Types of Forex Traders

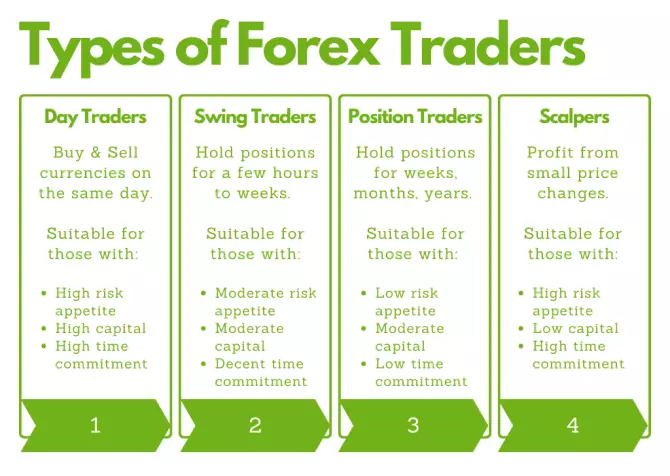

There are four main types of Forex traders:

-

1

Day Traders - Engage in buying and selling currencies within a single trading day. Suitable for those with high risk appetite, high capital, and the ability to put in extensive time

-

2

Swing Traders - Hold positions for a few hours to several weeks. Suitable for those with moderate risk appetite, moderate capital, and the ability to occasionally look after the trades

-

3

Position Traders - Hold positions for weeks, months, or years. Suitable for those with low risk appetite, moderate capital, and the inability to put in much time

-

4

Scalpers - Profit from small price changes with fast trades. Suitable for those with high risk appetite, low capital, and the ability to put in extensive time

Forex trading, also known as foreign exchange trading, happens in the decentralized global market where currencies are bought and sold. It is a popular form of investment and speculation, attracting individuals and institutions worldwide. In this article, the experts at TU provide an insightful overview of the various types of Forex traders, shedding light on the different approaches and strategies they employ. This article aims to familiarize you with the diverse range of Forex traders and also reveal the most profitable Forex strategy.

Do you want to start trading Forex? Open an account on Roboforex!What is Forex trading?

Forex trading, also known as foreign exchange trading or FX trading, involves the exchange of one currency for another. This exchange occurs for various purposes, including tourism, international commerce, and trading activities.

Forex trading takes place on a currency exchange market, enabling individuals and businesses to buy goods and services both locally and internationally. For instance, if you reside in the United States and wish to purchase something from the United Kingdom, you would need to pay for it using British Pounds (GBP). Consequently, the equivalent amount of U.S. dollars (USD) must be exchanged for GBP.

What sets Forex trading apart is the absence of a centralized marketplace for foreign exchange. Instead, trading occurs electronically over the counter (OTC), facilitated by computer networks connecting traders worldwide.

With Forex markets operating 24 hours a day, five and a half days a week, across major financial centers like London, New York, Paris, and Tokyo, there is constant activity. As one market closes, another opens, ensuring a continuous flow of trading opportunities. This dynamic nature of the Forex market leads to significant fluctuations in price quotes, making it a highly dynamic and exciting market to participate in.

4 types of Forex traders

Forex trading encompasses a variety of trading styles, each with its own principles and requirements. Let's delve into four prominent types of successful Forex traders and explore their key principles and necessary qualifications.

Day trader

| Quick Overview | |

|---|---|

|

Duration |

Short-term (Minutes to Hours) |

|

Tools used |

Technical Analysis, Flash News, Screeners, Trading Bots |

|

Trading Frequency |

High |

|

Risk |

High |

|

Success Rate |

Low |

Day traders engage in buying and selling currency pairs within the same trading day, without holding any positions overnight. Their objective is to profit from small market changes that occur within a day. Day traders rely on technical analysis indicators and patterns to identify potential entry and exit points for their trades.

Key principles:

Leveraging short-term price movements:

Day traders focus on capitalizing on small market fluctuations occurring within a single trading day, seeking to profit from these short-term price changes

Engaging in intraday trading:

Day traders execute trades within the same trading day, avoiding holding positions overnight. Their objective is to close all trades before the market closes

Utilizing technical analysis:

Day traders often rely on technical analysis indicators and patterns to identify potential entry and exit points. They make use of charts, trend lines, moving averages, and other tools to inform their trading decisions

Maintaining active monitoring:

Day traders vigilantly monitor the market throughout the trading day, staying abreast of news events, economic releases, and other factors that impact currency prices

Implementing risk management:

Effective risk management strategies are vital to day traders. They employ stop-loss orders and may employ leverage to enhance their trading positions, acknowledging the additional risk involved

Requirements:

Education and knowledge:

