Top 7 Day Trading Indicators You Should Know

Top day trading indicators:

Moving averages - show the price value averaged according to different formulas for the selected period.

RSI - shows the overbought and oversold zones of an asset.

Volume - shows vertical trading volumes on a given candle.

If you are involved in stock trading or forex trading or virtually any other type of market, you’ve probably heard of technical indicators in the context of day trading.

In this guide, we will explore our top seven picks for technical indicators that every trader should look into for day trading. Our experts at Traders Union compiled this list of important indicators based on many different factors, such as principle, type of signal, basic setups, and how the indicator functions to benefit traders using it. We will also explore which indicators are best for day trading, whether or not indicators are smart to use for day trading, and how to use indicators for day trading. This guide will break down the best platforms for day trading and how to match different indicators for day trading. Let's start by explaining exactly which types of indicators are beneficial for day traders who need a little bit of a boost in their day-to-day trades.

Do you want to start Day Trading? Open an account on IC Markets!

What indicators are best for day trading?

Stock market trading (as well as FX and other markets trading) entails a great deal of chart analysis and decision-making based on patterns and indications. Indicators are crucial in market research, regardless of whether a trader is a rookie or a seasoned pro. The stock market is quite dynamic, and current events and other events have a big impact on the market. The indicators give vital market information and assist you in maximizing your profits. Learn more about the many sorts of indicators and their relevance in this article.

An indicator will predict where the market will move next to the best of its ability. Averages, directions, movement, accumulation, and distribution are all predicted by the best possible technical indicators. These are the best indicators for day trading.

Top 7 Technical Analysis Indicators for Day Trading

The following technical analysis indicators are the most ideal for day trading. These include moving averages, relative strength, volume, Stochastic Oscillator, average directional index, Aroon Indicators, and accumulation and distribution line.

