Top 20 Chart Candlestick Patterns - Traders Union

Candlestick patterns hold the key to understanding market sentiment and price action, making them an indispensable tool for traders seeking to make informed decisions. By gaining proficiency in reading them, you'll be better equipped to navigate the complex and ever-changing landscape of trading with precision and confidence. In this in-depth guide, the experts at TU will examine the top 20 best candlestick patterns that can significantly elevate your trading performance, covering the full spectrum from bullish and bearish patterns to those that signal reversals.

According to Traders Union’s experts, the best candlestick patterns you should know for better trading include Bullish Engulfing, Bearish Engulfing, Hammer, Shooting Star, and Morning Star. These patterns encompass bullish, bearish, reversal, and continuation situations, allowing you to gain a deeper understanding of market movements and make well-informed trading decisions.

Do you want to start trading Forex? Open an account on Roboforex!How do candlestick patterns work?

Top 10 Forex Chart Patterns You Should KnowUnderstanding candlestick formations

Candlestick formations are visual depictions of price fluctuations that can be observed on stock charts. They provide crucial information about the opening, closing, high, and low prices for a specific period, as well as the general sentiment surrounding a stock. These patterns are easy to identify and can serve as templates for spotting potential trading opportunities.

The history of candlesticks

Candlesticks have been utilized by traders since the 18th century, initially by Japanese traders and later adopted in the Western Hemisphere in 1989. Nowadays, trading platforms generate candlestick charts, making it simpler for traders to examine price movements. Candlesticks can represent various time periods, such as one minute, one day, or one month, displaying the price action for each trading period.

Types of candlestick formations

There are several types of candlestick formations, including bullish, bearish, continuation, and reversal patterns. It's essential to learn how to spot these patterns and understand their significance in the context of trading. Focusing on mastering one pattern at a time can help build a solid foundation for trading.

Bullish candlestick formations

Bullish candlestick formations can indicate a reversal after a bearish trend or a continuation of an established bullish trend. It's important to note that these patterns may include one or more bearish-looking candlesticks.

Bearish candlestick formations

Bearish candlestick formations suggest lower prices ahead and can either confirm an existing trend or signal a reversal after a bullish rally.

Japanese candlestick formations

Japanese candlestick formations are the foundation for all candlestick patterns. They were initially used by Japanese rice traders in the 1700s and introduced to the Western world in the late 1980s. Today, they are the go-to charting method for many traders.

