Top 10 candlestick patterns every trader must know

In the ever-evolving world of trading, mastering the art of technical analysis is crucial for a successful trader. Candlestick patterns, a key component of this discipline, have become an indispensable tool for those seeking success in the Forex market. These patterns not only offer a comprehensive visual representation of market sentiment, but also provide traders with valuable insights into potential price movements. In this article, we delve into the top 10 most powerful candlestick patterns that professional traders rely upon to enhance their trading performance.

According to Traders Union’s experts, some of the best bullish candlestick patterns include the Hammer, Three White Soldiers, Bullish Engulfing, Morning Star, and Piercing Line. These patterns indicate potential bullish reversals or continuations and can be effective in guiding traders' decision-making. On the other hand, the best bearish candlestick patterns include the Three Black Crows, Bearish Engulfing, Evening Star, Head and Shoulders, and Doji. These patterns suggest potential bearish reversals or continuations.

Do you want to start trading Forex? Open an account on Roboforex!Understanding a candlestick

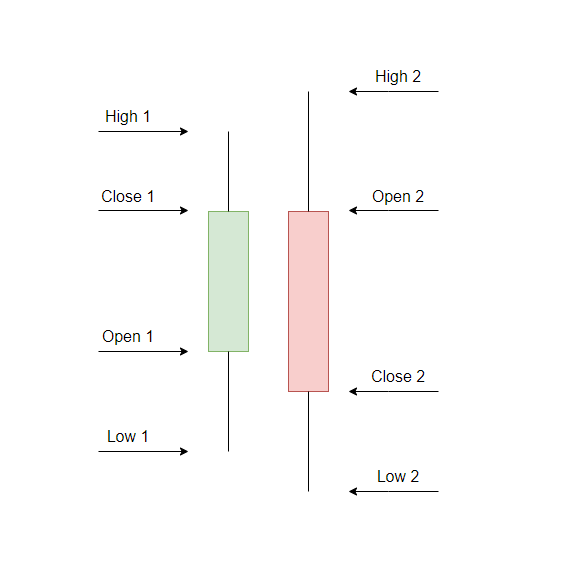

A candlestick is an element of the chart containing key information about the price range over a period of time:

-

The price of the beginning of the trading period (Open).

-

Maximum price of the period (High).

-

Minimum price of the period (Low).

-

The price of the end of the trading period (Close).

Candlestick pattern

If the close price is higher than the open price, the candlestick is bullish or white (left side of the image above).

If the close price is lower than the open price, the candlestick is bearish or black (right side of the image above).

The price range between the Open and Close is called the “body” of the candlestick.

The thin lines between the body show the high and low prices and are called the “shadows”.

Best bullish candlestick patterns

Based on the opinion of various analysts and seasoned traders, our experts have shortlisted the following as the best bullish candlestick patterns:

Hammer

The Hammer candlestick pattern materializes when the low of a security significantly surpasses its opening price, but eventually rallies to close in close proximity to the opening price. The extended lower shadow of this pattern reveals that, initially, sellers managed to push the price down, however, buyers regained control and drove the price back up, hinting at a possible bullish reversal.