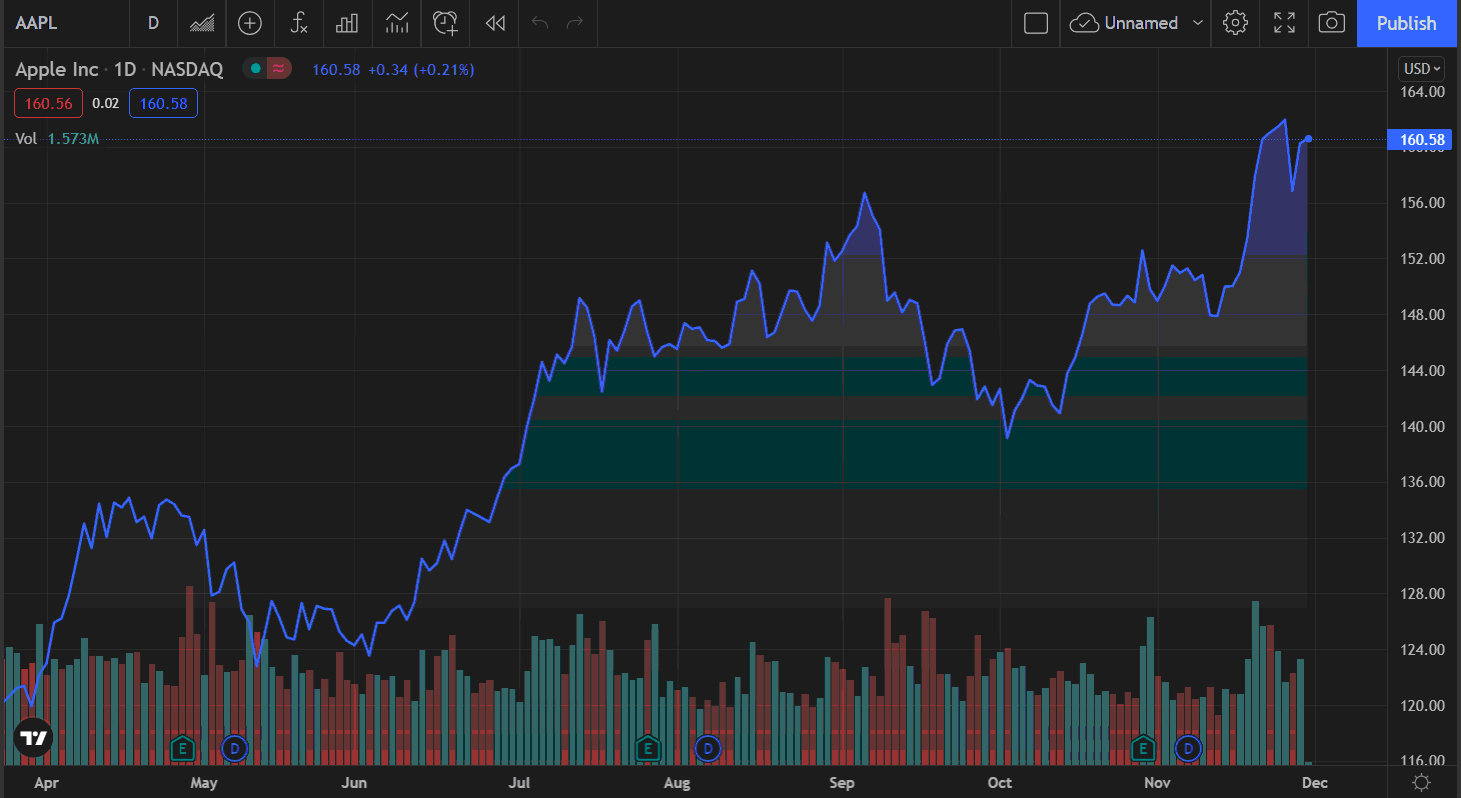

1. Moving Averages or Moving Average Convergence Divergence

The moving average indicator aids traders in determining the trend's direction as well as its momentum. It also offers a variety of trading indications. The price is in an upward phase when the moving average indicator is above zero. It has entered a negative period if the moving average indicator is below zero.

MA Indicator

The indicator is made up of two lines: a moving average indicator line and a slower moving signal line. It signifies that the price is declining when the moving average indicator passes below the signal line. The price is rising when the moving average indicator line passes over the signal line.

2. Relative Strength (RSI)

There are at least three significant applications for the relative strength index (RSI). The indicator plots recent price gains with recent price losses as it swings from 0 to 100. As a result, the RSI levels aid in determining momentum and trend strength. An RSI is most commonly used as an overbought and oversold indicator.

