CFTC | U.S. Financial Regulator

The Commodity Futures Trading Commission is another government regulator whose license is mandatory if a broker decides to work with stock, cryptocurrency, or commodity futures.

Every country has a financial regulator that grants licenses to financial sector companies, ensures favorable investment conditions, and counteracts fraud Regulators differ in their mandates, resources, and forms of cooperation with other government authorities.

Holding a license enables a broker to:

-

Render brokerage services legally in the local market.

-

Attract more clients.

-

Improve its reputation in domestic and international markets.

For a trader, a license is a guarantee of the broker’s reliability. In the U.S., routing the trades of residents and non-residents to the exchange market requires the broker to hold licenses from the CFTC, the Securities and Exchange Commission (SEC), and the Financial Industry Regulatory Authority (Finra) , and be registered with the Securities Investor Protection Corporation (SIPC). These licenses and registrations guarantee that the broker operates legally in U.S. financial markets.

In this post, TU explores the CFTC’s objectives, resources, advantages, procedures for finding licenses on the website, and procedures for filing complaints, as well as reviews. Finally, a TU expert offers his opinion of this regulator.

Description and functions of the CFTC

The CFTC was established by the U.S. Congress in 1974 and is an independent government agency that carries out the SEC’s functions regarding the supervision of the futures and options market. The CFTC is one the most reputable regulators alongside the SEC and the National Futures Association (NFA). The NFA is the industrywide, self-regulatory organization for the U.S. derivatives industry, which comprises retail off-exchange foreign currency (Forex), on-exchange traded futures, and OTC derivatives (swaps).

Tasks and purposes of the CFTC in the Forex market:

-

Control prices in the derivatives market, ensure market pricing, and prevent manipulations with prices of futures and options.

-

Coordinate the operation of brokers, exchanges, and investors. Protect the rights and interests of traders.

-

Analyze brokers’ performance and take measures if some parameters vary from the standards. The measures can be preventive (recommendations, retraining of the staff) or reactionary (in case of violations – fines, unscheduled inspections, or bankruptcy initiation).

The CFTC’s role comes down to revealing violations in the operation and interaction of market participants. The regulator has access to the daily trading volume. The closest attention is paid to the largest trades and volumes of separate assets. On some occasions, the CFTC would stop the trading and cancel the most suspicious trades, which would turn out to be technical errors. In cases of serious violations, the CFTC engages the SEC, which has broader powers in the stock market.

To obtain a CFTC license, a broker has to:

-

Register with the National Futures Association.

-

Obtain the Futures Commission Merchant (FCM) status. Only brokers of this type can conclude agreements for managing clients’ money and trades.

-

Maintain a fixed ratio of minimum net capital to the amount of client money in segregated accounts. A 3-5% change in the ratio can become a reason for daily oversight by a special commission.

-

Disclose the risk prevention system.

-

Confirm the availability of a code of ethics for communication with clients. Later, the broker’s employees must take ethics tests.

-

Disclose an internal employee supervision system intended to prevent violations.

A CFTC license is necessary for every broker that offers trading of futures and options on the several U.S. stock and commodity exchanges. Requirements regarding registered capital and trading volumes differ depending on the broker type, such as a Futures Commission Merchant (FCM) or introducing broker (IB); and status, such as independent or guaranteed.

Official website and information

The Commodity Futures Trading Commission website is largely informational. The licensees' database and registered brokers’ documents are available on the National Futures Association (NFA) website.

Overview of the CFTC website:

-

Upper main menu.

Section of the website

-

News and information section.

Section of the website

-

The footer partially repeats the upper main menu and contains the site map, glossary, privacy policy, commodity exchange regulations, etc.

Section of the website

Upper main menu structure:

-

About the CFTC. The regulator’s structure, provisions, and mission.

-

Industry Oversight. A section about regulation and regulated entities.

-

Law & Regulation. Regulatory framework, filings that regulate financial markets, etc.

-

Market Data & Economic Analysis. Statistics, reports, etc.

-

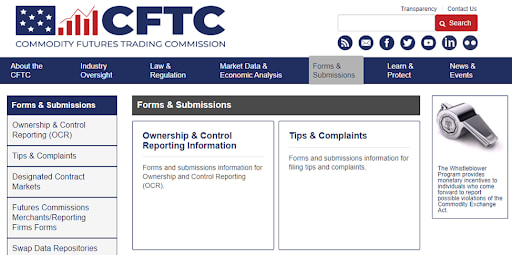

Forms & Submissions. Forms for filing information with separate divisions of the regulator, as well as complaint submission forms.

