Arbitrage Trading in Forex: The Ultimate Guide

Arbitrage is a strategy of trading on the difference of rates for one asset on different exchanges.

Arbitrage involves a constant search for assets with price differences, investing large sums of money to quickly capitalize on small exchange rate differences. The strategy belongs to professional systems with a high level of risk.

What is Forex arbitrage?

Forex arbitrage is a strategy that allows traders to profit by simultaneously buying and selling currencies on different exchanges at different prices. To do this, traders utilize the difference in currency prices on different exchanges to make a profit.

Forex arbitrage can be an effective way to make profits, but it can also be risky. A trader must be able to quickly identify and capitalize on arbitrage opportunities, and be prepared for the fact that prices can change before they can complete a trade.

How Forex arbitrage works

Forex arbitrage works when the price of a currency on one exchange differs from the price on another exchange. For example, if the price of the euro on one exchange is $1.10 and the price on another exchange is $1.11, a trader can make a profit by buying euros on the first exchange and selling them on the second exchange.

For arbitrage to be successful, the trader must be able to quickly identify an arbitrage opportunity and complete the trade before prices equalize. The trader must also be prepared for the possibility that prices may change within a short time, which could result in a loss.

For an arbitrage strategy to work, the following conditions must be met:

-

There must be a difference in the prices of the same asset or closely related instruments. For example, if a company's stock price is $10 on one exchange and $11 on another, a trader can make a profit by buying the stock on the first exchange and selling it on the second exchange.

-

The price difference must be large enough to offset the cost of making the trades. Transaction costs include brokerage commissions, spreads, and other expenses.

-

The price differential must be stable enough to allow the trader to complete the trade before prices equalize. Asset prices can change rapidly, so the trader must be able to quickly identify an arbitrage opportunity and complete the trade before prices equalize.

If at least one of these conditions is not met, the arbitrage strategy may not work.

Additional factors that can affect the success of an arbitrage strategy are:

-

Liquidity of the asset. An arbitrage strategy will be more effective if the asset has high liquidity, meaning that it can be easily bought or sold at the market price.

-

Duration of the arbitrage opportunity. An arbitrage opportunity can be temporary, so the trader must be able to quickly identify it and complete the trade before it disappears.

-

Speed of market response. If the market reacts quickly to price changes, the arbitrage opportunity may disappear before the trader can complete the trade.

An arbitrage strategy can be effective, but it can also be risky. A trader must be able to assess the risks of an arbitrage strategy and take steps to mitigate them.

Types of Forex arbitrage

There are several types of Forex arbitrage:

Local arbitrage is a type of arbitrage that takes place on a single exchange. A trader buys a currency in one market and sells it in another market on the same exchange.

Cross Arbitrage is a type of arbitrage that takes place on two different exchanges. A trader buys currency on one exchange and sells it on another exchange.

Transit arbitrage is a type of arbitrage that takes place on three or more exchanges. A trader buys currency on one exchange, sells it on a second exchange, buys it again on a third exchange and sells it on the first exchange.

Arbitrage Trading Strategies:

Liquidity arbitrage is a type of arbitrage that takes advantage of the difference in liquidity on different exchanges. A trader buys a currency on an exchange with low liquidity and sells it on an exchange with high liquidity.

Spread arbitrage is a type of arbitrage that utilizes the difference in spreads on different exchanges. A trader buys a currency on an exchange with a narrow spread and sells it on an exchange with a wide spread.

Interest rate arbitrage is a type of arbitrage that takes advantage of the difference in interest rates between two currencies. A trader buys a currency with a low interest rate and sells it on a currency with a high interest rate.

Example of cross-arbitrage

Suppose that on the exchange in London the price of euro is 1.10 dollars and on the exchange in New York is 1.11 dollars. A trader can make a profit by buying euros on the London exchange for $1.10 and selling them on the New York exchange for $1.11.

The trader's profit will be:

($1.11 - $1.10) * 100,000 = $1,000 dollars

This example does not include transaction costs such as brokerage commissions and spreads. These costs can reduce a trader's profits.