RSI Indicator

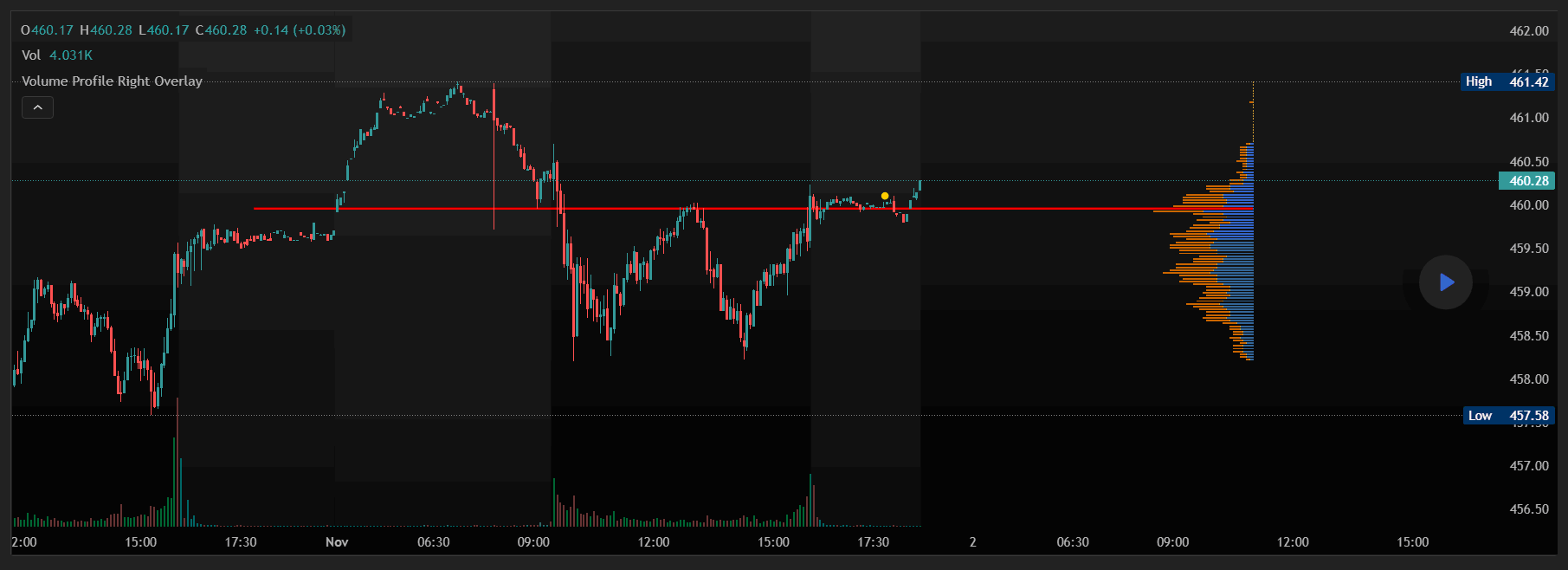

3. Volume

Measure the positive and negative flow of volume in a security over time using the on-balance volume indicator (or OBV). A running sum of up volume minus down volume is used to calculate risk with this indicator. The amount of volume on a day when the price rallied is known as up volume. The volume on a day when the price declines is known as down volume. Depending on whether the price moved up or down, each day's volume is added or deducted from the indication.

Volume Indicator

4. Stochastic Oscillator

The stochastic oscillator is a stock and forex technical indicator that compares the current price to the price range over time. When the trend is up, the price must be setting new highs, according to the chart, which is shown between zero and one hundred. Because the price tends to make fresh lows in a decline, the stochastic determines whether or not this is the case. Since it is uncommon for the price to achieve continuous highs, we recommend keeping the stochastic around 100.

Stochastic Oscillator

5. Average Directional Index

The average directional index (ADX) is a trend indicator that is used to determine a trend's strength and momentum. When the ADX rises above 40, the trend is thought to have a lot of directional power, either up or down, depending on the price movement. The trend is deemed weak or non-trending when the ADX indicator is below 20.

ADX Indicator

The ADX is the indicator's primary line, which is normally black. There are two more lines that can be displayed if desired. DI+ and DI- are the two types. These lines are frequently red and green in hue. All three lines work together to display the trend's direction as well as its momentum.