-

Learn & Protect. Videos, publications, reparations program, and the Registration Deficient (RED) List, which contains names of foreign entities that seem, upon investigation, to be acting in a capacity that requires registration with the CFTC, but they are not registered with the CFTC.

-

News & Events. News and information about planned events.

-

Forms & Submissions. This section contains forms for filing complaints and information with the regulator and is useful for those who are familiar with the U.S. legal framework and regulatory theory.

It also makes sense to look through the general financial news sometimes. If the regulator issues a warning to a broker, it will appear in the financial news.

How to confirm a broker’s license on the CFTC website

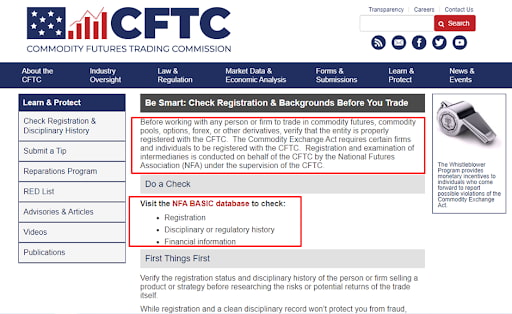

To obtain a CFTC license, a broker must register with the NFA. The “Learn and Protect” section contains a link to the NFA website where you can confirm a broker’s registration.

Section of the website

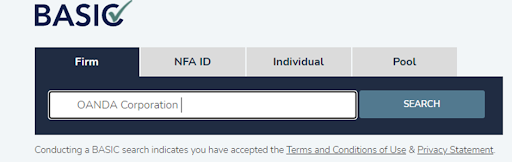

How to confirm a broker’s license on the NFA website:

-

1

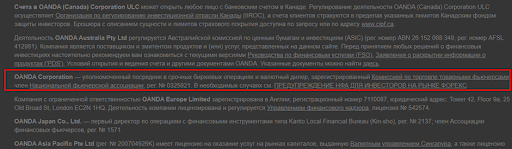

On the broker’s website, search information that it holds licenses from the CFTC and NFA and, therefore, has the right to render services in the USA.

Section of the website

-

2

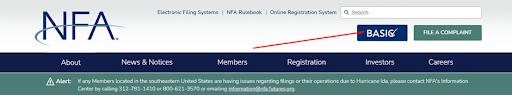

Go to NFA’s website and click “Basic” in the top right corner.

Section of the website

-

3

Enter the broker’s legal name or license number (if it is on the broker’s website).

Section of the website

-

4

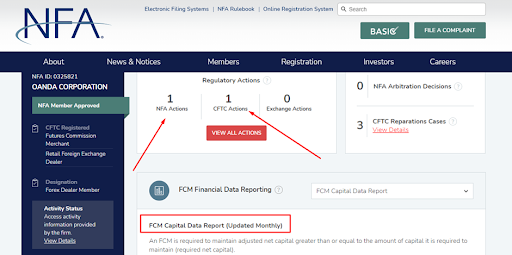

Review the information obtained.

Section of the website

The U.S. regulatory system is unique in that the absence of publicity may result in a fine. Brokers must disclose information in full. On the Commodity Futures Trading Commission website, an investor can find everything about a company, including financial statements. The screenshot above shows the broker’s valid licenses and FCM status.

CFTC’s basic requirements for brokers

Basic requirements to obtain a license:

-

Register with the National Futures Association.

-

Disclose information completely and operate transparently.

-

Provide information about the staff’s qualifications and the risk management system.

There are special requirements that depend on the broker type, services rendered, etc.

The CFTC requires brokers to daily recalculate client account balances and submit the results. It enables the regulator to promptly reveal possible manipulations and the use of insider information, as well as prevent artificial changes in quotes.

CFTC license | Pros and cons

Brokers that provide services in the futures and options market must be licensed by the CFTC. Without a license, brokers cannot access exchanges, and introducing brokers cannot access FCMs. Therefore, this is more about brokers’ compliance with U.S. law than about confirming brokers’ reputations. Brokers that don’t plan to operate in the American market aren’t interested in obtaining a CFTC license because of the complicated procedure.

