Top 10 Effective Forex Trading Strategies - Traders Union

As a new or experienced trader, it is essential to understand that success in the highly competitive Forex market depends on a variety of factors, including market analysis, risk management, and strategy implementation. To help you navigate this complex landscape, Traders Union experts have put together a comprehensive guide to the top 10 most effective Forex trading strategies that everyone should know. In this guide, you will learn how to identify entry points, set profit targets, and manage stop-losses, all while maximizing your profits and minimizing your risks. With clear examples and helpful illustrations, this guide is an essential resource for anyone looking to start making money in Forex trading today.

According to Traders Union’s experts, 10 effective Forex strategies to learn include:

Moving Average strategy;

50 pips a day strategy;

Breakout strategy;

Chart Pattern strategy;

Trend Following strategy;

Bounce strategy;

Overbought and Oversold strategy;

Counter-trend Forex strategy;

Bollinger Bands strategy;

Pivot Points strategy.

Choose your Forex trading style

When it comes to Forex trading, there are several different styles that traders can choose from based on their personality, risk tolerance, and time availability. So let us briefly review the most common Forex trading styles, their pros and cons, time frames, and key components.

Scalping

Scalping is a fast-paced trading style where traders aim to make small profits by opening and closing positions within seconds or minutes. This style requires a high level of concentration and quick decision-making skills.

Pros and Cons

👍 Pros

•High potential for profit in a short period of time;

•Opportunity to trade frequently and generate multiple small profits;

•Requires minimal market knowledge.

👎 Cons

•High risk due to the fast-paced nature of trading;

•Requires strict discipline and risk management;

•High transaction costs due to frequent trades.

Best suited for

Scalping is best suited for full-time traders with strong nerves and excellent automation/programming skills. This style is not recommended for beginners or traders with limited time availability.

Best Crypto Scalping Strategies and Tools for BeginnersDay trading

Day trading involves opening and closing positions within the same trading day. This style requires traders to analyze market trends and indicators to make informed trading decisions.

Pros and Cons

👍 Pros

•Potential for high profits;

•Opportunity to trade frequently;

•Requires less capital than long-term trading.

👎 Cons

•High risk due to the volatile nature of the market;

•Requires a high level of discipline and focus;

•May require advanced technical analysis skills.

Best suited for

Day trading is best suited for experienced traders who have a high tolerance for risk and can devote several hours a day to trading.

Top 7 Day Trading IndicatorsSwing trading

Swing trading is a medium-term trading style where traders aim to capture price movements that occur over a few days to a few weeks. This style requires a more relaxed approach to trading and is ideal for traders who cannot monitor the market all day.

Pros and Cons

👍 Pros

•Potential for high profits;

•It requires less time and effort than day trading;

•Less stressful than scalping or day trading.

👎 Cons

•Trades may take longer to reach the profit target;

•Requires patience and discipline to hold positions for several days;

•May require advanced technical analysis skills.

Best suited for

Swing trading is best suited for traders who have some experience in trading and can devote a few hours a day to monitoring the market.

Top 7 swing trading indicatorsLong-term position trading

Long-term position trading involves holding positions for weeks, months, or even years. This style requires a more passive approach to trading and is ideal for traders who cannot monitor the market regularly.

Pros and Cons

👍 Pros

•Low risk;

•Requires minimal effort and time;

•Ideal for traders who want to diversify their portfolio.

👎 Cons

•Potential for low profits;

•Trades may take a long time to reach the profit target;

•May require strong fundamental analysis skills.

Best suited for

Long-term position trading is best suited for traders who have a long-term investment horizon and are looking to diversify their portfolio. This style is not recommended for traders looking to make quick profits.

What is position TradingBest Forex strategies with examples

Moving average strategy

The moving average strategy is one of the most popular and widely used Forex trading strategies. This strategy involves using the moving average indicator to identify trends in the market and generate trading signals. Traders use different types of moving averages, such as simple moving average (SMA) or exponential moving average (EMA), depending on their preference and trading style.

To implement this strategy, traders look for crossovers between the moving average of two different time durations. For example, when the shorter duration moving average crosses above the longer duration moving average, it is a signal to buy, and when the shorter duration moving average crosses below the longer duration moving average, it is a signal to sell.

