How to Avoid Forex Trading Scams? - Basic Rules and Expert Advice

How to avoid forex trading scams:

Research brokers' reputation and regulatory compliance.

Beware of unrealistic promises of guaranteed profits.

Look for transparent fee structures and secure trading platforms.

Educate yourself about forex trading concepts and risks.

Stay vigilant for red flags like unsolicited investment opportunities.

The Forex (Foreign Exchange) market is massive, with a daily average trading volume of more than 6 trillion US dollars. Big money attracts scammers. Most of the Forex trading scams promise unreal and quick returns by using “secret algorithms” or advanced bots that perform trading for you.

It's important to ensure that the forex broker you're working with is legit and regulated by reliable financial authorities. Otherwise, you can lose all your money, and there will be no possible way to get it back. In this article, we’ll discuss the most important types of Forex scams and how to spot them. So, let’s dive into it.

Forex Scam Definition

A Forex scam is a scheme that scammers use to cheat Forex traders by claiming to offer a trading system that will allow them to earn a high profit within a short period of time. According to CFTC (Commodity Futures Trading Commission), Forex scams became a common fraud type in early 2008. It certainly doesn't mean that any online trading platform that claims high profit is a scam. That's because high profits are possible, but promising easy and quick cash to every user is not.

Top-5 Forex Trading Scams You Should Know

Scammers around the world all the time come up with new schemes and ideas of Forex scams to defraud people. But the following are the four most popular types of Forex scams that you must be aware of.

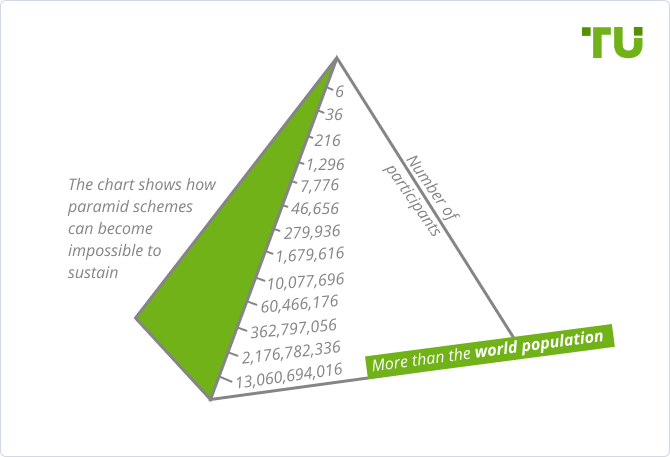

Forex Pyramid Scheme/Forex MLM

The Forex Pyramid Scheme is an unsustainable and sketchy business model that’s even banned in most countries. It’s called a pyramid scheme because its structure resembles the pyramid, as the below image shows.

Forex Pyramid Scheme/Forex MLM

In the Forex pyramid scheme, top-level investor(s) (the owner of the scheme) recruit new paying members who pay the upfront fees of the recruiter. Then the recruited members further recruit their own underlings who pay the upfront fees of their respective recruiter and so on. In simple words, the owner and further recruiter make money from the fees paid by the newly recruited members instead of trading Forex. The higher up a certain trader is in the pyramid, the more money s/he will generate. It's important to note that this business model in its nature is similar to MLM (Multi-level marketing), but it involves no tangible goods' sale.

Bid/Ask Spread Scam

Bid/Ask spread scam is one of the oldest forms of Forex scams in which scammers on specific currency pairs offer very large (sometimes unreal) bid/ask spreads. Resultantly, it makes it nearly impossible to make money on trades. Moreover, because of the commissions, all the potential profits that a trader can earn from his/her investment are canceled and go to the broker. That’s why financial bodies around the globe issue strict spread regulations where only small spreads are allowed. But there are plenty of brokers available in the Forex industry that aren’t regulated by any financial body. Therefore, any new trader can fall victim to such a scam if s/he doesn’t have the right knowledge.

Signal Seller Scam

Signal Seller Scam

It’s possible to find online platforms that claim to offer solutions that inform the traders about the best time to purchase and sell currency pairs to earn profit. These are called signal seller scams, and mostly they're initiated by investment account companies, pooled asset managers, and retail traders. Such groups or individuals with attractive portfolios charge novice traders monthly, weekly, or even daily fees to offer tips. Based on the current market trends and technical analysis, this process can be automatic or manual, or a combination of both. Most of the time, signal sellers vanish after grabbing the trader's money.