Best Forex Candlestick Patterns - Bullish & BearishBullish Reversal Patterns

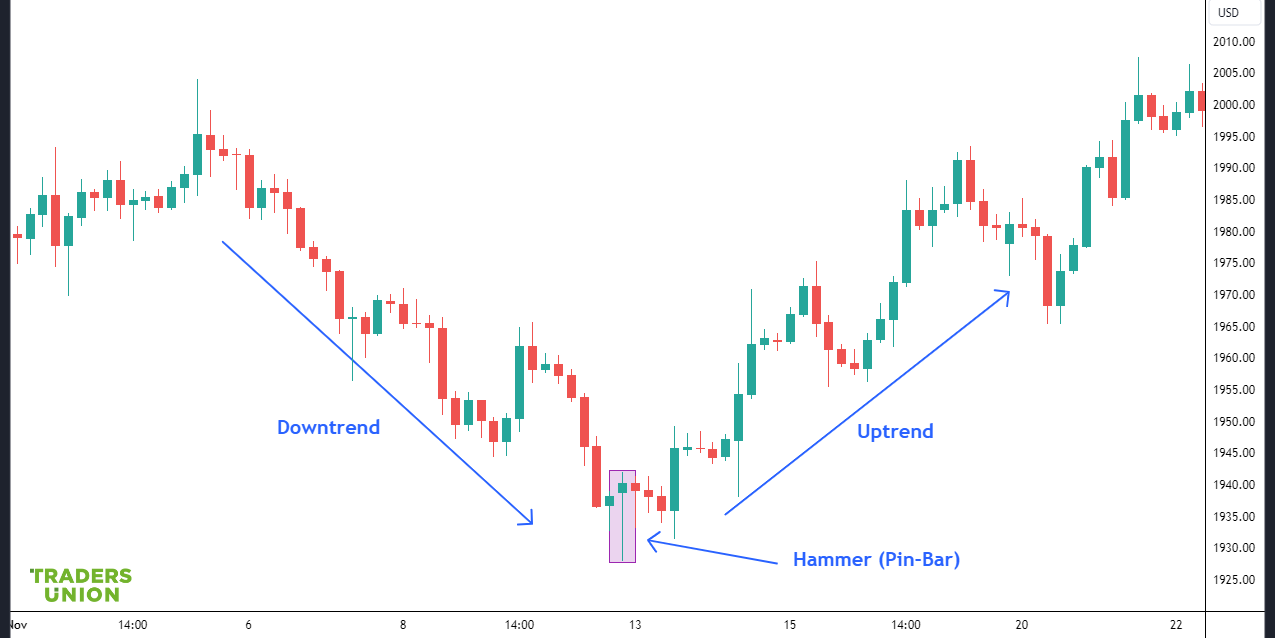

Hammer

A Hammer candlestick pattern is formed when a security's low significantly surpasses its opening price, but the security rallies to close near the opening price. This pattern's long lower shadow indicates that sellers initially pushed the price down, but buyers regained control and pushed the price back up, suggesting a potential bullish reversal.

Image: Hammer candlestick pattern

Bullish Engulfing

The Bullish Engulfing pattern emerges when a small red candle is succeeded by a more substantial green candle, which entirely encompasses the candle from the prior day. The pattern suggests that buying pressure has overcome selling pressure, creating a shift in market sentiment that could lead to an upward price trend.

Image: Bullish Engulfing pattern

Morning Star

A Morning Star pattern consists of three candlesticks: a long red candle, a small-bodied candle (either red or green) that gaps lower, and a long green candle that closes within the range of the first candle. The pattern indicates a weakening downtrend, as the small-bodied candle represents indecision in the market, followed by a strong green candle that suggests a bullish reversal.

Image: Morning Star pattern

Piercing Line

The Piercing Line pattern is a two-candle pattern with a long red candle followed by a long green candle that opens lower than the previous day's low but closes more than halfway above the midpoint of the first candle. The second candle's strong close indicates a shift in market sentiment and suggests that the bulls are gaining control.

This pattern predominantly appears in stocks due to their potential for overnight gaps, as opposed to currencies or other round-the-clock trading instruments. Nevertheless, this pattern can materialize in any asset class on a weekly chart.

Image: Piercing Line pattern

Inverted Hammer

The Inverted Hammer is a single candle pattern with a small body, long upper shadow, and little or no lower shadow. This pattern occurs after a downtrend, and its long upper shadow represents buyers attempting to push the price higher. The small body indicates a potential trend reversal as buying pressure increases.

Image: Inverted Hammer pattern

Bearish Reversal Patterns

Doji

A Doji candlestick pattern is formed when a security's opening and closing prices are nearly equal, resulting in a candlestick with a small or non-existent body and potentially long shadows. This pattern represents market indecision, as neither buyers nor sellers could gain control, and may signal a potential trend reversal or continuation, depending on the context of the preceding candles and overall market trend.

Image: Doji candlestick pattern

Bearish Engulfing

The Bearish Engulfing pattern occurs when a small green candle is followed by a larger red candle that completely engulfs the previous day's candle. This pattern suggests that selling pressure has increased, and the market sentiment has shifted toward bearishness, potentially leading to a downward price movement.

Image: Bearish Engulfing pattern

Evening Star

An Evening Star pattern consists of three candlesticks: a long green candle, a small-bodied candle (either green or red) that gaps higher, and a long red candle that closes within the range of the first candle. The pattern indicates a weakening uptrend, with the small-bodied candle representing market indecision, followed by a strong red candle that suggests a bearish reversal.

Image: Evening Star pattern

Dark Cloud Cover

The Dark Cloud Cover pattern is a two-candle pattern with a long green candle followed by a long red candle that opens higher than the previous day's high but closes more than halfway below the midpoint of the first candle. The second candle's strong close indicates a shift in market sentiment, suggesting that the bears are gaining control.

Image: Dark Cloud Cover pattern

Shooting Star

The Shooting Star is a single candle pattern with a small body, long upper shadow, and little or no lower shadow. This pattern occurs after an uptrend, and its long upper shadow represents sellers attempting to push the price lower. The small body indicates a potential trend reversal as selling pressure increases.

Image: Shooting Star pattern

Continuation Candlestick Patterns

Rising Three Methods

This bullish continuation pattern consists of a long green candle, followed by three small red candles within the range of the first candle, and concludes with a green candle that surpasses the high of the first green candle. This pattern indicates that the uptrend is likely to continue.