One of the advantages of using the moving average strategy is that it is easy to understand and implement. However, it may not work well in choppy or ranging markets, where the price moves sideways and the moving average generates false signals.

Moving average strategy

50 pips a day Forex

The 50 pips a day Forex strategy aims to make 50 pips a day by identifying high-probability trades using a combination of technical indicators. This strategy can be applied to any currency pair and uses a 15-minute chart for entry and exit signals.

To use this strategy, traders should look for currency pairs that have a tight spread and are trending in a specific direction. Traders should then use technical indicators such as the Moving Average and Relative Strength Index (RSI) to confirm the trend and identify entry and exit points.

50 pips a day Forex strategy

In the above illustration, the rectangular box denotes a 50 pip move in a 5-min candle that could’ve been captured by a trader following this currency pair closely.

Breakout strategy

The Breakout strategy is a Forex trading strategy that involves identifying a key price level, such as support or resistance, and waiting for the price to break through that level. The idea behind this strategy is that when a significant price level is broken, it signals a shift in market sentiment and often results in a large price move in the direction of the breakout.

There are several different types of breakout strategies, including horizontal, trendline, and channel breakouts. A horizontal breakout occurs when the price breaks through a key horizontal level, such as a previous high or low. A trendline breakout occurs when the price breaks through a key trendline, which is a line that connects two or more price points and shows the direction of the trend. A channel breakout occurs when the price breaks through a key channel, which is formed by drawing parallel lines above and below the trendline.

Breakout strategy

In the above illustration, we can observe the sudden surge in points once the trend breakout takes place.

Chart-pattern-trading

In chart pattern trading, traders identify patterns such as head and shoulders, double tops, and triangles. These patterns are used to predict future price movements and can be used in conjunction with technical indicators such as moving averages and oscillators to confirm the trade.

To use this strategy effectively, traders should have a good understanding of technical analysis and be able to identify different chart patterns. It is recommended to use this strategy on a longer time frame, such as the daily or weekly chart, to avoid false signals and increase the probability of success.

Chart pattern trading

Trend following strategy

Trend following is a Forex trading strategy that involves identifying the direction of the market trend and taking positions that follow that trend. The strategy is based on the idea that the trend is your friend, and that by following the trend, traders can increase their chances of success.

The strategy offers clear entry and exit points, as traders can use technical indicators to identify the direction of the trend and set stop-loss orders to limit their risk. Additionally, trend following can be used in a variety of markets, providing traders with flexibility and opportunities for profit.

However, trend following can also have its drawbacks. The strategy can result in late entries and exits, as traders must wait for confirmation of the trend before taking a position. This can lead to missed opportunities for profit.

Trend following strategy

Bounce strategy

The bounce strategy is a popular Forex strategy that involves identifying key support and resistance levels in the market. Many traders believe that if a market dropped to a specific level in the past and then 'bounced' back, this level could be an important level in the future. Traders can use this strategy to enter trades when the price reaches a key level, with the expectation that the price will 'bounce' back in the opposite direction.

For example, let's suppose a trader is using the bounce strategy to trade the EUR/USD currency pair. They identify a key support level at 1.05756, which has been a strong level in the past. They place a buy order at this price point with a stop loss at 1.05600 and a profit target at 1.06586. The price drops to 1.05756 and then bounces back up, hitting the profit target and resulting in a profit.

Bounce strategy

Overbought and oversold

The overbought and oversold strategy is a Forex strategy that involves identifying when a currency pair is overbought or oversold. This strategy is based on the idea that when a currency pair is overbought, there is a high likelihood that the price will decrease, and when a currency pair is oversold, there is a high likelihood that the price will increase. Traders can use technical indicators such as the Relative Strength Index (RSI) or Stochastic Oscillator to identify overbought and oversold levels.

One of the main advantages of the overbought and oversold strategy is that it can be used in all market conditions and is suitable for all levels of traders. When used correctly, this strategy has a high probability of success, making it an attractive option for traders looking to make profitable trades. However, it's important to note that false signals can occur in choppy or ranging markets, which can lead to losses. Additionally, identifying the exact entry and exit points for a trade can be challenging, making proper risk management crucial.