Hammer candlestick pattern

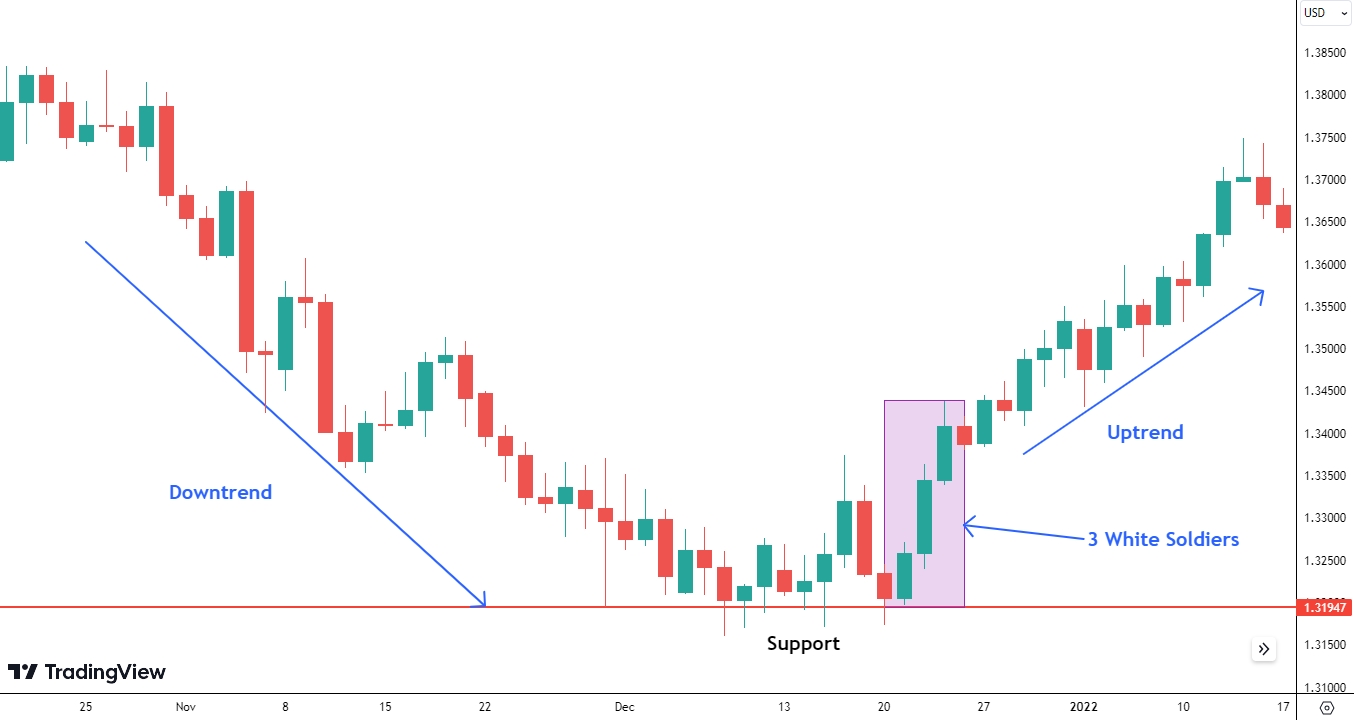

Three White Soldiers

Comprising three consecutive long green candles, each with a higher closing price than the preceding one and an opening within the body of the previous candle, the Three White Soldiers pattern signifies strong bullish momentum. It may indicate a potential trend reversal or the continuation of a pre-existing upward trend. Traders often interpret this pattern as a confirmation of a bullish market and might see it as an opportunity to initiate long positions or expand existing ones.

Three White Soldiers pattern

Bullish Engulfing

A Bullish Engulfing pattern appears when a small red candle is followed by a bigger green candle that completely covers the previous day's candle. This pattern implies that the buying pressure has surpassed the selling pressure, triggering a change in market sentiment that could result in an upward price movement.

Bullish Engulfing pattern

Morning Star

The Morning Star pattern is made up of three candlesticks: a lengthy red candle, a small-bodied candle (either red or green) that exhibits a lower gap, and a long green candle that closes within the first candle's range. This pattern signals a faltering downtrend, as the small-bodied candle reflects market indecision, succeeded by a robust green candle that suggests a bullish turnaround.

Morning Star pattern

Piercing Line

A Piercing Line pattern consists of a two-candle formation, featuring a long red candle followed by a lengthy green candle that opens below the previous day's low but closes more than halfway above the midpoint of the initial candle. The strong close of the second candle indicates a shift in market sentiment and implies that bulls are taking control. While this pattern predominantly emerges in stocks due to their susceptibility to overnight gaps, it can manifest in any asset class on a weekly chart, even though it is less common in currencies or other 24-hour trading instruments.

