Best Trading Journal Software

Best Trading Journal - TraderVue

Best Trading Journals:

TraderVue - best for intraday trading.

TraderSync - best for online trading performance analysis.

Edgewonk - best for monitoring cryptocurrency transactions.

Trademetria - best for risk management.

Are you wondering if trading journals are right for you? Journaling your trades can help you improve your profitability over time. By keeping a trading journal, you can identify patterns of success in your trading and avoid repeating your mistakes in the future.

Here are the six top trading journals for 2023 and why you need one.

What Is a Trading Journal?

The purpose of a trading journal is to keep track of your trades and their outcomes, and to provide a summary of your trading experience. Although it is not a brokerage account statement, it provides information on why trading strategies were chosen or avoided.

A trading journal can provide a record of each trading strategy's performance over successful trades. A trading journal allows you to assess the potential of a specific trade regardless of how the market performs.

A trading journal is also not expensive to create. This would assist you in becoming disciplined and following consistent trading strategies by using spreadsheets or Excel. When you are unable to follow your trading strategy every time, you should record the trading entries in your journal. Noting when things go wrong and why they happen can help you avoid responding the same way to similar situations in the future.

Best Trading Journals Compared

| Supported markets | Costs | Free option | |

|---|---|---|---|

Stocks, futures, and forex. |

Starting at $29.95/month |

Yes, 30 trades per month |

|

Stocks, forex, options, and futures. |

Starting at $29.95/month |

7-day free trial |

|

Stocks, futures, options, and forex. |

$39.95/month or $29,95 on annual plan |

Yes, 30 free trades per month |

|

Edgewonk |

Stocks, forex, futures, contract for difference (CFDs), cryptocurrency, and commodities. |

$169/year |

No |

TradeBench |

Stocks, forex, CFDs, futures, and cryptocurrencies |

No paid plans |

100% free |

Chartlog |

Forex |

Starting at $14.99/month |

Yes |

Best Trading Journal 2024

TraderVue

Go to the WebsiteOnline trading journals such as TraderVue are very popular among day traders today. If you use Excel, you can import your data from 82 different trading platforms and brokers automatically.

This journal software offers traditional features like data analytics tools and easy-to-digest insights into how you can become a better trader.

In terms of risk management, TraderVue excels. Traders are always exposed to risk, so it is important to take steps to minimize and manage it. Its risk analysis tools are unparalleled and will provide you with ideas on how to reduce risk and improve performance.

As a free member, you can track up to 30 trades per month. However, subscribing to the highest-cost package for $49 per month will give you access to more risk analysis tools. All other features are included with the $29 monthly membership.

TraderVue

👍 Pros

• Trade journal and trading social media platform that are easy to use

•An advanced tool for analyzing your trading history

•A free plan includes 100 stocks with flexible pricing options

👎 Cons

•Subscription costs accumulate over time

TraderSync

Go to the WebsiteAs you'd expect when signing up for a service in this category, TraderSync gives you all the tools you need. Using the platform, your trades are automatically tracked or imported and displayed in an easy-to-read format.

You can track your performance in real time thanks to intraday trading data on the platform in addition to access to simple tracking and analytics tools. Besides stop-loss tracking, it also offers a mobile app with all the tools you need to manage and mitigate risk. Another key feature of TraderSync is the way it flags your mistakes.

It is inevitable that you will make mistakes when you trade. If you encounter them, it's best to address them right away. You can track your mistakes in TraderSync's mistake tracker and learn how to prevent them in the future.

The cost of a membership ranges from $29.95 per month to $79.95 per month, with an annual discount of 13%. The 7-day free trial period comes with all memberships, and credit card information is not required until the trial ends.

TraderSync

👍 Pros

• All plans include a free 7-day trial

• Options, futures, forex, and stocks are all supported

• Charts with interactive features and artificial intelligence

👎 Cons

•The Elite subscription comes at a higher price than other trading journals

Trademetria

Go to the WebsiteAnother easy-to-use trading journal is Trademetria, which tracks all the key metrics and allows you to review your trading performance easily. Multiple tools are available to help you analyze potential improvements to your strategy using the platform's data analytics tools.