Overbought and oversold strategy

Counter-trend Forex strategies

Counter-trend Forex strategies are trading techniques that involve identifying and taking advantage of market movements that go against the trend. These strategies are based on the premise that trends are not always constant and that markets often experience pullbacks or corrections before continuing with the trend. By identifying these countertrend movements, traders can enter positions that offer attractive risk-to-reward ratios.

One of the primary advantages of counter-trend Forex strategies is that entering trades at key levels helps traders take advantage of market movements that go against the trend, potentially yielding significant profits. Additionally, these strategies can be used in all market conditions, making them a versatile option for traders.

For example, suppose a trader is using a counter-trend strategy to trade the EUR/USD currency pair. They identify that the pair has been trending upwards but has reached a resistance level at 1.06453. They anticipate a pullback and enter a short position at this price, with a stop loss at 1.0650 and a profit target at 1.060. The price subsequently drops, hitting the profit target and resulting in a profit off of the trade.

Counter-trend Forex strategies

In the above illustration, we can observe how a strong uptrend is followed by a deep red candlestick signifying a steep fall. A counter-trend Forex strategy aims to capture such moves.

Best Support and Resistance Trading StrategiesBollinger Bands strategy

The Bollinger Bands strategy is based on the concept of support and resistance levels. The bands represent a moving average line and two standard deviation lines, which form an envelope around the price. The strategy assumes that the price will stay within the envelope, and when it hits the upper or lower band, it may indicate a reversal. This strategy is popular because it can be applied to any time frame, and it's easy to identify the signals.

The advantages of using Bollinger Bands as a trading strategy are that it can provide clear entry and exit signals, especially when the price breaks through the upper or lower bands. It can also be used in conjunction with other indicators to confirm a trade, and it's relatively easy to use for beginners. However, one disadvantage of this strategy is that it can give false signals when the price is trending strongly. Traders may also need to adjust the settings for different currency pairs or time frames, and it requires constant monitoring to avoid missing out on potential trades.