To avoid scam, you can familiarize yourself with the rating of the best legal signal providers.

Withdrawal Fraud

Keep in mind, most of the time, those people fall victim to Forex trading scams who want to make money very quickly. That's why we recommend you avoid any platform or services that come with a “get rich quick” mentality. One of the most common types of Forex scams is withdrawal fraud, where a trader is unable to withdraw funds from his/her account. In such situations, when the trader inquires, the broker (scammer) either doesn't respond at all or makes an unclear and confusing apology. That's why it's imperative to choose a licensed and trusted broker who is also regulated by a renowned financial authority. You can also be interested in information about what to do if the broker does not withdraw money.

“Trading Bots” Scams

Forex Robot or a Trading Bot is a computer algorithm that automatically performs Forex trading in the market. One of the most popular and legitimate trading bots is MetaTrader. But the fact of the matter is that the market is also filled with countless scams. Most commonly, new traders fall victim to this type of fraud where a scammer offers a trading bot that’s not capable of making any money. It means the so-called trading bot can’t make informed decisions. Instead, it works on the basis of curve fitting that uses the past market data and creates solid patterns. But the market doesn’t always behave in the same way as it did in the past. You may also be interested in knowing how to avoid MetaTrader 5 scams.

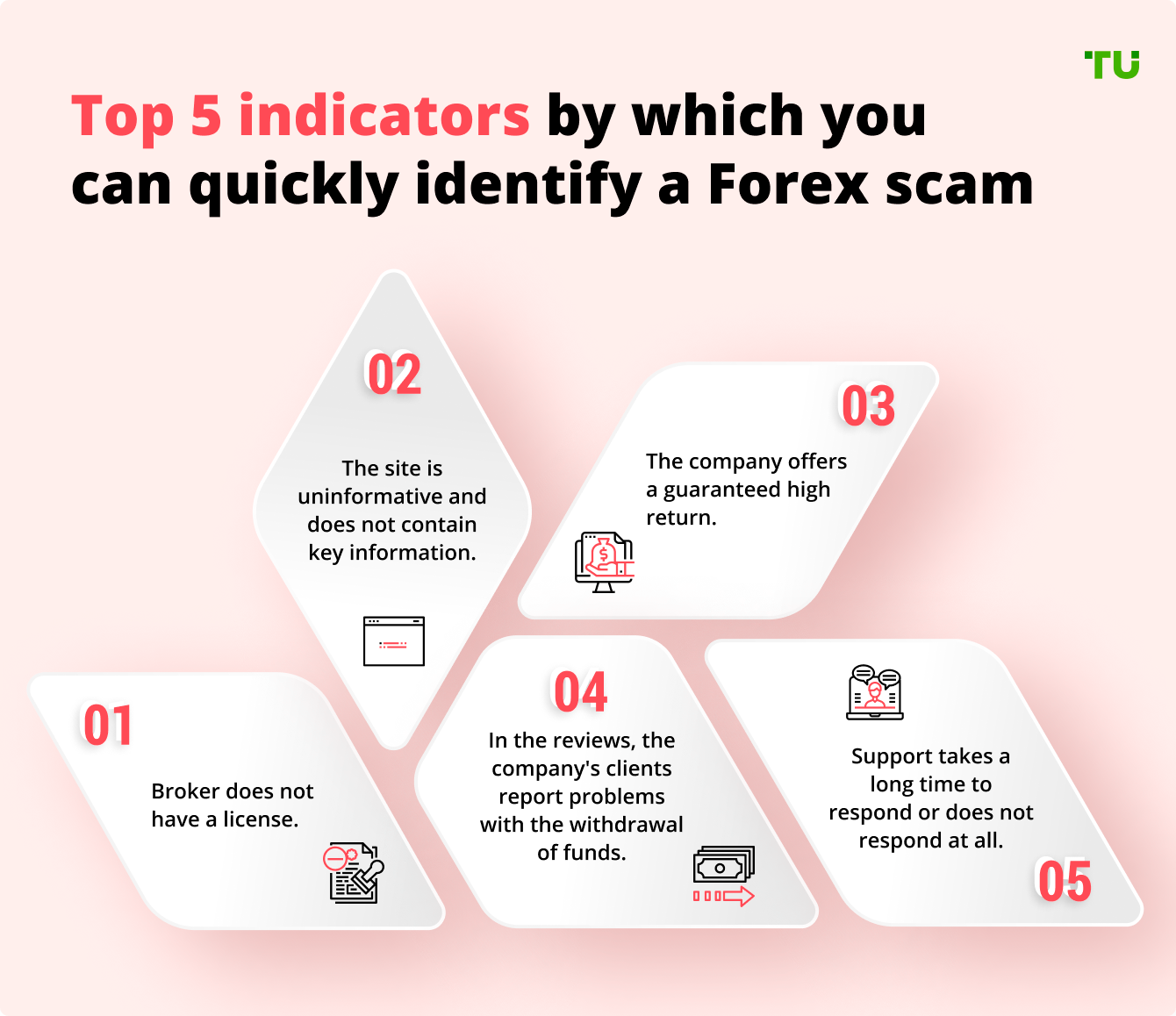

How to Spot Forex Scammers

As you can understand, fraudsters and scammers put a lot of effort into convincing people, which makes it a little difficult to spot them. However, you can read the following information to spot Forex scammers.

Get Rich Quick Mentality

Undoubtedly, you can earn a handsome living out of Forex trading, but just like any other earning method, it takes time, effort, and skill. If any online trading platform or service promises or claims that you’ll get rich quickly, consider it a red flag. Start searching for alternatives and look for a regulated broker.

Guaranteed Success

There's nothing about the Forex market that any expert, renowned broker, or any other entity can guarantee. The foreign exchange is basically a chaos system that's influenced by the variables and factors which are too many to count. Resultantly, anything can happen anytime, which means no trader can eradicate the risk factor entirely. Therefore, if you hear someone boasting or claiming to guarantee your success, consider it a scam, report it (if possible), and walk away.

No Contact or Background Information