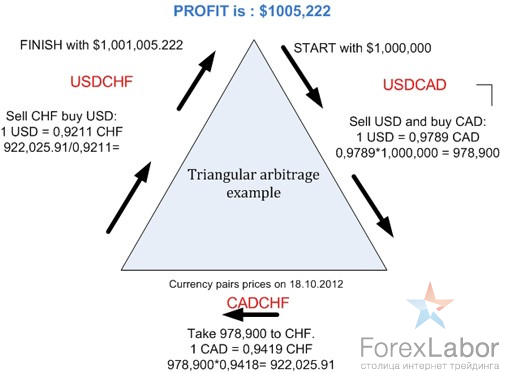

Example of triangular arbitrage

Suppose that on an exchange in London, the price of currency B is 1.10 in currency A, and on an exchange in New York, the price of currency B is 1.20 in currency C. On the exchange in Tokyo, the price of currency C is 1.05 in currency A.

Triangular arbitrage

To take advantage of this arbitrage opportunity, a trader must open accounts on the London, New York and Tokyo exchanges. The trader must then perform the following steps:

Buy currency B on the exchange in London for 1.10 of currency A.

Sell currency B on the exchange in Tokyo at a rate of 1.20, receiving 1.2 of currency C.

Sell currency C on the exchange in New York at a rate of 1.05 for currency A.

Calculation of profit. You have 1.10 units of currency A. You buy 1 unit of currency B and sell it on the Tokyo exchange - you have 1.2 units of currency C. You sell it for currency A, getting 1.2*1.05 - 1.26 units of currency A. Your profit is 0.16 units of currency A.

Advantages and disadvantages of Forex arbitrage

👍 Advantages:

• Forex arbitrage can be an effective way to make profits.

• It can be used to make profits on short-term price fluctuations.

• It can be used to make profits on various currency pairs.

👎 Disadvantages:

• Forex arbitrage can be risky.

• It requires quick identification of arbitrage opportunities.

• It requires completing trades before prices equalize.

How to get started in Forex arbitrage

To get started in Forex arbitrage, a trader needs to open an account with a broker that offers arbitrage opportunities. The trader should also access stock exchange data to track currency prices on different exchanges.

Some tips for a trader who is going to engage in Forex arbitrage:

-

Get a good understanding of arbitrage. Before you start trading Forex, it is important to understand how arbitrage works and the risks involved.

-

Find a broker that offers arbitrage opportunities. Not all brokers offer arbitrage opportunities, so it is important to find a broker that offers a wide range of instruments and markets.

-

Get access to exchange data. To identify arbitrage opportunities, you will need access to exchange data. You can access exchange data through a broker or through a third-party company.

-

Use automated trading systems. Automated trading systems can help you identify and execute trades quickly, which can be important for arbitrage.

-

Be prepared to take risks. Arbitrage can be risky, so it's important to be prepared for losses.

-

Only trade on liquid currency pairs. Liquidity means that an asset can be easily bought or sold at the market price. Trading on liquid currency pairs will help you avoid large spreads and commissions.

Beware of scams. There are companies that offer fraudulent arbitrage opportunities. Be cautious and do your research before investing in any arbitrage opportunity.

Conclusion

Forex arbitrage is an effective way to make profits, but it can also be risky. A trader must be able to quickly identify arbitrage opportunities and complete trades before prices flatten.

FAQ

Is Forex arbitrage profitable?

For arbitrage to be profitable, the price differential must be large enough to cover the costs of the trades, such as commissions and spreads. If the price difference is too small, the trader will not be able to make a profit.

Is Forex arbitrage legal?

Arbitrage is a legal trading strategy that is used in various financial markets, including Forex. Arbitrage is not fraud or deception. It is simply a way of using price differences to make a profit.

Is arbitrage good or bad?

Arbitrage can be both good and bad. On the one hand, arbitrage helps eliminate inefficiencies in pricing. This leads to a fairer valuation of assets and more efficient markets.

On the other hand, arbitrage can lead to less liquid markets. If traders continually use arbitrage to make profits, it can make it difficult for other traders to buy or sell assets at a fair price.

Is it easy to arbitrage?

No, arbitrage is not easy. Arbitrage is a strategy that requires the trader to be able to find and exploit inefficiencies in pricing. These inefficiencies can be small and difficult to detect. In addition, arbitrage can be risky because asset prices can change rapidly.

Team that worked on the article

Alex Smith is a professional day trader for a proprietary trading firm within the foreign exchange (forex) and crypto markets. His area of expertise is day trading and swing trading within the 15min-4hr time frames for both the London and NY open. At Traders Union, Alex is a firsthand experience expert, providing explanatory videos and tutorials on brokerage companies, how to open a trading account, how to withdraw profit, etc.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.