Bollinger Bands strategy

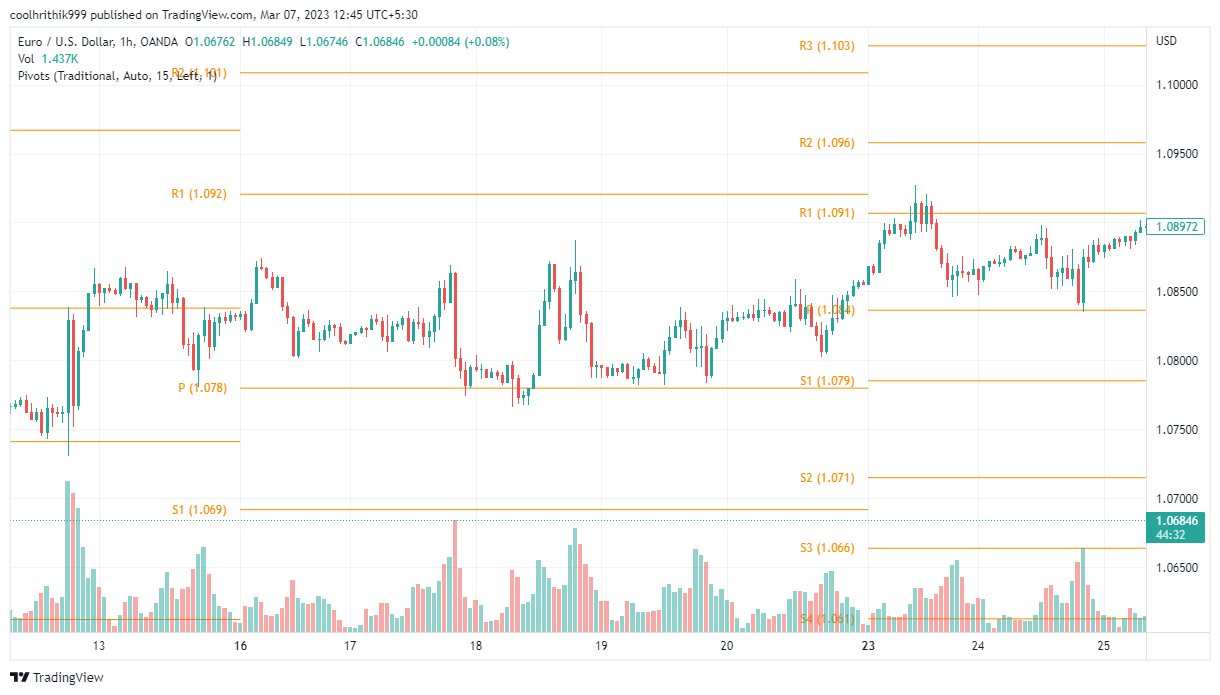

The Pivot Point – essential supply and demand levels

The Pivot Point strategy is a popular Forex trading strategy that is based on the concept of support and resistance levels. It is calculated by taking the average of the high, low, and closing prices of the previous trading session. The pivot point and its associated support and resistance levels can provide valuable information about the market's sentiment, including supply and demand levels.

Pivot Point strategy

What are Forex strategy components?

Traders Union experts have devised the following list of the components of a Forex trading strategy:

-

Trading goals: The goals that a trader sets for themselves, such as profit targets or risk management objectives.

-

Timeframes: The timeframe a trader operates on, such as intraday or swing trading.

-

Trading instruments: The markets or financial instruments a trader focuses on, such as Forex currency pairs or commodities.

-

Entry and exit signals: The signals used to enter or exit trades, such as technical indicators or chart patterns.

-

Position sizing: The process of determining the appropriate size of each trade based on account size and risk tolerance.

-

Risk management: The strategies used to manage risk, such as stop-loss orders or hedging.

-

Trading psychology: The mindset and emotional state of a trader when entering and exiting trades.

-

Backtesting and optimization: The process of testing and refining a trading strategy using historical data.

-

Trading plan: A written plan outlining the trader's approach to the market and their trading strategy.

How to choose your trading strategy and style?

When it comes to choosing a trading strategy and style in Forex, the experts suggest considering the following important factors:

1. Research and educate yourself on different strategies: Before you can choose a strategy, you need to know what's out there. Spend time learning about different Forex trading strategies and techniques.

2. Evaluate your abilities: Consider your strengths and weaknesses. For example, if you're good at analyzing charts and data, a technical analysis-based strategy may be best for you. On the other hand, if you're more comfortable with fundamentals and news events, you may prefer a news-based approach.

3. Assess your availability: Different trading styles require different levels of time commitment. If you have a full-time job, you may not have the time for day trading. Consider which styles fit best with your schedule.

4. Test on a demo account: Before committing to a strategy, try it out on a demo account. This will give you the opportunity to see how it performs in a risk-free environment.

5. Consider your risk tolerance: Some trading styles, such as scalping, can be very high-risk. Make sure you choose a strategy that aligns with your risk tolerance.

How To Choose Which Expert Advisor Fits Your Trading Needs?How to build your Forex strategy?

Building a solid Forex trading strategy is crucial for success in the market. Here are some steps to help guide you through the process:

1. Demo testing: Before risking any real money, it's important to test your strategy on a demo account. This allows you to practice trading in a risk-free environment and to fine-tune your strategy without incurring any losses.

2. Backtesting: Once you have a basic strategy in place, backtesting can help you determine its effectiveness in different market conditions. This involves using historical price data to simulate trades and evaluate the strategy's performance over time.

3. Starting with the minimum amount: When you're ready to start trading with real money, it's important to begin with the minimum amount required by your broker. This will allow you to manage your risk while you gain experience and confidence in your strategy.

4. Keep a trading journal: To help you track your progress and refine your strategy over time, it's important to keep a trading journal. This should include notes on your trades, the reasoning behind them, and the outcomes.

5. Continuously monitor and adjust your strategy: The Forex market is constantly changing, and your strategy needs to be flexible enough to adapt to new conditions. Regularly monitor your strategy's performance and make adjustments as needed to keep it effective in current market conditions.

Best Trading Tools To Improve Your Analysis SkillsRisk-management is the key to Forex trading success

Risk management is a critical aspect of Forex trading success, as it helps traders minimize their losses and protect their capital. Here are some basic risk management techniques that traders can use:

1. Set stop-loss orders: A stop-loss order is an order to sell a currency pair when it reaches a certain price. By setting a stop-loss order, traders can limit their losses and protect their capital.

