The Best FX pairs to Trade During the London Session

Best London Session Forex Pairs to Trade:

EUR/USD GBP/USD, EUR/GBP, and USD/CHF are the best currency pairs for the London session

It is no longer a surprise that experienced traders and novices can make more money trading during the London session. As prices start to move from liquidity providers based in the UK, the London session becomes quick and active, but traders can typically expect volatility to rise. Hence, learning about the best London session Forex pairs should be a top priority for traders.

Among the reasons traders pay more attention to the London market is that it is very active, and being the hub of trading is a top factor. Spreads are lower when there is a lot of buying and selling, which results in less consolidation and more opportunities to profit.

So at this point, the best pairs to trade during the London session are what could be stopping you from engaging the market right away. And that is what you will learn by reading this article.

Major European FX trading sessions

It is certain that in the foreign exchange market, currencies trade 24 hours a day, five days a week. But this occurs in different trading sessions on various continents.

For instance, there are typically four main trading sessions, but people often refer to the Sydney and Tokyo sessions as Asian sessions. As a result, the three sessions of the Forex market—Asia, London, and New York—are often referred to as the 3-session market.

Global FX Sessions

-

Asian sessions (22:00 – 08:00 GMT)

-

London Session (08:00 - 16:00)

-

New York session (13:00 - 21:00 GMT)

Specific opening and closing times apply to each season's market. For instance, the Forex market opens in New Zealand, Australia, Asia, then Europe, and finally, North America because the day starts in the Far East.

Trading hours for the European FX session, also known as the European trading session, are from approximately 08:00 GMT to approximately 16:00 GMT. The London session, which begins right as the Tokyo session ends, is known for its tremendous liquidity and high volatility.

The London session is when the majority of price changes occur, including changes in the value of currency pairs and prices. Of all the FX trading sessions, the European session is the busiest. This is because of the London session's 36.7% share of the overall trading volume. Due to the high liquidity, most currency pairs are traded with relatively small spreads.

So the European FX trading session turns out to be the best trading window, as determined by the trading hours. It is a significant global financial hub and the standard for all European financial centers.

London session key takeaways

The London trading session offers the best times for both new and experienced Forex traders. It offers more trading opportunities to boost profits than the Asian or American sessions. The daily average for foreign exchange turnover during the London trading session is 32%. It overlaps with the New York session throughout the entire year.

| London Session Key Takeaways |

|---|

Spreads are minimal during London sessions |

There are massive liquidity and high/moderate volatility breakouts |

London Session accounts for over 32% of all trading activities globally |

The London session runs concurrently with other trading sessions, moves quickly, and is extremely busy |

During the London session, which lasts from 8:00 GMT to 12:00 GMT, the euro and the pound sterling make for the best currency pairs to trade |

The peak overlap occurs between 1300 and 1600 GMT during the London/New York active hours |

The U.S. and London forex markets overlap by almost four hours, so traders have longer hours to trade and profit because this is when there is the most activity |

Having taken note of some key takeaways from the London session, the next trading mystery to be unraveled is the best currency pairs for the London session. So the next question should be: what is the best time to trade the best London session Forex pairs?

What is the best time to trade Forex in London?

Timing is crucial when trading currencies, and there are good trading times and bad trading times. Because of this, it is not advisable to trade without having a specific day or time strategy in mind, even though it is possible to do so around the clock.

Monday through Friday appear to be the days when people around the world engage in different financial activities. Forex traders experience the same thing. But that does not mean Monday mornings are the best time to trade London Forex pairs.

However, Monday afternoons are best because the market starts to warm up after the morning hours, and trade volume increases. Again, don't anticipate that the Forex market will reach peak liquidity during this time, but it’s still well worth taking a peek at the market when Monday afternoon rolls around.

Trading volume increases, and the Forex market reaches its peak liquidity from Tuesday morning through Thursday. These are known as Times of High Liquidity (i.e., Tuesday through Thursday). Keep the majority of your trading locked to the middle of the week if you're looking for liquidity.

The best Forex trading time in London is between 8:00 and 17:00 GMT. Therefore, many professional traders (those who trade full-time) believe 14:00 GMT is the best time to enter the market. This is because many people are anticipating the shift to New York at a time when London is coming to an end.