If you have ever worked with any online legitimate trading platform, then you would already know that they publicly announce their contact and address information. It's never a wise decision to only believe in the charts or flow diagrams explaining the success of any platform. Consider searching for the background information and official profit and loss statements. Read their license, terms and conditions, and contact information.

We recommend you only choose the online Forex trading platform that offers a demo account that you can use to test their services (especially support service) without involving your real money. Most importantly, make sure that the brokerage you’re considering is regulated by famous financial bodies in your area.

Unsolicited Marketing

Persistent and unsolicited marketing is generally one of the biggest signs of deceitful activities. If anyone is trying to sell your Forex services with too little information, it most probably will be a scam. Keep in mind that no legitimate online trading platform asks you to provide your personal information unless you’re opening an actual trading account. So, only a scammer will ask you to provide your personal information directly that s/he can even use for identity theft.

Scam Risk Assessment Table

In order to avoid online Forex trading scams, we have prepared the table for your convenience. Consider reading the following points to understand the table properly.

-

If the company scored 30-50 points - a high risk of scam

-

If the company scored 20-30 points - the average risk

-

If the company scored 0-20 points - low risk

You can search for all the facts regarding your considered brokerage and add up the scam risk score. The final result will allow you to determine if the broker is in high, average, or low-risk territory.

| Fact | Why it’s important | Scam Risk Score |

|---|---|---|

| Fact The company does not provide a license to provide financial services |

Why it’s important Licensing is a prerequisite for reliability for any forex broker and financial company |

Scam Risk Score 20 |

| Fact The company promises a yield of more than 100% per annum |

Why it’s important Suspiciously high yield. On average, a return of 20-30% per annum is already considered as high |

Scam Risk Score 10 |

| Fact You are guaranteed a positive result |

Why it’s important Investing is always risky. There are no completely risk-free strategies |

Scam Risk Score 10 |

| Fact You are not provided with proven performance |

Why it’s important Trusted investment managers and financial intermediaries provide brokerage statements or other documents that support promised returns |

Scam Risk Score 5 |

| Fact Negative reviews on the internet |

Why it’s important Very often, scam victims leave reviews, the presence of which is an additional signal of danger. |