Image: Rising Three Methods pattern

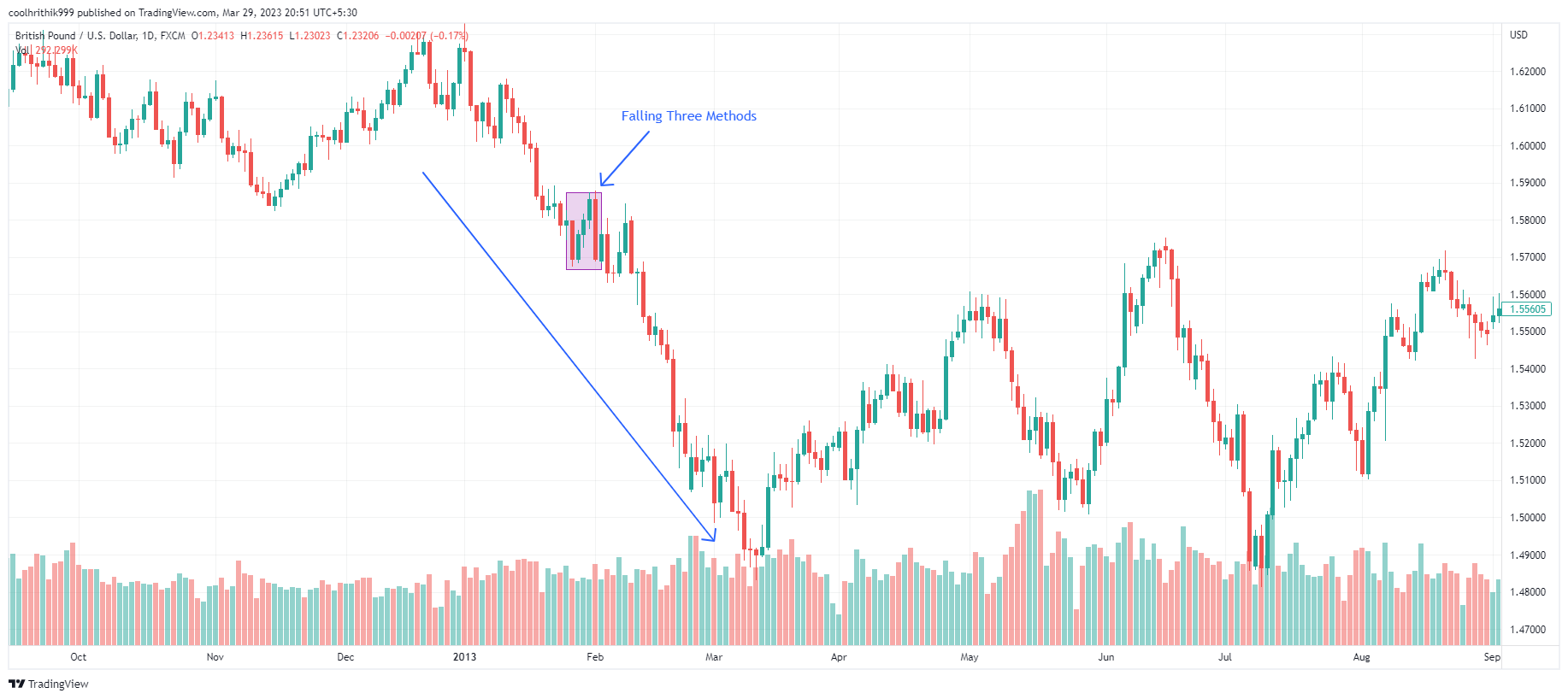

Falling Three Methods

This bearish continuation pattern is the inverse of the Rising Three Methods. It starts with a long red candle, followed by three small green candles within the range of the initial red candle, and ends with a red candle that goes below the low of the first red candle. This pattern suggests that the downtrend will persist.

Image: Falling Three Methods pattern

On-Neck Line

This bearish continuation pattern occurs during a downtrend. It consists of a long red candle followed by a green candle that opens lower than the previous candle's close and closes near the low of the previous red candle. This pattern suggests that the downtrend is likely to persist.

Image: On-Neck Line pattern

Separating Lines

This continuation pattern can be either bullish or bearish. In a bullish trend, a green candle is followed by a red candle that opens at the same level as the previous green candle's opening. In a bearish trend, a red candle is followed by a green candle that opens at the same level as the previous red candle's opening. The trend is expected to continue in its original direction.

Image: Separating Lines pattern

Side-by-Side White Lines

This bullish continuation pattern features two long green candles with similar opening prices. The second green candle should close higher than the first one, indicating that the uptrend will likely continue.