Advantages of trading with a CFTC-licensed broker:

-

Access to the derivatives market through СМЕ, COMEX, and other exchanges.

-

Access to full information about the broker. The broker’s publicity is one of the regulator’s main requirements.

-

Guarantees of the broker’s reliability and the safety of traders’ money.

A CFTC license confirms that the broker is registered with the NFA and has an identification number in U.S. databases.

Disadvantages of trading with a CFTC-licensed broker:

Additional fees are the only disadvantage. CFTC-licensed brokers incur additional expenses, such as exchange and clearing fees, that are partially passed on to traders. To recoup their time and expenses, traders have to manage capital of at least a few thousand USD.

CFTC’s jurisdiction

The CFTC is a U.S. government regulator responsible for overseeing the futures and options markets. The regulator operates through the NFA: a broker registers with the NFA, obtains a license number, and only then registers with the CFTC. Registration with the CFTC entitles the broker to represent traders’ interests in the U.S. derivatives market. Any licensed FCM can work with both residents and non-residents of the U.S. on the condition that they abide by U.S. laws. Licensed IBs and FIBs (foreign introducing brokers) can also cooperate with residents and non-residents by concluding agreements with futures commission merchants (FCMs).

Besides the NFA, the regulator cooperates with the SEC, which has enhanced powers. Due to the integration into the system of private U.S. regulators, the CFTC can reveal minor violations at an early stage.

Submission and consideration of complaints

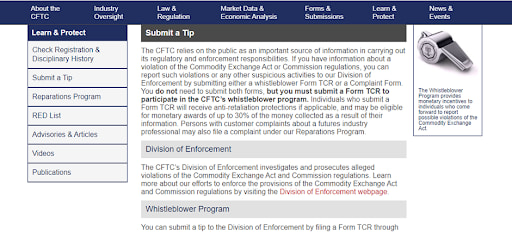

Although licenses are granted by the National Futures Association (brokers only officially register with the CFTC without obtaining a license number), complaints can be filed with both regulators. The CFTC and NFA consider every complaint by all traders, investors, or any private individual who sees a violation. Under the CFTC’s Whistleblower Program , those who report violations are offered monetary rewards in the form of percentages of fines paid by offenders. According to the CFTC’s data, since 2014, whistleblowers have helped the regulator find violations amounting to over $1 billion and received about $123 million in rewards.

Section of the website

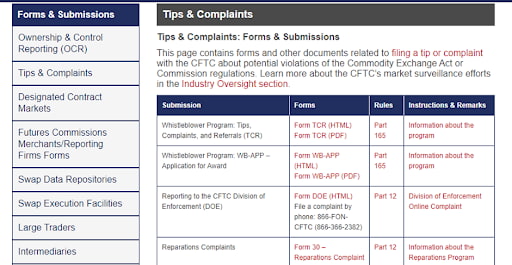

How to file a complaint with the CFTC:

-

On the website’s homepage, open the “Forms & Submissions” section and select “Tips & Complaints”.

Section of the website

-

Select the relevant form.

Section of the website

Optional method:

-

Click “Submit Tips & Complaints” in the footer.

Section of the website

-

Fill out a standard complaint form. Filling out options and recommendations are also on this page.

Section of the website

How to file a complaint with the NFA:

-

In the top right corner of the website’s homepage, click “File a Complaint”.

Section of the website

-

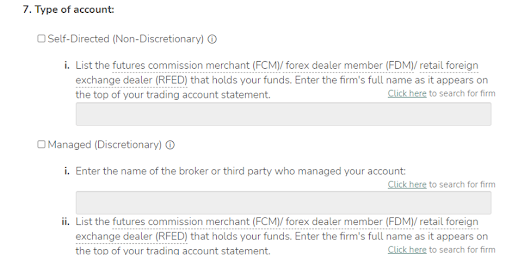

Look through the general description of what you can file, how, and where. At the bottom of this page, there is a complaint submission form consisting of 8 questions.

Section of the website

The questions are general. After you submit the complaint, you will be contacted by the regulator’s representatives and be able to send files and other evidence of violations. Complaints can be submitted anonymously, but the NFA warns that it frustrates their consideration.