Piercing Line pattern

Best bearish candlestick patterns

Based on the opinion of various analysts and seasoned traders, our experts have shortlisted the following as the best bearish candlestick patterns:

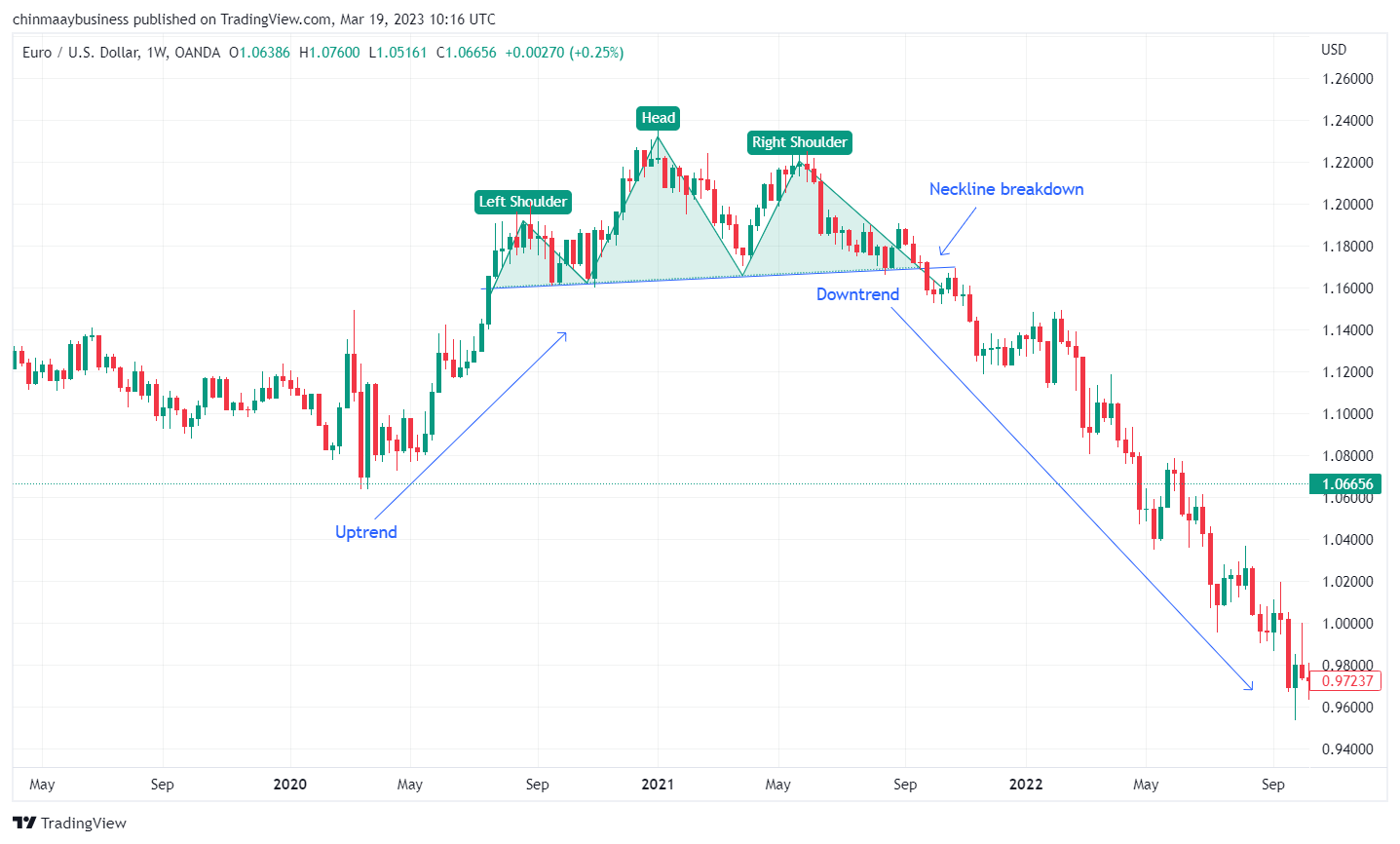

Head and Shoulders

The Head and Shoulders pattern is well-known for trading potential trend reversals. This pattern features three peaks, with the middle peak being the highest (the head) and the other two peaks being slightly lower (the shoulders). The primary indication of this pattern is that an uptrend is coming to an end, and that a downtrend may follow.