A risk management tool is also included in the journal. You will know the potential risk and reward before, during, and after you make your trades when you use the platform.

A notable feature of Trademetria is its ability to challenge you. By creating challenges based on your performance trends and tracking your improvement, you can identify areas where you can improve. Your progress as a trader over time can be visualized using this tool.

You can track up to 30 trades per month for free with Trademetria. If you're an active trader, your monthly fee will be between $29.95 and $39.95. Choosing an annual membership over a monthly one will save you 40%.

Trademetria

👍 Pros

•Keep track of your trading performance

•Make the most of your trading data analytics

•Become a better trader

•Test your strategy against different scenarios and see how it would have performed

•One-time payment solution at an affordable price

👎 Cons

•Performance tracking for traders

•A web-based platform that can be accessed from anywhere

•The ability to perform comprehensive analytics

•Get quotes in real time

•Equities, options, futures, forex, cryptos, and CFDs are supported

•API and PnL Simulator

Edgewonk

It's common for trading journals to track forex, futures, options, and stocks, but Edgewonk takes that a step further. The platform also allows you to track your cryptocurrency trades. Using supported brokers and platforms, you can automatically import data. Edgewonk allows you to import spreadsheet data directly from Excel if your trading platform is not supported.

Whenever you review your journal, you can upload screenshots of trading charts and make trade notes to make it easier to comprehend the data.

A $169 annual membership plan is the only membership option offered by Edgewonk. In terms of monthly cost, that amounts to $14.08.

Edgework

👍 Pros

•Keep track of your trading performance

•Make the most of your trading data analytics

•Become a better trader

•Test your strategy against different scenarios and see how it would have performed

•One-time payment solution at an affordable price

👎 Cons

•Analyses require comprehensive datasets

•It is not ideally suited to long-term investors

TradeBench

With TradeBench, you can review your trading data at a glance with color-coded charts and graphs. The user interface is attractive and easy to use, and trading activity can be imported from any broker or trading platform.

Risk assessment and trade analysis tools are included in the journal. The solution is among the most effective on the market.

TradeBench stands out in terms of price. The journal is free to use, and membership isn't required. Ads are TradeBench's source of revenue.

It's a completely free trading journal, but you don't have to sacrifice functionality for cash.