Day traders must possess a comprehensive understanding of trading principles, technical analysis, and market dynamics. They dedicate time to learning the intricacies of trading and keeping themselves updated with market trends

Sufficient capital:

Day trading necessitates an ample amount of capital to capitalize on small price movements. Traders should possess enough funds to cover potential losses and meet margin requirements if utilizing leverage

Technological resources:

Day traders rely on fast and reliable internet connections, robust trading platforms, and charting software to execute trades swiftly and efficiently

Discipline and emotional control:

Successful day traders exhibit discipline and emotional control. They adhere to their trading strategies, avoid impulsive decisions, and manage their emotions in response to market fluctuations

Swing trader

| Quick Overview | |

|---|---|

|

Duration |

Medium-term (Days to Weeks) |

|

Tools used |

Technical Analysis, Fundamental Analysis, Screeners, Research Report |

|

Trading Frequency |

Medium |

|

Risk |

Medium |

|

Success Rate |

Decent |

A swing trader aims to take advantage of medium-term price movements in the Forex market. They hold positions for a duration ranging from a few hours to several weeks. Swing traders rely heavily on technical analysis to identify potential entry and exit points.

Key principles:

Holding positions for a medium-term duration:

Swing traders aim to take advantage of medium-term price movements in the Forex market. They typically hold positions for several hours to a few weeks

Focus on technical analysis:

Swing traders analyze chart patterns, trends, support and resistance levels, and indicators to make informed trading decisions

Prioritizing technical analysis over fundamentals:

While swing traders consider significant news events, their primary focus lies in technical analysis rather than fundamental analysis. They search for patterns and signals in price charts to identify potential swing trading opportunities

Risk management and stop-loss orders:

Swing traders implement risk management strategies to safeguard their capital. They may employ trailing stops to secure profits as the trade moves favorably

Patience and discipline:

Successful swing trading requires patience as traders await the development of price movements over a longer timeframe. Traders must exhibit discipline, adhering to their trading plan and avoiding premature exits

Requirements:

Proficiency in technical analysis:

Swing traders should possess a solid grasp of technical analysis principles, chart patterns, and indicators. They need the ability to analyze price charts and identify potential swing trading setups

Sufficient capital:

Swing trading may necessitate a larger amount of capital compared to day trading, as positions are held for a more extended period. Traders must have adequate funds to cover potential losses and margin requirements

Time commitment:

Swing trading requires dedicated time for monitoring the market and analyzing price charts. Traders must allocate time for research, trade management, and monitoring price movements

Risk management skills:

Effective risk management plays a crucial role in swing trading. Traders must assess and manage the risks associated with each trade, including setting appropriate stop-loss levels

Position trader

| Quick Overview | |

|---|---|

|

Duration |

Long-term (Months to Years) |

|

Tools used |

Fundamental Analysis, Screeners, Research Reports, Technical Indicators |

|

Trading Frequency |

Low |

|

Risk |

Relatively Low |

|

Success Rate |

Relatively High |

In contrast to day traders, a position trader takes a long-term approach to Forex trading. They hold their positions for extended periods, ranging from weeks to months or even years. Position traders focus on identifying and profiting from longer-term trends in the Forex market.

Key principles:

Long-term trading approach:

Position traders hold positions for weeks, months, or even years, embracing a patient and long-term mindset

Focus on longer-term trends:

Position traders seek to identify and capitalize on longer-term trends in the Forex market. They look beyond short-term price movements and pay attention to fundamental analysis and economic factors that shape currency pairs over the long haul

Emphasis on fundamental analysis:

Position traders prioritize fundamental analysis to comprehend the economic and political influences impacting currency prices. They analyze economic indicators, central bank policies, geopolitical events, and other macroeconomic factors to inform their trading decisions

Patience and tolerance for short-term fluctuations:

Position trading requires patience and the ability to withstand short-term price fluctuations or temporary setbacks, as traders focus on the bigger picture

Effective risk management and larger stop losses:

Position traders typically set larger stop-loss levels due to the longer holding periods of their trades. Implementing risk management techniques is crucial to protect capital and manage potential losses

Requirements:

Strong understanding of fundamental analysis:

Position traders need to possess a comprehensive knowledge of fundamental analysis principles and the ability to analyze economic data and news events. This enables them to interpret how these factors can influence currency pairs over the long term

Sufficient capital:

Position trading often requires a larger amount of capital compared to other trading styles, as trades are held for an extended period. Traders must have enough funds to cover potential losses and margin requirements

Proficient time management:

Position trading demands allocating sufficient time to stay updated with market developments, news events, and the analysis of fundamental factors that shape long-term trends

Advanced risk management skills:

Position traders must excel in assessing and managing the risks associated with each trade. This includes setting appropriate stop-loss levels and determining the optimal position sizing to protect capital