Scam Risk Score 5 |

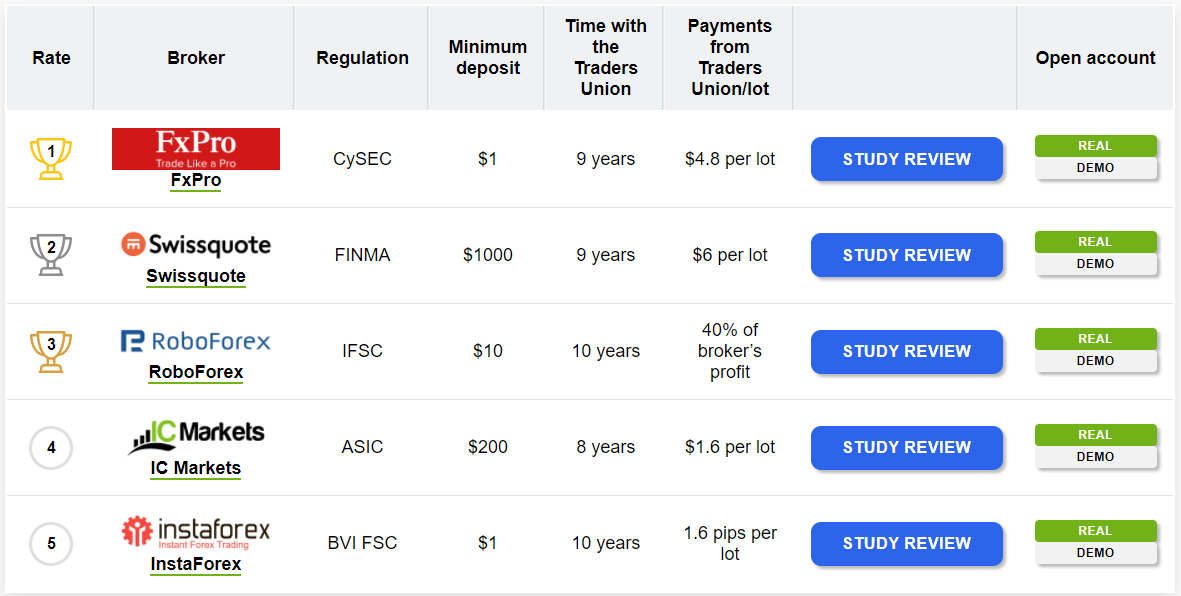

Top 3 Fully Reliable Forex Brokers

If you’re looking for an online Forex broker that’s completely trustable and reliable, then consider opting for any of the following options.

How to Avoid Forex Trading Scams: Expert Advice

The most important thing to keep yourself from Forex scams is to perform comprehensive research. Take your time to understand the rules and regulations of a trading platform and never rush your decisions. Keep in mind that the market is filled with tons of Forex brokers, and each of them claims to be the best one. So, choosing a reliable, trusted, and suitable broker based on your needs can be a challenging task. Investing time in performing research will not only help you to avoid scams but will also allow you to maximize your profits in the long run.

The first step is to perform a google search and go to reputable Forex forums and websites such as TradersUnion to read the online reviews.

Forex Brokers Ratings by Traders Union

As you can see that the above image contains multiple brokers and provides information against each of them. You can see the regulations and also study a detailed review of each broker that’ll allow you to determine whether you can start trading on a certain online trading platform or not. Such online websites offer unbiased information based on their comprehensive research and study that saves you a lot of time and effort.

The most factors that you need to keep in mind while performing your research about a certain trader are:

License and Regulations

All the legitimate and reliable online Forex brokers are authorized by multiple financial regulatory bodies. Some of the world-famous and trusted regulatory authorities are:

License and Regulations

It's important to make sure that the brokerage you choose is regulated by the financial body of your area. Not only will it ensure the protection of your funds and interests, but the brokerage will also be responsible and will be held accountable in any case of misconduct.

Avoid Unreal Opportunities

As mentioned earlier, there's no easy money in Forex trading, and you need to earn it by spending time and effort. For example, if someone tells you that you can make 20 percent gain every single month by using their platform, it’s a scam. That’s because there’s a lot of patience, education, and screening time required to earn profit in Forex trading. So, we recommend you completely avoid the claims that appear too good to be true.

Avoid Forex Management Funds

Despite their popularity, most of the Forex management funds are entirely scams. In these scams, people promise you that they will offer experts and experienced professionals who will perform informed and educated trading on your behalf. In return, you're asked to pay for such services, and as soon as you pay, you never hear from them again. So, if anyone asks you to pay money for such services, then most probably s/he is attempting to scam you.