TradeBench

👍 Pros

•Keep track of your stock, forex, crypto, and CFD trades

•A variety of trading tools for better execution

•Any online brokerage can be used

👎 Cons

•Could use more features to make it more robust

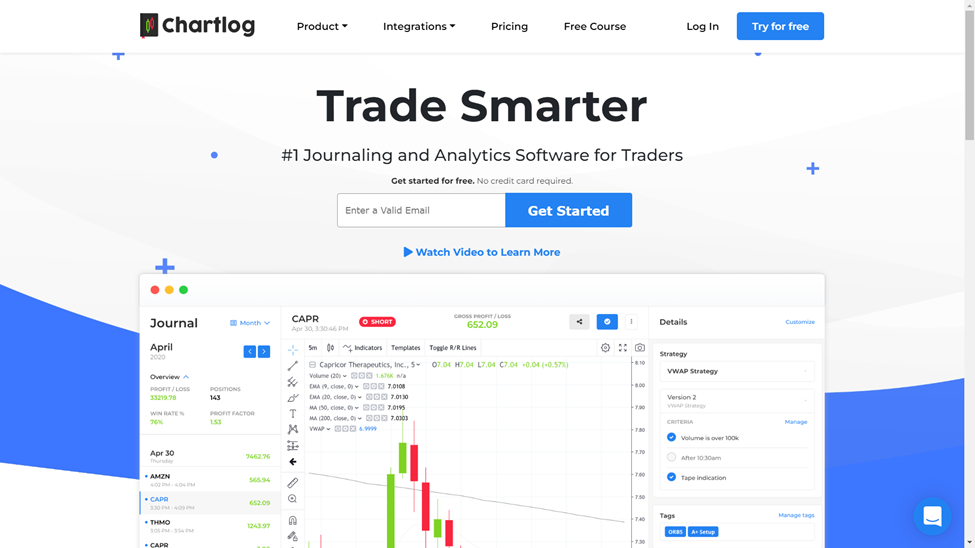

Chartlog

A unique feature of Chartlog is that it includes advanced charting tools from TradingView. TradingView tags trades and setups automatically based on strategies and indicators. A trader who already uses TradingView for charting may benefit greatly from this platform.

Most major brokerages can import data automatically into Chartlog, and you can take notes on any trade. Besides filtering and analyzing your trade data, it also provides risk-adjusted performance reports. The only caveat is that you need a top-tier Pro subscription if you want to analyze trades based on date ranges, durations, assets, or tags.

A monthly subscription to Chartlog starts at $14.99. If you want all the journal analysis tools, you'll pay $39.99 per month for the Pro plan.

Chartlog

👍 Pros

•Over 100 indicators are available in the advanced charting feature

•Customer support that is always ready to help

•Data imports that are automatic and real-time, which are convenient for many traders

•Analyzes the data available in order to provide an interpretation of your performance

•Measures your trading performance and provides detailed reports

👎 Cons

•The analysis of your journal entries requires a lot of discipline

•DAS Trader Pro is the only software that supports automatic data imports

Why Should I Use a Trading Journal?

Here are some of the main benefits of using a trading journal:

It helps you track and analyze your trades. By recording details like entry/exit points, reasons for taking the trade, price targets, etc. you can look back and see what's working and what's not. This allows you to learn from past trades.

It forces you to be more disciplined and stick to your trading plan. Trading can be emotional, especially when real money is at stake. A journal allows you to record not just the facts of each trade, but also your feelings and reasoning behind each decision. By reflecting on these entries, you can begin to understand the emotional triggers that might influence your trading decisions

It identifies your strengths and weaknesses as a trader. Over time you can see patterns emerge related to the types of setups you trade best, markets you should avoid, mistakes you repeatedly make, etc.

It tracks important trading statistics like win/loss ratio, profit factor, percentage of profitable trades, etc. These metrics allow you to quantify and improve your overall trading performance.

It provides a record for tax purposes. Meticulous trading records are important for reporting profits/losses come tax time.

It gives you something to review and learn from during periods when you are not actively trading. You can look back over past trades and analyze them in order to keep improving. A journal can be an invaluable tool for learning and education.

So in summary, a trading journal is a vital tool for reflecting on results, avoiding mistakes, developing your skills, and tracking important performance metrics. It promotes discipline and ongoing education. Every serious trader should keep one.

How to Use a Trading Journal Correctly

Here are a few tips you can follow to use a trading journal correctly.

-

Be sure to start the journal before the trade and finish it after it has taken place.

-

Make a note of everything. Make sure nothing is left out. Honesty is essential. Keep a written record of the times you forgot to exit a trade. Explain why.

-

Keep your emotions in mind at all times. Afterwards, make sure you record them.

-

You should include observations about yourself, your trading, and the forex market in the journal. Market observations are usually sparsely included in trading journals, which tend to focus primarily on self-analysis.

-

Whenever possible, take screenshots of intraday charts and write comments on them. Observe patterns and take note of them.

-

Real-time patterns will begin to emerge after a couple of months.

-

Trading journals are excellent tools for training your eye to see the setups you want to trade.

-

You can record anything in your journal, no matter how silly it may seem. Make a note of it. No matter the reason why you missed a trade, just write it down.

