What Is The Best Time Of Day To Trade EUR/GBP?

Trading on the EUR/GBP market intensifies at 6:00 GMT, when the European session opens. At 7:00 GMT with the start of trading in London, volatility increases further and remains at high levels until 16:30 GMT, making this period a good time for active intraday traders.

The best time to trade EUR/GBP depends on the strategies used. When volatility is low - you can consider range trading strategies. If high - trade intraday breakouts.

Knowing how volatility changes intraday (and intra-week) will help you to choose the right strategy and increase your chances of making profits.

Is EUR/GBP a good pair to trade?

EUR/GBP is considered a good pair to trade for various reasons like:

-

Stability: EUR/GBP is often seen as a relatively stable currency pair. Both the Euro (EUR) and the British Pound (GBP) are major currencies, and they tend to exhibit less extreme fluctuations compared to some other pairs, making it appealing for traders looking for a more predictable market.

-

Lower spreads: This pair usually has lower spreads compared to more exotic or less-traded currency pairs. Lower spreads can reduce trading costs.

-

Geographic and economic links: The Eurozone and the United Kingdom have strong economic ties, so similar factors, like economic data, geopolitical events, and monetary policy, influence their currencies. If you are in Europe, it will be easier to understand the economic circumstances and interpret the news background.

-

Liquidity: EUR/GBP is one of the most traded currency pairs in the world, which means it enjoys high liquidity. This liquidity allows for comprehensive entry and exit from trades without causing significant price distortions.

-

Diversification: Traders can use the EUR/GBP pair to diversify their currency trading where the USD plays a big role.

Despite these advantages, it's essential to conduct thorough research, have a well-defined trading strategy, and manage risk properly when trading EUR/GBP or any other currency pair.

EUR/GBP trading hours

As with most currency pairs, the timing of the trading sessions plays a crucial role in intraday volatility for GBP/EUR.

-

Asian session: This session, which occurs from 8:00 AM to 5:00 PM as per Tokyo time, is relatively quiet for EUR/GBP. The pair tends to experience lower volatility during these hours because London and New York traders are primarily inactive.

-

European (London Session): The volatility surge on EUR/GBP is observed at 6:00 GMT, when traders in a major European financial center like Frankfurt start working. At 7:00 GMT, traders from London join them, raising volatility well above the average level.

-

American Session (New York): After a slight dip in volatility at 10-11:00 GMT (when traders in Europe can leave for lunch), US trading opens at 12:00 GMT. Overlapping trading sessions in the U.S. and Europe cause volatility to reach its maximum level.

However, trading hours may change due to daylight saving time and winter time which you need to keep in mind.

The best times to trade GBP/USD

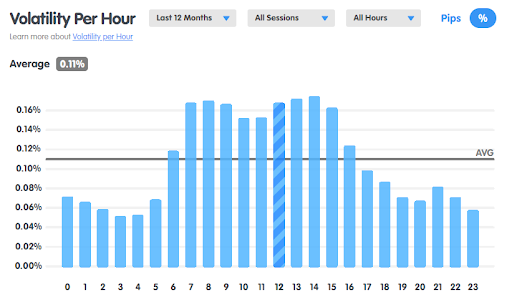

As the picture below shows, the average volatility is 0.11% per hour.

Volatility per hour - Source: Babypips.com, GMT Time Zone

If you expect to make money on EUR/GBP currency pair quotes, you can focus on analyzing charts and searching for trading sets during 2 periods:

-

European (London) Session: EUR/GBP experienced the highest trading activity during the European session. This session generally runs from 8:00 AM to 4:00 PM GMT. The core trading hours within this session are between the timings 8:00 AM and 12:00 PM GMT when London markets are fully operational. It is during these hours that important statistics are often published for Europe and the UK.

-

Overlapping London and New York Sessions: Another period of significant activity for EUR/GBP is when the London and New York sessions overlap. This occurs from about 8:00 AM to 12:00 PM New York time, corresponding to 12:00 PM to 4:00 PM GMT. It's often the most volatile time for this currency pair due to the simultaneous trading activity in Europe and the United States.