Image: Side-by-Side White Lines pattern

Other Candlestick Patterns

Harami

The Harami pattern consists of a small-bodied candle (either red or green) that is completely contained within the range of the previous day's large-bodied candle. This pattern indicates a potential trend reversal or consolidation, as the small-bodied candle signals a decrease in momentum from the previous day's strong price movement.

Image: Harami pattern

Spinning Top

A Spinning Top is a candlestick pattern with a small body and long upper and lower shadows, indicating a significant price movement during the trading session but a close near the opening price. This pattern represents market indecision and suggests that neither bulls nor bears could maintain control, potentially leading to a trend reversal or continuation, depending on the overall market trend.

Image: Spinning Top pattern

Marubozu

The Marubozu candlestick pattern has a long body with little or no shadows, indicating that the opening price is either the high or low of the session and the closing price is the opposite end. A green Marubozu indicates strong buying pressure, while a red Marubozu suggests strong selling pressure. This pattern can signal a continuation or acceleration of the current trend.

Image: Marubozu candlestick pattern

Three White Soldiers

The Three White Soldiers pattern consists of three consecutive long green candles, each with a higher close than the previous candle, and each opening within the body of the previous candle. This pattern indicates strong bullish momentum and may signal a potential trend reversal or continuation of an existing uptrend. Traders often view the Three White Soldiers pattern as a confirmation of a bullish market, and may consider it an opportunity to enter long positions or add to existing long positions.

Image: Three White Soldiers pattern

Three Black Crows

The candlestick pattern consists of three consecutive long red candles, each with a lower close than the previous candle, and each opening within the body of the previous candle. This pattern indicates strong bearish momentum and may signal a potential trend reversal or continuation of an existing downtrend. Traders often view the Three Black Crows pattern as a confirmation of a bearish market, and may consider it an opportunity to enter short positions or add to existing short positions.

Image: Three Black Crows pattern

Are candlestick patterns reliable?

Candlestick patterns are widely used by traders to predict price direction, but their reliability can be influenced by various factors. It is essential to understand that candlestick patterns alone may not always provide accurate insights, and it is crucial to combine them with other trading strategies to increase their effectiveness.

Several factors can impact the reliability of candlestick patterns, and being aware of them can help you trade with greater confidence. These factors include:

-

Timeframe: Shorter timeframes are typically less reliable than longer ones due to increased volatility. Trader sentiment is more likely to change frequently in the short term, whereas daily or weekly timeframes offer more reliable insights into long-term trends.

-

Trading instrument: Different trading instruments exhibit unique behaviors, with liquidity being a crucial factor. Some candlestick patterns may be more suitable for Forex trading, while others work better with stocks. In general, the higher the trading volume, the more reliable the candlestick patterns will be.

-

Key levels: The context in which a candlestick pattern occurs is essential. If support and resistance lines are nearby, the trade has a higher potential for success.

-

Pattern size: Larger patterns tend to be more reliable, as significant price movements often produce stronger signals.

-

Candlestick pattern type: The reliability of candlestick patterns varies depending on the specific pattern. In general, patterns with more candles are more reliable, although they may appear less frequently.

It's important to remember that memorizing candlestick formations is not necessary to grasp price movements. This is a common mistake among new traders. Instead, focus on gaining a deeper understanding of how markets work, and you'll be better equipped to use trading tools like candlestick charts effectively.

Best Trading Software and ToolsHow to trade candlestick patterns?

Candlestick patterns are an essential tool in any trader's arsenal. They help you understand market sentiment and price action, enabling you to make well-informed trading decisions. To trade candlestick patterns effectively, consider these five expert tips that will elevate your trading skills and empower you to harness the full potential of these powerful patterns.

Context and location

The foundation of successful candlestick trading lies in understanding context and location. Context requires you to always compare the current candlestick to the most recent price action, ensuring you don't place excessive importance on individual candlesticks. Location, on the other hand, emphasizes trading candlesticks only at significant price levels. For example, a pinbar at a previous double top/bottom carries more weight than a random pinbar within your charts.

Size

Candle size provides valuable insights into strength, momentum, and trends. Larger candles often signal a more robust trend, while smaller candles appearing after a long rally may foreshadow a reversal or the end of a trend.

Wicks

Long wicks at critical support/resistance levels often hint at potential reversals. They typically signify rejections and failed attempts to move the price higher or lower. Long rejection-wicks are common around double tops/bottoms and can be a reliable pattern on their own. Conversely, a large candle without wicks usually indicates great strength.