How to Choose a Trading Journal Software

Traders have a variety of trading journal software to choose from, but most fall into one of these groups

Online or offline trade journal:

Online journals are a great convenience because they reside in the cloud, so you can access them wherever you are from whatever device you are using. Updates are done for you, so you don't have to worry about losing your trading journal if your computer crashes. Your data is safely stored in the cloud, so you don't have to worry about losing it when your computer crashes. On the other hand, offline trade journals are usually excel sheets or desktop programs. Unfortunately, both can only be accessed from the computer where they are installed. When trading from multiple devices (phones/tablets), you have to enter your trades on one computer with your trading journal installed, which becomes tedious

Excel sheet or application:

Consider the future when selecting a journal. There might be some merit in using an Excel sheet. But what if it contains hundreds or even thousands of trades? A trading journal based on Excel does not have the same level of functionality as online and offline desktop applications.

Manual or automated trade journal:

Logging trades and analyzing your trading performance are two basic functions that both types of trading journals offer. Manual trading journals, on the other hand, require you to enter all the data yourself. The process can become extremely tedious, time-consuming, and error-prone. As opposed to this, an automated traded journal records your trades for you fully automatically. Data entry is not required. They also take screenshots of how your chart looked when you opened/closed trades in real-time, so you're constantly up to date.

When choosing trading journal software, there are several important factors to consider:

User-friendliness and ease of use. The platform should have an intuitive interface that allows you to quickly and easily log your trades. The simpler it is to enter trades and access your data, the more likely you are to stick with the habit of keeping a journal. Software that is cumbersome or complicated to use will be quickly abandoned.

Flexibility in setting up custom fields/layouts. Look for software that allows you to customize fields and templates to match your trading style and record all the details you want to track. The ability to tailor layouts is key.

Analysis tools and charts. Robust journal software will allow you to generate insightful performance reports and graphs from your recorded trades. Look for features like automatic calculation of metrics such as profit factor, win/loss ratio, etc.

Accessibility and ability to sync across devices. Being able to access your journal on both desktop and mobile allows for convenient logging anytime. Cloud-syncing also provides extra data backup.

Security and encryption. Your trading records contain sensitive data, so the software should have security protections like encryption, password protection and secure cloud back-up.

Depending on what you choose, your trading journal will be future-proof, user-friendly, and able to dig deep into your trading performance.

Best Forex Brokers

FAQs

What is the best trading journal?

There are several trading journal options available, and the best one depends on individual preferences and needs. Some popular trading journals include Edgewonk, Tradervue among others. It's recommended to research each journal and compare their features, ease of use, and pricing to determine which one is best for your specific trading needs.

Which trading journal is best for TradingView?

TradingView offers a built-in journaling feature that allows traders to record and analyze their trades. This journaling feature is suitable for those who use TradingView as their primary trading platform. However, if you prefer a more comprehensive trading journal, you may consider using an external journaling software such as Edgewonk or Tradervue.

Are trade journals effective?

Trade journals can be very effective for traders as they allow them to keep track of their trades, analyze their trading performance, and identify areas for improvement. By recording their trades in a journal, traders can develop a better understanding of their trading patterns, identify mistakes, and refine their trading strategies.

What is the best trading journal for Interactive Brokers?

Interactive Brokers provides its own trade journaling feature that allows traders to record and analyze their trades. However, if you prefer a more comprehensive trading journal, you may consider using an external journaling software such as Edgewonk or Tradervue.

What is a trader journal?

By keeping a trading journal, you can track your trading activity and learn from both successful and unsuccessful trades to improve your trading activity. When you track your progress, you can learn from mistakes you have made when opening or closing positions.

What should be in a trading journal?

Keeping a trading journal should detail all aspects of a trade, including the date, time, instrument, direction, entry and exit prices, position sizes, and the result of the trade once completed.

Are trade journals effective?

There is a good correlation between the quality of trade journals and the quality of the trading data imported. You will get better results if you import more trades for analysis. It is a great tool for all types of traders and a great addition to a trade simulator to keep track of trades.

How do I review my trades?

To review your trades, follow these three tips: Keep a journal of all your trade results, look for common trends, and record trades to review later.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!