Scalper

| Quick Overview | |

|---|---|

|

Duration |

Very Short-term (Seconds to Minutes) |

|

Tools used |

Technical Analysis, Flash News, Screeners, Trading Bots |

|

Trading Frequency |

Very High |

|

Risk |

Very High |

|

Success Rate |

Very Low |

A scalper is a type of Forex trader who specializes in capitalizing on minuscule price changes in the market. Their primary focus is on making quick profits through rapid buying and selling of currency pairs. By leveraging high-frequency trading strategies, scalpers aim to generate small gains from each trade. However, it is essential for scalpers to have a strict exit strategy in place, as a significant loss can easily offset the accumulated small gains.

Key principles:

Exploiting small price changes:

Scalpers focus on capitalizing on tiny price movements in the Forex market. They aim to make quick profits by executing numerous trades and taking advantage of short-term fluctuations

High-frequency trading:

Scalpers engage in rapid trading, aiming to enter and exit positions within seconds or minutes. Their objective is to accumulate small gains through multiple trades

Technical analysis and chart patterns:

Scalpers heavily rely on technical analysis indicators and chart patterns to identify short-term trading opportunities. They utilize tools like moving averages, oscillators, and price patterns to make swift trading decisions

Tight stop-loss and take-profit levels:

Scalpers set tight stop-loss and take-profit levels. This ensures that potential losses are minimized, and profits are secured quickly

Constant monitoring and concentration:

Scalpers need to monitor the market continuously, as they actively search for opportunities to enter and exit trades. They require high concentration and focus to make quick trading decisions

Requirements:

Speed and execution:

calpers must have access to fast and reliable trading platforms and internet connections. Quick execution is essential to capitalize on small price changes

Discipline and emotional control:

Successful scalpers possess discipline and emotional control. They stick to their trading plan, avoid impulsive decisions, and maintain composure during fast-paced trading

Scalping strategy knowledge:

Scalpers should have a deep understanding of scalping strategies, technical indicators, and chart patterns. They need to be proficient in identifying optimal entry and exit points for quick trades

4 types of Forex traders - Comparison

| Particulars | Day Trading | Swing Trading | Scalping | Position Trading |

|---|---|---|---|---|

|

Risk |

High |

Assets for copy trading

Moderate |

Regulator

High |

Moderate |

|

Capital |

High |

Assets for copy trading

Moderate |

Regulator

Low |

Moderate |

|

Duration |

Short-term |

Assets for copy trading

Medium-term |

Regulator

Short-term |

Long-term |

|

Skills Required |

Advanced |

Assets for copy trading

Intermediate |

Regulator

Advanced |

Intermediate |

|

Frequency of Trades |

High |

Assets for copy trading

Low |

Regulator

Very High |

Low |

|

Time Commitment |

High |

Assets for copy trading

Moderate |

Regulator

High |

Moderate |

|

Market Sensitivity |

High |

Assets for copy trading

Moderate |

Regulator

High |

Moderate |

|

Technical Analysis |

Essential |

Assets for copy trading

Essential |

Regulator

Essential |

Essential |

|

Fundamental Analysis |

Less Crucial |

Assets for copy trading

Important |

Regulator

Less Crucial |

Important |

|

Emotional Control |

Essential |

Assets for copy trading

Important |

Regulator

Essential |

Important |

|

Leverage Usage |

Moderate |

Assets for copy trading

Moderate |

Regulator

High |

Moderate |

|

Commissions Impact |

High |

Assets for copy trading

Low |

Regulator

High |

Low |

Which type of trading is best for Forex?

Choosing the best trading style for Forex is a subjective decision influenced by individual factors. Here are some key considerations:

Personality alignment:

Select a trading style that matches your personality and comfort level. If you prefer a relaxed approach, consider swing trading or position trading. If you thrive in fast-paced environments, day trading or scalping might be more suitable

Time commitment:

Different styles require varying levels of time commitment. Day trading and scalping demand active monitoring, while swing trading and position trading involve longer holding periods and less frequent monitoring

Risk tolerance:

Each style carries different risk levels. Day trading and scalping can be high-risk due to rapid market fluctuations, while position trading and swing trading involve holding positions during market volatility

Trading goals:

Consider your objectives. If you have long-term investment goals, position trading could be ideal. For shorter-term profits, day trading or scalping may be better

What is the easiest Forex strategy?

Determining the easiest Forex strategy is a subjective matter that varies from person to person. What may be considered easy for one individual may not be the same for another. The ease of a Forex strategy depends on factors such as personal preferences, trading proficiency, and the amount of time available for trading. While there is no universally easiest strategy, it can be noted that certain approaches may be comparatively simpler for some traders.