2. Use proper position sizing: Proper position sizing is crucial to risk management, as it ensures that traders do not risk too much capital on any one trade. As a general rule of thumb, traders should risk no more than 1-2% of their account balance on any one trade.

3. Control emotions: Emotions can lead to impulsive and irrational trading decisions, which can result in significant losses. Traders should develop a trading plan and stick to it, regardless of market conditions or emotions.

4. Use moderate leverage: While leverage can increase potential profits, it also increases potential losses. Traders should use moderate leverage to manage their risk and avoid excessive losses.

5. Diversify: Diversification is a risk management technique that involves spreading your capital across different currency pairs or asset classes. By diversifying, traders can reduce their exposure to any one market or currency pair.

6. Use a risk-reward ratio: Before you enter a trade, determine the potential reward and risk. A risk-reward ratio of at least 1:2 means that the potential reward is twice the potential risk. This means that even if you lose on some trades, you can still be profitable in the long run.

Forex Risks Investors Should ConsiderWhat are the best Forex strategies for beginners?

According to Traders Union’s experts, the following Forex strategies are best-suited for beginners:

1. Position trading: Position trading involves holding positions for an extended period, typically days or weeks, to capitalize on long-term market trends. This strategy is ideal for beginners as it allows them to make trading decisions based on fundamental analysis and long-term market trends, rather than short-term fluctuations.

2. Trend following: Trend following is a popular Forex strategy that involves identifying the direction of the market trend and following it. This strategy can be effective for beginners as it provides clear entry and exit points based on technical indicators.

3. Breakout trading: Breakout trading involves taking positions when the price breaks through key levels of support or resistance. This strategy can be effective for beginners as it provides clear entry and exit points based on technical analysis.

4. Price action trading: Price action trading involves analyzing the price movement of currency pairs to identify patterns and make trading decisions. This strategy can be effective for beginners as it does not rely on other complex technical indicators and can be easily learned.

5. Swing trading: Swing trading involves holding positions for several days to capture short-term market movements. This strategy can be effective for beginners as it provides a balance between short-term and long-term trading, allowing traders to take advantage of market volatility without being too exposed to risk.

6. Copy trading: Copy trading involves copying the trades of more experienced traders. This strategy can be effective for beginners as it allows them to learn from experienced traders and gain insight into successful trading strategies.

Forex Trading Strategies for BeginnersIs there a 100% winning strategy in Forex?

Unfortunately, there is no 100% winning strategy in Forex. The foreign exchange market is highly unpredictable, and no strategy can accurately predict market movements 100% of the time. Even the most successful traders experience losses from time to time.

However, a good Forex trading strategy should aim to have a positive risk-to-reward ratio, where potential profits are greater than potential losses. For example, if a trader has a strategy that wins 60% of the time and makes an average profit of $100 per winning trade while losing an average of $50 per losing trade, over the course of time, it would be considered profitable.

In addition, a good strategy should have clear entry and exit rules, a well-defined risk management plan, and the ability to adapt to changing market conditions. It should also be thoroughly tested through demo trading and backtesting to ensure its effectiveness before being used in live trading.

Overall, while there is no guaranteed way to win in Forex, a well-planned and executed strategy can help traders achieve consistent profits over time.

Is Forex Trading Profitable?Best Forex brokers

FAQ

What is the most profitable strategy in Forex?

There is no one-size-fits-all answer to this question, as the profitability of a strategy depends on several factors such as market conditions, trading style, and risk management techniques. Some popular strategies among traders are trend-following, breakout, and carry trading.

What is the easiest Forex strategy?

The easiest Forex strategy is a subjective matter, as what may be easy for one trader may not be so for another. However, some simple strategies for beginners include the use of support and resistance levels, moving averages, and basic chart patterns.

Is copy trading good for beginners?

Copy trading can be a good option for beginners who are just starting to learn about the Forex market. It allows them to follow and learn from experienced traders' trades and strategies. However, it is essential to conduct thorough research and choose reliable and trustworthy copy trading platforms.

What is the 80/20 rule in Forex?

The 80/20 rule in Forex refers to the observation that 80% of a trader's profits are typically generated by 20% of their trades. This rule emphasizes the importance of focusing on the quality of trades rather than quantity and emphasizes the need for proper risk management techniques.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.