However, the UK Forex market is most active right after the London session begins at 8 am (UK time). As traders start interacting with the market, liquidity and volatility are likely to be high at this time. Around 10 a.m. (UK time), trading typically becomes less liquid, and it picks up again once the American markets open at around midnight (UK time).

Below are the results of votes based on a survey executed by top TU Forex experts on the best days to trade in a week.

| Days of the week | Votes | % |

|---|---|---|

Monday |

339 |

Assets for copy trading 16% |

Tuesday |

285 |

Assets for copy trading 14% |

Wednesday |

730 |

Assets for copy trading 35% |

Thursday |

400 |

Assets for copy trading 19% |

Friday |

326 |

Assets for copy trading 16% |

Total |

2080 |

Assets for copy trading 100% |

Best Forex pairs to trade in London trading sessions

London sessions currency pairs like GBP/USD and EUR/GBP are popular Forex pairs to trade during the London session. This is particularly true when the London and New York markets overlap and when the European session is open at nearly the same times as the London session.

Other currency pairs to consider include:

Also, the GBP/USD, EUR/GBP, and USD/CHF are included among the best currency pairs for the London session. Below is the ranking of the best currency pairs for the London session, starting from the first to the last, based on their trading volume according to TU experts.

| London session Forex pairs | % |

|---|---|

|

EUR/USD |

28% |

|

USD/JPY |

13% |

|

GBP/USD |

11% |

|

AUD/USD |

6% |

|

USD/CAD |

5% |

|

USD/CHF |

5% |

|

NZD/US |

4% |

|

EUR/JPY |

4% |

|

GBP/JPY |

4% |

|

EUR/GBP |

3% |

|

AUD/JPY |

3% |

|

EUR/AUD |

2% |

|

Other |

12% |

Be aware that you can trade multiple currency pairs during the London session. Among the most traded currency pairs during the London session are EUR/USD, GBP/USD, EUR/GBP, and USD/CHF. Pay close attention to all volatility, liquidity, and currency pair indicators.

Currency pairs classification

The currency pairs in the Forex market follow one common rule – only two monetary units are involved in trading, always, where one is bought and the other is sold. Other options of interaction between the national currencies are impossible (there are options of exchanging money for other assets, however, precious metals for example). This is also stipulated by the ISO regulation.

We’ve deciphered the currency pairs above, but it is not enough to only know the ratio between the currency that is sold and the currency that is bought. You also need to understand which type of the currency pair it is, because that is what determines the trading strategy.

Today, there are three types of currency pairs in Forex trading:

-

Majors

-

Minors or crosses

-

Exotics

Let’s understand the notions of “direct” and “inverse” currency pairs. Direct pairs are those, where the quotes are provided in US dollar, New Zealand dollar and Australian dollar and also British pound (their currency codes are on the right side). Inverse currency pairs is when the codes of the US dollar, New Zealand dollar and Australian dollar or British pound is on the left side of the quotation (which means that this is the currency that is being purchased).

Example: EUR/USD is a direct pair, USD/CAD is an inverse pair.

What are the most popular currency pairs?