Head and Shoulders pattern

Three Black Crows

The Three Black Crows candlestick pattern is identified by three consecutive long red candles with lower closing prices than the previous candle, and each opening within the body of the prior candle. This pattern signifies strong bearish momentum and may signal a potential trend reversal or continuation of an existing downtrend.

Three Black Crows pattern

Doji

A Doji candlestick pattern is formed when a security's opening and closing prices are almost identical, resulting in a small or non-existent body and potentially long shadows. This pattern represents market indecision and may indicate a potential trend reversal or continuation, depending on the context of the preceding candles and overall market trend.

Doji candlestick pattern

Bearish Engulfing

The Bearish Engulfing pattern appears when a small green candle is followed by a larger red candle that completely engulfs the previous day's candle. This pattern can indicate that selling pressure has intensified, and that the market sentiment has shifted towards bearishness, potentially leading to a downward price movement.

Bearish Engulfing pattern

Evening Star

The Evening Star pattern consists of three candlesticks, with the first being a long green candle, followed by a small-bodied candle (either green or red) that displays a higher gap, and finally a lengthy red candle that closes within the range of the first candle. This pattern suggests a weakening uptrend, with the small-bodied candle indicating market indecision and the powerful red candle implying a bearish reversal.

Evening Star pattern

How to trade candlestick patterns effectively?

Successful candlestick trading is based on several key principles. By mastering these principles, you can identify high-probability trades and improve your trading performance. Here are some essential factors to consider when trading candlestick patterns, as suggested by our experts:

Consider context and location: To effectively trade candlestick patterns, it's crucial to always compare the current candlestick to the most recent price action and analyze the bigger picture. Additionally, you should only trade candlesticks at important price levels.

Size matters: Candle size can reveal a lot about the strength, momentum, and trends in the market. When candles suddenly become larger, it often signals a stronger trend, while small candles after a long rally can suggest a potential reversal or the end of a trend.

Interpret wicks: The length of a candle's wick can also provide valuable insights into potential reversals. Long wicks at key support/resistance levels can indicate rejections and failed attempts to move the price higher or lower. However, do note that not all wicks are reversal signals.

Analyze body: The body of a candlestick represents the distance the price has traveled from the open to the close. Experts suggest that you should interpret the body in the context of the wicks and the size.

Consider support and resistance levels: Support and resistance levels can act as significant price barriers and often provide valuable insights into potential trading opportunities. By combining your analysis of candlestick patterns with your understanding of support and resistance levels, you can make more informed trading decisions and increase your chances of success.

Focus on risk management: While analyzing candlestick patterns is important, it's equally essential to focus on risk management. By setting appropriate stop-loss orders and managing your risk effectively, you can minimize potential losses and increase your chances of long-term success.

Pros and cons of using candlestick patterns

Experts have highlighted the following pros and cons of using candlestick patterns for trading:

👍 Pros

•Better than traditional charts: Candlestick charts provide a detailed visual representation of price action, making them more useful than traditional bar charts. By analyzing price action over time, traders can identify patterns and make more informed predictions about future market movements.

•Offers a psychological viewpoint: The psychological factors of greed, fear, and hope can influence currency trades, which is why technical analysis is critical in understanding these market sentiments. By using candlestick pattern analysis, traders can read changes in market determination of value without any influence from psychological factors. This type of analysis displays the interaction between buyers and sellers, making it easier to understand the emotions prevalent in the market.

•Easy to interpret: Candlestick charts are visually appealing and easy to understand, making them accessible to all traders. With customizable colors and outlines available on most charting platforms, users can personalize the appearance of the charts to their liking.