For individuals with limited time to dedicate to frequent trading activities, strategies such as scalping may pose more challenges. Scalping involves making multiple trades within short timeframes to profit from small price movements. This style demands continuous monitoring of the market and quick decision-making, which may not be feasible for traders with time constraints.

On the other hand, holding strategies, such as position trading or swing trading, may be considered easier for those who prefer a more relaxed approach. These strategies involve holding positions for longer periods, ranging from days to weeks or even months. Traders utilizing these approaches have more time to analyze market trends, make informed decisions, and execute trades accordingly.

Ultimately, the easiest Forex strategy is highly subjective and depends on individual circumstances. Traders should consider their personal preferences, available time, and trading skills when selecting a strategy that aligns with their goals and comfort levels.

What is the most profitable Forex strategy?

When it comes to determining the most profitable Forex strategy, scalping stands out as a commonly mentioned approach. Scalping involves executing multiple trades to capitalize on small price fluctuations in the market, aiming to accumulate profits over a short period.

Scalping is considered profitable and has the potential to give a Forex trading profit per day due to the numerous trading opportunities it presents. Traders utilizing this strategy can benefit from frequent entry and exit points, potentially increasing their chances of making profits. The ability to take advantage of even the smallest market movements can lead to cumulative gains over time.

One key aspect to consider in scalping is slippage. Slippage refers to the difference between the expected execution price and the actual price at which a trade is filled. It can occur due to market volatility or delays in trade execution. Being sensitive to slippage and taking appropriate measures to mitigate its impact is crucial for maintaining profitability in scalping.

It's worth noting that scalping requires a certain level of knowledge, temperament, and the ability to make rapid decisions. Traders must be comfortable with the fast-paced nature of scalping and have the necessary skills to analyze market conditions swiftly.

How to choose my type of trading style?

To choose the trading style that suits you best, consider the following tips:

Self-awareness:

Understand your own personality traits, cognitive abilities, emotional tendencies, and social preferences. Assess factors such as your patience, risk tolerance, and the time you can dedicate to trading. Perhaps, you also can be interested in more information about how to develop self-awareness skills in trading.

Time availability:

Different trading styles require varying levels of time commitment. If you have limited time available, shorter-term strategies like scalping may be suitable. Conversely, if you can allocate more time to analyze the market, swing or position trading could be a better fit

Forex knowledge:

Evaluate your level of understanding of the Forex market and learn how to trade Forex for beginners at first. Some trading styles may require a deeper knowledge of fundamental factors, while others rely more on technical analysis. Choose a style that aligns with your current knowledge and expertise

Consider pros and cons:

Familiarize yourself with the advantages and disadvantages of different trading styles. Evaluate factors such as the risk-reward ratio, potential profitability, and challenges associated with each style. This will help you make an informed decision

Start with one approach:

It's recommended to begin with one trading approach and master it before exploring other styles. Developing expertise and consistency in one approach is often more effective than attempting to combine multiple strategies right away

Be open to change:

As you gain experience and knowledge, you may find that your trading style evolves. It's possible to adapt and change your trading style over time as you discover new strategies or improve your skills. However, it's crucial to establish a solid foundation in one approach before exploring others

Can I change my Forex trading style?

Yes, you can change your Forex trading style. It's important to understand that your trading style doesn't have to be static and fixed. As you gain experience, knowledge, and insights into the market, you may find that your trading style evolves over time.

Regardless of your current trading style or goals, there is always room for growth and development. The Forex market is dynamic and ever-changing, offering new opportunities and challenges. By staying open to learning and adapting, you can explore different trading styles and techniques to find what works best for you.

Best Forex brokers 2024

Summary

In conclusion, the world of Forex trading offers various styles that cater to different individuals. Day traders focus on short-term price fluctuations, while swing traders aim to capitalize on medium-term trends. Position traders take a long-term approach, and scalpers profit from small price changes. Choosing the right trading style requires self-awareness, considering factors like personality, time commitment, and knowledge. Assessing your risk tolerance and aligning your trading goals is essential.

FAQs

What are the 4 types of Forex traders?

The four types of Forex traders are day traders, swing traders, position traders, and scalpers.

What type of Forex trading is best?

The best type of Forex trading depends on individual preferences, goals, and trading skills. There is no one-size-fits-all answer.

Which type of trader is most successful?

There is no definitive answer as to which type of trader is the most successful. Success in Forex trading depends on various factors, including knowledge, skills, discipline, and market conditions.

What is the rule of 531 in Forex?

The rule of 531 in Forex suggests focusing on five currency pairs, sticking with three trading strategies, and choosing one time frame for trading. It is a guideline for simplifying and streamlining trading decisions.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Scalping

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

-

4

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

-

5

Day trader

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).