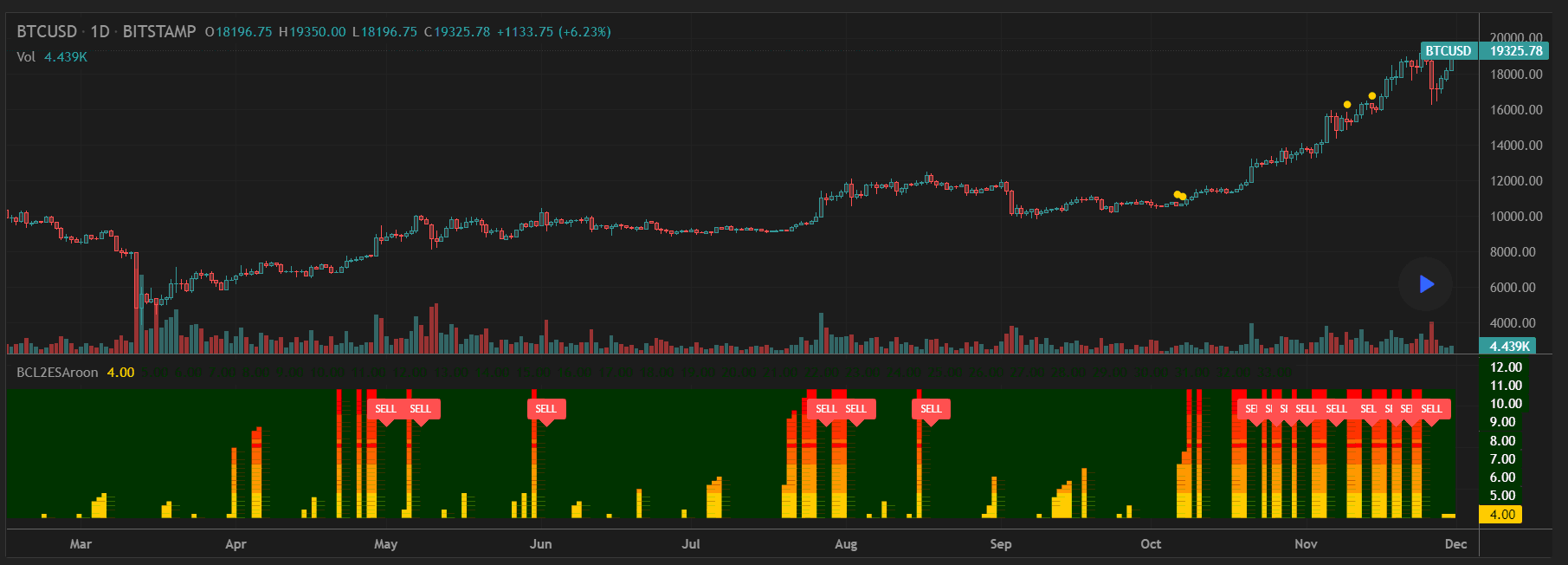

6. Aroon Indicator

The Aroon oscillator is a type of technical indicator that determines if a security is currently in a trend and, more specifically, whether the price is making new highs or lows throughout the calculation period.

Aroon Indicator

The indicator may also be used to predict the start of a new trend. There are two lines in the Aroon indicator: an Aroon-up line and an Aroon-down line. The first hint of a likely trend shift is when the Aroon-up crosses above the Aroon-down. If the Aroon-up reaches 100 and remains very close to that level while the Aroon-down remains near zero, it indicates that an uptrend is underway.