CFTC-licensed brokers | How to check on a broker

Any broker may have several licenses.

-

Do you want to know which licenses a broker currently holds and which types of services they permit?

-

Do you want to be among the first to know which warnings the regulator issues to its licensees and whether your broker has committed violations?

-

Do you want to save time by not studying regulators’ websites?

If so, see Traders Union’s brokers' ratings. Every month, TU’s analysts monitor regulators’ websites and update information about licenses, warnings, and recommendations. Keep track of events through Traders Union!

Reviews of the CFTC by investors and traders

This is what private traders think about the SEC.

Constantin, cryptocurrency investor, St. Petersburg

I have heard more about the SEC than the CFTC, but I know that both regulators make a lot of noise in the cryptocurrency market. Recently, the Commodity Futures Trading Commission advanced claims against two exchanges – BitMEX and Binance – thinking that stablecoins and BTC-class cryptos are within its jurisdiction. BitMEX had to change its executives and Binance underwent a series of attacks by regulators from other countries. It seems like certain regulators agreed to attack specific exchanges. On the other hand, every time such news is published, the BTC price drops by about 10% a day and then gradually goes back up. Those who monitor the price chart make good money on these swings.

Pavel, professional trader | Omsk, Russia

Many traders confuse CFDs with securities and don’t know how brokers access the real market. In the U.S., CFDs are considered to be useless instruments. Contracts are concluded without real assets available and market makers can change prices artificially. But it doesn’t mean that, in the USA, only real assets are traded and only by residents.

Brokers in the USA:

-

FCMs (Futures Commission Merchants) are clearing members that have the right to route clients’ trades to the exchange. They are regulated not only by the NFA and the CFTC, but also by the exchange.

-

IBs (Introducing Brokers) can work with clients directly, but cannot accept their money and place it in segregated accounts. These brokers are intermediaries that can work with several FCMs and must be licensed by the NFA and the CFTC. IBs can be guaranteed or independent. The former work with only a single FCM (smaller registered capital is required) and the latter work with several FCMs.

-

FIBs (Foreign Introducing Brokers) work exclusively with non-residents of the USA and route trades to FCMs. But they don’t need to have offices in the U.S. and, therefore, don't need to be licensed by the CFTC or comply with U.S. laws.

In other words, a trader that accesses the U.S. market opens an account with an FCM, but trades with it through an IB or an FIB. In the first case, a non-resident trades through an intermediary that operates in the U.S. jurisdiction, and in the second case – outside of it. The difference is in the risks. Regardless of whether you trade though an IB or an FIB, you hold an account with an FCM. An agreement with this type of broker guarantees all protective mechanisms of the U.S. law, as FCMs open segregated accounts for traders, while IBs/FIBs only organize trading.

A broker’s status can be checked on the NFA website where all CFTC-licensed brokers are registered.

Vadim, trader, Moscow

While there are no CFTC-licensed brokers in Europe, a CFTC license is mandatory for almost every broker in the USA. When I try trading options, I sometimes check if a broker holds such a license, but, overall, I think all U.S. brokers are reliable.

Yevgeny, trader, Belgorod

In Europe, a CFTC license can hardly help you. Everything is easier. Brokers open offices in Europe, obtain licenses from European regulators, and easily work with CFDs. Licenses from the SEC and the CFTC are only of interest to U.S. residents. For example, why should I register with a subsidiary of an American broker, disclose my trading volumes, and pay taxes and huge fees if I can buy a Nasdaq index or invest in gold futures through a FinEx company, or trade with brokers licensed by the Bank of Russia? Instruments and quotes are the same and reliability is high. Why should I access the U.S. market if it’s easier and cheaper to trade the same assets with licensed Russian brokers? As a Russian citizen, I don’t need a CFTC-licensed broker. And U.S. residents don’t have a choice because there are no non-licensed legal brokers in the USA. If an entity has no license, it means it’s a pyramid or a shelf company.

Andrey, professional trader, Moscow

The review correctly says that the U.S. regulatory system is really cool, but it has some drawbacks:

-

Conservatism. To obtain a license, a broker has to turn itself inside out: show every cent, layout plans, provide each team member’s pedigree, etc., not to mention the contributions. It only makes sense that brokers then pass their expenses on to traders.