•Works well with indicators: Candlestick charts work well with indicators, making them an essential tool for any trader looking to use technical analysis in their trading system.

•Reveals market sentiment and psychology: Candlestick charts provide insight into who is in control of the market and what the overall sentiment may be over a given time frame. Through various patterns and formations, traders can assess the market's bias.

•Great for algorithmic trading: Candlestick patterns are easy to describe and code, making them an excellent tool for algorithmic trading.

👎 Cons

•Can lead to Apophenia: Candlestick charts can lead traders to suffer from apophenia, a cognitive bias where one sees patterns in random data. This can lead to meaningless interpretations and incorrect predictions.

•Inconsistent data: Candlestick charts can have gaps, which may cause inconsistencies in the data. For example, a candle may close at one level, and the following candle may open at a different level, making it difficult to analyze.

•Technical analysis is subjective: Candlestick charts can show different biases, and technical analysis can be subjective. This can create conflicting signals, especially when indicators are added.

•Lagging indicator: Candlestick patterns are lagging indicators because traders typically wait until the candle closes before entering a trade. This can limit the effectiveness of this science, as traders are left to speculate about future price movements based on past data.

•Analysis paralysis: Candlestick charts can display multiple biases, which can create conflicting signals and make technical analysis subjective. This can lead to analysis paralysis, where traders are unable to make informed decisions due to the overwhelming amount of information.

Best Forex brokers 2024

Summary

In conclusion, the five best bullish candlestick patterns as per our experts include the Hammer, Three White Soldiers, Bullish Engulfing, Morning Star, and Piercing Line. Furthermore, the top five bearish candlesticks are Three Black Crows, Bearish Engulfing, Evening Star, Head and Shoulders, and Doji. Each pattern has a unique formation that indicates potential bullish/bearish reversals or continuations. Trading candlestick patterns effectively requires a deep understanding of the market and the patterns themselves. By combining technical analysis with fundamental analysis, traders can make more informed decisions and increase their chances of success. It is also essential to be aware of the potential biases and limitations of candlestick charts and use them in conjunction with other tools to make well-informed trading decisions.

FAQs

Which is the best bullish candlestick pattern?

There is no one-size-fits-all answer to this question as the effectiveness of candlestick patterns can vary depending on the market conditions and the time frame being analyzed. However, some of the most popular and effective bullish candlestick patterns include the Hammer, Three White Soldiers, Bullish Engulfing, Morning Star, and Piercing Line. Traders should always analyze candlestick patterns in the context of the bigger picture and consider multiple technical and fundamental factors before making a trading decision.

What is the most reliable candlestick pattern for Forex?

Again, there is no definitive answer to this question, as the reliability of candlestick patterns can vary depending on various factors. However, some of the most reliable candlestick patterns for Forex trading include the Three Black Crows, Bearish Engulfing, Evening Star, Head and Shoulders, and Doji. These patterns have proven to be effective in indicating potential bearish reversals or continuations, and traders should consider multiple technical and fundamental factors before using them in their trading decisions.

Which candle pattern is bullish with bearish?

The Harami candlestick pattern is a bullish reversal pattern that features a small real body that is contained within the preceding candle's larger real body. This pattern indicates that the previous bearish trend is losing momentum, and there is a potential bullish reversal. This candlestick pattern can appear in both uptrends and downtrends, and traders should always analyze it in context with the overall market trend and other technical and fundamental factors.

Which is the best bearish candlestick pattern?

As with the best bullish candlestick pattern, the most effective bearish candlestick pattern can vary depending on market conditions and the time frame being analyzed. However, some of the most popular and reliable bearish candlestick patterns include the Three Black Crows, Bearish Engulfing, Evening Star, Head and Shoulders, and Doji. These patterns have shown to be effective in indicating potential bearish reversals or continuations, and traders should analyze them in the context of the bigger picture and consider multiple technical and fundamental factors before making a trading decision.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.