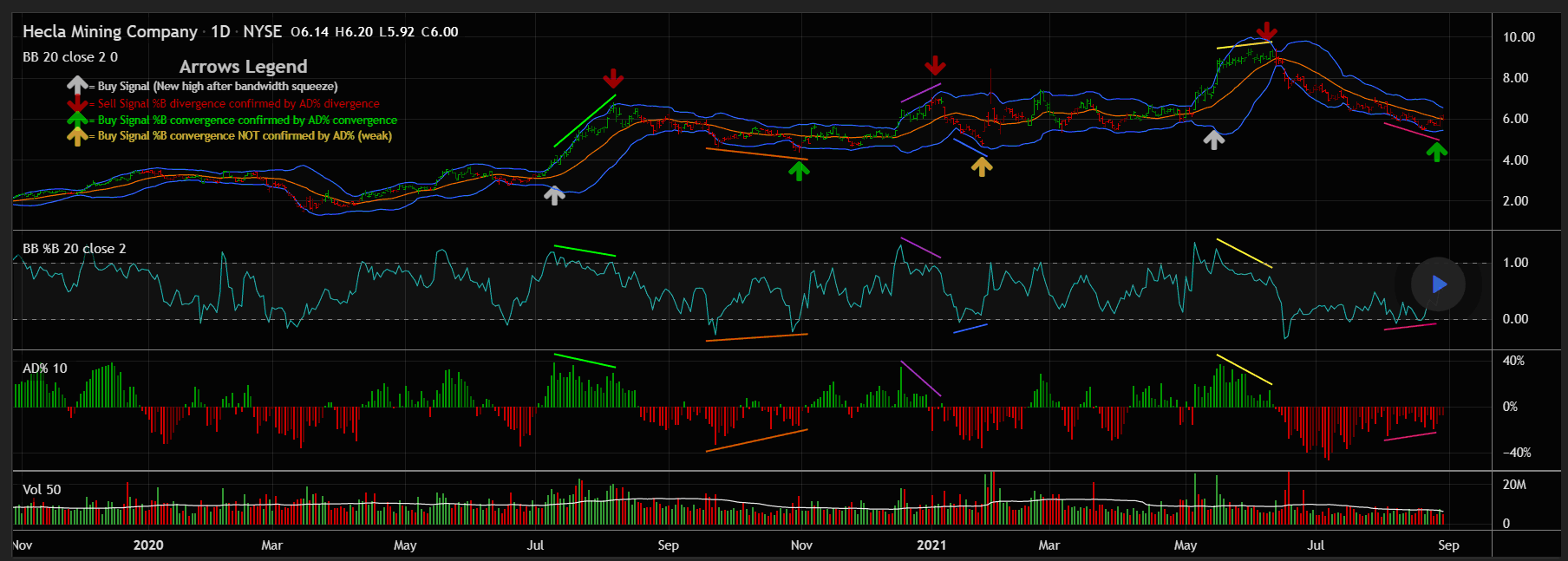

7. Accumulation and Distribution Line

The accumulation/distribution line is used to assess the money movement in and out of an asset. It focuses on the security's closing price for the period and considers the period's trading range and where the closure falls within that range. The indicator gives volume more weight if a stock closes near its high than if it closes at the midpoint of its range.

Accumulation/distribution line

Because the stock is closing over the range's midway point, the indicator line is going up, indicating purchasing activity. This aids in the confirmation of an upward trend. If A/D is decreasing, on the other hand, it suggests the price is closing in the lower half of its daily range, and hence volume is negative. This aids in the confirmation of a downward trend.

Should I Use Indicators in Day Trading?

Technical indicators are used by day traders constantly. Think of them as a vital tool for predicting market movements and volume. With just fundamental facts, there is no possibility to generate money on short time frames in forex or binary options. As traders, we must employ tools that present price activity and market data to aid in the formation of profitable analyses.

So, how exactly do indications assist you in becoming profitable? Which ones do you choose? There are thousands of technical indicators available, so it’s understandable why traders might get overwhelmed and consider not using them. However, technical indicators in day trading are vital. As long as you employ the proper sorts of indicators for your selected market, indicators may be quite useful for day traders.

Learn More about Best Indicators for Successful TradingHow to Use the Best Day Trading Indicators?

There are many best practices for using day trading indicators. To start, keep your charts clean. Because a trader's charting platform serves as his or her doorway to the markets, it's critical that the charts aid rather than hinder market research. Charts and workspaces that are easy to read (the full screen, including charts, news feeds, order input windows, etc.) can increase a trader's situational awareness, helping them to quickly comprehend and respond to market events. From the background color to the style and color of a moving average to the size, color, and font of the words that display on the chart, most trading platforms allow for a considerable deal of flexibility when it comes to chart color and design. Traders can more efficiently employ indicators if they set up clean and aesthetically attractive charts and workstations.

We also recommend avoiding overloading yourself with data, especially if you are just starting out as a day trader. Today's traders frequently employ numerous monitors to display various charts and order input windows, as well as indicator notifications. Even if six monitors are employed, it is not a good idea to use every square inch of screen real estate for technical indications. When a trader tries to comprehend so much data that it all becomes lost, this is known as information overload. This is known as analysis paralysis; if a trader is confronted with too much information, he or she will most likely be unable to reply. Eliminating superfluous signs from a workstation is one way to minimize information overload; if you're not using it, get rid of it. This will help to reduce clutter. If there are numerous indicators of the same type on the same chart, one or more of them can be deleted.