-

Bureaucracy. You have to get a license for every step you take. In Europe, if you have $1 million registered capital, you are free to work with CFDs, stocks, and so on. In the USA, there are separate requirements for every type of activity. One highly-specialized license won’t make you competitive. If you want to deal with futures, you need to obtain licenses from the NFA, CFTC, SEC, and Finra and register with SIPC. There is a separate industry of private regulators and auditors in the USA.

-

Fees. Exchange, clearing, and repository fees and margin. There are specific fees for every instrument. And with just $100, you obviously won’t earn anything in the U.S. market.

I think all this transparency is not worth such efforts. Brokers spend half their time fighting against regulators and auditors, traders pay extra fees, and regulators successfully add funds to the budget by nitpicking.

Expert’s assessment

The Commodity Futures Trading Commission (CFTC) is an independent federal agency serving as the SEC’s number two. It is responsible for the supervision of futures trading, which is a relatively small field, while the SEC stays in full control of the stock market. In other words, if a broker wants to operate in the currency or stock market, it has to obtain an SEC license. If the broker wants to also cooperate with the CME (Chicago Mercantile Exchange) to provide access to trading futures and derivatives, it has to acquire licenses from two more regulators: the NFA and the CFTC. The pros of such a system are complete control over every licensee and maximal transparency and publicity. The cons are bureaucracy, numerous statements, etc. The acquisition of all licenses may take 9-12 months.

The CFTC is deemed the world’s best regulator of futures trading. In the same way as the SEC, it advances claims against cryptocurrency exchanges, initiates investigations, and takes cases to court. The Commodity Futures Trading Commission has a limited mandate compared to the SEC, but futures brokers must obtain both licenses and, therefore, undergo double control. For the past 5 years, the CFTC has been collecting $0.5-1.3 billion in fines annually. No European regulator can boast such effectiveness.

Conclusion

The Commodity Futures Trading Commission is another government regulator whose license is mandatory if a broker decides to work with stock, cryptocurrency, or commodity futures. For brokers, it means additional expenses and time for registration and audits. But this is exactly why the U.S. financial system is considered to be the most transparent and reliable.

About the author of this review

Oleg Tkachenko, author and analyst at TU

Oleg Tkachenko has been TU’s financial analyst and economic observer since 2016. During this time, he has prepared more than 100 reviews of financial companies and analytic articles on technical and fundamental analysis, as well as developed over 10 trading systems. Oleg’s motto is to help everyone come all the way from a novice trader to a professional.

FAQs

What is the CFTC?

The Commodity Futures Trading Commission (CFTC) is a government regulator responsible for the complete supervision of the U.S. futures and options market participants and their interaction. The regulator’s tasks are to ensure that brokers comply with U.S. financial laws and disclose public information; inform traders and investors; and prevent violations and abuse.

What do I get from trading with CFTC-licensed Forex brokers?

-

1

Access to trading futures and options in the U.S. exchange market.

-

2

Guarantees of the segregation of client accounts.

For traders, a CFTC license is proof that a broker indeed is a proper intermediary in the open competitive market, does not process trades in its own system, offers real market quotes, and works with independent liquidity providers.

How to check if a broker holds a CFTC license?

There are two options:

-

1

The CFTC only registers brokers. Prior to registration, licenses are issued by the NFA. A license can be found under the company’s legal name by selecting “File a Complaint” on the National Futures Association website.

-

2

Find the company in the brokers rating on the Traders Union website. Every month, TU’s analysts update information about each broker’s valid licenses.

How to submit a complaint against a broker to the CFTC?

-

1

Open “Forms & Submissions” and then “Tips & Complaints” on the CFTC website or “File a Complaint” on the National Futures Association website. Select the relevant complaint form.

-

2

Contact Traders Union’s legal department. Consideration of applications by the CFTC takes a lot of time. The regulator only considers complaints that are confirmed by screenshots, statements, and verified documents. Save your time by getting free consultations from TU’s lawyers who are interested in protecting TU’s members. If you cannot settle your issue with the broker, lawyers at TU will help you submit a complaint to the CFTC in compliance with the regulator’s requirements.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

CFTC

The CFTC protects the public from fraud, manipulation, and abusive practices related to the sale of commodity and financial futures and options, and to fosters open, competitive, and financially sound futures and option markets.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

5

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).