold. They include:

Central Banks Gold Reserves

Gold is a part of the gold and foreign exchange reserves of most countries. The government can buy and sell gold, which affects prices. As a result, the gold reserves of a country can have a significant impact on the price of gold.

Jewelry Industry Demand

In countries such as India and China, demand is huge, affecting prices. In addition, jewelry is often seen as a store of wealth, and when demand for gold jewelry increases, the price of gold also tends to increase.

Monetary policy

Gold is usually growing during high-scale emissions (QE programs). In 2023 we have such QE programs and ultra-low interest rates worldwide. This monetary policy creates a "hot money" effect, which leads to an increase in the price of gold.

Speculative trends and Technical analysis

Long-term trends and short-term fluctuations mostly drive the gold prices. Investors watch the news, economic reports, and central bank activity. Speculative trends can also affect gold prices, such as fears of inflation or concerns about deflation.

Technical analysis is the use of price charts to predict future price movements.

They include:

-

Support and resistance levels

-

Fibonacci retracements

-

Moving averages

Investors can make trading decisions using technical analysis.

Step 4. Choose Your Gold Trading Strategy

There are different gold trading strategies that you can use.

-

Buy and hold: this is a long-term strategy where an investor buys gold and holds it for some time. The goal is to sell it at a higher price than they bought it for.

-

Day trading: this is a short-term strategy where an investor buys gold and sells it within the same day. They hope to make a profit from the price difference.

-

Swing trading: this is a medium-term strategy where an investor buys gold and holds it for a few days or weeks. They hope to make a profit from the price difference.

-

Options: this is a strategy where an investor buys or sells options contracts. They hope to make a profit from the price difference.

-

Leveraged ETFs/ETNs: these are short-term strategies where an investor uses debt to increase their exposure to gold. They hope to make a profit from the price difference.

-

ETFs/ETNs: these are long-term strategies where an investor chooses to invest in gold-based Exchange Traded Funds or Exchange Traded Notes. They hold it for a while, hoping to profit from yield.

-

Gold mining stocks: this is a long-term strategy in which an investor chooses to invest in gold instead of physical gold. They hope to make a profit from dividends or capital appreciation.

-

Bullion: this is a long-term strategy where an investor buys physical gold and stores it safely. The goal is to sell it at a higher price than they bought it for.

Summary

The article shows that gold can serve as an important part of an investment portfolio when used strategically. Gold can be bought, sold, traded, and stored in many different ways.

Various factors such as central bank gold reserves, jewelry industry demand, monetary policy, and speculation drive the Gold prices. As a result, investors can use several different gold trading strategies depending on their goals. As a result, investing in gold is the best decision ever!

FAQs

What is the "hot money" effect?

The "hot money" effect is when investors rapidly move money into an investment, causing a price increase.

What is technical analysis?

Technical analysis is the study of price charts to predict future price movements.

Why do prices fluctuate?

Prices fluctuate because of different factors, including central bank gold reserves, jewelry industry demand, monetary policy, and speculation.

What is arbitrage?

Arbitrage occurs when a market has different prices for the same thing, such as gold trading at $1,525 in one place and $1,522 in another. This provides an opportunity for investors to buy low and sell high.

Glossary for novice traders

-

1

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

2

Short selling

Short selling in trading involves selling an asset the trader doesn't own, anticipating its price will decrease, allowing them to repurchase it at a lower price to profit from the difference.

-

3

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

4

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

5

Social trading

Social trading is a form of online trading that allows individual traders to observe and replicate the trading strategies of more experienced and successful traders. It combines elements of social networking and financial trading, enabling traders to connect, share, and follow each other's trades on trading platforms.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).