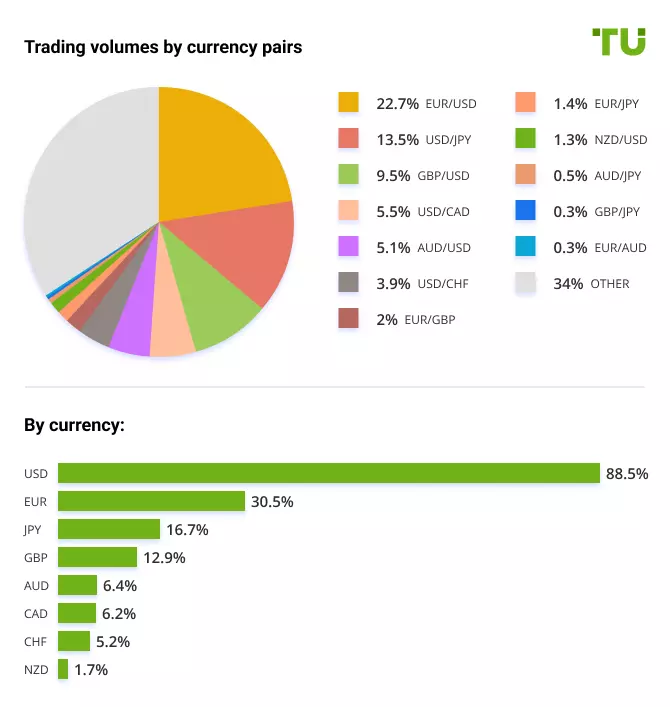

Trading volumes by currency pairs

EUR/USD

The Euro/U.S Dollar is the most crucial Forex pair. The currencies are the most traded globally and have the first and second largest reserve currencies accounting for 22.7% of trading volumes. This pair is used in almost a quarter of all currency transactions.

The Euro is the newest currency among the major pairs. It was launched in 1999, initially replacing 11 national currencies but is now used by over 300 million individuals in nineteen European countries.

The U.S Dollar is the world's primary reserve currency and controls trade internationally. The Federal Reserve, the nation's central bank, regulates the flow of U.S. dollars. The U.S. dollar remains a haven in times of crisis and the primary global reserve currency, despite predictions that it will eventually cede its dominant position to the Euro.

USD/JPY

The U.S. dollar against the Japanese Yen is the second most traded currency pair, with 13.5% of trading volumes. And this is because the Yen is the third most traded currency worldwide and a well-liked reserve currency.

For equity markets, this is the crucial currency pair to monitor. The Japanese Yen is usually seen as a haven in times of uncertainty. This is a result of various factors, such as the super low-interest rates in Japan since the 1990s, the need to repatriate funds due to the country's favorable net foreign asset position, and historical, traditional factors. A rising yen usually means falling stock markets.

This is a crucial currency pair to monitor for equity markets. In uncertain times, the Japanese Yen is frequently regarded as a refuge of safety. This is due to several causes, including Japan's historically low-interest rates since the 1990s, the need to repatriate funds due to the country's favorable net foreign asset position, and conventional historical factors. A rising yen frequently signals a decline in stock prices.

GBP/USD

The British Pound against the Dollar is the third most traded currency pair. It makes up for 9.5 percent of trading volumes. The currency pair is usually called "the cable" by traders and investors, which comes from the 19th century when the exchange rate was transmitted across the Atlantic by a submarine cable.

AUD/USD

The Australian Dollar, the official currency of the Australian Commonwealth since 1966, replaced the Australian Pound (which includes Australia, seven dependent territories, and three countries). The Australian Dollar (AUD) is one of the world's most traded currencies (fifth behind USD, EUR, JPY, and GBP), accounting for 5.1% of trading volumes. Iron ore, coal, petroleum gas, gold, and aluminum oxide are just a few of the essential commodities that the Australian economy produces and exports in significant quantities. For this reason, the Australian Dollar is also referred to as a commodity currency and the Canadian Dollar.

USD/CAD

The Canadian Dollar, sometimes known as the loonie in foreign exchange trading, is the name of the one-dollar coin featuring a picture of the loon, a common bird in Canada. It makes up 5.5% of the trading volume. Due to the close ties between their economies as neighbors, the Canadian and American dollars have a strong correlation. Canada exports 85% of its total output to the U.S. while importing 50% of its total imports of goods and services. Oil and lumber are two of Canada's largest exports, and the price of oil is a key determinant in determining the value of the Canadian Dollar. Because of this, the Canadian Dollar is included in a group of currencies known as commodity currencies.

USD/CHF

The currency code, CHF, is derived from the former Latin name for Switzerland, Confoederatio Helvetica, with the F standing for Franc. The Swiss Franc is also called the "Swissie" in the world of currency trading. The Swiss Franc is also supported by significant gold reserves, making Switzerland's economy one of Europe's most prosperous and secure.

The Swiss have been reluctant to adopt the Euro or enlist in the EU. With its historical neutrality regarding international wars, the Swiss Franc's stability is one factor that makes it a haven currency. The currency pair also, like the USD/CAD, accounts for 3.9% of the trading volume.