What is the daily volatility of the EUR/GBP?

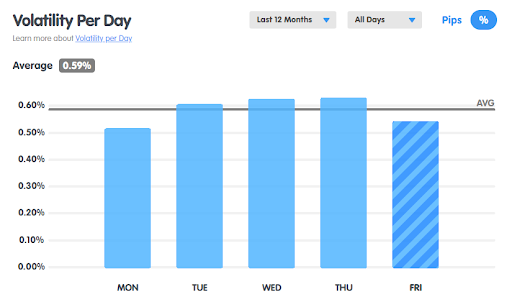

You may notice that in US dollar currency pairs, the day of highest volatility is often on Friday. But this is not the case with EUR/GBP.

Volatility per day - Source: Babypips.com

-

Highest volatility: Wednesday and Thursday

-

Lowest volatility: Monday

How to trade EUR/GBP?

Here are some common trading strategies for EUR/GBP:

-

1

News Trading: Pay attention to economic events and news releases that can impact the Euro (EUR) and the British pound (GBP). Key events include central bank announcements (e.g., Bank of England and European Central Bank decisions), economic data releases, and geopolitical events.

The saga of the UK's exit from the European Union (Brexit) caused important trends on the EUR/GBP pair.

-

2

Trend Following: This strategy involves identifying and trading in the direction of prevailing trends. Use technical analysis tools like moving averages, trendlines, or trend indicators to determine the current trend in EUR/GBP.

-

3

Patterns: chart patterns (e.g., head and shoulders, double tops/bottoms) and candlestick patterns, can help you identify potential reversal or continuation signals.

Analyze the EUR/GBP chart to spot these patterns and make trading decisions accordingly.

-

4

Algorithmic Trading (Algo): Algorithmic trading involves using computer programs to automate trading decisions based on pre-defined criteria. Traders can develop algorithms to trade EUR/GBP, considering technical indicators, news sentiment, and other factors. Algo trading is effective for executing trades swiftly and without emotional bias.

If you want to read the latest overviews for EUR/GBP market, visit: EUR/GBP forecast for today by Traders Union analysts

Pros of trading the EUR/GBP currency pair

Trading the EUR/GBP currency pair offers several advantages, as you've mentioned:

-

Low spreads: EUR/GBP often has lower spreads compared to more exotic or less-traded currency pairs. Lower spreads can reduce the cost of entering and exiting positions, making it cost-effective for traders.

-

Geographic advantage: EUR/GBP is particularly attractive for traders based in or focusing on Europe. It's the pairing of the Euro, used by many European countries, and the British Pound. This proximity can make it easier for European traders to stay aware of relevant news and events.

-

Fundamentals and economic data: This currency pair is influenced by various economic and fundamental factors. Traders can access a wealth of data, statistics, and news related to the Eurozone and the UK, which can provide valuable insights for trading decisions.

Best Forex brokers

Summary

Weigh everything that matters when you plan your trading with EUR/GBP volatility in mind.

On the one hand, focusing on the hours when the market is active will help you stay focused, avoid overtrading and catch important trends intraday.

On the other hand, you may miss out on some important trading setups that will form during hours when you will be away from EUR/GBP trading.

Consider diversifying your trading activities to include a range of currency pairs and assets, and ensure that your risk management strategies are robust.

FAQs

What is the best session to trade GBP?

The best time to trade is considered to come with the opening of the London session at 7:00 GMT. With a slight dip for lunch at 10-12:00 GMT, high volatility persists until 16:30 GMT.

How to trade EUR/GBP successfully?

Successfully trading EUR GBP will require you to focus on economic data, trade during session overlaps, use risk management, combine technical and fundamental analysis, and stay informed.

What time is EUR/GBP most active?

EUR/GBP is most active during the overlap of the London and New York trading sessions, usually from 8:00 AM to 12:00 PM New York time (12:00 PM to 4:00 PM GMT).

What is a good risk management strategy for EUR/GBP trading?

To manage risk, use stop-loss orders, position sizing, and risk-reward ratios. Diversify your portfolio and avoid overtrading.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

4

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

5

Algorithmic trading

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).