Can I Match Different Indicators for Day Trading?

Not only is it possible, but it is also necessary to combine indicators in order to be successful and really reap the rewards of technical analysis indicators. If the signal of one indicator confirms the signal of another, it amplifies the signal as a whole.

Combining or matching indicators is also not that difficult. To start, ensure that you are not using too many indicators that are part of the same class. Start by combining one momentum indicator, one trend-following indicator, and one volatility indicator together. Knowing which indications fall into which categories, as well as how to combine the finest indicators in a meaningful way, will help one make far better trading selections. Combining indicators incorrectly, on the other hand, may cause a lot of confusion, incorrect price interpretation, and, as a result, incorrect trading judgments.

The issue with indicator redundancy is that when a trader chooses many indicators that indicate the same information, they end up giving the information supplied by the indications too much weight, and they can easily miss other things. Because both of their indicators give them the green light, a trader who utilizes two or more trend indicators may assume the trend is stronger than it is, and they may overlook other crucial signs his charts convey. To prevent redundancy while indicator matching, employ a diversity of indicator kinds and try not to use too many of the same indicator types.

How to Combine Trading Indicators?

One indicator is unlikely to be sufficient for a successful trade. This is due to the complexity of the financial markets. A single indicator can't linearly capture such complexity. Therefore, reinforcement is needed to elaborate a robust trading strategy.

Combining indicators requires a structured approach to filter out noises and create more accurate signals. The following is a step-by-step guide for effective combination:

Select Your Primary Indicator: Start with a powerful foundational indicator. The indicator should align with your trading strategy. For reversal strategies, oscillators like RSI (Relative Strength Index) can be effective. On the other hand, Moving Averages suit trend-following strategies.

Choose a Secondary Indicator: Choose a complementary trading indicator. This indicator should provide additional trading insights. For instance, you can combine a trend-following Moving Average with a momentum indicator such as the MACD (Moving Average Convergence/Divergence) indicator to confirm trends.

Filter Out Conflicting Signals: Assess signals from both indicators. If the signals conflict, exercise caution since conflicting signals show unpredictable market conditions. You should wait for clearer confirmation.

Consider Timeframes: Ensure that the primary and secondary indicators are aligned across various timeframes. The convergence of trading signals across different timeframes increases the chances of a profitable trade.

Confirm the Volume Analysis: Integrate volume-based indicators to confirm the strength of price movements. Using volume, you can validate the correctness of a price trend or propose potential reversals.

How to Choose Trading Indicators?

Some common mistakes that traders make include selecting many indicators or indicators that are conflicting or redundant. These mistakes can lead to false signals, confusion, or paralysis. To prevent this, you should select indicators that complement each other while providing different perspectives and confirmation.

Selecting the right trading indicators for day trading impacts your chances for success. The following are five essential factors to observe when selecting indicators:

Volatility of the Asset: Different trading instruments have different levels of volatility. Indicators like ATR (Average True Range) and Bollinger Bands are ideal for gauging the potential price movements of highly volatile assets.

Overbought/Oversold Conditions: Indicators like Stochastic Oscillator and RSI are essential for establishing oversold and overbought conditions. The two indicators indicate potential reversals in price trends.

Pattern Recognition: Identify indicators that recognize chart patterns, such as flags, head and shoulders, and triangles. Pattern recognition indicators reveal insights into potential breakdown or breakout scenarios.

Market Trends: Moving Averages (MA) help establish trends by levelling price fluctuations over a given period. Such indicators help differentiate between sideways, upward, and downward trends.

Volume Analysis: Volume is a significant indicator of market momentum and interest. Volume-based indicators assist traders in understanding the importance of price movements regarding trading volumes.

Best Platforms for Day Trading

There are many benefits to using trading platforms like Interactive Brokers and eOption as a day trader in the stock market, foreign exchange, and options.