Best Forex brokers

Top Forex brokers in London offer the best currency pairs for the London session. So traders can take advantage of the best trading conditions offered by these brokers when trading during the London Forex market hours. Below are the top reputable brokers with a well-designed trading platform, low costs, good spreads, leverages best for beginners, and the best London session Forex pairs.

Tickmill: Best for novices and professional traders

-

Account Minimum: $100

-

Account currency: USD, EUR, PLN, CHF, GBP

-

Spread: Starts from 1.6 pips for the Classic account and 0 for Pro and VIP

-

Instruments: Currency pairs, commodities market assets, stock indices, stocks, bonds, and cryptocurrencies

The following organizations have jurisdiction over Tickmill since its founding in 2014:

-

UK Financial Conduct Authority (FCA)

-

The Cyprus Securities and Exchange Commission (CySEC)

-

The Seychelles Financial Services Authority (FSA)

The broker offers three main trading accounts called the Pro Account, Classic Account, and VIP Account. This account covers over 80 CFD instruments to trade on, including Forex, indices, commodities, and bonds.

Again, they provide a swap-free Islamic account and a demo trading account. Additionally, you can trade CFD currencies, stocks, commodities, and indices with low spreads and high leverage.

👍 Pros

• Multiple regulations and licenses and protection against negative balance

• There are accounts available with no commissions

• Includes favorable spreads and overnight swap fees

• Outstanding selection of trader research tools and analysis

👎 Cons

• There are no stocks available and no cent account

• There is no access to MetaTrader 5. Additionally, customer service is only available from 7:00 to 16:00 GMT, five days a week

FxPro: Best for Forex and CFD traders and offers multiple platforms at a low cost

-

Account Minimum: $100

-

Account currency: USD, EUR, PLN, GBP, AUD, CHF, JPY, ZAR

-

Spread: Starts from 0.1 pips

-

Instruments: Forex, Spot Indices, CFD for Energy, Spot metals, CFD for shares, CFD for agricultural products, CFD for indices, Base Metals & Gold Future CFDs, CFDs on Crypto (*CFDs on Cryptos are not available to retail clients of FxPro UK)

FxPro is regarded as having a high level of trust because they are governed by the FSCA and FCA, two top-tier regulators, making them a low risk for traders. With its top Forex pairs and the ability to trade equity indices, cryptocurrencies, metals, and energy, FxPro is the best platform for Forex and CFD traders.

👍 Pros

• FxPro offers the MetaTrader 4, MT5, and cTrader platforms for free, and there are no deposit fees

• Low commission and spreads with a cTrader account that protects against a negative balance

• Excellent customer service and a great account opening process

• With a cTrader account, the costs are minimal, and the customer service is excellent

👎 Cons

• High trading costs for certain stock CFDs, plus an inactivity fee

• You can only trade CFDs and Forex

Expert Opinion

In my experience, EUR/USD, GBP/USD, and USD/CHF offer the best opportunities during London session. However, I would also keep an eye on EUR/GBP. As the two major European currencies, their price moves often correlate to news and economic reports from the region. The interplay between them can sometimes result in sharp but short-lived moves.

For newer traders, my advice would be to start by focusing only on one or two of the major pairs during the London session. Don't try to trade everything at once. Get familiar with the typical market behaviors and price action of your chosen pairs before expanding. Study charts from prior London sessions to spot recurring patterns and support/resistance levels.

Look for consolidative periods early in the session to find high-probability entry points, then aim to take partial profits during peak volatility between 10am-12pm GMT as volumes build ahead of the NY open. Don't be greedy - lock in a portion of profits and move your stop to breakeven when possible.

FAQs

What is the London Session?

The London forex session is among the most liquid trading sessions because major currency pairs can trade at a high volume during that time. The European trading session begins just as the Asian trading session is about to end, taking over and keeping the currency market active.

When is the London foreign exchange session?

The London Session, which takes place from 08:00 to 17:00 GMT, is regarded as the capital because it draws the most attention as the major financial hub.

Which countries participate in the London Session?

Countries that participate in the London Session include the United Kingdom, Germany, France, Italy, Spain, Switzerland, Canada, Australia, Japan, Hong Kong, and Singapore.

Is the London session a good time to trade?

The London session is a great time to trade because it has the most trading activity and opportunities.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.