How To Get Started With Forex - Step-By-Step Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How To Get Started With Forex:

Understand the basics of Forex trading.

Choose a reliable Forex broker.

Open a trading account.

Develop a trading plan.

Learn technical and fundamental analysis.

Start trading.

Continue learning and improving.

For those looking to venture into Forex trading, this step-by-step guide offers a comprehensive overview of the basics to get you started. It covers essential aspects of Forex trading, including top strategies and key rules for beginners.

How to start Forex trading for beginners

Forex trading involves buying and selling assets in the decentralized foreign exchange market, the largest financial market globally. It offers opportunities for individual investors to speculate on prices and profit from interest rate differentials or exchange rate changes.

Here’s a step-by-step guide to help you get started in Forex trading:

Step 1: Understand the basics of Forex trading

Forex Market Overview: The foreign exchange market (Forex) is a global marketplace for trading currencies. It operates 24 hours a day, five days a week, and involves the buying and selling of currencies to make a profit.

Key Concepts: Familiarize yourself with key Forex concepts such as currency pairs, pips, spreads, leverage, and margin. Understanding these terms is crucial for successful trading.

Step 2: Choose a reliable Forex broker

You will not be able to act on the international financial market on your own, so you will need a special intermediary - a broker, who realizes your deals on the stock exchange.

Research Brokers: Look for brokers that are well-regulated by financial authorities such as the Financial Conduct Authority (FCA), Commodity Futures Trading Commission (CFTC), or Australian Securities and Investments Commission (ASIC).

Compare Features: Evaluate brokers based on their trading platforms, spreads, leverage options, deposit and withdrawal methods, customer service, and educational resources.

We have compared brokers for you according to all these parameters and offer you to familiarize yourself with their conditions in the table below:

| Min. deposit, $ | Min Spread EUR/USD, pips | Min Spread EUR/USD, pips | Leverage, 1: | Investor protection | Forex regulation | Open account | |

|---|---|---|---|---|---|---|---|

| 100 | 0,5 | 0,5 | Up to 1:30 or up to 1:300 | €20,000 £85,000 SGD 75,000 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | Open an account Your capital is at risk. |

|

| No | 0,5 | 0,5 | Up to $400:1 retail, 500:1 Pro | £85,000 €20,000 €100,000 (DE) | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | Open an account Your capital is at risk.

|

|

| No | 0,1 | 0,1 | Up to 1:200 | £85,000 SGD 75,000 $500,000 | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | Open an account Your capital is at risk. |

|

| 100 | 0,7 | 0,7 | Up to 1:400 | £85,000 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | Study review | |

| No | 0,2 | 0,2 | Depending on the asset | $500,000 £85,000 | SEC, FINRA, SIPC, FCA, NSE, BSE, SEBI, SEHK, HKFE, IIROC, ASIC, CFTC, NFA | Open an account Your capital is at risk. |

Step 3: Open a trading account

Demo Account: Before opening a live account, start with a demo account to practice trading without risking real money. Most brokers offer demo accounts with virtual funds.

Live Account: Once you feel confident, open a live trading account. You'll need to provide personal information and documentation for verification.

| Demo | Standard | PAMM | ECN | Cent | Micro | Swap Free | VIP | Managed | STP | Open account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | No | Yes | No | Yes | Yes | No | No | No | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | No | No | Yes | Yes | No | Yes | Open an account Your capital is at risk.

|

|

| Yes | Yes | No | Yes | No | Yes | Yes | No | No | Yes | Open an account Your capital is at risk. |

|

| Yes | Yes | No | Yes | No | Yes | Yes | Yes | No | Yes | Study review | |

| Yes | Yes | No | Yes | No | No | No | No | Yes | Yes | Open an account Your capital is at risk. |

Step 4: Develop a trading plan

Set Goals: Define your trading goals, risk tolerance, and time commitment. Be clear about what you want to achieve and how much risk you are willing to take.

Strategy Development: Choose a trading strategy that suits your goals and risk tolerance. Common strategies include day trading, swing trading, and scalping.

Keep in mind that a trading plan should contain the principles of capital management, as well as detailed instructions for your actions not only in the situation of a profit, but also in the situation of a loss.