Body

The body represents the distance the price has travelled from the open to the close. Interpreting the body in the context of the wicks and size is crucial. A small body with large wicks indicates indecision, a large body without wicks shows strength, a small body without wicks suggests a lack of interest, and a large body with long wicks demonstrates high volatility and extensive trading activity.

Analyzing candlestick patterns in conjunction with market sentiment

To add depth to your trading strategy, consider examining candlestick patterns in relation to prevailing market sentiment. This approach helps you understand the underlying emotions and psychology driving market participants, enabling you to make more informed decisions based on a comprehensive understanding of market dynamics.

Market sentiment can be assessed through various methods, such as analyzing news events, evaluating market breadth indicators, or observing the behavior of market participants in social media and trading forums. By combining the insights gained from candlestick patterns with an understanding of market sentiment, you can identify potential turning points in the market, gauge the strength of trends, and detect early signs of reversals.

Best AI Trading SoftwareBest way to use candlestick patterns

To make the most of these patterns, consider adopting the following strategies that not only simplify complex concepts but also enhance your trading skills and decision-making capabilities.

Confluence

Combining candlestick patterns with other technical analysis tools is a powerful strategy known as confluence. By identifying areas where multiple technical factors align, you can increase the probability of successful trades. Examples of confluence include support and resistance levels, trend lines, or Fibonacci retracements. These tools can help validate the signals generated by candlestick patterns and provide a more robust trading strategy.

Volume confirmation

Volume plays a crucial role in the reliability of candlestick patterns. By analyzing trade volumes alongside the patterns, you can gauge the strength of market sentiment and determine the likelihood of a trend continuation or reversal. High trading volumes tend to confirm the validity of a candlestick pattern, while low volumes may cast doubt on its significance. Ensure you pay close attention to volume when interpreting candlestick patterns to enhance the accuracy of your predictions.

Best Volume Indicators in TradingIncorporating technical indicators

Integrating technical indicators with candlestick patterns is an effective way to strengthen your trading strategy. Indicators such as Moving Averages, Relative Strength Index (RSI), or Moving Average Convergence Divergence (MACD) can complement and confirm the signals generated by candlestick patterns. This combination results in a more comprehensive analysis of the market, increasing the likelihood of successful trades.

Time frame analysis

Analyzing candlestick patterns across multiple time frames can provide valuable insights into market dynamics. By examining patterns on shorter and longer time frames, you can identify trends, support and resistance levels, and potential reversals. This approach allows you to develop a more nuanced understanding of the market and make more informed trading decisions.

How Does Support and Resistance Work in TradingPatience and discipline

The key to successful trading with candlestick patterns lies in patience and discipline. Resist the urge to act impulsively based on individual patterns. Instead, wait for confirmation from other technical tools and remain disciplined in adhering to your predefined trading plan. By exercising patience and discipline, you can minimize losses and maximize potential gains.

Double Bottom and Double Top Reversal PatternsBest way to use candlestick patterns Best Forex brokers 2024

Summary

In this article, the experts at TU have delved into the top 20 candlestick patterns and their importance in trading. Key takeaways include understanding the components of a candlestick chart, recognizing various pattern types, and acknowledging that candlestick patterns' reliability can be influenced by factors such as timeframe, trading instrument, chart environment, pattern size, and pattern type. To trade candlestick patterns effectively, consider expert tips such as paying attention to context and location, examining candle size and wicks, analyzing body characteristics, and incorporating market sentiment analysis. By applying these insights, you can refine your trading strategy and enhance your overall performance.

FAQs

What is the best candlestick pattern to trade?

The best candlestick pattern to trade is subjective and depends on the trader's strategy, but the Bullish and Bearish Engulfing patterns are often considered highly effective due to their strong reversal signals.

What is the most powerful candlestick pattern?

The most powerful candlestick pattern is often regarded as the Hammer (bullish) or the Shooting Star (bearish) pattern, as they typically indicate a strong reversal signal when they appear after a downtrend (Hammer) or an uptrend (Shooting Star).

Which candlestick pattern is most reliable for day trading?

For day trading, the most reliable candlestick pattern is the Doji pattern, as it indicates indecision in the market and could potentially signal a reversal or continuation of the existing trend.

What is the 3-candle rule?

The 3-candle rule pertains to a pattern involving three candles arranged in a particular order, signifying that the existing trend has weakened and a shift in the opposite direction could potentially commence.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).