Summary

We recommend using moving averages, relative strength, volume, Stochastic Oscillator, average directional index, Aroon Indicators, and accumulation and distribution line as the most useful indicators for day trading. We also strongly recommend the use of technical indicators, both as a beginner trader and as an experienced trader.

FAQs

Which is the best indicator for day trading?

There is no single "best" indicator for day trading, as different traders may have different preferences and strategies. Some commonly used indicators for day trading include moving averages, Bollinger Bands, Relative Strength Index (RSI), and the Stochastic oscillator.

Do indicators work in day trading?

Indicators can be helpful in day trading, but they should not be relied upon as the sole basis for trading decisions. Successful day traders often use a combination of indicators, along with other factors such as market trends and news events, to make informed trading decisions.

What technical indicators do day traders use?

Day traders use a variety of technical indicators to analyze price movements and identify potential trading opportunities. Some commonly used indicators include moving averages, Bollinger Bands, Relative Strength Index (RSI), and the Stochastic oscillator. Other indicators that may be used include MACD, Fibonacci retracements, and volume indicators.

What is the most profitable trading indicator?

There is no single indicator that is guaranteed to be the most profitable for trading, as success in trading often depends on a combination of factors including market trends, risk management, and individual trading strategies.

What should I do if an indicator starts contradicting and diverging during a specific trade?

In many cases, it may be time to get out of the transaction. Keep precautionary stops in place and examine how the deal settles from the sidelines if your indicators start contradicting or diverging throughout a trade. Spectating versus being in the eye of the storm are two very distinct situations. Familiarity generates confidence, so don't rush into trades without first familiarizing yourself with the indications. We recommend using technical indicators with a demo account first so that you can get used to the indicator as well as the market. This is especially the case for forex and binary options trading.

What are some ways to apply technical indicators to my day trading practices?

Our biggest piece of advice is to keep it simple. It's easy to get caught up in indication overload, when there are so many clues that the interpretation becomes clogged or inconsistent. To summarize, begin with the simplest indications and master them carefully. The aim is to achieve indicator convergence so that you can make rapid, accurate, and efficient decisions. Indicators should help you make better judgments, not limit them.

We also recommend applying indicators in a way that fits your trading style and strategies. Consider intra-day trading indicators on a smaller time frame if you want quick movement and shorter holding periods. On a five-minute chart, using a five and fifteen-period moving average, as well as a stochastic oscillator, can offer accurate intra-day trends. A swing trader may opt to utilize a daily chart with a 50-period and 200-period moving average to discern the bigger general trend. It's a question of resources, time management, and restraint. Determine your personal style and use indications to support it.

What are the different types of technical indicators?

There are thousands of different technical indicators out there. However, all of them can be pretty much split into two groups – overlay indicators and independent indicators.

Overlay indicators are put directly on the chart's price section (specifically via candlesticks, chart bars, chart lines, etc.). The indicators become aligned with the stock price and give additional accuracy and convenience when they are overlayed. These indicators scale and fit to the price chart, revealing important information such as the visual trend direction, trading range, and support and resistance levels.

Independent indicators that aren't generally superimposed are presented in a separate window from the price charts. Without the distraction of attempting to overlay them on top of a price chart, they are simpler to follow and comprehend on their own.

Are technical indicators completely necessary for day trading?

There are some traders who don’t utilize technical indicators. However, we’d be bold enough to say that successful day traders need these tools to get ahead. It is critical to employ technical indicators in conjunction with one another while day trading. Although these indicators are most useful for day traders and people looking to make rapid money in the stock market, they may also be used by long-term investors. It's vital to note, nevertheless, that technical indicators are instruments for predicting the future price movements of an asset.

Given that even the preceding indications cannot guarantee precise outcomes, it's best to combine them with excellent research to increase your chances of success. Furthermore, various indicators should be used to determine and validate price patterns on stock charts. Once again, no one indication can guarantee a 100% accurate forecast of the future. However, validating your conclusions with various indications will greatly increase your chances of success. We recommend giving technical analysis a shot!

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.