Step 5: Learn technical and fundamental analysis

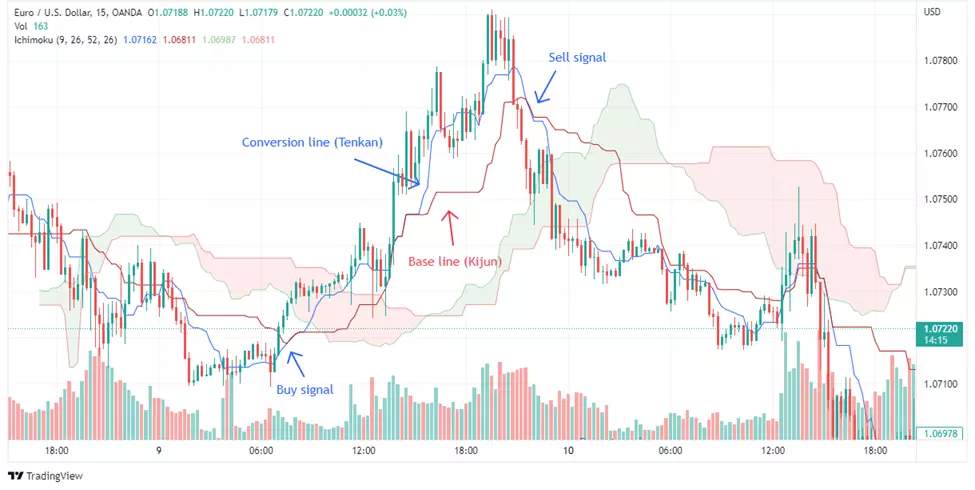

Technical Analysis: Learn how to read and interpret charts, use technical indicators, and recognize patterns to make informed trading decisions.

Fundamental Analysis: Understand how economic indicators, news events, and geopolitical developments affect currency prices.

Step 6: Start trading

Place Trades: Begin by placing small trades to test your strategy and build confidence. Use stop-loss and take-profit orders to manage your risk.

Monitor and Adjust: Continuously monitor your trades and adjust your strategy based on your performance and market conditions.

Step 7: Continue learning and improving

Stay Informed: Keep up-to-date with the latest market news, analysis, and trends. Follow reputable financial news sources and Forex forums.

Education and Practice: Continuously improve your skills through education and practice. Participate in webinars, read trading books, and engage with the trading community.

By following these steps, you can get started with Forex trading and gradually build your skills and confidence. Remember that successful trading requires patience, discipline, and continuous learning.

Top Forex trading strategies for beginners

For beginners, approaching Forex trading can be overwhelming due to the variety of strategies available. Here are some top strategies ideal for beginners:

Scalping: Involves making frequent, small trades to profit from minor price movements, with positions held for only a few minutes or seconds. Scalping requires skill and discipline.

Day trading: Buying and selling securities within the same trading day to profit from small price movements over a few minutes or hours.

- Swing trading: Holding positions for a few days to several weeks to capture price movements or "swings" within a trend, taking advantage of market fluctuations.

- Buy and hold strategy: Establishing long-term positions in currency pairs to benefit from interest rate differentials and potential appreciation over time, such as in the carry trade. This strategy requires patience and consideration of factors like central bank policies and global economic trends.

Top Forex trading tips for beginners

Here are five expert tips for beginners to help them navigate the Forex market:

Understand the markets: Educate yourself on the Forex market by studying currency pairs and learning the factors that influence them before investing your capital.

Create and stick to a trading plan: Develop a trading plan that includes your profit targets, risk tolerance, methodology, and evaluation criteria. Ensure each trade aligns with your plan.

Practice with a demo account: Test your trading plan in real market conditions using a risk-free demo account to gain experience without risking your capital.

Use fundamental and technical analysis: Combine technical and fundamental analysis to identify trading opportunities. Fundamental analysis focuses on news and financial data, while technical analysis uses charts and indicators.

Know your limits: Define how much you are willing to risk on each trade, set your leverage ratio according to your needs, and never risk more than you can afford to lose.

Prioritize your trading education

My advice for beginners is to approach this venture with a clear and structured plan. Understand how the market operates, familiarize yourself with currency pairs, and learn the factors that influence exchange rates.

Don’t ignore the importance of choosing the right broker. A reputable broker with excellent customer support can enhance your trading experience by providing necessary tools and resources. Begin with a demo account to practice without financial risk, gaining valuable hands-on experience with market dynamics and refining your strategies.

Determine the amount of capital you can afford to risk and never exceed this limit. Use stop-loss orders to protect your investments and avoid impulsive decisions. Develop a solid trading plan that includes your goals, risk tolerance, and criteria for entering and exiting trades. Sticking to this plan and avoiding short-term market-driven deviations will contribute to your long-term success.

Summary

As a beginner, it's crucial to manage your expectations and not focus solely on profits. Define your risk profile and never invest more than you can afford to lose. Choose a trading strategy that suits you and understand it thoroughly. Keep your emotions in check; use stop-losses and take profits to protect yourself. Accept that losses will happen and focus on earning more than you lose over time. Develop a strict trading plan to prevent bad habits, like overtrading. Lastly, choose the right broker to minimize potential losses. A good broker will help set you on the path to success from the start.

FAQs

What should a beginner do in Forex trading?

A beginner in Forex trading should educate themselves on the market, make a plan, practice with a demo account, and know their limits.

Is Forex profitable for beginners?

Yes, Forex trading can be profitable for beginners with the right education, strategy, and risk management.

Can I trade Forex with $100?

Yes, many Forex brokers allow trading with as little as $100, but it is important to manage risk carefully.

How to start with Forex trading?

To start Forex trading, a beginner needs to choose a broker, open an account, deposit funds, and start trading with a strategy and risk management plan in place.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.