Answer Some Important Questions

Bear in mind that being a trader and a potential customer, you have every right to ask as many questions as you want. Getting the answers to a few questions will allow you to determine if you’re choosing a reliable and trusted Forex broker or not. We recommend you only to consider the brokerage that comes with a demo account availability.

Consider opening the demo account and test all the functionality that a brokerage offers. Other than that, try to find out the answers to the following questions:

-

How easy is it to open your brokerage account?

-

How much time does the support team take to respond?

-

How binding is your contract with the broker?

-

Does the broker offer any email address, phone number, skype address, or any other way to contact?

-

Does a broker have a physical office in your country?

-

Is the broker registered and regulated?

-

Can you access their performance history?

Scam Forex Brokers Examples

Now that you understand what Forex scams are and how to keep yourself from them, it’s time to look at some scam Forex brokers. You can follow any popular online Forex trading forum or a website such as TradersUnion that regularly updates its list of scam Forex brokers. Not only will it help you to stay up-to-date, but it'll also help you to withdraw your funds immediately if you work with a blacklisted broker. Here are some of the most popular scam Forex brokers that you need to know.

4XP

4XP was founded by capital market dealers and retail-ended entrepreneurs, but it has become a scammer. That's why we strongly recommend you not to work with this online Forex trading platform to keep your money safe.

Reason for Blacklisting

4XP online Forex brokerage failed to fulfill its obligation to traders as well as its partners. According to most of the online reviews by real-time customers, it was impossible to withdraw funds, and all the deposits were frozen.

770capital

770capital promises to offer reliable services and modern features for Forex trading. But due to its suspicious announcements, we don’t recommend you to opt for this online Forex trading platform.

Reason for Blacklisting

The license of the financial body that 770capital shows regarding its regulation don't exist anywhere in the world, which is a clear sign of being a scam Forex Broker

Adamant Finance

Adamant Finance is yet another Forex broker that has tons of negative feedback online. Most of the online reviews directly mention that this platform is a straightforward scam. That’s why we don’t recommend working with this company.

Reason for Blacklisting

Adamant Finance isn’t regulated by any financial body. Moreover, the user agreement the company offers doesn't even contain the required financial obligation, and there's no explanation for that behavior as well.

Is Forex Legit Itself?

The simple answer to this question is yes. Forex trading is completely legitimate and legal, but you need to ensure that you work with a reputable, licensed, and reliable online brokerage. You can engage in the foreign exchange market if you’re interested and make real money. It’s also important not to trust everything online, especially in the hyped-up tutorials and online guides about Forex trading, because it's not a get-rich-overnight business.

Summary

There you have it. It’s everything you need to know about Forex trading scams. Don’t forget to perform comprehensive research regarding any online Forex broker by going to the reliable and reputable online forums and official portals (such as BASIC by NFA if you’re from the US). Make sure that the broker you’re considering is gully regulated and offers a low-risk Forex trading environment. Moreover, it’s also important to test the features and tools because they must be aligned with your unique requirements and financial goals.

FAQ

Can Forex trading make you rich?

Yes, Forex trading certainly can make you rich. But remember, it takes time, resilience, vigilance, skills, and the right effort that doesn’t happen overnight.

How do I know that my Forex trader is legit?

In order to find out whether your Forex broker is legit or not, you need to look for its licenses and regulations. Moreover, you can also use the risk assessment table that we have provided above for that as well.

Is forex trading a pyramid scheme?

No, Forex is a legitimate type of trading and isn’t a pyramid scheme. But many fraudsters use pyramid schemes around Forex trading to scam people.

What’s the most common sign regarding Forex trading scams?

The most common sign that allows you to spot a Forex trading scam is anything similar to get rich overnight or anything similar. In simple words, if it’s too good to be true, it’s most probably a scam.

Team that worked on the article

Jeremy Flint is an MBA graduate and freelance finance writer primarily emphasizing content creation for wealth managers and investment funds. A former U.S. Army officer, he brings strategic vision to content development and tactical analysis to stock picking and economic assessments.

He’s been obsessed with the markets since he was a teenager and is passionate about spreading financial literacy by using his expertise to break down obscure market concepts for retail traders. His main focus areas are fixed-income investing, alternative investments, macroeconomic news, and the oil, gas, and utilities sectors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.